Market Commentary: January 2018

Global Risk Assets had a strong start to 2018: Developed markets were boosted by macroeconomic data and upbeat corporate earnings. A commodity boom – as oil prices topped USD70 per barrel for the first time in three years and precious and industrial metals shone – lifted Emerging Markets. The declining USD also proved a boon to Emerging Market balance sheets. Local Fixed Income assets were mixed, with the property market dipping on Steinhoff knock-on effects (Resilient Group). Similarly, the local equity market suffered sharp declines, with Financials marred by Viceroy Research’s release of an inflammatory report on Capitec Bank.

Market View

Cash

The Consumer Price Index ticked up during December 2017, though remaining well within the target band. December’s 4.7% increase matched market expectations. This was largely driven by higher transport prices, as the oil price surged to fresh highs. While a stronger Rand has somewhat eased the pressure at the pumps, the South African Reserve Bank (SARB) is maintaining a cautious stance, particularly ahead of the Budget Speech in February.

“Food and alcohol prices eased during December, but the Western Cape may be hard-hit by drought-related price hikes.”

Retailers, attempting to reassure customers as to the availability and affordability of bottled water, have already seen a more than 90% rise in sales. The rational response to scarcity may yet see prices inch up. South African Cash returned 0.64% for January 2018.

Bonds

The SA 10-year government bond yield rallied by 23 points toward late January, but yields ticked higher at month-end on lingering political anxiety. The ALBI posted a modest gain of 1.91% for the month, while Inflation Linked Bonds (ILBs) declined by a noticeable 2.16%. The medium-term outlook for inflation presently points to only one 25bps cut during 2018.

“Global Bond markets were more volatile and the BarCap GABI gave up -3.11% during January.”

The US Federal Reserve, greeting its new chairman Jerome Powell, kept rates unchanged at their month-end meeting. The path of increases is still expected to be gradual, but US economic growth data and the tone of the Federal Reserve Bank minutes, increasingly point to a more hawkish stance. US yield curves steepened during the month and credit spreads tightened. The 10-year T-bill rates closed the month 0.3 % higher, at 2.71%. Similarly, as the Bank of England and European Central Bank (ECB) see inflation gradually inch toward their 2% targets, they have committed to reducing stimuli, putting some downward pressure on government bonds overall. Asian bond markets were unsettled by an unexpected announcement by the Bank of Japan that it would taper its purchases of longer dated bonds. However, the Governor moved quickly to dispel fears of aggressive policy movements but yields nonetheless ticked higher. High yield bonds outshone their investment grade peers, and Emerging Market (EM) Debt (while outperforming T-bills) closed 0.5% lower.

Property

Speculation that Resilient Group would become a target for now-notorious activist short-sellers Viceroy Research, shook the South African Property Market. The Listed Property Index closed nearly 10% lower for the month. Resilient Group, comprising the Fortress Income Funds, NEPI Rockcastle, and Resilient, subsequently saw the broader market scrutinise their valuations, earnings reports and management communications. Despite moves to allay investor jitters, including pushing forward the release of half-year results, the Group saw more than R30 billion wiped off the value of its four constituents since January 11. Share prices fell by as much as 27%. Panic selling notwithstanding, investment managers have largely expressed their support for the Group, with some property managers seeing this as an opportunity to buy relatively cheaply. The effects of the drought have started filtering through to Cape Town house prices, which to date had been remarkably buoyant. The Cape Town residential sector registered an inflation-beating return of 9.7% in the fourth quarter of 2017 (FNB Surveys). House price growth, however, has slowed in the Western Cape (from 4.8% house price inflation to 4.4% quarterly), while it has ticked up in the other provinces. This, perhaps, reflects catch-up growth elsewhere, and a reluctance to jump on the ‘semigration’ bandwagon (relocating from Gauteng, the Eastern Cape and KwaZulu-Natal) while the water-crisis plays out. The increasing appetite in the logistics space is still evident, with the sector also benefiting from slightly improved business confidence. Amazon’s recent decision to acquire 18 hectares of space in the Cape Town surrounds is potentially quite telling.

“Essentially, the fundamentals of the South Africa property market have remained unchanged from December 2017, or if anything, perhaps even improved.”

While downgrades are still a real risk, and fiscal discipline is being challenged, moves by newly-elected ANC president Cyril Ramaphosa (including sweeping changes at State Owned Enterprise Eskom) have been cheered by global and local investors alike.

In offshore property, the FTSE EPRA/NAREIT Developed Markets Real Estate Index, also proved lacklustre, yielding a total return of -1.28% for January.

“The US rental housing market slowed substantially in January, after a decade of unprecedented growth.”

This is a reflection of an easing in inventory shortage, despite concerns that increased supply is concentrated at the higher end of the market. Affordability is still a major problem, and middle-income and multifamily units will remain a growth area. Asian property markets have seen an increase in foreign buying appetite, with Singaporean property prices finally seeing an uptick (after falling for four years). Strong growth prospects in Eastern Europe, including peripherals such as Bulgaria and Romania, bode well for the region. SA companies with an Eastern European presence may stand to benefit, though concerns remain that a number of these forays have been ill-timed or under-researched. Selectivity and ease of entry/exit will therefore remain essential in the South African listed property space.

Equity

A cloud of gloom hung over the South African equity market during January, as markets gauged the likelihood of meaningful economic change in the Cyril Ramaphosa era, and react to the fall-out from the Steinhoff scandal. Regarding the latter, there is still little certainty as to the extent of any wrongdoing, the size of the liabilities, the potential for further damages and litigation, and the ability of the company (or its core business units) to recover. Investors have therefore remained extremely jittery of corporate South Africa. Viceroy Research, widely credited for exposing the rot at Steinhoff, continued their headline-topping low-point inducing ways: The firm released a report on Capitec at month-end which sent the stock tumbling. The somewhat inflammatory report likened the bank to a loan shark and alleged that it was vastly understating its defaults. Its shares slumped by nearly 24% at one stage, setting the stage for the worst week on the Johannesburg Stock Exchange (JSE) since January 2016. Capitec moved quickly to allay investors’ fears, with the SARB and National Treasury coming out in support of the bank. In a somewhat unusual move, the SARB subsequently issued a statement, confirming that Capitec was “solvent and well capitalised”, with “adequate liquidity”. Share prices steadied modestly, though the JSE financial index closed the month 2.98% lower.

The substantial month-end slide notwithstanding, the ALSI moved sideways for much of the year, ending on a muted 0.1% higher. Resources gained considerable ground, the RESI up 3.18%, echoing the rise in commodity prices. The GCSI Commodity index was up by 3.4% in January, with substantial gains in Energy (+5%), Precious Metals (+2.2%) and Industrial Metals. Commodities, according to the bulls, are just hitting their stride. Precious metals and industrials have been boosted by a declining dollar, a mismatch in supply-and-demand and improved prospects for global growth. Uncertainty around monetary policy, within rising inflationary environments, and the fundamentals of the global bond market have added to the traditional safe-haven appeal. South African miners and diversified miners, recovering from recent lows, were poised to benefit (despite currency headwinds). Platinum prices were noticeably higher, and Impala Platinum proved to be one of the biggest gainers on 31 January.

A further noticeable feature of the JSE during January was the relative weakness of traditional rand hedges (large multinational industrials).

“While investors are unsettled by fears around corporate governance, SA Inc has seen a return to favour post Cyril Ramaphosa’s victory.”

ABInBev, British American Tobacco and Richemont, have been amongst the market’s worst performers since 13 December (losing between 6% and 10%, respectively). Conversely, many unloved SA-centric stocks (including cement producer PPC, and retailer Mr Price) are seeing an uptick in share prices.

South Africa’s economic prospects, despite a change in leadership and improved investor sentiment, are still fragile. Globally, equity markets appear set for a more volatile year and geopolitical concerns continue to linger and spill over to local markets. On the domestic front, equities remain vulnerable to ratings downgrades, political noise (with rumours still swirling regarding President Jacob Zuma’s future), contagion fears and local currency moves. Well-timed and well-researched investment in SA Inc, and agility in allocations will therefore be essential.

International Markets

Global risk assets had an excellent start to 2018, with Developed and Emerging Market equities ending mostly higher. The MSCI All Country World Index gained 5.6%, boosted by resurgent global economic growth and upbeat earnings reports. The UK market, however, missed out on the wider rally, faltering at the start of 2018 on residual concerns around a hard Brexit and strength in sterling. The FTSE 100 dipped by nearly 2%. Continental Europe continued to thrive, with the Stoxx All Europe yielding 1.84% for the month. Emerging markets too, posted substantial gains – the MSCI Emerging Markets outshone developed peers gaining 8.3% for the month. African markets lagged slightly, but outstripped developed counterparts, as the MSCI EFM ex SA ticked up by 6%. US equity markets saw their strongest start in 30-odd years, as sentiment was boosted by positive growth and jobs data, relief at the end of a US government shutdown, and impressive corporate earnings. US GDP growth, largely driven by increased consumer spending (3.8% for the last quarter of 2017), registered a healthy annualised 2.6% growth rate. The US jobs market has continued to improve. Not only has the pace of hiring beat consensus estimates for the month, but wage growth (measured by average hourly earnings) has reached its best level in a decade. Perhaps, perversely, the buoyant jobs data is a potential threat to equity investors: tight labour markets are likely to feed into increased labour costs and inflation, prompting the Federal Reserve to steepen its hiking path. Consumer Discretionary and IT stocks led sectoral gains, with the Republican Tax Reform seen as a boon for prospective earnings.

“A month-end slump in healthcare and energy put something of a damper on US investor appetite.”

Industry giants Amazon, Berkshire Hathaway and JPMorgan announced that they were would establish a healthcare system for their US employees. The news unsettled the healthcare system, with drug companies and service providers fretting about cost-competition. A resurgence in crude oil prices (with the commodity ticking up by 7.4% for the month, exceeding the USD 70 per barrel mark for the first time in three years) boosted energy sector gains. The improvement in oil prices boosted the UK market, but the FTSE 100 missed out on the wider rally. Corporate news, with the failure of construction company Carillion making headlines, weighed on the wider bourse, as did painful progress around Brexit. In contrast, European equities advanced against a robust growth backdrop, and improved economic outlook. The Eurozone registered its strongest growth in a decade, unemployment remains at record lows, and consumer and business confidence is at multi-year highs. The Spanish economy shrugged off Catalonian tensions and registered a 0.7% growth rate for Q4 2017. France, for long a laggard, saw renewed confidence (under newly-elected President Emmanuel Macron) and grew at its fastest annual pace since 2011. On a sectoral basis, investors favoured growth-oriented cyclical stocks and the financial sector. As in the US, bond proxies (Telecoms and Utilities) were laggard. Japanese equity markets had a solid start to the year, but pulled back toward month-end on Yen-strength and speculation that the Bank of Japan (BoJ) would start to withdraw stimulus earlier than anticipated. Preliminary data on industrial production and unemployment was positive, but markets are watching the annual wage negotiations keenly. Wage growth will be a necessary prerequisite to boost spending and keep the BoJ’s inflationary expectations on track. The Nikkei closed the month 1.47% higher. Chinese equity markets registered a 6% gain, fuelled by better-than-expected economic growth data (the latest data shows GDP growth at 6.8% in 2017’S Q4). Positive Chinese growth data spilled over into commodities (including industrial metals) and emerging Asian markets. In general, Emerging Markets rallied on the commodity price boom. Russian markets led Emerging Europe, boosted by positive growth data (1.5% per annum, after two years of recession) and the rise in crude oil prices. Latin America was the regional winner, led by Brazilian equities. A rather rapid recovery, and rising commodities set an upbeat tone for Brazilian equities, though some doubts remain as to the October election outcome. Standard and Poor’s downgraded the country’s sovereign debt from BB to BB-, as the uncertainty around pension reform lingers, and cast a shadow on the country’s fiscal and monetary policy progress.

“Amongst African peers, Nigeria and Ghana delivered stellar returns: the latter delivered over 20%, and the former over 15% in US Dollar terms.”

While the Nigerian Monetary Policy meeting for January was postponed, Governor Godwin Emefiele has signalled a positive outlook, implying that interest rates may be cut by mid-year. The Zimbabwean Stock Exchange, long a refuge against hyperinflation, appears to have lost some of its appeal, closing modestly lower. Despite a favourable review from the IMF on progress toward macroeconomic stabilisation and reform, the Egyptian stock market closed softer.

Currency

The US dollar continued its slump during January, with the index losing 3.2% during that month. Losses in the greenback have mounted since US President Donald Trump’s inauguration, and the unit fell to its lowest level in three years. This, perhaps, is simply a market correction, given the lofty height that the currency had reached. The message from the current US administration (reiterated at the recent World Economic Forum in Davos) appears to be: a weaker dollar is good for the US economy, and it may well form part of Trump’s trade agenda.

“The biggest gainers against the greenback thus far have been the British Pound and Japanese Yen.”

Sterling shrugged off some Brexit uncertainty (exacerbated by a leaked impact-report), and instead cheered signs of consensus on the transition period, due to start in March 2019. An improvement in the domestic growth outlook, and the labour market, boosted the Pound to its highest level since the decision to exit the European Union. The Yen, in turn, is testing Japanese companies’ ability to prove profitable in a strong-Yen environment, as it reaches new highs against the USD (up nearly 2.1% since the end of 2017). Thus far, however, the Japanese stock exchange is proving resilient to the currency headwinds. Emerging Market currencies, overall, posted solid gains. The Mexican Peso recouped lost ground (up 5.7% from a prior-month depreciation of 5.3%), as the sixth round of talks around the North American Free Trade Agreement (though not conclusive) took a more conciliatory tone. Despite ongoing political rumblings, the Turkish Lira gained 1.3%; and the South African Rand posted another solid gain of 4.9%.

Performance

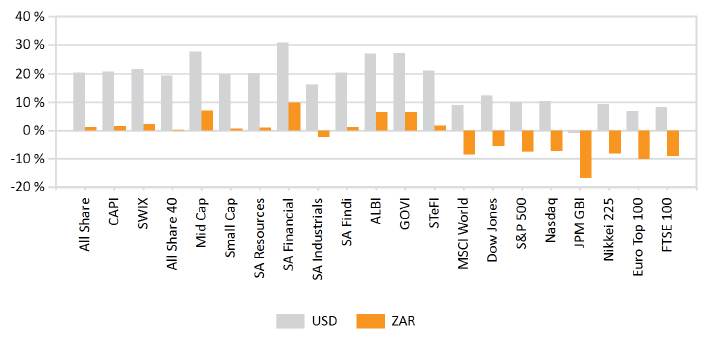

World Market Indices Performance

Monthly return of major indices

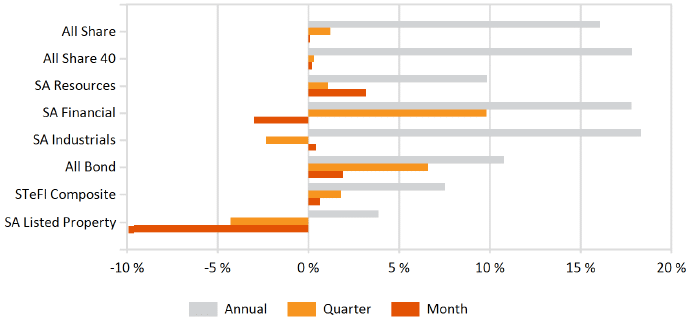

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

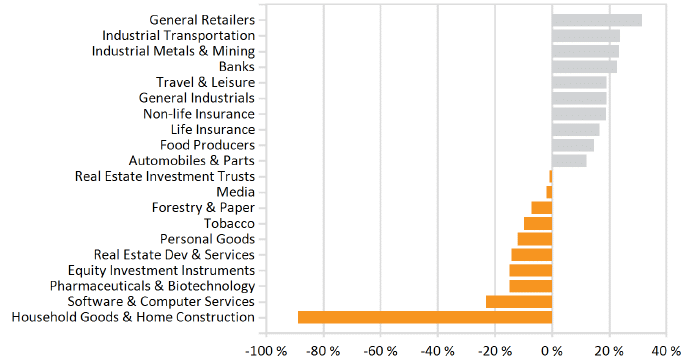

Monthly Industry Performance