Market Commentary: November 2020

Global Market Themes: Vaccine hopes and a Biden presidential victory spur global markets higher Dollar weakness, accommodative Federal Reserve Bank policy further boost Emerging Markets France goes ahead with digital taxation of US tech giants Oil and industrial metal prices surge on hopes of economic recovery SA Market Themes: South African markets rally in line with global risk-on sentiment Monetary Policy Committee leaves rates unchanged, inflation outlook stable South Africa suffers further downgrades from major ratings agencies South Africa in the grip of a second wave of COVID-19 infections, tighter regulations loom

Market View

Global Market Themes

Risk-on sentiment drove global markets higher in November. The MSCI World closed 12.7% higher followed by Emerging Markets (MSCI EM) at 9.2% higher. Investors pinned their hopes on the possibility of an effective vaccine to combat the COVID-19 pandemic being made available soon.

On three successive Mondays in the month, markets were greeted by announcements that the Pfizer/Biotech, Moderna and AstraZeneca/Oxford vaccines had proven effective in reducing symptomatic cases of the virus. Attention now turns to how quickly the vaccines can be approved, manufactured, distributed and administered on a broad scale. There are still some logistical challenges, particularly with the more effective Moderna and Pfizer/Biotech vaccines, which require storage at -70 degrees Celsius. The less effective AstraZeneca/Oxford vaccine, which is still 70% effective, can be stored at regular fridge temperature and is considerably less expensive.

“Emerging Markets (EM) have made large pre-orders for this vaccine. Shortly after month-end, the UK government announced that it would roll out vaccination to high-risk candidates, the elderly and healthcare workers in the second week of December, making it the first nation to do so.”

The UK and Europe have been hard-hit by the second wave of the virus, and most countries have introduced new lockdown regulations or localised restrictions. The economic recovery consequently stuttered. But as investors start to see light at the end of the tunnel, these markets were also the biggest gainers during the month. The FTSE100 gained 12.6% and the STOXX All Europe gained 14.3%.

A further boon to investors was the announcement that Joe Biden had emerged victorious in the US election. Biden’s victory is likely to usher in a more conciliatory and predictable policy regime in the US. Regarding international trade, Biden is likely to avoid tit-for-tat tariff measure where possible. It would be a mistake to believe that Biden is more sanguine regarding what is perceived as the threat from China’s economic and trade ascendancy. This perception is perhaps the single unifying element between the country’s right and left. Biden, however, is likely to take a more diplomatic stance. He is also likely to attempt to exert multilateral pressure, and garner greater support from the US’s traditional allies.

During the month, it also became clear that the US has to regain substantial diplomatic currency. European countries had for some time been threatening to impose a digital services tax, aimed largely at US tech giants.

“Under the current tax regime, companies such as Amazon only pay taxes on income in the countries in which they book their profit. The argument, however, is that these companies make big profits on sales in Europe and other regions, and that this income should be taxable at ‘point-of-sale’ as it were.”

France had already introduced a 3% revenue tax from digital services last year, but suspended collections while negotiations for a broader overhaul of the global tax system played out in the Organisation for Economic Cooperation and Development (OECD). Negotiations have thus far been fruitless, and France served tax notices to Google, Amazon and Facebook in the last week of November. This could put the incoming US administration in a difficult position.

A further keynote of the Biden presidency will be the green economy. Biden has already announced his intention to re-join the Paris Climate Agreement on the first day of his administration.

In terms of fiscal stimulus, it is likely that the Democrats will not gain control of the Senate. This will only be decided on 5 January, with two special run-off elections in Georgia. The results are likely to usher in a divided Congress, with the Republicans controlling the Senate and the Democrats controlling the House. Agreeing on a stimulus-package will consequently be challenging, and the eventual package will be smaller and less far-reaching than if the Democrats had an outright-win. US consumer sentiment, already under pressure in the face of rising infection rates, lagged further in November.

“One thing that the Biden victory has not changed is US monetary policy, one of the key market drivers. The US Federal Reserve Bank has reiterated its commitment to an accommodative monetary policy. Lower interest rates have improved the debt servicing prospects of EM. “

Coupled with a weaker US dollar, this is positive for the prospects of an EM economic recovery. The economic recovery prospects, increased global industrial demand and a stable energy demand also spurred commodity prices higher. Industrial metals and oil posted double-digit gains. Copper prices were 12.8% higher, platinum gained 14.2% for the month and oil prices soared by 26.2%. Commodity-linked EM countries easily outperformed developed and other EM peers, with Brazilian and Russian markets leading the pack and gaining over 15%. China, which has thus far been the stand-out performer in 2020, posted more modest returns in November. The MSCI China gained 2.7% and the MSCI China A Onshore gained 6.8%. Nonetheless, for the year-to-date the indices are 26% and 31.7% higher.

South African Market Themes

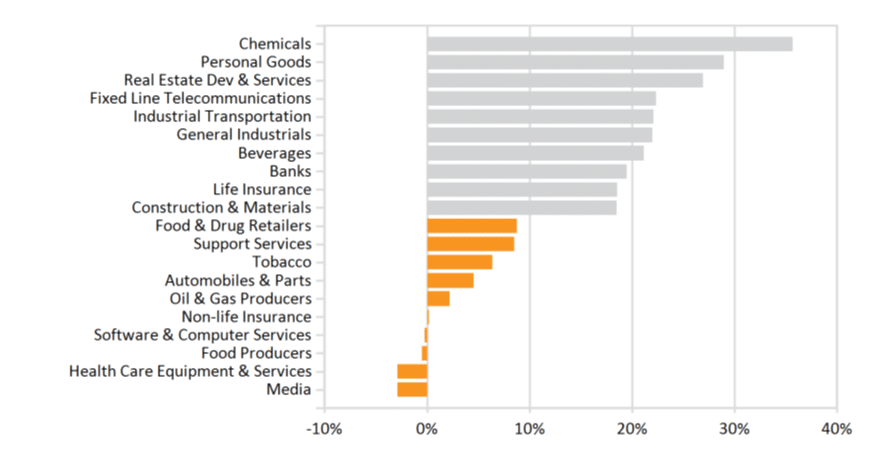

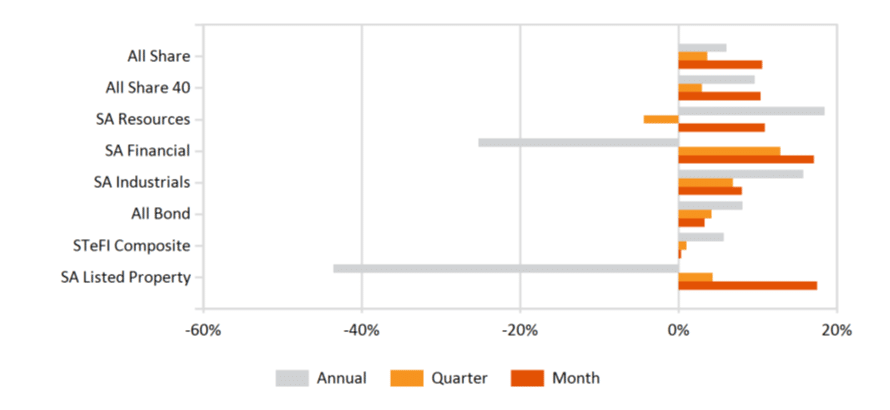

South African investors benefited from global risk-on sentiment. Equity indices posted substantial gains, with the SWIX closing 8.3% higher, led by a stellar 17.1% gain in the Financial subindex. All domestic asset classes, however, ended the month in the green, somewhat unusual in such a tumultuous year. The All Bond Index gained 3.2%, Inflation-Linked Bonds closed 2% higher and the beleaguered listed property sector posted a double-digit gain (18.4%).

Financial stocks were helped by strength in the banking sector, with FirstRand the standout performer, gaining over 20%. The resources subsector gained 10.9%, with losses in goldminers offset by substantial gains in platinum giants. Northam Platinum gained over 13% for the month. Naspers and Prosus reported more modest gains during November, partly due to relative weakness in Chinese parent Tencent. South African retailers, who had been hoping for a boost from Black Friday sales, are likely to have been disappointed. Overall physical sales were down by roughly 2 million transactions versus 2019. Online sales, however, increased by 60%.

“The South African Reserve Bank’s (SARB) Monetary Policy Committee left interest rates unchanged at its latest meeting, citing a largely stable inflation outlook.”

SARB Governor Lesetja Kganyano indicated that even though there are no demand-side pressures evident in a weak economic environment, and food inflation is likely to remain modest, the SARB is hesitant to bank on a stronger rand and weaker dollar. Exchange rate pressures could still result from heightened fiscal risks. The rand was notably stronger during November, but is still down roughly 9.4% against the Greenback for the year.

The South African government and labour unions were set to square off in the Labour Court in early December over the proposal to freeze wages for government employees over the coming three years. Should the unions receive court backing, the court has heard that the government will need to borrow over R78 billion to honour its three-year wage commitment. The country, which is grappling with a seemingly insurmountable fiscal deficit, can ill afford to incur further international debt.

“During November, two of the three major ratings agencies, Moody’s and Fitch, downgraded the country’s sovereign debt by one notch. It sinks the rating “deeper” into junk status. While it does not affect South African issuances’ inclusion in major investable indices, it does signal a significant loss of confidence.”

It also means that a rise out of junk status is unlikely in the medium-term. Markets, however, were little moved by the news, buoyed instead by the wave of global optimism.

South Africa is in the grip of a second wave of COVID-19 infections, putting the country’s nascent economic recovery at risk. Emerging hotspots include the Western Cape’s Garden Route and the Eastern Cape’s major metropoles. Toward month-end it became increasingly likely that regional lockdowns and/or tighter regulations would be imposed to combat the resurgence of the virus. The matter is made more difficult by many factors, one of which is “coronavirus fatigue”. Another factor which is likely to translate into increased transmission rates is that many people who work in major cities traditionally return home for the festive season. This is particularly likely to be the case for travel between the Western Cape and Eastern Cape.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance