Market Commentary: February 2023

Global Market Themes: US Federal Reserve likely to hike rates by 25bps in March. Chinese markets close lower; rely on domestic consumer to spur growth. Broader markets experience knock-on effects from US interest rate revision. Bank of England expects inflation to fall to 4% by year-end. SA Market Themes: SA markets down for the month. Rand depreciates against all major currencies. Finance Minister Enoch Godongwana outlines greylisting path in the Budget speech. Government pledges to take on R254 billion of Eskom’s debt.

Market View

Global Market Themes

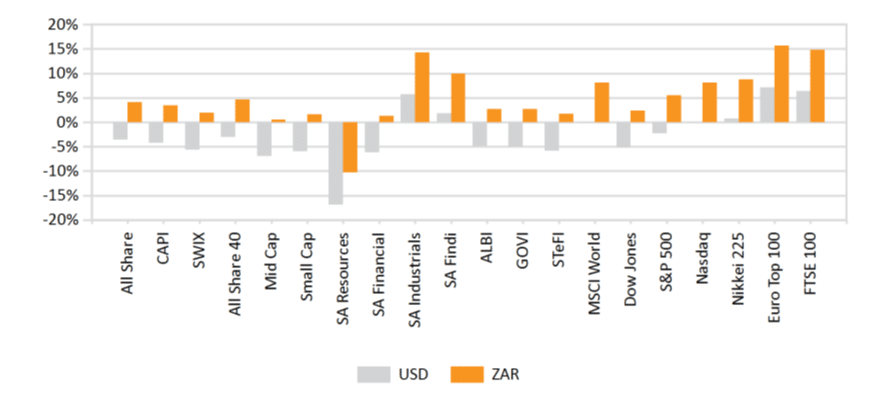

Global markets experienced a mixed performance in February. Starting off with some positive momentum from January, they ended up dropping across the board as sentiment shifted towards risk aversion. This change was spurred on by higher-than-expected US inflation data, with the pace of deceleration slower than market participants expected prior to the print. The Federal Reserve’s (Fed’s) preferred measure of inflation, core CPE (personal consumer expenditure), rose 0.6% month on month, triple the upwardly revised 0.2% the Fed had expected. With the current year-on-year change in this inflation measure at 4.7%, the Fed should have enough impetus to continue raising short-term interest rates going forward. Current market consensus, as shown by the implied Fed funds futures rate, shows a 25bps increase this month (March) and another 25bps hike in May. In addition, hopes of a pause to interest rate hikes this month have been dispelled as the US labour market remains strong, with an unemployment rate of only 3.4% – the lowest unemployment rate in over 50 years. Fed Chair Jerome Powell has communicated that if the US economy does not see a marked slowdown, expected to be reflected in the labour market, then the US could speed up the pace of its rate hikes and extend them. The S&P 500 and the MSCI World both dropped -2.4% for the month. These losses were mild in comparison to emerging market declines (see below).

In the UK, the FTSE 100 posted a modest gain of 1.8% (in GBP), despite ongoing strikes across many public sectors and persistent inflation pressures suppress economic activity.

Bank of England (BOE) Governor Andrew Bailey is trying his best to keep the economy buoyant, stating that interest rate hikes are not necessarily inevitable. Markets seem unconvinced, having priced in a meagre 10% probability that interest rates hikes will be placed on hold. UK consumers have been struggling for some time now due to the cost-of-living crisis, and it appears there is still a long way to go to resolve this. Current grocery inflation in the UK has reached a record high of 17.1% year on year. The BOE has stated that it expects inflation to fall from 10.1% in January to around 4% by the end of the year. The European Central Bank (ECB) has presented a more hawkish stance compared to the UK. Eurozone members show conflicting inflation prints and the ECB will not end rate hikes until it is confident headline price growth is heading back towards 2%. The Stoxx All Europe index was up 2% (in EUR) for the month.

The MSCI China Index fell -10.37%, despite the superpower’s leading gauge for production levels hitting an 11-year high. The official manufacturing Purchasing Managers’ Index (PMI) stood at 52.6 last month against 50.1 in January, based on data from the National Bureau of Statistics, beating expectations as production expanded after the lifting of Covid-19 restrictions. China has identified its domestic consumers as the key driver of short-term economic growth, citing weak global exports, ongoing US export tariffs and the continued feud over technology security as constraints on foreign demand.

Keeping with Asia, Kazuo Ueda is set to become the next governor of the world’s third-largest economy, Japan, succeeding current Bank of Japan (BOJ) Governor Haruhiko Kuroda. Kuroda has been a source of stability for the country’s economic policy for many years, and ushering in a new era of leadership has brought volatility into the market. Although Ueda is unlikely to make any drastic policy changes initially and has assured markets that he will communicate his vision for policy development, inflation in Japan is starting to become an issue and it seems the country has decided to employ an academic to issue the bad news of monetary tightening. Ueda is set to chair his first BOJ policy meeting on 27 April.

The MSCI Emerging Markets Index fell -6.48% for the month with the Brazil – IBOVESPA dropping 7.49% (in BRL). Brazil’s trade surplus fell 35% from the same month last year, and the Ministry of Development, Industry, Trade and Services said the decline came from a significant decrease in exports of crude oil, coffee and beef. It is worth recalling that revisions to the upside on interest rate expectations in the US often lead to negative implications for developing countries.

When markets are more risk-averse, capital tends to move towards safer allocations, moving capital away from higher-risk emerging economies and towards the relatively safe US Dollar.

Emerging Frontier Markets were slow to respond to the global rally in January. The MSCI Emerging Frontier Markets Africa ex South Africa Index rose 3.2%. While most other indices experienced this level of growth last month, gains in the frontier markets were moderate in comparison. Precious metals did not perform well this month, with palladium down 14.2% and silver down 11.9%. Platinum and gold were both down 5.8% and 5.3%, respectively. Volatility in the energy sector has subsided, with coal and natural gas gaining 1% and 2.3%, respectively. Oil dropped by 2.4%.

All returns above are in USD, unless stated otherwise.

South African Market Themes

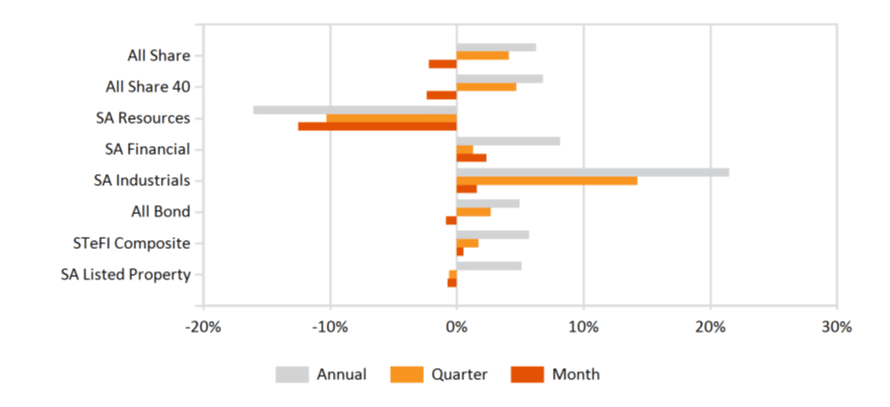

SA markets lost momentum this month following a very strong January. Risk-off sentiment rippled through global markets and domestic markets followed suit. The SWIX and the All-Share indices both shed -2.3% and -2.2%, respectively. The resource sector took the biggest hit on the JSE, dropping 12.5%. This segment remains the most volatile sector in the market as global demand dynamics change rapidly. China’s PMI data surprised to the upside in February, which could lead to positive price movement going forward. Financials and Industrials ended in the green, rising 2.8% and 1.6%, respectively.

The Rand did not fare well this month, depreciating 5.3% against the Dollar and 2.9% against the Pound.

The SA Reserve Bank (SARB) has hiked interest rates by 375bps to date, while the Fed has had a 450bps hike, contributing to the weakening Rand as the relative return on risk diminishes. This change in interest rate differentials has played out a lot in the last 12 months. As the difference between the real interest rates of two countries changes, capital flows towards the country with the relatively higher real interest rate (in this case, the US). This mechanism affects the foreign exchange markets as people now demand more US Dollars in relation to Rands, increasing the value of the Dollar and decreasing the value of the Rand. With the continuing uncertainty around US inflation and the future path of short-term interest rate hikes, markets have receded into risk-off sentiment, at least in the immediate term. The South African bond market, represented by the All-Bond Index (ALBI), dropped 0.9%. The Composite Inflation-Linked Index (CILI), an inflation-linked bond index, rose 0.45%.

This month’s domestic economic news was largely focused on Finance Minister Enoch Godongwana’s National Budget Speech. The most electrifying topic on the agenda was the state of crisis at the country’s energy utility, Eskom. The state has committed to take on R254 billion worth of Eskom’s debt over the next three years. While this commitment comes with strict guidelines aimed at improving capacity, the ongoing burden it places on the nation’s fiscus is alarming. The current national debt sits at 69% of GDP, and government officials expect this level to keep rising to a peak of 75.1% of GDP by 2025. The cost of servicing national debt is roughly R366 billion, which equates to about 20% of total tax revenue collections. These numbers paint a gloomy picture of the overall national balance sheet in the long term.

Godongwana also addressed the greylisting cloud hanging over the country, stating that 15 of the 20 deficiencies identified by the Financial Action Task Force (FATF), which sets global standards to combat money laundering and the financing of terrorism across national borders, will be resolved through two legislation acts. The remaining five issues can be settled through changes in regulation and practices that do not require legislation. The National Treasury expects to address the deficiencies by January 2025.

Loadshedding continues to dampen economic activity in the country, with PMI numbers down to 48.8, as Eskom implemented power cuts every day this year. Political instability also continues to unsettle investor confidence as concerns around a possible national government coalition have caused headwinds for the economy. A petrol price increase from March will place further pressure on both supply chain logistics and household expenditure. Overall, it has not been a positive month for the South African market and investors will need to remain vigilant and adaptable to navigate increasingly uncertain market conditions ahead. Time will tell whether the measures stated by Godongwana in his Budget will be sufficient to lift SA from greylisting status and whether the aid provided to Eskom will keep the lights on.

All returns above are in ZAR.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices