Market Commentary: October 2019

Here are this month’s highlights: Global equity markets were boosted by easing trade tensions between the US and China, as the two countries reached an interim trade-deal at month-end. Renewed risk-appetite saw emerging markets outperform developed peers, and global government bond yields ticked higher. Local investor sentiment was weighed down by a tepid response to the MTBPS, Moody’s looming review and political uncertainty.

Market View

Cash

South African cash investors netted 59 basis points (bps) in October. Inflation edged down to 4.1% in September. Slowing price increases for housing and utilities contributed to the improved inflation figures. October’s numbers, however, are expected to reflect the 18 cent increase in fuel prices, driven by rising oil prices and a weaker rand. The South African Reserve Bank (SARB), nonetheless, maintains that inflation is likely to remain below the mid-point of its target range. Consumers are looking forward to the promise of one further rate cut during 2019.

Bonds

South African bond yields jumped sharply at month-end as investors reacted negatively to Finance Minister Tito Mboweni’s Medium-Term Budget Policy Speech (MTBPS). The ALBI lost 0.35% for the month and Inflation-Linked Bonds (ILBs) closed lower at -0.14%. Local bonds were modestly lower than global peers, with the BarCap GABI closing near-flat in local currency terms, up 0.67% in US Dollar terms.

Some market participants were disappointed that Minister Mboweni did not make bolder commitments to austerity in light of South Africa’s considerable financial challenges. The outlook regarding the country’s fiscal position is not positive. Tax revenues are lagging, partly due to a sluggish economy, but also due to inefficiencies in the South African Revenue Service’s (SARS) tax collection process.

“Mboweni plans to improve revenue collection by allocating more resources to SARS, but South Africans are still likely to face tax hikes in the February 2020 budget.”

The main task facing the government is curbing expenditure, otherwise the debt-to-GDP ratio will top 70% by 2023. This is particularly worrying because the February 2019 budget had estimated just under 60% for the same period. Treasury acknowledged that there was a significant fiscal deterioration since tabling the 2019 budget, but Mboweni’s mini-budget is thought to do little to address the main issues despite announcing some cost-cutting measures.

At month-end, South African bond investors were also fretting about the outcome of Moody’s review of the country’s sovereign credit rating due on 1 November. The country saw its rating revised from stable to negative. The ratings agency cited the material risk that government would not be able to stop the deterioration of its finances. In Moody’s view, the low-growth-high-debt scenario outlined in the MTBPS is not consistent with a Baa3 rating. Such comments raise the spectre of a further downgrade, which would take the country to below investment grade and spark substantial outflows.

“Global government bonds declined in October, as some easing of trade tension saw demand for safe-haven assets abate.”

The US Federal Reserve Bank (the Fed) lowered interest rates for the third time in 2019. The 25 bps reduction is in keeping with expectations, as well as with the Fed’s message. The Fed, in its public statements, has pointed to the fact that consumer-spending is driving a strong US economy, but there are risks arising from external sources (the US-China trade war, geopolitical tensions and Brexit uncertainties). Consequently, the Fed has signalled that the October rate cut is likely to be the last for the year.

The 10-year T-bill yields ended the month at 1.69%. European government bond yields were noticeably higher, given a more constructive outlook on the Brexit process. Although not resolved at month-end (the initial deadline), a pending UK election in December is likely to result in a concrete plan of action. Demand for safe haven European government bonds therefore abated: 10-year Bund yields ticked up 17 bps to -0.4% and UK 10-year gilts were 14 bps higher. In keeping with increased risk-appetite, high yield and emerging market bonds outperformed corporate and government bonds.

Equity

The domestic equity market posted solid gains during October. At 2.6%, the local bourse tracked global markets higher, but underperformed emerging market peers.

“Gains were tempered at month-end by the disappointment in the MTBPS, with Minister Mboweni painting a bleak picture of the country’s financial position and economic outlook.”

The prospect of a ratings downgrade from Moody’s early in November, also added to investor nerves. SA Inc was under pressure as the month drew to a close. On the political front, investors were shaken by developments within the ranks of the DA, the country’s main opposition party. The DA leadership race is now in full swing, with the party set to elect an interim leader and chair on 17 November.

While local macroeconomic data was lacklustre, there were some positive data releases. The IHS Markit South African composite Purchasing Managers’ Index (PMI) improved slightly but remained in contractionary territory at 49.4. Manufacturing output rose by a more substantial three points, reaching 48.1 in October according to the Absa Manufacturing PMI. Consumer sentiment remains subdued, with the quarterly FNB/BER Confidence Index falling to its lowest reading since the last quarter of 2017.

“On a sector and stock level, the Resource sector was the best performer of the local subsectors, easily outstripping Financials and Industrials.”

Amongst gold miners, Sibanye Gold and Anglogold Ashanti were the best performers, with share prices up by 38% and 14%, respectively. Diversified miner BHP Billiton posted a modest decline, as industrial metals and iron ore softened on weaker demand from China. Within the Financial sector, Capitec and FirstRand built on prior month gains and were up 6.6% and 5%, respectively. Large cap counters Naspers and newly-listed Prosus proved to be a drag on the local bourse, losing 6.5% and 5%, respectively. Beleaguered Sasol investors responded positively to the remedial actions taken by its board of directors. These include the axing of both its joint CEOs, and senior role-players in the Lake Charles Project. Sasol shares consequently registered an 8% jump for the month.

Since local investors had little reassurance from the MTBPS and from Moody’s, optimism regarding SA Inc is tempered, leaving room to pick up quality counters at subdued prices.

Property

South African property provided investors with a solid return for October, as the ALPI gained 2.8% and the SAPY a more modest 1.8%. The listed property sector, however, remains the poorest performing among local asset classes for the year-to-date. Hopes of a strong turnaround in the listed property sector, following a particularly poor 2018, have largely dissipated.

The sector was boosted somewhat by the positive outcome of investigations surrounding the Resilient Group and by Edcon’s survival. Resilient, after a dismal 2018, gained 3.9% during October, bringing its year-to-date recovery to 28.8%. Yet, most companies struggled during the first 10 months of the year. Vacancies in the office and retail sector continue to rise, with Growthpoint, SA’s largest listed property company, reporting a 26% rise. Redefine, a firm that earns most of its income from this space, has reported that it saw an average rental decrease of 2% for renewed leases over the past year.

“It is not only in South Africa that retail landlords are having a tough time.”

South African-listed Intu, which has traditionally been a favourite for local investors wishing to obtain offshore exposure, has reported that like-for-like net rental income will be 9% lower for 2019. This is largely due to its exposure to the struggling UK retail sector, where major players were declared insolvent and subsequently struck deals to keep them afloat. Intu share prices have slumped and the firm has lost nearly 60% in market capital for the year-to-date.

Overall, for South Africa’s top listed property counters, rental growth upon lease expiry has declined to -3.5%. With property counters appearing cheap at the moment, it seems to be a buyers’ market. Caveat emptor, however, since discounts may well reflect an economic reality of stretched property values, weak growth prospects, lack of management focus and high gearing

“Property remains a sound long-term investment but requires an ability to withstand short-term volatility and a judicious selection process.”

In developed property markets, the FTSE EPRA/NAREIT Developed Rental Index generated a 2.4% return in USD. The UK, following months of Brexit uncertainty and difficult conditions for High Street retailers, regained some of its prior months’ underperformance. It recorded the best performance for the month, providing a total USD return of 10.30%. The UK construction Purchasing Managers’ Index (PMI) reflected tempered optimism amongst UK homebuilders, as it rose to 44.2 in October.

Asian property markets did well, with a 2.49% return in USD for October. Despite ongoing protests in Hong Kong, property prices in that nation have remained at record highs. During October, Hong Kong’s chief executive Carrie Lam announced a series of measures aimed at lifting more citizens onto the property ladder. Demand for residential real estate in particular was strong, due to a dearth of available flats and a generation of Hong Kongers less willing to live with their parents after marriage. Overall, steady demand from mainland China buyers has also boosted property prices. Hong Kong listed real estate stocks jumped during October, with developers adding about USD 4 billion to their market capitalisations. Analysts, however, are concerned that the measures could overheat a housing market that is already ranked as the world’s least affordable

“A UBS analysis of property market bubbles worldwide, published in September 2019, ranked Hong Kong as the most expensive amongst 25 global cities.”

North American real estate provided somewhat more lacklustre returns, at 1.57%, and the Canadian market proved to be the global laggard, generating only 0.14% for the month.

Global real estate fundamentals remain healthy, with decent medium-term growth prospects. Specific sectors such as the logistics and distribution subsector, and greening initiatives within subsectors are nonetheless likely to garner more attention.

International Markets

Global listed equity markets performed well in October, with emerging markets beating their developed market peers. The MSCI World gained 2.54% and the MSCI EM closed 4.22% higher in USD (1.88% and 3.54% for ZAR investors).

UK equities lagged developed peers, with the FTSE100 registering a 1.87% loss. Markets were volatile against a backdrop of mixed macroeconomic data and ongoing political uncertainty.

“On the macroeconomic front, the Bank of England vindicated analysts’ expectations by revising its GDP growth forecast for 2019 lower and keeping interest rates on hold at its 7 November meeting.”

UK data was lacklustre. The Composite Purchasing Managers’ Index (PMI) increased modestly, closing at the key 50 mark (values below 50 signal contraction and values above signal an expanding economy). The IHS Markit/CIPS Services PMI beat market expectations to end at 50, and the Manufacturing PMI rose to its highest since April. The latest unemployment data shows a slight rise, as firms slowed down their hiring activity amidst Brexit uncertainty. According to the Confederation of British Industry (CBI), the quarterly headcount for reporting firms fell at its sharpest rate since April 2010. The CBI Business Confidence Index also showed that optimism about export prospects, given the wrangling around Brexit, had fallen to a 17-year low.

Simultaneously, investment intentions amongst the 400 manufacturing firms surveyed deteriorated dramatically, with plans to spend on buildings, plants and machinery, and training and retraining at their most negative since the Global Financial Crisis. Consumer confidence was similarly lower, and UK retail trade remained subdued.

On the political front, Prime Minister Boris Johnson managed to negotiate a revised withdrawal agreement with the European Union and parliament enacted a bill for a UK general election on 12 December.

“Sterling rallied on the news. This in turn had a negative impact on large cap internationally exposed FTSE counters, which also performed negatively on some mixed Q3 results.”

Small and mid-cap domestically-focused counters, including real estate and utilities, managed to temper losses. In company news, Vodafone revealed plans to close 1000 European stores, but signalled that this would not affect its UK operations. Instead, UK markets welcomed the commitment to spending an additional GBP 5.5 million and creating 100 more jobs by opening 24 new franchise stores.

European equity markets posted positive returns, with the STOXX All Europe gaining 1.21%. Overall, stocks benefited from solid earnings reports, with 50% of reporting companies surpassing expectations. Investor confidence was underpinned by an alleviation in US-China trade tension, the likelihood that a no-deal Brexit was off the cards and talk of increased government spending.

Economic news was largely positive, as the Eurozone saw growth of 0.2% for the third quarter, beating expectations. This was driven by positive news from France and Spain, and a better-than-expected performance from the powerhouse German economy. Business confidence in the region and measures of activity improved modestly. The region’s flash composite PMI ticked up marginally into expansionary territory. Manufacturing, however, remained in contractionary territory, and consumers remained wary ahead of the 31 October Brexit deadline.

At a sector level, there was a continuation of the move away from more defensive sectors such as consumer staples and utilities. Cyclical and economically sensitive stocks, including consumer discretionary, industrials and materials were amongst the best performers.

“The US equity market ended the month in positive territory, with the S&P500 2.17% higher. On the macroeconomic front, data was lacklustre.”

The US’s GDP growth rate has slowed to 1.9% for the third quarter and a weakness in the trade-dependent manufacturing sector seems to have seeped into the broader economy. The Institute for Supply Management’s manufacturing PMI remains in contractionary territory for the third consecutive month, and the IHS Markit US services PMI, at 50.6, points to the weakest expansion since February 2016. Overall, measures of business and consumer confidence point to a subdued outlook.

US jobs growth is slowing – during 2019, an average of 160 000 jobs were added on monthly basis, a nearly 30% slower pace than in 2018. Recognising the uncertainty on the economic outlook, the US Federal Reserve Bank (the Fed) cut interest rates for the third time this year. Alongside news of a ‘Phase One Trade Deal’, the interest rate reduction and a predominantly positive earnings season boosted the stock market to fresh highs during the month. The month’s strongest performing sectors were healthcare and technology, partly boosted by company specific news. The energy sector continued to be a laggard in the US as the shale boom slows. The more defensive sectors, utilities and real estate, have trimmed year-to-date gains as recessionary fears ebbed and as US investors rotated into value stocks.

“Japanese equities ended the month higher, gaining just over 5%, as the partial trade agreement between the US and China eased global growth concerns.”

The yen weakened during the month, proving a short-term boon to export-oriented manufacturers, but ended the month nearly unchanged against the US Dollar. On the macroeconomic front, there is some concern that the hitherto strong services sector is beginning to drag. The Jibun Bank Japan Services PMI contracted in October for the first time in three years. The Tankan survey of manufacturers also showed that manufacturing sentiment was at its lowest level in over six years. Consumer spending was lower in October, reflecting the impact of the consumption tax increase and following evidence of frontloading in September.

The country is yet to assess the full impact of Typhoon Hagibis, one of the strongest storms to hit the country in 60 years. Global insurer Aon, in its latest monthly catastrophe report, has estimated that the economic costs will come to USD 10 billion. On a more positive note, the country is likely to continue to see improved tourism revenues, with euphoria from the successful hosting of the Rugby World Cup still strong and the 2020 Olympic Games still to come.

“Chinese economic data was mixed. Industrial production was ahead of expectations, retail sales data for September was positive and the Caixin China General Manufacturing PMI rose unexpectedly.”

The People’s Bank of China implemented a second 50 bps cut in the reserve requirement ratio, with a third cut likely to follow and thereby released roughly CNY 900 billion into the banking system. Third quarter GDP growth, however, slowed to 6% from 6.2% in the second quarter. Nonetheless, Chinese equity markets were boosted by the hopes of a preliminary trade deal with the USA as both sides agreed to roll back tariffs on goods. The stock market was also supported by buying ahead of the MSCI’s widely anticipated announcement that the weighting of mainland Chinese stocks in the MSCI Emerging Markets Index would be increased to a weight of 4.1%.

“The MSCI China index rose just over 4% and the MSCI China A Onshore returned 2.8%. “

Emerging Asia, benefiting broadly from the trade deal, was the regional leader amongst emerging peers. The Indian bourse rose 3.9%, helped by a positive corporate earnings season and expectations for further tax reductions. Taiwanese equity markets reached all-time highs, driven by a recovery in the semiconductor industry and an upswing in 5G-related demand.

Latin American markets followed closely, led by a 2.36% gain in Brazilian equities. The country finally saw its landmark pension changes approved, despite some stiff opposition. The overhaul is expected to save the government almost USD 200 billion over the next ten years. The central bank also implemented an interest rate cut, bringing rates to 5%, which is a historic low. Argentinian markets were lower, as the defeat of Mauricio Macri to Personist leader Alberto Fernandez in the presidential elections and the return of the left to power saw many international investors worried about a new era of government intervention. The Central Bank of Argentina imposed capital controls shortly after the meeting, to prevent a slide in the country’s very sensitive peso.

“In Emerging Europe, Middle East and Africa, Russian markets performed particularly well. The Russian bourse generated 5.34% in local currency terms. “

Despite some weakness in oil counters, Russian energy companies benefited from rising gas prices. Hungarian and Polish equities also put in a solid performance for the month. Turkish equities, on the other hand, took a knock from deteriorating market sentiment.

October saw a series of sallies into Northern Syria, and the USA imposed sanctions on Turkey. African equity markets lagged their emerging peers, with the MSCI EFM Africa ex SA yielding 2.15% in US Dollar terms. Performances were mixed, with Egypt and Kenya posting solid returns, and oil-rich Nigeria seeing substantial losses. Aside from energy-sector losses, domestically-focussed Brewers and FMCGs lagged, reflecting the pressure Nigerian consumers are under.

Currencies and Commodities

Currency markets saw the US Dollar dip, with the USD index losing 2% in October. The pound was one of the strongest currencies, ending the month 5.3% firmer against the dollar. The snap election in December is expected to cut the risks of a hard Brexit, despite the fact that the initial deadline of 31 October passed with no result. The Norwegian Krone was one of the weakest performing developed market currencies, as the currency’s moves are closely linked to the price of Brent Crude Oil.

Emerging Market currencies were supported by easing trade tension and improved risk appetite, as well as general commodity strength. The strongest performers were the Brazilian Real, Mexican Peso and Korean Won. The South African Rand fell sharply at month-end, following the pessimistic MTBPS from Finance Minister Tito Mboweni. Due to the weaker dollar, the rand-dollar exchange rate was relatively stable. Depreciations against the stronger British Pound and Euro were noticeable at 4.3% and 1.6%, respectively.

“In commodities, the GSCI index ticked nicely higher in October.”

Gains were broad-based across the subsectors. Precious Metals posted a 3.3% gain, as a weaker dollar supported gold (+2.7%) and silver (+6.5%). Industrial Metals were up 1.7%, led by gains in PGM (Platinum Group Metals), with Platinum prices up 5.6%.

Supply concerns were fuelled by the closure of Chilean mines amid government protest and boosted copper prices. The energy subsector posted a modest gain, although oil prices were mixed. Brent crude oil dipped 2% and West Texas Intermediate (WTI) ended nearly flat. Overall, however, rising US oil stocks and weak Chinese factory activity put pressure on oil prices at month-end. Analysts predict that oil prices are likely to remain under pressure until inventories show a sustained decline and demand conditions stabilise.

Performance

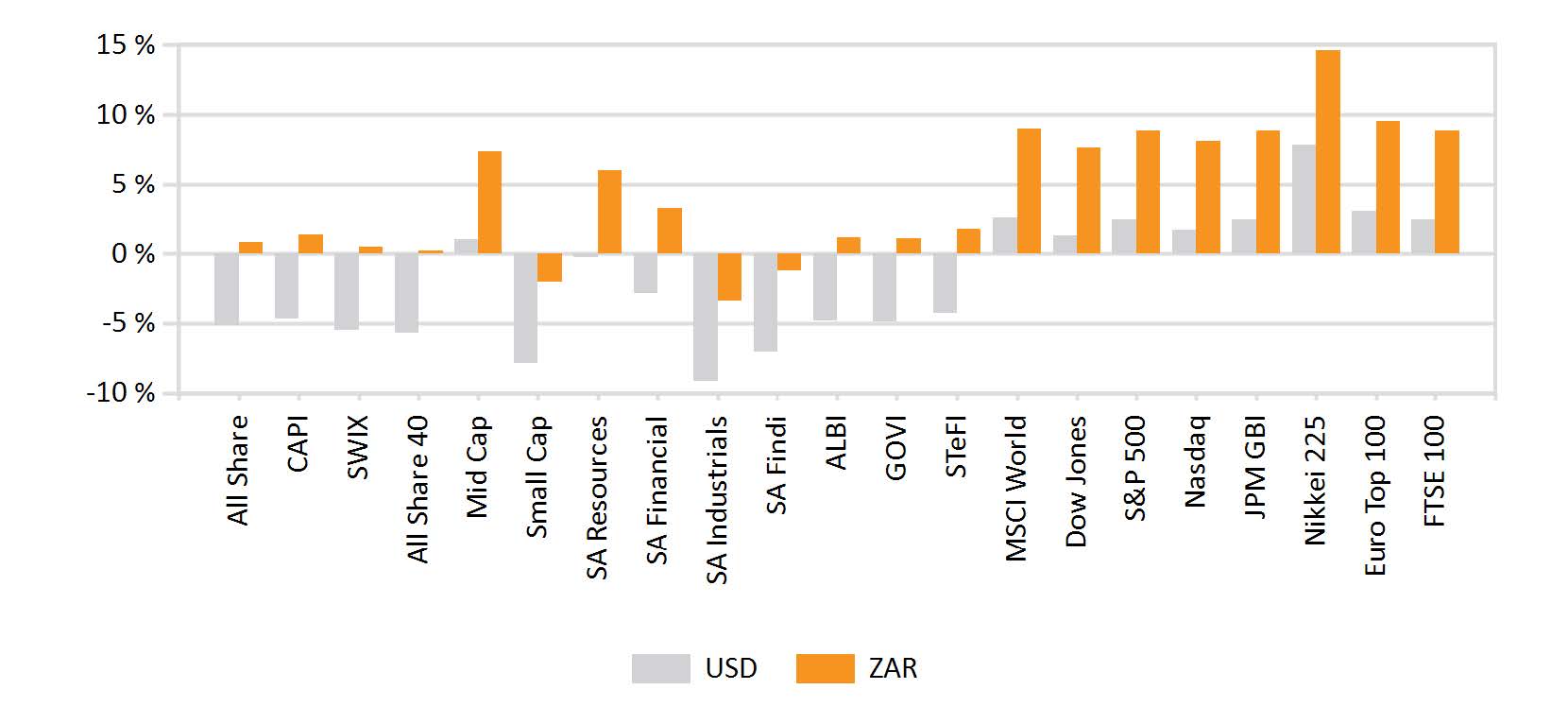

World Market Indices Performance

Monthly return of major indices

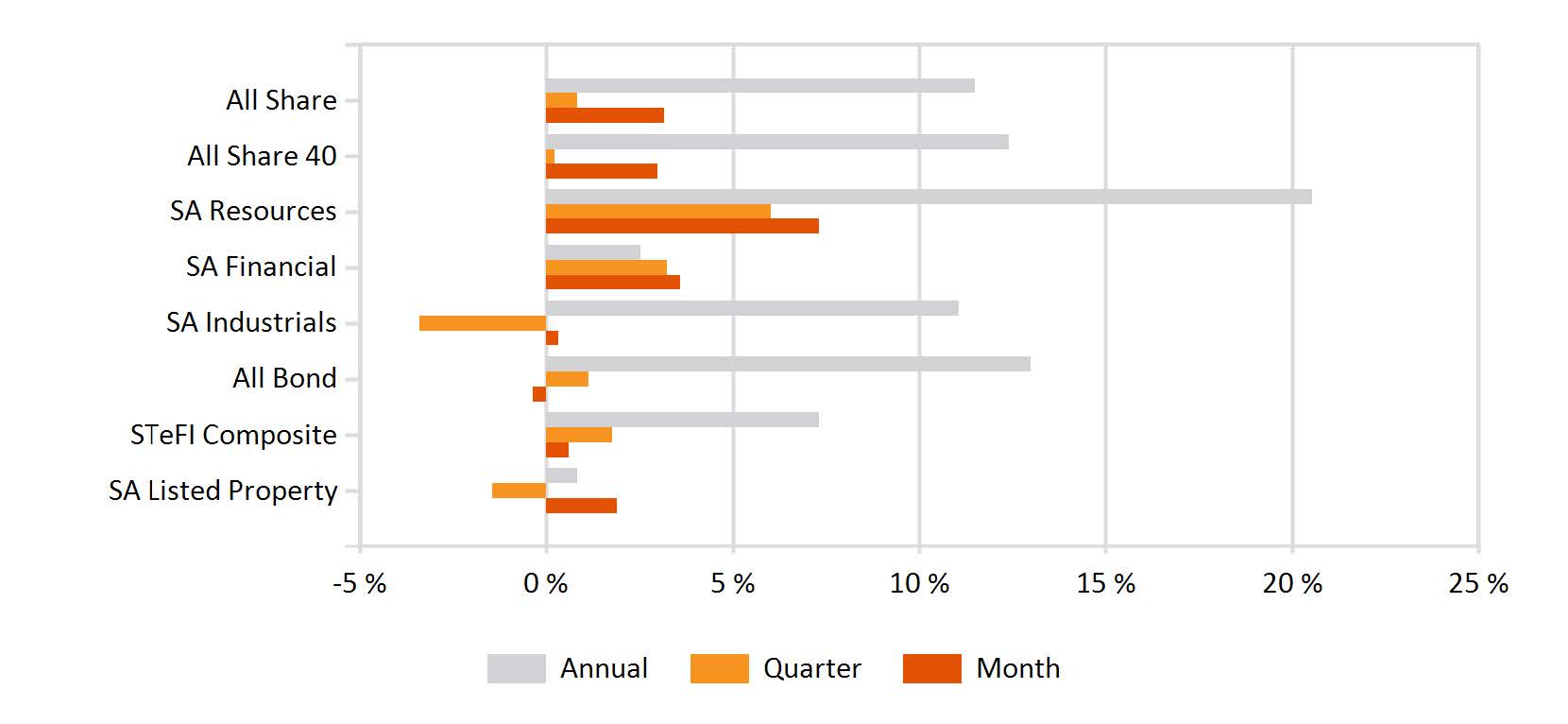

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

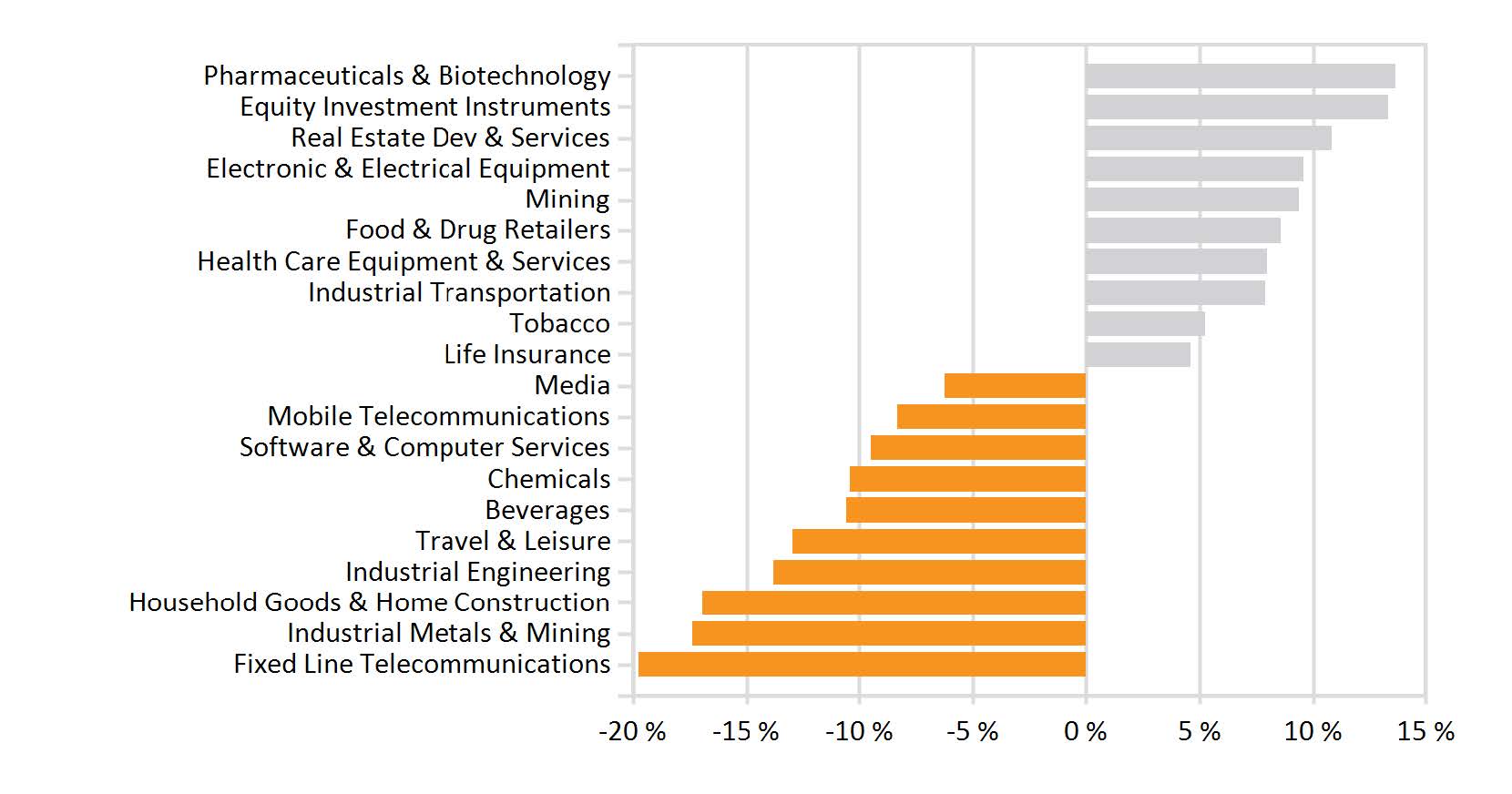

Monthly Industry Performance