Market Commentary: September 2018

Here are this month’s highlights: September was a month of contrasts: Even as new trade tariffs took effect in the Sino-US standoff, the US, Canada and Mexico brokered a deal on NAFTA; While South African growth languished, the US economy steamed ahead and the Federal Reserve fulfilled expectations of a rate hike toward month end.

Market View

Cash

South African Cash yielded a return of 0.56% for the month, easily outstripping other asset classes. While the South African Reserve Bank (SARB) left rates unchanged at the September Monetary Policy Committee meeting, it sounded a more hawkish tone.

Currency weakness, higher international oil prices and higher-than-expected electricity tariffs continue to pose an upside risk to headline inflation.

“The consumer price index unexpectedly declined to 4.9% during August, likely due to the lagged impact of fuel price increases, as consumers received a temporary reprieve.”

The SARB warns that inflation, while still in its target range, is likely to continue moving away from the mid-point. Remaining accommodative, given the particularly poor domestic economic growth prospects, the SARB maintains inflation targeting as its primary mandate. The public may therefore expect a tightening cycle, unless there are material changes.

Bonds

South African fixed income markets were largely unchanged during September: The ALBI closed 0.25% higher and inflation-linked bonds gained 0.43%. The SARB has a proven track-record in inflation-targeting, and the government has demonstrated its commitment to fiscal discipline through restructuring state-owned enterprises (SOEs) and the state capture enquiry.

“These measures mean that South African bonds are likely to gain appeal, even as the US Federal Reserve Bank raises interest rates and Emerging Market (EM) risk remains elevated.”

The Federal Reserve raised interest rates by 0.25 basis points (bps) at its September meeting, while the European Central Bank (ECB) left interest rates unchanged. Both moves were in line with market expectations, and September therefore saw a degree of calm return to financial markets after a noticeably volatile August. As risk aversion ebbed, government bonds restored some of their year-to-date gains and government bond yields were higher. The 10-year T-bills closed at 3.06%, while equivalent Bunds and Gilts closed at 0.47% and 1.57%, respectively.

In Italy, the government agreed to a higher-than-expected budget deficit of 2.4%. This raised eyebrows amongst European Union peers (as it appears to run counter to Rome’s commitment to fiscal discipline) and leading bond yields in peripheral Europe rise more than expected. Italian yields closed more than 45 bps higher, at 3.15%. The BarCap GABI closed 0.86% lower in USD.

“EM bonds, despite a tumultuous quarter, saw hard currency sovereign and EM corporate bonds tick up, although local currency bonds were lower.”

Much of the EM-risk aversion was sparked by idiosyncratic domestic political risks in Turkey, Argentina and Venezuela; renewed geopolitical risk regarding Russia, the Korean peninsula, Iran, the Middle East; and increasing US trade tension with China.

The Turkish government has seen total foreign-currency denominated debt rise to 70% of GDP (versus 30% in South Africa) leaving it extremely vulnerable to changes in offshore investor sentiment. The Turkish government, however, surprised markets with strong policy action and EM bonds experienced some respite – the JP Morgan EM Bond Index global spread dipped 10 points overall. Nonetheless, local currencies and local currency bonds therefore felt the risks more.

High yield bonds closed at 2.1%, outperforming government and investment grade peers, and boosted by higher energy prices and a return of risk-appetite. Global investment grade bonds provided a 0.6% return, but performance was mixed across sectors. Europe saw a particularly solid performance from the transportation sector and technology companies, and corporate issuance was strong. Amongst the companies to issue, Vodafone raises Euro 18.4 billion in the largest corporate hybrid issuance for the year (hybrids are bonds with equity-like characteristics).

Equity

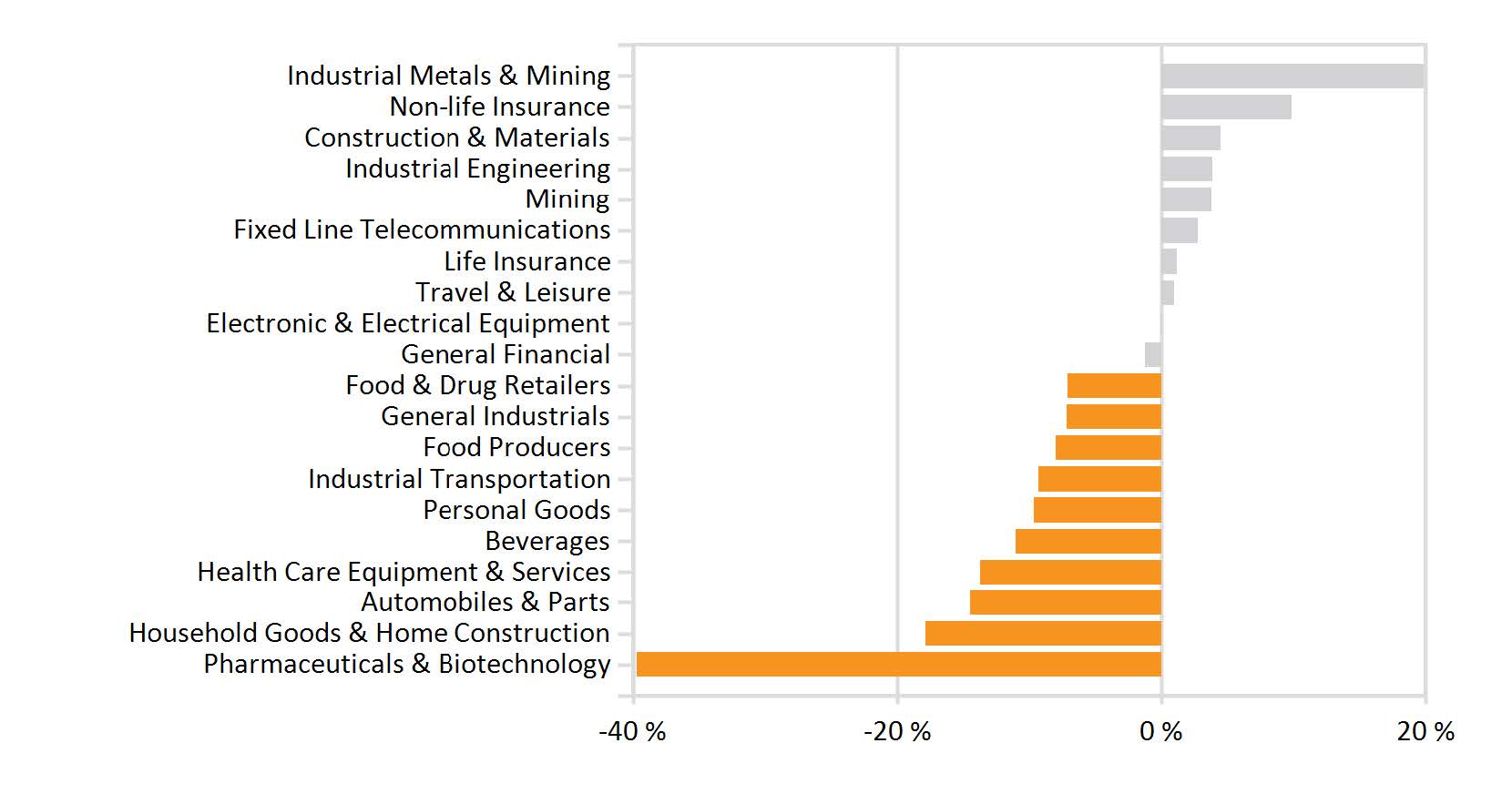

South African equities underperformed global peers. The ALSI closed 4.17% lower, while the MSCI EM lost 0.53% and the MSCI World was up 0.56%.

The local bourse saw returns tempered by a firmer rand, and particularly poor sectoral performance from industrials – the sector lost over 7%. Amongst Industrials, dual-listed large cap rand hedges underperformed. MTN was one of the more volatile stocks in the telecommunications sector, as the company saw sentiment swing wildly: The stock has plunged over 27% as the Nigerian government made a claim for a $8.1 billion refund on 29 August.

“However, the biggest detractor was industry heavyweight Naspers (NPN). The share fell more than 32% during the month, after the company announced the unbundling of its video entertainment operation.”

The company expects that the new company, Multichoice Group, will list on the JSE in the first half of 2019. Investors, though acknowledging the positives (including economic transformation, and the company’s long-term strategic direction) were somewhat unsettled by the announcement.

Credit ratings agency, Moody’s released a mid-month research note indicating its belief that spin-off would reduce the firm’s business diversity and impact the cash available for debt servicing (given that the video entertainment operation was one of the more mature investments, yielding stable cashflows and dividend yields). The note, however, went on to confirm that cash generation from e-commerce operations and sizeable holdings in Tencent remained supportive of credit fundamentals. NPN’s September losses perhaps unsurprisingly echo the 35% loss that Tencent has suffered since January.

“The Chinese company, however, has bought back shares for the first time since 2014, fuelling speculation that a rebound may be on the cards.”

On a sectoral basis, Resources outperformed, edging up just over 1% and bringing the year-to-date gains to over 20%. This is in line with gains in the Bloomberg Commodity Price index (rising just over 1.9% in September) and with improved growth prospects in China. The mining sector was also boosted by the Department of Mineral Resources announcement that some of the provisions of the final version of the Mining Charter would be eased, although the BEE ownership target would remain. Trade and tourism related stocks were boosted by the positive amendments to visa regulations announced by South African President Cyril Ramaphosa, which are also aimed at attracting much-needed foreign skills.

Property

Listed property markets shed just over 2.5% in September. The sector continues to face noticeable headwinds – the recent announcement that South Africa has entered a technical recession has highlighted poor economic growth prospects.

There are still notable pockets of opportunity, with some companies benefiting from their exposure to and diversification into South Eastern and Emerging Europe. MAS, for instance, has reported distribution per share growth of 30% for the 2018 financial year. On the local domestic front, consumers are still heavily indebted, and the decision by the SARB to leave rates unchanged (and therefore the base home loan rate at 10%) may encourage some buyers.

“Given the poor economic outlook, and the SARB’s more hawkish tone, home-buyers may look to take a leap while interest rates are still at the lower-end.”

The South African property market remains somewhat skittish, however, with many buyers adopting a ‘wait-and-see’ attitude. The market is likely to wait for a greater degree of policy certainty, particularly around the issue of land expropriation without compensation.

Global Property slightly outperformed South African markets, with the FTSE EPRA/NAREIT closing -2.37% lower. Global property market prospects appear to be increasingly sensitive to interest rate movements: As ultra-accommodative policy eases, and inflation rises, investors become more focused on the inflation-hedging ability of long-term leases.

“Niche-specific characteristics continue to favour the logistics and e-commerce related sectors, both in Europe and the US.”

The German residential sector continued to provide positive returns within Europe, while Singapore yielded 0.85% within Asia, making it a global star performer. The overall improved economic growth outlook means that real estate fundamentals remain healthy, offering opportunities for astute investors.

International Markets

Global equity markets proved to be fairly resilient, even in the face of rising trade and geopolitical tension. The US registered its strongest quarterly growth in five years, and the S&P500 ended 0.57% higher.

In terms of market performance, a new sector was added to the S&P500 at month-end, causing some rebalancing and perhaps making it more difficult to unpack performance on a sectoral basis.

“The change sees the communications services sector replace the small telecommunications services sector.”

It includes a number of heavyweight stocks previously included in the consumer discretionary sector, including Alphabet, Netflix and Facebook. US growth data continues to be upbeat, with recent consumer and business sentiment surveys showing that confidence is at a multi-year high. In the UK energy counters surged ahead, and sterling weakened on fears of a hard Brexit. The resource, mining and oil-and-gas rich FTSE100 found both factors to be tailwinds, and ended the month just over 1% higher.

“Beleaguered Prime Minister Theresa May is finding it increasingly challenging to keep her constituency appeased, as evidenced by recent calls for new party leadership and a second referendum.”

While retail sales have been surprisingly upbeat (ticking up 0.3%), consumer confidence has dipped. Business owners too are feeling the pinch: UK manufacturing exports slumped to their lowest level in two years; businesses are reportedly slowing their pace of hiring and business confidence is lower.

With the tension around Brexit far from resolved, the Eurozone was somewhat lacklustre. The STOXX All Europe closed 0.52% higher. Trade war rhetoric, migrant tension and Italian budget concerns added to Brexit-related worries. On the macroeconomic front, ECB President Mario Draghi noted the ‘relatively vigorous’ pickup in inflation and the modest uptick in wage growth as particularly positive.

“European stocks lost some momentum toward month-end, as the Italian government’s budget vote flew in the face of EU guidance”

The government approved a wider-than-expected goal of 2.4%, affirming fears that populist coalitions were willing to breach EU-deficit targets in order to fulfil campaign promises. This sparks concerns regarding fiscal discipline in other peripherals, including Spain and austerity-hit Greece.

The European Union’s Economic Sentiment indicators also fell during September, to their lowest level in more than a year. To date, the impact of trade tariffs and escalating tension is difficult to quantify, but it is to be noted that Europe’s manufacturing export boom has reversed trend, and the Eurozone trade surplus declined. Amongst the sectors that are notably impacted by trade concerns are vehicles and food and drink – both on Brexit-related issues and with regard to US tariffs.

“Japanese stocks posted solid gains, despite the country being hit by a series of natural disasters. The Nikkei ended the month up 6%.”

A noticeably weaker yen boosted the prospects for healthy corporate earnings growth, and spillover trade tensions were soothed somewhat by a new round of talks between Japanese Prime Minister Shinzo Abe and US President Donald Trump. Trade tension nonetheless lead broader Asian markets lower.

Chinese equities softened, as the US escalated its trade war with Beijing, and tit-for-tat tariffs were imposed on over USD 250 billion of goods. Offshore sentiment toward China, however, was positive: both the MSCI and FTSE Russel announced that more mainland shares would be added to their flagship equity indices during the first half of 2019 (the MSCI is set to more than quadruple the share).

Elsewhere in Emerging Asia, Indian markets were laggard, with the SENSEX declining more than 6%. The oil-importing country has been hurt by increasing inflation and a widening trade deficit as oil prices continue to rise.

“Outside Asia, Latin American and Emerging Middle East and African markets posted stronger results. The regional gainers were boosted by higher commodity prices and by some respite from cross-border tension.”

Mexican equities were buoyed by the tri-lateral trade agreement with the US, and by respite from anti-migrant sentiment (the month saw record amounts of cash being remitted by Mexicans working in the US). Brazilian equities weathered the growing uncertainties around October’s presidential election, ending the month nearly 3.5% higher.

Argentine markets, however, continued to be extremely volatile. The peso has continued to lose ground, inflation is rampant, and the country has seen itself turn to the IMF for an additional bailout – sparking widespread anti-austerity protests.

“In EMEA, the Turkish government took decisive steps to address inflationary concerns – hiking interest rates by a higher-than-expected 675 bps.”

This has been hailed as positive by international investors, somewhat stemming concerns regarding systemic vulnerability and capital flight. Russian markets were amongst the star performers, boosted by its Central Bank action and strong energy counters, despite still-simmering spy-and-election-meddling tension with the EU and US.

African markets performed poorly, with the MSCI EFM ex SA lagging (at -4.7%), the MSCI EM (-0.53%) and the MSCI BRICS (-1.12%).

Currency

In currencies, the USD Index was flat in September and currency pairings were mixed. The yen depreciated sharply, while the Canadian dollar strengthened on positive trade talks. The Turkish lira was boosted by strong policy intervention, and the Russian rouble surged in line with energy-sector strength (up 8.2% and 2.8%, respectively).

“The South African rand too managed a solid gain, although the currency has been extremely sentiment-prone and remains vulnerable.”

The Bloomberg Commodities Index posted a solid 3.9% return, led by substantial gains in the energy sector. Oil prices hit over USD 80 per barrel – levels last seen in 2014 – and a gain of over 9% for the month. South African consumers are not alone in feeling the impact, with widespread protests in even developed nations (such as Germany).

“The weak rand and increased domestic taxes, however, mean that South African motorists have been harder hit than most.”

Anecdotal evidence shows that the fuel levy (including the Road Accident Fund and tax) has increased by more than 150% since 2008, a litre of petrol at the coast will cost you R16.49 versus R9.17 10 years ago and inland prices have hit a record-breaking R17.08. Industrial metals were slightly higher (+1.4%) on largely positive macroeconomic data, while gold dipped (-0.7%) as safe-haven demand ebbed.

Performance

World Market Indices Performance

Monthly return of major indices

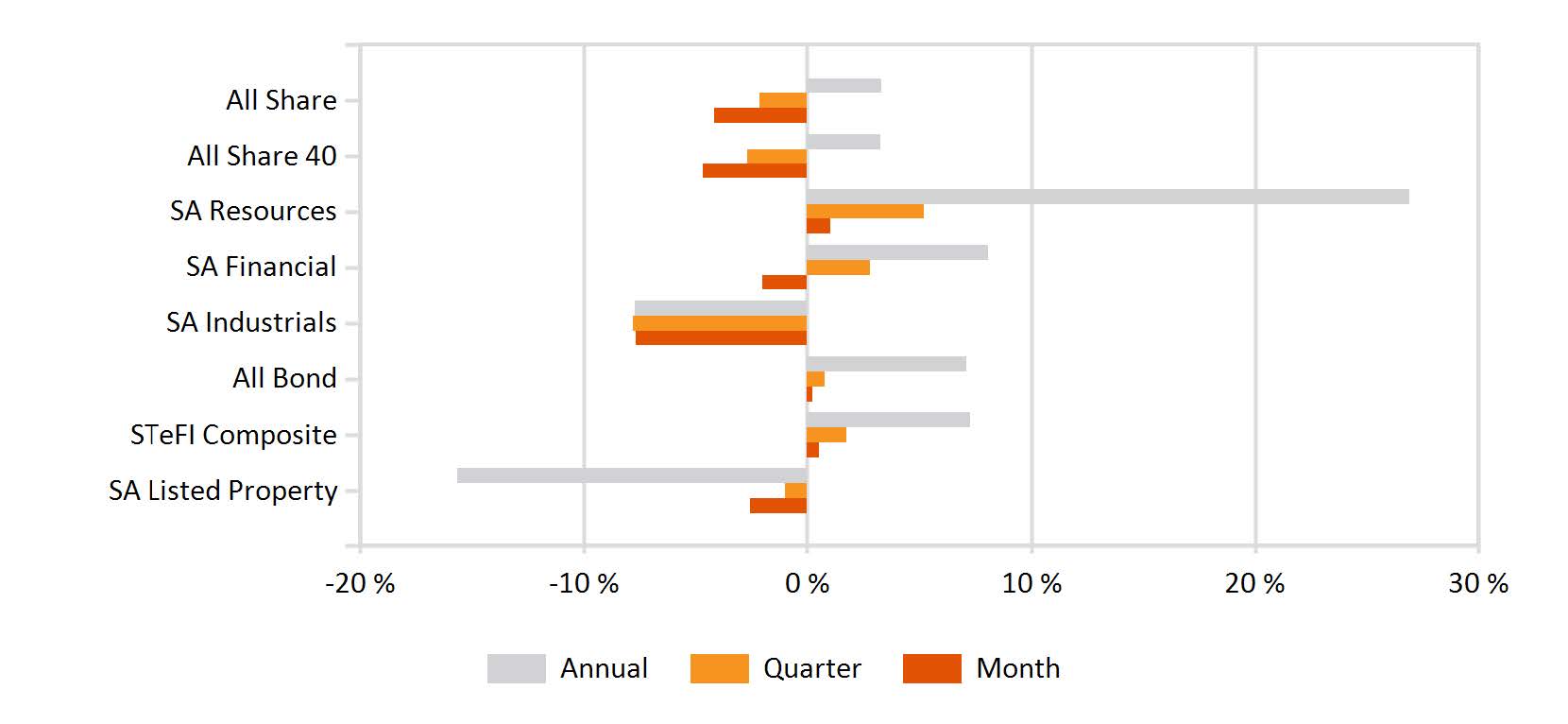

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance