Market Commentary: May 2019

Here are this month’s highlights: Global Equities dipped sharply, in the face of tougher trade talk and global growth headwinds. The knock-on effect of Sino-US trade tension and slowing Chinese growth has taken its toll emerging markets and commodities. Local equities managed to outperform global peers, as local elections spurred investor confidence. The rand, however, was noticeably volatile. Safe-haven asset classes and defensive sectors performed better than riskier counterparts.

Market View

Cash

South African cash generated 61 basis points (bps) in May. The latest data shows that inflation declined to 4.4% for April 2019, undershooting market expectations. Slowing housing and utilities prices, as well as food, offset an additional hike in fuel. This is below the South African Reserve Bank’s (SARB) target range, implying that there may be some room for rate cuts.

While keeping the repo rate unchanged at 6.75%, the Monetary Policy Committee (MPC) delivered a dovish statement after its mid-May meeting. Two of its five members voted for a 25-bps rate cut, signaling that the next movement could be downward. Rising oil prices and a volatile rand, however, remain a threat.

Bonds

South African bonds barely outstripped cash returns, with the ALBI yielding 0.64% in May. Inflation-linked bonds had a negative return of 0.72%, giving up the gains seen in April. Despite the positive election results, yields rose some 5 – 10 bps in May, mainly due to a risk-off sentiment towards Emerging Markets and ever-sharper trade-war rhetoric.

“Overall, South African fixed coupon bonds offer attractive real yields – ranging between 4% and 4.7% for the 10-year and longer dated bonds (assuming 5% inflation) and 3.35% for linkers.”

For the month, local fixed income assets underperformed global peers by some margin, as the BarCap GABI gained 2.92%.

On the global front, central banks remain accommodative, and are wary of making significant rate adjustments, given global growth concerns, ongoing geopolitical tension and the escalation of the Sino-US trade spat. The May Federal Open Market Committee meeting minutes attest that the Fed believes the current shortfall in inflation to be temporary and will therefore keep rates on hold. More dovish comments from (inter alia) vice chair, Richard Clarida, indicated a willingness to cut rates if growth proved to be slowing. Markets are currently pricing in three rate cuts for 2020.

Safer-haven US T-bills proved attractive to risk averse investors – US Treasuries returned a positive 2.4% for the month, and yields fell. European bonds showed a more muted response to ongoing tensions, and gained only 1.1% for the month, with the Italian market a notable underperformer. Amidst fears that the country’s high debt levels would cause a stand-off with European Union peers, Italian bonds gave up 0.4% in local currency terms. The spread between the 10-year Italian government bond and the equivalent German Bund widened to 2.95%. This, after the Italian finance ministry received a warning from the European Commission regarding increasing debt levels, expected to rise to 135% of GDP by 2020.

“Energy counters struggled, which had a knock-on impact on High-Yield bonds.”

US High Yield gave up 1.3% in local currency terms. Emerging Market bonds, vulnerable to sentiment, lagged developed peers, and only managed to eke out 0.6% for May. After a sharp pull-back in the beginning of the month, better-quality investment grade corporate bonds clawed back some losses and managed a slightly better return of 0.7%.

Equity

South African equities slipped in May, effectively cutting the year-to-date performance in half. The SWIX lost 5.64%, with the year-to-date return for May now at 5.74%. The local bourse managed to marginally outperform the MSCI World and fared substantially better than its Emerging Market peers.

Local elections proceeded uneventfully, with the results favoring the ruling African National Congress. Cyril Ramaphosa’s confirmation as President of the Republic of South Africa, and the appointment of his Cabinet, were greeted favorably by local and global investors.

“On the economic front, the South African Reserve Bank (SARB) sounded a negative tone: It revised its economic growth forecasts downward.”

This was expected, given the spate of poor mining, manufacturing and retail data from the first quarter of the year. The first quarter GDP data, expected in June, is likely to point to a contraction, as industry suffered widely under the unexpected rolling blackouts and amidst some jitters ahead of local elections. The SARB has lowered its growth forecast for the year to 1%.

The ABSA Manufacturing Purchasing Managers’ Index fell to 45.4 in May, two points lower than the April reading and the fifth consecutive contraction. The latest reading of the composite index (April) at 50.30 signals that the economy is expanding, albeit at a modest pace.

The BER consumer confidence index ticked higher for 2019’s second quarter. But South African consumers remain under pressure — clear from several indicators: Total Vehicle Sales dropped by -5.7% year-on-year in May, its fifth consecutive decline proving that debt-ridden and cash-strapped consumers are wary of taking on chunky investments/expenditure.

All major sectors of the index were lower, with industrials showing the biggest loss (-5.95%). Naspers dipped by nearly 9%, dragging on the index. British American Tobacco also slumped further, hitting a three-month low at month-end.

“Despite some jitters after the suspension of its CEO Peter Moyo, and a consequent dip in Old Mutual Limited share prices, financials outperformed their peers, yielding -2.31% for the month.”

With ratings agencies leaving South Africa’s status unchanged for the time being, analysts believe that the commitment shown by the country’s new leadership will be key to unlocking foreign investment and boosting local demand.

Property

Listed South African property dipped, albeit to a lesser extent than equity counterparts. The SAPY lost 0.87%, while the more inclusive ALPI closed -2.04% lower. This is due to its larger exposure to UK and small cap SA companies, both of which underperformed.

The housing market continues to be weighed down by the depressed macroeconomic outlook. The conflation of higher taxes, lower GDP growth and forecast growth, higher inflation and lower real wages, and higher utility prices have noticeably impacted the sector.

May was the peak reporting period for companies with a February/March financial year-end. The general message has been a continuation of themes highlighted during 2018. Retailers remain under pressure, not only from e-tailers, but also as consumer spending and, consequently, foot-traffic declines, vacancy levels have been difficult to maintain, and foreign investors remained wary amidst policy uncertainty.

“Most reporting companies have seen downward revisions to their full-year growth forecasts/guidance.”

This is due to the depressed local and offshore demand, but also reflects that non-recurring earnings from previous periods have been stripped out and that Merger and Acquisition activities have slowed.

The sector showed considerable divergence between listed property companies: Growthpoint, often seen as barometer for the market’s overall health, lost 2.77%, in line with the ALPI. SA Corporate lost over 17% on news of imminent management changes, and in an environment that is extremely sensitive to ESG considerations. The index was boosted by a recovery in Resilient Group shares after being cleared by the FSCA of wrongdoing. The Resilient REIT gained 3.87% and NEPI Rockcastle ticked 3.21% higher. Weak fundamentals will continue to weigh negatively on the sector in the short term, but the yield spread between the SAPY and the Long Term South Africa Government bond remains positive (10% average forward yield versus 8.97%).

The FTSE EPRA/NAREIT Developed Rental index gained 1.7% in rand terms, and ended near the flatline in dollar terms (0.08%), during May, materially outperforming local property. Key risks to the global-listed property outlook remain, but analysts predict that global commercial real estate is poised to maintain its steady performance. Capital values and rents are both predicted to edge up further in 2019.

“The prospect of interest rate hikes initially weighed on US markets, but the Fed’s recent dovish tone has engendered cautious optimism.”

Nonetheless, pending home sales in the US were lower in April compared with March, and the 2% dip in sales is the 16th consecutive month of contraction. Mortgage applications have increased, and consumer confidence has ticked up. Cooling home prices, while helping buyers on the affordability front, have a deterrent impact, in that investors run the risk of a negative return when selling homes.

Elsewhere in the Eurozone, some analysts are warning of a potential house price bubble, should the European Central Bank maintain real interest rates at negative levels. House prices have been rising rapidly in most large economies, as have rental rates. In the UK, on the other hand, house prices cooled during May, with year-on-year price growth slowing to 0.6%, down from 0.9% in April 2019, as demand appeared to wane. Although the Brexit delay has given the office and industrial production sectors some breathing space, relocation of key financial services and industries are still a threat.

“An interesting development in the global REIT market is that investors now need to factor in climate change risks.”

According to a joint 2018 survey by climate analytics and a real estate technology firm, Four Twenty Seven and GeoPhy, 35% of global REITS are exposed to climate change risks, including flooding, typhoons or hurricanes, and elevated sea-levels.

There has therefore been a rise in the number of REITs that specifically look at ESG factors. In 2018, the number of property funds and REITs that use ESG strategies climbed to 108, up from 30 strategies in 2010. It also saw the launch of the FTSE EPRA Nareit Green Indexes, which were created to provide a sustainable extension to the FTSE EPRA Nareit Real Estate Index Series. Factors included governance, climate change and carbon, community relations and philanthropy, pollution and toxics, green building and smart growth.

Investors, who are quick to cotton on to these trends, including their application to local markets, are likely to have first mover advantage. Fundamental investors may therefore find pockets of value in global retail REITs, and unlisted property remains a favoured investment channel.

International Markets

Global markets slumped, against a backdrop of tougher trade talk and rising geopolitical risks. The MSCI World closed 5.77% in the red. Emerging markets underperformed developed peers, as the MSCI EM closed 7.26% lower, led by substantial losses in China (the MSCI China lost 13.09%).

“The escalation of trade tensions toward month-end saw US stocks plummet to their lowest point this year: the S&P500 closed the month 6.3% lower.”

US companies have felt the impact of the slowdown in global growth, subdued inflation data and higher input costs (including higher wages). US corporate earnings season concluded with no year-on-year earnings growth.

Trade rhetoric between the US and China has taken a sharper tone: President Donald Trump indicated he was “nowhere near” making a deal, and his Vice President, Mike Pence, alluded to being able to “more than double tariffs on China if needed”.

Simultaneously, China announced that it would be creating an “unreliable entities list” that would have details of companies and individuals restricted from doing business with Chinese firms. The country had also put in place a plan to stop exports of rare earth metals to the US. Nearly 80% of the world’s rare earth metals are produced in China, and they form key components of many products (especially in advanced electronics).

“Macro models have forecast that US GDP would be some 0.7 percentage points lower in 2020.”

President Trump also announced that Mexican goods would be subject to a 5% tariff, unless the flow of unauthorised migrants across the border was addressed. Automakers were particularly hard-hit, given the importance of cross-border chains in the industry. Analysts estimate that the price tag of a 5% tariff on USD 346 billion of Mexican imports to the US could generate roughly USD 17 bn. Despite these tariffs being less extensive than those levied on Chinese goods, US consumers are likely to feel their effect far faster, as upticks in food prices, for example, are directly observable. This may end up being a double-edged sword for Trump: Tariffs on Mexico marry two campaign-trail rabble-rousers – immigration and trade.

” But, if Middle America feels the impact of increased tariffs more acutely, it may yet harm his bid for re-election.”

On a sectoral basis, energy stocks posted the biggest losses in the latter half of the month, as US crude inventories showed a smaller than expected decline. Tech stocks continued to bear the brunt of the so-called techonomic war, as the US moved against telecommunications giant Huawei. Defensive real estate shares held up the best.

Macroeconomic data was mixed: Personal income and spending rose more than expected in May. The University of Michigan’s consumer sentiment index, at 100 points, hit its highest level since September 2018. US jobless claims ticked higher, but remain at 50-year lows. On the downside, retail sales and industrial production dipped on month-on-month. The composite PMI reflected a decline in the Manufacturing PMI, the Services PMI and the Non-Manufacturing. The ISM Manufacturing PMI missed market expectations and dipped lower – tellingly the new orders component has dropped into negative territory. It raises concern as it could be a signal that capex and expansion plans have been put on hold due to trade uncertainty.This would ultimately filter through to job losses and waning consumer confidence.

European equities gave up some of their year-to-date gains, amidst ongoing Brexit uncertainty, and against the backdrop of key European Parliament elections and a ratcheting up of trade tension. The STOXX All Europe closed 4.43% lower.

“The Italian bourse was the hardest hit, with the Milano Indice Borsa (MIB) giving up just over 9%.”

Investors reacted negatively to the Italian election results, which saw a victory for far-right nationalists. The League party, under leadership of Matteo Salvini, has taken an openly Eurosceptic stance, which could set it on a collision course with Brussels.

On a sectoral basis defensive stocks, including consumer staples and utilities fared better, registering modest losses and outperforming financials and materials. Macroeconomic data from the Eurozone was somewhat lacklustre. Sentiment, as measured by the Business Climate indicator for the Euro Area, was negatively impacted by trade wars and hit its lowest level since August 2016.

The IHS Markit Eurozone Purchasing Managers’ Index dipped to 47.7, declining for the fourth consecutive month and, critically, giving a signal of a broader economy in contraction. New export orders, perhaps unsurprisingly, given the trade-tit-for-tat, dipped sharply. On the positive side, consumers, though not optimistic, have tempered their negative view: the Consumer Confidence Index for the European Union has gone up by 1.1 points, reaching -6.2 points. German economic growth appears to be stable and forecasts for both the country and the Eurozone show GDP growth of 0.4% for the first quarter.

UK equities could not buck the trend, but significantly outperformed Developed Market peers. The FTSE100 closed 2.87% lower. British politics remained turbulent: having secured an extension of Article 50 until October 2019, beleaguered Prime Minister Theresa May tendered her resignation, and was due to step down on 7 June. This has set the stage for a leadership battle in the Conservative Party and ultimately for the position of Prime Minister. Dominic Raab, ex Secretary of State for Exiting the European Union), Michael Gove, Secretary of State for Environment, Food and Rural Affairs, Jeremy Hunt,Secretary of State for Foreign and Commonwealth Affairs, Sajid Javid, Home Secretary, and the controversial ex-Foreign Minister Boris Johnson are all credible contenders, with the latter emerging as the bookmakers’ favourite.

“Sterling bore the brunt of investor jitters, giving up year-to-date gains against the dollar and euro.”

The Bank of England kept rates unchanged at its latest interest rate meeting, and raised its growth forecast to 1.6%. Despite the fraught political environment, UK markets have proven resilient: Unemployment is down to the lowest rate in 45 years; business and economic sentiment indicators show an improvement; Consumer confidence has ticked up and UK consumer spending increased by 0.7% year-on-year. The composite Purchasing Managers’ Index registered a modest increase and an expansion at 50.90, though manufacturing data was weak.

Asian markets closed mainly lower, as Sino-US relations soured. The nikkei closed 7.44% in the red, surrendering the gains made in 2019. Japanese economic data was mixed: private consumption and capital expenditure dipped, and Japanese consumers have a decidedly negative outlook (the Consumer Confidence index hit a 4-year low), but official figures show healthy GDP growth of 2.1%.

“The Bank of Japan is unlikely to implement any policy changes in the near future.”

Chinese equity markets posted substantial losses. The MSCI China and MSCI China A-Onshore Indices lost roughly 13% and 9%, respectively. Investors were unnerved by the escalation in trade tension, and foreigners sold an estimated 53.7 billion (USD 7.78 bn) of Chinese yuan-denominated stock in May, triple the April outflow and the highest since 2016. It is clear from the latest Purchasing Managers’ Indices and industrial production data that higher tariffs, and the ‘techonomic’ war are having an impact on industrial production data: The composite PMI dipped to 51.5 points, with the Manufacturing, Services and Non-manufacturing measures all heading south, and industrial production showing lacklustre gains (5.4% year-on-year versus consensus expectations of 6.5%).

“The IMF has also cut its forecast for Chinese economic growth by 0.1 % , though at 6.2% the country is still a pack leader.”

Chinese policy responses to prop up growth have been significant, but measured. The People’s Bank of China has cut the reserve requirement ratio by a combined 20 bps. This brings the number of cuts since 2018 to six, and some analysts predict a further three cuts before 2020.

The government has added fiscal policy to its arsenal of stimulus tools: It has fast-tracked infrastructure projects; cut taxes for corporates, raised export tax rebates, lowered Value Added Tax rates, added to the list of allowable deductions for individuals and raised the minimum taxable income for individuals. Official figures, though taken with a healthy pinch of salt, suggest that the new policies have saved over 500 billion yuan (USD 76 bn) for Chinese businesses and consumers in 2019. The Chinese government has proven itself ready to stimulate further, should the economic engine continue to sputter.

Other Emerging Asian markets were hit by the slowdown in their neighbour and particularly by the dip in technology-stocks — Korea and Taiwan posting losses of 4% and 7%, respectively. On the positive front, Indian equities were boosted by the dip in oil prices and greater policy certainty post the elections.

Emerging Latin America was mixed: Mexican stocks fell sharply as the US announced a 5% tariff on all goods from the country, but the Brazilian and Argentinian markets advanced. The former was boosted by positive news on pension reform, and the BOVESPA gained 0.7%. The latter reacted positively to the country being included in the MSCI Emerging Market Index again, alongside new Emerging Europe and Middle East entrant Saudi Arabia.

Elsewhere in EMEA, Turkish stocks advanced toward month-end on hopes of improved US-Turkish relations, but still ended in negative territory. Russian and Greek markets posted gains, with Greek markets the year-to-date EM darling. The Russian bourse closed 4.14% higher, aided by a rally in banking stocks, and positive macroeconomic growth data.

“African markets closed lower, but outperformed Developed and Broader EM markets counterparts.”

The MSCI EFM Africa ex SA index lost 2.83% in contrast to the MSCI EM’s 7.26% slump. Performance was mixed: Kenyan stocks lost ground, posting a 4.7% decline for May, Egyptian markets lagged at -7.70%, while Nigerian equities gained roughly 6.5%.

Currencies and Commodities

In currencies, the US dollar index showed a modest uptick of 30 bps. Emerging markets were broadly weaker, though performance was mixed. With the US introducing fresh tariffs on 10 May, the Chinese renminbi declined by 2.5% against the USD.

Fresh restrictions on the flow of goods from Mexico, and the threat of more tariffs to come, saw the Mexican Peso dip by nearly 3%.

“The South African Rand has remained volatile, although the election outcome was regarded as positive, and closed 1.15% lower against the USD. “

Sterling was one of the weakest developed market currencies, hamstrung by British politics.

The overall GSCI commodity index closed lower, as energy prices saw a reversal in the previous months’ trend. Oil prices slumped by nearly 14% during the month on higher than expected US inventories, and heightened concerns around global growth.

“Hedge Funds and other portfolio managers have been liquidating some of their bets on rising oil prices, compounding the effect. “

Counteracting supply and demand factors will likely contribute to oil-price volatility in the coming months. The upward pressure from tighter supply, as OPEC cuts take effect, exports from Iran and Venezuela leave the pool and geopolitical tension escalates in the Middle East, may yet outpace the downward pressure of the lack of demand.

Gold made modest gains, driven by safe haven demand. Platinum Group Metals closed lower, with the platinum price losing just over 13% during the month.

Performance

World Market Indices Performance

Monthly return of major indices

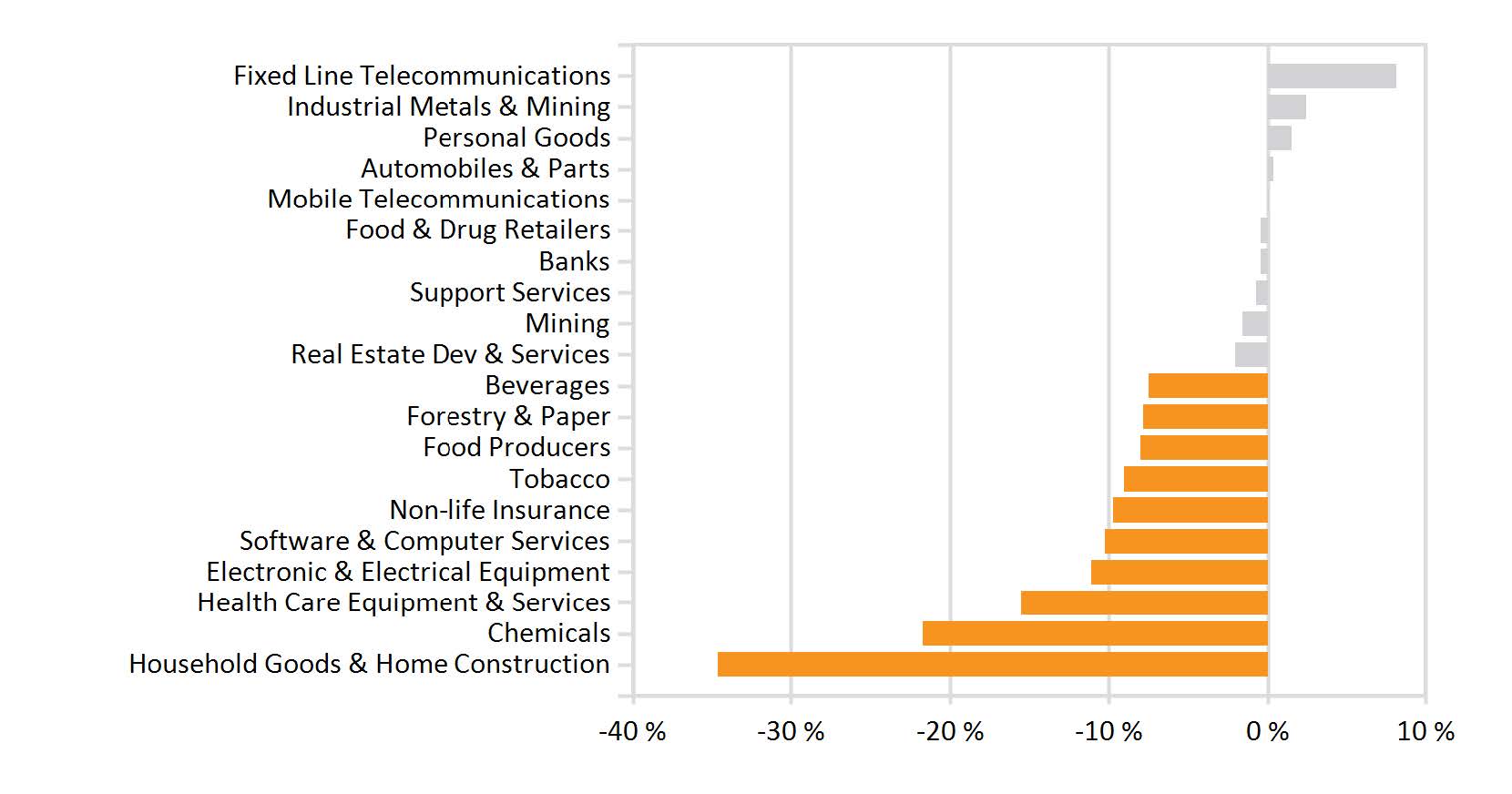

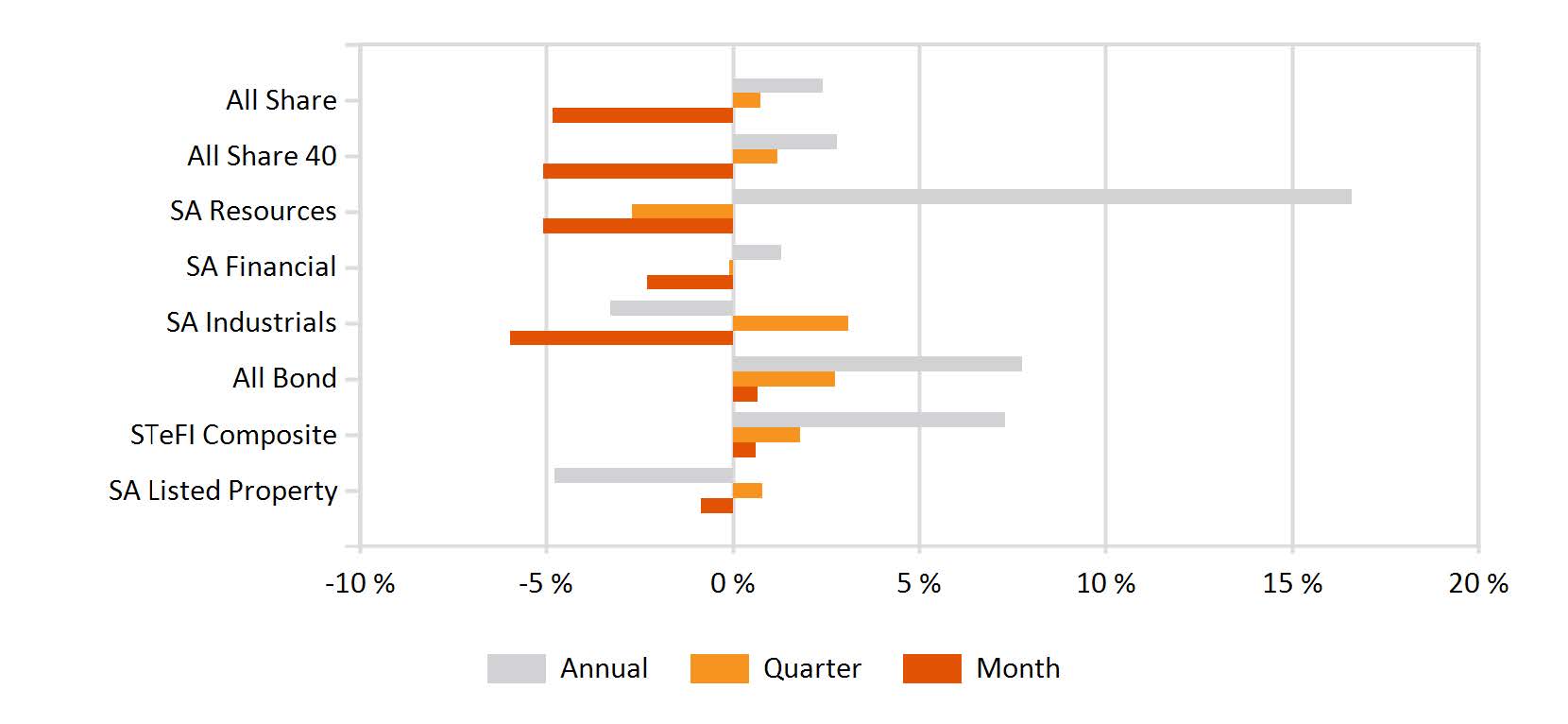

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance