Market Commentary: October 2021

Global Market Themes: Global equities stage broad rally, led by Developed Markets (DM) Emerging Markets (EM) post lacklustre returns, amidst China-spill over impacts United States (US) equities post fresh record highs Global property rebounds, as Evergrande fears ease Slowing Chinese demand a drag on iron ore and coal, other commodities soar SA Market Themes: South African equities post solid gains, with resources leading the way Economic recovery threatened by new bouts of load shedding Composite Purchasing Managers’ Index signals economic contraction Rand weakness continues Inflation trending higher ahead of November Monetary Policy Committee (MPC) meeting

Market View

Global Market Themes

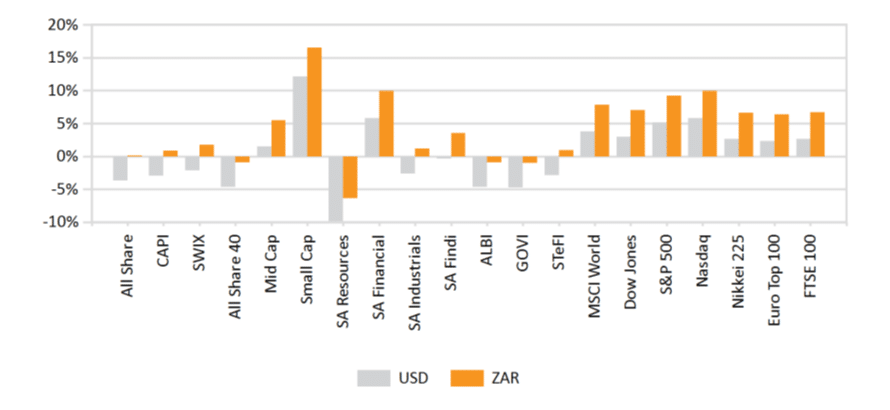

Developed Markets (DM) staged a resounding rally, with the MSCI World gaining more than 5.6% in US dollar (USD) terms. Overall, Emerging Markets (EM) gave a lacklustre performance, with fears of a slowdown in Chinese growth spilling over elsewhere. The MSCI EM closed just under 1% higher. Within EM, however, widely disparate performance numbers were evident, with Russian equities a star performer.

United States (US) markets surged higher, and the S&P500 notched up a 7% gain in USD. Earnings expectations for the third quarter (Q3) were largely upbeat, lifting major indices.

“Investors were reassured by the positive update from Caterpillar Inc. (the well-known construction machinery and equipment company), as it is often seen as a bellwether stock.”

It can be thought of as a virtuous cycle: Due to an increase in demand for premises or facilities, construction activity increases. Higher demand likely signals a growing economy. The uptick in construction activity is also beneficial for job creation or better pay for salaried workers. This increases the spending power of the average citizen, leading to higher demand for goods and services, and further fuelling the virtuous cycle.

Toward month-end, a few earnings misses from major names, including Apple and Amazon, put a damper on investors’ enthusiasm. US labour markets were surprisingly tough for employers – companies such as Starbucks face the twin pressures of labour shortages and higher wage inflation. Americans appear reluctant to return to work, despite several US states scrapping the USD 300 Pandemic Unemployment Assistance before its expiry on 6 September. At 4.8% (September), the US jobless rate remains well above the pre-crisis level of about 3.5%. The most recent ADP report shows that, while hiring is increasing and 571 000 jobs were added in October, there are still more than 10 million open jobs.

The mixed economic indicators, including a lack of consumer confidence, have not dissuaded the Federal Reserve Bank from their hawkish stance, and plans remain afoot to taper quantitative easing to a full stop by mid-next year. The Fed believes that current inflation, which is at a 30-year high, is transitory. Analysts’ predictions proved true, as the Fed announced early in November that it would begin scaling back its massive USD 120 billion monthly bond-buying programme from November 2021. US bond yields were largely higher, with the appetite for bonds waning on expectations of Fed tapering. The US 10-year Treasury yield increased from 1.49% to 1.56% during the month.

“On the political front, wrangling over the USD 1.2 trillion bipartisan infrastructure bill and the social spending plan took centre stage. At month-end, the much-vaunted Infrastructure Bill found overwhelming support in the Senate.”

It is faced with a potentially rocky and time-consuming path in the House of Representatives. However, House Speaker Nancy Pelosi has said that the majority of the Progressive Caucus will not approve the bill until Senate passes an even more ambitious USD 3.5 trillion social spending plan. The infrastructure plan will deliver USD 550 billion in new federal investments in America’s infrastructure over five years and Democrats claim that the bill will pay for itself through a multitude of measures. The Congressional Budget Office brushed aside several of the pay-for provisions, ultimately finding that the bill would add USD 256 billion to the budget deficit over the next ten years, as the government would have to borrow extensively to fund it.

European shares posted solid gains in October, with the STOXX All Europe gaining 4.5% for the month. Third-quarter earnings reports showed evidence of healthy demand, though supply-side and cost pressures are likely to come to the fore in the coming months. Top-performing sectors included utilities, information technology (IT) and consumer discretionary. Eurozone growth beat expectations, with quarter-on-quarter growth hitting 2.2% for the third-quarter. This leaves the Eurozone’s level of economic activity at only 0.5% below its pre-pandemic levels.

“Within the Eurozonethere were disparities. The Spanish government reluctantly gave up its plans to impose additional taxes on utility companies, which helped boost stock prices in southern European states. “

Higher energy prices continue to be a boon to Russian equities, with the IMOEX gaining 1.7% for the month in local currency terms and delivering more than 26% for the year-to-date. German stocks ticked higher, with the DAX delivering 3.6% for October.

Supply-side constraints were also more broadly evident in Europe: forward-looking data indicates that supply bottlenecks are likely to start weighing on growth. The Eurozone’s Composite PMI fell to 54.3 in October 2021. While this is still in expansionary territory, it is the slowest expansion in business activity in six months. This is largely attributable to supply-side bottlenecks, including in the energy sector, and fears regarding the resurgence of COVID-19 due to new variants.

The European Central Bank (ECB) notes that inflation has hit a 13-year high, at 4.1% in October 2021, largely due to aforesaid supply bottlenecks and rising energy costs. It has not indicated any significant change to its policy stance. Bank President, Christine Lagarde, reiterated at its latest monetary policy meeting that the current inflationary pressure is regarded as transitory, and that the bank is in no hurry to tighten policy.

The FTSE 100 posted a more modest gain than its Eurozone peers, ending the month 2.2% higher in local currency terms. Higher oil prices continue to be a boon to United Kingdom (UK) stocks. Greater stability in Chinese markets also helped the recovery of some of the UK large-cap stocks, which have notable exposure to China. In addition, the third-quarter earnings season got off to a strong start, with financials performing particularly well. Domestically focused stocks suffered as a result, particularly consumer-facing sectors, such as housebuilders. UK retailers also struggled, as rising COVID-19 infections sparked fears of new restrictions. Supply-side shortages, partly due to soaring energy costs and shortages in raw materials, staff and certain skills, are likely to drive inflation higher.

“Analysts suggest that the UK’s GDP growth rate will be far slower for the third-quarter than the second, with estimates at 1.5% (versus 5.5% in Q2).”

October saw a recovery in Chinese equities, with the MSCI China and MSCI China A Onshore closing 3.2% and 2.2 % higher respectively. The People’s Bank of China (PBOC) in an attempt to boost flagging growth, gave the market a CNY100 billion injection, capping off the biggest injection in nearly two years. One of the reasons for the rebound in Chinese equities is that the beleaguered property sector shows signs of settling down. Evergrande reportedly made the required coupon repayment ahead of its deadline, thereby avoiding default for the second time in as many weeks. Contagion concerns linger with S&P noting that nearly a third of Chinese developers face some refinancing pressure in 2022.

China’s GDP growth rate slowed down in the third-quarter, dipping by 3% from the second quarter to reach 4.9% year-on-year. Economic data from the powerhouse has been mixed: While retail sales have grown by 4.4% year-on-year, they remain below pre-pandemic levels. The Caixin China General Composite PMI inched higher 0.1 points to 51.5, confirming an economy in expansionary territory. Exports rose by 28.1% in October, largely fuelled by demand from Southeast Asia and Developed Markets.

“The Chinese government set a goal of 6% annual growth at the beginning of 2021. It is achievable, but unlikely given that it is currently hampered by supply chain bottlenecks, new COVID-19 outbreaks and dire power shortages.”

Flooding across China’s key coal-producing provinces, resurgent demand for Chinese goods and conflicting Chinese Communist Party energy policies took their toll. In addition, artificial market distortions, including power rationing and price controls, have contributed to the energy shortage. Power rationing is in place for more than a dozen Chinese provinces and some provinces have ordered factories to halt production for several days a week.

Aside from oil, commodity markets were broadly stronger. Industrial metals delivered a solid performance due to the easing of COVID-19 restrictions and the resultant pent-up demand. Copper and Platinum prices rose by 9.7 and 5.7% respectively. Precious metals also ticked upward, with Gold achieving a 1.5% return. Oil, however, remains the slickest operator: Prices have surged by 61.6 % for the year-to-date.

South African Market Themes

South Africans headed to the polls to cast their ballots in the local government elections on 1 November. Analysts predicted that voter turnout would be poor, as the general populace became more disillusioned with the political process. It was also predicted that there would be more hung councils, where no outright winner could be declared and where coalitions would need to be formed. Both the predictions were borne out.

The South African Rand had a tough month and weakened even further at month-end to close at R15.30 to the USD. A combination of factors weighed on the local currency, ranging from purely domestic issues to global market sentiment. On the domestic front, stage four load-shedding, implemented at short notice by Eskom, is likely to have weighed on investor sentiment, as did uncertainty ahead of the 1 November election. On the international front, the Fed’s warning regarding the normalisation of interest rates sent global bond yields higher, dimming the lustre of riskier assets such as the Rand. Over the course of the month, the rand depreciated by 1.4%.

“This has not boded well for motorists, who were already facing rapidly climbing petrol costs. Over the course of the year, the petrol price has increased by a whopping R4.68 (inland for unleaded 95) – an increase of more than 33%!”

To date, this increase has not been fully passed on to consumers, but inflation is hotting up. It accelerated in September 2021 to 5%, above the 4.5% mid-point target from the South African Reserve Bank (SARB). Inflationary pressure is beginning to build, and the SARB may well feel the need to tweak interest rates. Whilst the Bank has thus far held back, it may be forced to reconsider at the next meeting of the Monetary Policy Committee (18 November). The Quarterly Projection Model indicates that a 25bps hike in the repo rate is on the cards in the fourth quarter of 2021.

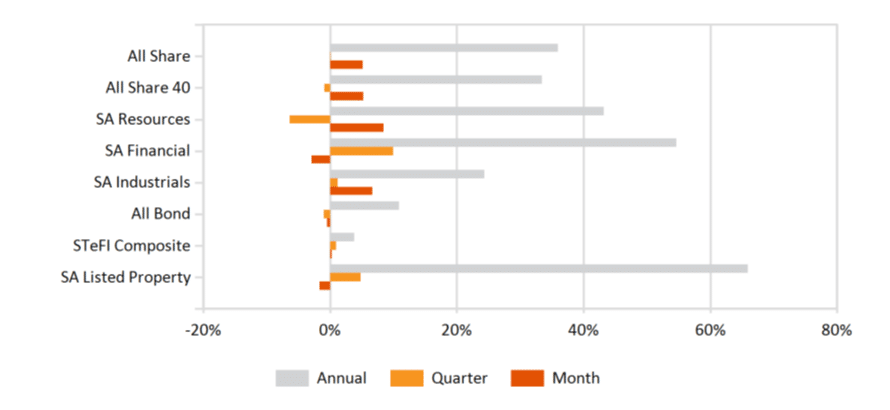

As inflation ticks higher, inflation-hedging assets have become more attractive. Inflation-Linkedbonds (ILBs) provided a return of 0.5% for the month, bringing the year-to-date gains to 10.5%. Local listed bonds had a lacklustre month, and the All Bond Index (ALBI) closed 0.5% lower. The local listed property had a dismal end to the month, losing more than 1% on the last trading day. This, perhaps, is partly a reflection of the political uncertainty ahead of the local government elections. The All Property Index (ALPI) closed 1.39% lower.

“The South African Property Owners’ Association (SAPOA) released its third-quarter report toward the end of October. The report shows that the office vacancy rate has hit a new all-time high of 15.4%.”

The report also predicts that mixed use developments and co-working spaces will continue to lead the way, based on the change in demand due to the impact of the COVID-19 pandemic.

South African equities followed global peers higher. The All Share Index gained 5.1%, while the Capped SWIX (the Shareholder Weighted Index in which the holdings of Naspers/Prosus is capped) was 2.7% higher. The resource sector shone during October, with the subindex delivering a return of 8.4%. Industrials were not far behind, gaining 6.7%. Financials, however, detracted from performance, losing 3.2% for the month. Resource counters delivered double-digit returns: AngloGold Ashanti stocks appreciated by a whopping 20%, Anglo Platinum followed close on its heels, at 18% and Impala Platinum delivered 15%. Market behemoth Naspers provided a solid return, reversing some of the prior month losses and gaining just short of 4% for the month.

November is likely to be an interesting month in South African stock markets, as several companies deliver their third-quarter earnings reports. Many companies were badly affected by the looting in July, and this is likely to have had an impact on earnings per share. One such company, Tiger Brands, suffered a double whammy.

“Subsequent to the looting, it was forced to recall 20 million KOO and Hugo’s canned vegetable products due to potential defects in the cans. It is estimated that this will have cost up to R3.18 in earnings per share.”

Nonetheless, the outlook is that headline earnings per share (HEPS) from total operations will increase between 15% and 25% compared to 2020. Tiger Brands is not the only company with an optimistic outlook, and as results are released in mid-November, traders are likely to keep a close eye on the market.

In other company news, Steinhoff, once the darling of the South African stock exchange before its fall from grace, sees its woes continue. In early September, Presiding Judge Slingers ruled that the liquidation bid the company faced in the Western Cape High Court be upheld. Steinhoff sought leave to appeal, on the basis that the company is registered overseas, and its apex holding company is based in Amsterdam. The matter will now be heard by the Supreme Court of Appeal (SCA). Commentators question whether the repeated requests for leave to appeal and postponements by Steinhoff’s lawyers border on abuse of process, and are little more than an attempt to avoid questions regarding whether it is insolvent. Steinhoff shares declined by 16.6% during the month.

October saw a contraction in the country’s private sector, with the IHS Market South Africa Purchasing Managers’ Index (PMI) falling to 48.6, its lowest level since July 2021. Output and new orders were sharply lower, due to shortages of raw materials and a two-week strike by the National Union of Metalworkers (NUM).

“The resultant lay-off of staff does not bode well for the country’s rampant unemployment figures. Analysts predict that the third-quarter release will see the unemployment rate increase from 34.4% to above 35% – more than a third of the potential workforce is unable to find work in the current economic environment.”

Against this backdrop, local politics and local policy will come under sharp scrutiny in November. Political parties will look to solidify the coalitions needed to govern in hung municipalities, and Finance Minister Enoch Godongwana is set to deliver his first medium-term budget in November.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices