Market Commentary: March 2023

Global Market Themes: Sticky inflation compels the US Fed to hike interest rates by 25bps. Banking crisis, sparked by SVB collapse, forces government to step in. Lending conditions tighten, displaying further signals that the US economy is slowing down. China and EM markets remain buoyant, with the MSCI China Index up 4.5% along with an upbeat Manufacturing PMI of 51.9. SA Market Themes: SARB surprises the market with a 50bps interest rate hike. Rand appreciates 3.3% against the greenback. Loadshedding continues to constrain the economy, while South African PMI prints 48.1. Shoprite plans to open 400 new stores along with its first apparel outlet.

Market View

Global Market Themes

Global markets demonstrated some strength and resilience in March, amid an uncertain economic environment, with the MSCI ACWI (All Country World Index) up 3.1%. Characterised by stubborn inflation, slow economic growth and a rising interest rate environment, the global economy presents a challenging landscape for companies to deliver performance. The US Federal Reserve (Fed) raised interest rates by 25bps on 22 March, bringing the lower bound of the Federal Funds rate to 4.75% and marking the ninth hike since March 2022. While comments from Fed Chair Jerome Powell suggest that the rate hike cycle may be nearing its end, he qualified the comments by saying that the “inflation fight is not over”. The US monthly CPI data will be released on the 12 April and will likely provide valuable insights that will guide the Fed’s actions going forward.

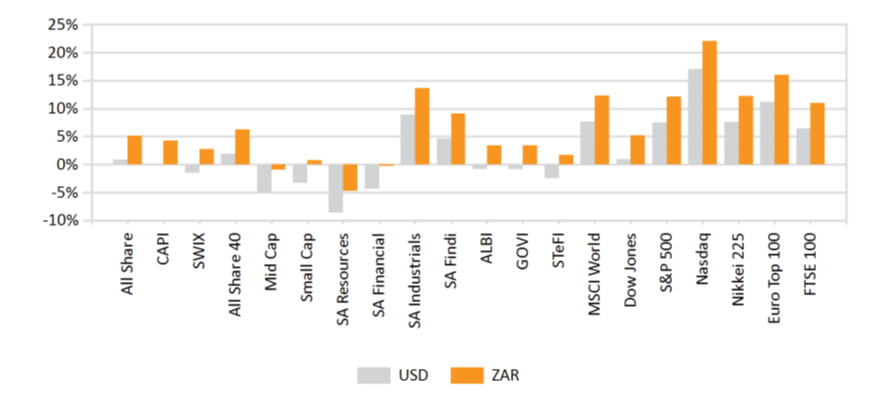

The S&P 500’s constituents had a mixed performance this month, with the Financials sector pulling back -10.6%, while the IT sector gained a solid 9.33%. Overall, the index returned 3.7% for March.

The US banking sector took center stage this month, triggered by the collapse of Silicon Valley Bank (SVB), and raised concerns about the interconnectedness of the financial system as a whole.

In this case, SVB’s portfolio was overly exposed to interest rate risk (longer-duration bonds). As interest rates rose in the US, bond prices fell, and the bank started making significant losses. The bank’s depositors, most of which were start-ups, began to get worried about their ability to access their funds and started withdrawing. As SVB was unable to meet the withdrawal requests, it quickly became insolvent, forcing the bank to sell its assets at a loss of USD1.8 billion.

While big banks are considered well capitalised, relative to pre-2008 levels, concerns about the state of the industry put many smaller regional banks under immense pressure. The Fed responded swiftly to the market’s fears of possible contagion in the sector and explicitly assured the public that all deposit accounts would be insured for their full value, retroactively. This action required a change in FDIC (Federal Deposit Insurance Corporation) policy, which initially only insured deposits up to USD250 000. In SVB’s case, 89% of its depositors were above this threshold. What this means going forward is a precedent has been set that, should an institution deemed systemically important land into a state of crisis, the government will step in. The overarching goal of such policies is to ensure that the financial system is more resilient to panic sentiment.

While the markets priced in a possible interest rate cut following the banking crisis, this did not materialise. Powell reiterated that cuts are not on the Fed’s radar for the remainder of 2023. Banks have become far more cautious in their lending activity for businesses and households, as seen by the rapid rise in the Domestic Respondents Tightening Standards index. Historically, there has been a relatively strong positive correlation between ease of lending and employment. Should this trend continue, it would have a positive implication for inflation going forward. Finance and credit services fell 59% in March.

The European Central Bank (ECB) made a loud statement to the market by increasing rates by 50bps, suggesting that fighting inflation remains the bank’s top priority. As interest rates across the broader market rise and more financial institutions’ balance sheets are placed under pressure, we will likely see further collapses down the line. The Eurozone GDP growth forecast is set at 0.7% for 2023. The STOXX All Europe was down -0.6% (EUR). The UK also faces a tough road ahead, following the recent headline inflation numbers printing 10.4% year on year. The Bank of England will likely be prompted to tighten conditions further, placing downward pressure on consumer demand and business sentiment. The FTSE 100 closed the month down -2.5% (GBP).

Emerging Markets (EM) outperformed their developed counterparts in March, with the MSCI EM and MSCI China indices delivering 3% and 4.5%, respectively.

The China Manufacturing PMI (Purchasing Managers’ Index), as a gauge for production efficiency, remained upbeat at 51.9 in March, following 52.6 the previous month.

China also forecast its GDP growth to be 5.7%, which is strong compared to the global growth forecast of 2%. Asian tech giant Alibaba saw its share price rise roughly 15%, following the announcement to split the company into its six separate business units. This strategic move will allow each unit to explore funding options on a standalone basis and potentially unlock value for shareholders. Each business unit will have its own CEO and board of directors to oversee the strategic direction of each business on its path to possible public listing. Alibaba has already started to approach banks in this regard. This move could be the first for large tech firms in the market splitting up. For example, the estimated breakup value of Amazon’s units is 70% above its current market price.

The GABI (Global Aggregate Bond Index) rose 3.2% (USD) along with precious metals like Gold and Platinum rising 7.8% and 4.1%, respectively. The biggest mover in the Commodities sector was Silver, rising 15.2%.

South African Market Themes

In an unexpected hawkish move, South African Reserve Bank Governor Lesetja Kganyago issued a 50bps interest rate hike, taking the repo rate to 7.75%. As a result, the prime lending rate currently sits at 11.25%, the highest level since 2009. The Rand responded positively, appreciating 3.3% against the Dollar. While the announcement was in stark contrast to market expectations (a 25bps increase), it has come off the back of a rapidly declining Rand and stubbornly high inflation.

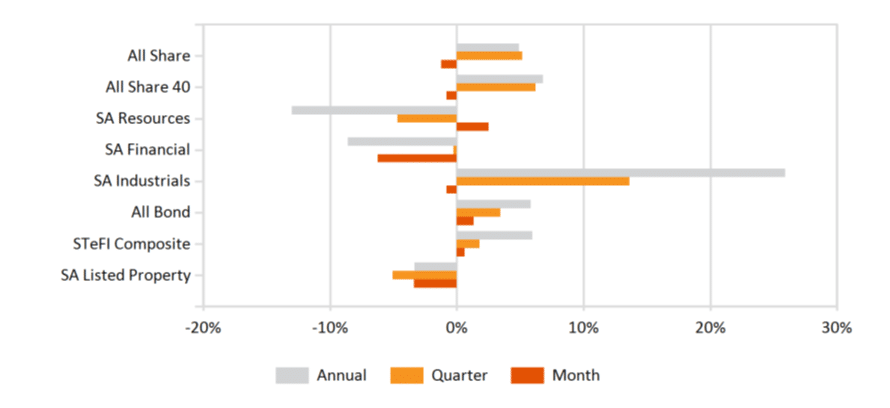

Local Equities ended the month in the red, with the FTSE JSE All Share and SWIX indices down -1.3% and -1.9%, respectively. At -6.6%, the Financials sector experienced the biggest decline. Resources, benefiting from a rise in the price of Gold and other commodities, was the only sector to conclude the month in the green, rising 2.5%. Listed property fell another -3.4%, marking its third consecutive monthly decline.

Persistent loadshedding has entrenched itself in the supply chain, continually eroding corporate profits and catalysing food price inflation.

As such, the CPI print for February came in at 7%. A strengthening Rand will hopefully ease the pressure on input costs such as fuel. However, this benefit will likely be offset by the OPEC oil production cut announced in early April. As a result, we can expect higher input costs along with higher inflation. South Africa’s PMI came in at 48.1, a slight down tick from 48.8 in February, indicating further contraction in production efficiency. Shoprite CEO Pieter Engelbrecht said if the group did not have to deal with the intense loadshedding it would have been able to increase its profits by more than 30% for the 26 weeks to 1 January 2023, instead of the reported 10%. Despite the operational headwinds, Shoprite still plans to open 400 stores this year and has already revealed its first apparel store. This move is seen as a clear bid for Pick n Pay Clothing’s market share.

Transaction Capital, the group which controls WeBuyCars and SA Taxi vehicle financing, saw its share price plummet by nearly 60% in March, following an announcement that it was restructuring its taxi operation. The taxi industry has not been able to recover to pre-pandemic levels and the operation’s earnings have decreased by 46%. Group CEO David Hurwitz has assured investors that default in one subsidiary will not trigger a breach in covenant clauses on another.

Looking ahead, growth prospects for the country remain grim. The SARB’s revision on GDP growth for 2023 is set at 0.2% year on year. Thereafter, the economy is expected to grow by 1% in 2024 and 1.1% in 2025. South Africa’s equity market continues to display a disconnect between its own growth path and the underlying economy. This is largely due to roughly 70% of all JSE ALSI revenue coming from offshore markets.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices