Market Commentary: January 2017

Market View

Cash

South African inflation topped market expectations, rising 6.8% year-on-year in December 2016, the fastest pace since February 2016. While fair weather has seen pressure on food-producers (indicated by PPI) subside, pass-through to domestic consumers has been limited. The manufactured food and beverages component remained the largest contributor to inflation, and the prospect for easing in early 2017 is a boon to consumers. The Monetary Policy Committee, however, warned that the increasingly uncertain geopolitical environment makes it likely that the moderation will be attenuated by higher fuel prices and currency volatility. The SARB, though maintaining rates unchanged, still considers the risk to be moderately on the upside and inflation is likely to hover near the upper band of the range over the course of 2017. Cash (STeFI Returns) earned 0.63% for January 2017.

Bonds

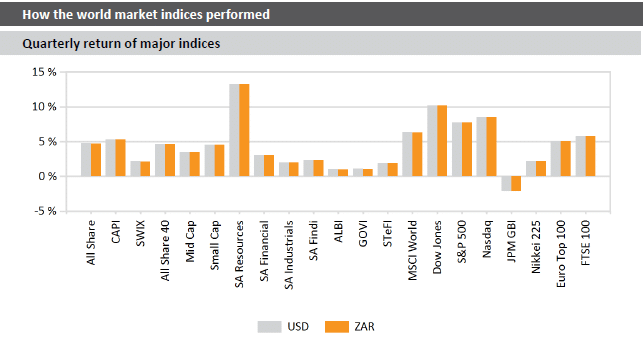

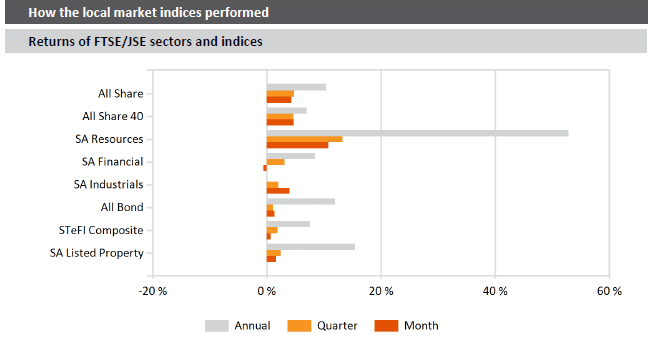

Fixed-income assets had a largely positive start to the year: The ALBI gained 0.75% ; and The Barclays ILB index closed the month 1.43% higher. Nerves were evident in the local market, with rumours of an imminent Cabinet reshuffle rife ahead of the mid-February State of the Nation Address. Against a politically uncertain global backdrop, the liquidity and depth of the SA market have been both blessing and curse, as the market remains vulnerable to foreign investor sentiment. The last two weeks of January saw net foreign sales of R4.5 billion. South African government bonds nonetheless easily outperformed developed market peers – European Union Government Bonds ticked up only 0.27%, US-T-bills were 0.24% higher. The broader Emerging Market peer group, however, outperformed, with the JP Morgan Emerging Markets Government Bond Index gaining 2.25%, boosted by the ongoing search for yield.

Property

SA listed property recorded a 1.6% total return for January 2017. The historic yield for the SAPY ticked 13 bps higher, to 6.53. The asset class delivered a solid 15.4% for the past 12 months, but prospects for listed property are somewhat glum. The South African Property Owners’ Association reports that tough retail conditions are translating into lower trading density growth, whilst the office and industrial sectors remain in a vulnerable state. The national vacancy rate in the office sector was reported as 10.7% for Q4 2016. Though vacancies in industrials are notably lower (4%), a solid pipeline of land has been earmarked for development by large listed companies, potentially introducing supply side pressure. The market is likely to see considerable activity in the coming months, as February heralds the start of the results season.

The JSE has also released a market consultation paper regarding replacing the current property index with three new indices – the SA REIT, Tradable Property and All Property Indices. The new distinctions may introduce some reclassification and reweighting between listed funds: the All Property index will be the most representative, but more biased toward foreign-domiciled stocks, while the Tradable index will be the most liquid. Simultaneously, South African listed property companies will continue to attempt to diversify their earnings base, with Intu, for example, announcing its intention to enter into Spain. The listed space is nonetheless likely to see increasing pressure, and opportunities in unlisted property may offer a better risk-return profile. Both direct and listed investments, however, require prudent allocations of assets across portfolios, with due cognisance of effective foreign exposure, political risks and interest-rate sensitivity.

Equity

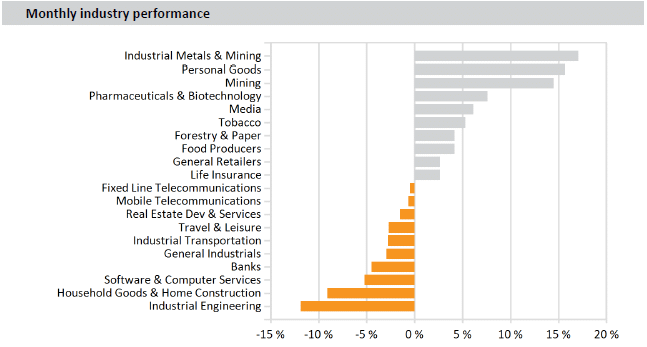

The South African All Share Index closed 4.06% higher, spurred upward by resource gains. Precious metals were notable leaders, with Platinum counters surging – the index gained 23.13% for the month, while the broader Resource sector gained 10.25%. The local bourse outstripped developed peers (MSCI World 2.39%) but lagged the broader index of Emerging Markets (5.92%). As elsewhere, South African markets appeared to be cheered by newly-elected President Trump’s first week as President, amidst promises of increased infrastructure spending and pro-business policies. Company news was fairly thin on the ground, and markets were guided by developments offshore, and by local currency moves. Dual listed luxury goods maker Richemont was a notable gainer for the month, partly boosted by better than expected news from China. South African Industrials posted a solid return during January, up by 3.96%, but Financials struggled. Banking stocks took a battering, as the sector is increasingly caught in the political crossfire. The ANC Youth League is actively pursuing a case against Barclays, as a leaked report indicated that the Bank benefited unduly under the Apartheid government. While the January Purchasing Managers’ Index rose to its highest level in six months, and tipped into expansionary territory at 50.9, the outlook for the South African economy remains sombre. The State of the Nation Address is likely to induce mid-month market jitters, and political noise is set to be elevated in the second half of 2017 (as the ANC approaches its leadership conference). Agile allocations, however, will identify the opportunities this presents and take advantage of significant pockets of return in SA Inc.

Foreign Equity

Developed markets were buoyant in January, with the MSCI World ending the month 2.39% higher in dollar terms. US indices touched record highs, with investors still relishing the promises of increased infrastructure spending, tax cuts and regulatory easing in President Trump’s busy first weeks. The S&P500 index closed 1.99% higher, and the NASDAQ rallied as Technology stocks ticked up in anticipation of renewed IT-refreshment appetite from America. European markets remained unsettled, with growing unease as to whether the EU will see further exits. Macroeonomic data, however, remains largely positive, with overall joblessness at a low point (9.6%) and GDP rising by 0.5% for Q4. The region also saw a surge in its inflation rate to 1.8%, and the ECB left rates unchanged at its January meeting, in line with expectations. Italian and French markets bore the brunt of Brexit-contagion fears, closing -5.1 and -1.8% lower respectively.

The UK FTSE fell -0.3%, further dragged down by weakness in the energy sector and pharmaceuticals. The former was particularly volatile, seeing a notable uptick in Sales, Merger and Acquisitions activities – Royal Dutch Shell sold its North Sea Assets and its interest in a Thai gas field – increased geopolitical noise and profit-taking. Energy prices weakened over the course of the month, with Brent Crude giving up 3.36%. Within the Emerging Market Group, geopolitics and energies dragged on the Russian bourse (as it declined -1.5%, whilst the broader index gained 5.92%. Brazilian and Chinese markets easily outstripped peers, gaining on commodity strength and improved economic prospects. Chinese markets, however, remain prone to speculative trading, and the market is not yet reassured as to how predictable, if at all, monetary authorities’ interventions will be in 2017. Sino-US relations are also under increasing scrutiny, with President Trump showing little sign of softening his protectionist stance. The de facto risks and diplomatic implications are not yet clear. An understanding of potential spillovers, however, will be essential in building a well-diversified portfolio, with a judicious mix of developed and emerging market exposure.

Currency

The US dollar index was 2.6% lower in January. The Bloomberg Commodity Index gained a modest 0.14% for the same month, but Precious and Industrial Metals (notably Platinum and Copper Prices at 10 and 8.9%) surged. Commodity-linked currencies gained on precious metal strength (the New Zealand and Aussie dollars gained 5.5% and 5.2%, while the Brazilian Real was 3.3% higher against the USD). The Turkish Lira continued to spiral, losing -6.7% as Middle Eastern tension showed little sign of subsiding. Weakness was less pronounced in the Mexican Peso, despite a flurry of Presidential orders. The Yen improved modestly in January and the Pound gained ground as British economic updates surprised to the upside. The Rand, despite softening at month-end on Cabinet reshuffle concerns, put in a solid performance, gaining 1.7% against the USD. In the present environment of heightened diplomatic tension, market participants are wary of the prospects and global implications of currency wars.