Market Commentary: May 2022

Global Market Themes: Elevated volatility amidst central bank action, Russia-Ukraine conflict – global equities mixed United States (US) equities gain modestly (0.2%); Emerging Markets (EM) tick higher (0.4%); United Kingdom (UK) bourse rides the oil-wave (1.1%); but Europe flounders (Eurostoxx -0.8%) Tightening global monetary policy – Rate hikes by United States (US) Fed and Bank of England (BoE) Energy prices continue to hot up – European embargo of Russian seaborne oil adds fuel to the fire Chinese equities gain ground as Omicron-induced restrictions let up somewhat in major cities SA Market Themes: Recurring rolling blackouts, likely to continue throughout winter, suppress green shoots of economic recovery South African Reserve Bank (SARB) hikes rates by 50 basis points (bps), in line with expectations Bonds and Inflation Linked Bonds (ILBs) consequently tick higher, gaining roughly 1% and 2% Financials fly high on rate hikes, subindex 3.5% higher, while industrials and resources dip South African equities end modestly higher, gaining 0.5% in May A volatile Rand hits a fresh yearly low against the dollar at mid-month, before clawing back to R15.58/USD

Market View

Global Market Themes

Global markets were volatile during May, and stock market returns were mixed. While United States equities delivered muted upside (the S&P500 gained 0.2%) and the UK bourse (the FTSE100) closed significantly higher, their European counterpart (the STOXX All Europe) lost 0.8%. Emerging Markets showed a similar divergence. The MSCI EM gained a modest 0.44%, with losses in Russia and India offset by solid gains in China and Brazil.

“The two major themes in global markets have remained unchanged from the previous month: the ongoing war in Ukraine, and the steady rise in global inflation.”

In the United States, the Federal Reserve Bank (the Fed) has become increasingly hawkish. Fed Chairman, Jerome Powell, has indicated that the Bank will move aggressively to keep inflation in check. Although it was no surprise that the Fed announced a rate hike after its Federal Open Market Committee (FOMC) meeting, the 50 basis points (bps) is the largest in two decades. The Fed also outlined its plan to start unwinding its USD 9 trillion balance sheet as of June, in a bid to dampen excess liquidity. Recessionary fears have resurfaced in the States, and consumer confidence has continued to ebb. The Composite Purchasing Managers Index (PMI) has also dipped substantially, with all three components (Manufacturing, Non-Manufacturing and Services) registering a decline during May. While the Composite PMI remains in expansionary territory at 53.6 (down from 56 in the prior month), the magnitude of the decline is a source of concern for policymakers and the public alike.

The FTSE 100 continued to ride the oil-wave, with the UK bourse gaining 1.1% during May. The growth-outlook, however, is far from sanguine. Data from the Office of National Statistics showed that UK GDP declined by 0.1% between February and March, and the governor of the Bank of England (BoE), Andrew Bailley, has warned that a recession is a distinct possibility. In the face of the highest annual inflation rate in four decades (9% in April versus 7% in March), the BoE hiked interest rates by 25 basis points. UK consumers are feeling the pinch of rising energy prices (although the UK is an oil-giant) and consumer confidence has fallen sharply.

“Chancellor Rishi Sunak, in an attempt to ameliorate the cost of living crisis, has announced a GBP15 billion support package, which is partly funded by the energy profit levy.”

The Eurozone’s stock market, where investor sentiment has been hard-hit by the ongoing conflict, rising energy prices and higher inflation, has continued to lag its Developed Market (DM) peers. The STOXX All Europe lost 0.8% during May. Unlike its peers, the European Central Bank has been reluctant to hike interest rates, signalling that it might only do so in July and September. This painful wait and see attitude might cost the zone dearly, as it is potentially heading for a stagflationary trap. Eurozone inflation is expected to be roughly 8%, and while the zone is still in growth territory (signalled by a PMI of 54 and above the watermark 50), production has been slowing down. The agreement by EU leaders to a partial embargo of Russian oil, set to take effect at the end of the year, does little for its growth prospects. Nor does the fact that Russian gas giant, Gazprom, has halted supplies to Shell in Germany, because the country refuses to use the Kremlin’s rouble-payment system.

Chinese equities ended a three-month losing streak in May, and the MSCI China gained 1.1% during the month. China, however, is still being hamstrung by the government’s hard stance on COVID-19 related lockdowns, with Shanghai only recently surfacing from its latest round. The government has also stepped up its stimulus package to cushion the impacts of severe restrictions.

“The government has promised to broaden tax credit rebates, increasing tax cuts by more than USD 21 billion. They will also postpone social security payments, including pension insurance premium payments, for small firms, businesses and severely distressed sectors until the end of the year.”

This means that deferred payments will reach roughly 320 billion Yuan this year. A 200 billion and 300 billion bond issuance is expected to boost the ailing aviation and railway construction sectors. Banks have also been urged to extend loan repayment holidays. Sentiment was further lifted by an apparently softer stance from the US, where President Biden indicated that they would consider removing some of the tariffs on Chinese imports.

Elsewhere in Emerging Markets, Asian equities advanced marginally, while Latin America easily outstripped EM and DM peers. The MSCI EM ended the month 0.4% higher. Brazilian equities were one of the star performers, as energy prices boosted the oil-rich nation’s bourse. Chile advanced even more strongly. A series of constitutional changes has been tabled which aims to eliminate some of the more unorthodox policies which hindered growth and stability. Politics also played a role in Colombia’s rally, as a successful first round of elections boosted sentiment.

Oil price gains show little sign of slowing, and spot prices were 7.9% higher in USD. There has been increasing pressure on the Organization for Petroleum Exporting Countries (OPEC) to increase production, alleviating the pressure from the interruption in Russian oil supplies. Other commodities were largely lower, with Gold giving up 3.1%, Copper losing 3.3% and Palladium losing a whopping 14%. The reason for the dip in Gold is likely to be twofold: the relative attractiveness of inflation-linked instruments has increased, given a rising global rate; and several fundamentally sound equities are trading at depressed valuations, making them attractive for astute investors. Palladium, on the other hand, a key component in the manufacturing of catalytic converters for cars, has remained under pressure due to the ongoing lockdowns in manufacturing giant China.

South African Market Themes

May was a rather gloomy month for many South Africans: Eskom managed to surpass its own “worst case scenario” regarding loadshedding. The scenario, presented at a media briefing in March 2022, estimated that there would be a total of 295 days of loadshedding between April 2022 and March 2023, and predicted that there would be 22 days of loadshedding (not reaching beyond Level two) in May. The chilly reality is that there were 24 days of loadshedding to kick off the winter, and that it hit as high as Level four on more than one occasion.

Although South Africa’s GDP growth rate for the first quarter beat expectations (at 1.9% versus the expected 1.2%), the outlook for Q2 growth is far from rosy. The easing of the remaining restrictions boosted the first quarter numbers, and by notable growth in the manufacturing sector (4.9% versus 2.4% in Q4 of 2021). The former is a once-off event, and the latter will continue to be severely impacted by an inability to keep the lights on and the production belts spinning.

“Industrial production had already dipped by roughly 5% in April, coinciding with the “first” rounds of power cuts. Additionally, the impact of the flooding in KwaZulu Natal is likely to weigh on Q2 GDP growth.”

Understandably, business confidence in the country is at a one-year low with the RMB/BER business confidence index falling to 42 in the second quarter.

While South African consumers were given a temporary reprieve from rising fuel prices, June brought on sharp price hikes – with motorists having to fork out R2 per litre more at the pump. However, if the Treasury and the Department of Mineral Resources and Energy had not extended the R1.50 reduction in the fuel levy prices would have increased by nearly R4 per litre. At the urging of opposition parties, Parliament will debate the record rise in petrol prices and possible interventions to shield the public from the brunt of the global energy crunch on the 15 June. The government has warned that the state cannot afford a continued fuel-price intervention.

With fuel and food prices rocketing globally, South Africa’s inflation rate remained above the South African Reserve Bank (SARB’s) targeted mid-point (4.5%) for the 12th consecutive month, coming in at 5.9% in April 2022.

“The SARB has effectively and efficiently broadcast its intention of implementing the necessary rate hikes in its fight against inflation, and the announcement of a 50 basis points hike in the repo rate was, therefore, no surprise.”

Interest-rate sensitive asset classes, such as bonds and Inflation Linked Bonds (ILBs) gained ground, with the All Bond Index (ALBI) and Composite Inflation Linked Index (CILI) ticking 1% and 2% higher. Financial equities were also higher, with the subindex gaining roughly 3.5% for May. Resources (-0.4%) and Industrials ( -2.2%), however, proved a drag on the bourse, and the Capped Shareholder Weighted Index (Capped SWIX) ended the month a modest 0.5% in the green.

The Rand had a highly volatile month, as emerging market jitters and a hawkish Federal Reserve Bank weighed on sentiment. At mid-month, the local unit hit a nadir of R16.24/USD. The timely and intentional actions of the SARB, however, reassured market participants and the currency recovered lost ground to end the month at R15.58/USD.

Performance

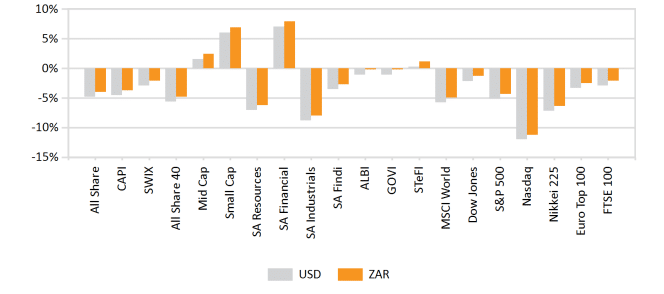

World Market Indices Performance

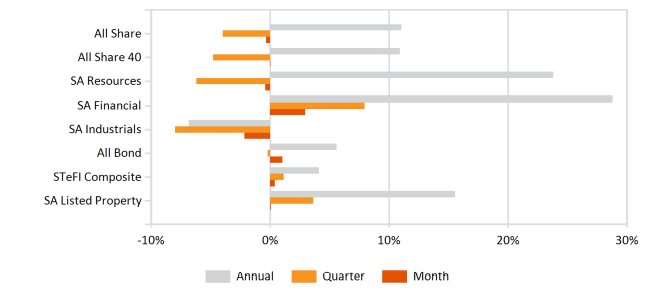

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices