Market Commentary: October 2017

Here are this month’s highlights: Developed and Emerging market equities ticked up during October, with South African equities outperforming global peers. The Rand and SA government bonds remained under pressure as fiscal slippage and domestic politics weighed on the local markets. Strong earnings, and tech sector gains led international markets higher, but investors will keep a close eye on Brexit negotiations and tax reform progress toward year-end.

Market View

Cash

South African inflation overshot its 4.9% market expectations, rising to 5.1% for September. The reading was boosted by the substantial rise in transport costs, with a particularly noticeable uptick in fuel prices. Rand weakness, together with supply-side and geopolitically-motivated pressure, saw the price of all grades of petrol rise by 67 cents in early September. As the local currency remains volatile, and Middle Eastern tension escalates, the Automobile Association is predicting another hike.

Market-watchers agreed that Finance Minister Malusi Gigaba’s medium-term budget was in line with (somewhat glum) expectations. However, they did not think it bode well for the domestic economy or consumers, nor was investor confidence bolstered by another mid-month Cabinet reshuffle. Pressure on the fiscus makes tax increases imminent, potentially also in Value Added Tax. The South African Reserve Bank remains bearish on local growth prospects, and an interest rate cut by early 2018 appears to be highly unlikely. South African Cash yielded a 0.62% for October.

Bonds

The underwhelming fiscal outlook, a mid-month Cabinet reshuffle and Rand-jitters weighed heavily on South African bond markets. The ALBI substantially underperformed domestic asset class peers and global fixed income, declining by 2.28%. At its worst point during the month, South African 10-year government bond yields spiked by nearly 70 bps. ILBs dipped by 0.87% and global bonds were also modestly lower, with the Barcap GABI registering a -0.38% decline. Developed market government bond yields diverged over the course of the month: US 10-year yields rose to 2.38%, UK 10-year gilts edged lower and 10-year Bund yields dropped from 1.46% to 0.36%. The latter is a reflection of the European Central Bank’s announcement (albeit largely anticipated) that bond purchases would be halved to Euro 30 million a month, but would be extended to September 2018.

US bond markets ticked up slightly toward month-end, on speculation as to Federal Reserve Chairperson Janet Yellen’s replacement, and an expected USD 1.5 trillion budget deficit increase should the Trump administration push through tax cuts. European peripherals diverged — the escalating tensions between Catalonia and Madrid saw Spanish government bonds underperform. Conversely, a more settled political outlook and a sovereign credit ratings upgrade boosted Italian sovereigns. Investment grade and high-yield credit spreads tightened in October.

Property

The South African Listed Property Index closed 1.9% higher in October. Local REITS have been increasingly affected by the lacklustre economic environment. Consequent once-off measures to enhance the bottom line has left analysts in doubt as to the quality of earnings.

Many SA-centric listed property companies are trading at discounts to their net asset values. This has also put management at a disadvantage for funding acquisitions or developments. Local companies are therefore also continually looking to expand their offshore operations.

“Many SA-centric listed property companies are trading at discounts to their net asset values.”

A recent report by JLL, entitled Africa Prime Industrial Report, suggests that the significant undersupply of prime logistics and warehouse space on the continent presents a key growth opportunity. Total demand for industrial space in African countries currently stands at just over 15 million square metres.

The increasing appetite for industrial real estate is a global phenomenon: The evolution of global logistics, driven by changing consumer demands and e-commerce growth, means that the logistics/warehousing sector remains in vogue. The UK, an area targeted by several South African companies, has seen further yield compression and an uptick in rental growth, with occupier demand remaining strong and on a limited supply of new space. While the trend is not as pronounced in the US, it is nonetheless evident. As in South Africa, selectivity and nimble asset allocation, even within asset classes that are traditionally regarded as long-term players, will therefore remain key drivers of return.

Equity

South African equities put in a strong showing in October, despite increasing domestic political and fiscal pressure. The SWIX closed the month 6.5% higher, substantially outstripping global and Emerging Market peers (the MSCI World was 1.9% higher, while the MSCI EM closed 3.5% higher).

Industrial shares were the most notable performer on the local bourse. The index gained 7.6% for the month, closely followed by the Resources Index (+7.1%). Naspers Limited has continued its stupefying rise. Its share returned 18.18% for October, bringing its year-to-date gains to nearly 72%. Other Rand Hedges have also delivered solid returns, as the local currency remains volatile, mired in political uncertainty and concerns about fiscal slippage.

“Ratings agencies, however, may pay more heed, and a rate-cut before year-end is not off the table.”

Finance Minister Malusi Gigaba’s mid-month medium-term budget delivered few surprises and did little to reassure investors. The budget, inter alia, announced that faltering state-affiliated airline SAA and the South African Post Office, would both receive further bail-outs. News that this would likely be partially funded by the sale of shares in turnaround-story Telkom, has led pundits to question the investment acumen of the state. Richemont and BAT benefited from their preferred status as hedging stocks, as well as from solid corporate results, gaining 8.3% and 5.3% for October, respectively.

Resources posted a strong month, partly boosted by Rand-weakness and recovering commodity prices, with the Platinum subsector gaining 19.53%. Diversified miners (such as Anglo American and BHP Billiton) recouped prior-month losses to close October 8% and 6% higher (solidifying year-to-date gains of 34% and 15%, respectively). Local general retailers and consumer discretionary stocks have remained under the cosh, leaving consumers to feel the pinch ahead of the festive season. Unemployment remains elevated and price pressure is still feeding through from higher oil prices and a volatile Rand. With only one monetary policy committee meeting remaining before year-end, respite in the form of an interest rate cut, is exceedingly unlikely.

South African politicians, and state-affiliated organs are under ever-heavier scrutiny. The recent release of ex-journalist Jacques Pauw’s controversial book ‘The President’s Keepers’ has ensured that the spotlight will remain firmly on state-capture and corruption. Whether the fall-out will have much impact on the ruling party’s elective conference in December remains to be seen. Ratings agencies, however, may pay more heed, and a rate-cut before year-end is not off the table.

International Markets

October was a solid month for global risk assets. Developed and Emerging Markets ticked up, with large cap, technology and growth stocks leading gains.

US markets were boosted by strong earnings statements, which outstripped forecasts. Upbeat growth statistics saw GDP growth topping hurricane-hit expectations at 3% per annum and unemployment at a 16-year low of 4.2%. Optimism was further fuelled by Trump’s ambitious plans for tax reforms. This would include substantial concessions to corporates, a prospect that would add to the bottom-line and to potential capex.

“Technology stocks have continued to reach record highs, with Microsoft, Intel and Alphabet all reporting solid earnings.”

Technology stocks have continued to reach record highs, with Microsoft, Intel and Alphabet all reporting solid earnings. Amazon and other online platforms have similarly benefited from the technology-fuelled change in consumption patterns as demand shifts online. Eurozone technological firms followed US peers higher. Notably, AMS, the Swiss semi-conductor maker for Apple, saw its share price surge on strong demand for the iPhone X.

Eurozone economic activity remains resurgent – GDP growth is at 0.6% for the third quarter of 2017 and at a six-year high of 2.5% per annum. Unemployment hit a multi-year low, reaching levels last attained pre-global financial crisis (GFC). The European Central Bank, while announcing that it would taper its Quantitative Easing, has nonetheless acknowledged that core inflation, dipping to 0.9% in September, has not reached the desired levels. Tapering would reflect the same patient and persistent approach the Bank had maintained in feeding inflationary pressures.

Despite ongoing political upheaval, Spanish equities (while lagging peers) managed a 1.6% gain. A mixed bag of corporate results in the Brexit-beleaguered UK saw equities end the month in the green. Oil majors were particularly strong, as Brent crude topped the watershed $60 per barrel mark toward month-end, and BP reported that its year-on-year profits had more than doubled. Rising tension in the Middle East, with the Saudi Arabian crackdown adding to existing pressure, and the likelihood that OPEC would extend its output-cap agreement, continues to bode well for the trajectory of the oil price. The UK financial sector, the hardest-hit by ongoing Brexit-wrangling, reported mixed third quarter results. Barclays saw lower bond and currency-trading revenues and a weaker performance from its investment banking arm; RBS turned a modest profit, but a multi-billion dollar fine from the US Department of Justice (harking back to the GFC and misselling of mortgage-backed securities) still hangs over executives’ heads.

“Technology stocks boosted Taiwanese stocks (iPhone X), and there was a slight respite from the Korean-peninsular tension. ”

The financial sector has also been weighed down by potential passport issues and the relocation of key firms, pending the outcome of Brexit negotiations. Regarding the latter, the divorce has proven to be less-than-conciliatory: European chief negotiator Michel Barnier was gloomy in his outlook with comments including the words ‘deadlock’. Japanese equities experienced a positive month, closing 5.5% higher. Its Prime Minister Shinzō Abe’s support-base appears to remain solid, enhancing investor confidence, Yen-weakness boosted exporters and corporates reported better-than-expected quarterly results.

Emerging Markets were broadly positive, with emerging Asia leading the advance. Technology stocks boosted Taiwanese stocks (iPhone X), and there was a slight respite from the Korean-peninsular tension. Moreover, news that China might end its boycott of Korean goods, and its clampdown on visitors, was a noticeable boon to Korean markets. Chinese stock markets reached a 26-month high, as investors took heart from solid economic data, with third quarter GDP growth recorded at 6.8%. Consumption-led growth has continued unabated, with the latter contributing nearly 65% to GDP growth during 2017. The vision for Chinese growth, which includes reforms of state-owned-enterprises and increasing liberalisation, is likely to remain unchanged as President Xi Jinping secured his political primacy for the foreseeable future at the recent Communist Party Congress.

“International investors will keep a keen eye on US policy.”

Indian markets, which proved disappointing for the year-to-date, were boosted by the announcement of a government injection to local state-lenders and additional infrastructure-spending. Despite a favourable trend in oil prices, and a 25 bps interest-rate cut, Russian equities’ gains were tempered. Latin American markets proved laggard, with the Mexican economy posting its first contraction in four years and concerns are rife that negotiations to modernise NAFTA would prove fruitless.

International investors will keep a keen eye on US policy. President Donald Trump’s tour of Asia is likely to set the stage for Sino-US-Russian relations, while the Federal Reserve looks set to receive a new Chair (Jerome Powell) and its policy is likely to remain largely unchanged. Rising tension between the Senate and the House in the States has cast doubt on the administration’s ability to push through tax reforms before year-end. Brexit negotiations, in turn, are likely to see limited progress before 2018, and investors are likely to adopt a wait-and-see attitude prior to year-end.

Currency

The US Dollar Index closed 1.6% higher against a basket of currencies, boosted by positive economic data and the prospect of tax reforms. In the UK, markets were anticipating an interest rate hike by the Bank of England (heralded to be the first in a decade), but weaker-than-expected economic data and staled Brexit negotiations dragged on the currency. Waning confidence in Prime Minister Theresa May and in-party fighting may add to Sterling woes. Amongst other developed markets, the commodity-backed Canadian Dollar struggled, registering a -3.3% loss against the dollar, partly on trade-tensions.

“Diplomatic tension and trade-relations weighed on the Turkish Lira and Mexican Peso (-6% and -4.7%). The Rand, in turn, suffered large losses against major currencies…”

Emerging Markets were mixed against the USD. Reform momentum and easing political tension boosted the Indian Rupee and Korean Won (+1% and +2.4%). Diplomatic tension and trade-relations weighed on the Turkish Lira and Mexican Peso (-6% and -4.7%). The Rand, in turn, suffered large losses against major currencies, with fiscal slippage and a Cabinet reshuffle weighing on the unit. The depreciation of 4.2% against the USD, 2.7% against the Euro and 3.9% against the Pound leaves it as the third weakest amongst its Emerging Market peers.

Performance

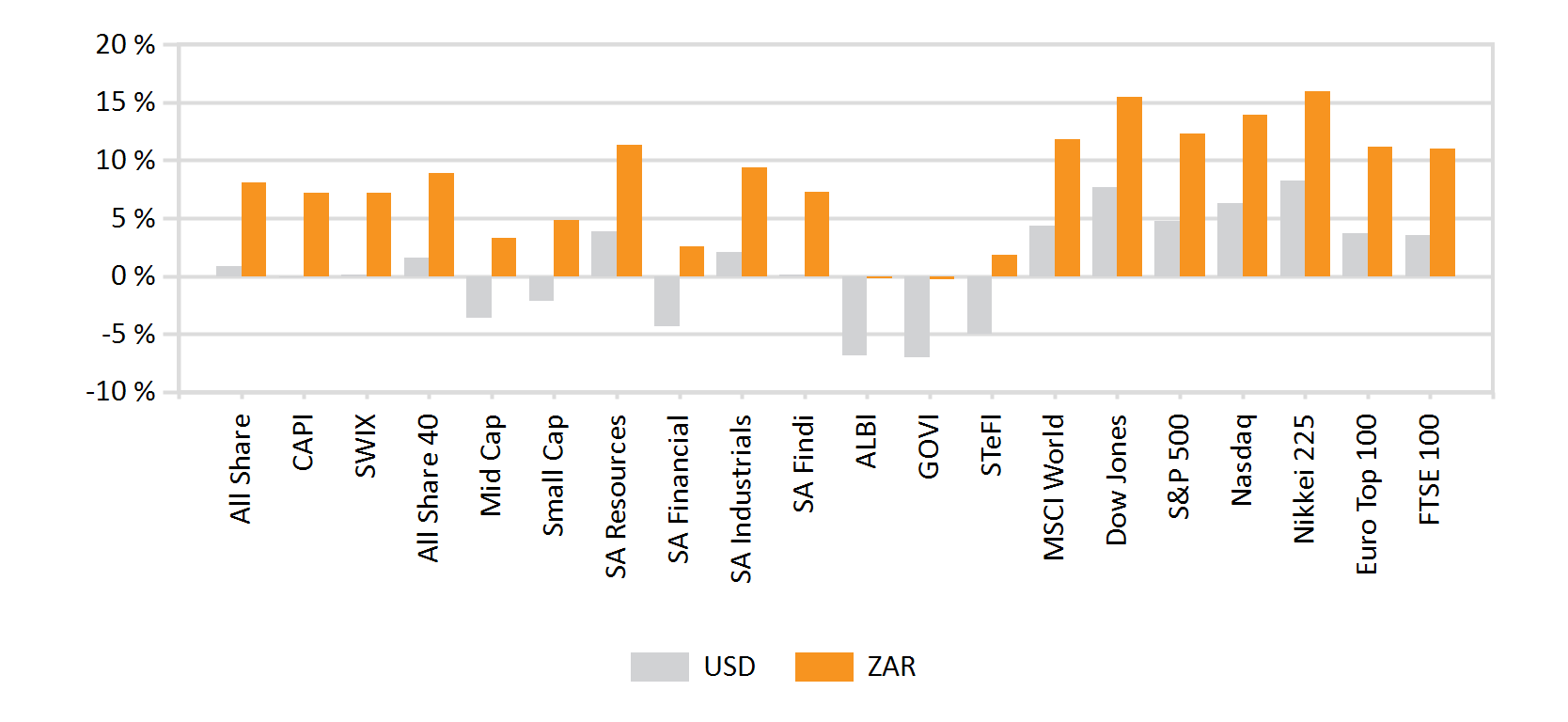

World Market Indices Performance

Monthly return of major indices

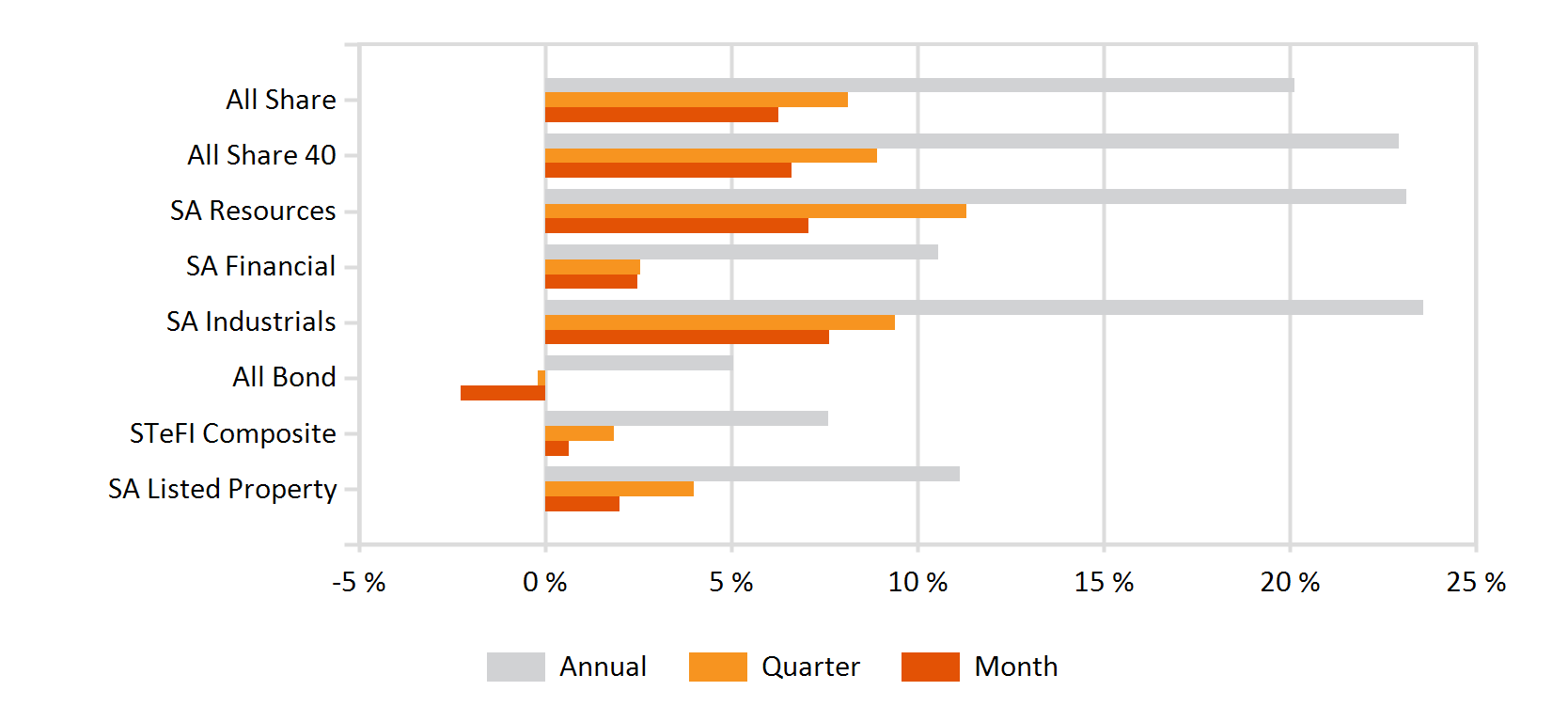

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

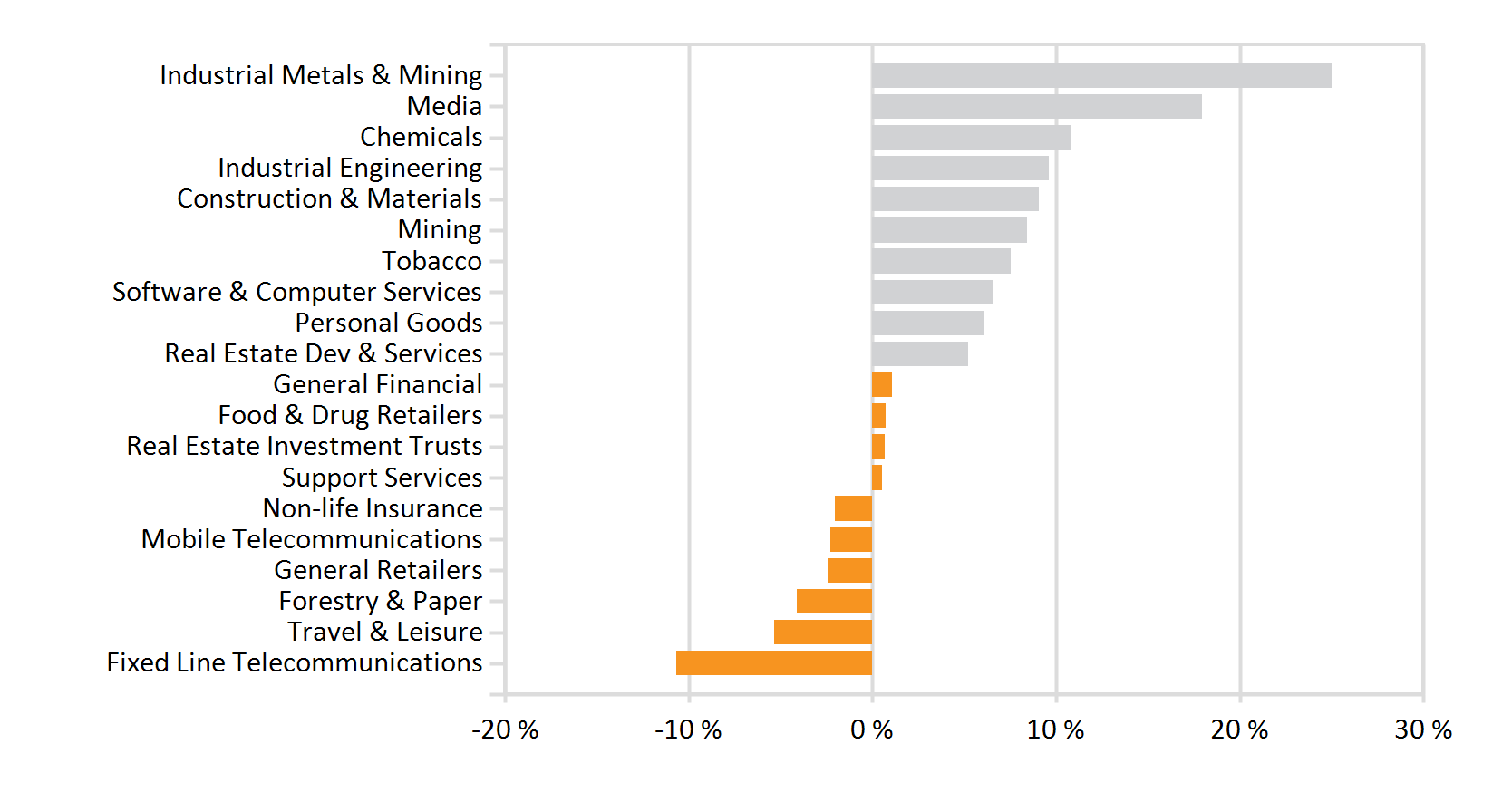

Monthly Industry Performance