Market Commentary: December 2020

Global Market Themes: Global equities continue risk-on rally, despite resurgent COVID-19 Emerging Markets climb as commodities shine, Chinese GDP growth accelerates US markets shrug off election fall-out Extension of CARES Act benefits COVID-19 vaccine roll-out as Europe battles second wave Brexit concludes with a fizzle SA Market Themes: Mutation in COVID-19 fuels contagion and higher death tolls President Cyril Ramaphosa places South Africa on Adjusted Alert Level 3 Lockdown Alcohol companies take on renewed ban on liquor sales Additional restrictions weigh on consumer-, domestic- and travel-and-tourism sectors SA stocks benefit from global risk-on sentiment, despite challenging domestic fundamentals

Market View

Global Market Themes

Global equities continued their strong run during December, as investors remained cautiously optimistic regarding the roll-out of recently developed COVID-19 vaccines. The MSCI World closed the month 4.2% higher, bringing its 2020 gains to 15.9%. Emerging Markets (EM) outshone developed peers (DM), with the MSCI EM registering a 7.3% gain. In 2020, EM outstripped DM by nearly 3%. Accommodative global monetary policy and record low interest rates have fuelled the search for yield.

The recent victory (albeit disputed) of United States (US) President-Elect Joe Biden has also been a boon to EM, as diplomatic relations are likely to be less combative under the incoming leader. Counterintuitively, investors also reacted positively to a divided Congress. It is felt that the division may prevent further tax hikes and the tightening of regulation for technology companies and the healthcare sector.

“Incumbent President Donald Trump, however, is not going quietly. He continued to contest the election results, fuelling civil unrest fears. Investors largely shrugged off the political noise, with the S&P500 gaining 3.8% for December (and 18.4% for the year).”

Sentiment was no doubt boosted by the fact that Congress finally agreed on a pandemic relief plan. The agreement will see many of the CARES Act support measures extended, including more generous unemployment benefits and the renewal of direct payments to struggling households. This is regarded as an essential step in the US economic recovery, as downtrodden consumer spending, a big driver of economic growth, was potentially at risk without further government support.

Strong domestic consumer spending is a part of the reason for China’s resurgent GDP growth. Despite being seen as the country first hit by the pandemic, GDP growth accelerated steadily throughout the year, advancing 4.9% in the third quarter. China will end the year in positive territory, having recouped the 6.8% contraction experienced in the first quarter. Retail trade rose by 5% year-on-year in November and the consumer confidence gauge is nearly back at pre-pandemic highs.

“Chinese equities did well during December, with the MSCI China gaining 2.7% and the China A Onshore equivalent closing 6.2% higher, continuing their phenomenal performance. The indices were 29.4% and 40% closed 2020 higher, respectively.”

Risk-on sentiment and rapidly rising commodity prices boosted EM elsewhere. Russian markets were 5.8% higher in local currency terms in December, while the Brazilian bourse gained 9.3%. Oil prices strengthened by 8.2% during the month, precious metals provided solid gains, and iron ore prices continued their stellar rise. Iron ore closed 25.6% higher in December, and 92.7% higher for the year.

In Europe, equity markets posted gains as several countries started to roll out vaccination programmes. The STOXX All Europe closed 3% higher. The European Central Bank (ECB) did test support for major European indices by downwardly revising growth forecasts for 2021, citing the renewed lockdowns and slower-than-anticipated economic recovery. Conversely, sentiment was boosted by the ECB’s extension of its pandemic emergency purchase programme (PEPP), with the bank announcing a further Euro 500bn commitment. The UK bourse has had a tumultuous year, grappling with the unrelenting pandemic and finalising the Brexit process. The FTSE100 experienced its worst year since 2008, but closed December higher. Most Britons spent the festive season confined to their homes, as the UK entered a tiered lockdown.

“Brexit finally occurred on the last day of the year, and, given the current economic climate, the UK left the EU with a fizzle, rather than a bang. On 30 December, the House of Commons voted 521 for and 73 against the agreement and the Bill was passed by the House of Lords. The deal, which was only struck at the 11th hour (on 24 December), contains new rules on how the UK and the EU will live, trade and work together. “

Some of the key points include that Northern Ireland, long a sticking point, will continue to follow many of the EU’s rules to avoid a hardening of its border with the Republic of Ireland. The UK is now able to negotiate its own bilateral trade agreements and is in talks with the US, Australia and New Zealand. UK nationals will need a visa if they want to stay in the EU for more than 90 days in a 180-day period, bringing to an end an era of largely free labour movement between Britain and the rest of Europe. British companies are likely to face more hurdles in the trade of their goods, although at present additional tariff measures appear to be on hold. Pundits have expressed their belief, that even though the compromises contained in the deal largely favour the EU, at least Brexit headlines will be a thing of the past.

South African Market Themes

In South Africa, the news was dominated by the rapid rise in COVID-19 infections and related deaths for the month. A mutated variant of the virus, which appears to be more contagious and have a higher fatality rate, was identified as the main cause of this unsettling trend. As the numbers continued to climb, President Cyril Ramaphosa addressed the nation on 28 December, announcing that the country would enter into an adjusted Alert Level 3 Lockdown. Some of the restrictions include an immediate ban on alcohol sales, the curtailment of businesses’ operating hours, beach and public park closures, banning social gatherings and the imposition of a 9pm to 6am curfew.

“Opposition parties and the public were vocal in their criticism of the government’s management of the procurement and distribution of COVID-19 vaccine process.”

The man-in-the-street was largely left guessing as to when a vaccine would arrive, and the lack of clarity and apparent delays in implementation have left the public frustrated. At a time when public cooperation is most required, government and the country can ill afford such ill-will. Another contentious point was the alcohol sales ban, with the Liquor Traders’ Association and South African Breweries intending to challenge the matter in court, citing large-scale loss of livelihoods.

Investors on the local bourse were fairly bullish, against a backdrop of rising global risk-appetite and commodity strength. The South African All Share Index ended the month 4.2% higher, led by resurgent resources at 9.4%. Amongst the biggest climbers in the resource subsector, diversified miner BHP Billiton recorded a solid 9% return, while Kumba Iron Ore saw its share price rocket by over 18%.

“Local economic data was not all downbeat. StatsSA published its latest GDP growth figures at the beginning of the month, showing that the economy grew by 66% quarter-on-quarter. The quarter’s 13.5% heralded the first positive number of four quarters of negative growth, signalling that the country may be emerging from recession. However, analysts have warned that these figures need to be seen in the light of a very depressed starting base.”

For example, the restaurant sector registered 7000% growth for this period. They went from being effectively non-operational at rock-bottom, to suddenly reopening for business, which has a massive base-effect. And, the subsequent djusted Level 3 regulations could scupper some of the progress made thus far. The economy is still far from its 2019 levels, and it is estimated that it will only reach those levels in 2024, if subsequent developments do not derail progress.

The rand strengthened against the dollar, trading at 14.66 per USD at 31 December, a low for the year. Economist have warned, however, that the currency remains vulnerable to volatility, especially amidst concerns about global growth and the country-specific credit risk. We have yet to see progress in the reduction of South Africa’s high debt burden, and the roll-out of the vaccine will place a further burden on the fiscus.

Performance

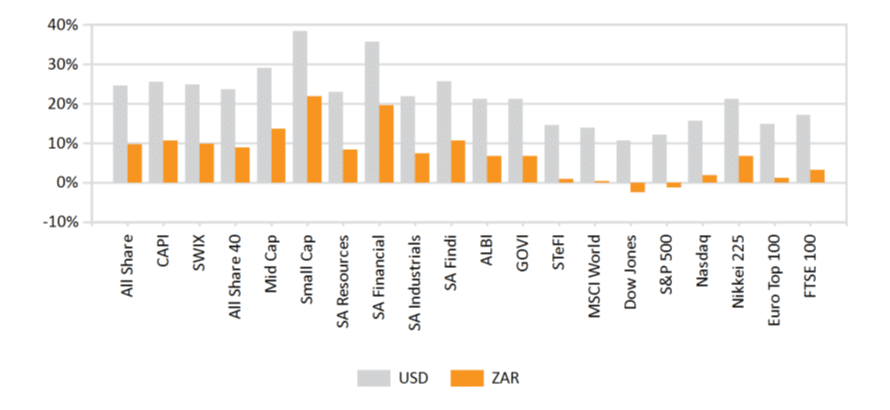

World Market Indices Performance

Monthly return of major indices

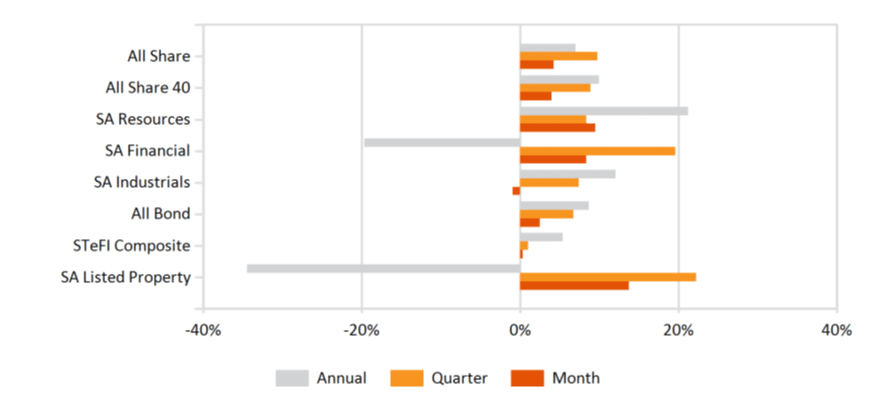

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

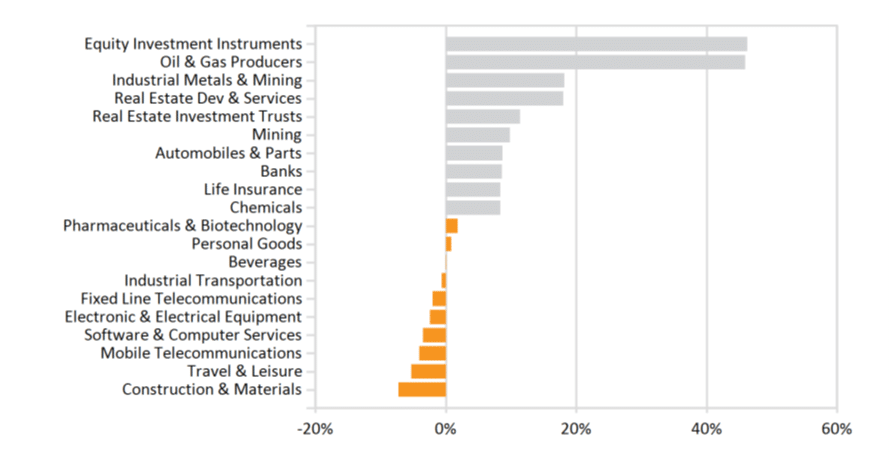

Monthly Industry Performance