Market Commentary: June 2021

Global Market Themes: Solid month for Developed Market (DM) equities as Covid-19 restrictions ease US stocks shine, supported by favourable economic data Widening gap between vaccine roll-out in DM and Emerging Markets (EM) takes its toll on the latter’s stocks Chinese stocks dip due to profit-taking and open market operations by People’s Bank of China (PBOC) Commodities post substantial losses SA Market Themes: South African equities slump, with resources and commodities the biggest drag on performance SARB reiterates belief that inflation is transitory, but longer-term upward pressures on the horizon GDP growth comes in stronger than expected for Q1 2021 Tighter restrictions as South Africa moves into Adjusted Lockdown Level 4

Market View

Global Market Themes

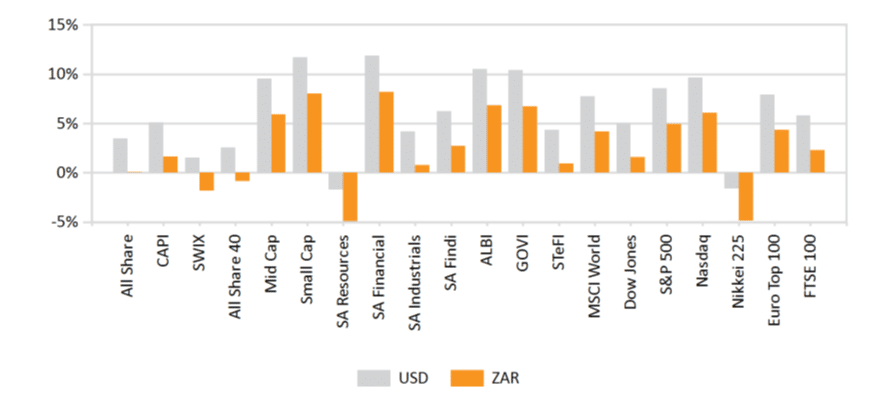

Global markets appear to be on an upward trajectory, fuelled by the reopening of major economies and the roll-out of vaccines. The MSCI World closed 1.5% higher, but Emerging Markets (EM) lagged. The MSCI EM gained a lacklustre 0.1%.

US markets outshone their Developed Market (DM) peers. The S&P500 gained 2.3% for the month, moving to new highs and closing out a fifth consecutive quarterly advance. The economic recovery is boosting traditional growth stocks, such as technology-focused companies, as well as adding momentum to the healthcare and consumer discretionary sectors.

Sentiment was supported by generally favourable US economic data. Although the Institute for Supply Management’s gauge of factory activity fell slightly, edging down to 60.6. Considering that the watermark between expansion and contraction is at 50 points, this is still a robust growth rate. Consumer confidence came in slightly lower than expected, but at 85.5 nonetheless represents the second-highest reading since the start of the pandemic. The labour market rebounded from the previous month’s disappointment. Employers added 850 000 non-farm jobs in June, beating expectations. More importantly, employees appear to be returning to the workforce in droves.

“Weekly jobless claims fell to their lowest level since the start of the pandemic. This is perhaps partly attributable to the fact that some states are likely to end unemployment benefits earlier than the anticipated September cut-off.”

An increasing number of US states have seemingly resumed “business as usual”. Texas was one of the first states to rescind the mask mandate, as early as March, and the Centre for Communicable Diseases (CDC) has indicated that fully vaccinated people will not be required to wear masks.

US inflation has been running hotter, with the May reading indicating a 5% year-on-year increase. The Federal Reserve Bank (the Fed) has to some extent remained sanguine, expressing the belief that the increase is transitory. The latest Federal Open Market Committee meeting, however, suggests that the hawks are rising, The median committee member now expects two rate hikes in 2023, whereas only three months ago the consensus was for no rate hikes.

“European equities fared better, as more and more countries lift restrictions. The STOXX All Europe gained 1.5% for the month. Analysts are predicting that a resumption of “business as usual” will see eurozone GDP grow at an estimated 5% during 2021, with GDP trend growth reaching pre-pandemic levels as early as the first half of 2022. “

Optimism was somewhat tempered by the spread of the Covid-19 delta-variant. In late June, the number of new cases rose for the first time in 10 weeks and some countries were forced to keep some restrictions in place for longer than anticipated. The Eurozone’s vaccine roll-out, however, is on track and estimates from the Centre for Disease Prevention and Control suggest that 70% of the adult population would have received at least the first dose of the vaccine by July. The EU has, in addition, introduced the EU Digital Covid Certificate for vaccinated citizens. This is set to facilitate the reopening of international borders, a hope that remains far in the future for many countries, particularly in EM.

Chinese equities once again saw a divergence between the two major indices. The MSCI China A Onshore dipped by 1.8%, while the MSCI China gained a meagre 0.1%. At month-end reports of profit-taking by domestic investment funds and open market operations by the People’s Bank of China (PBOC) contributed to the largest one-day percentage drop since March 2021. The PBOC, however, confirmed at its latest policy meeting that it would keep the macro leverage ratio stable, signalling that tighter policy was not on the cards. June’s official manufacturing PMI met expectations, and the private (and some say more reliable) Caixin PMI moved in tandem, confirming that the economy remains in a post-pandemic recovery phase.

“Tensions continued to simmer on the political front. In his speech at the centennial of the Chinese Communist Party’s founding, President Xi Jinping reiterated his commitment to the reunification with Taiwan. He also delivered a strong message that China would not tolerate the West’s criticism of, or interference in, its position regarding Taiwan.”

EM, seemingly disheartened by the slow vaccine roll-out, underperformed their DM peers. The MSCI EM closed 0.17% in the green. Asian EM were the main detractors, with their European and Latin American counterparts faring somewhat better. As the oil price continues to surge, Russian equities are performing particularly well. The IMOEX gained 3.2% in local currency terms for June, and is over 16% higher for the year-to-date. Brazilian investors were cautious due to emerging allegations regarding corruption in the government’s purchase of coronavirus vaccines. The country’s electricity regulator also announced a 50% increase in the tariff surcharge as of July. This is likely to impede the recovery in the local manufacturing sector. The BOVESPA managed a 0.4% gain.

Precious and industrial metals closed the month significantly lower: Gold declined by over 7%, Copper was 8.7% lower and Platinum lost 9.6%. A rising US dollar and China’s efforts to slow inflation are partial reasons for the declines. China has indicated that it will release metals from state reserves in a methodical and well-timed manner, increasing supply and pushing prices back to a normal range. Backwardation in some commodities, where the forward price for the futures contract is lower than the spot price and therefore creating a sell-signal, accounts for some of the recent slump as futures contracts rollover.

“Oil, iron ore and coal, however, bucked the trend. Oil prices were 7.6% higher, while iron ore and coal gained 8.4% and 6.1% respectively. With more and more economies reopening, and industrial production getting back up to speed, demand for industrial inputs is climbing.”

South African Market Themes

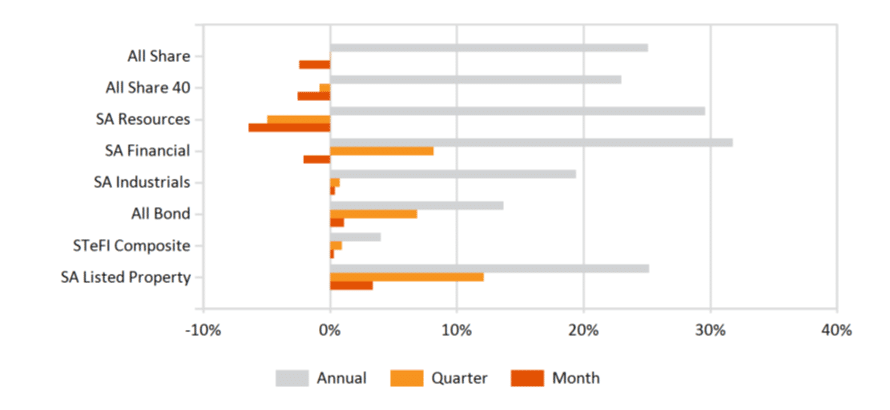

South African equities had a poor month, with the All Share Index losing 2.4% during the month. Resource stocks were the main detractors, as the sector gave up 6.4%. Given the broader decline in commodities, this was largely to be expected. Large-cap commodities firms were the biggest detractors: Amplats lost a whopping 9.3% month-on-month, while Anglo American and Glencore recorded losses of 7.9% and 5.2%. Financials were 3% lower, but Industrials bucked the trend slightly, with the sub-index closing a modest 0.4% higher. Naspers and Prosus also recorded monthly declines of 1.7% and 1.8% respectively. Given their large market share, the drag on the index is substantial.

“South African inflation is hotting up. May’s annual headline inflation, measured by the consumer price index (CPI) came in at 5.2% year-on-year, from a low base in May 2020. Month-on-month, prices increased by 0.1%, easing from a 0.7% increase the prior month.”

The sharp upward pressure is largely attributable to fuel and food inflation. Oil prices, in particular, have recovered sharply. Administered prices (e.g. electricity prices) have also increased.

The South African Reserve Bank (SARB) has reaffirmed its belief that this is a transitory effect, and that it is unlikely to adjust interest rates soon. A potential spanner in the works comes from the ongoing public sector wage negotiations between trade unions and the government. A heated dispute about the government’s proposal to freeze public servants’ wages for three years is raging since February 2020. The government’s rationale is that it will ease the debt burden, by cutting government spending by R300 billion. Major trade unions have rejected the deal and are agitating for an increase of CPI+4% (effectively 8.2%). Unions have threatened to strike over the matter. Should the government concede, inflation is likely to tick higher due to demand-side pressures (earnings and consumption dynamics). It may also result in the government’s implementation of alternative mechanisms to generate revenue.

“South African taxpayers, to some extent, got off lightly in the 2021 Budget. Tax brackets remained unchanged and VAT was left at 15%. This is unlikely to be the case in the 2022 Budget. An increase in excise taxes and/or VAT appears to be one of the state’s preferred routes to generate additional tax revenue. Both are likely to spur inflation higher.”

Fixed income and property provided superior returns in June. The All Bond Index closed the month 1% higher and the All Property Index easily outperformed other asset class measures, gaining 3%. Conversely Inflation-Linked Bonds, had a poor month, with the CILI losing 1.48%. With interest rates still low, and likely to remain so for the near future, the adage that “cash is king” no longer holds, with cash assets only generating 0.3% for the month.

The rand, after hitting a winning streak against major currencies, slowed its gains. The currency ended at R14.30 against the dollar, which is 4% weaker than at May month-end.

South Africa’s GDP growth for the first quarter of 2021 surprised to the upside, beating the SARB’s projections of 2.7% and coming in at an annualised 4.6%. This is nonetheless a 3.2% contraction from the same period in 2020. Business confidence increased sharply in the second quarter of 2021, climbing to 50. This is well above pre-pandemic levels, and the highest since 2014. Especially in the manufacturing, retail and motor trade industries.

“However, as the delta-variant took hold of the country, confidence is likely to ebb. Toward the end of June, President Cyril Ramaphosa announced that the country would enter Adjusted Level 4 of lockdown. It is a response to the rapid rise in new Covid-19 cases linked to the highly transmissible delta-variant.”

The restrictions include the banning of alcohol sales, restaurants and gym closures inter alia, the prohibition of social gatherings and a curfew starting at 9pm and ending at 4am. The latest lockdown is intended to end on 11 July, but with many provinces yet to hit their third-wave peak, it seems unlikely.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices