Market Commentary: February 2017

Market View

Market View

Cash

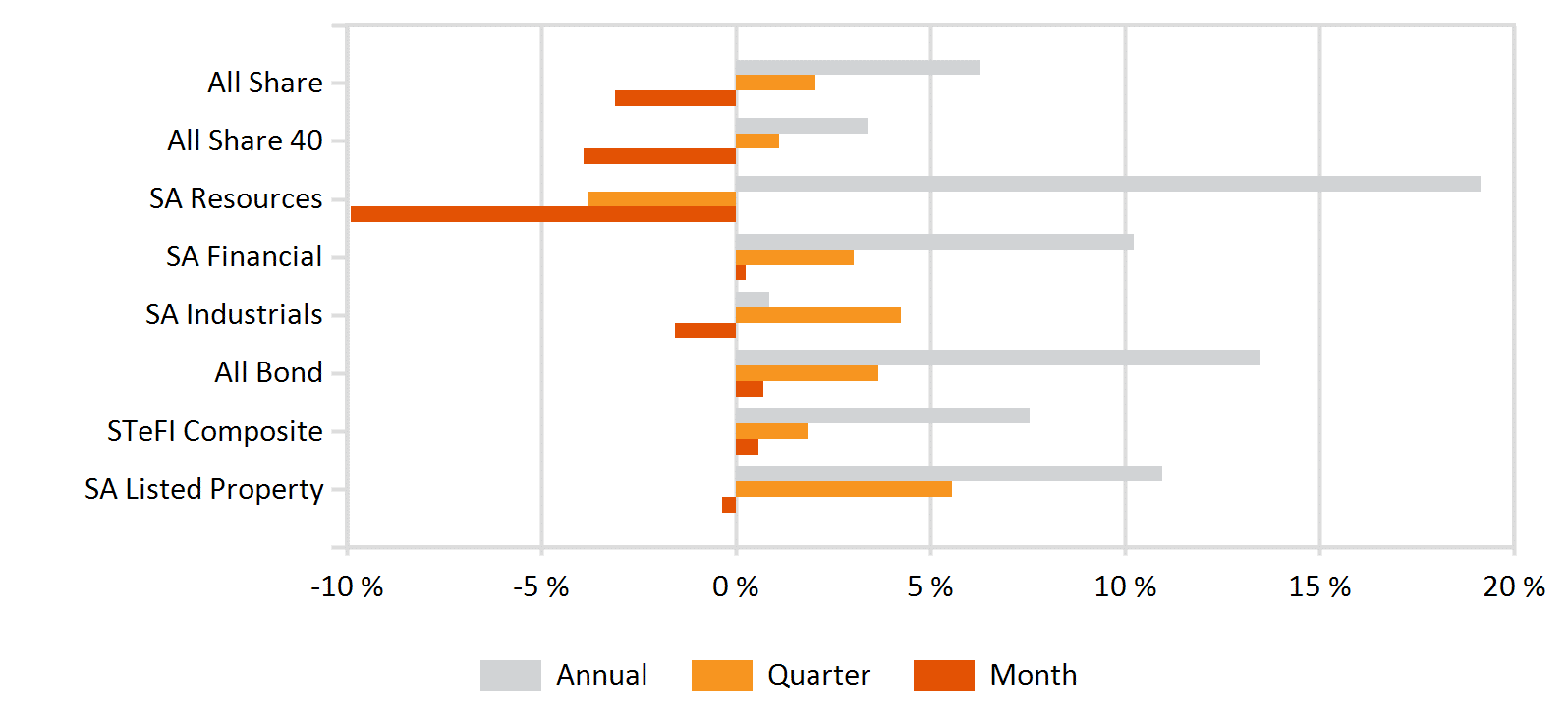

South Africa’s domestic inflationary pressure abated somewhat during January 2017, reaching 6.6% year-on-year in that month after an unexpected rapid 6.8% gain in December 2016. Easing food price pressure, a stronger rand (lower imported inflation) and moderating transport costs boosted local consumer’s spending power. However, Producer Price Inflation ticked up at a more rapid pace, creating the prospect for a lagged pass-through effect in the coming months. The details of the budget, which included a 30% per litre increase in the fuel levy as well as a rise in sin-taxes on alcohol and tobacco, are likely to put a sizeable and immediate dent in pockets. Nonetheless, Treasury’s outlook provides for inflation to moderate to an average of 5.7% in 2017 (down from 6.4% in 2016). Some analysts predict rate cuts as early as the next Monetary Policy Committee meeting, but political uncertainty and a still-shaky confidence mean that risks remain to the upside. The South African Reserve Bank is therefore likely to maintain its relatively dovish stance, with inflation likely to hover near the upper-band of the Bank’s target range over the course of 2017. Cash (STeFI Returns) earned a modest 0.57% for February.

Bonds

Fixed Income assets were mixed in February: The Barclays ILB index edged -0.07% lower, but the ALBI gained 0.71% for February. The Budget delivered few surprises, and Finance Minister Gordhan’s careful balancing act has been welcomed by most investors. The lingering unease from an incident-filled State of the Nation Address, and ongoing political in-fighting, however, nearly overshadowed the prudent (albeit not necessarily popular) budget takeaways.

Property

SA listed property was -0.36% lower in February, in a notable turnaround from recent months. The historic yield for the SAPY ticked 6bps higher, to 6.59%. Year-to-date, the under-pressure listed property sector has underperformed domestic bonds (1.26% versus 2.08%) and barely outperformed Cash (1.22%). The start of February’s results season has been largely positive. The largest listed property company, Growthpoint, reported DPS growth of 6.1%, but remains concerned about negative reversions to its office portfolio. Overall, management teams remained negative on local fundamentals. The listed space is, nonetheless, likely to see increasing pressure, and opportunities in unlisted property may offer a better risk-return profile. A number of companies are turning to offshore diversification, but this requires a prudent and measured approach, with some firms overestimating potential rental returns or missing market nuances. Listed property investors, therefore, increasingly need to be keenly aware of effective foreign exposure, political risks and interest-rate sensitivity.

Equity

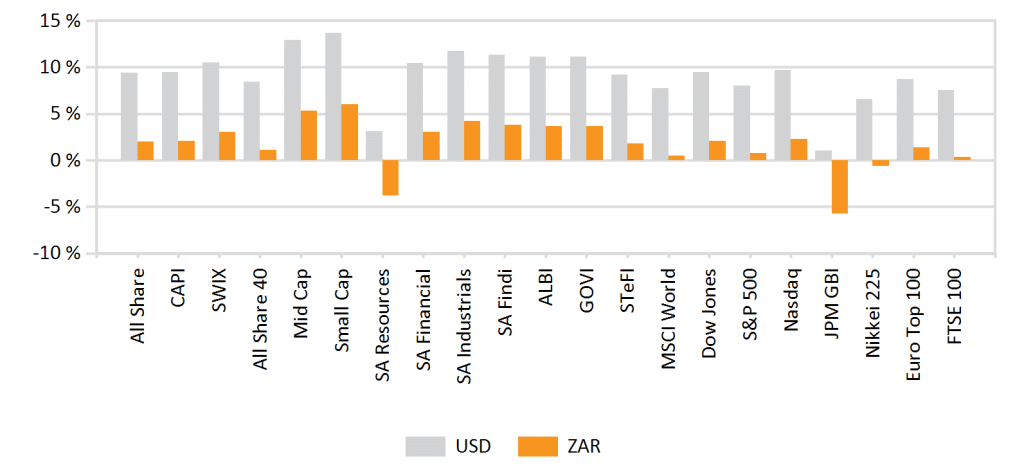

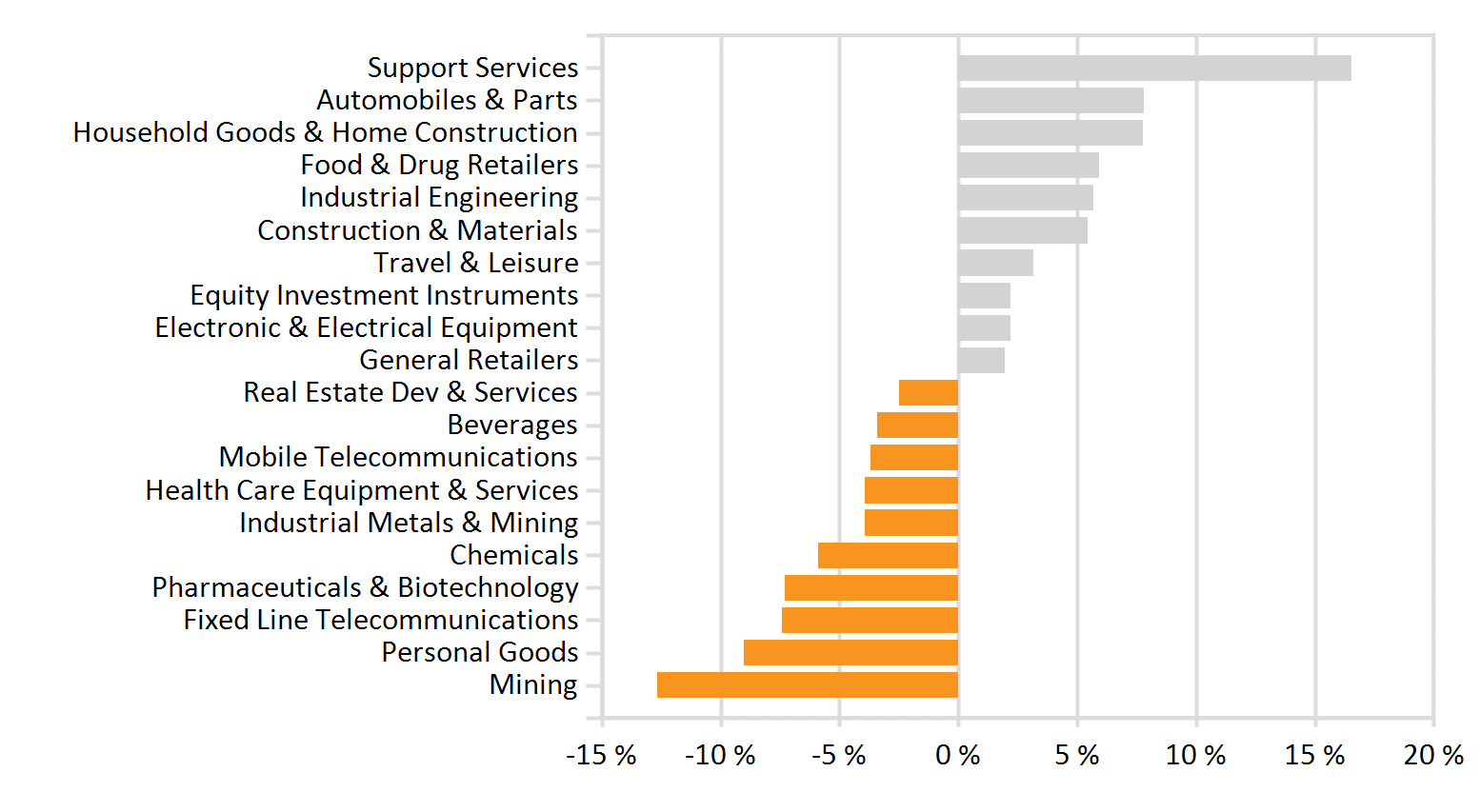

The South African All Share Index gave up -3.11% over the course of February, bucking the broadly upbeat global trend. Large caps, industrials and resource shares were under pressure. The resource sector nearly erased prior month gains, losing 9.91% despite improved commodity prices. Precious metal prices rose an average of 3.50% to 3.9%, but against a backdrop of tough domestic labour conditions, political uncertainty, and a stronger Rand, local mining companies struggled to capitalise. As Iron Ore and Copper Prices experienced significant weakness, Diversified Miners such as BHP Billiton were not spared the fall-out, paring prior month gains. Simultaneously, confidence in developed market prospects improved – despite political sensitivities, and some uncertainty around President Trump’s policies. South African stocks consequently underperformed developed and emerging peers, as equity investors rotated toward the US, China and other Emerging Markets (MSCI World gained 2.77% and MSCI EM rose 3.06%, led by China). The State of the Nation Address, as anticipated, fuelled mid-month investor jitters. The prudent Budget outlined by the Finance Minister went some way to assuaging ratings fears, but a June reprieve is far from a foregone conclusion. The South African equity market has thus far seen a resurgence in long-term value counters, with resources the year-to-date winner. Simultaneously, opportunistic investors unlocked significant pockets of opportunity in other sectors in SA Inc (eg. financials). Agility in rotating between sectors and a well-diversified equity exposure will be essential if investors are to take advantage of current market circumstances.

International Markets

Developed markets were resilient in February, encouraged by widespread improvements in global economic data, and the MSCI World ended the month 2.7% higher. Momentum faltered somewhat at month-end as doubts on the speed of policy reforms (including regarding tax policy) in the US, populist politics in Europe, and Brexit wrangling weighed on sentiment. Nonetheless, European markets were boosted by positive growth and inflation data: Manufacturing in the zone remains in expansionary territory, with the flash composite purchasing managers’ index 1.6 points higher in February. Business sentiment is positive, and investors are reassured by the stability of the largest economy (Germany), despite political tension. The continued improvements in peripherals (Italy and Spain) have also supported consumer sentiment, and consumer staples improved to be one of the month’s top gainers. European financials underperformed, as the merger between the LSE and Deutsche Borse is under scrutiny. The ECB has maintained a dovish tone of late. European equity funds, in the last week of February, experienced the largest inflows in more than a year. The Eurostoxx index ended 2.39% higher. Despite ongoing Brexit tension, UK markets regained some oomph after a lacklustre January, and the FTSE rose by 3.1%. The Bank of England revised its growth projections upward for 2017, to 2.0% from 1.4%, bolstering investor sentiment. Domestically focused firms have continued to do well, with notable strength in UK housebuilders and financials. Simultaneously, sterling weakness has been a tailwind to export oriented firms.

US indices maintained their upward trend, and the S&P500 index closed 4.0% higher. US employment and manufacturing data continues to improve, and the Federal Reserve Bank has not ruled out a rate-hike in March. The details of President Trump’s tax plan are not yet clear. Measures aimed at streamlining the regulatory environment, however, have already seen a jump in pharmaceutical and financial stocks. Japanese equities closed 0.9% higher. December’s corporate earnings reporting season (concluding in February) ended on an upbeat note, with the majority of earnings surprising to the upside. A somewhat weaker Yen has also boosted the prospects for export-oriented firms. Chinese stocks were boosted by improved growth data from the world’s second largest economy: the Official PMI was firm at 51.3 for January and trade data trumped expectations. Equities continue to mop up cash, as additional capital controls to curb hot money flows and measures to address a potential property bubble were put in place. The People’s Bank of China, in the first such move since 2013, hiked short-term interest rates by 10bps. Investors will keep a wary eye on any future tightening, and on how well the Bank communicates its intentions (historically, the Bank has managed to surprise markets). Emerging markets outperformed their developed peers, benefiting from relative currency strength and an uptick in commodities.

Russian markets, however, proved an exception, as depressed energy prices weighed on the bourse. Geopolitical tension between the US and Russia remains elevated. Indeed, diplomatic and policy repercussions are likely to guide markets in the near term, as President Trump solidifies his US-centric economic plan, elections play out in Europe and Brexit necessitates renegotiation of trade-arrangements. An understanding of potential spill-overs, however, will be essential in building a well-diversified portfolio with a judicious mix of developed and emerging market exposure. Major global markets saw some evidence of inflation ticking up, against a backdrop of modest economic recovery, consequently slowing some of the recent upward momentum in developed market sovereign bond yields. Reflationary trade is likely to become more pronounced in the coming months, as the first rounds of finance and monetary policy announcements conclude and provide guidance. US bond investors are still weighing the minutes of the Fed meeting as well as President Trump’s fiscal plans and have shied away from shorter-dated US Treasuries.

European political uncertainty, however, has bolstered the demand for safer German and UK bonds with prices and yield moving in opposite directions. The yield on 10-year Bunds dropped from 0.44% to 0.21%, while the UK Gilt equivalent yield dropped by 27bps to 1.15%. Overall, the search for yield sees the more risky fixed income favoured: EM Bonds outperformed developed and South African counterparts, with the JPMorgan Emerging Markets Government Bond Index gaining 1.8%. Similarly, High Yield issuances outperformed Investment Grade and Corporate bond. Global high yield rose an average of 1.5%, versus an advance of 1.2% in the investment grade BoFA ML Global Corporate Bond Index.

Currency

The US Dollar was mixed against a basket of major currencies, closing 2% higher against the Euro and 1.6% higher against the British Pound. The Yen was nearly flat, in a boon to beleaguered Japanese export firms. A number of Emerging Market currencies, however, were notably improved: Asian currency market were generally buoyant; the Brazilian Real and Russian Rouble closed 1.2% and 3.1% higher; some bounce returned to the demoralised Mexican Peso (3.6%) and Turkish Lira (3.49%). African currencies were mixed: The Naira, as market participants have been anticipating, was allowed to depreciate by -1.12% against the USD, but availability remains restricted, and the spread between the Black Market Rate (about 450 per USD) and Official Rate (310) remains wide; The Ghanaian Cedi was one of the poorest performing currencies globally, at -7.06%; The Rand, despite jitters around the State of the Nation Address, had another solid month, appreciating 2.64% against the dollar over the course of February.