Market Commentary: January 2019

Here are this month’s highlights: Global markets, after a wobbly start to the year, closed the month on a high note. The Federal Reserve sounded a decidedly more dovish note, the US government shutdown came to an end, and a resolution to the Sino-US trade war appeared to be on the cards, all serving to whet investors’ risk appetite.

Market View

Cash

Cash posted a 60 basis points (bps) return for January 2019. Consumer prices in South Africa fell by 0.2% month-on-month in December, in line with market expectations. The improvement in the rate is largely attributable to decreasing pressures at the petrol pumps (with the cost of fuels declining 8% in December).

Food price inflation remained steady. Headline inflation hit the midpoint of the South African Reserve Bank’s (SARB) target range, registering 4.5% on an annual basis. The SARB consequently left interest rates unchanged at 6.75% at its January meeting. This more accommodative stance is seen against a backdrop of still sluggish domestic growth, with the SARB lowering its growth forecast for 2019 from 1.9% to 1.7%.

Bonds

The ALBI posted a solid 2.9% for the month, outstripping both local Inflation linked bonds (+1.65%) and global government bonds (The Barcap GABI gained 1.52% in USD).

Sentiment towards domestic assets was boosted by a resurgence in Emerging Market optimism, and the SARB’s decision to keep monetary policy unchanged. Highly-liquid South African bonds, despite country-specific idiosyncrasies, remain attractive to foreign investors in terms of their relative real yield.

“Bond investors cannot rest on their laurels, however, as key risks remain in place.”

These include the state of the fiscus (government spending, revenue and deficits) in a low growth environment, the risk that the state will need to bail out underperforming SOEs, and the risk that Emerging Market risk-aversion will resurface.

Over the month, inflation linked bond yields fell about 10bps to 15 bps across the yield curve. The real yield curve moved lower (relative to December) as inflation expectations remained anchored at the mid-range of the target band. Real yields are estimated to be 3.2% for the 5%-6% inflation range. The near-term inflation outlook will likely see some negative prints, and the shift in the yield curve has been more pronounced and consistent at the mid-to-long (6 – 15 years) end of the spectrum.

The US Federal Reserve Bank elected to keep rates unchanged at its month-end meeting and market watchers have been somewhat surprised at the ‘doubly dovish’ tone of chairman Jerome Powell’s comments. Not only has no reference been made to rate hikes – implying that these may be on hold for 2019 – but the Fed has also called a pause to its balance sheet normalisation. The Fed’s stance encouraged a dip in longer term bond yields, with the 10-year T-bill yield falling to its lowest level in a month, ending at 2.7%. Longer dated bonds ended at 3.03%. European bond yields followed suit.

Sentiment towards peripherals Italy and Spain improved with the former’s government bond yield falling by 37bps. Italian government bonds therefore ended the month in the green at 1.2% for January. The European Central Bank and the Bank of England have left monetary policy unchanged, as expected in the currently uncertain Brexit scenario.

“Investment grade corporate issuance was healthy and the uptake reasonable. The credit spread between high risk, investment grade corporate and government bonds therefore narrowed across most sectors.”

Emerging Market bonds provided a return of (JPMorgan EMBI) 4.4%, but US High Yield bonds outstripped all fixed income asset classes, generating 4.6% in dollar terms.

Equity

South African equities managed a solid performance for January, although the SWIX’s 3.09% return somewhat lagged Emerging Market peers and the MSCI World. Sentiment towards South Africa was mixed. On the one hand, President Cyril Ramaphosa continued his investment drive at the World Economic Forum in Davos.Foreign investors appear to be somewhat reassured as to the country’s growth prospects.

“The International Monetary Fund indicates that the country will grow at an 1.4% estimated rate in 2019, up from 0.9% in 2018.”

The good news, however, was tempered by the view on the ground. According to a PwC survey, South African CEOs are not particularly confident in their companies’ revenue growth prospects. Over half of the survey respondents indicated that they were extremely concerned about social instability, uncertain economic growth, the emergence of populist politics and the spill-over effects of the US-Sino trade war and a global growth slowdown.

CEOs also voiced their fears around employment and skills shortages. Unemployment remains stubbornly high, but nearly half of South Africa’s eligible youth is not currently involved in the education and training that could springboard them into employment.

“Policy uncertainty (including around land expropriation without compensation) and electioneering have added to investor jitters. Indeed, the JSE CEO fears the impact of election noise on foreign sentiment.”

The ANC’s election manifesto, released in early January, caused additional noise. It included plans to expand the SARB’s mandate and raised the spectre of prescribing assets for pension funds (to invest in government’s infrastructure programme).

On a sectoral basis, SA Financials performed well, yielding nearly 6%, but Industrials lagged the pack, eking out a meagre 0.88%. Dual-listed shares and Rand Hedges saw waning demand off the back of a stronger rand. British American Tobacco, after a bruising year-end, recouped some of its losses, with the share price climbing nearly 10% toward month end. Sentiment was partly boosted by news that the company had bid for US-based Reynolds, and was continuing its drive into the nascent and rapidly growing Japanese market.

Fellow industrial heavyweight Naspers, after a tough 2018, saw its share price climb by 25% during the month. This is against the backdrop of a concerted consolidation of local platforms and a continued push into e-commerce. The company has increased its e-commerce footprint by acquisitions and investments in the global classified sector, amounting to just over USD 700 billion in the past year Under the OLX umbrella, it holds stakes in Russian internet groups Mail.Ru and Avito, alongside its highly-prized stake in Tencent.

“South African Financials, for the most part, seem to be shrugging off the advent of a host of new banking players.”

The proposed entry of Discovery Bank, Bank Zero and Tyme (inter alia) has prompted the traditional big four to become nimbler, more fintech focused, and tailored in their offerings. The strategies seem to be paying off, yielding solid financial results even against a tough economic backdrop of rising interest rates.

The macroeconomic backdrop and offshore investor sentiment appears slightly improved. This is partly a reflection of progress in addressing corruption, matters of state capture and restructuring governance at SoEs.

The country, however, remains extremely vulnerable to external shocks. The latest data from the HIS Markit Purchasing Managers Index rose to 49.6 in January. While this is an improvement, it still signals a contraction in manufacturing activity.

“Offshore investors are likely to await the outcome of the Budget Speech and local elections, which would clarify the direction and tone of pro-business policies.”

This reticence to invest may mean ample opportunities to pick up quality companies at relatively attractive entry points.

Property

The South African property sector had a solid start to the year. The SAPY gained 9.18%, and the more inclusive ALPI gained 8.39%. According to analysts, this reflects a renewed optimism and a return of confidence.

While very little has effectively changed, and the fundamentals remain the same, the market has adapted its expectations and more of the risk is already priced in. The 2018 property index slide is regarded as a black swan event, and one that is unlikely to return.

“President Cyril Ramaphosa has demonstrated his intention to counter corruption, and grow the economy, and foreign investors are holding him to account in this regard.”

Five countries, including the UK (South Africa’s biggest contributor in terms of Foreign Direct Investment (FDI)) wrote to the Presidency calling for a ‘clear, unqualified and manifest political commitment to the rule of law, independence of the judiciary and to honest and ethical business practices’.

A sustained drive towards infrastructure investment is likely to yield an uptick in the construction and real estate sectors, even as interest rates are set to rise. While international investors remain cautious, particularly as questions remain regarding land expropriation without compensation, there has been increasing appetite from less-traditional trading partners. This includes the intended R10 billion investment by Saudi Arabia in a new crude oil refinery and petrochemical plant in the Western Cape.

The SA REIT sector’s renewed focus on corporate governance is expected to support positive sentiment for investment in listed property this year. A further shift in focus sees investors emphasising the need for clean, green and sustainable investments and earnings streams. South African REITs still carry relatively high exposures to offshore markets – predominantly in the UK – and therefore carry some of the Brexit related risk.

Counters that have more exposure to selected Eastern European countries, such as Poland, are likely to fare better. One such company is Echo Polska Property (EPP), in which SA-based Redefine Property owns a 40% stake. EPP posted a total return of 21% in 2018, even as the rest of the market slumped. Current depressed levels mean that agile investors have ample opportunity for bargain-hunting, particularly as the SARB looks set to increase interest rates in its next Monetary Policy Committee meeting.

“Global Property returns outstripped the local sector, with the FTSE EPRA/NAREIT returning 10.85%.”

According to international real estate advisor, Savills, several key trends will drive prices in developed markets. European real estate remains in demand due to the relocation of UK businesses. Prime offices in central business districts will therefore remain a top pick for core investors, especially in Germany and southern European cities.

Office vacancies in Europe are at an all-time low, and supply is not coming on line quickly enough to accommodate a growing workforce. In Berlin and Munich, with vacancy rates of 1.4% and 2.5%, there is almost no available office space. Analysts predict that prime office rents in Europe will continue to rise, by an average of 3.4%.

Meanwhile, as e-commerce and greening trends grow in prominence, the property sector is witnessing some fundamental changes globally. Demand for logistics space is on the increase: the share of logistics in European property investment activity rose to 14% of the total and is expected to tick up in 2019. The changing demographics of investors and tenants are also driving demand for so-called smart mixed use space and niche sectors.

“Trends in this regard include co-working and co-living arrangements, retirement communities and purpose-built student accommodation.”

Technological disruption will also come from unusual avenues: Autonomous vehicles will mean that CBD parking spaces become largely redundant, as self-driving cars can park themselves on the outskirts of cities, allowing for the redevelopment of parking into retail, office and residential space; The use of 3D printing to provide low-cost housing (with a home currently being printed and erected in 24 hours at a cost of USD 4000) may roll out to a wider market as it becomes cheaper; Modular homes (constructed in factories and constructed onsite) are set to make inroads, with a UK engineering company already developing a home that can ‘unfold’ in 10 minutes; The rising usage of drones, both for delivery purposes (such as Amazon’s Flying Warehouse) and for monitoring property maintenance, will also change the nature of demand.

Property funds and property managers who remain on top of these innovative trends and learn to adapt will prove resilient.

Investors need to be conscious that in many of these nascent markets, despite some risk, there are significant first-mover advantages and opportunistic returns to be had.

International Markets

Global equities rallied in early 2019, in sharp contrast to the December doldrums. Strong corporate earnings results, optimism over US-China trade talks, and the news that the Federal Reserve Bank would keep interest rates on hold, boosted global risk appetite.

“The MSCI World registered a heartening 7.8% gain for the month. Emerging Markets outstripped their developed peers, with the MSCI EM up 8.77%.”

US Federal Reserve policy spilt over into most major markets: The Fed signalled that it would be putting the brakes on any rate increases and that it would allow itself to be guided by current data. While many market participants greeted this as a positive development, it reaffirms analysts’ observations that US growth is not as robust as had previously seemed the case.

The government shutdown that lasted for the best part of the month has done little to quell concerns about ongoing political noise and policy stand-offs. The S&P 500 nonetheless closed 8% higher.

Industrial and energy stocks were the strongest performing sectors, as strong corporate earnings were recorded in the former. The oil price barrelled past the USD 55 level, and Brent Crude registered its best January in 15 years.

Technology stocks lagged, partly in expectation of interest rate hikes, and partly on cautions regarding holiday-sales from tech giants Apple and Amazon.

“European stocks put in a solid performance, and the STOXX All Europe gained 6.6% for the month. This rebound is despite the political impasse with Brexit not yet being resolved and mixed Eurozone economic data.”

The economy grew at 0.2% in the fourth quarter of 2018, bringing the growth rate for the year to 1.2%. While this is positive, it is decidedly lower than 2017. The zone was caught in the crossfire of tit-for-tat trade sanctions, and was hurt by the slowdown in Chinese growth.

The manufacturing new export orders component of the Purchasing Managers Index fell to below 50, indicating a contraction. Market sentiment in Europe fell to a 26-month low, according to the Zew Economic Sentiment Indicator. The pervasive and violent nature of the gilet jaunes protests in France have strengthened fears around resurgent populist politics. Italy dragged on its peers, as the country slipped into a technical recession.

UK equities had a positive month, though gaining more modestly than European counterparts. The FTSE 100 closed the month up 3.63%. The political tension that has weighed on the UK continued into January: the House of Commons voted twice on Prime Minister Theresa May’s withdrawal agreement, and their backing was secured only after material amendments were made to the backstop arrangement. Market participants viewed this as a positive development, as it reduces the probability of a ’no deal’ outcome.

“The commodity-heavy FTSE was also boosted by the rise in commodities.”

Gold, copper, silver, palladium and oil all ended the month in the green. Retailers, on the other hand, continued to face challenges, with consumer confidence still at record lows, and employees facing widespread uncertainty as to future job prospects. As an illustration, even as Tesco’s announced its best Christmas sales growth in a decade, 9 000 jobs are on the line as part of its cost-cutting measures.

Japanese equities lagged global peers, with the Nikkei adding 3.8% for the month. As exports make up about 17% of the country’s GDP, Japan has been hurt by the US-Sino Trade War. Sectors that were heavily impacted include the semiconductor manufacturing industry and electronics.

Car manufacturer Nissan, whose three-way alliance with Mitsubishi Motors and Renault was put in doubt by the allegations against and subsequent arrest of former boss, Carlos Ghosn, has continued to struggle. Japan has consequently trimmed its export expectations.

Other economic data from Japan was mixed: Retail sales rose by a better than expected 1.3% year-on year in December, but consumer confidence dipped and industrial production declined by 0.1%. The consensus seems to be that there will be limited inflationary pressure, and that Japan’s economic growth will slow during 2019.

“Chinese stocks proved to be the best performing amongst Asian and EM peers. Markets were buoyed by apparent progress in trade-talks with the US.”

At month-end, it was announced that Treasury Secretary, Steven Mnuchi, and Trade Representative, Robert Lighthizer, were scheduled to visit China in mid-February for the next round of talks.

Economic data, however, was mixed: GDP growth for 2018 was 6.6%, a 28-year low; the Caixin manufacturing Purchasing Managers’ Index fell to a two-year low; but the Services PMI showed a more modest decline and the sector remains in expansionary territory.

Consumers, nonetheless, remained confident with the index ticking up slightly, and supporting stronger month-on-month retail sales. Most Emerging Asian Markets were boosted by the positive momentum on Chinese trade talks – Korea, Thailand, the Philippines and Indonesia all posted strong returns. India was the region’s laggard.

“The automotive sector, materials and equipment, and cement and steel sectors were notably lower. Investors have raised concerns about corporate governance and the slow pace of reform.”

Weaker macroeconomic data has also added to downward pressure ahead of the government 2019/2020 budget. The SENSEX closed the month only 53 bps higher.

Overall, Emerging Markets had a particularly solid month, with Latin America leading the pack, closely followed by Emerging Europe, Africa and the Middle East. Latin American markets, which are commodity heavy and have benefited from positive reform momentum, performed well despite notable headwinds.

In Venezuela, the Maduro regime’s legitimacy was called into question, and the US has imposed sanctions on the state-owned oil company. Maduro is effectively being held hostage, as the US will hold any oil sales proceeds until he declares himself willing to step down.

“In Brazil, another bourse heavyweight suffered substantial declines: Shares in Vale – the world’s largest producer of iron ore – plunged following the recent collapse of a dam at one of its mining complexes.”

In emerging Europe, the lifting of US sanctions on Rusal and EN+ gave Russian markets a much-needed lift. Simultaneously, however, the US announced that it was withdrawing from a nuclear treaty with the country. Turkish markets were able to recoup some of the prior months’ losses, supported by steady central bank policy, easing inflationary concerns and a weaker US Dollar.

The MSCI EFM Africa ex SA was one of the weaker indices, but nonetheless closed 3.15% higher. In local currency terms, Kenya and Egypt were amongst the strongest performers. Nigeria dipped, as election uncertainty continues to be elevated.

Currencies and Commodities

In commodities, the overall GSCI index was up by 9% in January, led by gains in Energy (+13.8%) and Industrial Metals (+5.3%). Precious Metals were positive, with gold closing 3.1% higher. Crude Oil gained 18%. Brent Crude (+13%), and Heating Oil (+12.5%) registered the biggest gains for the month.

“Oil counters were given a boost by the Federal Reserve Bank, putting rate hikes on hold. Lower-than-expected interest rates provide a much-needed sentiment boost, which reflected in the broader market.”

The weaker outlook also served to undercut the dollar, which has historically had an inverse relationship with oil-prices.

Companies’ balance sheets and ability to undertake capital expenditure were bolstered by lower borrowing costs and relatively ‘easy money’. The ongoing crisis in Venezuela, and measures by Saudi Arabia to reduce shipments to the US, saw prices receive a supply side boost.

OPEC’s production declined by 890 000 barrels per day in January, according to a Reuters survey, which is the largest monthly decline since early 2017.

In other commodities, one of the biggest losses was in Cocoa, with Cocoa futures touching seven-week lows toward month end. This partly reflects downward price pressure from the supply side, as West African weather conditions hit the sweet spot for a bumper crop in Ghana and the Ivory Coast sweethearts, Ghana and the Ivory Coast.

“In currencies, the US dollar lost ground, with the Dollar Index slipping by 0.6%. The government shutdown that lasted for most of the month, did little to instil confidence in FX traders.”

Commodity linked developed market currencies registered the biggest gains against the Dollar, with the Canadian, Australian and Kiwi equivalents gaining between 3% and 4%.

Emerging market currencies had a solid month, and the rand was one of the biggest gainers (+8.4%), followed closely by fellow BRICS Brazil (+6.5%) and Russia (+5.9%). The Indian rupee was one of the worst performers, however, as the net oil importer saw its balance of trade deteriorate.

Performance

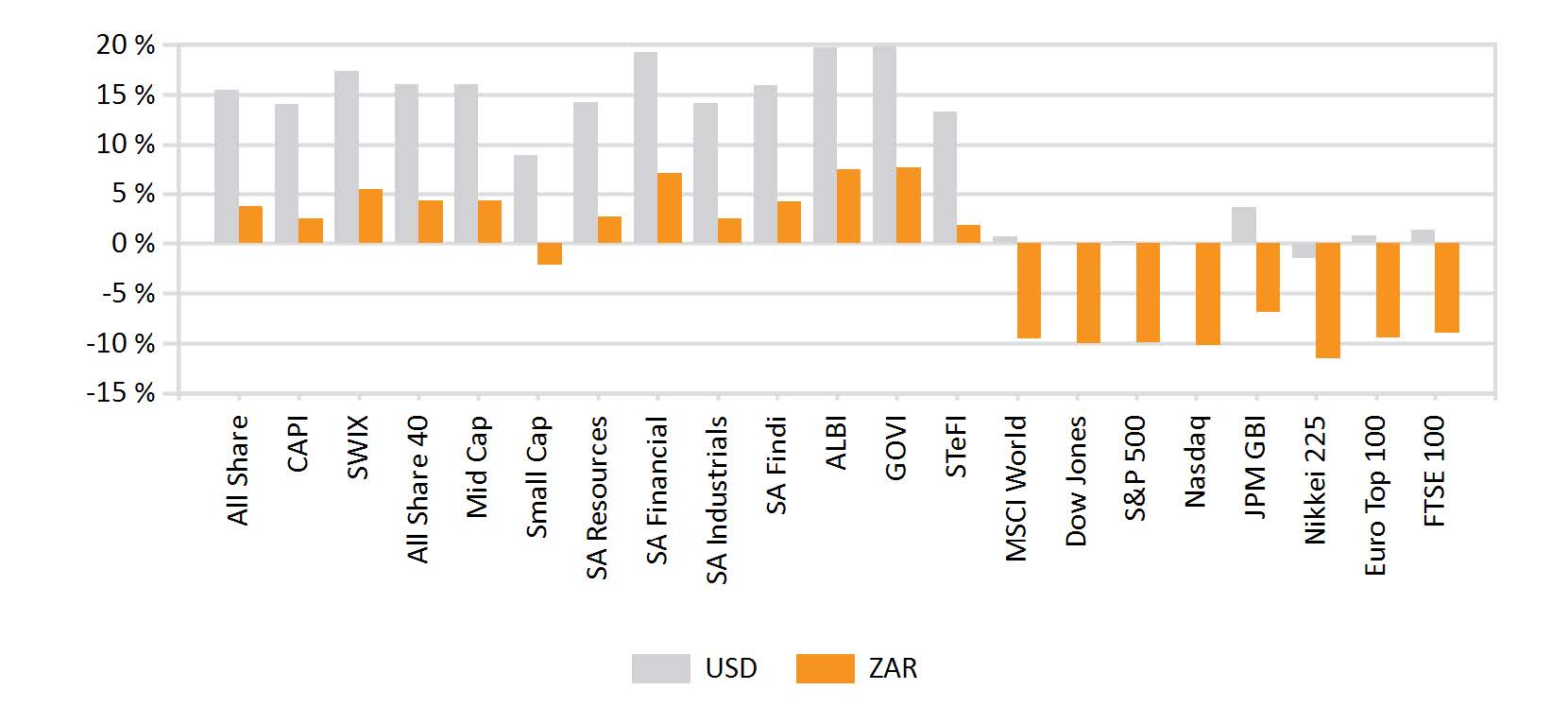

World Market Indices Performance

Monthly return of major indices

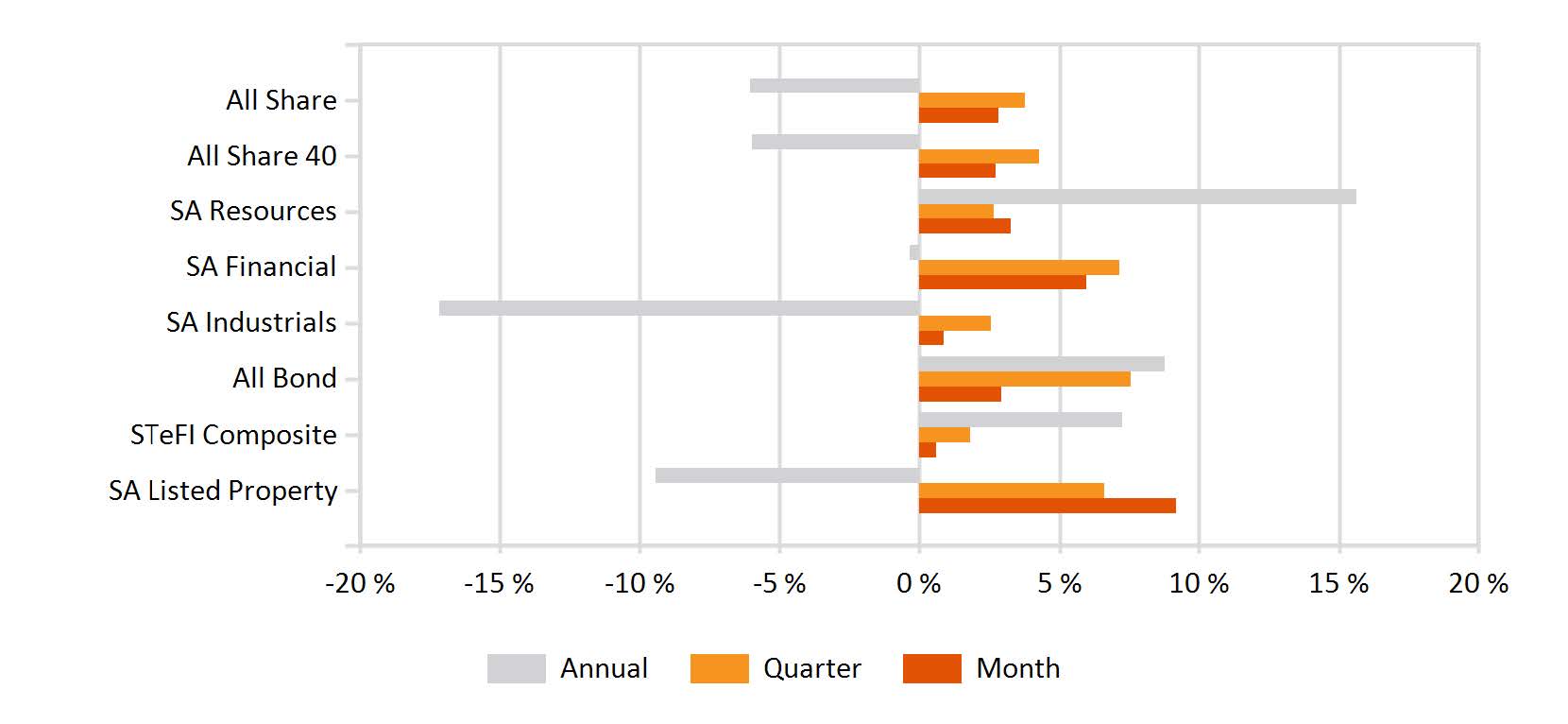

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

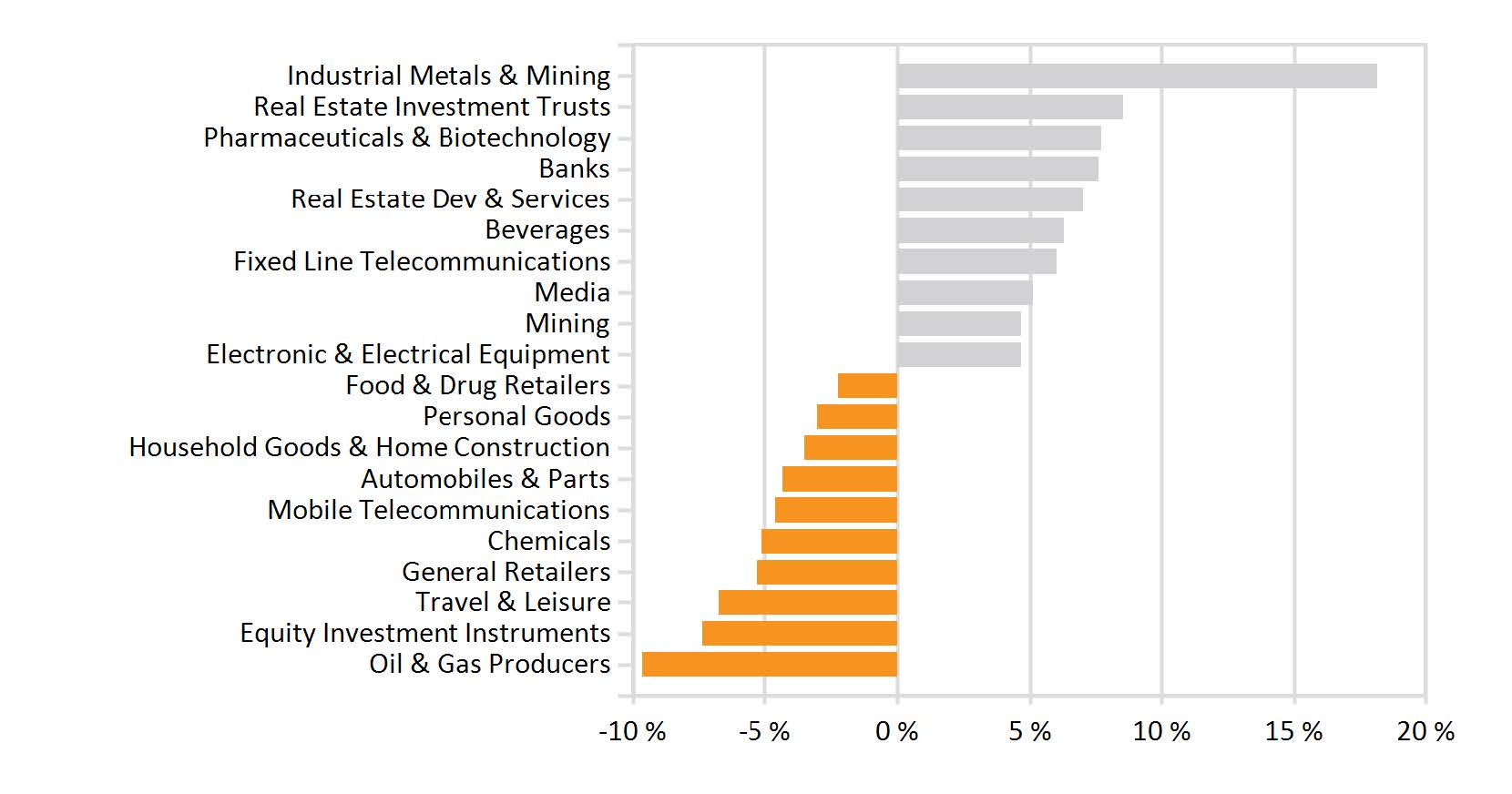

Monthly Industry Performance