Market Commentary: June 2019

Here are this month’s highlights: It was a volatile month for global risk assets. The oil price ticked up on supply concerns, as tensions between Iran and the US escalated and OPEC agreed to maintain production cuts. Sentiments on a resolution to the trade-spat between the US and China swung from negative to positive as Presidents Xi Jinping and Donald Trump met at month-end on the sidelines of the G20 summit in Osaka, Japan. Central Banks reaffirmed their commitment to an accommodative monetary policy environment, acknowledging that global growth was a concern. Easy money boosted the appetite for risk assets (equities, high yield bonds and Emerging Markets), as growth jitters boosted demand for safe haven assets (developed market equities, gold and government bonds).

Market View

Cash

South African cash generated 57 basis points (bps) by June month-end. South Africa’s annual inflation rate rose to 4.5% in May 2019, up slightly from the prior month’s reading of 4.4%. This is in line with expectations, and still in the mid-point of the South African Reserve Bank’s (SARB) target range.

“Despite rand volatility, a pullback in oil softened the inflationary impact of the transport component of the index.”

Conversely, prices rose faster for housing and utilities, and food price inflation ticked up 30 bps.

The SARB made headlines for a reason other than their monetary policy meetings this month: ANC secretary general Ace Magashule’s comments on the expansion of the SARB’s mandate to target growth and inflation sowed some doubt as to the Bank’s ongoing independence. The perceived impact on the credibility of the SARB was such that President Cyril Ramaphosa was prompted to release a statement on 6 June, reiterated in his State of the Nation Address on 20 June, reaffirming the SARB ‘s mandate. This somewhat quelled investor fears, but the rand was notably volatile.

Bonds

Local bonds gained a solid 2.23% in June, while inflation-linked bonds ticked up by a meagre 0.13%. Global government bonds, measured by the BarCap GABI, provided a similar return to SA counterparts and ticked up by 2.22%.

The South African bond market faces several risks, and analysts are quick to point out that the SARB, with less room to manoeuvre than developed market peers, may struggle to move in lockstep with the Federal Reserve. In previous interest rate cycles, the SARB and many other emerging market currencies have aimed to keep in line with the Fed’s movements.

“Risk is mounting in the South Africa bond market: Fiscal deficits were initially projected to widen to 4.7% for 2019, but analysts predict that the budget deficit is expected to near 6% of GDP for the current financial year.”

The debt burden will continue to grow as a number of State-Owned Enterprises have already applied for additional government funding and bail-outs. Many municipalities are also in a dire state, underscored by the latest comments from the office of the Auditor General. Of the 257 municipalities included in the audit, only 18 received a clean audit.

The deteriorating audit outcomes are indicative that various local government role players have either delayed implementation or disregarded the Audit Office’s recommendations. This is attested to by a track record of largely incomplete projects, unsupervised projects, misallocation of capital, tender irregularities, failures in service delivery and poor maintenance of completed projects and infrastructure. The accountability for financial and performance management seems to be sorely lacking, and municipalities remain an increasing drain on the fiscus.

The budget deficit, and governments costs of servicing debt is on an upward trajectory. With SARS undershooting revenue collection targets for the fifth consecutive year, the gap between revenue and spending is set to widen further. South African bond yields are therefore already pricing in a negative debt trajectory.

“The spread between South African government debt and the emerging market average remains at levels similar to December 2015 (Nenegate).”

In the current interest rate, inflationary and growth environment, South African long bond inflation-adjusted yields are amongst the highest in the world. Somewhat perversely, the recent pullback in foreign ownership of SA bonds, on fear of fiscal slippage and ratings downgrades, means that local bond yields are based on a solid local investor underpin, and bonds have held up well. The asset class has returned 7.60% for the year-to-date.

Global monetary policy remains accommodative, as growth jitters and the spillover impact of escalating geopolitical tension take center stage. At its June meeting, the Federal Reserve left interest rates unchanged, and indicated that the case for a more accommodative policy had strengthened.

“The European Central Bank signaled its intent to stimulate further if the growth outlook did not improve, the Bank of England kept its rate and outlook unchanged.”

The Bank of Japan indicated its willingness to add further stimulus, the reserve banks of Australia and New Zealand implemented their first ever rate cuts since 2017, and emerging market central banks accelerated interest rate cuts in June.

This is the fifth month of net rate cuts, following an extended tightening cycle, while EMs were battling a strong dollar and rising inflation. Amongst major EMs, some of the most recent interest rate decisions: Russia, where the central bank cut rates on 14 June and signaled two more in 2019; India saw rates cut by 25 bps on 6 June, citing the slowest economic growth in four years; Brazilian monetary authorities left the key rate at a record low on 19 June, citing slowing economic activity. The People’s Bank of China stepped up liquidity support and confirmed its intent to use various monetary policy tools to stabilize money markets and boost banking system liquidity.

During the month, trade and growth jitters were felt in bond markets: US Treasury yields moved lower, especially at the short end of the curve and US Treasury yields fell to below 2% for the first time since President Donald Trump took office. German 10-year Bund yield fell to an all-time low of -0.34%, US investment grade and high yield spreads tightened in June. Emerging Market debt continued its year-to-date rally: the JP Morgan EMBIG has posted 1.6% for the year-to-date and 3.8% in the second quarter.

Equity

The local bourse gained ground in June, with the SWIX returning 3.12%. The rally somewhat lagged global peers, as the MSCI World and Emerging Markets indices registered numbers of over 6%.

StatsSA revealed some discouraging data on the local economy: The 4 June release confirmed that South Africa’s GDP had shrunk by 3.2% in 2019’s first quarter. Weak levels of investment, more than 270 hours of loadshedding, a strike in the gold-mining industry and a drought-hit agricultural sector all took their toll.

“Exports of goods and services declined in the first quarter, falling by over 26%, despite a weaker rand favoring resources.”

The South African Trade Surplus, at 1.74 billion in May 2019, showed some resilience but came in below expectations. The country is in real danger of recession (two quarters of negative growth), as there is little sign that Q2 would show much improvement in the numbers. The seasonally adjusted Absa Purchasing Managers’ Index rose for the month of June, but remained in contractionary territory. Manufacturing activity in Africa’s most industrialised economy rose to 46.2, from 45.4 in May. The RMB/BER Business confidence index was unchanged, remaining at a two-year low for the second quarter.

“Consumer Confidence, on the other hand, was boosted by recent elections and the apparent stabilisation of the power supply – it rose from two points in the first quarter to five points for the second quarter. “

Households, however, still face a tough economic environment of low employment, low growth and higher prices. Retail sales reflected this hesitant confidence – month-on-month sales improved and showed positive growth on the latest reading, though this may have been boosted by the number of public holidays in the month.

On a sectoral basis, Resources were the best performing sub-index, registering over 10%. Industrials and Financials recorded more modest returns of 3.76 and 1.29%, respectively. Naspers’s share price continued its upward trend, registering a 4.3% gain for the month. The firm delivered another strong set of results on the 21 June, ahead of the unbundling of its global internet and e-commerce assets. Revenue increased 29% year-on-year, trading profit grew 22% year-on-year and core headline earnings grew 26% to USD 3 billion (from USD 2.4 bn in the preceding period). The firm reported an IRR of 20% on existing assets (excluding Tencent) since 2008, and its strong balance sheet and net cash position leaves them in a position to pursue growth opportunities elsewhere.

Multichoice, which was spun off from Naspers in February, had a solid showing for the month, despite reporting a loss in its first full-year results.

“The share price of the largest Pay-TV group in Africa was supported by strong growth in subscriber numbers and significant cost-cutting measures.”

SASOL share prices hit a new low, after slumping in May 2019, losing a further 4.4% in June. Gold miners showed significant gains – DRDGold rose by over 50%, Harmony by 25% and otherwise beleaguered Sibanye Stillwater by 20%. Diversified miner BHP Billiton hugged the overall resource benchmark, gaining just over 10% for the month.

With the likelihood of a recession, and the axe of ratings downgrades still looming, investors remain cautious of SA Inc. The momentum from the election, and President Ramaphosa’s pro-business stance, however, appear to be encouraging offshore punters.

Property

South African listed property put in a decent performance, the SAPY gaining 2.2% and the ALPI ticking up 1.54% in June. The South African housing market has picked up after the May elections, but not enough to counteract the prior months’ slowdown.

“The latest release of the FNB Property Barometer shows that the FNB House Price Index has ticked up by 3.5% year-on-year for June 2019.”

Given that inflation is currently at 4.5%, house-prices have been declining in real terms. The deflationary cycle may be a boon to buyers, as it improves the average buyer’s affordability in the residential space.

The SA REITS sector has faced considerable headwinds from lower economic growth and poor prospects, underscored by the latest GDP reading. It is also still struggling to shrug off the impact of negative news on the Resilient Group. The market may still have some room for mergers and consolidation, but these moves are likely to be delayed until there is greater policy clarity.

Oversupply remains a problem, especially in the retail sector: while the amount of new space being built has ebbed, there is still considerable overhang. Rental escalations in general have also struggled to keep pace with inflation. The overall South African REIT sector has been supported of late by its substantial exposure to growing Eastern European markets. Echo Polska, with its considerable Polish holdings, was one of June’s top performers (gaining over 8%).

“Overall, analysts believe the South African listed property sector is fairly priced on a 12-month view and offers significant opportunities for savvy investors.”

The FTSE/EPRA NAREIT Developed Rental Market index gained a more modest 1.24% for the month. Globally, the housing market is feeling the pain of growth jitters. In the UK, the IHS Markit/CIPS UK Construction PMI showed a sharp contraction, as did housing starts and construction output.

In the US, commensurate measures dipped by 0.8% and 0.9% month-on-month. Prospects for US REITs, however, may be improving. Given that they are yield-oriented companies, these funds benefit when interest rates decline. US equity REITS have registered a 18% return for the year-to-date. Prospects for US malls have improved significantly as some retailers return to bricks-and-mortar in pursuit of an enhanced customer experience.

“Within the broader market , industrial REITS remain the belle of the ball. In the US, UK and rest of Europe, the emphasis for most companies was on last-mile distribution facilities.”

Logistics and warehousing have been in high demand. In Emerging Europe, improved growth prospects and relatively rapid penetration of retail, previously underdeveloped, saw healthy appetite for new developments. In Russia, Moscow’s retail outlet development is set to grow by 72% in 2019, as three outlet centres are currently under construction.

Overall, the Asia-Pacific region proved to be one of the best performers in the listed real estate space, despite and perhaps in some cases because of the China-US trade-spat. The region saw a record USD 45 billion of commercial property investment in the first quarter of 2019, a trend which looks set to continue.

Demand for Industrial Properties and Logistics has remained strong in Hong Kong, partly as it provides an alternative route to market for businesses looking at China.

“Singapore proved to be the best performing listed real estate market in June, recording a USD return of 9.83%.”

Overall, real estate fundamentals remain healthy, with an estimated forward FAD (funds available for distribution) yield of 4.72% and decent medium-term growth prospects. Global Real Estate companies are in a better position than before the Global Financial Crisis, with stronger balance sheets, healthy loan-to-value ratios, solid credit ratings and lower interest rates.

International Markets

June was a month of opposing factors: Central Banks, faced with the prospect of weaker economic growth, signalled their commitment to easier monetary policy boosting risk assets, even as the self-same growth jitters boosted safe-haven assets; Diplomatic relations between the US and China reached boiling point, yet toward month-end Presidents Xi Jinping and Donald Trump agreed at the G20 meeting in Japan to resume trade talks, boosting global sentiment.

“There was progress on the Mexico-US migrant front, a deal saw tariffs suspended ‘indefinitely’, but relations between the US and Iran deteriorated rapidly.”

Risk assets, including equities and credit, therefore rallied alongside their safe-haven counterparts. The MSCI World closed 6.59% higher, and Emerging Markets slightly lagged their developed peers at 6.24%.

In the US, the S&P500 closed 7% higher, in line with the Dow Jones Industrial Average and the NASDAQ (at 7.1 and 7.4%, respectively). The broad market posted its best first half since 1997. The June bounce erased some of the prior month losses, and came off the back of gains in technology giants, dovish comments from the Federal Reserve Chair, Jerome H Powell, and potential easing of Sino-US trade talks.

“Measures of consumer and business confidence reflect an at-best muted optimism regarding future economic conditions.”

Despite month-on-month retail sales inching 0.5% higher, big ticket spending has remained depressed. Durable goods orders fell by 1.3% from May to June; Total Vehicle Sales were unchanged and New Home Sales data reflect a 7.8% drop.

The ISM Manufacturing Purchasing Managers’ Index (a measure of business confidence) has dipped 5o 51.7 in June 2019, the weakest pace of expansion in three years. The decline is led by a substantial drop in the new orders index, further evidence of scepticism.

The University of Michigan’s Consumer Sentiment Index dipped by 1.6 points to 98.2 and the IBD/TIPP Economic Optimism Index slumped to 53.2 from May’s 58.6 points. On a sectoral basis, Materials, Energy and IT were amongst the best performers.

” High-tech dominance has been the hallmark of the past several years in the bull run.”

Google, Facebook, Amazon and Apple have edged out old stalwarts like General Electric, Walmart and Exxon. Facebook’s recent unveiling of a plan for a new digital currency has sparked concerns that the tech giant’s reach is expanding too rapidly. They have come under increased attention from Republican and Democratic leaders and from government regulators. Nonetheless, technology is up roughly 26% for the year.

“Stock specific concerns saw some market leaders fall from grace: Boeing, one of the best performers in 2018, dropped around 20% in the past four months, beset by problems with flagship-model the 737.”

Turning again to sector specifics, even though all 11 of the subsectors of the S&P recorded gains, the more defensive real estate and utilities sectors lagged.

UK news was dominated by the Conservative Party leadership race, with Boris Johnson tipped to be the favourite. The new Prime Minister will have a challenging task in resolving the Brexit impasse, and averting a no-deal exit.

The Bank of England has consequently been far less dovish than its US and European counterparts. British macroeconomic data was largely negative. Consumer confidence edged lower, as did June retail sales , the lowest since the Global Financial Crisis.

Business confidence is low, and the IHS Markit/CIPS UK Manufacturing PMI saw its steepest decline since February 2013, dipping 1.4 points. Consumers and businesses are deferring big-ticket spending and capex until there is clarity around Brexit. The FTSE 100, perhaps not surprisingly, lagged its European and US peers, posting a 3.97% return for June.

“On a sectoral basis, energy stocks and basic materials gained nicely.”

The STOXX All Europe lagged American indices and returned 4.43%. There were notable star performers, Luxembourg and Italy registering stock market gains of similar magnitude to the US. This, despite the still-smouldering issue regarding the latter’s budget deficit. The Anti-Establishment coalition has delayed setting a target until 2020, and Italian Prime Minister Giuseppe Conte is said to be in talks with the European Commission to avoid a disciplinary procedure.

Performance was solid across the board, with export-oriented regional heavyweight Germany’s DAX rising ahead of the G20 summit on hopes of a constructive dialogue on trade tariffs. Business confidence within the European Union and the broader Eurozone took a knock, declining an of average six points to a five-year low.

“Manufacturing remains in contractionary territory, with the IHS Market Eurozone Manufacturing PMI at 47.6 for June 2019.”

Services boosted the composite PMI into expansion (52.2), although it registered a month-on-month decline. The Consumer Confidence Index dip (by 0.7 points) is reflected in lower month-on-month retail sales and depressed consumer spending. Sectoral returns were similar to those in the US – Information Technology, Industrials and Materials were amongst the biggest gainers. Defensive stocks such as Utilities and Consumer Stables lagged, and Real Estate lost ground.

Japanese stock markets closed modestly higher, as the country geared up to host the G20 summit in Osaka at month-end. The Nikkei rose 3.52%. As elsewhere, lacklustre economic growth data created the expectation of further Central Bank stimulus and boosted risk appetite.

The latest inflation data shows that consumer price inflation dipped by 0.2% from the previous month, underscoring the difficulty the Bank of Japan faces in achieving its 2% target. The Bank’s Tankan Index for large manufacturers’ sentiment fell to a three-year low, signalling waning business confidence and manufacturing and industrial production contracted in June.

“The Consumer Confidence Index fell to its lowest since November 2014.”

Japanese consumers appear to be distinctly downbeat, a spill-over from growing global growth concerns and trade tension in this export-oriented economy.

One of the hardest hit sectors is the automotive sector, as car manufacturers globally face increasing headwinds. This includes weaker demand, dragged down by a slump in demand from China (a function of both easing growth in that country and its trade-spat with the US); increased regulation, particularly regarding emissions in the EU; the competition to provide economically viable and practical electric cars to an increasingly green market; and the trend away from individual car ownership. The rise of ride-hailing services such as Uber, and new competition from Google’s driverless car business, is eating into traditional car companies market.

“Chinese equities showed substantial gains: The MSCI China and MSCI China A-Onshore gaining 8.03% and 5.67%, respectively. “

Sentiment around trade talks swung from optimism to pessimism, and back again during the month. At month-end, Presidents Donald Trump and Xi Jinping, on the sidelines of the G20 summit, agreed to a tentative truce.

Meanwhile, Chinese data was lacklustre: the Official NBS manufacturing PMI in was unchanged at 49.4, its fourth consecutive month of contraction; Industrial production month-on-month, the Services PMI and the non-manufacturing PMI eased lower. The latest readings are somewhat conflicting: On the one hand, the latest available data on month-on-month retail sales and consumer confidence is positive; on the other hand, declining vehicle sales show a slowing appetite for big-ticket spending. Rising steel production and cement production point to the success of an infrastructure spending push, while decreasing electricity production goes hand in hand with slowing industrial production.

“Emerging Asian markets’ performance remains closely linked to that of regional leader China and the vagaries of the US-Sino trade relationship.”

Korea and Taiwan posted positive returns, boosted by tech stocks and an easing of North-South Korean tension. Indian markets were the regional laggard, with the SENSEX posting a 0.54% dip. The nation saw its current account deficit widen to 2.1% and faces increasing pressure from rising oil prices.

Emerging Middle Eastern, European and African markets were mixed. Conflict between the US and Iran came to a boiling point, while Turkish diplomatic tensions simmered. Turkish equities, were buoyed by hope for a political sea-change: Incumbent President Recep Tayyip Erdogan’s reign may be at risk, as his candidate for mayor of Istanbul lost to the coalition People’s Republican Party. Turkish equities gained 7.71% for the month.

The United Arab Emirates lagged counterparts, giving up nearly 1%. Russian equities gained 3.77%, boosted by increasing oil prices, improved perceptions of political risk and the opportunities for bargain-hunting caused by 2018’s knee-jerk sell-off.

“Russian markets have delivered amongst the best year-to-date performance, up over 17%.”

Within Africa, the Nigerian bourse failed to take advantage of the rising oil price, as it lost over 4%. Large Cap counters and traditional investor favourites, such as Guarantee Bank, Nigerian Breweries, Guinness Nigerian and Nestle Nigeria, posted substantial losses, reflecting the tough economic conditions the country faces.

Elsewhere in EM, Latin American markets were mainly higher, with Argentinian stocks reaching a record high off positive reform momentum, and hopes of a trade truce. The Brazilian stock market and the Real were under pressure as the Central Bank cut its 2019 economic growth forecast to 0.8% from 2%. The index nonetheless ticked up by just over 4%. Laggards included Colombia and Chile. For the quarter, Financials and Consumer Staples led sectoral gains.

Currencies and Commodities

Commodity markets resumed their upward trajectory in June, with the GSCI index up by 4.4% for June and by 13.3% for the year. Gold prices climbed 8% on safe haven buying, and the Precious Metals sub-index gained 7.7%.

“Industrial metals were also stronger (2%), with Iron Ore moving significantly higher, boosted by stimulus from the Chinese government and the agreement between presidents Trump and Xi Jinping to resume trade talks. “

Energy counters ticked higher (the sub-index returned 6.6%, led by a 9% jump in oil prices). Bearishness regarding the state of the global economy and the demand-side impact was tempered by supply side factors. This includes the OPEC deal extension, whereby the group agreed to stick to existing output cuts of 1.2 million barrels per day for nine months; a larger-than-expected drawdown in US Crude Oil Inventories; and possible disruptions to supply from the Gulf, as tension between the US and Iran escalate.

In currencies, the USD Index was 1.7% lower in June, though it staged a late month recovery after the month-end G20 meeting saw an agreement from Presidents Trump and Xi Jinping to resume talks. The agreement saw the Chinese Yuan strengthen to its highest level in six weeks, while safe haven currencies such as the yen gave up gains.

“Amongst developed markets, the Canadian Dollar, backed by stronger energy prices, registered the strongest gain at 3.2% higher. “

Emerging market showed widespread gains against the Greenback: The Russian Rouble gained 3.4% and the Korean Won 2.8% on stronger energy prices and diplomatic ties. South Africa’s near-neighbour Zimbabwe banned the use of foreign currency (notably rands and US Dollars) as medium of exchange, effective immediately on 24 June. This has left so-called RTGS (bond notes and electronic cash and newly rebranded as the Zimbabwe Dollar) the only legitimate payment method. Many Zimbabweans have expressed dissatisfaction at the lack of forewarning and abrupt implementation, and fears of hyperinflation have resurfaced.

The South African Rand, in a notably volatile month, gained 3.5%. The resilience of the local unit was tested several times: The currency weathered the fall-out from weak GDP readings and the backlash of the conflict regarding the SARB’s independence, and responded largely positively to President Ramaphosa’s State of the Nation Address.

Performance

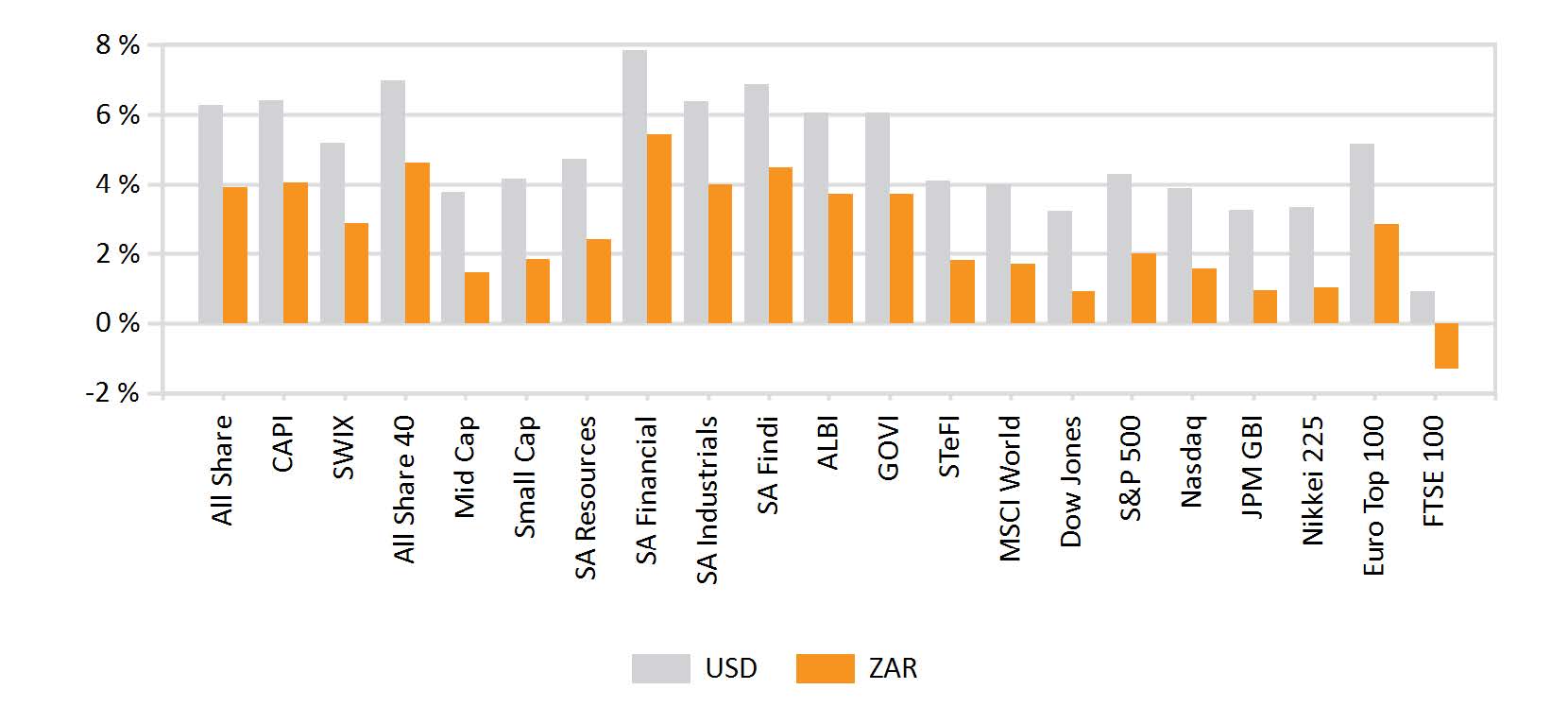

World Market Indices Performance

Monthly return of major indices

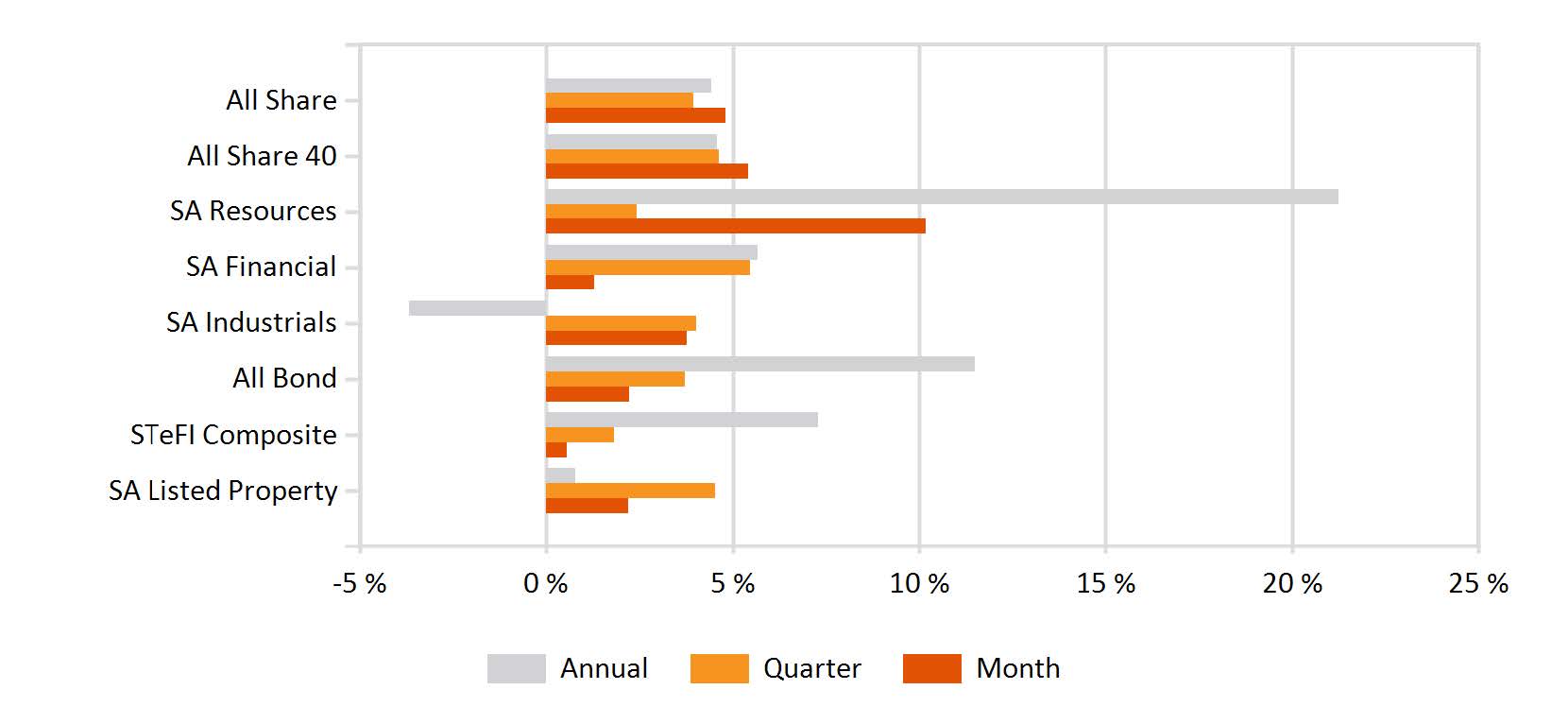

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

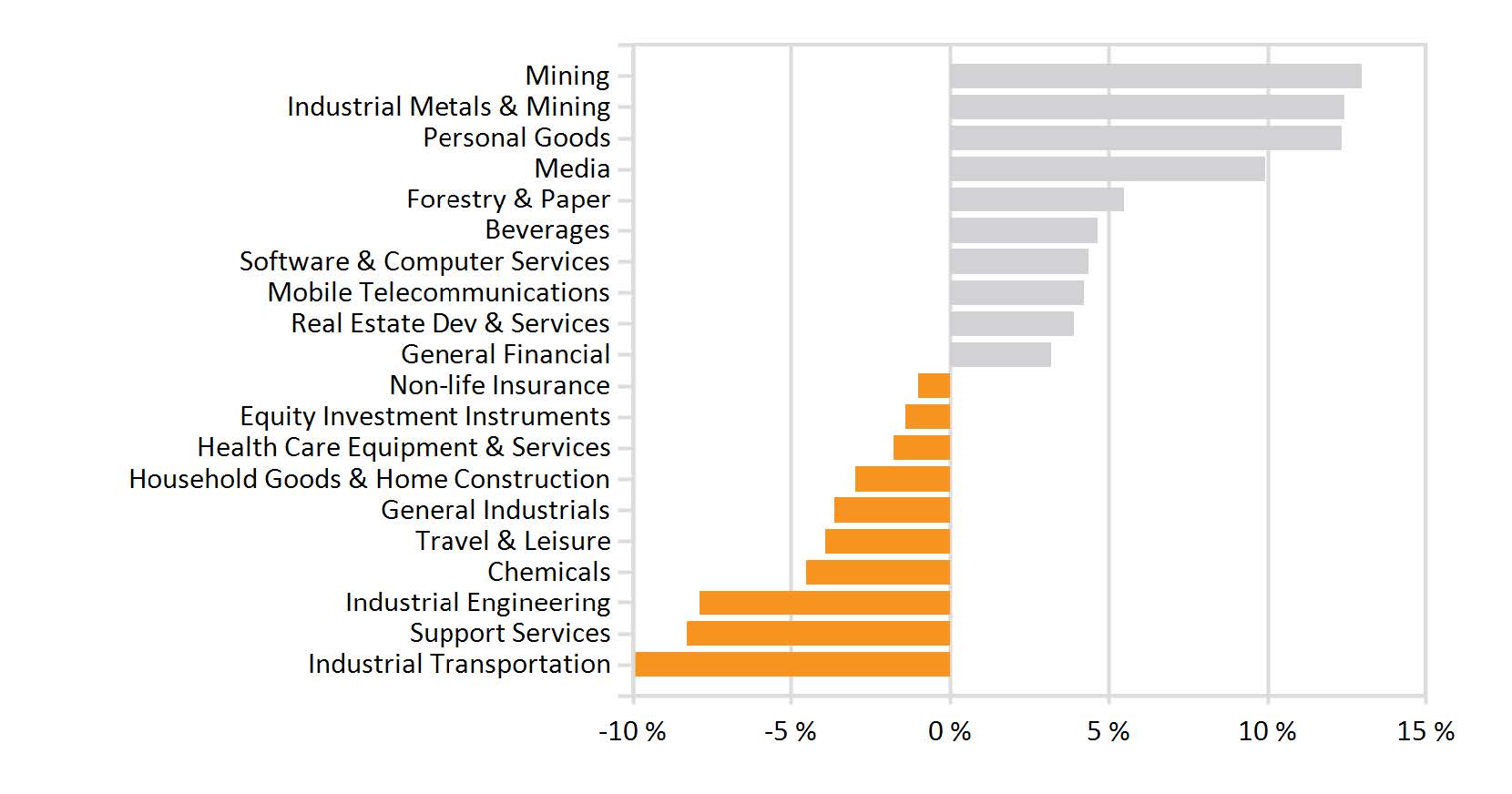

Monthly Industry Performance