Market Commentary: January 2020

Here are this month’s highlights: The South African Reserve Bank reduces interest rates; local equity suffered the effects of the coronavirus outbreak as did the property sector which experienced persistent downward selling pressure and commodities were also significantly affected with investors pricing in the potential slow-down in China and its impact on global growth. Investors seek safety in global fixed income assets during times of market uncertainty. Brexit finally occurred and the phase-one deal was signed by the US and China, but was largely overshadowed due to the coronavirus outbreak.

Market View

Cash

Cash added 53 basis points (bps) in the first month of 2020. Local Consumer Price Inflation (CPI) rose to an annualised 4% in December 2019, up from 3.6% the month prior. The 4% level is below the South African Reserve Bank’s (SARB) 4.5% targeted level. This is likely due to the persistence of tepid economic growth, a decline in global crude oil prices, and subdued domestic credit growth. Given the inflation environment, the SARB reduced interest rates by 25 bps to a key reference rate, repo rate, of 6.25% mid-month.

“Looking forward, the bank estimates inflation for this year to be around 4.7%, down from 5.1% previously.”

It has revised its GDP growth forecasts lower as well; the latest estimates for 2020 and 2021 are 1.2% and 1.4%, respectively, each down by 0.2%.

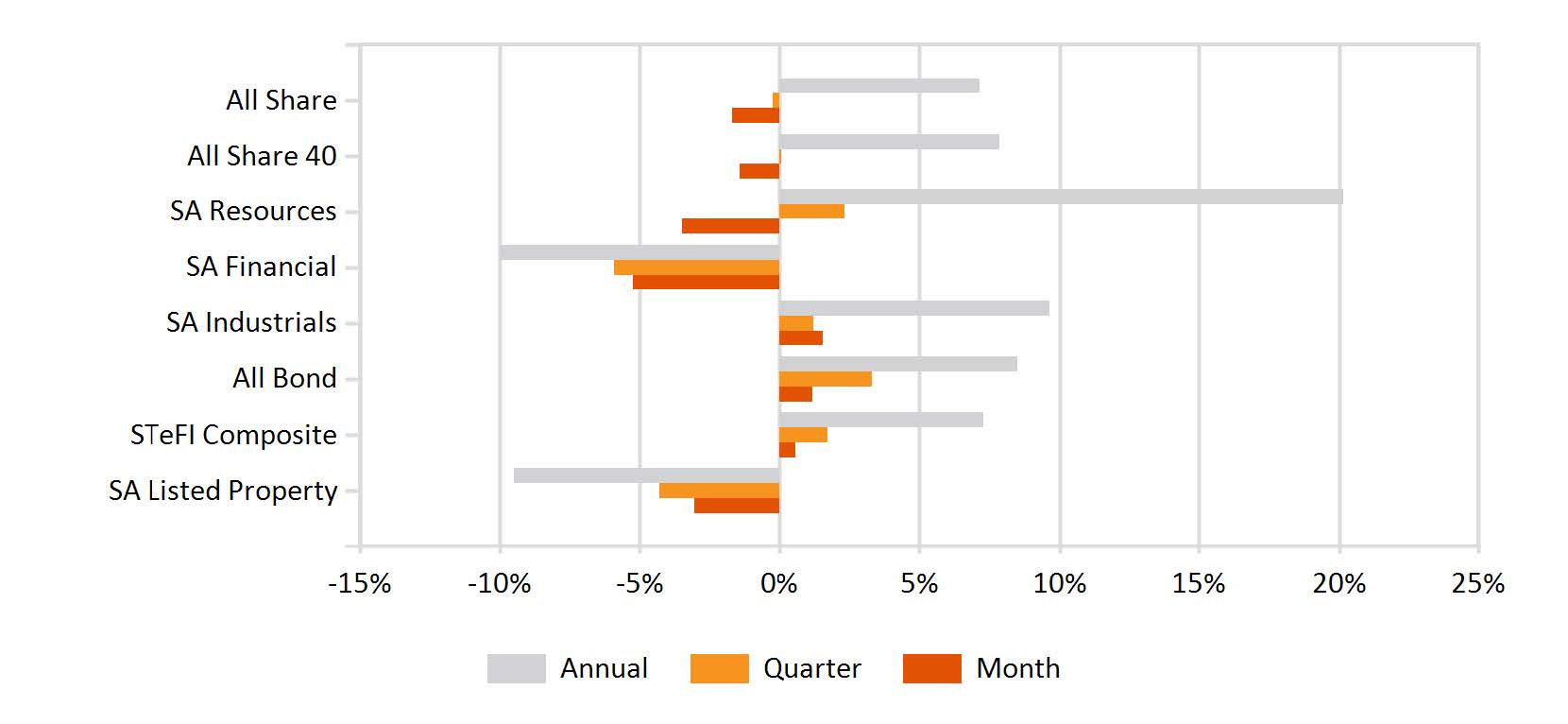

Bonds

SA nominal bonds added 1.6%, per the All Bond Index, with inflation-linked issues up 1.2%. Due to significant currency weakness, global bond peers returned 8.7%, per the Barclays Aggregate Bond Index, in ZAR and 1.3% in USD. As with global fixed income assets, which received a bid due to investors seeking safety in times of greater market uncertainty, likely arising from the coronavirus outbreak, local nominal fixed income assets fared well relative to domestic risk assets. More broadly, Emerging Market (EM) bonds lost 1.1% in USD, per the JP Morgan EM Bond Index.

Equity

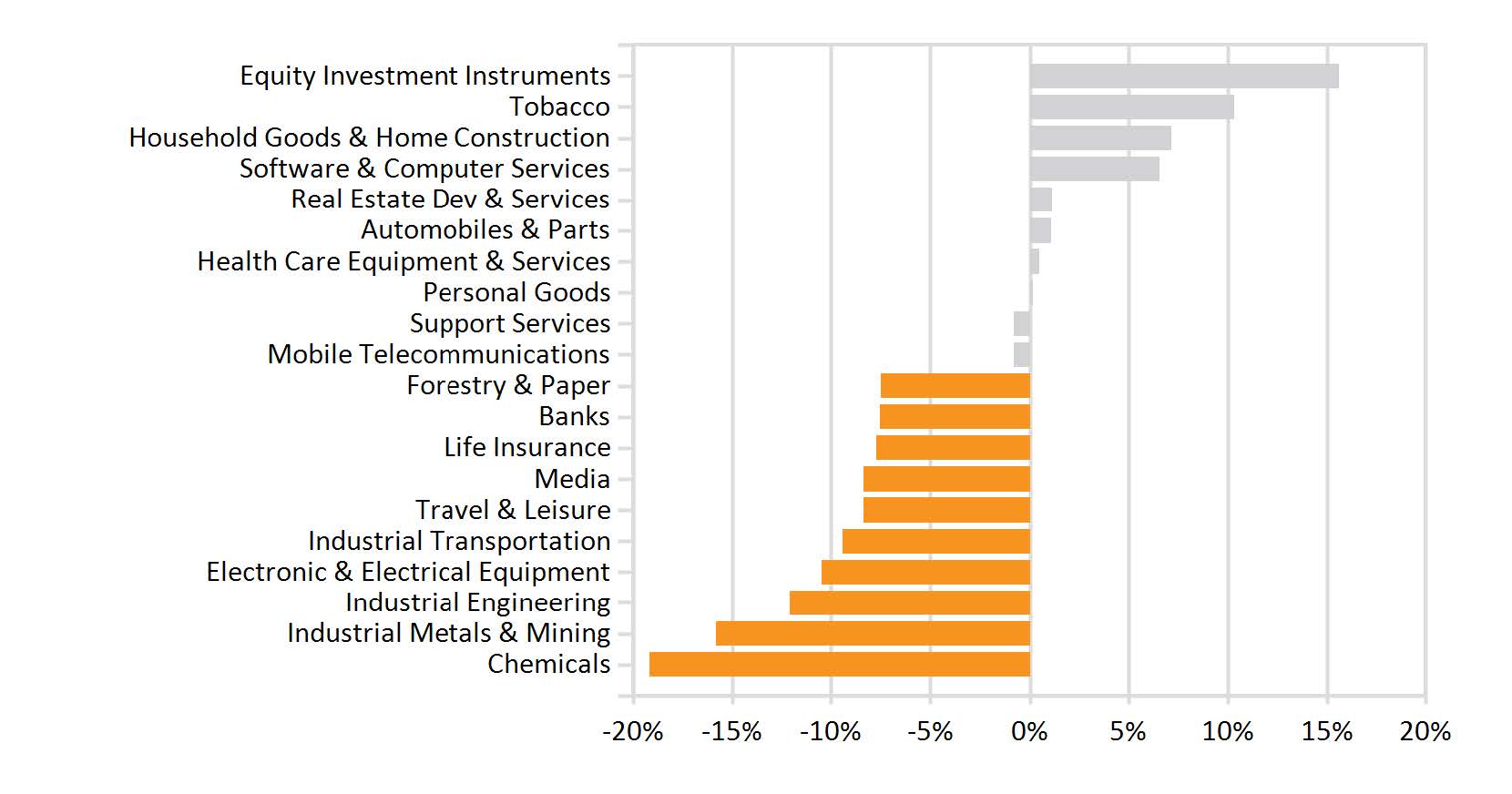

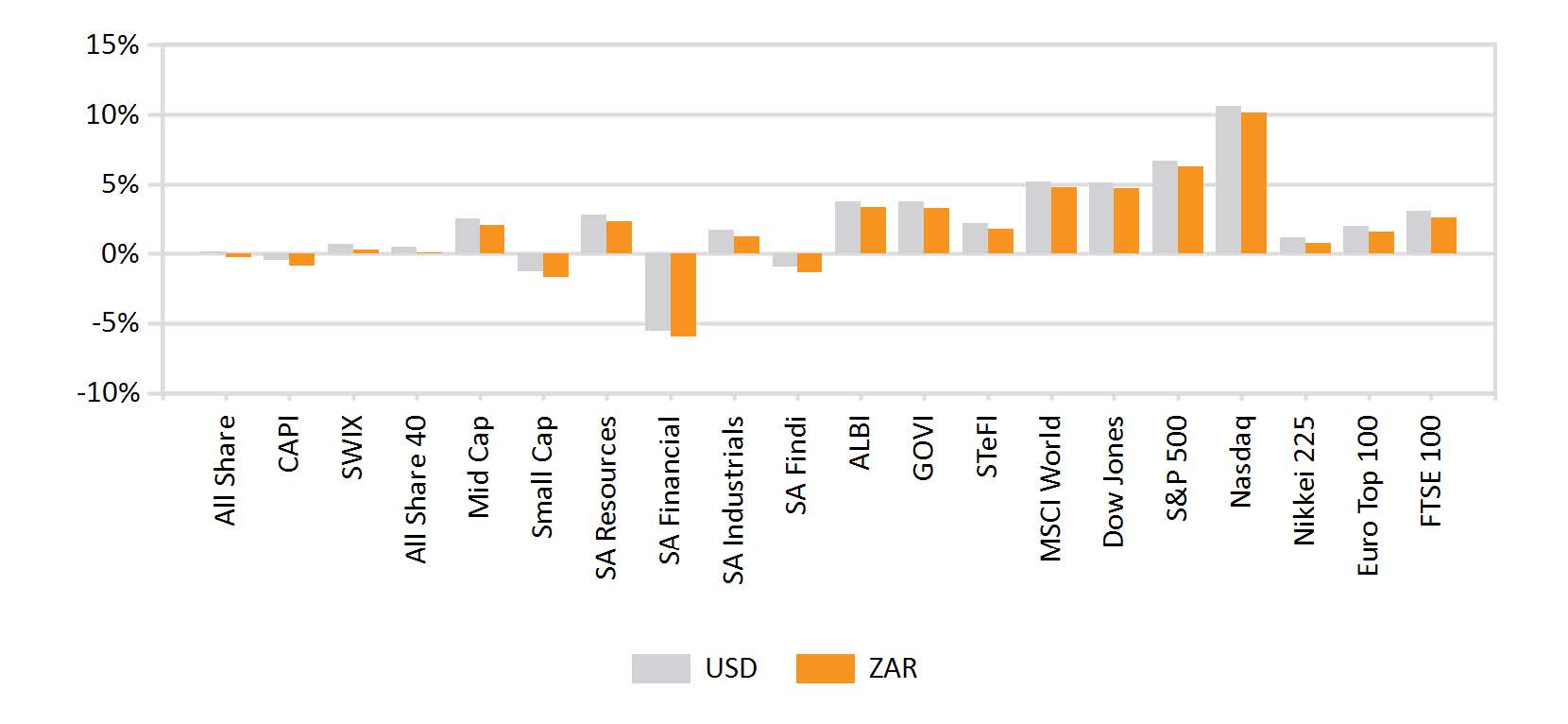

Local equity suffered as the coronavirus outbreak took its toll on EM. The rand experienced its largest monthly decline since August 2018 – the month that saw the start of a major, four-month, correction in global equities. SA equities fell more than EM peers in USD terms; the All Share Index fell by -8.3% versus the MSCI EM Index fall of -4.7%. In rand terms, the All Share Index lost -1.7% and the Capped SWIX was down by -2.6%. Sectorally, the local bourse’s decline was led by Financials (-5.2%) and then Resources (-3.5%); Industrials managed to post a 1.6% gain in rand terms.

“South Africa experienced a quarter-on-quarter decrease of -0.6% in GDP in the third quarter of 2019.”

Contractions across six of the ten sectors that make up the economy drove this decline; primary detractors were the mining sector, the manufacturing industry and the transportation and communication industry. Each contributed -0.5% to the overall decline. Sectors which expanded over quarter were the trade, catering and accommodation industry (0.4% contribution), along with finance, real estate and business services (0.3% contribution).

The domestic economic outlook remains weak. The progress towards growth reforms is slow by many accounts, the country remains hobbled by electricity supply shortages, while a growing government debt-to-GDP ratio is imposing severe constraints on the state’s ability to use fiscal policy as a tool to stimulate the economy.

Property

SA listed property ended January 3.1% lower, per the SA Property Index. As with local equity, the resultant global risk-off environment likely caused by the re-escalation in US and Iranian tensions in early January and the coronavirus outbreak, hurt the property sector.

“The property sector experienced persistent downward selling pressure due to declining foreign interest and general caution by local institutional investors following the January 2018 Resilient Group debacle. “

This, despite the shares in this market appearing to offer value, on a historical basis and relative to other assets.

Offshore property gained 0.8% in USD, per the FTSE/EPRA NAREIT Global Real Estate Index. January saw the first signs of negative impacts of travel restrictions, due to the coronavirus, on the global hospitality industry. Japanese hotel Real Estate Investment Trusts (REITs) sold-off strongly during the month as investors priced the likely slowing of tourism activity in Asia-Pacific, which is particularly dependent on mainland Chinese travellers.

International Markets

China’s coronavirus outbreak has increased uncertainty about its economic growth outlook. The World Health Organisation (WHO) declared the outbreak a global crisis with several cases worldwide exceeding 24 000 at end January. In response, the Chinese government has instituted policies to limit the movement of its people with employees told to stay at home in selected provinces throughout the mainland. Financial markets have likely interpreted these developments to have a material dampening effect on Chinese Q1 GDP – lower production and consumer activity as a result of the outbreak. Many market participants now anticipate significant downward revisions of 2020 GDP growth forecasts, with actual, record, GDP growth at its lowest level in over 20 years. The repricing of Chinese GDP growth expectations has led to a -4.8% decline in Chinese equities in USD terms. This has spilled over into other Emerging Markets (EM), with currencies and equity markets being the worst hit.

“The MSCI World Index lost 0.6% in USD, developed markets fared better than EM counterparts as the MSCI EM Index lost -4.7%. The MSCI EFM Africa ex SA buckled the negative trend, posting a gain 1.9% gain in USD.”

Manufacturing data from the world’s four largest economic regions – G4 economies: USA, European Union (EU), China and Japan – continued to stabilise in January. Using Manufacturing Purchasing Managers Index (PMI) data, the latest reading of the GDP-weighted G4 economies saw a marginal improvement in January manufacturing production, to a reading of 48.12. The G4 index appears to have bottomed in September 2019 at the 48.0 level. The 0.12 improvement is, in truth, of little significance. Rather, financial markets are likely most interested in whether monthly improvements such as this can be maintained, indicating a turnaround in global manufacturing that could be viewed positively for global economic growth, and thus global equities and risk assets broadly. The index crucially remains below the 50-point level – the threshold which marks expanding manufacturing activity from a contraction – implying that G4 manufacturing production remains weak, and, in turn, global growth is likely to remain subdued.

“The phase-one trade agreement between the US and China was signed mid-month. China has promised to increase its purchases of US agricultural products.”

The US, in return, has indicated its willingness to reduce the current level of import tariffs applied to Chinese goods. Both parties committed to avoiding currency intervention going forward, as it would undermine this latest deal. A discussion of further rounds of agreements was deferred by the US till after its November elections. Markets were little moved by the actual signing event, having first learnt that a deal was verbally agreed to in December, likely overshadowed by the coronavirus outbreak.

Brexit finally occurred at midnight on 31 January, following multiple delays over the past three and a half years; this event has helped to alleviate some uncertainty across financial markets. A new deadline, 31 December 2020, is now on the horizon. A transition period spanning nine months to the end of this year was established between the EU and the United Kingdom (UK) to allow for the renegotiation of the two bodies’ relationships. During this interim period, the UK will continue to abide by EU rules, for example allow for free passage between the two regions; but have no say in developing new EU rules.

Currencies and Commodities

The Goldman Sachs Commodities Index (GSCI) closed January down by -10.8% in USD. This broad-based basket of both soft, wheat, and hard, copper, commodities likely declined significantly as investors priced-in the potential slow-down in China and its knock-on impacts on global growth. Commodities are sensitive to the global economic growth cycle; industrial commodities such as oil and copper are highly sensitive. Thus, a -11.9% and -10.0% decline, USD terms, in these respective key production inputs is not surprising.

“The US Dollar, per the DXY Index, closed 1.0% higher, as the coronavirus sparked concerns about Chinese and global growth, leading investors to seek safety in the assets of the world’s largest economy.”

EMs, broadly weakened against the USD, with the rand suffering a 7.3% decline.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance