Market Commentary: July 2021

Global Market Themes: Developed Market (DM) equities continued to perform well, MSCI World gains 1.7% in USD Emerging Market (EM) equities decline, against the backdrop China’s additional regulations Safe haven assets find favour amidst concerns around Delta variant and slowing global growth Commodities led higher by gold SA Market Themes: Wide-spread unrest dominates local news, causing investor jitters Local equities shrug off socio-political concerns, closing over 4% higher. Resources lead the charge on the local equity front

Market View

Global Market Themes

Despite increasing concerns about the impact of the Delta variant of COVID-19, global equities continued to gain ground. Developed Markets (DM) outperformed their Emerging Market (EM) peers by over 8% in US Dollars (USD). The MSCI World gained just short of 1.8%, whereas the MSCI EM lost 6.7%.

The S&P500 gained nearly 2.4% during July, with US companies generally posting strong earnings results for the second quarter of 2021. The proportion of companies beating earnings estimates has been far ahead of the five-year average, with nearly 90% of companies that had reported by the end of July beating analysts’ expectations. This, however, may be partly a reflection of muted expectations.

“US inflation surprised to the upside for the fourth consecutive month, with the headline consumer price index (CPI) hitting 5.4% year-on-year (y-o-y) in June. The Federal Reserve Bank (the Fed) at its July meeting acknowledged that there were upside risks to inflation, but retained the view that this would be transitory. Nonetheless, the Fed is sending clear signals that a tapering of asset purchases is moving closer, and is likely to take place late in 2021 or early in 2022, as the economy reaches full employment again.”

Full employment, for the Fed’s purposes, means the highest amount of employment that can be sustained while maintaining a stable inflation rate. Economists predict that the unemployment rate will reach 4.5% by the end of 2021, which is merely 50 basis points (bps) off the Fed’s current estimate of full employment. With the US vaccination programme continuing apace, most market sectors are returning to full capacity, including tourism and travel. The unemployment rate has consequently continued to decline, reaching 5.4% during July. Moreover, non-farm payrolls increased by 943 000 in July, considerably better than the 850 000 from the previous month.

US Treasury yields declined sharply in July, reaching lows last seen in February. Bond prices were elevated (yields move inversely to prices) as a result of a combination of demand-side factors: the Fed has continued its asset purchase programme and institutional investors have rebalanced their asset allocations following a period of strong equity gains. On the other hand, US President Joe Biden’s infrastructure push, which is likely to be funded partly by debt issuance (leading to higher supply in the bond market, and consequently lower prices) may lead to a rise in yields. To date, however, details of the programme have been hard to pin down.

“European equity markets modestly underperformed their US peers, with the STOXX All Europe closing 2.17% higher. The top-performing sectors included real estate, materials and information technology. The energy sector, however, proved a drag on performance. The announcement of the European Commision’s “Fit for 55%” package of proposals may have contributed to a decreased appetite for fossil fuel stocks. The initiative aims to reduce harmful emissions by 55% by 2030, and includes a carbon border tax, fuel taxes, and an expansion of the Emissions Trading System.”

Composite Purchasing Managers Index (PMI) data has improved in most major European economies, with service sector PMIs outweighing those of the manufacturing sector, as more subsectors of the European Union’s (EU) economy reopen. EU business confidence also increased at its fastest pace in more than two decades, increasing by 1.3 points to 12.7. Eurozone employment levels rose at their fastest pace since data-collection began 24 years ago and unemployment edged down to 7.7% (as at June 2021), its lowest level since May 2020.

The European Central Bank (ECB) unlike its US counterpart, has little scope left to cut interest rates further, as key rates are either below or near-zero. At its meeting in July, the bank elected to keep the ECB refinancing rate at 0.05%, its lowest rate ever. It therefore appears to be less scope to use monetary policy as a tool for effecting Eurozone economic recovery. Fiscal policy is likely to be required to do most of the heavy lifting if the Eurozone is to shrug off the low-inflation, low-growth environment it has been trapped in. As most European Union members have approved their recovery plans, policymakers hope that the European Recovery Fund (approved by all 27 nations in June 2021) will be the catalyst.

“Equities in the United Kingdom (UK) lagged DM peers, with the FTSE100 gaining less than 0.1% (in GBP) in July. Economic data was somewhat mixed: The Office for National Statistics (ONS) confirmed that the economy grew much slower than the anticipated 1.5% and flash PMI data indicates that supply bottlenecks are putting a cap on activity levels.”

On the other hand, consumer confidence reached its highest level since the pandemic started. Most legal restrictions related to COVID-19, including the requirement to wear a mask in public, were lifted on 19 July. After a marked increase in daily cases, the move initially caused some market jitters, and equities dipped in the first half of the month. During the second half of the month, however, infection rates tailed off, and markets bounced back. Energy, financial and basic materials stocks delivered strong second-quarter results, further fuelling the uptick.

“The staging of the Olympic Games in Tokyo did little to boost market sentiment, as the Japanese government largely failed to reassure the population and market participants as to COVID-19 safety measures.”

A state of emergency was reimposed in Tokyo in early July and spectators were banned from Olympic events, but many athletes elected to withdraw from the Games. There was growing dissatisfaction with Prime Minister Yoshishide Suga’s handling of the situation, and his support base slid to a record low of 33%. The Nikkei dipped 5.2%.

Chinese equities posted substantial losses, with the MSCI China A Onshore and MSCI China indices losing 5.1% and 13.8% respectively. The sell-off was sparked by the Chinese authorities’ crackdown on technology and education companies. Chinese blue chips shed 4.4% in the latter days of the month, registering their largest daily decline in more than a year. Moreover, US-China talks got off to a decidedly frosty start, further dampening investor sentiment. The “Chinese meltdown” triggered a broad decline in Asian equities, with India the only market to end in positive territory (the SENSEX Index registered a 0.4% uptick).

Emerging markets elsewhere were similarly lower, despite stronger oil prices. More broadly in the commodities space, oil prices continued to trend higher, gaining 1% in USD. Gold also closed higher, as did copper (by 2.5% and 3.7%, respectively) while industrial metals largely declined.

South African Market Themes

South African newsflow was dominated by the violence, rioting and looting which gripped parts of Gauteng and KwaZulu-Natal following the arrest of former president Jacob Zuma. With new infections surging due to the spread of the Delta-variant of COVID-19, the country also remained in Adjusted Level 4 of the national lockdown, despite initial indications that it was due to end on 11 July. Global and local investor jitters were evident during the month.

Nonetheless, local equity markets managed to notch up gains during July. The All Share Index closed nearly 4.2% higher, bucking expectations of a sharp decline. The move, however, was fuelled almost solely by a stellar performance from the Resource subsector, which gained roughly 11.7% for the month. The performance is attributable to several factors: It is partly a correction of the previous month’s abysmal performance (the market was 6.4% lower); partly a result of increasing global demand as the economic recovery elsewhere gathers pace; and partly a result global earnings optimism. Miners were amongst the biggest gainers, with diversified miners’ Anglo American Plc gaining more than 14% and BHP Billiton delivering over 12%. After approval of the Naspers/Prosus shareswap, shares in the respective entities took a noticeable dip early in July, before rallying again. The rally, however, was short-lived, as headwinds from China spilled over to Naspers.

“With Tencent, Naspers’ single biggest investment, becoming the victim of Chinese authorities’ latest tech crackdown, share prices in the behemoth of the JSE fell by more than 12% between 22 and 27 July. Share prices recovered some ground, but closed 6.3% lower.”

The local bond market closed higher, with the All Bond Index (ALBI) registering a gain of 80 bps. Local property stocks also managed to buck expectations, with the All Property Index (ALPI) closing near the flatline (only 40 bps lower). Quite reasonably, market participants had expected a considerably worse performance from listed property stocks, given that a number of malls and shopping centres were at risk from rioters.

“Although the South African market appears to have recovered somewhat from the nadir in July, the unrest has exposed some lingering concerns. The country was on track to be one of the best EM equity markets for 2021, and the International Monetary Fund had estimated that GDP growth could reach about 4%. This progress, however, is likely to be curtailed by a number of factors, including the over-reliance on specific economic subsectors and the disquieting underlying socio-political landscape.”

The uptick in local equities has largely been fuelled by a particularly strong commodity export market. Surging metal prices saw exports rebounding at the fastest pace globally, and turned a longstanding budget deficit into a surplus. The rand had also been particularly strong partly as a result of the export boom. South Africa has one of the single strongest export markets in the world due to metals such as platinum and rhodium. But economists estimate that these markets are already at very mature levels, and that the country has passed peak exports. Platinum prices, for instance, have fallen by more than 15% from the six-year highs experienced in February 2021, and could soften further if Chinese demand slows and DM countries start to withdraw pandemic-era stimuli.

The improvement in South Africa’s fiscal position to date, while partly attributable to the export-boom, is also partly attributable to the incumbent government’s reform agenda. The latter included a commitment to fiscal austerity, which saw a three-year freeze on public sector wages, inter alia. The riots exposed a deep-seated political divide and a key risk is that the unrest places more bargaining power into the hands of trade unions. In an effort to appease the broader supporter base, President Cyril Ramaphosa might feel compelled to accede to some of the unions’ demands. In the longer run, however, this would only further erode investor confidence, drive up local bond yields and cause a depreciation in the rand.

The shorter-term cost of the riots is still being quantified. Initial indications included some rather shocking statistics. Supply chain security was severely affected as major transport arteries were closed for several days. This included the port of Durban in KZN, which accounts for roughly 70% of South Africa’s imports. Retail trade and production account for about 20% of Gross Domestic Product (GDP) amounting to roughly USD 70 billion, and local banks estimate that nearly USD 14 billion of this figure was lost as a result of the unrest. According to early estimates: 3 000 stores were looted; 100 shopping malls suffered serious fire damage; 1 200 retail outlets, 50 000 informal traders and 40 000 businesses were affected. In addition to the infrastructure damage caused, 150 000 jobs were put at risk in a country where unemployment exceeds 30%. Economists have estimated that the overall cost to the national economy due to the destruction caused by the pro-Zuma protests will exceed R50 billion.

“The unrest also saw many vaccination centres shutting down temporarily, futher slowing the pace of immunisation, and boding ill for the further easing of lockdown restrictions (and the avoidance of new restrictions). The pace of immunisation in South Africa had already been lagging even its EM peers, with only roughly 2% of a population of 60 million having been fully vaccinated at the end of July.”

The roll-out has been rather rapidly extended to include younger age cohorts, with 35 to 50 year-olds becoming eligible in August, and 18 to 35-year olds due to become eligible as of 1 September. It is hoped that this will help the country achieve its target of 67% of the population by the end of 2021, though this appears to be unlikely.

Economists consequently revised their forecasts for the country’s economic growth lower: NKC African Economics revised its full-year forecast for 2021 to 3.8%, from 4.3%; JPMorgan suggested that growth would be 0.4% lower, while Deutsche Bank shaved 0.8% off its estimates. Ratings agencies S&P and Moody’s are also likely to revise estimates lower.

Performance

World Market Indices Performance

Quarterly return of major indices

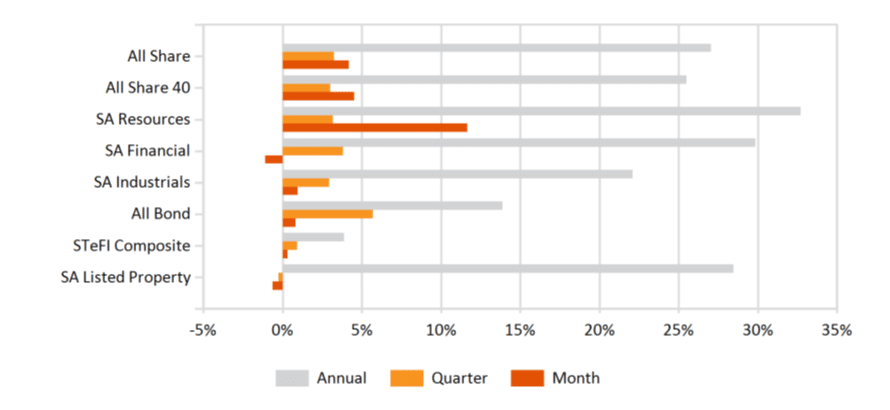

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices