Market Commentary: October 2022

Global Market Themes: Narrative of global slowing in place of interest rate hikes buoys risk assets Third quarter company earnings in line or better than expected, supporting equities Appointment of new prime minister provides stability for UK markets Xi Jinping secures third term. No end to zero-Covid policies SA Market Themes: Domestic markets post strong recovery Inflation slows marginally to 7.5% in September Tax collection benefits from higher global commodity prices Debt-to-GDP estimated to peak at 71.4%

Market View

Global Market Themes

Markets closed higher in October as extremely negative investor sentiment coming into the month, gave way to optimism that major central banks would slow the current pace of interest rate hikes. This optimism buoyed all major risk assets, supported by the primary line of thinking that a slowdown in the pace of rate increases is a signal that the global monetary policy tightening cycle underway is closer to its end. This, to a degree, reduces uncertainty around the future path of global short-term rates. Developed Market (DM) equities performed strongly off the back of this evolving market narrative, and the MSCI World Index returned 7.2%. The Emerging Markets Index was dragged lower due to weak Chinese equity markets, leading the headline index to post a 3.1% decline. Global bonds were marginally negative: the Bloomberg Barclays Global Aggregate Bond Index returned -0.7%. Consumer price inflation remains stubbornly high globally relative to government and corporate bond yields, meaning this asset class remains unattractive. On commodities, gains in energy prices offset weaker agricultural and precious metal prices. The S&P Goldman Sachs Commodity Index returned 6.7%.

US equities appear to have looked through the central bank’s latest comments (as captured in the Federal Reserve Bank’s September meeting minutes released mid-October), that inflation remains unacceptably high and therefore continued monetary policy tightening remains the way forward. Notably, the bank indicated that the risk of doing too little (high inflation becoming economically embedded over the long term) far outweighs the risk of too much in terms of hike rates today and into the short to medium term. Chairman Jerome Powell has already indicated that the bank is willing to accept rising unemployment and economic pain (a mild recession) to combat inflation. With this context, the latest inflation print was surprisingly on the upside, coming in at 8.2% year on year.

Labour market data showed continued strength and the 10-year bond yield rose a further 20 basis points over the month to close above 4% – a level last seen in late 2007.

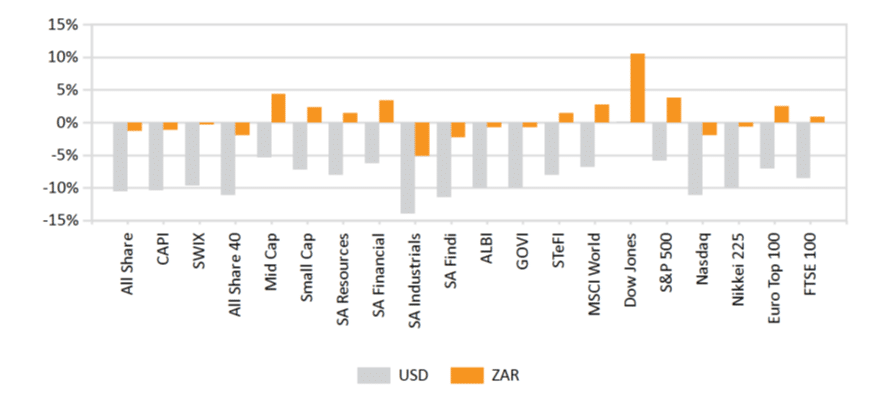

Beyond the narrative of a slowdown in the pace of global rate hikes, US equities found further support in October through better-than-expected third quarter company earnings. At the end of the month approximately three quarters of companies had posted results stronger than expected, with this quarter’s reporting season now halfway done. The energy sector saw robust earnings results, while selected retail counters posted materially weaker results. Of the three major equity indices, the Dow Jones Industrial Average led the way, returning 14.1%, the S&P500 gained 8.1%, while the NASDAQ Index returned 3.9%. The spread of returns here indicates the relative outperformance of value-over-growth counters.

The European Central Bank (ECB) added 75 basis points to the Eurozone’s baseline interest rate, bringing it to 2%. The bank noted that the region is likely to be entering a recession in 2023. Preliminary economic growth data signalled that the region grew by 0.2% quarter on quarter for the third quarter, following a 0.8% expansion in quarter two. Consumer price inflation hit a new annualised high of 10.7% in October, driven primarily by energy costs. Concerns over shortages of natural gas during the winter season eased somewhat as storage facilities across the region were at or near capacity at the end of the month. An increase in gas imports, implementation of measures to reduce energy consumption at both household and business level and a warmer than anticipated autumn all played a part in easing energy worries.

European equities closed higher in October. The MSCI European Economic and Monetary Union (EMU) Index, a broad measure of the region, gained 8.9%. Third quarter earnings showed resilience here too, as energy and industrial counters led markets higher, while the consumer discretionary and staples sectors proved the weakest. The ECB’s comments regarding an impending recession fuelled the notion that the bank would likely slow the pace of its monetary tightening, thus buoying equities across the region further.

Markets in the United Kingdom (UK) responded positively to the appointment of Rishi Sunak as prime minister. The UK 10-year bond yield fell from north of 4% to the 3.5% level, a sign of returning stability to the domestic bond market.

Sunak is seen as fiscally conservative with prior experience as Chancellor of the Exchequer, head of the UK Treasury. The Bank of England’s conclusion of its temporary bond-buying programme provided a further immediate-term tailwind for UK bonds in October. Equities, per the FTSE 100 Index, added 6.1% over the month. Broadly speaking, the most economically sensitive segments of the equity market performed strongly, despite the latest economic growth data showing a surprise monthly contraction of 0.3%. Meanwhile, business surveys suggest this weakness is set to continue in the fourth quarter, while initial Purchasing Manager Indices (PMIs) data for October signal the same thing, thus adding to concerns of an imminent recession in the UK.

Xi Jinping secured his third term as Chinese president following the country’s 20th National Party Congress in the middle of the month. Much of the public remarks made during the week-long event emphasised the need for an increased focus on domestic security. This focus was driven home by the latest appointments to the seven-member Politburo, the highest decision-making body in the country. New appointees overwhelmingly possess intelligence backgrounds. Markets fell on the Monday following the Congress’s closure and continued to sell off for the remainder of the month. Investors appeared to be pricing in concerns that Xi would continue policies focused on reducing the country’s exposure to foreign influence at the expense of domestic economic growth. This carries negative implications for business in China. Furthermore, news that the country’s zero-Covid policy would not be relaxed in the near term added further fuel to the sell-off. The Shanghai Shenzhen CSI 300 Index lost 10.1% during October.

Weighed down heavily by Chinese equities, Emerging Markets (EM), per the headline MSCI EM Index, lost 3.1%, despite its Developed Markets peer group benefitting from the short-term tailwind narrative of a slowing pace of global rate hikes. Indonesia and Thailand bucked the trend in the aggregate index, returning gains for the month. Equity markets of oil-exporting countries – Kuwait, UAE and Saudi Arabia – were supported by a rise in oil prices due to the decision by the Organisation of Petroleum Exporting Countries (OPEC) to cut its collective production quotas. In the Americas, both Mexico and Brazil beat the headline index thanks to currency strength relative to the US Dollar. A further positive for Brazil was the conclusion of national elections which helped volatility subside.

All returns above are in USD.

South African Market Themes

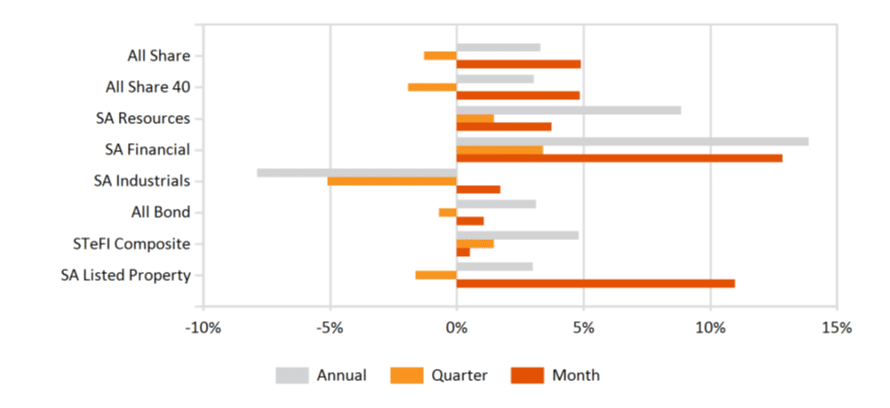

Local equities ended the month higher. The All Share Index gained 4.9%, while the SWIX added 5.0%. This strength was centred on the Mid-Cap index, which returned 8.1% as the large and small capitalisation indices added 4.9% and 3.5%, respectively. In terms of sectors, Financials led the way, recovering by 13.2% to end a four-month losing streak. Resource counters collectively gained 3.7%, with Industrials adding 1.7%. The Rand weakened by 1.5% against the US Dollar, closing the month at the R18.35 level. Year to date, the currency has weakened by 15.2% against the Greenback, the latter’s strength a function of the relative increase in short-term rates throughout 2022, which has attracted capital back to the world’s largest economy. Fixed income assets diverged on a nominal versus real basis, the All Bond Index rose by 1.1%, while the Composite Inflation-Linked Index declined by 1.3%. Listed property posted a strong recovery, with the All Property Index gaining 10.5%.

Annualised Consumer Price Inflation slowed marginally to 7.5% in September, down 0.1% from the previous 12-month period and the high of 7.8% reached in July.

The headline print was driven mostly by higher prices for food and housing/hotels, while transport inflation slowed notably. Rand weakness continues to drive up inflation as exchange-rate-sensitive goods – such as vehicles and vehicle parts, household contents and alcoholic beverages – show accelerating price gains on an annualised basis. Market consensus is that the SA Reserve Bank is likely to raise the repo rate by 50 basis points at its November meeting, bringing the reference rate to 6.75%. Analysts see this as the likely peak in rates for the current cycle but note that upside risks to this forecast remain.

The National Treasury’s medium-term economic forecasts published late last month expect the local economy to grow by an average annual rate of 1.7% from 2022 until 2024. The Treasury anticipates inflation will moderate somewhat to average 5.5% per year over the same period. Both forecasts appear to be broadly in line with market consensus.

Tax revenue has exceeded the government’s February 2022 assumption of R83.5 billion for this fiscal year. This is thanks to higher commodity prices, which has supported mining revenues and in turn buoyed corporate taxes collected. This factor contributed to approximately 75% of the tax collection overshoot. Custom duties and personal income taxes accounted for the remaining 25% of the overrun. The government now expects tax revenues in the coming two fiscal years to amount to R94.7bn and R99.7bn, respectively. The Treasury anticipates the tax windfall from higher global commodity prices to peter out over the next two years, with the slowdown in Chinese demand being the primary reason. The Treasury has earmarked this better-than-expected collection for supporting state owned enterprises, reducing the government’s total borrowing requirements and partially offsetting higher-than-forecast debt-servicing costs. With the above in mind, the Treasury estimates South Africa’s gross debt-to-GDP ratio will peak at 71.4% in the current fiscal year, declining to 70.4% in the 2024/2025 fiscal year. Relative to our EM peers, which carry an average debt ratio of 65.1%, we remain elevated, but are well below DM countries, which average 112.4%.

All returns above are in ZAR.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices