Market Commentary: March 2018

Here are this month’s highlights: March was a particularly volatile month for global equities, as politics, tech and trade concerns weighed on investor sentiment. Monetary policy developments were mainly as expected, including decisions by the South African Reserve Bank to cut the repo rate, the US Federal Reserve Bank’s Federal Funds Rate increase, and the Bank of England keeping rates unchanged. Despite a shot-in-the-arm from the Moody’s ratings reprieve, local markets were weighed down by global trade jitters.

Market View

Cash

Annual inflation moderated noticeably, though the Monetary Policy Committee (MPC) maintained its 2018 forecast at 4.9%. The South African Reserve Bank (SARB) consequently elected to cut interest rates by an additional 25 basis points (bps) at its March 2018 MPC meeting, the first time since June 2017. The committee noted that risks to the inflation forecast were seen to be evenly balanced: the recent reprieve from Moody’s rating agency has fuelled broader optimism regarding the country’s growth prospects.

“The local currency improvement has gone some way to mitigate the expectation regarding the pass-through from increased taxes.”

The VAT rate increase, however, is due to kick in on the 1 April, and is likely to cause some upward pressure. The Department of Energy released fuel price adjustments for April, signalling significant hikes in pump prices (between 69 and 72 cents per litre). This is partly in aid of the increased General Fuel Levy and Road Accident Fund Levy, announced in the 2018 budget, and partly attributable to the oil price recovery. Market-watchers feel that significant exchange rate stability, and a further boost to growth prospects will be required to justify any further rate cuts during this year. South African cash returned 0.56% for March, and ended the quarter with a 1.76% gain.

Bonds

South African investors heaved a sigh of relief as the country avoided a ratings downgrade from international credit ratings agency Moody’s. Before midnight on 23 March, South African investors were cheered by the announcement that the country’s sovereign rating would be maintained at Baa3, one notch above junk status. A downgrade would have triggered the country’s expulsion from the Citi World Government Bond Index and potential outflows of nearly R100 billion.

“The change in outlook is heralded as a particularly positive sign. It signals that international investors give credence to the commitments made by the newly elected government toward fiscal discipline.”

Whilst confidence is building, the stable outlook still reflects a careful balance of risks, with the new administration facing several challenges.

The ALBI closed the month with a gain of 2.02%, far outpacing the South African equity market for the year-to-date. The ALBI has delivered just over 8% for the year, as investors cheered local political developments. Inflation-linked bonds yielded 4.92% for the month, and the year-to-date has seen a yield of under 4%.

“Global bond markets had a mixed month, with the Barcap GABI ending the month only 1.46% higher.”

For the year, bond investors have been unsettled by monetary policy uncertainty, Brexit nerves and trade-war jitters. The US Federal Reserve Bank, in its first-rate decision under newly-elected chairperson Jerome Powell, increased its benchmark rate by a quarter of a percentage point. The underlying economic data has for some time pointed to the likelihood of a hike, and markets had, to some extent, been pricing in at least three rate-increases. The reaction was therefore less pronounced than may have been expected, but the volatility in equity markets spilled over into safe-haven demand for government bonds. The US yield curve flattened noticeably toward month-end, with 10-year T-bill rates dropping to 2.74%, down from 2.86% in February. Overall, equity market volatility has fuelled an appetite for safer haven government bonds. Investment grade and high yield spreads consequently widened. The European Central Bank (ECB), too, appears to be growing gradually more comfortable with the continent’s inflation and growth prospects. The ECB has dropped its pledge to accelerate its monthly bond purchases in the case of economic weakness. While this is not a significant departure, it does signal increasing confidence and further progress toward monetary policy normalisation. Eurozone bond yields therefore tracked US longer dated bonds lower. The Bank of England has kept its programme unchanged, perhaps reflecting that it is still wary of the upside risks from Brexit. The Bank of Japan, conversely remains the counterweight, with its asset purchases set to remain elevated. The bank’s purchases of Exchange Traded Funds (ETFs), for instance, hit a monthly record of Yen 831.1 billion. While the Japanese parliament has approved Governor Haruhiko Kuroda for a second term, it has been noted that he failed to achieve his intended inflation objectives. The bank is, therefore, more likely to maintain stimuli, although increasingly favouring fiscal policy. Overall, equity market volatility has fuelled an appetite for safer haven government bonds. Investment grade and high yield spreads consequently widened. In an environment of falling developed market yields, however, emerging markets and higher yielding (riskier) assets have held up surprisingly well.

Property

The domestic property market seems unable to shrug off the Resilient stigma, closing 0.96% lower for the month. Year-to-date losses have come to almost 20%. The uncertainty about property rights, and expropriation without compensation, is likely to have fed the general market malaise, colouring foreign perceptions. It is, however, true that analysts had long been warning about lofty valuations in local listed property counters. The sell-off was sparked by the Viceroy report and company-specific concerns, but may equally reflect a correction in line with economic fundamentals. It is to be noted that it creates a significant buying opportunity for astute investors. After hitting a new low at the end of March (R50 per share), Resilient has already kicked off the quarter with a significant recovery. Resilient and Greenbay gained 3% and 6%, respectively, on the first day of trading, and the former had gained over 20% by mid-April.

The FTSE EPRA/NAREIT index, conversely, recorded a healthy 3% gain (net USD) for March 2018. The best performing listed real estate market for the month was the UK (6.2% gain), with sentiment potentially improved by progress in Brexit negotiations. The prospects, however, remain somewhat muted, with analysts expecting that retail rents and office rents (particularly in central London) to decline over the next couple of years. Brexit means that investors, particularly in office space, have continued to switch their attention to continental Europe. The gap between real estate and 10-year government bond yields has seen an influx of new capital. Eurozone REITs have raised fresh capital, and German open-ended funds have seen a revival. The German residential market, particularly in key cities such as Frankfurt and Berlin, is seen to be booming. The outlook for rental growth on the continent is largely positive.

“If the Eurozone economy continues its stable growth path, returns of 5 – 6% per annum appear to be a reasonable expectation for investment grade European real estate.”

In the US, as elsewhere, physical retail space is still lagging, with demand concentrated at the high-end within A-grade malls. Positive growth prospects mean that consumers can perhaps dig into their pockets, and luxury retail and consumer products will retain their place in the real estate sector. Retail property performance across Asia Pacific remains similarly mixed. Demand for prime and CBD retail space has been steady in key cities and markets in Japan and Australia. Buoyant corporate profits and strong business confidence have bolstered the confidence of Japanese corporates, and the country’s REITs have seen a renewed appetite as corporates look to embark on a new capex cycle. Some markets such as Singapore and Hong Kong are expected to attract greater investor interest in 2018 on the back of anticipated recovery after a long period of underperformance.

Limited core investment options within some real estate markets (including in Asia Pacific, Africa and less developed Eastern European markets) may mean that capital is being squeezed into specific corners, and even into alternative segments. This may favour emerging markets, including those with relatively deep capital markets (such as South Africa and Nigeria)

“Locally and globally, unlisted property also continues to be an attractive alternative, provided risk-management takes centre stage.”

In an environment where the chase for absolute returns is swaying investment decisions toward higher risk strategies, active asset management, value-creation and a due cognisance of risk management will remain key drivers of performance.

Equity

Local investors were cheered by the month-end reprieve from Moody’s, but the Johannesburg Stock Exchange (JSE) was not spared the fall-out of global trade tensions. The All Share closed over 4% lower, and has lost more than 5% for the year-to-date, significantly lagging Global, Emerging Market and African peers. The MSCI World lost 1.3% over this period, while the MSCI EM gained 1.28% and the MSCI EFM Africa ex SA gained over 7% for the quarter.

On the domestic front, the emotionally charged and technically complex land restitution process, may still dent investor confidence. Uncertainty, mainly regarding the effective implementation and enforcement of property rights, is likely to remain elevated in the run-up to the Constitutional Review Committee’s August report back to the National Assembly.

“Overall, however, the newly-elected government has been lauded for reform initiatives already implemented including a crackdown on corruption, changes in State Owned Enterprises governance, a revision of the Mining Charter and the commitment to bringing the Renewable Energy Programme back on track.”

Statistics South Africa released a report during March that signalled that the economy performed better than expected in Q4 2017, and research organisation, the Organisation for Economic Co-operation and Development (OECD) indicated an upward revision to its growth forecast at 1.9% for 2018. The March Absa Manufacturing PMI numbers proved to be disappointing — 46.9 for the month, indicating a contraction. Naamsa Vehicle Sales, conversely and despite the muttering regarding tax increases, reflected improved consumer sentiment up 1.1%, from -3.8% year-on-year. The SARB implemented a 25 bps rate cut, signalling its positive outlook on inflationary prospects, despite upward pressure from the newly-implemented taxes.

Trade and Industry Minister Rob Davies announced that South Africa would request an exemption from the US Steel and Aluminium tariffs. While South African producers are a small contributor to the US import pool (under 2%), the tariffs could threaten job security at several companies. These include steel producer ArcelorMittal South Africa, resources group South32 and aluminium products producer Hulamin. While gold saw some safe-haven buying on equity market volatility, the resource index declined by 2% for the month. The Financial index registered a 3.1% loss for the month and closed the quarter lower, eliminating the initial ‘Ramaphoria’ boost to the banking sector. Industrials, were the biggest detractor. Market darling Naspers suffering a significant loss, after announcing the sale of 190 million shares in Tencent on 22 March. The JSE giant lost 5% on the day of the announcement, 11.5% for the month and just over 16% for the quarter.

International Markets

Tech and trade, with a sprinkling of spy drama, dominated global market headlines during an extremely volatile March. Diplomatic ties between Russia and its Western counterparts deteriorated rapidly. The Kremlin was accused of being involved in a nerve-gas attack in Somerset in the UK in early March on ex-spy Sergio Skripal and his daughter. The UK has been adamant that the attempted poisoning was politically motivated, and has raised security concerns. It has also alleged that the Russian government has been involved at the highest level, a claim Russia continues to deny. A number of Russian diplomats have consequently been expelled from Britain and other Western countries (over 150 Russian envoys have been sent home by countries pledging their support to the UK). After the UK sent 23 and the US 60 diplomats packing, Russia has responded like-for-like. The UK has seen several its consulates closed, and the US consulate in St Petersburg was set to close in April. Perhaps perversely, spy-gate garnered even more solid support for Russian President Vladimir Putin. He won by a landslide in the recent elections, as previously uninterested, largely antipathic Russians came to the polls in force. Despite being congratulated on his victory by US President Donald Trump, escalating tension in Syria has seen a marked cooling between the presidential houses. The MICEX, despite a stronger oil price and improved outlook for domestic growth, was -0.49% lower for the month.

Technology stocks were hit by a mid-month rout, as a data-breach/privacy scandal rocked heavyweight Facebook. Jittery investors did an about-face on many of the hitherto market darling FANGs (including Facebook and Amazon). On the 17 March, news broke that Facebook, already under suspicion for its role in the 2016 US elections, was being investigated by both the UK Parliamentary Committee and the Federal Trade Commission. Allegations regarding the abuse of and/or lack of protections for users’ personal data have come to the fore again. Recent reports tie the firm to political consulting firm Cambridge Analytica (allegedly active in manipulating voters in the Trump election and Brexit referendum), and have seen CEO Mark Zuckerberg called to testify before UK and US regulatory bodies.

“Facebook shares slid by over 2%, wiping USD 50 billion off the market cap in the days following the news.”

Step-cousin Snapchat saw poor taste come back to bite it: popular personality Rihanna slammed the social media platform for making light of domestic violence on a recently launched app. The market cap fell by USD 800 million (USD 1.2 per share) on 17 March. Company-specifics, however, have not been the only contributor to the fizzle: analysts suggest that the technology sector and social media firms will be subject to noticeably stronger regulation in future. The European Commission, for instance, has proposed a user-locale based tax on digital revenue. This means that firms such as Google, Amazon and Facebook, will pay at least 3% tax on their turnover on online services to European Union (EU) users. US President Trump has also taken issue with Amazon on the tax-issue, though firing a number of related salvos via Twitter. Tesla too, has come under pressure, following a fatal pedestrian accident during March. Semiconductor maker Nvidia announced that it was suspending its own experimentation in the SDV market, leading to a sharp drop.

“Technology counters got some relief toward month-end, clawing back losses on a broader bounce ahead of earnings season.”

Microsoft stock rose noticeably following reports of a coming reorganisation at the company. Other US market news was overshadowed by the technology slump and talk of trade wars. The trade war tension escalated during the month – with tension flaring in the Eurozone and within emerging markets (including with major US-debt holder China). While President Trump announced that the EU would be granted a temporary exemption, trade friction spilled over into the international constituents of the UK, US, Japanese and Emerging Markets. China, in turn, announced retaliatory measures against US steel and aluminium manufacturers.

Despite other US market news being benign – an upward revision to estimated GDP growth (2.9% for Q4), continued record-low unemployment, upbeat consumer sentiment readings, and a positive outlook for corporate earnings – US markets experienced one of their worst quarters in over two years. The S&P closed the month 2.54% lower, and year-to-date gains were erased by the March-slump closing at -0.76% for the quarter.

Trade tension spilled over into major European markets and the UK. The Stoxx All Europe registered a -1.96% decline, and the FTSE100 closed 2.03% lower, even as progress was made toward a feasible and palatable Brexit plan. European economic indicators, though coming off their rosy highs, are still pointing toward a steady expansion. Despite Brexit tension, and some electoral tension in Italy and Germany, the policy framework within the Eurozone remains intact and largely predictable. The European Central Bank has followed through on its commitment to normalising monetary policy. It is therefore not surprising that on a sectoral basis, relatively defensive businesses (geared toward stable growth prospects) outperformed financials, technology and basic materials.

UK markets had a negative month, with the threat of looming trade wars weighing on large cap international constituents. The decline comes despite the big Brexit news: Secretary of State for Exiting the European Union, David Davis, announced that the UK and EU have negotiated an extended transition period. The deal has secured additional grace for many businesses, with operations continuing ‘as normal’ until December 2020. Domestic data also boosted sentiment, with UK wage-growth rising at the fastest rate for over two and a half years in the last quarter of 2017. The 2.6% increase was in line with expectations and reflects a relative reduction in pressure on real incomes. With unemployment at a 33-year low, consumer and business sentiment may finally begin to shrug off Brexit Blues. British retailers continue to see significant pressure, with a number of companies either closing branches or cutting staff during 2018. Next has already confirmed that its year-ends results, in line with expectations, reveal a 2.9% drop in profits. While March sales figures were positive (with a 2.3% year-on-year improvement), they are likely to have been boosted by the Easter holiday period, particularly in food retailers. The rally in sterling, partly aided by Brexit progress, somewhat weighed the large caps and dual listed firms.

Trade-related concerns remained at the forefront of Sino-US relationships. The public hard-line stance has seen tit-for-tat tariffs and restrictions introduced, including on Chinese investment in US technology firms. The nations may be working behind the scenes to ameliorate the impact of a spiralling trade war, and to facilitate an agreement in the Korean peninsula, but retaliatory measures seemed inevitable. China has indeed announced an increase of 25% on 128 US products, set to take effect in early April.

“Investor jitters saw a broad pull-back from Asian markets: the Shanghai index lost 3.22% for the month, the Japanese Nikkei lost 3.39% and Emerging Asia struggled.”

The strength of the Japanese Yen, which has appreciated by nearly 6% against the dollar for the year-to-date, has added to trade-related corporate earnings nerves. While Japanese economic data has remained stable, and the re-election of the Bank of Japan’s Governor signals monetary policy continuity, Japanese Prime Minster Shinzo Abe has seen his popularity plummet. The government has been caught up in a land-sale scandal, in a year which sees the ruling Liberal Democratic Party hold elections for its next president. The weakest performers in Emerging Asia were India, the Philippines and Indonesia, with the SENSEX posting a 3.46% loss. South Korea, on the other hand, had a markedly more positive month: The Won was boosted by news of talks between the US and North Korea (set for May), an extension to the free-trade pact with the US (known as KORUS) and its partial exemption from new US steel tariffs. Emerging Latin America struggled, but losses were less pronounced than elsewhere. Despite losing ground in March, and flaring tension in the run-up to the October elections, Brazil remained one of the better performing Latin American markets. Improved retail sales data, a stabilising inflation outlook and the prospect of further rate cuts (after the Central Bank implemented a 0.25% snip) have boosted sentiment. The BOVESPA closed near the flat-line and has gained more than 11% for the year-to-date.

“The stronger commodity complex boosted the broader emerging market group, with the Ghanaian market one of the best performers for the first quarter. It gained more than 30% in local currency terms.”

The country’s stock market performance remains closely correlated to the oil price, but copper also contributes markedly. Improving economic fundamentals, a central bank rate cut, and the affirmation from ratings agencies as to the positive credit outlook have all added to the commodity boost. While Kenyan politics have remained unsettled, the country has seen several improvements, including an extension from the International Monetary Fund on its standby loan. Egyptian markets have returned to favour, with the country gaining nearly 14% in local currency terms for the year-to-date.

Currency

The US continued lower for the year-to-date, with March seeing a further 0.5% decline in the basket. Sterling appreciated noticeably against the dollar, as the announcement came through that the Brexit treaty had seen significant progress, and the Pound was 1.9% higher against the USD. Trade tensions spilled over into currency markets, somewhat tempering gains, but the Euro ended the month 0.9% higher.

“Emerging market currencies were mixed.”

The Russian Rouble was hurt by escalating diplomatic tension, and closed -1.6% lower against the Greenback, despite stronger oil prices. The rand traded weaker against major currencies at the start of the month, as the threat of land expropriation without compensation weighed on investor sentiment. The local unit was nearly 2% lower against the dollar, and 3% lower against the Euro mid-month. The decision by the SARB to cut rates at the end of the month saw a further sell off at month-end, despite Moody’s favourable credit ratings review. While trending lower over the course of the month, the local unit has nonetheless held up well over the quarter, appreciating by nearly 4.5%.

“Commodities were largely positive for the month, with substantial gains in oil prices.”

OPEC’s efforts to curb supply had proven fruitful, despite President Trump’s drill-at-will mentality, and Brent Crude rallied by 5.1% for the first quarter. Metal prices were mixed, reflecting the trade-related uncertainty plaguing global markets. Industrial metals saw substantial losses (the sub-index declining 4.5%), as steel and aluminium-related counters, and downstream activities and inputs came under pressure. Copper and Palladium have suffered, with the latter one of the worst performing commodities for the month. Conversely, trade jitters have seen many investors turn to safe havens such as gold. The commodity showed modest gains for the month (0.4%), but has had three straight quarters of gains. Moreover, exchange traded fund holdings of the soft commodity are at a 50-year high.

Performance

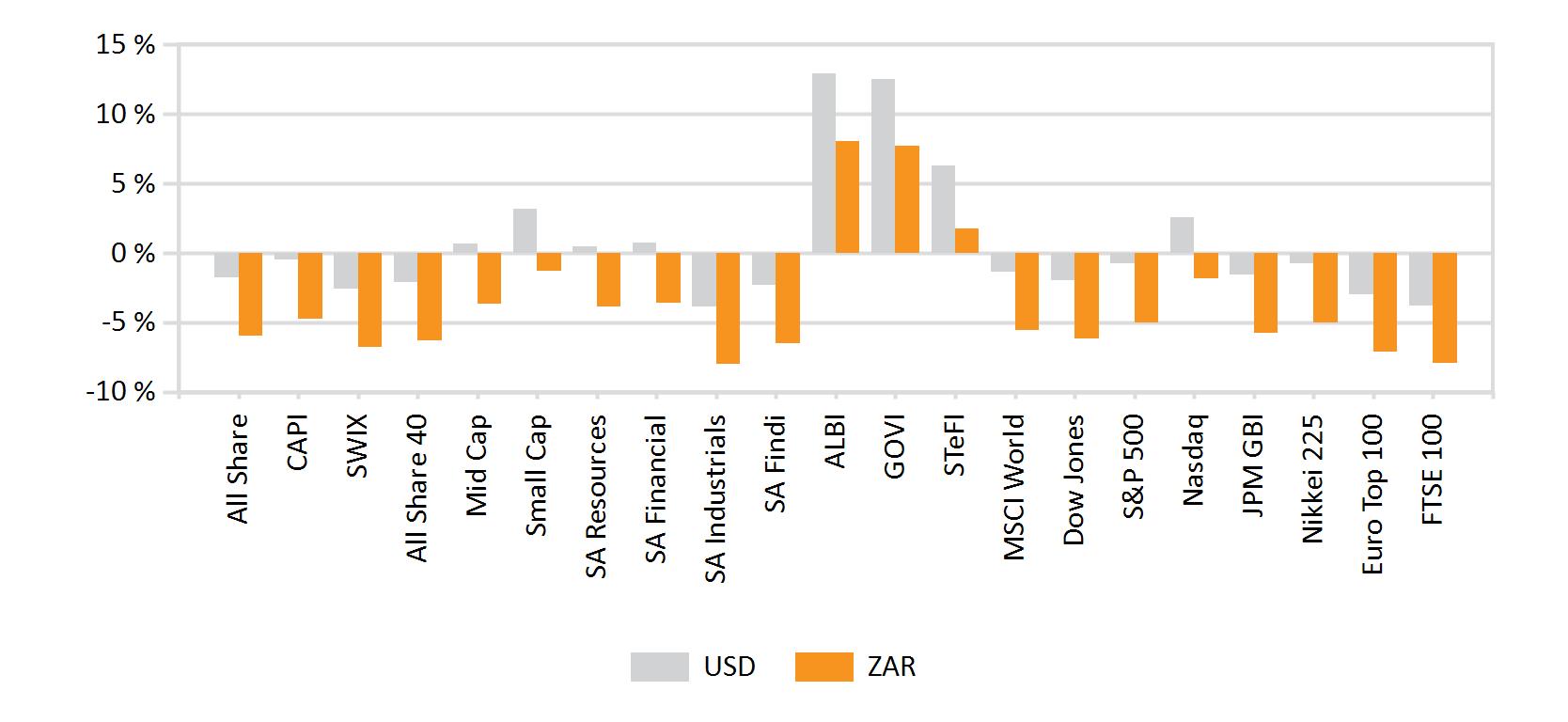

World Market Indices Performance

Monthly return of major indices

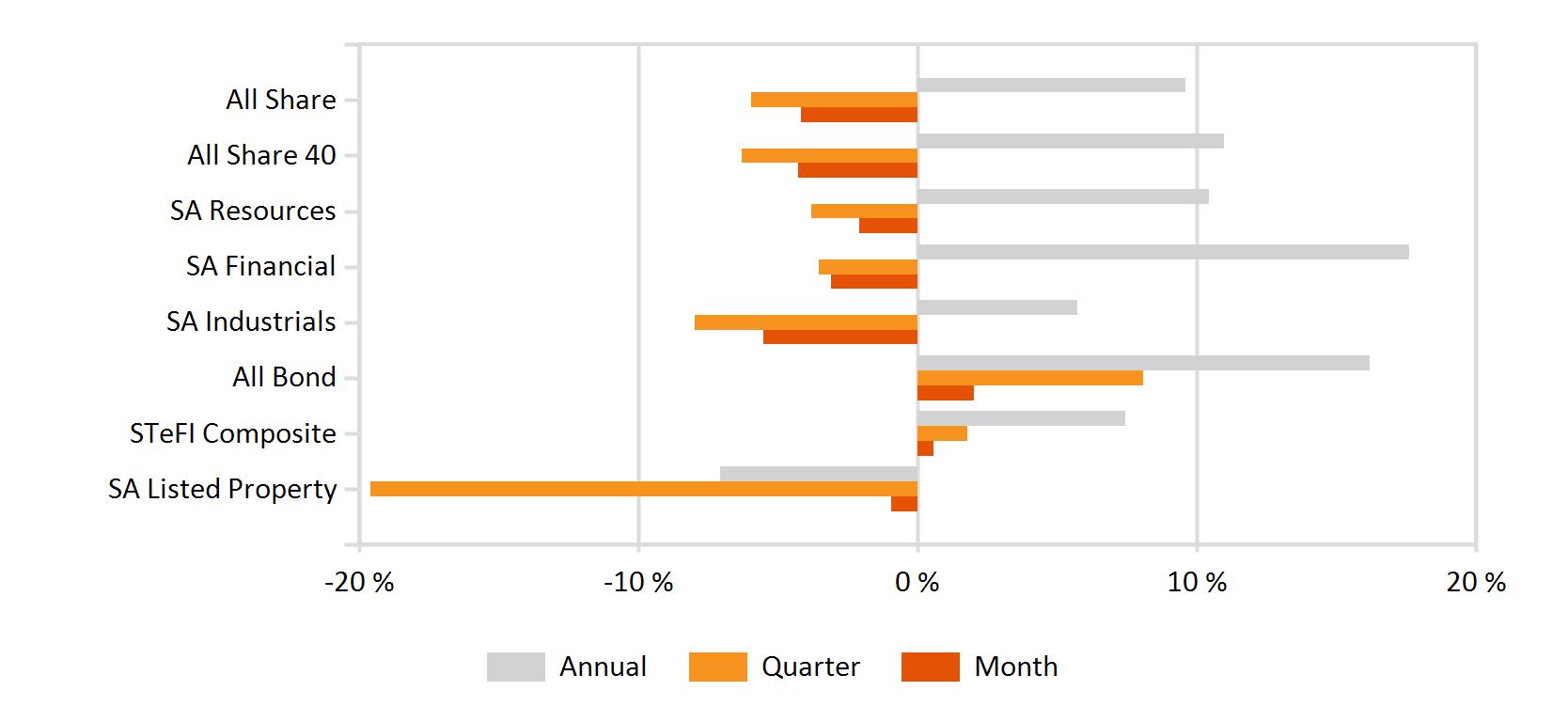

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

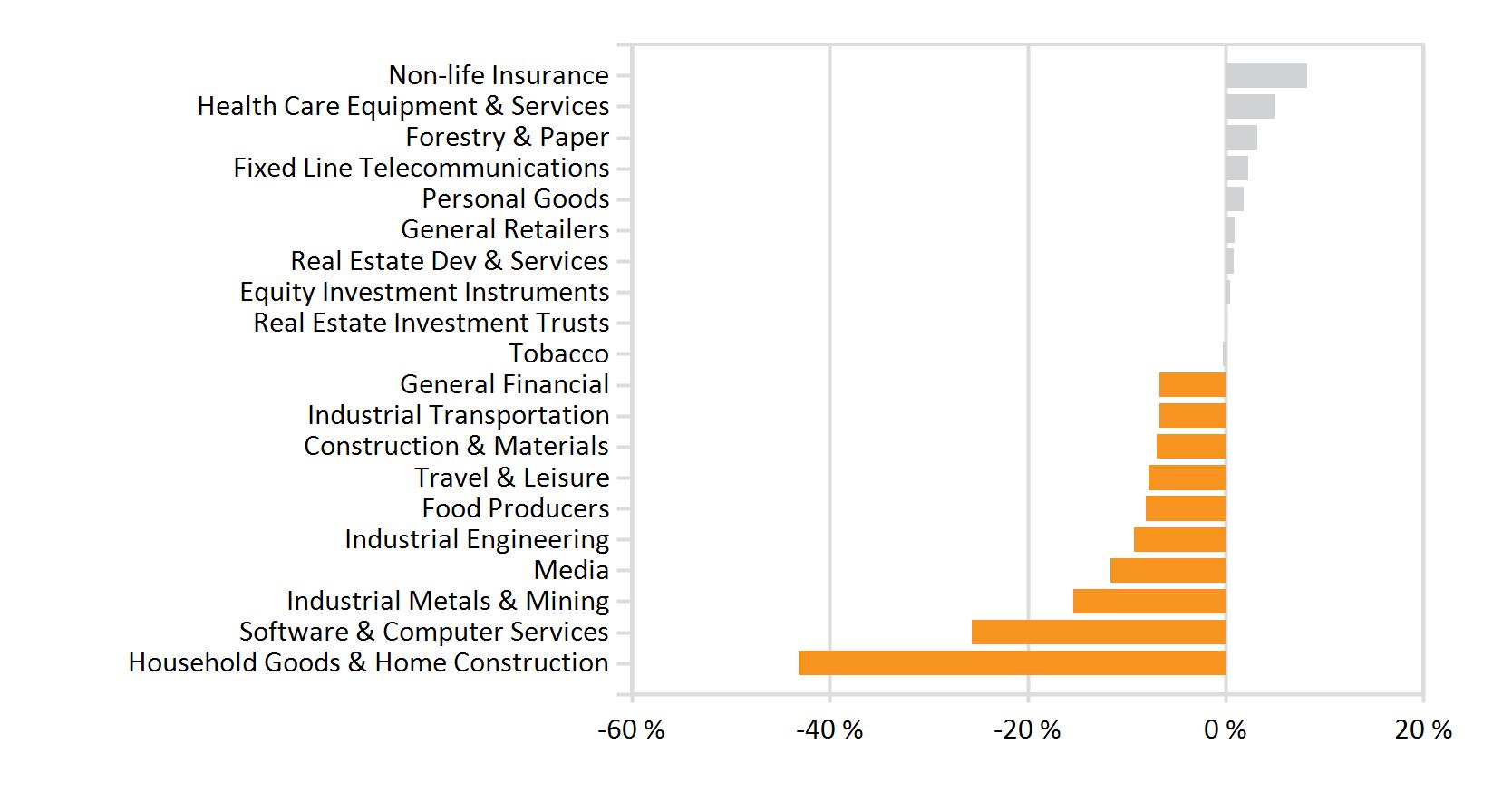

Monthly Industry Performance