Market Commentary: January 2022

Global Market Themes: Global equities largely lower, roiled by escalating Russia-Ukraine tensions, inflationary fears and hawkish central banks Highly volatile US equities lose more than 5%, entering correction territory UK, European equities buck the trend, ending in the green Chinese equities continue to lose ground, against the backdrop of slowing growth and regulatory hurdles Emerging Markets (EM) end January lower, but outperform Developed Markets (DM) Oil and gas prices rally, industrial resources post stellar returns SA Market Themes: South African equities buck the trend, ending in positive territory Resources and Financials post over 3% Consumer Price Index (CPI) ticks higher South African Reserve Bank announces hike in the repo rate, meeting expectations South Africans reel from sharp increases in oil prices, Rand battles back from December doldrums

Market View

Global Market Themes

It was an unsettled month for global equities, which suffered their worst monthly decline since 2009. The rapid spread of Omicron throughout much of the world, renewed lockdown measures, a more hawkish US Federal Reserve and escalating geopolitical tensions between Russia and Ukraine had investors pulling back sharply from risky asset classes. The MSCI World lost 5.3% over January. Emerging Markets (EM) outperformed their Developed Market (DM) peers, despite pockets of weakness in China and Russia.

US markets were hard-hit by the prospect of tighter central bank policy and the S&P500 suffered its worst monthly pullback since March 2020, when the pandemic took hold. The index closed 5.2% lower, and volatility heightened: the Chicago Board Options Exchange Volatility Index (CBOE VIX) hit a 52-week high toward the end of January.

“Tech stocks were amongst the worst performers, the NASDAQ100 gave up 9.1% for the month. Meta Platforms (previously Facebook) lost more than 25%, Netflix gave up nearly as much, eBay was 10% lower and Microsoft Inc gave up 3%.”

The selling pressure on growth stocks is two-fold. Market participants have started rotating out of “stay-at-home” stocks (such as eBay, Meta, Netflix), where the pandemic-induced revenue growth is unlikely to be sustainable. The fear of tightening, and consequently higher financing costs, further soured sentiment toward growth stocks. Value stocks traditionally benefit from a growing conviction that central banks will raise rates, partly because Financials (which for a large component of the basket of value stocks) benefit from rising government bond yields.

The Federal Reserve’s (the Fed’s) more hawkish commentary around inflation and monetary policy sent markets into a tailspin, most notably following Fed Chair Jerome Powell’s press conference toward the end of the month. Indications are that the Fed may raise the federal funds rate sooner (or at a faster pace) than expected. Fed fund futures are now pricing in a 100% chance of a March rate hike, and economists are pricing in five rate hikes in 2022. This as inflation continues to come in hotter than expected with the Consumer Price Index gaining a further 0.5% for December. Year-on-Year, the increase is 7%, the largest 12-month increase since 1982.

“On the labour market front, the US Department of Labour posted worse-than-expected figures for January.”

US consumers are somewhat less upbeat about their income, with the Conference Board’s Consumer Confidence Index dropping two points from the previous month. Retail sales also reflected ebbing consumer spending, with December figures proving somewhat disappointing (given too that the holidays are a big spending season).

Eurozone equities performed better than their US peers, but the STOXX All Europe still closed 3.9% lower for the month. The sentiment was surprisingly resilient, given the surge in Omicron infections across the continent. Within the Eurozone, countries’ responses to the fourth wave have differed wildly: UK, Denmark and Spain have lifted restrictions; France has limited restrictions in place, although it only recently lifted the ban on UK tourists. The Netherlands has maintained its 10 pm curfew on restaurants, bars and cultural venues (which only reopened on 26 January). Eurozone inflation has ticked higher, partly fuelled by higher energy prices, and hit 5% in December.

“While central banks elsewhere have broadcast the likelihood that interest rate hikes are likely to be sooner and faster than envisaged, the European Central Bank (ECB) has rejected the idea. Since its December meeting, the ECB signalled that rates were unlikely to increase in 2022. “

Eurozone manufacturing remains in expansionary territory, despite notable supply bottlenecks and Omicron-dampened consumer sentiment: the composite Purchasing Managers’ Index (PMI) has remained above the 50 mark. On the equity front, as elsewhere, there was a sharp divergence between stocks that are classified as value and those classified as growth. The MSCI EMU Value Index bucked the trend and registered a positive return. Amongst the top performers were energy and Financials. The former on soaring oil prices and the latter on the prospect of monetary tightening.

Emerging Market (EM) equities closed the month in the red but outperformed their DM counterparts – the MSCI EM was 1.9% lower in United States Dollar (USD). Within EM, however, there was a marked divergence. Russian equities lost substantial ground, and the IMOEX closed 6.8% lower in local currency terms. The losses come despite soaring oil prices and are attributable to the antagonistic stance President Putin has taken concerning Ukraine.

“The US has threatened to impose sanctions, including halting technology exports to Russia and stopping the Nord Stream two gas pipeline between Russia and Germany.”

Moscow, however, supplies roughly 40% of Europe’s gas, so it is in the interest of the continent to pour oil on troubled waters. Brazilian equities, in contrast, have benefited immensely from resurgent resource prices, and the BOVESPA gained just under 7% in Brazilian Real for the month. Asian equities sold off sharply, partly due to a rotation away from tech stocks (which are a major export for many Asian economies).

Chinese equities bore the brunt of the Asian sell-off, with the MSCI China A Onshore losing nearly 9% in January in USD. Chinese equities have delivered the worst performance amongst EM peers over the past 12 months. Real GDP growth has slowed down significantly, and monthly economic activity indicators attest to dampened domestic demand and consumer sentiment. The sell-off is perhaps mainly attributable to the Chinese government regulatory clampdown in several sectors, including property, education, and technology. Increasing COVID-infection rates have also seen stricter measures put in place, representing a significant hurdle to a resumption of “normal” economic activity. The People’s Bank of China (PBOC) has indicated that it stands ready to ramp up stimulus policies. With the prospect of further easing, market participants anticipate that growth will pick up over the medium term. This potentially presents a significant buying opportunity for equity investors.

On the commodity front, oil prices continued their upward march. Potential supply-side constraints due to the escalating tension with Russia, have driven prices even higher. Brent Crude prices surpassed the USD 90 per barrel for the first time in seven years and ended the month at just under USD 90 per barrel. Prices have increased by a whopping 62% over the past 12 months. Industrial inputs were also sharply higher, with iron ore registering a 12.8% monthly gain and coal gaining more than 50%. In contrast, crypto bulls had a tough month. Bitcoin and Ether fell further, wiping billions off the value of the emerging asset class. Bitcoin was trading at a six-month low toward the end of the month and over 20% below its 200-day moving average.

South African Market Themes

South African equities bucked the global trend and ended the first month of 2022 on a positive note. The Shareholder Weighted Index (SWIX) closed 2.3% higher, boosted by solid performances from the Resources and Financials subindices which delivered 3.6% and 3.5% respectively.

A sharp increase in the price of iron ore (more than 12.7% over the month) proved a boon to mining companies such as ArcelorMittal and Kumba Iron Ore. Share prices in the former closed the month more than 14% higher, and the latter gained just under 11%.

“Higher oil prices saw South African oil giant Sasol post a whopping 36% return. Meanwhile, Financials benefited from the announcement by the South African Reserve Bank (SARB) of a 25 basis points hike in the repurchase (repo) rate.”

Banking giants such as Standard Bank and Absa posted share-price gains of over 6% and over 11% respectively.

The SARB had been vocal in broadcasting its intention to hike rates, in the face of rising inflationary pressures, so market participants were dealt no nasty surprises. South African inflation hit a five-year high, coming in at 5.9% year-on-year in December 2021, and edging toward the upper limit of the Bank’s target range (3 -6%). At its January meeting, the Monetary Policy Committee cited global and local inflationary pressures and indicated that a gradual rise in the repo rate would be sufficient to anchor inflation expectations. The Bank is treading a fine line between maintaining an accommodative policy stance to support credit demand and economic recovery and keeping local inflation in check. As global oil prices continue to soar, local fuel prices and other input costs (transportation costs) have risen sharply, adding to cost-push inflation. Motorists are bemoaning ever-increasing petrol prices.

The latest adjustments published by the Department of Mineral Resources and Energy came into effect on 2 February and saw the price of petrol 95 increase to more than R20 per litre. Diesel and illuminating paraffin, which many poor households rely on, saw increases of 80 cents and 101 cents per litre respectively.

“According to research conducted by the Pietermaritzburg Economic Justice and Dignity organization (PMBEJD), the average cost of the household food basket, which comprises 44 core food items most frequently bought by lower income households, increased by 8.6% year-on-year from January 2021 to January 2022. Of the 44 items in the basket, 31 saw price increases.”

Elsewhere on the economic front, forecasters expect that the South African economy will expand at a substantially slower rate in 2022 than in 2021, with the Organization for Economic Development (OECD) predicting a 1.9% expansion in its latest update (December 2021). SA consumer sentiment dampened, hurt by rising inflation and the return of loadshedding, remained well below the long-term average, according to the FNB/BER Consumer Confidence Index (at -9 versus the average of +2).

With the COVID-19 relief grant set to expire in March, the state is seeking additional funding to extend the grant and alleviate pressure on poor households. It has been in talks with various multilateral lenders, including the International Monetary Fund and the New Development Bank.

“Toward the end of January, it was reported that the government had secured a USD 750 million low-interest loan from the World Bank, its first budget support from the global institution since the end of Apartheid a quarter of a century ago.”

Sources close to the state have indicated that negotiations are afoot for a further USD 800 million. If anything, this is telling of the serious headaches that policymakers are facing.

Despite local economic woes, and investor jitters ahead of the State of the Nation Address and the Budget Speech in February, the Rand improved against major currency pairs. The local currency gained 3.8% against the greenback over the month.

Performance

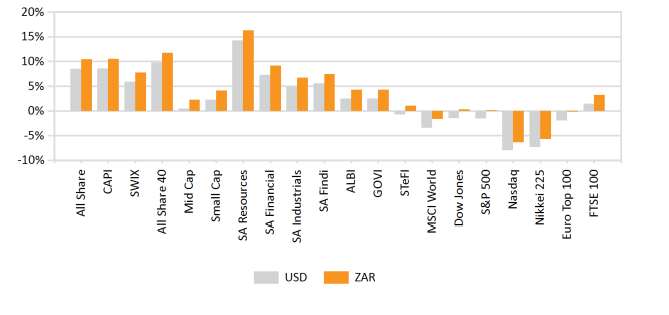

World Market Indices Performance

Quarterly return of major indices

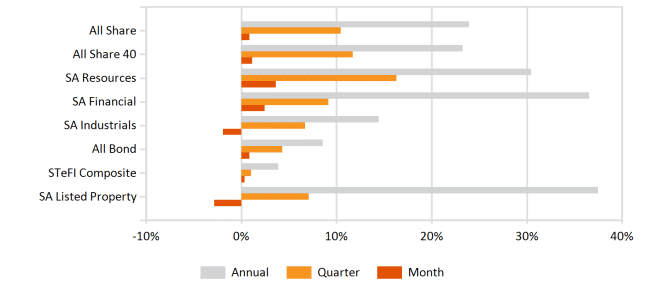

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices