Market Commentary: May 2017

Market View

Cash

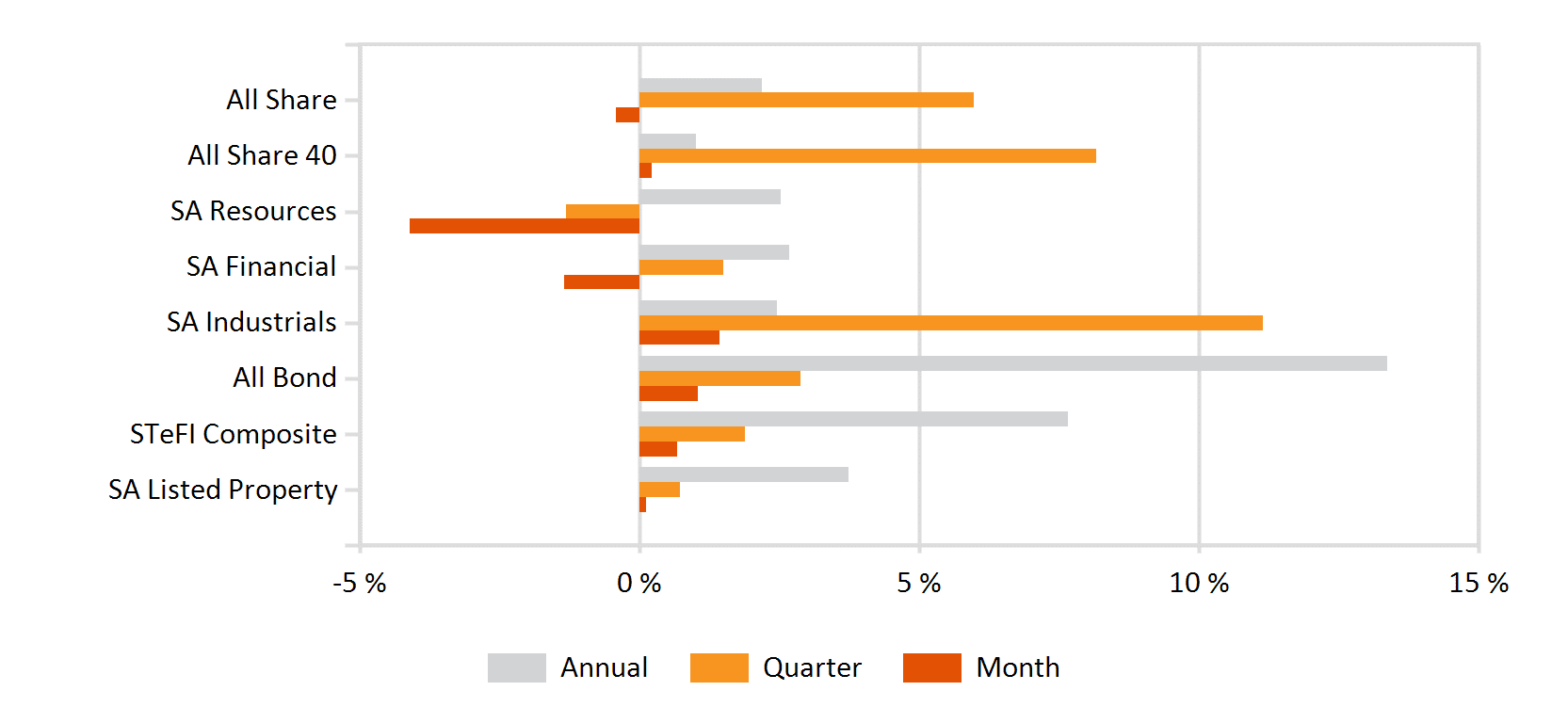

Inflation continued to trend lower in April 2017 with the index registering a 16-month low of 5.3%, down 0.8%. Improvement in agricultural prospects and pump-prices saw a considerable easing for core components. Food inflation eased by 2% and transport by 3.1%. The continuous commodity price index comprising energy, agriculture, soft commodities and metals, which has a knock-on impact on Producer Price Indices and Consumer Price Indices, has eased nearly 17.7% for the year-to-date. This was boosted by Rand stability and lower energy prices (petrol and diesel prices eased in April by 24 cents and 10.5 cents, respectively). The South African Reserve Bank (SARB) is nonetheless maintaining an extremely cautious stance, particularly as Moody’s potential downgrades loomed. The SARB left the repo rate unchanged at 7% at its recent meeting. Cash returns (STeFI) were 0.67% in May.

Bonds

South African Bonds underperformed global counterparts, but were surprisingly resilient. As emerging market bond sentiment trumped local political concerns, the ALBI closed 1.03% higher. Its global counterpart, the BarCap GABI, gained 1.28% in USD as emerging market bond sentiment remained positive and speculation about the ANC’s National Executive Committee meeting contributed to lower yields. The Barclays ILB index inched -0.08% lower, amidst stronger-than-expected local inflation figures. The local market was supported by lower-than-expected inflation numbers. Global bonds were firmer across the risk spectrum, but developed market bond yields continued to taper off, despite some unsettling geopolitical developments. US President Donald Trump remains under scrutiny with vociferous criticism for his withdrawal from the Paris Climate Agreement and the noise around the FBI-enquiry unlikely to subside.

Ten-year T-bills lost 8 bps, closing at 2.2%. UK bonds rallied just prior to month-end on safe-haven buying: opinion polls suggested that the Conservative Party’s stronghold was not as secure as Prime Minister Theresa May had gambled on. Eurozone bonds were generally buoyed by lower inflation numbers and the still-supportive stance of the European Central Bank. Greek yields ticked higher, with the 10-year figure reaching 6.1% as the country faces a number of crunch-talks with creditors. Conversely, German and Sterling equivalents gave up 2 bps apiece, ending at 0.3 and 1.07%. Month-end buying in US Corporates sustained the Corporate Index, which outstripped government bonds by 0.41%. The High yield index gained 0.73%, though energies remained under pressure.

Property

The SA listed property sector returned 0.11% for May, reflecting the exceedingly challenging local environment. The historic yield of the SAPY ended at 6.82%, while the yield to maturity of the R186 Government Bond closed at 8.59%. Some listed counters have been able to trump expectations, but the recent results may mask some of the underlying weakness. Some evidence of the underlying weakness is that a number of companies are electing to distribute capital profits in order to meet shorter-run investor expectations. Distributions in excess of income streams are ultimately unsustainable. Vukile, Investec Property and Redefine distributed capital profits, which included trading profits, underwriting and development fees. Growthpoint too indicated that their future revenue stream now includes development fees and trading profits. Such revenue profits are likely to make their way into distributable earnings, potentially distorting present earnings’ numbers.

We note that a number of companies have increased their offshore footprint of late, but that the move, in some cases, may have been premature. This appears to be borne out of the fact that Attacq sold its interest in Atterbury Cyprus Limited and Atterbury Serbia Limited, and Coronation Fund Manager’s reduction in its holdings of Capital and Counties. Simultaneously, Tower continues to grow its Eastern European portfolio. It acquired four retail properties from Konzum, Croatia’s largest supermarket (and a wholly-owned subsidiary of Agrokor, the largest company operating in the Balkan region). The property sector still offers attractive value propositions at current levels. However, poor fundamentals, political risk and volatility will likely drive short-term price performance in listed counters. Unlisted exposure may offer an attractive alternative to institutional investors.

Equity

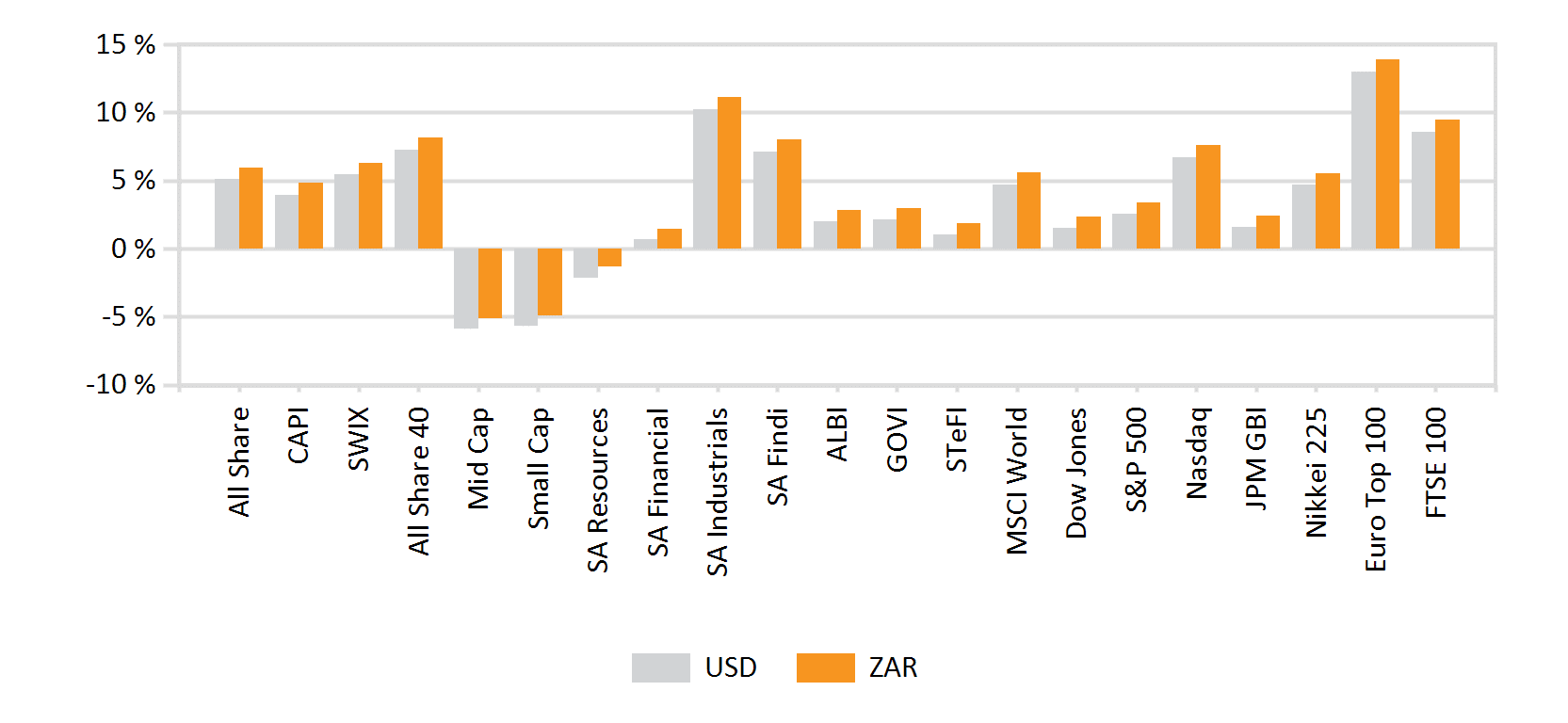

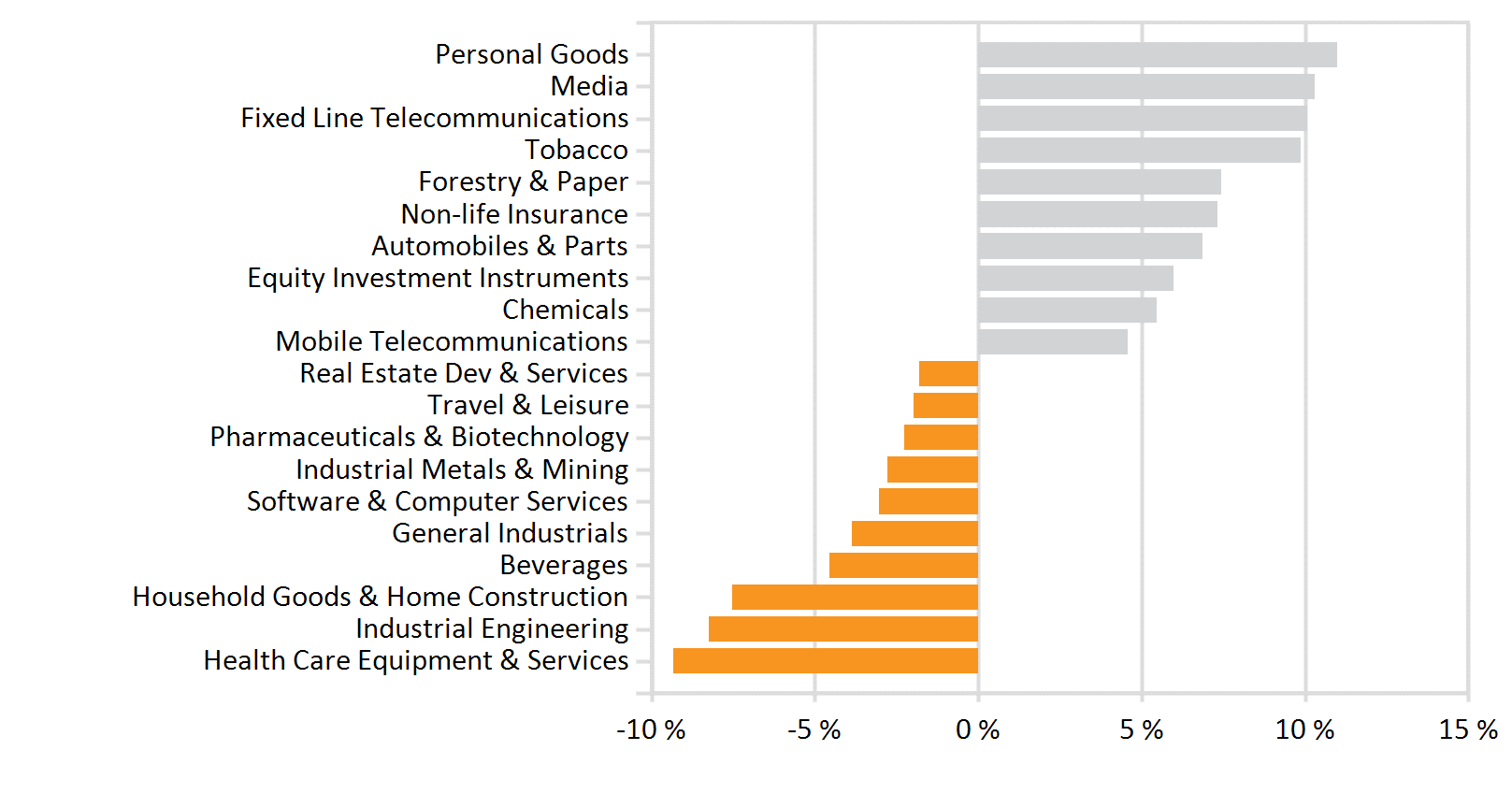

Resource counters weighed on the Johannesburg Stock Exchange during May: The All Share lost -0.42%, and the SWIX edged -0.07% lower. Developed and other Emerging Market equities easily outstripped SA peers — the MSCI World gained 2.12% and the MSCI EM closed nearly 3% higher. Platinum proved the worst performing of the South African Sub-Indices (-15.46%), and overall resources lost -3.48% against a backdrop of lower metal prices, ebbing safe haven demand and a stronger Rand. Substantial losses in Impala Platinum led the plunge, with labour unrest adding to the sector’s woes. The mine has embarked on a restructuring process which may cost 1000 jobs in the near-term. South African consumers remain under pressure and prospects are gloomy with unemployment at a 14-year high of 27.7% in Q2 2017. The latest statistics from Stats SA indicate that the country has entered a technical recession (two subsequent quarters of GDP contraction), and the momentum in manufacturing remains negative. Production contracted by 4.1% y/y in April and -0.3% for the three-month period up to April. General Retailers consequently registered a loss of -8.56%, and major retailers Mr Price, Truworths, Woolworths and Foschini all reported weak sales numbers and decreases in headline earnings.

SA Financials lost -1.81% despite sound underlying fundamentals. Prospects of further downgrades and concern about profitability weighed on the Index. Barclays Africa was one of the worst performing shares for May, losing -17.6% as the Group announced that it was surrendering control of its Africa Unit with a R26-billion sale. The more defensive sectors, including Healthcare (+2.00%) and Industrial Rand Hedges benefited from reticence to take on SA-Inc exposure. Aspen (+7.13%) registered substantial gains, Reinet, Steinhoff International and BAT maintained their solid year-to-date performance. Telecoms declined, although Vodacom was the strongest performing share for the month at 9.29%. The year-to-date performance of Naspers, however, remains unmatched — a 7% spike in May brought the year-to-date gains to 34.83%. Sector-specific risks, a tough global environment and global economic concerns make a diversified equity exposure and an ability to be nimble essential.

International Markets

Developed markets put in a strong showing in May, and the year-to-date surge in Emerging Markets remains on track. UK equities registered the largest gains (+4.4%), perversely boosted by political uncertainty ahead of the June 9 elections. The more defensive sectors and large caps led gains. A weaker pound supported diversified large caps and export-oriented firms. Continental data and interim elections remained supportive of a gradual Eurozone recovery and a relatively stable political core. The Eurozone composite Purchasing Managers’ Index remained in expansionary territory and at a six-year high. Unemployment fell to 9.3% and quarterly GDP growth remained steady at 0.5%. Most corporates reported good earnings growth and European Equities saw a tenth consecutive week of inflows. However, energy stocks came under pressure as the US withdrew from the Paris Climate Accord. US energies were consequently laggard (-3.4%), while Financial and Telecoms were also relatively poor on a sector basis (-1 and – 1.2%). Nonetheless, the overall bull market has continued — the S&P500, NASDAQ and Dow all reached fresh highs in the last week of May.

The MSCI World gained 2.12%, but Emerging and African Markets outstripped developed peers. The MSCI EM was up by 2.96%, and a stellar performance from a number of key markets saw the MSCI EFM Africa ex SA index climb 9.38%. Leaders included Nigeria, Kenya and Egypt (12.2%, 11.1% and 7.1% in USD, partly on currency movements). Asian markets rallied with gains in both minnows and major markets. The Nikkei was 2.36 % higher, with upbeat labour market and industrial data supportive of real GDP growth (2.2% in Q1). Inflation expectations are also finally erring on the upside. Japanese corporates reported solid earnings, with an average increase of over 26%. Nintendo was a major winner, whilst tech-giant Samsung announced that an industry-wide boom in demand for memory suppliers (chips used in PCs, smartphones etc.) would necessitate an expansion to its Chinese and South Korean manufacturing plants. The news and recent surges in Apple, Alphabet and Alibaba boosted tech-related stocks in the region and abroad. Despite the resurgence in appetite for traditionally more risky technology stocks, the defensive sectors (food and telecoms) saw an uptick, as political tension with North Korea remained elevated.

Chinese markets were stable on resilient domestic demand with positive preliminary reads on Purchasing Managers’ Indices, and the CSI 300 was 1.78% higher. The Hong Kong Stock Exchange advanced on solid earnings from blue-chip heavyweights. Moody’s however, downgraded China’s credit rating for the first time since 1989, citing concerns about high and rising levels of indebtedness and its government’s use of reserves to prop up its currency. Korean stocks outperformed as investor perceptions were boosted by President Moon Jae-In’s election. India advanced on the hopes of further government reforms, with the SENSEX up by 4.13%. Emerging Europe rebounded at month-end, after robust factory data from Hungary and Turkey. Russian markets slumped by -5.7% on energy weakness and Brazilian markets were nearly equally laggard. The latter lost ground on regional tension, commodity weakness and renewed corruption-related news-flow. The developed market recovery appears to be well underway, though Brexit and election outcomes may still add to volatility. Attractive valuations and momentum in emerging markets, however, still present unique opportunities for the astute investor within a diversified portfolio.

Currency

The US Dollar extended its slide, giving up -2.1% in May. Emerging market currencies were consequently largely stronger. The Rouble eked out gains (+0.41%), despite oil price weakness. The Mexican Peso was resilient and added 1.49%, and the South Korean Won was boosted by positive investor sentiment (1.63%). The Nigerian Central Bank retains a tight rein on the currency and investors remain unsettled by the proliferation of parallel rates. The official rate depreciated by -2.92% against the USD. Commodity weakness and new noise around pervasive corruption weighed on the Brazilian Real, dragging it 1.36% lower. Sterling was volatile, as political uncertainty weighed on the currency. Polling ahead of the June 9 election showed that a resounding Conservative victory was unlikely. The Pound closed -0.22% lower against the USD. Conversely, political and economic news-flow from the Eurozone boosted the common unit to a 3.2% dollar-gain. The Yen appreciated modestly, but a year-to-date gain of 5.47% will continue to weigh on the trade balance. The Bank of Japan maintained its policy, providing some breathing room for exporters. A broad basket of Emerging Market currencies posted gains against the dollar, with the strongest performance in the Turkish Lira (2.4% higher on monetary policy changes). Surprising to a number of market participants, the Rand was stronger, despite local political challenges. The unit closed the month 1.5% firmer against the USD.