Market Commentary: July 2018

Here are this month’s highlights: Global equities had a positive month, with developed markets edging out emerging market peers. Corporate earnings’ season started on a positive note, despite concerns regarding the impact of ongoing geopolitical noise and simmering trade tension. Global bond markets were mixed, a hawkish Federal Reserve Bank statement sent the dollar higher towards month-end and oil prices declined as OPEC and Russia agreed to increase output.

Market View

Cash

South African cash posted a modest return of 0.6% for July. Consumer Price Index (CPI) inflation increased to 4.6% for June, with the year-on-year inflation rate accelerating off the back of a weaker rand, higher fuel prices and challenging ongoing wage negotiations. The South African Reserve Bank kept the repo rate unchanged at its mid-month meeting, but took a more hawkish tone, reiterating that risks to the inflation outlook had started to materialise, mainly in higher transport costs, and that domestic conditions remained constrained.

Bonds

South African fixed income assets had a mixed month – the ALBI gained 2.44%, and Inflation-linked bonds posted a modest 0.29% gain. Sentiment towards SA corporates was buoyed by the announcement, following the annual BRICS summit, of USD 14.7 billion trade and investment deals between South Africa and China. State-Owned Enterprises (SOEs) were also boosted by the signing of a USD 2.5 billion government-backed loan between cash-strapped power utility Eskom and the China Development Bank.

Global government bond markets, in a continuation of first-semester volatility, were noticeably weaker, with the BarCap GABI losing 4.59%.

“Effectively, despite the noise around trade wars, little changed in the policy backdrop.”

The overall healthy growth environment paves the way for developed market central banks to reduce stimuli: The Federal Reserve Bank’s meeting minutes were particularly hawkish; the European Central Bank (ECB) reiterated its intention to end quantitative easing at year-end; the Bank of England remained on track to raise rates at the start of August; the Bank of Japan indicated that it would implement quantitative easing for an ‘extended period’ (although speculation surfaced that it would reduce its purchases of government bonds).

Conversely, Chinese authorities continued to loosen monetary policy in an attempt to stimulate the economy. Japanese government bond yields and 10-year UK Gilts increased by 5 bps, while 10-year T-bill yields and 10-year Bund yields ticked 10 and 15 bps higher, respectively.

A slew of strong corporate earnings reports boosted sentiment, and corporate bonds outperformed sovereigns. Risk-on sentiment, new Initial Public Offerings (IPOs) and a tech-and-oil rally saw increased appetite for high-yield bonds. EM Debt consequently also improved, with hard currency EM debt returning 2.5%.

Equity

South African equities bucked the global and Emerging Market (EM) trend, and inched lower. The ALSI was a modest 0.25% in the red, but resources were noticeably weaker, partly held back by a firmer rand. The RESI index was 1.4% lower, as gold miners continued to lose their shine.

The current investment environment appears highly sentiment-driven and volatile. Consequently, equity investors need to be particularly aware of the cyclical nature of markets, of being agile in their allocation, and of building sufficiently diversified portfolios.

Property

South African listed property markets were lacklustre: The more concentrated SAPY closed -0.5% lower, while the more inclusive ALPI yielded -1.3%. Prompted by local and global economic and political sentiment, longer run sovereign bonds rerated during June and ended July with an 8.79% yield-to-maturity of versus the SAPY’s 8.67%.

“The local sector’s struggle, and its rapid move from hero to zero, sees little sign of abating – for the year-to-date, the losses have come to just over 21%, from a previously consistent double-digit annual performer.”

The latest earnings releases from UK-centred listed stocks have done little to boost the broader index: Hammerson reported nearly flat earnings growth and lacklustre valuations, Tower Property Fund undershot its forward guidance on distribution growth, and retail-focused Intu clearly struggled. The Tower’s portfolio has nonetheless, in a trend echoed in much of the South African market, been boosted by Eastern European counters, with its Croatian prospects particularly positive. Investors will therefore be keeping a close eye on the earnings as they trickle in from SA REITs, not only for how they fare in a difficult local economic environment, but also for how well they have managed offshore exposure and investors’ expectations.

Amongst others, market stalwart, Growthpoint as well as members of the beleaguered Resilient Group are expected to report toward the end of August, including NEPI (thus-far star of the stable).

“Despite the constraints, there has been little change in South African Property fundamentals, and, at a 9.5% forward yield, the sector remains attractive.”

Global Listed Property continued to outperform SA peers. A struggling UK market (-1.1% in USD terms) spilt over into South Africa, with UK-centred Hammerson, Intu and Capital and Counties lagging. Hong Kong listed real estate was the month’s star performer, registering a 5.71% gain. Overall the FTSE EPRA/NAREIT delivered 0.91% for July.

Sectoral opportunities continue to be key in allocation. The so-called ‘death of bricks and mortar’/retail apocalypse appears to be a somewhat exaggerated rumour, but the rise of e-commerce has undoubtably changed the nature of demand.

“The new trend is omnichannel retail, which has seen a number of traditional brands embrace e-commerce platforms.”

It has also seen pure e-tailers take up not only logistics, distribution and warehousing space, but also invest in physical shop space.

A-grade quality malls and centrally-located logistics continue to trade at a premium with e-tailers such as Amazon, for instance, taking up quality space in Cape Town recently. Healthy real estate fundamentals are being underpinned by global growth trends, with a smattering of political impetus. In this regard, aside from the selected European centres that are vying for the title of alternative financial centre (versus London), some manufacturers are likely to relocate amidst ongoing trade tension. This illustrates the need to take into account unintended consequences, a bigger macroeconomic picture and the need for diversity on an overall portfolio level. Careful selection, timing and monitoring is crucial in this regard.

International Markets

Global developed markets outperformed their emerging peers, boosted by strong company results and resilient economic data. The MSCI ACWI gained 3.02%, while the MSCI EM posted 2.2%.

The US economy posted its strongest GDP growth rate since 2014, at 4.1% for Q2, and unemployment remains at record lows. However, optimism is tempered by escalating trade tension and geopolitical noise, with both Iranian and North Korean diplomatic relations taking a knock.

Of the S&P500 companies that had reported by month-end, 86% beat expectations. The S&P500 closed 3.72% higher, with Financials and Industrials recovering nicely from a disappointing June. Current stellar performers, Megacap technology stocks, took something of a beating.

“Facebook suffered the biggest one-day loss in US stock market history with USD 120 billion wiped off its value in one day.”

Conversely, Apple headed steadily upward toward the milestone USD 1 trillion market cap value, and it is worth noting that with the exclusion of the Facebook, Apple, Amazon, Netflix and Alphabet’s Google (FAANGS), US equity markets would be down for the year-to-date.

In the UK, the FTSE100 closed 1.3% higher, as relative Sterling weakness filtered through to offshore-centred company’s profits. Amongst reporting companies, heavyweight BP was boosted by stronger oil prices in the first half of the year, while British American Tobacco saw lower US corporate tax rates have a positive impact on its bottom line.

“British consumers, however, appear to be feeling the pinch: retail sales declined, and High Street closures continued to make headlines.”

Employment data, moreover, has been mixed – despite high levels of employment, UK wage growth slowed to a six-month low in June. Political uncertainty too remains at the forefront, with little progress in Brexit negotiations.

Eurozone markets were mainly higher, boosted by both positive corporate reports and by an agreement between the European Union and the US to work together in reducing tariffs on non-auto industrial goods.

The MSCI EMU returned 3.5% for July. Financials were particularly strong, as a number of banks yielded encouraging results. Information technology lagged, with Nokia disappointing investors. On the macroeconomic front, Eurozone unemployment remained stable at 8.3% and inflation ticked up to 2.1%. The ECB has maintained its positive stance on the health of the Eurozone economy – GDP growth remained in expansionary territory at 0.3% for Q2 – but seemingly confirmed that financial markets are likely to see interest rates on hold until 2019.

“Japanese equities, after an initial sharp decline, recovered nicely to post 1.3% for the month.”

The market was led by the oil and coal sector, and financials also registered a solid month, partly on speculation regarding the Bank of Japan’s monetary policy. Japanese companies typically report later than other developed markets, so August is likely to be a busier month. Nonetheless, initial readings have yielded more upside surprises in profits, partly due to continued yen-weakness.

“Emerging market equities drew support from positive macroeconomic releases, although returns were tempered by the weak performance of heavyweight China.”

The effects of trade tariffs weighed on Asian markets, as the first of USD 34 billion worth took hold, and a further 10% on an additional USD 200 billion was announced.

Chinese economic growth slowed to 6.7% for Q2, and manufacturing data was softer than expected. Meanwhile, financial deleveraging, and monetary intervention, contributed to a weaker yuan and did little to dissipate US-Sino tension.

“While concerns over the ongoing trade dispute with the US, and a resurfacing of North Korean tensions weighed on Asian markets, Latin America proved to be a regional star performer.”

Brazilian equities were boosted by healthy corporate earnings growth. Despite an easing of oil prices, oil-and-gas companies led the market. Mexican markets also did well, as the peso and local equities posted gains. President-elect Andres Manuel Lopez Obrador, despite fears of an anti-establishment stance, promised to continue prudent fiscal management, and household demand remained upbeat.

Within EMEA, Turkish markets remained in the doldrums, but Russia came off well after hosting a successful FIFA World Cup.

Currency

In currency markets, the hawkish tone of the Fed sent the dollar higher toward month-end, and EM currencies came under increasing pressure.

The USD Index, after initial weakness, ended the month 0.1% higher against a basket of currencies. EM currencies, after holding their own for most of July, came under pressure toward month-end as the Fed’s hawkish tone and trade jitters sunk in. The yen depreciated noticeably (-1.1%) and sterling (-0.6%) continued its Brexit-related struggle.

The vulnerability of some emerging markets was highlighted starkly by the Venezuelan government’s unusual move in knocking off three zeroes from the denomination of bills. The environment of hyperinflation, low growth and political tension has left authorities little room to manoeuvre.

“While the rand proved to be one of the better performers during July (+3.4%), as a highly liquid counter took a beating toward month-end.”

The Bloomberg Commodities Index slipped again in July. Base metals were largely lower, with industrial metals such as zinc, lead and nickel particularly weak. This is partly a reflection of jitters in the industrial and manufacturing sector, as trade tariffs start to take effect. Precious metals also softened, with gold declining 2.4%.

A departure from the recent trend saw OPEC announce supply increases, and energies declined by 4.9%. Agricultural products bucked the trend, with a material recovery in soy beans, wheat and corn sending the sub index 3.9% higher.

Performance

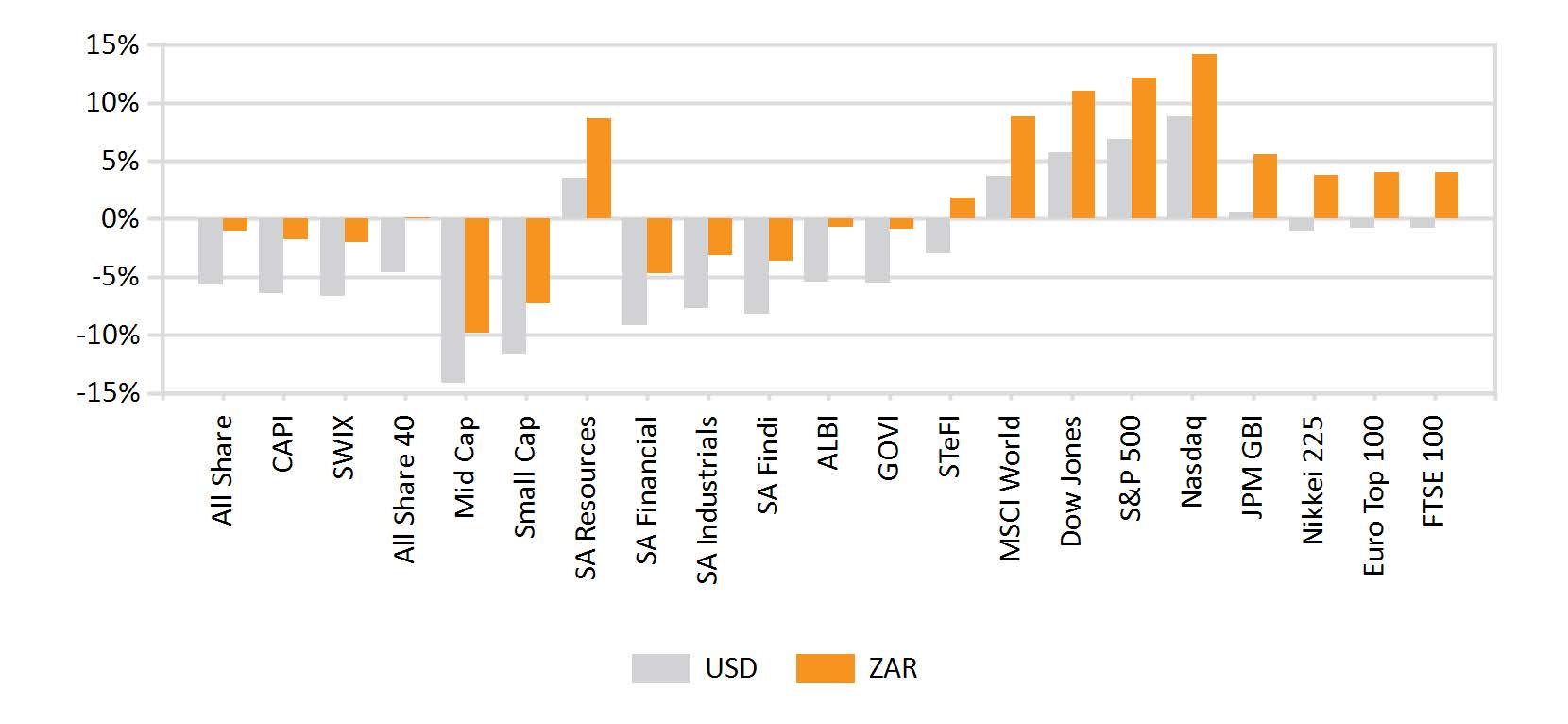

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

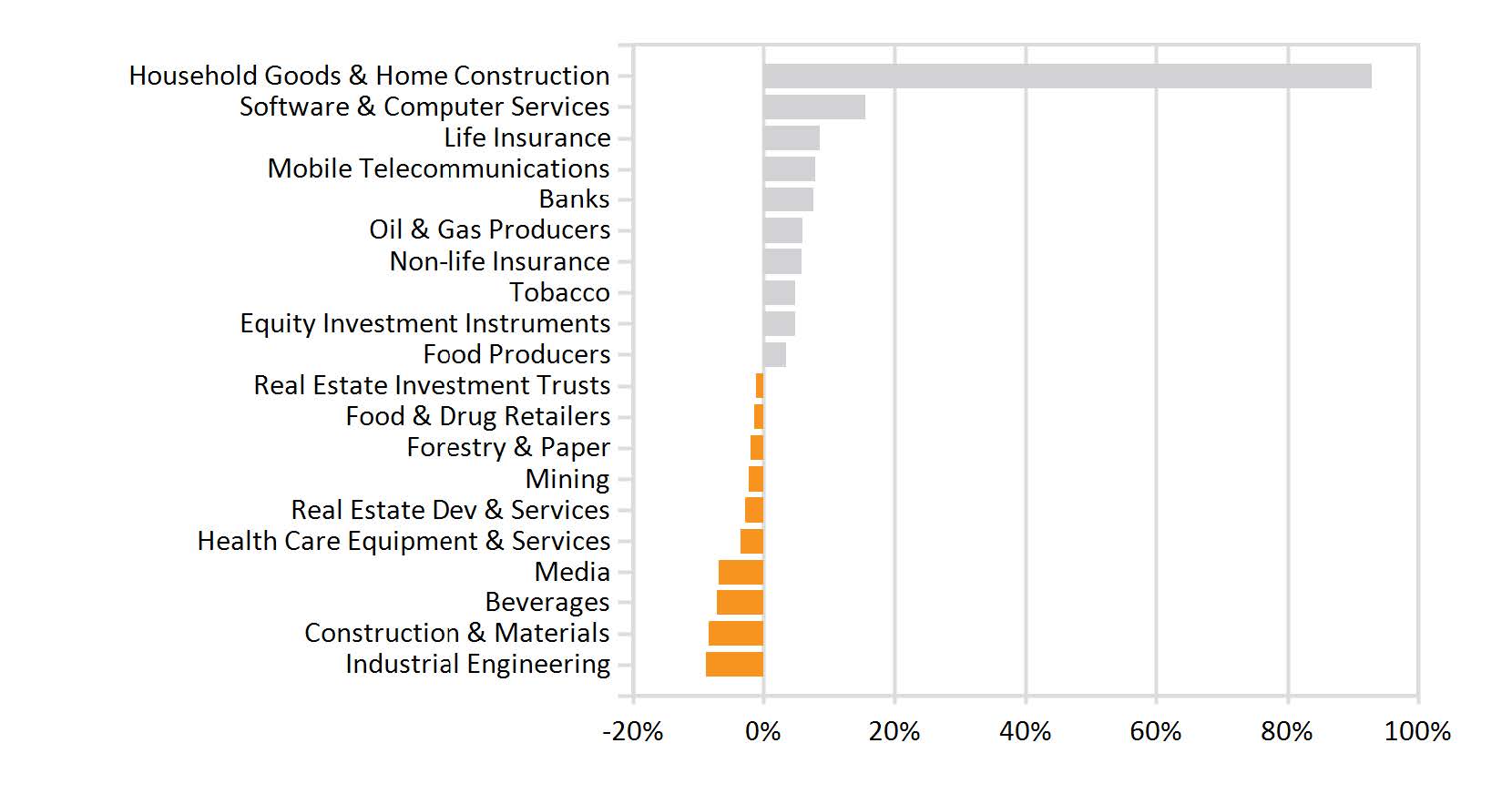

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance