Market Commentary: November 2018

Here are this month’s highlights: Developed market equity markets staged a rally at month-end on news of a likely trade-compromise between China and the US, and a more dovish tone from the US Federal Reserve. While Emerging Markets benefited from risk-on sentiment, South African equities were under pressure and underperformed peers. The rand strengthened against the USD, oil prices continued to slip and gold posted a modest gain.

Market View

Cash

South African money markets yielded 58 basis points (bps) for November. The Monetary Policy Committee, at its meeting towards month-end sounded a hawkish tone, and hiked the repo rate by 25 bps. The South African Reserve Bank (SARB) governor, Lesetja Kganyago, cited concerns around domestic inflation, which trended upwards from the 4.5% mid-range. While still within the target band, at 5.1% for October, the rate has increased steadily from its low point in March. Rising transport costs, higher administered prices and a volatile currency remain upside risks to the forecast. The SARB is therefore eager to anchor inflation expectations at the lower end.

Bonds

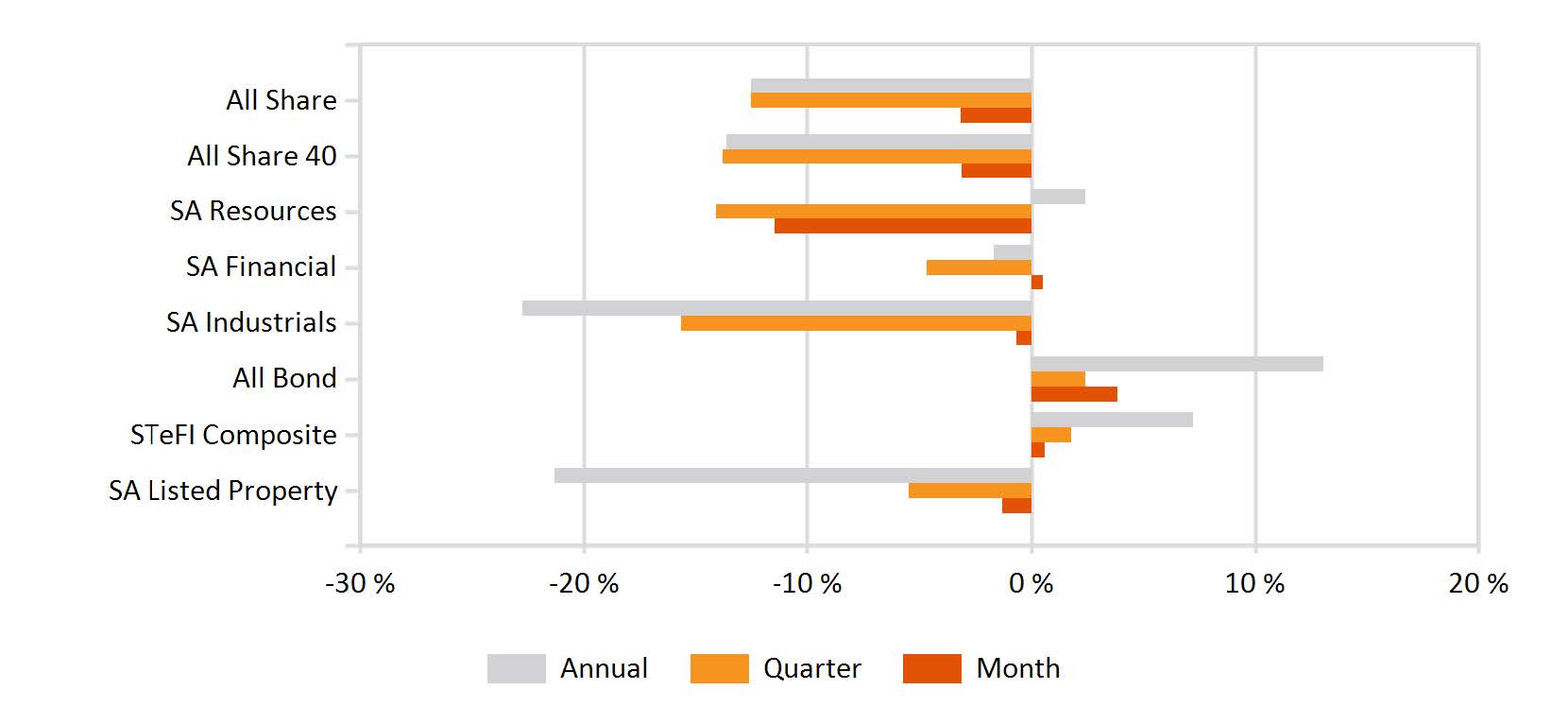

The ALBI posted a 3.87% gain, as South African bonds proved to be one of the best performing asset classes. Inflation-linked bond yields sold off even as fixed coupon bond yields fell, and linkers closed 1.14% lower.

“The international community appeared to be reassured by the new Finance Minister Tito Mboweni.”

Perceived improvements in governance (at State Owned Enterprises in particular) and fiscal restraint saw foreign flows returning to South African government issuance. The BarCap GABI, in contrast, closed a modest 0.31 % higher.

US Federal Reserve Chairman, Jerome Powell’s comments that the Fed funds rate was near neutral, was read by markets as a signal that the Fed would be less aggressive in its hiking cycle. Analysts are now pricing in only one additional rate increase in 2019, not two as previously expected. The more dovish tone saw debt concerns taking a back seat to falling global equity and oil prices, and emerging market bonds saw some return of risk appetite.

EM government bonds also benefited from improved investor sentiment towards Latin America. Ahead of hosting the G20 summit, Argentine assets benefited from the news that, after a second review, the country could soon receive another boost form the International Monetary Fund.

In developed markets, the yield on the benchmark 10-year Treasury note briefly dipped to below 3%, and ended at 3.01%, the lowest in over 10 weeks. Investment grade corporate issuance was strong, with many issuers apparently reading the bounce in equity markets as improved investor appetite.

“Demand for corporate issuance was laggardly, and trade worries and lower oil prices weighed on high yield bonds.”

Elsewhere, there was progress on the Brexit deal, but British Prime Minister Theresa May still has some way to go to sell it to the constituency. With Bank of England governor, Mark Carney, warning that UK corporates are ill-prepared for a hard Brexit, British 10-year gilts fell to a three-month low.

Equity

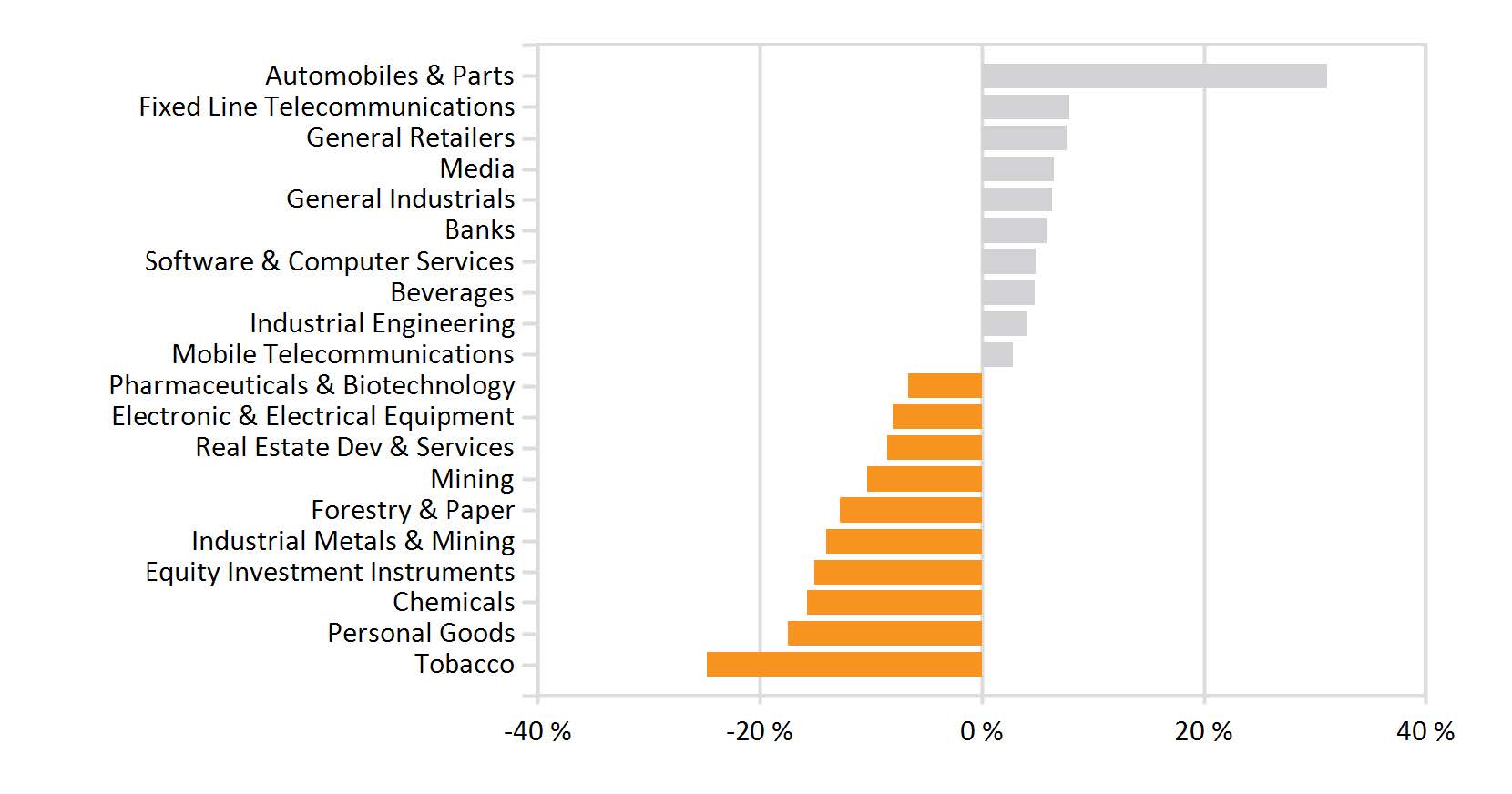

South African equities were under pressure, even as sentiment toward Emerging Markets improved. The All Share Index lost 3.22%, with only Financials posting a modest gain. Declining commodity prices, notably in the platinum sector weighed on the Resource sector.

“A stronger rand hurt export-oriented industries (including resources) and dual-listed large cap rand-hedges.”

Within the dual-listed space, market heavyweight British American Tobacco, long a market darling, has come under increasing pressure from US regulators and competition from next generation tobacco substitutes. The share price has shed over 40% for the year-to-date, with much of the dramatic decline coming in November. Richemont shares also registered a double digit loss, compounded by weaker Chinese demand and relative rand strength. Naspers shares, conversely, rebounded by 6.5%, nearly in direct proportion to Chinese A-shares.

Retailers remain bogged down by weaker consumer sentiment, and October retail sales were 0.6% lower on a month-on-month basis. It is expected, however, that November figures will be boosted by the extended Black Friday sales. Consumers will also benefit from a let-up in oil-price hikes, with pump-prices set to drop in early December.

Data on industrial production and business sentiment was mixed. The Absa Manufacturing PMI ticked up to 49.5 in November, which still indicates a contraction.

“The latest round of load-shedding will no doubt have a negative impact on manufacturing production.”

The latest GDP estimates nonetheless indicate that the country is no longer in recession. The current administration has done a solid job of reassuring investors, with its tough stance on corruption (linked to the ongoing saga of the Inquiry into State Capture) and its demonstrated commitment to fiscal discipline paying off.

Property

South African listed property shares closed lower (-1.29% measured by the more concentrated SAPY, and -4.6% measured by the ALPI). For the second time this year, a research report sparked a substantial sell-off in a property share – NEPI Rockcastle slumped by 14% after the report published by short-seller Viceroy. It alleges amongst other things that there has been an established financial fraud, and calls into question the M&A activities, cross-holding and governance concerns (also highlighted previously with regard to the Resilient Group), management’s transparency and reporting. Agile, non-benchmark-hugging allocations may have seen some investors steer clear of the stock, but the ripples were felt throughout the industry, since NEPI Rockcastle was one of the largest SA listed Property Index constituents.

“Global Property pared back prior month losses, and outperformed local peers and global government bonds. The FSTE EPRA/NAREIT Developed Rental Index gained 3.36% for November.”

This reflects the view from several market watchers: Rates tend to outperform after acute periods of interest-rate fear-driven selling.

Overall, the pick-up in global economic growth is providing a demand-side tailwind for REITs. Industry participants note that the fundamentals still point to significant value opportunities in selected sectors. New supply is generally in check globally; the cost of capital remains attractively-priced for the lower yield curve in spite of upward pressure on short-term interest rates; listed property companies’ dividend yield averages 4% for the first half of the year, and is expected to average 5% overall; and there may be an uptick in M&A activity. The latter observation is driven by the fact that, historically, direct/private market acquisitions of listed companies have picked up when listed companies are trading at these discounts.

“There is significant ‘dry powder’ in the real estate private market, partly as many investors have remained cautious in their allocations to Europe/UK during post-Brexit uncertainty.”

Retail rents have generally been under pressure – with UK High Street closures at a dime a dozen, and bricks-and-mortar facing off with e-tailers. Simultaneously, however, having a physical footprint in key locations in European High Streets, comes at an even higher premium. Tourism, which has picked up between European countries, has also been a key support to selected European High Streets, including ‘less traditional’ Prague, Barcelona, Madrid and Stockholm.

Investment and adoption of flexible office space and green building requirements has continued, in line with a more agile, more ESG-savvy and technology driven workforce. Investors also continue to engage increasingly with the Asian Pacific markets, with Seoul emerging as a stand-out market in terms of investment volumes.

“The rising rate environment and aggressive pricing put the brakes on the Hong Kong listed sector, but volumes are still 82% higher for the first nine months of the year.”

International Markets

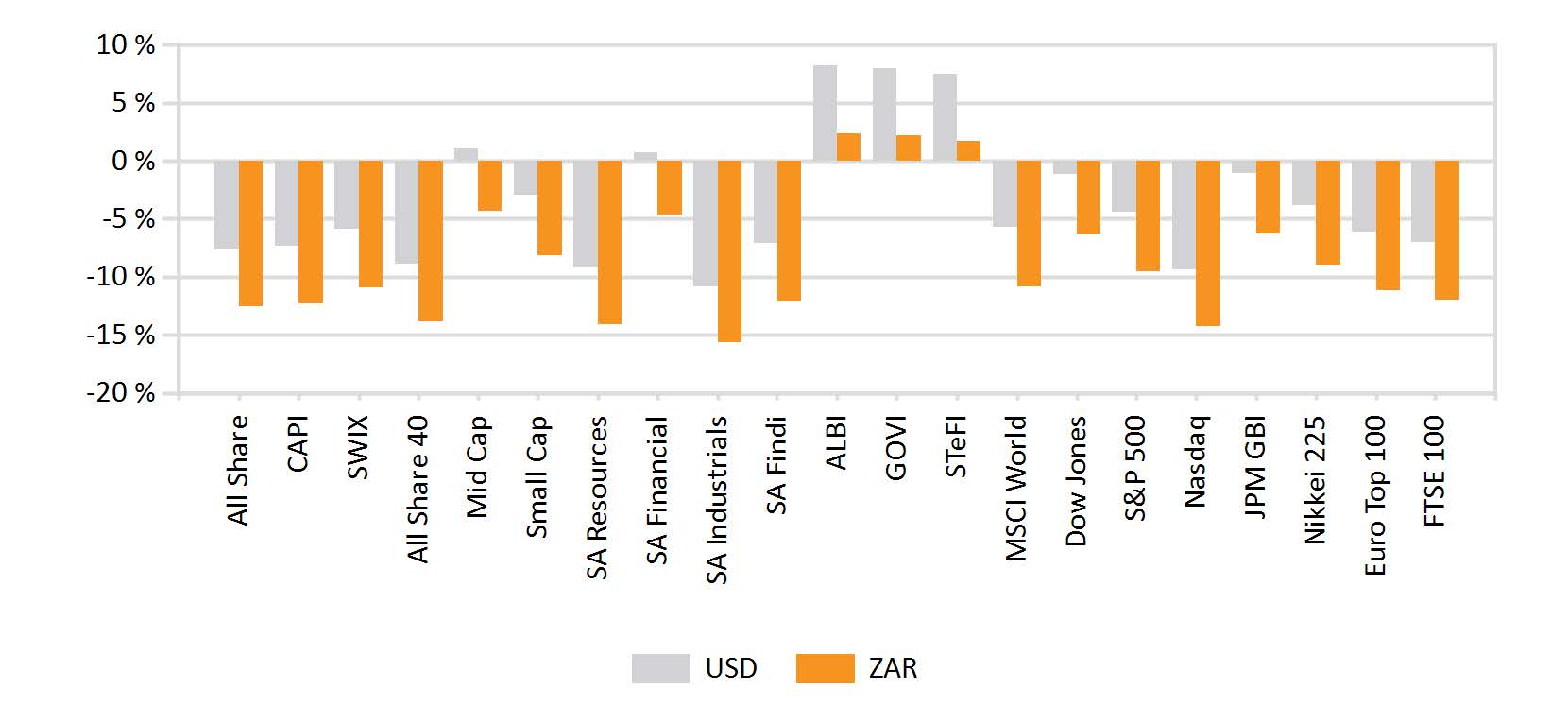

Equity markets were notably volatile during November: US midterm elections, Brexit negotiations, monetary policy and trade tensions caused investors to vacillate between risk-on and risk-averse sentiment. Global market equities ended the month mainly higher, with the MSCI World managing to gain 1.15%, and Emerging Markets outperforming developed market peers (MSCI EM at 4.12%).

In the US, trade tension appears to be weighing on consumer sentiment – while consumer confidence remains high, there is some concern that US economic growth is not as robust as anticipated. The Federal Reserve’s relatively dovish tone (with a less aggressive rate-hiking cycle) is evidence of this uncertainty. Market jitters regarding a more rapid tightening cycle were therefore assuaged and the Dow rallied. The S&P saw its biggest one day jump in seven years, and ended 2.1% higher as investors turned back to equities. The Fed’s lack of clarity regarding the path of rate hikes sets the stage for even more volatility in the months ahead. The VIX has climbed by 26% in recent weeks.

“Investors have expressed their concerns by turning defensive: on a sectoral basis, market darling tech stocks slumped by 2.1%; healthcare was a star performer posting 7% and utilities found favour.”

Signs of weakness persisted in the Eurozone, against the backdrop of trade wars, Brexit tension and an end to quantitative easing. The STOXX All Europe closed 1% lower, led by losses in Germany (-2%) and France (-1.7%). Automakers, in particular, weighed on the German bourse as vehicle manufacturers tackle emission standards and potential tariffs. Italian markets were also weak, as the stand-off with other EU nations on austerity and the budget resurfacing. Italian GDP contracted for the third quarter, and Purchasing Manager Index (PMI) readings for November were below the 50-point mark (indicating contraction).

Consumer confidence in the Eurozone has deteriorated to its lowest level since March 2017, and flash purchasing manager indices point to slowing activity. The composite PMI fell to 52,4. Business climate indicators, after hitting their lowest point in 17 months, finally showed some signs of picking up, partly as progress is made toward a Brexit deal. The deal was underwritten by the 27 EU member-country leaders, and December sees it submitted to the UK parliament.

“Prime Minister May has had a difficult time selling it to her constituency.”

Monetary policy expectations and macroeconomic data in the UK is highly dependent on whether the EU withdrawal agreement can be concluded. Consumer sentiment and spending measurements have continued to deteriorate – consumer confidence dipped three points to its lowest level since December 2017.

“Business confidence is at its lowest since the UK originally voted to leave the EU in 2016.”

Bank of England Governor, Mark Carney, has made it clear that British companies are ill-prepared for a no-deal Brexit, with GDP estimated to contract by 10.5% in the worst case scenario. Large cap energy counters weighed on the UK bourse, and the FTSE100 closed -1.6% lower. Japanese equities registered a 1.9% gain, boosted by strong earnings’ reports and a weaker yen. Prime Minister Abe Shinzo also announced further fiscal stimuli to offset the consumption tax rate increase, and ameliorate potential domestic demand declines.

Chinese equities rebounded from trade-jitters, despite some fears around slowing economic growth. The MSCI China closed 7.3% higher, and China A-shares gained 2%. At month-end, sentiment was also boosted by the more conciliatory stance between President Xi Jinping and US President Donald Trump on the sidelines of the G20 Summit. The US has agreed to hold off on further tariffs, provided China honours its commitments to improve the balance of trade (by purchasing agricultural products, inter alia) and to respect and protect US Intellectual Property (IP) rights.

“Emerging Asia’s positive performance was echoed by an uptick in the MSCI Europe, Middle East and Africa Index.”

The MSCI EFM Africa ex SA registered a modest gain of 0.2%, partly dragged down by the weakness in commodity-exporting giants. Oil-rich Nigeria was hurt by the energy price decline, by some uncertainty ahead of key elections and by perceptions of investor protection. The broad index (the Nifty) closed 4.9 % lower.

Within the broader EM group, concerns around rising US debt levels dissipated somewhat off the back of Fed President Powell’s more dovish tone, and a weaker US dollar. Latin American markets were the weakest, although Argentinian markets were boosted by hosting the G20 summit. In Brazil, markets also reacted favourably to the appointment of reform-focused President Jair Bolsonaro. Mexican markets were a weak point – tensions with the US regarding the migrant crisis have ramped up and the newly-elected ‘hard-line’ president is unlikely to capitulate.

Currencies and Commodities

The USD ended the month on a fizzle, after seeing some volatility on trade war concerns, and so-called ‘Fed watch’. The basket ended a modest 0.1% higher against a basket of currencies. In developed markets, resource backed southern hemisphere dollars (the AUD and the NZD) were the biggest gainers (up by 5.4% and 3.3% respectively). The yen gave back prior month gains, closing 0.5% lower. British Sterling was buffeted by the turning tides of Brexit related sentiment – hitting a midmonth low of 1.15 against the Euro, it eventually ended near the flatline.

“Emerging Market Currencies were mixed: Turkey’s lira (+7.1%) benefited from dramatically improved US diplomatic ties, the South African rand climbed 6.5% against the dollar.”

The Indian rupee staged a recovery from its record low, as lower oil prices eased worries about the current account deficit and inflationary pressure. Elsewhere, however, geopolitics continued to weigh: The fall-out from perceived Russian election-meddling; Middle-Eastern and Ukrainian tension added fuel to the oil-backed rouble’s decline. Border and trade tension with Mexico continued to flare, and the Mexican peso was 0.3% lower.

In commodities, the GSCI index was -11.3% lower, as oil prices plunged by nearly 20%. The turnaround is partly attributed to OPECs inability to agree on cutting supply, even as more alternative sources (fracking and shale) come online. Industrial and Precious metals were higher, with Palladium adding 7% and Gold up by 0.6%. Livestock also posted a healthy return, with Lean Hogs gaining 6.7% prior to the traditional Christmas pig-out.

Other Emerging Latin American and European Middle Eastern and Africa currencies were less positive: The Mexican peso lost 8%, with investors troubled by ongoing US trade and migrant tension; Geopolitical developments spilt over into oil prices and into the currencies of oil-exporters and the Russian rouble dipped by 0.3%.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance