Market Commentary: September 2019

Here are this month’s highlights: South African assets struggled during September, with Cash proving one of the better performing local investments. Local equities had a lacklustre month, but notable company news included the listing of Naspers spin-off Prosus. International equities were broadly higher, despite some unsettling macroeconomic and geopolitical news. Developed markets outperformed emerging market peers, and Chinese equities were weaker as the trade spat with the US continued.

Market View

Cash

Cash, with a 59 basis points (bps) return for September, was one of the better performing local asset classes. Inflation ticked up to 4.3% during August, with housing, utilities and food price increases exerting cost push pressure. Petrol prices jumped by 11 cents during September, further increasing by 18 cents during early October. The expectation is therefore that transport costs will continue to add inflationary pressure.

The South African Reserve Bank (SARB) consequently left interest rates unchanged at its September Monetary Policy Committee Meeting. The SARB also cited ongoing rand volatility and weakness.

“Since the July MPC meeting the rand has depreciated by 4.6% against the dollar and by 3% against the Euro.”

Market participants are, nonetheless, pricing in one further 2019 interest rate cut, as the SARB’s medium to long run forecasts still put inflation within the target range and allow for some room to manoeuvre and provide relief to cash-strapped consumers.

Bonds

South African bond markets were subdued during September, with nominal bonds generating 0.53% and Inflation-linked Bonds (ILBs) a meagre 0.39%. Local Bonds were well ahead of their developed market counterparts, as the BarCap GABI posted a -1.02% (in dollar terms) return for the month.

In South Africa, the SARB did not follow the US Federal Reserve Bank in cutting interest rates. This is partly a reflection that the risk status of SA Inc has prompted the SARB to allow the US interest gap to widen, to keep SA Bonds an attractive investment proposition. While SA Bonds continue to offer attractive real yield in SA terms, foreign investors have remained net sellers. This indicates that they don’t see the risk premium as sufficient compensation.

“Bond investors will be keeping a keen eye on developments as the Medium-Term Budget Policy Statement is set to be released on the 30 October, a day before ratings agency Moody’s gives feedback on South Africa’s sovereign credit rating.”

The former is unlikely to contain good news, with Finance Minister Tito Mboweni already warning that the growth outlook has worsened since the February budget, and that tax revenue collection was disappointing. The latter may provide bond investors some reassurance, with Moody’s analysts giving a cautiously optimistic view in media briefings early in September.

Outgoing European Central Bank President, Mario Draghi, announced steps to boost the faltering economy. This includes restarting quantitative easing, reducing the deposit rate by 0.1%, and providing more favourable long terms loans to banks to incentivise lending (TLTRO). Christine Lagarde, currently head of the International Monetary Fund (IMF), will step into Draghi’s position on 1 November 2019. Eurozone bond yields ticked up and 10-year T-bill yields ended at 1.75%. Elsewhere, Japanese bonds sold off on the Bank of Japan’s (BoJ) announcement that it would trim the size of its long-term government bond purchases in October; UK 10-year Gilts trended lower, as the Supreme Court ruled that Boris Johnson’s prorogation of parliament was unlawful, adding to the Brexit furore.

Equity

Domestic equities had a lacklustre September and the SWIX ended the month only modestly higher, gaining 37 bps. Local equities significantly underperformed global counterparts, as the MSCI World and MSCI EM gained 2.13% and 1.91%, respectively, in dollar terms.

SA Financials proved to be the best performing sector, generating 3.54% and boosting the overall index into positive territory. Resources and Industrials, on the other hand, struggled at -1.05% and -0.75%, respectively.

“On the political, microeconomic and macroeconomic front, South Africa had a volatile month.”

The impact of ongoing protests, riots and labour unrest in major South African cities is likely to filter through in measures of productivity and consumer spending during the coming months. Disruptions to local business were widespread and will likely have a knock-on effect on productivity. Already struggling, Small and Medium Enterprises are likely to bear the brunt.

In addition to severe censure of the country and even retaliatory attacks (South African stores were looted in Nigerian malls), the violence has left South African business owners, and investors demoralised and wary of making longer run capex and investment commitments. This has come against the backdrop of an already gloomy outlook for domestic growth.

The SARB revised its forecasts for economic growth lower – dropping by 0.9% to 0.6% annually for 2019. Consumer confidence remains subdued, further dampened by the recent spate of violence. Total vehicle sales dipped during August, reflecting the lack of appetite for big ticket spending.

“In company and sectoral news, the listing of Naspers spin-off Prosus grabbed headlines.”

In spinning off the unit, which comprises its international internet assets and includes its stake in Hong-Kong listed Tencent, Naspers hoped to establish Prosus as a tech giant, diversify its current shareholder base and ease its JSE dominance. The Amsterdam-listed subsidiary, still 73% Naspers-owned, saw its share price jump by 29% on the Euronext at its opening on 11 September. The company has a secondary listing on the JSE, and, with assets valued in excess of USD 100 billion, has knocked SAPPI out of the Top 40. Naspers shares slumped by a commensurate +/- 30% on the day of listing, and the JSE giant ended the month 34% lower. Prosus, after the initial euphoria, gave up just over 7%. Chemicals giant Sasol again delayed the release of its financial results, and share prices slumped by 12% during September, dragging the broader sub-index firmly into the red.

Amongst traditional rand hedges, British American Tobacco shrugged off prior months’ poor performance, returning just over 5%, and Reinet shares jumped by 8%. The star performers on the bourse, after particularly solid financial results, were First Rand and Capitec.

The tough local economic environment sees a number of quality shares trading at significant discounts, creating plenty of buying opportunities for savvy investors.

Property

The disparity in the South African listed property indices was quite apparent this month: the ALPI, with its exposure to offshore markets, registered a gain of 1.47%, while the SAPY yielded only 0.3%. The latest FNB Property Barometer showed a slight improvement in transaction volumes in the residential market. As in prior months, retailers remained under pressure, and the logistic sector extended its dominance.

“It was also a fairly busy reporting month, with several heavyweights publicising interim/final financial results.”

Once the darling of the SA listed retail property sector, Hyprop fell to a 5-year low. The slump followed its release of poor results. The company has faced considerable headwinds from its Ghanaian and Nigerian assets, where there have been significant write downs in property values (with further pressure from the recent spate of lootings).

Fairvest, on the other hand, operates primarily in the lower LSM and rural retail property sector. The company extended its run as one of the best-performing property stocks in South Africa. It declared 8% distribution growth for the year ending 30 June. Amongst the poorest performers for the month, Rebosis posted a 14% dip in its share price. After news that the company had agreed to merge with Delta Property Fund boosted its share price temporarily, the plan hit resistance amongst some shareholders. These include the Delta black economic empowerment consortium Cornwall Crescent, and Redefine (South Africa’s biggest real estate investment trust) which is exposed to Delta through its loans to Cornwall. Such disparate returns highlight the need to be selective in investing in listed South African property. It also highlights the potential to seek alternatives, by investing in the unlisted property sector. South African local property fundamentals remain weak over the medium-term, but listed property remains attractively priced. On average, SA centric companies are trading at forward yields above the long-term South African Government Bond.

The FTSE EPRA/NAREIT returned 2.6% in USD terms. The UK proved to be the best performing listed real estate market during September, in spite of Brexit uncertainty. Construction output has trended upward and house prices showed a 1.1% gain year-on-year for the three months to September. Analysts cite stable underlying market indicators, including completed sales and mortgages approvals.

Simultaneously, affordability measures such as wage growth and interest rates, remained supportive. The UK office sector has remained under pressure, but it is felt that much of the Brexit-penalty has already been priced in. The office sector has struggled across jurisdictions, as some segments saw considerable competition from flexible office space initiatives such as WeWork. The initiative has already disrupted the sector, with office landlords noting that tenants now expect higher standards for fit-out packages for new leases. Higher capital expenditure will therefore be required to remain competitive, putting significant pressure on margins.

“Despite the trouble in the office sector, the stocks that have delivered the lowest returns globally are all retail focused.”

This includes Intu (UK, -62%), CBL and Associates (-30%) and Wereldhave (Continental Europe, -23%). It underscores the noted trend in consumer behaviour, where changes have led to lacklustre growth in physical stores. Logistics and warehousing, conversely, have continued to perform well in 2019, with little sign of slowing down. It is clear that returns differ significantly on sectoral basis. Astute global investors therefore need to take care in selecting their portfolios. Overall, global listed real estate fundamentals remain healthy, and listed real estate appears to be fairly priced.

International Markets

September was a fairly decent month for global risk assets. Developed and emerging equities closed mostly higher. The MSCI World was 2.13% higher, the MSCI EM and BRIC gained 1.91% and 1.09% in US Dollar terms, respectively. African nations lagged, with the MSCI EFM Africa ex SA remaining near the flatline, at +0.02%.

The S&P500 gained 1.87% during the month, despite some lacklustre economic data. The September US Conference Board’s consumer confidence index slipped to a three-month low. Against the backdrop of ongoing and escalating US-China trade tensions, manufacturing and agricultural sector workers are feeling the pressure. The sharp drop has amplified jitters, as the consumer-spending fuelled growth engine may not be as robust as expected. Personal spending rose only 0.1% in September, the slowest since February and missing market expectations.

The Economic Optimism Index also dropped to a six-month low, from 55.1 to 50.8. The US S&P Case Shiller home-price index, though rising 2% year-on-year for July 2019, heralded the slowest rise in home-price appreciation since 2012. Business confidence is also lower, with the ISM Manufacturing PMI dropping further into contractionary territory, at 47.8 in September.

“The US economy added 130 000 jobs in August, following a downwardly revised 159 000 in July and missing market expectations of 158 000.”

The US Federal Reserve Bank, in the face of slowing growth and hiring, cut interest rates again in September.

The suggestion that the Trump administration would force Chinese firms to delist from US stock exchanges, and the threat that the President would be impeached, further weighed on investor sentiment at month-end. The delisting would affect over 150 Chinese firms, including giants such as Alibaba Group holding Ltd, Baidu Inc and JD.com Inc.

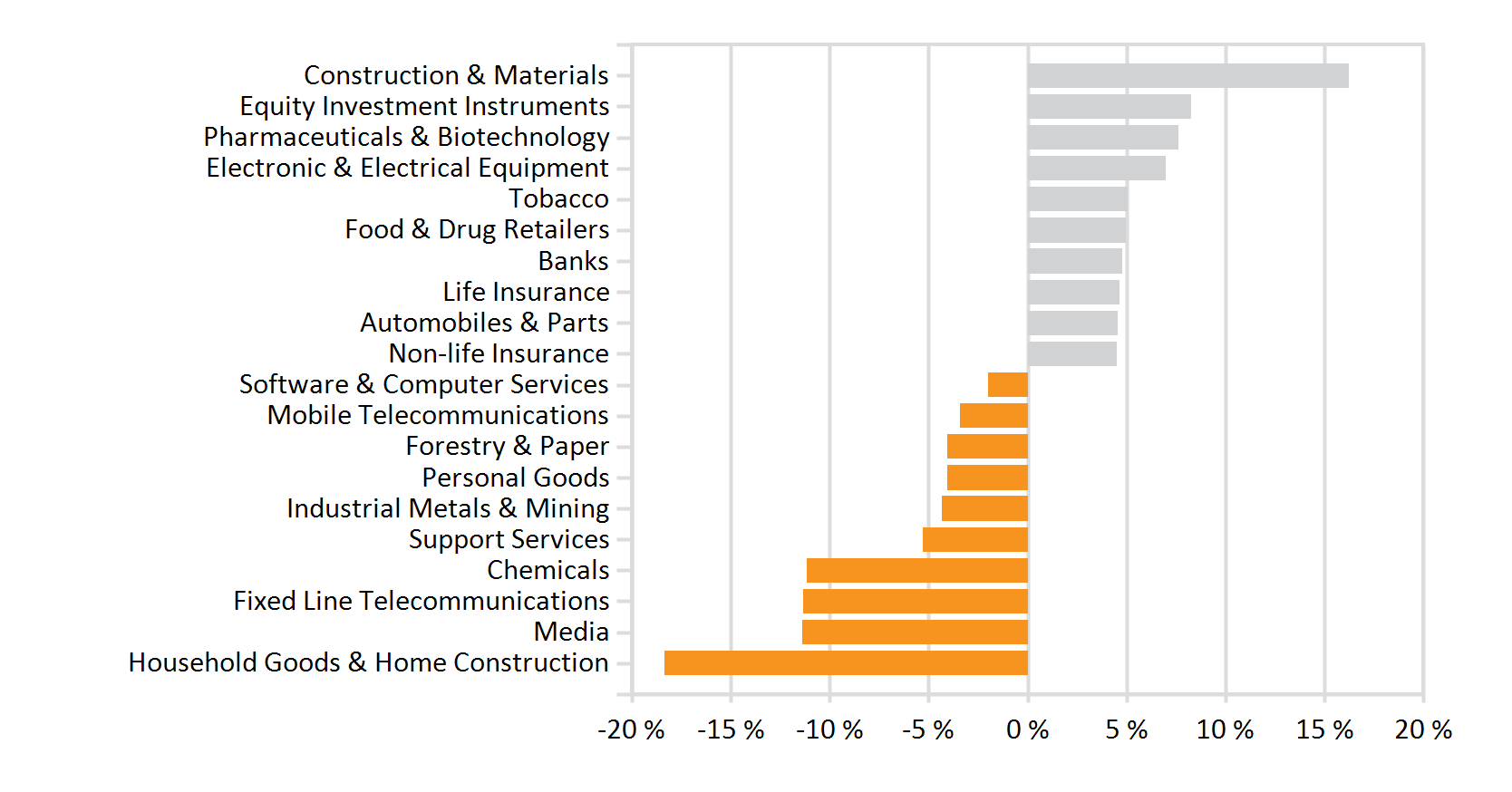

On a sectoral basis, there was a rotation from growth towards value stocks, and investors sold out of defensive low volatility stocks and higher growth technology companies, opting for value stocks. Financials (+4.6%), and Energies (+3.8%) were amongst the better performing sectors, having lagged the market in recent years.

Energy stocks were buoyed by the higher oil price, post attacks on Saudi Arabian oil processing systems. Consumer stocks and real estate lagged. Healthcare was negative, amid concerns around the Democrats’ 2020 proposals for Medicare for All, which could hinder corporate profits for companies.

The UK remains embroiled in Brexit chaos, but equity markets appeared to shrug off the latest Parliamentary pandemonium. The battle between Prime Minister Boris Johnson and Parliament intensified, as the UK’s High court ruled the prorogation unlawful. Analysts are estimating that there is an estimated 55% likelihood of a no-deal Brexit, with a 35% chance of a further extension to Article 50.

Somewhat perversely, given the present uncertainty the GfK Consumer Confidence measure showed some improvement. The pattern of spending reflects a consumer base that is bracing for Brexit. Retail sales were led lower by a substantial decline in non-essential online sales and clothing and footwear, while sales of food, household essentials and fuel rose. The CBI Business Optimism Indicator for the UK plunged to a three-year low. The IHS Markit/CIPS UK Manufacturing PMI clawed back from the previous month’s six-year-low, but remained in contractionary territory at 48.3.

“This is the longest consecutive run in contractionary territory since mid-2009.”

The FTSE100 closed 2.97% higher. In Europe, the STOXX All Europe closed 3.76% higher, led by Financials and Energy. Macroeconomic data appears to point to a slowdown in the region’s growth. The flash Eurozone manufacturing PMI fell to its worst level in nearly seven years, with a reading of 45.6.

The service sectors PMI also softened to an eight-month low. Despite, the noted weakness, the Eurozone composite PMI remained at just above the key watermark, registering 50.1 and signalling the slowest expansion since mid-2013. Business confidence is flagging, particularly amongst participants in the industrial, retail and construction sectors. Consumers have remained relatively more upbeat, and retail sales ticked up modestly. There is still, however, little appetite for big ticket spending.

Japanese equity markets ended the month higher, on an apparent easing in China-US tensions, despite a flare-up at month-end and despite the largely downbeat macroeconomic data. The Nikkei ended 5.8% in the green, with exporters boosted by a deterioration in the Yen. Sentiment was buoyed by a partial trade deal between President Donald Trump and Japanese Prime Minister Shinzō Abe, effective in 2020. Under the deal, there will be lower tariffs on US agricultural and other goods, potential relief regarding tariffs on Japanese auto exports, and an allowance for tariff-free digital commerce.

“The Bank of Japan’s (BoJ) Tankan survey showed that business confidence continues to wane, and has fallen to a five-year low.”

Japanese manufacturing activity fell at its fastest rate since February. Japanese consumer confidence dropped to its lowest point since June 2011, with consumers particularly gloomy ahead of a 10% sales tax increase as of 1 October.

An increase in VAT has typically had a sharp impact on activity, and analysts are expecting a dip in demand. It is not expected, however, that the impact will be of the order it was in 2014. The Japanese government has put various measures in place to mitigate the impact, including providing free early childhood education, tax credits for housing and autos as well as infrastructure spending.

Chinese equities underperformed regional peers, the MSCI China registering a 3bps decline, and the MSCI China A Onshore gaining only 70bps. This partly reflects the impact of the 10% tariff on USD 300 billion goods. Following the announcement, the renminbi weakened beyond the symbolic seven-per-dollar threshold and the US promptly labelled the country a currency manipulator. Talks are set to resume in October. Ahead of China’s National Day a number of investors also took profits. The latest readings show a dip in Chinese consumer confidence, but a modest increase in retail sales. Business confidence rose modestly, as measured by the Official NBS Manufacturing PMI, but the sector (at 49.8) still remains in contractionary territory. Industrial output increased by 4.4% in August 2019 – the smallest monthly gain since February 2002.

“Outside China, emerging Asian markets ended the month mostly higher. Korean and Taiwanese equities were solidly higher, following a recovery in technology shares.”

Korean markets were boosted by the recovery in the semiconductor sector and ended 4.8% higher. Taiwanese markets responded favourably to Apple’s launch of three new iPhone models and an increase in 5G-related demand.

Indian equities were higher after Finance Minister Nirmala Sitharaman announced a reduction in corporate income tax rates from 35% to 22%. This is in addition to the interest rate cuts, most recently in August, which the Reserve Bank of India implemented in an attempt to boost flagging domestic economic growth. The Composite PMI in India decreased to 49.8 in September, signalling a contraction, and consumer confidence in the world’s second most populous country dipped substantially for the third quarter of 2019. The SENSEX gained 3.57%. Hong Kong SAR was the region’s poorest performer, with escalating pro-democracy protests taking a violent turn.

Latin American markets put in the best performance amongst Emerging Market peers, with Argentinian and Brazilian equities the regional leaders. The latter posted a 3.57% local currency return. A number of central banks in Latin America implemented rate reductions to bolster their sluggish economies and steer inflation to back on target: Brazil and Chile reduced rates by 50 bps, and Mexico implemented a 25 bps cut. On the political front, Brazil’s senate approved Presidents Jair Bolsanaro’s pension reforms. The bill could save the federal government about 1 trillion reals over the next decade, and includes the introduction of a minimum retirement age. Latin American markets, in general, were boosted by the upswing in energy counters.

Russian oil and gas companies also drew support from higher energy prices, and the bourse (IMOEX) ended modestly higher. Within Emerging Europe, Middle East and Africa (EMEA), Emerging Europe was the best performer. In addition to the gains in Russia, Turkey and Greece also posted a positive month. Turkish returns were particularly impressive, the bourse gaining over 8%. This is partly off a low base, as the market was heavily penalised in prior months. It also reflects the banking sector’s reaction to a slew of rate cuts. Turkey’s Central Bank cut rates by 750 bps during the third quarter and the Borsa Istanbul Banks Index climbed 13% in September.

“African markets were mainly lower. Despite the stronger oil price, the Nigerian bourse ended 1.4% lower. “

Egyptian equities, on the other hand, recovered from a sharp sell-off in the latter part of the month. Protests erupted in response to allegations of corruption against the army and President Abdel Fattah el Sisi. Having registered a 11% loss in the days following the protests, the market recovered equally sharply and ended the month over 8% higher. This is off the back of still-positive macroeconomic data – Egypt was one of the fastest growing economies of 2019 at 5.6% – and a 100bps rate cut from the Egyptian Central Bank at month-end.

Currencies and Commodities

The GSCI commodities index ticked 1.7% higher during September, bolstered by modest gains in Energy and Industrial Metals (0.8% and 0.6% respectively), but lead by Livestock and Agricultural commodities. Oil prices ticked higher, after a volatile month, with brent crude ending the month 2% higher. Prices initially spiked by 20% after two key Saudi production facilities were hit by drone attacks on the 14 September. The extent of the damage appeared to be less than initially feared, and Saudi Arabia’s energy minister indicated that production would be back on track by the end of the month. The culprits behind the attacks have not been conclusively identified, but speculation is rife that Iran is to blame. This has done little to soothe US-Iranian tension. The attack has further destabilised an already volatile region.

“Despite the expectation of safe-haven buying, gold prices dipped by 3.5%. Other precious metals, including Silver (-7.2%) and Platinum (-3.9%) were also lower, and the overall Precious Metals index lost 3.9%.”

In currency markets, the US Dollar Index was 0.5% higher for the month. The yen lost ground, depreciating by 2.5% against the greenback, a move that would be welcomed by export-oriented Japanese firms. Sterling continued to ebb and flow on Brexit-related news as the 31 October deadline draws near. The pound, despite some noticeable swings, moved modestly higher against the USD (+1%). Emerging market currencies were mostly higher against the USD, with substantial gains in the Russian Rouble (3%) and Turkish Lira (3.3%). The battered rand ended the month nearly unchanged against the dollar, at 15.16 (versus 15.18) ZAR/USD.

Performance

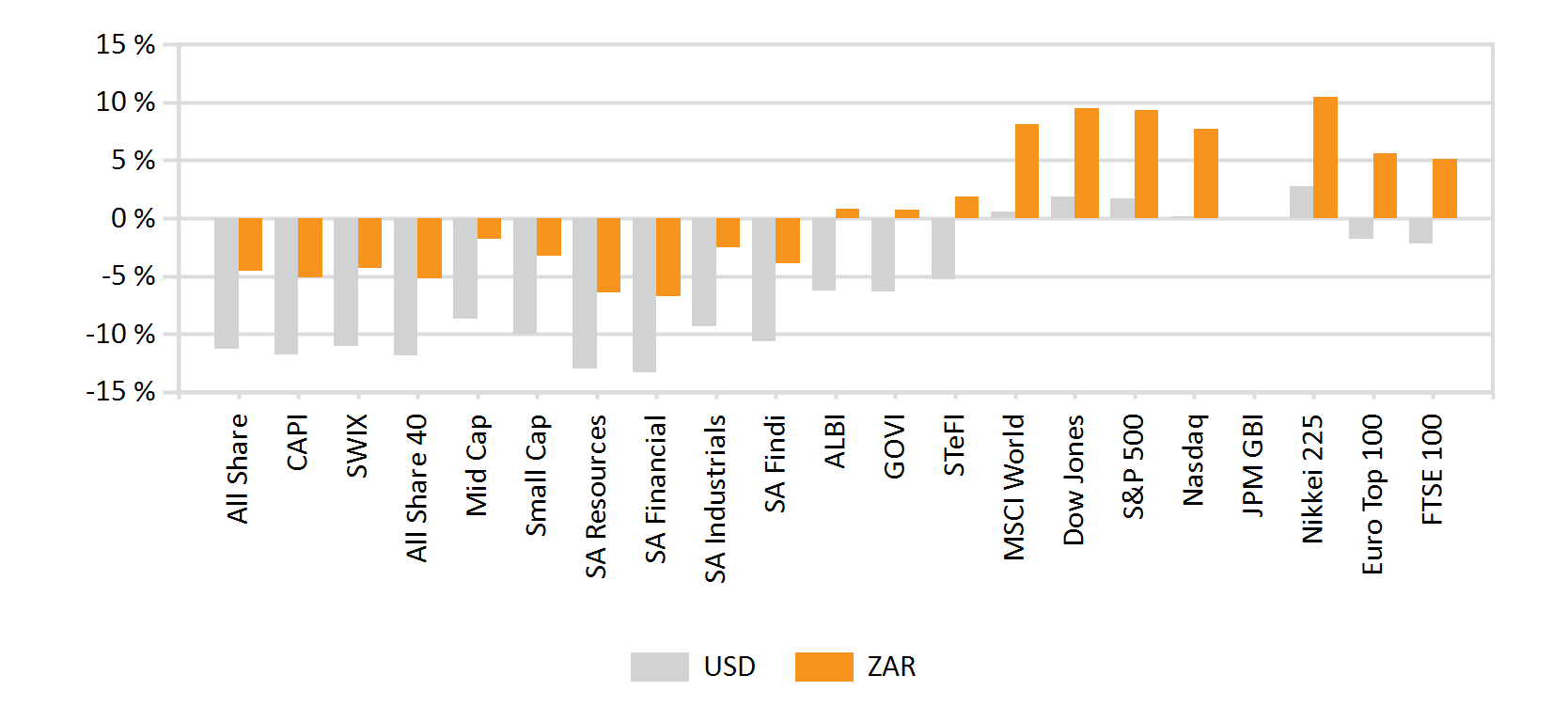

World Market Indices Performance

Monthly return of major indices

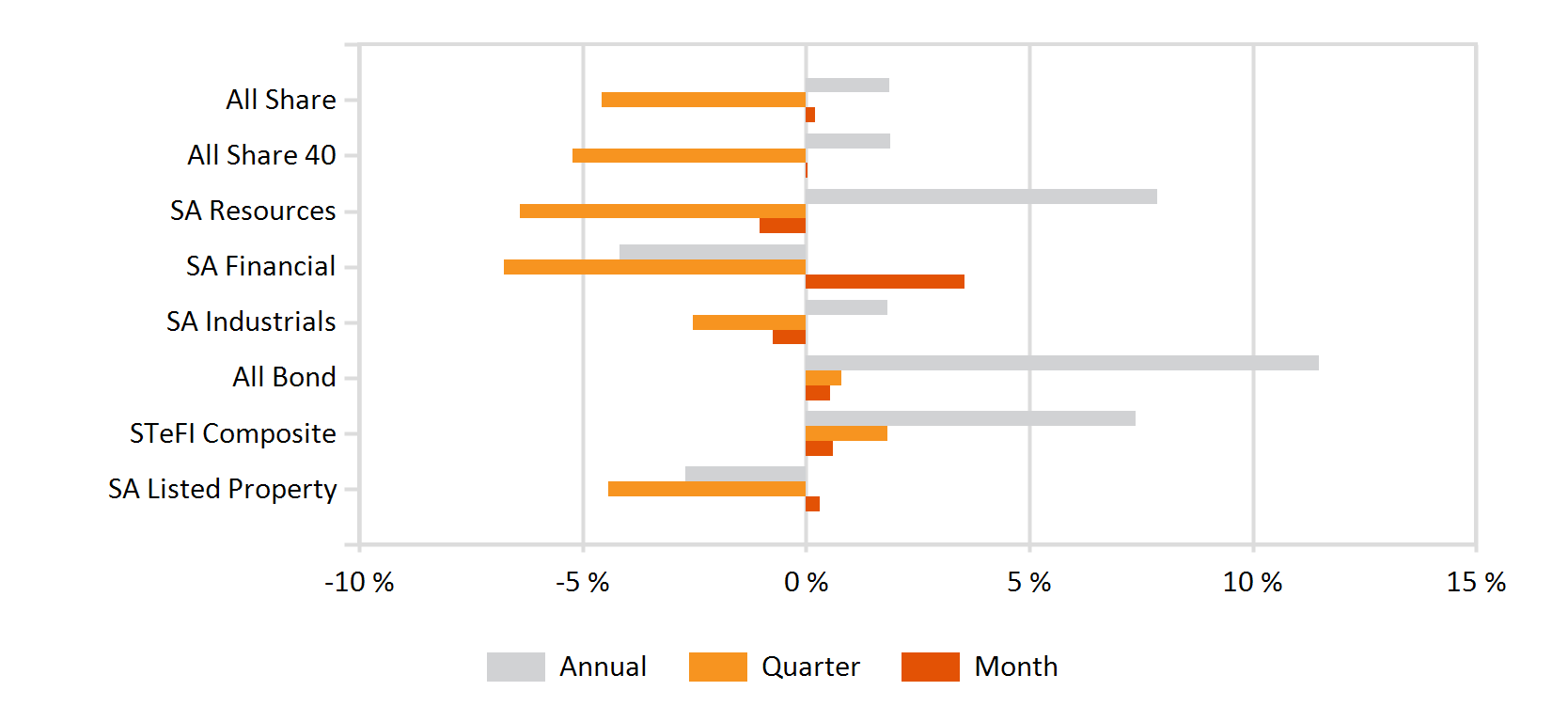

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance