Market Commentary: July 2020

Global Market Themes: Data points to continued recovery in China, it leads Emerging Markets higher. Resurgence of US-China tensions: Embassies close, Hong Kong special trading rights revoked, US considers travel bans and national security risks of TikTok and Wechat. US GDP growth plunges and the US Congress fails to agree on extension of enhanced unemployment benefits. European leaders agree on historic Euro 750 billion recovery fund. SA Market Themes: IMF grants South Africa a $4.3 billion loan. Inflation remains low and the SARB implements a further rate cut. Loadshedding hits struggling economy again.

Market View

Global Market Themes

Another volatile month for global risk assets. The continued rise of global coronavirus infections, second (and even third) waves of the pandemic and heightened US-China tensions weighed on investor sentiment. Conversely, reported progress on a vaccine and the broad support of global central banks remained a boon to risk-appetite.

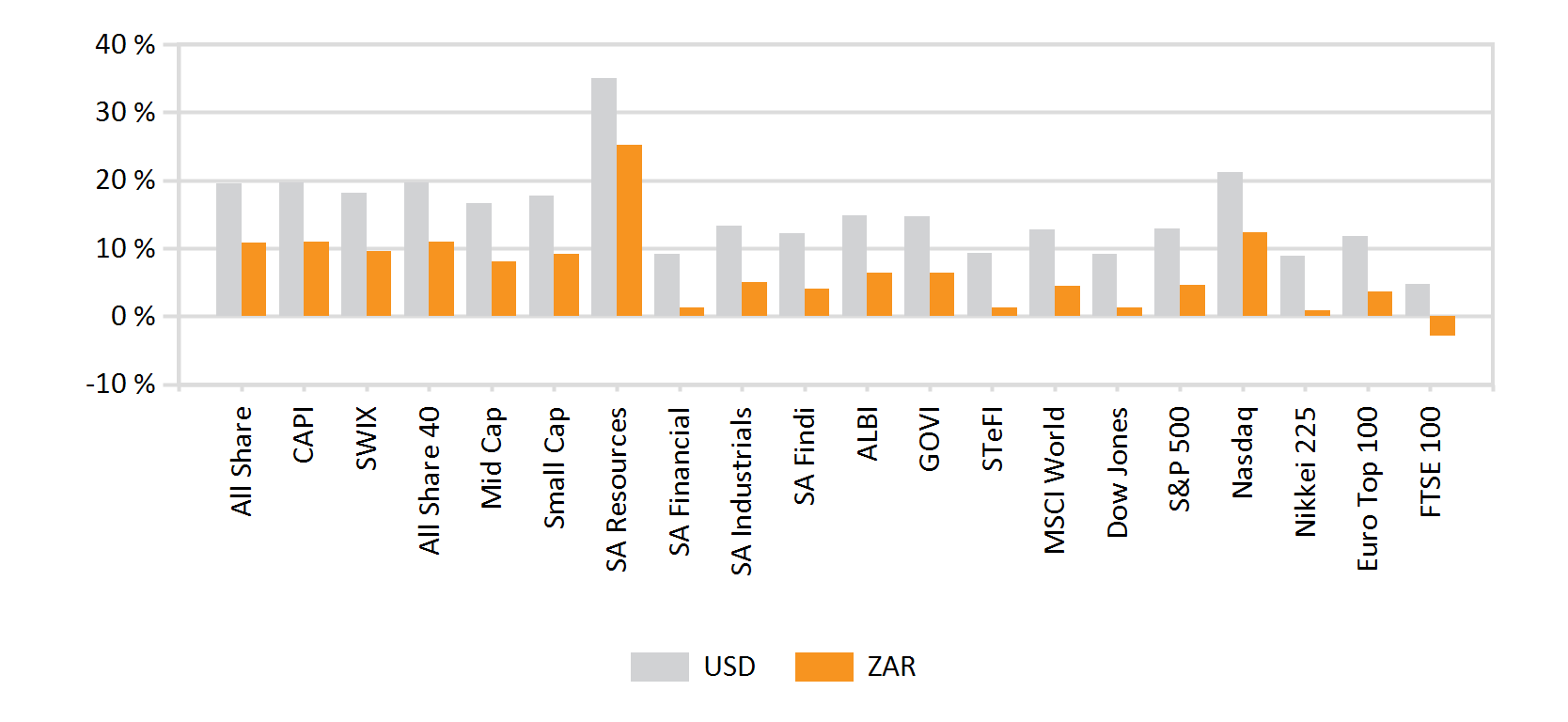

The MSCI World closed 4.7% higher in US dollar terms and Emerging Markets outperformed their Developed peers. The MSCI EM gained 8.9%, largely led by the resurgent Chinese equity market. MSCI China yielded 9.4%, while the MSCI China A Onshore index gained a staggering 14.8% in dollar terms. This, despite investors having braced themselves for the unlocking of RMB 1.36 trillion in restricted shares that became available for trading in the A-share market. The previous influx led to heavy selling by institutional investors, but it appears that current valuations and positive fundamentals stayed their hand.

“Overall, the economic releases from China are pointing to a slow and steady recovery.”

The NBS Manufacturing Purchasing Managers Index (PMI) is an official measure made up of predominantly large state-owned enterprises. It rose to 51.1 points in July, signalling an expansion and beating market expectations. China’s industrial production grew 4.8% in June from a year earlier, the third straight monthly gain. Profits at China’s industrial firms also grew in June, at the quickest pace since March 2019, marking the first monthly growth in earnings since November, before the onset of the coronavirus pandemic.

One of the ways in which China is trying to rebuild its economy post-pandemic is through another major infrastructure push. Analysts warn, however, that such a push comes with its own set of risks. Practically, all the infrastructure projects are being funded with more debt, which may be a drag on future growth.

There remains a need for caution, as China’s recovery could still be slower than suggested by the official data. A July survey of 1600 workers in 129 Chinese cities suggests that a fifth of employers were still operating at under 60% of their pre-outbreak capacity. Nonetheless, for the time being, the Chinese are doing something right, as China became the first country to return to positive growth post-pandemic. China’s GDP grew at 3.2% for the second quarter of 2020. Increased fiscal spending, the infrastructure push, healthy exports and an unexpectedly strong property market accounted for much of the economic upswing.

“A resurgence in tensions with the US could partly derail progress. The Trump administration withdrew its consent for the Chinese consulate to operate in Houston, Texas.”

Beijing retaliated by ordering the closure of the US embassy in Chengdu. The month also saw US President Donald Trump sign an executive order, which ended Hong Kong’s preferential trade treatment and the enactment of a bill that threatens sanctions against Chinese officials, individuals and potentially banks for any perceived erosion of Hong Kong’s autonomy. He has also threatened a travel ban on Chinese Communist Party members and has instigated a review of Chinese social media platforms Wechat and TikTok, to assess whether they pose a threat to national security.

As infection rates continue rising in the US and several states reinstate lockdowns, its economy appears to be in trouble. US GDP saw its worst contraction ever, shrinking at an annual rate of 32.9% between April and June of this year. The US has lost a further 15 million jobs since June. The fact that initial jobless claims rose for two consecutive weeks at the end of July underscores just how fragile the nascent consumption-driven recovery is. The Federal Reserve left rates at near-zero in its latest monetary policy meeting. Fed President Jerome Powell once again cautioned that the US’s road to recovery will be long and painful. The announcement came at a time when another round of tense negotiation between lawmakers was taking place over whether to extend the support granted to businesses and workers struggling with the pandemic. The issues discussed included whether the extra $600 per week in unemployment benefits would be extended – this support ended on 31 July. Some lawmakers believe that the current level of benefits serves as a disincentive to return to work.

“Despite the sobering economic news, US markets appeared to look through the uncertainty and the S&P500 ended the month 5.6% higher in dollar terms. The best performing sectors were Consumer Discretionary, Utilities and Materials.”

Financials reported steep losses, as banks set aside billions of dollars in anticipation of writing down bad loans. Other sectors are still flourishing, with Facebook, Amazon.com, Apple and Alphabet – which together account for almost one-sixth of the market capitalisation of the S&P500 – reported mostly healthy revenue gains.

The lacklustre economic data, election worries and the uncertain fiscal backdrop, however, pushed the yield on 10-year Treasury bills to their lowest level since early March. Demand for other safe-haven assets was understandably higher and Gold ended the month with an 8.5% gain. Support for broader commodities came from a sharp weakening in the US dollar and the Goldman Sachs Commodity Index gained 3.8% overall. The British Pound saw some of the biggest gains against the greenback (+5.5%), while Emerging Market currencies strengthened broadly – Brazilian Real (+4.6%) and South African Rand (+1.6%).

Elsewhere, European stock markets failed to match developed and Emerging Market peers. The STOXX All Europe lost 0.9% in Euro terms. European earnings were disappointing for the most part, although some sectors, including technology stocks, performed well. The poor overall performance comes despite the news that European leaders agreed on a deal for a Euro 750 billion stimulus package.

After five days of haggling, it was agreed that the fund will comprise Euro 390 billion in grants and Euro 360 billion in low interest loans. Peripheral economies such as Italy and Spain, particularly hard-hit by the pandemic, will likely be the biggest recipients. Spanish markets nonetheless fell by 4.8% as the country grapples with renewed outbreaks of the virus. Second quarter Eurozone GDP fell by 12.1%, the largest decline in the union’s history. The German economy shrank at its fastest rate on record, with total production of goods and services declining by 10% in the April to June period. Consumer confidence also stalled, after showing healthy gains in the previous months. The composite Purchasing Managers’ Index, however, showed a marked improvement into expansionary territory at 54 points.

“UK markets were amongst the worst laggards for the month and the FTSE 100 slumped by 4.2% in GBP. The Chancellor of the Exchequer has rolled back the furlough scheme that has protected the jobs of millions of UK workers, and those jobs will be at risk if the economy fails to recover before the scheme is wound down completely.”

On a positive note, UK retail sales improved markedly, up 13.9% month-on-month in June, while there was news that a Brexit deal might be finalised in September. The EU has reportedly signalled that it is willing to accept an agreement in which the European Court of Justice has no role in policing the Brexit deal and in which access to British fishing rights changes. The UK’s chief negotiator was more cautious, saying that a deal could be reached but that significant hurdles needed to be overcome first.

In Asia, returns were mixed. Despite Japan’s relatively low infection rate, the coronavirus has tipped the country into its worst recession in decades. The economy is expected to contract by 5.3% in the fiscal year and the recovery is likely to be slow. Adding to concerns, the country is seeing records in new cases being reported. Analysts fear that the Japanese government, which has already spent $2.2 trillion on stimulus, is rapidly exhausting its arsenal. The Nikkei closed 2.6% lower. Hong Kong, considered a poster child for its handling of the pandemic, is experiencing a so-called third wave. Social distancing measures were rolled back significantly in June, and suddenly the country is faced with a rapid increase in new infections.

“Brazilian markets were well-supported by the uptick in commodity prices and the BOVESPA gained 8.2% in local currency terms. Mexican shares dropped on gloomy economic news.”

This, despite markets cheering proposals for pension reform, aimed at increasing coverage and retirement income for Mexican workers. The reforms call for an increase in mandatory retirement contributions, mostly falling on corporations, from 6.5% to 15%.

Although global economic news was mixed and many countries are grappling with a second wave of infections, risk appetite appears healthy. This is perhaps recognition of the fact that investors are confident in the continued support of central banks and the glut of liquidity. Sentiment continues to ebb and flow on news of progress on the vaccine front. While progress is promising, a vaccine likely remains a while off still.

South African Market Themes

Month-end saw South Africa receiving a $4.3 billion (approx. R70 billion) loan from the International Monetary Fund (IMF). Fears were raised that such a loan would come with strict conditionality, thereby impairing the country’s sovereignty.

The loan is provided through the Rapid Financing Instrument, which is designed to support countries facing an urgent need for finance due to the COVID-19 pandemic. It is intended to help the country face the immediate financial consequences of the crisis, and it means that the IMF provides financing quickly without strict conditions. The country needs to demonstrate that it is in crisis, pledge that the funds will be directed to alleviate the crisis and that it will cooperate with the IMF to solve its balance of payments issues caused by the crisis, as well as outlining the economic policies that will be followed in this regard.

“South Africa is currently faced with an unsustainable debt position, with the recent emergency budget highlighting that government debt to GDP is expected to reach 81% by the end of 2020. Thus far, government has failed in its measures to cut down on spending.”

The government is also butting heads with trade unions about a three-year wage deal which was negotiated in 2018. Government does not want to honour the above-inflationary increases in wages which were negotiated at the time. Moreover, it is increasingly unable to do so, given the untenable fiscal position it finds itself in. It is estimated that, were it to honour the agreement, roughly R 37 billion would need to be diverted from other programmes, including social grants, health and educational spending.

Perhaps the most significant potential down-side of the IMF loan is that it is foreign currency-denominated. The country runs the risk that, if the Rand depreciates, then the loan and the interest to be paid will become even more expensive. The current state of the economy and the near-term outlook mean this is a likely outcome. The IMF has recently urged the country to undertake several structural reforms, including those which would improve the predictability of the regulatory framework in sectors such as mining, boost productivity and facilitate greater ease in doing business.

While the IMF loan does not come with conditionality, some pundits believe that conditionality would have been a blessing in disguise, necessitating the much-needed reforms that the government has been talking about, but which are yet to be put into action.

“There are some encouraging economic signs for local investors. Although South Africa recorded its third consecutive quarter of negative growth, the contraction for the first quarter came in slightly better than expected at -2%.”

The Absa Manufacturing Purchasing Managers’ Index came in at 53.9 points, well into expansionary territory. It has been the fastest expansion in the manufacturing sector since August 2013. The Standard Bank Purchasing Managers’ Index, which focuses on the whole economy, rose by a significant 10 points to 42.5 points in June, but unfortunately remains in contractionary territory.

The South African Reserve Bank (SARB), at its July Monetary Policy Committee meeting elected to cut interest rates by a further 25 basis points to 3.5%, providing some further relief to indebted South African consumers. The SARB has cautioned, however, that they believe that the second quarter of 2020 will be the only quarter when inflation will breach the lower bound of their inflation target range – annual inflation to June printed at 2.2%.

“An increase in administered prices is on the cards, as Eskom won its case against the National Energy Regulator (Nersa).”

The South Gauteng High Court ruled that Nersa had unlawfully included a R69 billion equity injection from the government in its calculation of Eskom’s allowable revenue. Eskom had previously indicated that this amount would be recovered through electricity price hikes. The judgement paves the way for the power utility to raise tariffs substantially.

Loadshedding hit the economy for the first time since lockdown was implemented in mid-July. Eskom reported that electricity demand had increased more than 30% from the lows reported in the more severe stages of lockdown. On the one hand, it is an encouraging sign that the economy is recovering, and that employment may begin to recover as a result. On the other hand, fears of further breakdowns add to the already-heavy burden of business owners.

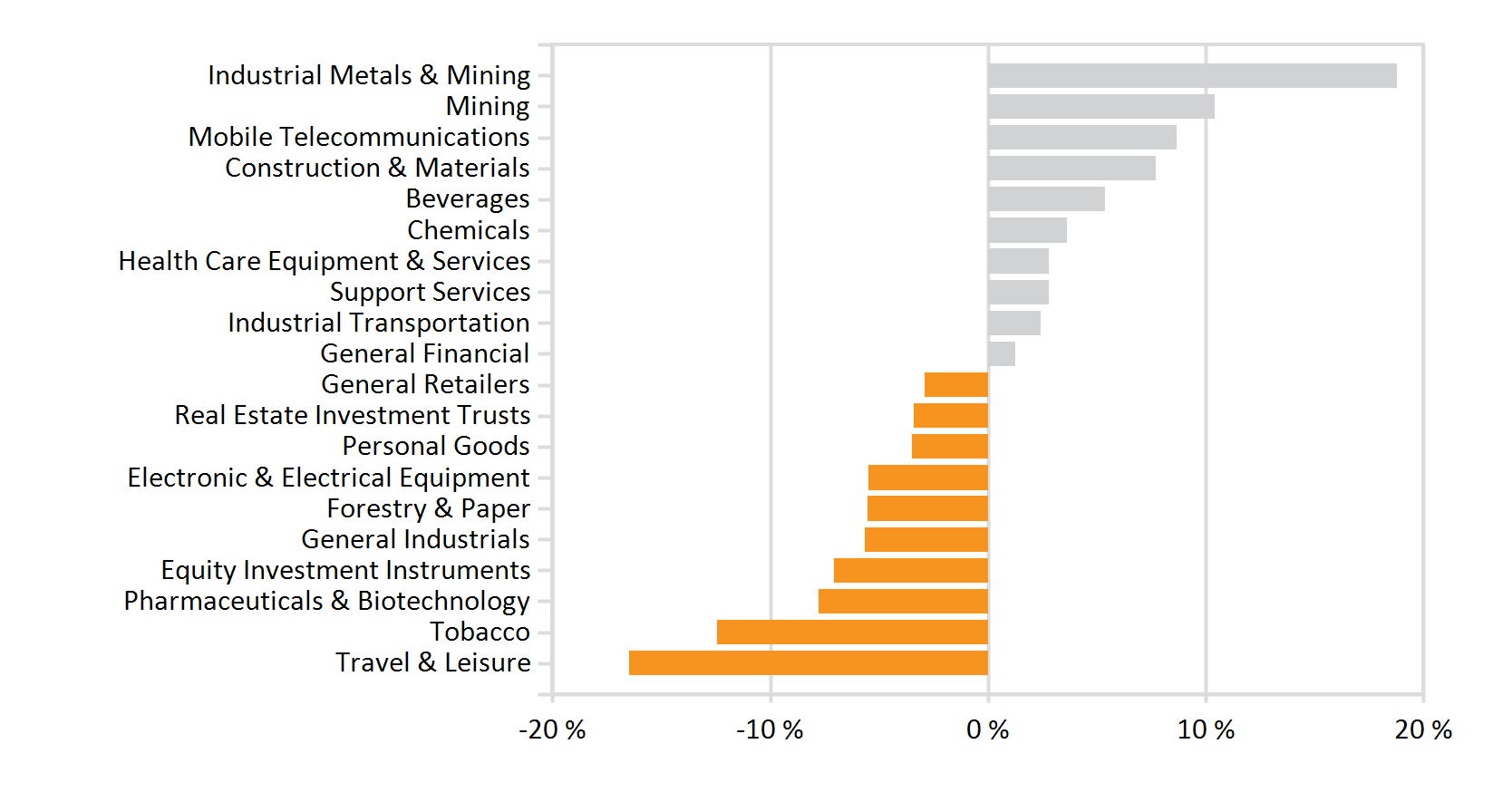

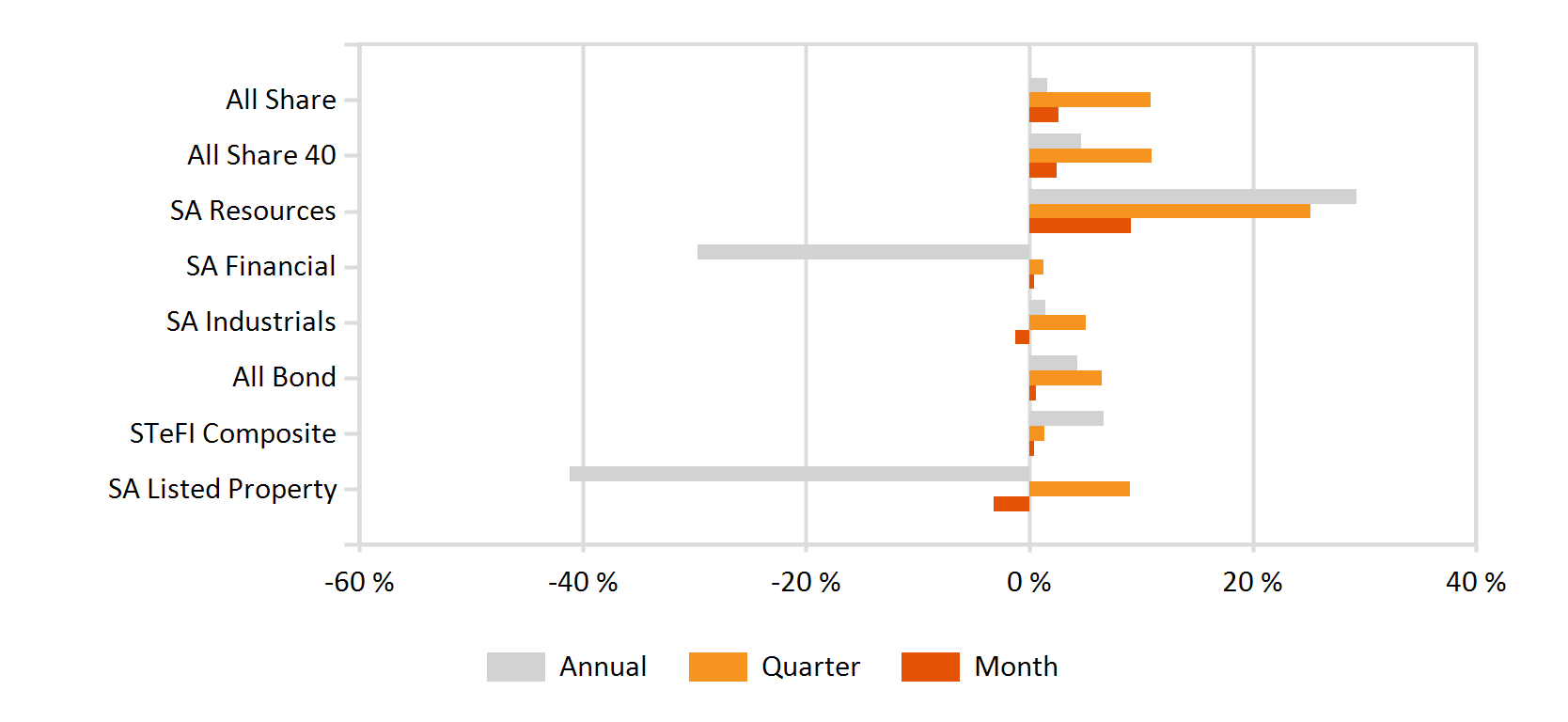

“South African markets for the most part lagged their developed and Emerging Market peers. The SWIX gained a middling 2.37% for the month. Against the backdrop of strong commodity markets and increased demand for industrial metals, the Resources subsector was the biggest gainer, registering a 9% increase.”

Goldminers did particularly well, with AngloGold Ashanti posting a 12.3% gain and Sibanye Stillwater generating a 27.8% return. Although financials struggled – the sub-index eked out only 0.4% for the month – returns were mixed in the banking sector. Banks are seeing their profit margins squeezed by lower interest rates and the need to provision for bad debts. Amongst the big banks, Absa delivered the poorest performance, losing 7% over the course of the month.

The South African listed property sector continues to lag its global counterpart. The local All Property Index lost a further 3.1% during July versus the 3.5% return of the FTSE EPRA/NAREIT Developed Rental Index. The sector has lost more than 39% for the year-to-date, as retailers continue to struggle, uptake in office space languishes and landlords grapple with defaulting lessors.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance