Market Commentary: October 2020

Global Market Themes: Developed market equities underperform Emerging Market (EM) Chinese equities lead EM higher as China set to record positive economic growth in 2020 US GDP growth recovery threatened by a lack of agreement on renewed fiscal stimulus Tech earnings slump as executives are grilled by US Commerce Committee Lockdown 2.0 threatens Europe’s nascent economic recovery Oil prices slump on COVID-19 demand and election speculation SA Market Themes: Local equity markets struggle, led lower by diversified miners MTBPS signals political commitment to structural reform despite concerns around SAA bail-out Expropriation Bill signals certainty around Expropriation without Compensation Post-COVID-19 Recovery Plan outlines five pillars to boost GDP growth

Market View

Global Market Themes

October proved to be a somewhat tumultuous month for developed markets. The MSCI World closed 3% lower in US dollar terms, while Emerging Markets easily outstripped developed market peers. The MCSI Emerging Markets Index closed 2% higher, led by resurgent Chinese equities. Global news was dominated by the run-up to the US election and by the alarming increase in coronavirus cases in major developed market economies. The S&P500 closed 2.6% lower, as pressures mounted ahead of the hotly-contested elections.

Chinese equities led Emerging Markets higher. China A-shares closed 3.5% higher in US dollar terms, while the MSCI China Index registered a 5.2% increase.

“Within Asia, new infections have slowed, and China, the first country to be hit by the virus, has had remarkable success in containing its spread. China is on track to be one of the only major economies to achieve positive GDP growth for 2020, having recorded an annualised 4.9% for the third quarter.”

Chinese consumer sentiment has all but recovered, with September retail sales rising by 3.3% (year-on-year). And, a boon for foreign exporters, Chinese consumer appetite for foreign goods has increased rapidly, with September seeing a 13.2% increase in imports (year-on-year). Sentiment was also boosted by the increasing consensus that a Biden victory would see a more conciliatory stance from the US.

Simultaneously, Chinese digital giant WeChat celebrated a small victory, as the US Appeals court blocked the Trump administration from banning the Tencent-owned application in the USA. The news sent Tencent prices soaring. In other company news, Hong Kong and Shanghai markets were preparing for the listing of Chinese digital finance group Ant Capital, which was expected to be the largest Initial Public Offering (IPO) in history. The listing was subsequently blocked by regulators, citing major concerns including the company’s capital shortfall.

US GDP is recovering, growing at an annualised rate of 33% during the third quarter, and beating estimates, but GDP remains 3.5% lower than pre-pandemic levels. It is to be noted, that increases in personal spending were one of the main drivers of economic growth, and that these were largely driven by the additional unemployment benefits extended under the CARES Act. The US Congress has thus far failed to reach an agreement on the next round of fiscal stimulus, although a Biden victory may result in some progress. Nancy Pelosi, the speaker of the US House of Representatives, has said that the burden is on incumbent President Donald Trump to push forward on stimulus talks.

“Treasury Secretary Steven Mnuchin, on the other hand, blamed Pelosi for holding up an agreement. The bitter finger-pointing on both sides underscores frustrations that a stimulus package to boost the economy in the face of the worsening pandemic has not yet been delivered. Both sides have called out areas of conflict since the White House made its USD1.8 trillion offer on 9 October.”

The ongoing argument between Republicans and Democrats about unemployment benefits perhaps most starkly illustrates where each side stands. The Democrats want a continuation of the monthly USD600 in additional unemployment benefits under the original CARES Act. When Act ran out in early August, President Trump signed an executive order providing for a monthly USD300, which the Republicans are in favour of continuing. The revised payments have either already petered out or will do so by 31 December, leaving millions of unemployed Americans in dire straits. Out of about 22 million jobs lost due to the pandemic, only 11.3 million were recovered. US consumer confidence is in the doldrums, over 20 points lower than in February before the pandemic hit. The October reading was little changed from the previous month. Disconcertingly, Richard Curtin, chief economist and research professor at the University of Michigan’s Survey Research Centre, is quoted as saying that “Fear and loathing created a false sense of stability…” and “loathing was generated by the hyper-partisanship that has driven the election to ideological extremes”.

Technology stocks, having entered October with rather frothy valuations after an unremarkable September, were ripe for profit-taking ahead of earnings results. The Nasdaq composite lost 2.4% for October. It proved to be a mixed bag of quarterly reports. Apple fell over 5% (wiping about USD100 billion off its stock market value) after its iPhone sales missed estimates, although its quarterly revenue and profit beat analysts’ expectations. Twitter reported fewer new users than Wall Street expected, sending its shares 17% lower at month-end. While Amazon reported a record quarterly profit, its shares nonetheless closed lower as the company issued a warning that costs would be considerably higher due to COVID-19 logistical challenges. Even far stronger-than-expected earnings from behemoth Microsoft, with earnings surging 32% for the third quarter of 2020, could not provide sufficient support for the top-tier tech stocks.

“Not helping matters is the fact that the chief executive officers (CEOs) of Facebook, Google and Twitter were up in front of the US Commerce Committee over their content moderation policies. The issue at hand is related to Section 230, a law which protects the companies’ ability to moderate content as they see fit. “

It generally provides immunity for website publishers concerning content posted by third-party users and it means that they cannot be held liable for, inter alia, defamatory statements. In the hearing, some lawmakers simply demanded more transparency, but others used the platform to confront the executives on other topics, including antitrust, misinformation about voting and election interference.

In Europe, a halting economic recovery has been all but scuppered by renewed lockdowns in most EU countries. Despite a record GDP increase for the third quarter, with the Euro Area GDP growth rate reaching 12.7%, GDP is still 4.3% lower for the year-to-date. Governments in major economies, cognisant of the economic impact of nationwide lockdowns, initially attempted a targeted localised policy response. The rapid surge in new cases, however, necessitated national lockdowns in Spain, France, the United Kingdom (UK), Italy, Germany and the Netherlands. Measures of Eurozone activity were mixed. The Composite Purchasing Managers’ Index (PMI) came in at 50 for October, at the tipping point between expansionary and contractionary territory. It is notable for its marked bifurcation between the manufacturing sector, which continues to recover, and the services sector, which remains on shaky ground. Equally concerning is the consumer confidence drop and Eurozone unemployment rate increase, rising to 8.3%. The STOXX All Europe closed 5.1% lower.

UK markets declined sharply at the end of October, as the country was poised for its second lockdown. The FTSE 100 fell 4.7%. After much back-and-forth, the UK furlough schemes, due to end on 31 October, was extended. Given that 9% of the UK’s workforce was still on furlough before the new lockdown, additional fiscal support was clearly on the cards. The perennial issue of Brexit also re-emerged in October.

“The European Council meeting on the 15 and 16 October passed without a deal being struck, the European Union began legal action against the UK government as a result of its internal markets bill and the UK briefly called off talks. Both parties have returned to the table, but any deal is likely to be hard-fought.”

Oil registered sharp declines during the month, as the Brent Oil price slumped 10.3%. Black gold suffered a threefold hit: coronavirus-related lockdowns caused a dip in demand, US crude stockpiles climbed by a record amount, and a Biden victory is likely to herald a move away from fossil fuels as he has signalled his intention to adhere to the Paris accord.

South African Market Themes

South African equity investors had a lacklustre month. The SWIX closed 2.3% lower, with the resource sub-sector leading the decline, losing 10.7% in October. Diversified miners were notable detractors amongst resource stocks. BHP Group fell by 13%, Exxaro Resources lost 12% and Anglo American lost 7% during the month. Naspers and Prosus, off the back of Tencent’s strength, ticked 6% higher. The local listed property sector continues to struggle, having lost over 50% during this year.

“Overall, foreign investors were net sellers of South African stocks ahead of the much-anticipated Medium-Term Budget Policy Statement (MTBPS) from Finance Minister Tito Mboweni. The minister made his statement on 28 October, and perhaps the biggest criticism was levelled against the decision to provide a further bail-out for beleaguered state airline SAA.”

Analysts speculate that this proves that political pressure was brought to bear, as the minister had previously indicated that no additional bailouts would be forthcoming. But perhaps more important points of the MTBPS were overlooked. These speak to the political will to implement much-needed structural reforms. The public sector wage-freeze proposal is one such example. The government has effectively proven itself willing to commit a breach of contract by not paying the third year of agreed salary increments. With the COSATU and other unions up in arms, this is a bold move. Although COSATU is an important ANC partner and were instrumental in President Cyril Ramaphosa’s rise to power, the government is taking them head-on when it comes to this matter.

The MTBPS also saw Minister Mboweni announce steps to make cross-border business easier. This includes the relaxation of rules around inward listings, loop structures and foreign corporate borrowings. At the same time, National Treasury announced that it was exploring the listing of foreign-denominated assets on local exchanges. The announcement builds on the statement in February that South Africa’s exchange control regulations would be phased-out and replaced with a new capital flow management system.

“One of the key takeaways for investors is that all instruments (including debt, derivatives and exchange-traded instruments) which reference foreign assets, but which are inward-listed, are traded in rand and are settled in rand on South African exchanges will be classified as domestic. It removes some of the restrictions for prudential limits under Regulation 28, which South African institutional investors previously faced.”

Two other important political announcements about the economy were also made during October: The Expropriation Bill and the Post-COVID-19 Recovery Plan. The publication of the Expropriation Bill appeared to pass without much comment. However, it finally provides greater certainty to landowners and investors about the circumstances under which Expropriation without Compensation may take place. Perhaps most noteworthy is that the Bill provides for the final adjudication to be made by a court of law. There will be no willy-nilly attempts to unlawfully capture (or hijack) assets.

“President Ramaphosa delivered the Recovery Plan on 15 October. It rests on five main pillars, one covering social support and the other four addressing structural reform. Three of the pillars are particularly interesting to investors, locally and offshore.”

The first is the energy pillar. Private sector producers will create at least 16 000 MW of generating capacity in the next four years. This push should create jobs in construction, in energy and manufacturing and could unleash billions in investment. Loadshedding and the lack of energy security has hamstrung economic growth and foreign direct investment for at least a decade. National Treasury calculates that the energy investment can directly add 0.25% to GDP growth annually, with confidence arising from energy security set to boost growth and investment. The infrastructure pillar is nothing new, with President Ramaphosa having driven this endeavour since 2018. The Infrastructure Fund took two years to come to fruition, but the budget has provided for a R100 billion infrastructure push over the next 10 years. This initiative, too, is estimated to have the capacity to add 0.25% to GDP growth annually.

A third pillar targets industrial growth. The focus is localisation targets and sectoral masterplans, and manufactured exports, particularly into Africa. Concerning localisation targets, President Ramaphosa noted that South Africa imports roughly R1.1 trillion in goods (excluding oil) every year. If the country were to manufacture “only” 10% of this locally, it could add 2% to GDP growth per year. Localisation targets have already been agreed with the Textile and Retail sectors, and proposals are afoot for transport rolling stock, agro-processing and healthcare amongst others.

.

“Local consumers will be heartened by the fact that spectrum release also forms part of the Post-COVID Recovery Plan. The plan aims to provide low-income households with affordable access to the internet through broadband connection subsidies.”

Another notable point is that the first spectrum auction will take place by the 31 March 2021. The Independent Communications Authority for South Africa (ICASA) opened the bidding for 4G and 5G networks to mobile network operators in October. The auction is likely to be a nice windfall for National Treasury, but it is also expected to result in more competitive pricing of internet services.

The Rand strengthened against the dollar during the month, surprising many analysts who were expecting weakness ahead of the MTBPS. The currency hit R16.25 to the dollar at month-end, as most Emerging Market (EM) currencies strengthened off the back of dollar weakness ahead of the US election results. The Biden win is likely to create greater stability in markets, which were rattled by Trump’s erratic behaviour. This, in turn, spurs risk-on sentiment, which is favourable for EM currencies.

Performance

World Market Indices Performance

Monthly return of major indices

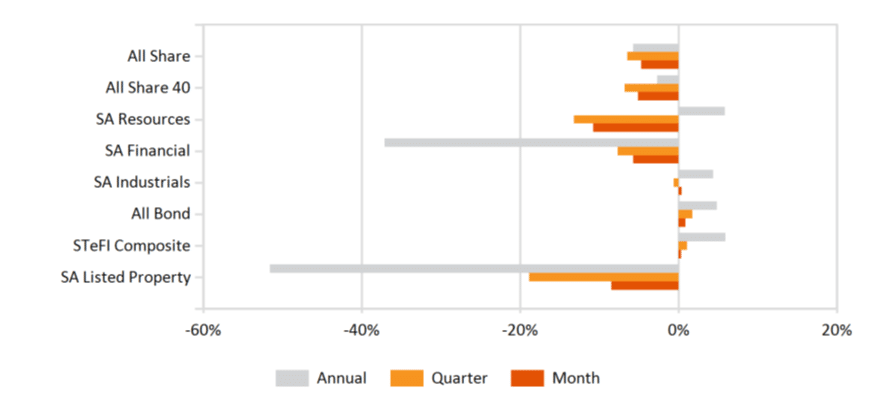

Local Market Indices Performance

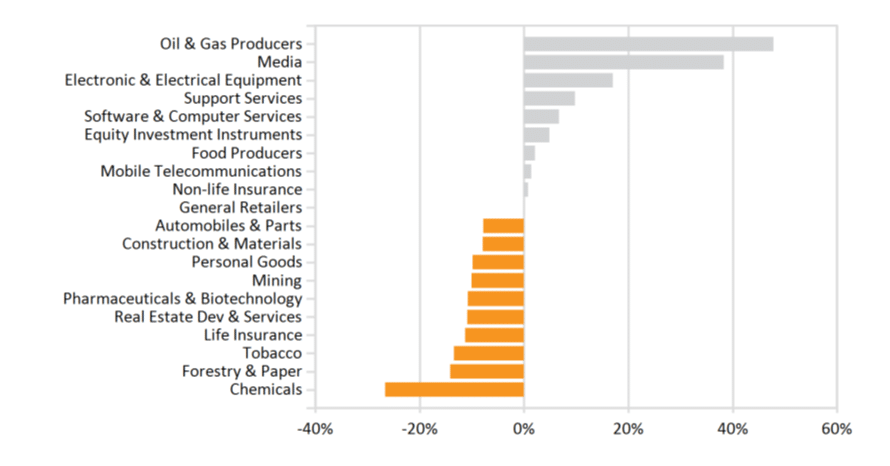

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance