Market Commentary: February 2019

Here are this month’s highlights: Global markets were largely upbeat in February, as there appeared to be progress in US-Sino relationships, even as those with North Korea worsened. Earnings results boosted sentiment, and the Federal Reserve’s newly dovish tone reassured investors as to the pace of. Emerging Markets were mixed. Of the BRICS, Chinese equities closed nicely higher; Brazil, India and Russia were lower; and South African equities posted a more modest gain.

Market View

Cash

The shortest month of the year saw cash post 55 basis points (bps). The latest data shows that South African inflation declined to 4% in January of 2019, its lowest level since March 2018. This is largely attributable to the ongoing dip in oil prices.

The Budget Speech 2019 delivered few surprises. Consumers will once again see a jump in sin taxes and fuel levies. VAT and income tax rates, however, were left unchanged.

” The latter is regarded as an acknowledgement that taxation levels in South Africa have reached or are near a ceiling.”

Effectively, however, higher earning individuals will still find themselves paying higher tax rates – the personal income tax rate was not adjusted, but neither have the brackets in which the respective rates are applied. As employers implement salary increases in line with inflation, the middle class may find itself creeping into a higher tax bracket.

Bonds

The ALBI declined during February, losing 44 bps, closely matched by inflation-linked bonds decline of 45bps. Global government bonds posted a solid 5.34% return, as investors sought safe haven in uncertain times. The Budget Speech did not deliver any particularly negative surprises, but nor did it gloss over the tough conditions facing the South African economy.

Finance Minister Tito Mboweni, during his speech, made reference to having ‘difficult’ conversations with rating agencies regarding the sovereign ratings outlook. Some analysts fear that the tempered, pragmatic and largely realistic budget has done little to assuage fears of a downgrade by Moody’s in the near future.

“Appetite for South African sovereign bonds therefore took a knock; even as fresh revelations are heard about the extent of state capture at the inquiry.”

The minutes from the January Federal Reserve meeting indicated that the Fed was eyeing an end to the balance sheet run-off, but that they would remain patient. The more dovish tones from all major central banks continue to exert downward pressure on fixed income yields, despite the rebound in risk appetite. The rebound, however, was selective — European assets are largely still hamstrung by the tense Brexit situation and the seemingly strong rise in populism. Additionally, the European Central Bank warned that the slowdown in economic growth in the Eurozone might be deeper and broader than previously thought. The US interest rate curve flattened in February at the short and medium end of the curve, and 10-year rates closed the month higher, at 2.72%.

“European equivalents’ prices also declined. US investment grade and high yield spreads tightened in February.”

Investment grade corporate bond issuance remained strong, the sector seeing its busiest February since 2015. European and US High Yield outperformed developed sovereign bonds, and Emerging Market debt benefited from the return of risk appetite (the J.P Morgan EMBIG yielded 0.6%).

Equity

South African equities managed to post a solid 3.41% for February. Resources and Industrials led gains (up by 9% and 3.5%, respectively). On a sectoral basis, Platinum was the best performing index constituent, with the sub-index closing 30% higher. This is partly attributable to increased sales volumes in Platinum Group Metals (PGM) overall, but profits were also boosted by favourable currency moves and higher commodity prices.

One of the more noteworthy developments in local equity markets during February, was the unbundling of Naspers’ video entertainment business. NPN share-holders received one MultiChoice Group (MCG) share for every NPN share owned. The latter listed on the JSE at R95 and quickly reached R106, trading within a fairly narrow range around this mark since the end of February.

MCG is a Pay TV business that will operate the DSTV and Showmax platforms in South Africa and Africa, as well as the GoTV platform for the additional 49 African countries. The move to unbundle has proved positive for both counters.

“MCG shares have managed to outperform their erstwhile parent, registering an 11% gain for the month, while Naspers itself rallied by just over 6%.”

The expectation is that the unbundling represents a sound strategic move: The South African operations have delivered good growth for several years, but are now fairly mature and key performance is expected to slow down in the medium-term. The African operations, on the other hand, have not yet achieved profitability, though may do so in the medium run.

With the South African currency proving to be one of the worst amongst Emerging Market peers, rand hedging stocks delivered solid returns, with British American Tobacco gaining 4%, despite some concerns around its acquisition of US subsidiary Reynolds.

The 2019 Budget Speech, though closely watched, delivered no real surprises. Market-watchers commented that the Finance Minister delivered a pragmatic and balanced budget, despite highlighting the stark structural challenges the country faces. Minister Mboweni announced that there would be no increase in personal tax rates, but the failure to adjust for bracket creep effectively means that most households will be paying more taxes. As expected, traditional sin taxes increased, as did the Road Accident Fund (RAF) and Fuel Levies.

“Perhaps most concerning to international watchers and domestic investors alike: The state has earmarked R69 billion as relief for beleaguered SOE, Eskom.”

The bailout has rekindled fears about South Africa’s fiscal prudence, as revenue growth still undershoots spending considerably. In its budget review, National Treasury noted the impediments and cut growth forecasts for the next three calendar years. And, this in turn has led to fears that Moody’s may yet downgrade the country’s credit rating.

On the macroeconomic front, National Treasury, despite a tempered view, commented that the economy appeared to be regaining its footing, after nearly a decade of weakness. Indeed, South Africa’s fourth quarter GDP growth was reported early in March and came in above expectations, at 1.4%.

Consumer confidence held steady for the fourth quarter, though initial readings showed that December was a particularly challenging month. Despite festive spending, retailers saw a 4.8% drop in monthly sales and a 1.4% decline from the previous year.

The Absa Manufacturing Purchasing Managers’ Index (PMI) decreased sharply to 46.2 in February from 49.9 in the previous month. This is the sharpest contraction since October 2018, clear evidence of the toll that Eskom’s loadshedding has taken on local businesses. The composite PMI, however, remained in expansionary territory (at 50.20) boosted by a stronger service sector.

Stats SA reported early in February that the latest data showed a slight improvement in employment figures (unemployment ticked 40 bps lower to 27.1%), though this is likely to reflect the seasonal impact of part-time festive hires. An interesting and unintended consequence of the RAF and fuel levy increases in the budget, is that South African jobseekers may be discouraged by the rising costs of road travel.

“National Treasury estimates that gross domestic product (GDP) will expand by 1.5% in 2019, scaling down its estimate from the 1.7% predicted last October.”

It also scaled down its expectation for 2020 and 2021, to 2.1%. These revisions take into account that household income is still in a fragile recovery phase, and that export growth is likely to slow in line with moderating global growth.

The somewhat dour outlook and the reticence of offshore investors to take a view prior to the election, has led to several quality local companies trading at significant discounts. There are therefore ample opportunities for astute and nimble investors to attain quality domestic counters at attractive valuations.

Property

South African listed property gave up gains during February, with the SAPY and ALPI closing 5.7% and 4.7% lower, respectively (in line with the dip in local government bonds). The sector remained under pressure, reflecting the somewhat gloomy outlook for South African growth.

The Resilient Group, which has had a tumultuous year on the corporate governance front, delivered a surprisingly sound operational performance. Analysts predict that the group’s restructuring, which included the unbundling of its long-time stake in Fortress, will feed through into positive mid-term results. Nonetheless, the company and its retail-focused counterparts face a potentially significant headwind in the form of Edcon.

“The under-pressure retailer is unlikely to renew the bulk of its leases, and some of its anchor tenancies will fall by the wayside.”

Global property, represented by the FTSE EPRA/NAREIT Developed Net Rental Index, returned -0.17% in USD, and outperformed the local sector. Indeed, for the year-to-date, in comparable USD terms, most developed markets have outperformed local counterparts.

Year-to-date (YTD) USD returns for North American markets reached 12.36%, while Europe registered 8.84% despite Brexit tension. The SA listed property sector for the YTD in USD terms, is 5.3% higher. The overall figures perhaps hide significant disparities.

“Within North America, for instance, the US housing market has been poor, whereas the Canadian market has made substantial gains.”

Canada was the best performing developed listed real estate market, providing a return of 3.67% for February. On a sector basis too, there are noticeable differences: At the same time as retailers face headwinds from e-commerce, logistics find the changing consumer habits a tailwind.

International Markets

Global equities continued their run in February, albeit at a more muted pace. The likelihood of resolutions to the US/China trade standoff and the UK/Europe Brexit impasse boosted major indices. The MSCI World registered a 3% gain for the month.

“Emerging markets, despite a particularly strong showing from China lagged their developed counterparts at +0.22%.”

US equities ended the month higher, the S&P 500 gaining 3.21% for the month. Sentiment was lifted by the news that the implementation of further tariffs on Chinese goods would be delayed.

Major economic data releases sent mixed signals, still weighed down by the partial government shutdown: December housing starts fell sharply, house prices slowed, retail sales were 1.2% lower and consumer spending dipped. Simultaneously, the latest US Composite PMI improved to 55.8, employment data remained robust and US earnings, despite some tech stock jitters, did not disappoint overall.

“On a sectoral basis, information technology was the strongest performer. Materials and industrials stocks also gained ground as fears of a Chinese slowdown and further trade tensions eased.”

European stocks had a solid month, with Materials and Industrials experiencing a noticeable uptick on easing Chinese growth and US recession fears. The STOXX All Europe outperformed its US counterpart, ending 3.9% higher.

Macroeconomic data was mixed, and differed considerably by country: While the French economy, despite being hamstrung by the Gilet jaunes protests, grew at a better-than-expected rate, the German economy did not manage to grow at all in the last three months of 2018.

While the gauge of consumer confidence in the European Union improved modestly, the Economic Optimism Index dipped in February. The Index aggregates sentiment across five representative sectors: Industrials, Services, Consumer, Retail and Construction.

“France, indeed, proved one of the best performing developed markets, with the French Bourse (the CAC) gaining 4.9%. Peripheral Spain and Italy struggled, amidst political tension.”

The Spanish electorate heads to the polls for the third time in four years and it was confirmed that Italy had slipped into recession in the last quarter of 2018.

The UK bourse ended higher, but lagged its European peers. The FTSE 100 gained 2.29%, boosted by large cap Industrials, Metals and Materials. It is unclear yet whether Britain will be able to avoid a ‘disorderly Brexit’ and meet the 29 March leave date is highly uncertain and the politicking surrounding the process is certainly not engendering business confidence.

Amidst this continued political uncertainty, the Bank of England cut its growth forecast for the year by 50 bps (to 1.2%), which is the largest downward revision since the referendum in 2016. On the macroeconomic front, as on the political front, signals were mixed. The labour market was stronger than expected, with wages growing at a healthy pace and unemployment remaining at a low, and retail sales data beat expectations.

“Conversely, the UK Purchasing Managers’ Index (PMI) fell to a 30-month low.”

Japanese equities were buoyed by improved prospects of a US-China trade deal, and investors appeared to shrug off disappointing macroeconomic data. Japanese manufacturing activity dipped sharply, on lower export orders, off the back of inter alia a stronger yen.

Results season ended mid-February and corporate earnings were largely disappointing. The automobile and tech stocks were hard-hit by the new diesel regulations under the Worldwide harmonised Light Vehicles Test Procedure (WLTP), introduced in September, and the slowdown in smartphone sales, respectively. The nikkei ended the month 3% higher.new Worldwide harmonized Light vehicles Test Procedure (WLTP) diesel regulations introduced in September

Chinese equities surged ahead, lifting the broader Emerging Markets and BRICs Index, despite noticeable weakness in fellow heavyweights Brazil, India and Russia.

“Chinese A-shares gained over 15%, and the MSCI China was 3% higher. The main performance driver, once again, was the apparent improvement in Sino-US relations, with substantial progress reportedly made on a trade-deal.”

Macroeconomic data, however, was mixed: Exports (despite trade tension) beat estimates, but the official PMI fell to 49.2, well into contractionary territory. As much of the movement in Chinese equities appears to be sentiment-driven, interpretation of the macroeconomic data carries substantial weight. The case in point: the contraction in manufacturing was seen as a signal that the central government will continue to roll out measures to fuel the slowing economic growth engine, thereby bolstering risk-on sentiment.

Equity markets in China were also boosted by the news that MSCI world increased the weighting of China-listed shares in the MSCI Emerging Market Index. Over the course of six months (beginning in May) the weight will go from 0.72% to 3.3%.

Led by China, Emerging Asia was therefore the star performer amongst its peers. Minnow Taiwan did well, but South Korea was hurt by the breakdown in talks between North Korea and the US. Indian equities performed poorly, amidst escalating tension with Pakistan and the SENSEX ended 1% lower.

After a strong start to the year, Latin American markets lost ground. The Brazilian index closed nearly 2% lower, as investors await clarity on pension reform. President, Jair Bolsonaro, has proposed a multi-pronged pension overhaul, which aims to save $270 billion over a decade. Mexican markets were also lower, unsettled by concerns that the state-owned oil company PEMEX, with debt of over $100 billion, would need additional government support.

“In Emerging Europe Middle East and Africa (EMEA), year-to-date gains were pared back by weak performances in Turkey, Russia and South Africa.”

Turkish stocks, after initial optimism about progress with regard to inflation and currency stability, dipped sharply at month-end. Russian markets failed to capitalise on higher oil prices, and the main board dipped by just over 1.4% in local currency terms.

Within African markets, unsurprisingly, Nigerian equities outperformed peers, with the NSE30 up nearly 5% in local currency terms. Overall the MSCI EFM ex SA gained 2.84%, beating the broader EM index (+0.22%).

Currencies and Commodities

In currencies, the USD index was 0.6% higher. Sterling gained 1.2% against the USD, on renewed hope that the UK would avoid a no-deal Brexit.

“Emerging Market currencies, however, were mainly lower. The most notable losses were in the South African rand (-5.9%), the Turkish lira (-3.3%) and the Brazilian real (-3%).”

In commodities, the overall GSCI index was up by 3.8% in February, led by the Energy sector’s consolidation of its excellent year-to-date performance. The subsector gained a further 7.2%, followed by Industrial Metals at 3.1%. Precious metals were softer (-0.8%), with gold down by 0.5%.

Agricultural commodities were the poorest performer – closing 5% lower overall and led by losses in wheat and coffee. Analysts predict that coffee prices will trend significantly higher in 2019. This is partly due to changing weather conditions, which blight the African crop and partly due to the fact that Brazil, one of the largest producers, is due to have an ‘off-season’.

Performance

World Market Indices Performance

Monthly return of major indices

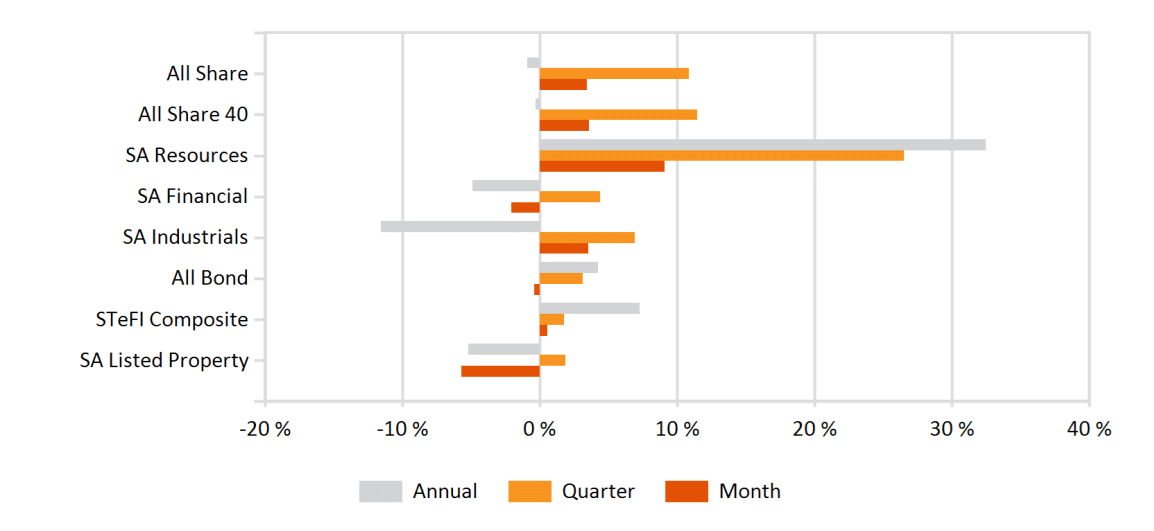

Local Market Indices Performance

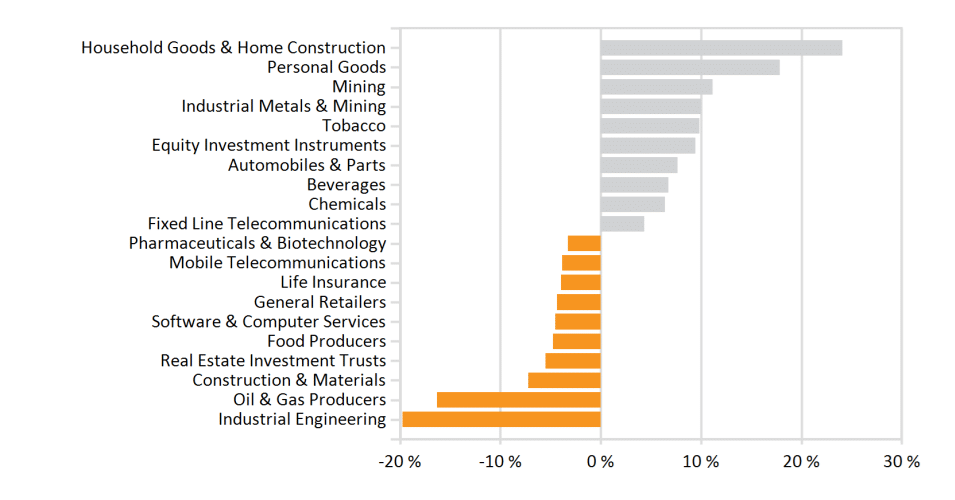

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance