Market Commentary: October 2018

Here are this month’s highlights: October proved to be a tough month for global risk assets, dubbed Red October by market watchers. Developed and emerging equities were volatile and ended sharply lower, with a tech sell-off grabbing headlines. Energy prices declined sharply at month-end, while Gold was higher on safe-haven buying.

Market View

Cash

South African Cash yielded 63 basis points (bps) for October, making it one of the few asset classes yielding a positive return. Unemployment reached 27.5% in the third quarter of 2018, and indebted domestic consumers’ prospects for relief are proving to be dim: With inflation under upward pressure from a weaker rand and rising input prices (including electricity and fuel), the South Africa Reserve Bank is unlikely to implement a rate cut before year-end. Government’s announcement of a slate levy on fuel, to take effect in the first week of November, will put additional upward pressure on final goods prices and the poor. Diesel prices are set to increase by 48 to 51 cents, while illuminating paraffin is set to cost 28 cents more per litre.

“The inflation rate remained at 4.9% for September 2018, with a sharp increase in the transportation component of the Consumer Price Index.”

Despite an increasing number of basic food items being added to the zero-rated basket for Value Added Tax, food inflation rose considerably, registering 3.9% year-on-year in September 2018, up from 3.5% in the previous month.

Bonds

South African bonds did not escape the emerging market sell-off, with the All Bond Index closing 1.66% lower. Inflation-linked bonds bucked the asset-class trend, gaining 0.64%. The South African policy environment saw an unexpected development: Nhlanhla Nene resigned from his relatively new appointment as finance minister, after further details of his meetings with the controversial Gupta family were released. Nene, while not implicated in the state capture report, admitted that his meetings and non-disclosure thereof, cast doubt on his integrity as a bearer of public office.

“President Cyril Ramaphosa accepted his resignation, and subsequently appointed Tito Mboweni, ex SARB Governor.”

The new Finance Minister delivered the medium-term budget to mixed responses. The medium-term budget is perhaps most notable for its stark realism: Mboweni’s speech highlighted the ongoing difficulties at state owned enterprises, poor economic growth prospects and an increase in the government debt/GDP ratio. The latter is projected to increase by 0.7% from initial projections of 55.1%, the former to come in at 0.7% (versus previous estimates of 1.5%). Concerns resurfaced regarding South Africa’s credit ratings, with S&P announcing a potential downgrade at month-end and Moody’s under pressure to put the country on watch.

“While the rand proved remarkably resilient, long-dated liquid South African sovereign bonds rose 25 bps.”

In global bond markets, safer corporates, investment grade and developed sovereign bonds gained ground against their riskier counterparts. The BarCap GABI outperformed Emerging Market peers, gaining 3.18% versus the JP Morgan Emerging Market Government Bond Index’s -2.2%.

“The latest US unemployment data and the minutes of the Federal Reserve Bank’s October meeting affirm the likelihood of a US rate increase in December.”

The European Central Bank left its stance unchanged and the Bank of Japan announced that it would keep its ultra-easy monetary policy in place (negative interest rates of -0.1% effectively means that borrowers are being paid to take on debt).

Political tension in Europe has not yet dissipated. The European Commission has rejected the Italian government’s proposed budget deficit and Moody’s downgraded Italian sovereign debt by one notch.

“In Germany, Chancellor Angela Merkel announced that she will not stand for re-election; and in Britain, there is still no clarity regarding Brexit.”

The spread between peripheral bond yields and German Bunds widened. The 10-year T-bills, after moving through the psychological 3.2% mark, closed at 3.14%, while equivalent Bunds and Gilts closed at 0.39% and 1.44%, respectively.

To add to the impact of risk-off sentiment, energy counters make up a large portion of the high yield bond sector. Alongside Emerging Market peers, High Yield Bonds consequently suffered as oil prices declined: US High Yields gave up 1.6% and their European counterparts dipped by 1%.

Equity

In a month marked by widespread risk aversion and global market volatility, South African equities underperformed global peers. The ALSI lost -5.76%, as Industrials slumped by 8%. Index heavyweight, Naspers, continued to sell-off during October, in tandem with the decline in Chinese parent Tencent, and the broader sell-off in tech stocks. The share rallied at month end, however, jumping 9.4% on the last day of trading and tempering losses.

Resources also rallied at month end, with diversified miners Anglo American PLC BHP Billiton gaining just over 4%, while commodity trading giant Glencore added over 6%. Impala Platinum was boosted by the release of a positive production update. Gold Miners, however, continued to retreat due to the strength of the dollar.

“Volatility in the rand translated into gains for traditional rand hedges such as Richemont and British American Tobacco.”

On the local economic front investor sentiment was tepid at best. The latest unemployment data from StatsSA paints a bleak picture for new entrants to the job market, with unemployment during the third quarter ticking up to 27.5%. Although youth unemployment declined modestly, this is likely an outcome of less active job seekers (discouraged workers are those who are unemployed, but no longer searching), rather than an increased pace of hiring.

“It is therefore fitting that the 2018 Jobs Summit, held in early October, identified youth employment as one of its key strategic focus areas.”

Other areas covered in the framework agreement that was signed at the summit include the affirmation from the financial sector to invest R100 billion in black-owned industrial enterprises over the next five years; an increased push for infrastructure spending; and further support for agro-processing products, such as the procurement of hectares for black farmers. Market-watchers are sceptical that interventions will be able to deliver on the targeted 275 000 jobs per year.

The Medium Term Budget – which saw a wider than expected budget deficit projection for the next three years (i.e government spending already outstripping revenue) – served as a further reality check to any lingering Ramaphoria. Treasury subsequently also revised its growth assumption lower, as year-to-date growth undershot projections. Newly-appointed Finance Minister Tito Mboweni has a tough balancing act ahead of him as he attempts to maintain fiscal discipline, while simultaneously fostering growth.

South Africa’s Purchasing Managers Index decreased to 46.90 in October, in its fourth month of contraction. Business activity and purchasing activity, including new orders and expected capital expenditures, dipped to four-year lows, signalling that business owners remain cautious.

“South African consumers are set for a tough festive season, feeling the pinch of the weaker Rand, increased VAT, and the spillover impact of rising input costs.”

Property

South African listed property shares edged 1.7% lower in October, making it one of the better performing asset classes for the month. The housing market, however, remains under pressure. According to the latest FNB Property Barometer, nearly 96% of sellers have been forced to drop their asking prices.

Despite a relatively weak rand, which could make local property a cheap destination, foreign buyers are turning more cautious. Foreign buying dipped to 4.1% as a proportion of total sales, likely reflecting the fact that the lack of clarity regarding Land Expropriation without Compensation is still playing on investors’ minds.

“The mini-budget, served as a stark reality check regarding overall growth prospects, but also held out hope for property managers in niche areas.”

The Medium-Term Budget included the announcement that R669 million is to be invested to revitalise government-owned industrial parks in township areas. It also adds impetus to infrastructure spending and green-building initiatives.

Global Property underperformed SA listed peers, with the FTSE EPRA/NAREIT giving up 3.1% (net total USD). The closure of Debenhams in the UK again highlighted the vulnerability of the traditional High Street and Department Store model. Investment managers therefore need to be particularly conscious of their ability to be selective in allocating to retail assets.

“Investments in A-class malls, high quality assets, properties with stable anchor tenants and attractive locations will continue to yield results.”

Asian markets were both the strongest and the weakest performing global markets in USD terms, with investors becoming still more comfortable with Japanese REITS, but simultaneously more concerned about the slow-down in China and potential government interventions. Japanese REITS yielded -1.3%, but Hong Kong slumped by 8.26%. Judicious regional allocation, and agility in taking advantage of niche opportunities will therefore remain essential.

International Markets

Global equities were extremely jittery during the month – market pundits have dubbed it ‘Red October’ and made much of the ‘frightening’ volatility in the traditional Hallowe’en month. The CBOE Volatility Index (VIX) hit a new eight-month high on during the last week of October.

“October has been the worst month for US equities in six years, with the S&P ending firmly in the red (-6.84%).”

Despite positive macroeconomic data – US GDP registered 3.5% growth for the third quarter of 2018, US unemployment remains at record low levels, wages ticked up and buoyant consumer spending is keeping the economy chugging along – investors were cautious, if not skittish.

Earnings reports were somewhat patchy, sparking concerns that corporate profits may have peaked. Technology stocks led the initial fizzle. Google’s parent Alphabet revealed disappointing advertising revenue growth for the third quarter; Trading in Apple shares was muted ahead of earnings; and Amazon gave cautious forward-looking guidance ahead of the Christmas holiday shopping season. This cautionary tone was echoed in the forward earnings guidance of several sector heavyweights, including Caterpillar.

“Reports that the White House was preparing to implement new wider-reaching tariffs on Chinese goods also weighed on sentiment.”

US stocks, however, bounced back at month-end, with technology shares rebounding – Facebook saw some of the damage from news of further data-hacking erased by better-than-expected earnings reports; Microsoft regained its place as second most valuable US company; IBM announced a revenue-boosting $34 billion acquisition of Red Hat (an open source software pioneer); Micron announced its acquisition of Intel’s stake in its joint venture.

“UK equity markets echoed their US counterparts, ending lower on geopolitical and trade tensions, and fears that corporate profitability had peaked.”

The FTSE was -4.85% softer. Energy heavyweights suffered, as the price of oil fell almost 9% over the course of the month. BP, nonetheless, posted strong quarterly numbers, doubling its profit from the previous year.

The outlook for Britain, both on the macroeconomic front and in terms of Brexit negotiations has been mixed: UK unemployment remains at a low of 4% and wage growth has accelerated to 3.1% (a nine-year high), but consumer sentiment has remained downbeat. British consumers remain under pressure, and the High Street is feeling the brunt, with British icon Debenhams added to the list of retailers set to close up shop(s). Hopes of a tentative Brexit deal were rekindled at month-end, sending sterling higher, but a no-deal outcome is still a distinct possibility.

“European economic data was lacklustre – the zone recorded its weakest quarterly growth in five years (at 0.6%).”

The zone has partly been weighed down by the slowdown in exports, likely reflecting the impact of Brexit, US tit-for-tat tariffs, slowing Chinese appetite and rising global trade tensions. The Eurozone manufacturing purchasing manager’s index (PMI), at 49.2, dipped into contractionary territory and hit its lowest in four years. As risk-off sentiment prevailed, the defensive telecoms sector was the only gainer. The Stoxx All Europe closed 5.51% lower.

“Equity markets across Asia sold off sharply, on escalating trade tension and softer economic data from China. Japanese equities lost just over 9%, the worst monthly sell-off since the 2008 global financial crisis.”

Japan has been hit by a wave of natural disasters – typhoons, heavy rains, earthquakes and flooding have caused widespread supply chain and manufacturing disruptions. Not surprisingly, monthly manufacturing data was weaker, and the Bank of Japan’s Quarterly Tankan Survey showed that business sentiment was decidedly downbeat.

The Bank of Japan, in its two-day month-end policy-setting meeting, once again acknowledged that inflation remains below the 2% target rate. The Bank revised its inflation forecast lower (to 1.5% for 2020) and indicated that easy monetary policy would remain in place. On a sectoral basis: Japanese financials suffered as a consequence of the Bank’s interest rate stance – negative interest rates discourage lending and lower banks’ profitability; and automakers bore the brunt of trade-related jitters and the stronger yen.

In China, third quarter GDP growth slowed to 6.5% in line with expectations. The government also reported its weakest manufacturing growth in two years (albeit still in expansionary territory, at 50.2), with new export orders contracting for a fifth consecutive month. Sino-US trade tension is clearly weighing on Chinese manufacturers, although the likely impact may be exaggerated.

“Chinese consumers remain the country’s main growth engine and consumer spending has remained robust.”

The Chinese government has also rapidly stepped in to ease conditions for local businesses and households. The range of measures includes a cut in banks’ reserve requirements; additional support for small private enterprises; revisions to corporate tax laws to facilitate share buybacks; additional rebates on export taxes and new tax deductions for households. The Shanghai composite index ended the month 8.26% in the red.

Asian minnows such as Korea and Taiwan were buffeted by headwinds – the slowdown in regional giant China, simmering geopolitical tension, natural disasters and the downturn in tech stocks. Emerging Asia was therefore the weakest amongst Emerging Market peers. Overall, however, Emerging Markets performed poorly – the MSCI EM closed 8.71% lower, versus the -7.34% in the MSCI World.

“Only two emerging economies managed to post gains – Brazil and Qatar. Brazilian equities were boosted by the victory of pro-business far-right candidate Jair Bolsanaro, closing the month 10.19% higher.”

Mexican markets, however, saw their worst performance in a decade – falling on migrant tension, inflationary fears and the news that an expected infrastructure-spending boost would not materialise. Emerging European markets were lower. Positive data from Russia, with inflation trending lower, unemployment declining and industrial production ticking up – could not outweigh the impact of lower energy prices and the threat of further sanctions.

“The MSCI EFM Africa ex SA closed 4.07% in the red, outperforming other emerging regions.”

Losses were tempered by better-than-expected performances from Nigeria and from the agricultural sector (benefiting coffee and cocoa exporters such as Kenya and Ghana).

Currencies and Commodities

In currencies, the USD climbed 2.1% against a basket of currencies. In developed markets, the yen closed higher against the dollar while sterling reacted negatively to Chancellor Phillip Hammond’s mini-budget at month-end.

The Euro was also somewhat volatile as Brexit negotiations and peripheral tensions continued to weigh on investor sentiment. Within Emerging Markets, currencies were mixed and volatile. The Brazilian real appreciated by 8.8% as the election of President Bolsanaro, who is viewed as pro-business, boosted investor sentiment.

“The tension between Turkey and the US ebbed and the lira clawed back 8.4%.”

The two countries appeared to reach common ground in their outrage at the murder of journalist Jamal Khashoggi, and with the release of controversial US Pastor Andrew Brunson.

Other Emerging Latin American and European Middle Eastern and Africa currencies were less positive: The Mexican peso lost 8%, with investors troubled by ongoing US trade and migrant tension; Geopolitical developments spilt over into oil prices and into the currencies of oil-exporters and the Russian rouble dipped by 0.3%.

“South Africa’s rand was volatile and ended the month over 4% lower against the USD.”

Commodity prices were mixed. Oil dipped to its lowest level in six months, as OPEC announced that it would increase supply to keep pace with demand, and effectively counter any impact from new US sanctions on Iranian supply.

According to the latest Bloomberg data, OPEC output is already at a two-year high, while Saudi Arabia’s output is at its highest since 1962. Chinese growth fears sent industrial metals lower, but Gold shone on safe haven buying, adding 1.8% for the month.

Performance

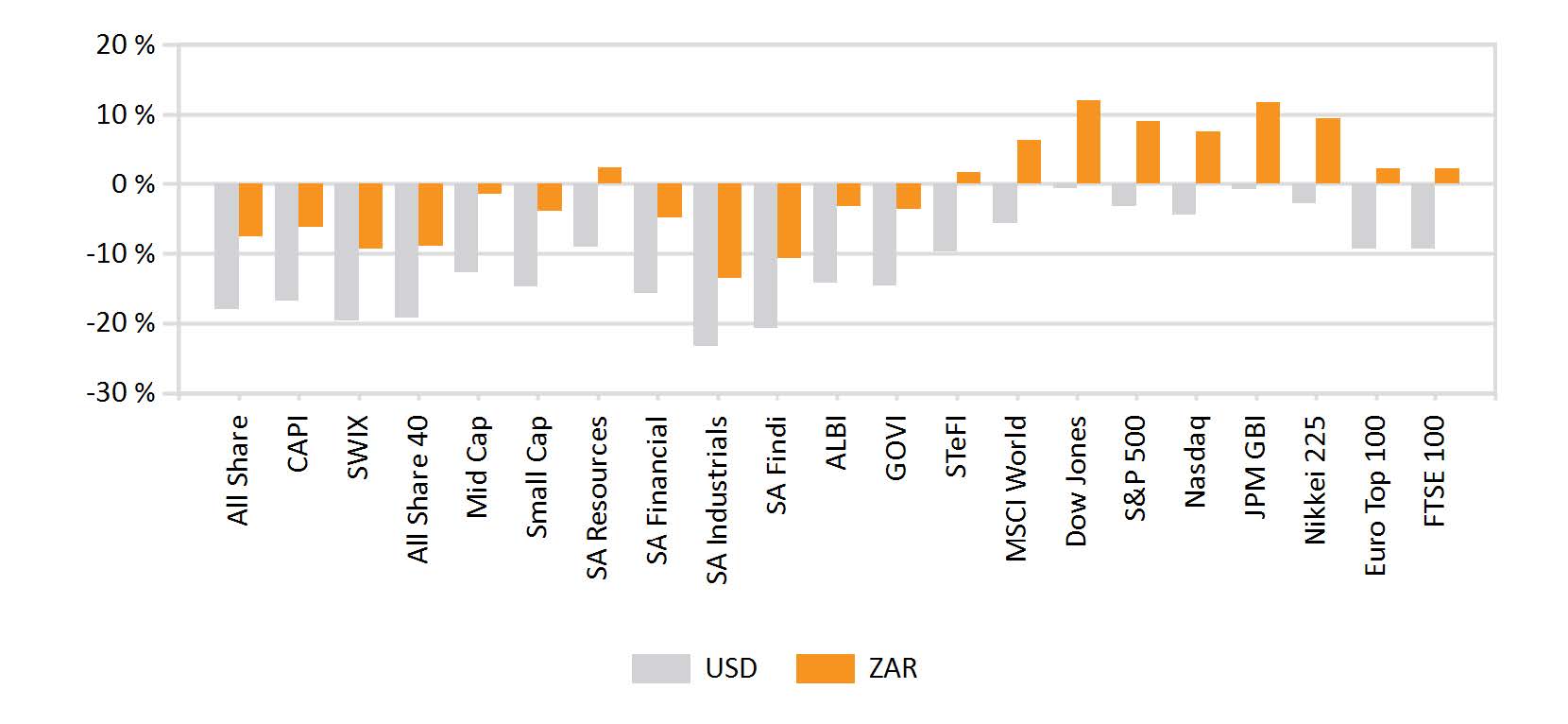

World Market Indices Performance

Monthly return of major indices

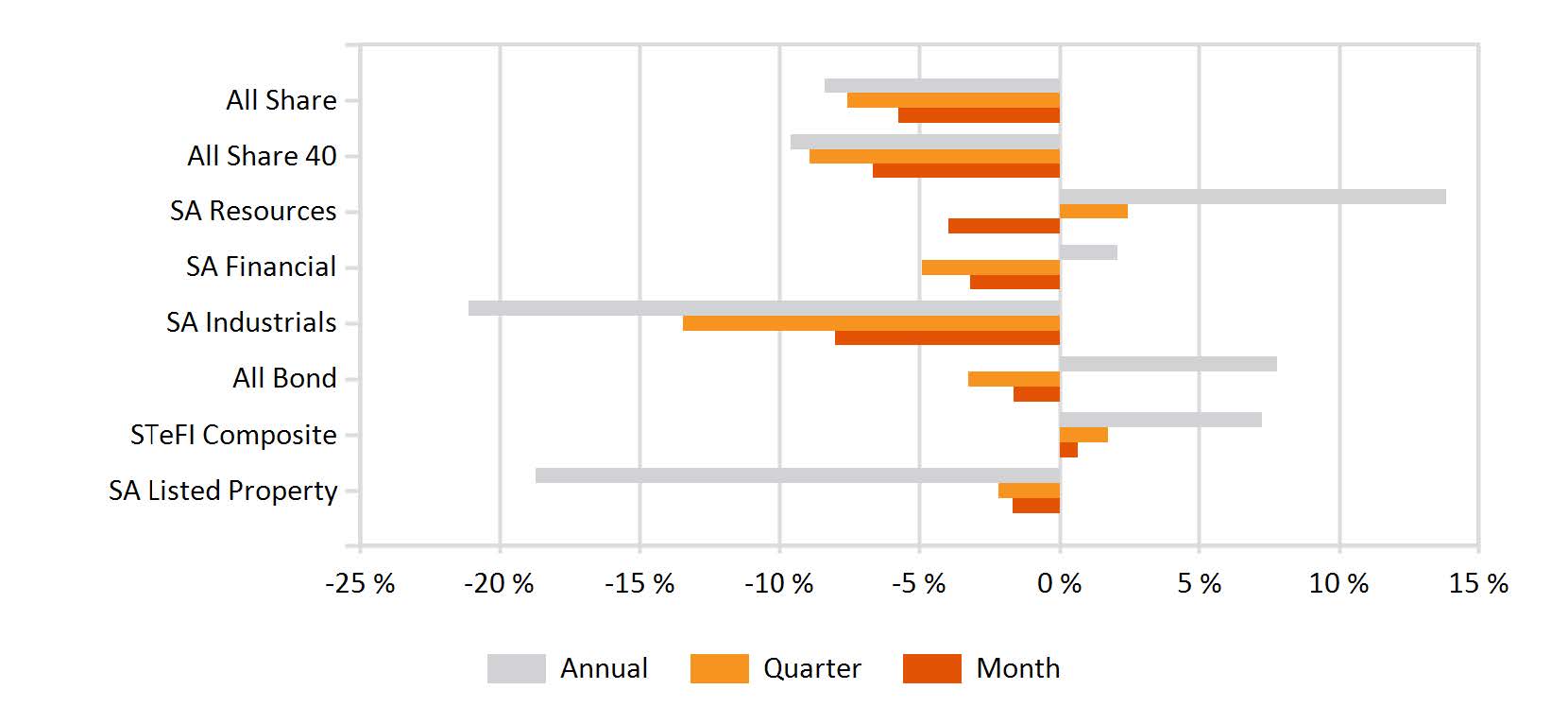

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

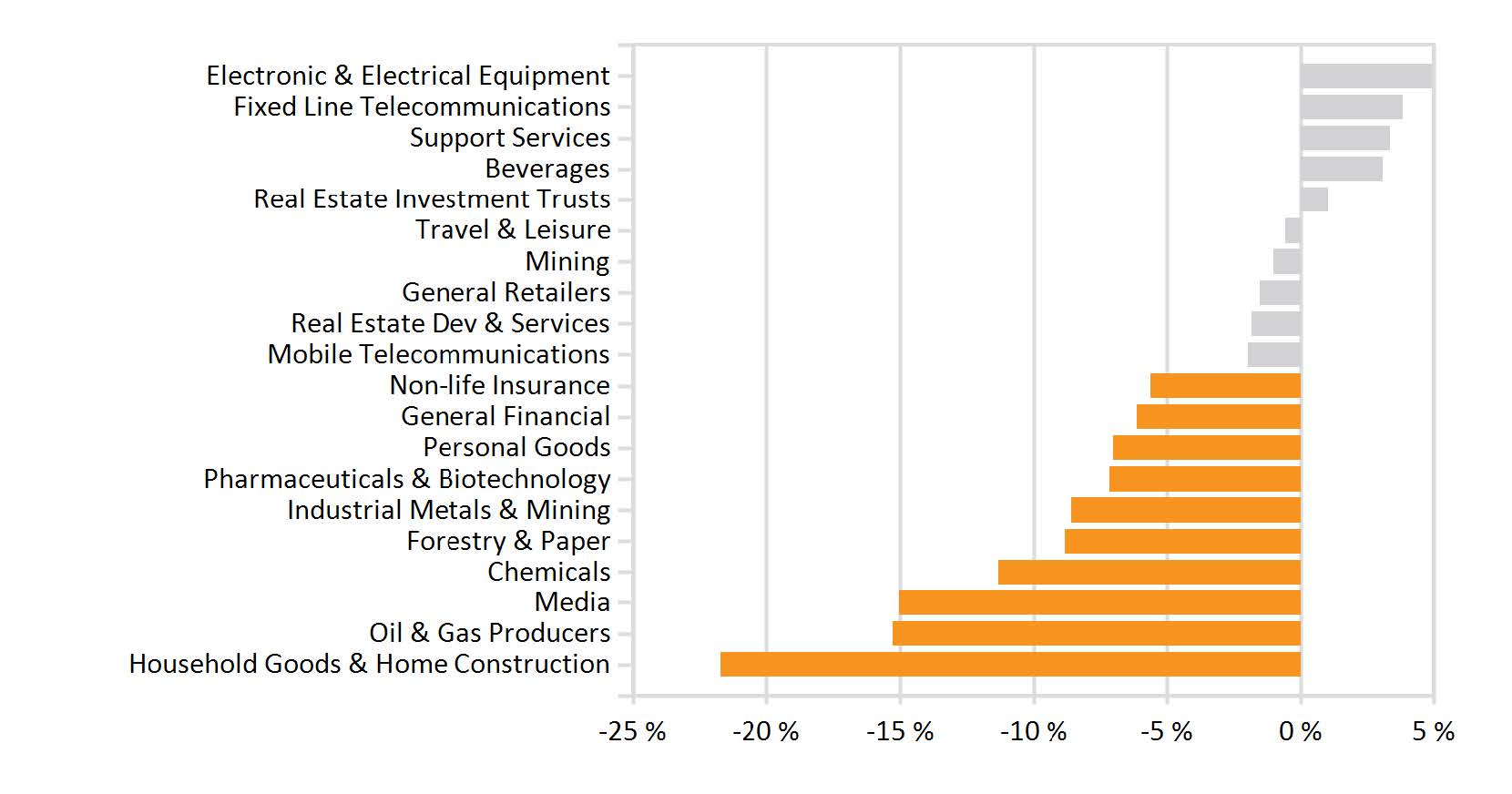

Monthly Industry Performance