Market Commentary: May 2020

Global Market Themes: United States unemployment soars to record highs US futures pricing in negative federal funds rate in 2021 UK short-term rates go negative UK faces no-trade deal Europe and Japan stimulus measures Sino-US tensions escalate – Phase One deal in jeopardy Hong Kong adds fuel to the fire – new Chinese national security law puts special status at risk SA Market Themes: SA Reserve Bank cuts a further 50 bps Lockdown moves to Level 3 from 1 June Tax revenue collection under pressure Rand recovery to be gradual yet volatile

Market View

Global Market Themes

United States (US) unemployment has soared to a record high of 14.7%. Against the backdrop of lockdown measures to combat the spread of the coronavirus, nearly 42 million Americans lost their jobs in the two months leading up to June 2020. White House economic advisor Ken Hasset projects that unemployment may reach 20% by the end of June. Senator Nancy Pelosi has managed to have the HEROES Act passed by the House of Representatives. The Act could see a further $3 trillion in support extended to struggling citizens.

Meanwhile the US Federal Reserve Bank (the Fed) is doing all it can to shore up financial markets and bolster the economy as unemployment soars and economic growth stalls. This included cutting the federal funds rate to near zero in March 2020. Observers have speculated that the Fed could even go so far as to cut rates to below zero, an unprecedented move in US history. Fed Chairman Jerome Powell insists that he believes negative rates are neither ‘appropriate nor useful’ for America, although he is facing pressure from President Donald Trump to push rates into negative territory. Markets are loath to dismiss the idea of negative rates, as is evident from May’s futures market pricing. The futures market is used as a hedge for and an outright bet on the Fed rate’s level for interest rates as far as three years down the line.

“Recent futures pricing action saw the yields on two-year Treasuries dip into record-low territory.”

In mid-May, prices for early 2021 contracts surged to above 100, a level that marks the boundary to negative interest rates. The previous low was seen in September 2011, against the backdrop of Europe’s sovereign-debt crisis and as the US economy struggled to climb out of a recession. Eurodollar options, commonly used as a hedge against Fed policy action, were also covering a bank policy rate as low as negative 45 basis points (bps) by mid-2021.

In the United Kingdom (UK), the Bank of England (BOE) in turn has issued negative-yield bonds for the first time in its history. This means that borrowers are paying the BOE for lending them money. This is a definitive sign of the premium placed on safety: Even if investors know they will receive less than their initial capital invested, they are willing to sacrifice performance in return for a guarantee. Andy Haldane, BOE chief economist, has explicitly not ruled out the possibility of interest rates dropping into negative territory in the face of slowing inflation. European counterparts and the Bank of Japan (BOJ) have already resorted to this measure.

“The UK faces the very real prospect of a no-trade deal with the European Union (EU). While the headlines were dominated by COVID-19, relations between the UK and the EU have become increasingly fractious.”

The Third Round of Brexit talks ended with ‘very little progress’ toward an agreement on some of the most contentious issues, as per UK chief negotiator David Frost. If Prime Minister Boris Johnson doesn’t ask for a further extension by 30 June, the two parties will only have six months left to strike an exceedingly complex free trade deal. The uncertainty around a no-deal exit is acting as a major deterrent to financial investors.

In Europe and in Japan investors are more optimistic about the gradual reopening of economies and about forthcoming stimulus measures. The European Commission has unveiled a €750 billion pandemic recovery plan. The European Central Bank (ECB) is also widely expected to increase its asset purchase programmes for this year at its policy meeting early in June. This is in response to the warning from President Christine Lagarde that the eurozone economy will shrink by between 8% to 12% this year due to COVID-19.

Japan is one of the countries gradually reopening its economy – the state of emergency for the five prefectures remaining under lockdown was lifted on the 24 May, a week ahead of expectations. On 27 May, the government announced the second supplementary budget for the year. The latest stimulus package (¥117 trillion or $1.1 trillion) brings the total to ¥230 trillion, or roughly 40% of Japanese annual GDP.

“Prime Minister Shinzō Abe also intends to increase Japanese bond issuance to approximately ¥210 trillion to help offset the impact of the virus on the economy.”

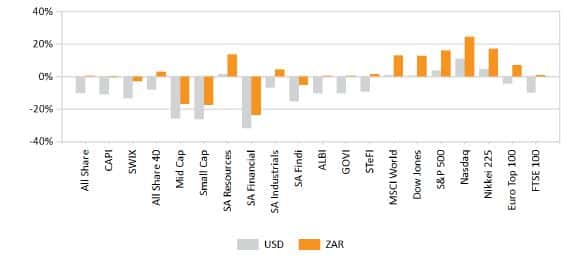

Stimulus measures and the gradual reopening of economies has rekindled global risk-appetite. Risk assets, particularly in developed markets, continued to rally in May, with the best equity performances in Germany (+7%), Japan (+6.7% and the S&P500 (+4.7%). A renewed appetite for risk also played out in fixed interest markets as corporate bonds outperformed government bonds, and high yield (HY) led the pack. High yield bonds, many of which are linked to the recovering energy sector, returned 4.5% in local currency terms. Emerging Market (EM) bonds and currencies also registered positive returns, with the currencies of oil exporters posting the strongest gains.

In the meantime, US-China trade tensions have escalated again. After an extended period of uncertainty, global investors seemed to heave a sigh of relief as a Phase One trade-deal was signed in early January. The deal, amongst other things saw China commit to purchasing $200 billion more in US products (than in 2017) over the next two years. This deal is now in serious jeopardy, as President Trump recently threatened to terminate the agreement if China failed to fulfil this promise. Yet, the reality is that the country is far off-target and is unlikely to be able to do so.

“With the pandemic shuttering large parts of the economy for at least two months, Chinese imports of US goods fell by 23.5% from 2019 levels. It is estimated that China is $21.2 billion behind schedule for the first three months of 2020.”

Chinese equity markets lagged Developed and EM peers, with the MSCI China and the MSCI China A Onshore indices losing 0.5% and 1.6%, respectively, during the month. Other EM equities fared somewhat better. Off the back of a stronger currency, pledges of central bank support and a resurgent oil price – oil prices strengthened by a staggering 42% – countries such as Russia and Brazil registered solid gains (3.1% and 8.5%, respectively). The MSCI EM, however, gained only 0.7% for the month, with appetite suppressed by the re-emergence of China-US tensions.

Aside from COVID-19 fanning the flames, Hong Kong has again emerged as a bone of contention between the superpowers. China passed a controversial national security law at the end of May. Relatively few details are known, but critics fear that it will curb the essential rights of residents in the financial hub. The US has warned that it is likely to impose sanctions on China. The Trump administration is also looking to impose sanctions on foreign banks and corporations that deal with Hong Kong financial institutions. Meanwhile, US Secretary of State Mike Pompeo has recommended that Hong Kong lose its special customs territory status, which it has enjoyed since becoming semi-autonomous in 1997. This would mean that tariffs and sanctions can be imposed on the roughly $34 billion trade surplus the US has with Hong Kong. It is also a homebase for 1 300 US firms and 85 000 Americans, who will all be affected by new visa rules and trade restrictions. Hong Kong, consequently, proved to be the worst performing amongst Developed Market peers, losing 8.4% in May.

In commodities, the increased 16.4% in May, led higher by the rally in energies. Gold, ever the safe-haven asset, posted further gains during May and ended 2.7% higher.

South African Market Themes

The South African Reserve Bank (SARB) moved in lockstep with many of its global peers, slashing interest rates by 50 basis points (bps) during its meeting in May 2020. This is the third rate cut in 2020 and brings the total reduction to 250 bps. It also takes the repo rate to its lowest level in 50 years. The SARB is doing what it can to shore up the country’s economy, which is languishing in lockdown lows. The SARB has forecast that the economy could contract 7% in 2020 and that the unemployment rate could surpass 50% this year. Like its international peers, the SARB has also undertaken measures to increase liquidity in the market, including purchasing government bonds in the secondary market.

“It’s estimated that the SARB’s combined interventions will inject roughly R300 billion into the economy.”

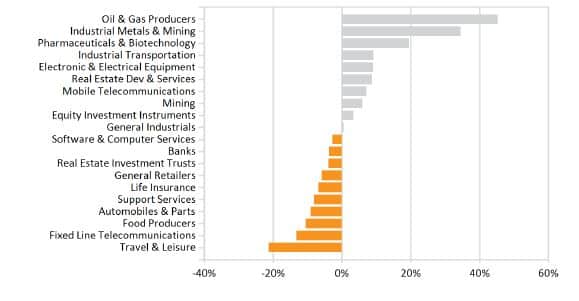

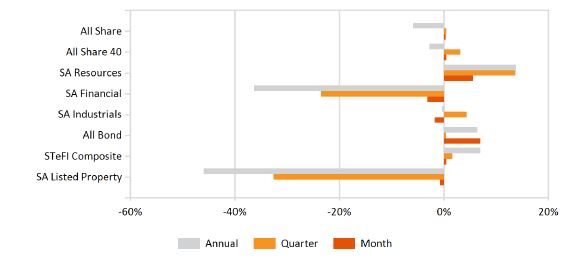

Shares in financials were notably lower, with bank margins being squeezed as interest rates fall. The global contraction in economic activity, and the understandable hesitance on the part of businesses and consumers to take on new debt, has also added to the banking sector’s woes. South African banks are likely to experience a sharp increase in bad debt levels, and these companies are likely to cut dividends for the next couple of years. The SA Financial Index ended May 3.1% lower.

Local industrials are still languishing in lockdown lows, and the sub-index lost 1.7% in May. In resources news, analysts predict a bull-market for gold for the next few quarters. Uncertainty about the pace of a global recovery have added to the lure of the safe-haven asset. Central bank liquidity injections have the effect of diluting the value of currencies. Set against a backdrop of zero interest on borrowing and the possible scenario of low growth and high inflation, gold looks even more attractive.

“As several South African mines reopened (or partially reopened) on 1 May, the resources sector surged ahead, ending the month 5.5% in the green.”

This was not, however, enough to boost the overall index into positive territory, and the SWIX registered a loss of nearly 1%, lagging developed and EM peers. The SARB has left itself some room to manoeuvre in cutting interest rates even further, with inflation projected to be near or even below the lower 3% threshold of the target-band. A few upside risks remain, however. Administered prices (including electricity) are set for further increases, the currency remains vulnerable and oil prices have rapidly rebound from their historic lows. The oil-price-bounce saw year-to-date losses erased. Not surprisingly, the fuel price at the pump is also set to increase. Consumers returning to work will face paying R1.16 more per litre.

As South Africa moves into lockdown Level 3 from 1 June, roughly eight million South Africans return to work. Toward the end of May, there was still some uncertainty as to whether the whole country would step into Level 3, or whether COVID-19 hotspots, mainly metropolitan areas, would remain at alert Level 4. In Level 3, many businesses are still unable to reopen their doors (hairdressers, salons, gyms etc) and the sale of tobacco is still banned. The tobacco ban has emerged as one of the most contentious parts of the lockdown laws. Estimates suggest that the country is losing R36 million daily in foregone sin taxes.

“South African retailers are struggling as cash-strapped consumers stick to the essentials. For a number of retail-focused Real Estate Investment Trusts (REITs) it will continue to be a tough market.”

As office-workers continue to work from home, the office-market is proving equally choppy. Meanwhile, in the lukewarm residential market house prices are predicted to fall by as much as 5%. With widespread job-losses and income uncertainty, demand will remain muted. Supply, however, is likely to increase as households can no longer afford their mortgages. Perhaps the only subsector of the property market that will continue to strengthen is in logistics and warehousing, as the popularity and necessity of arms-length shopping and trading grows. The All Property Index lost a fairly modest 0.5%, underperforming its global counterpart. The FTSE EPRA/NAREIT Developed Market Rental Index gained 0.6% as global economies begin to reopen.

“The South African Revenue Service (SARS) has also announced that it foresees that it will lose between 15% to 20% of tax revenue for the current fiscal year because of the lockdown.”

Not only has the dip in economic activity eroded the tax base (businesses still prohibited or forced to close down, excise taxes foregone, fewer goods sold and lower contributions from VAT), but downward bracket creep is likely for many taxpayers. The body envisages that it will have to reassess the national budget that was presented to Parliament in February of this year. While South Africa will get some funding from institutions like the IMF, SARS is still going to have its work cut out for it to address the shortfall. National Treasury is therefore planning to table a special adjustments budget on the

24 June.

In the meantime, South African bonds have rallied, with the ALBI gaining 7% to end May. This is partly a relief rally after the country’s exit from the World Government Bond Index (WGBI). It is also partly a response to the SARB’s aggressive policy easing and bond-buying in the secondary market. As investors piled into shorter-end securities after the SARB cut the repo rate to a record low, the yield curve steepened sharply. Analysts expect that longer-dated debt will also rally in the coming months. The country’s bonds are still offering some of the highest yields in the developing world, lagging only Turkey, Lebanon and Nigeria.

“The South African rand, in the meantime, has had rather a rocky road. The currency was not spared the massive sell-down in emerging markets in the swiftest and largest withdrawal from EM in history.”

The rand, during the time of the crisis, pushed weaker to extremely oversold positions. The crisis is now abating, in part because of a wave of financial stimuli, and a return of EM risk appetite is anticipated. But, in South Africa, that is tempered by the precarious position of its government’s finances. The rand recovered somewhat from its April lows and appreciated by roughly 4% against the dollar, but the currency is still very vulnerable to EM risk-off sentiment. And, the latest news regarding China, Hong Kong and the US are threatening to derail the EM recovery.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance