Market Commentary: December 2019

Here are this month’s highlights: Inflation is expected to remain the same going into 2020. However, consumers can expect increasing electricity, water and fuel prices in the new year. Local bond markets ticked up and local equities posted decent gains with SA Inc stocks trading at significant discounts, creating opportunities for astute investors. The South African listed property sector was the worst performing asset class. Emerging Markets ended the year on a positive note, while the US and China reached a phase one trade deal. The rand proved resilient despite the Eskom-induced gloom.

Market View

Cash

Cash provided a 60-basis point return for December 2019. Inflation decreased to 3.6% in November 2019, its lowest rate since December 2010. Transport prices were lower, while price increases for food and non-alcoholic beverages eased, boding well for consumers in the festive season.

“The South African Reserve Bank’s expectations for inflation in 2020 remains unchanged and the risks to the medium-term inflation outlook were seen to be balanced.”

On the one hand, demand side pressures remained muted, with food price inflation in particular being slightly lower. On the other hand, there is still upward pressure from higher wages, and rising electricity, water and fuel prices. Petrol prices rose modestly in December, rising by 22 cents per litre, while Diesel prices decreased by 15 cents to 16 cents.

Bonds

Local bond markets ticked up in December, with the ALBI gaining 1.89% and Inflation Linked Bonds (ILBs) 0.89% higher. Domestic bonds were therefore well ahead of global peers in local currency terms, as the Barcap GABI lost 4% in ZAR and gained a modest 58 bps in USD. South Africa’s credit rating has been close to junk status from all three ratings agencies since Moody’s affirmed its negative outlook in August 2019.

“The latest bout of loadshedding from power utility Eskom is seen by many analysts to be the straw that breaks the camel’s back.”

Global fixed income markets continued their strong showing in December. The safety play, however, ebbed in importance as the US and China reached a trade deal and moderately improved economic data supported risk-on sentiment. Demand for safe-haven government bonds therefore declined, and yields rose. The US 10-year yield ended the year at 1.92% and the yield curve steepened, as shorter dated yields fell.

German, Spanish and French 10-year yields rose by between 30 bps and 40 bps, lifting French government bonds back into positive territory. UK gilts ended the year at 0.82%, as the UK election ended in a resounding victory for the Conservative Party. The Bank of England’s Monetary Policy Committee voted to hold the interest rate steady at 0.75% and Andrew Bailey was appointed as Governor Mark Carney’s successor.

The Bank of Japan welcomed its government’s announcement of a significant supplementary budget, particularly focused on reconstruction, as it signals a two-pronged approach to stimulating growth. It has left its asset purchase programme unchanged.

“Corporate bonds did well and high yield bond issuance outperformed, capping off a good year.”

With oil and commodity prices strengthening, High Yield and Emerging Market (EM) debt performed well overall and ended the year ahead of safer fixed income instruments, both recording a 14.4% gain for 2019. EM local currency bonds did particularly well in December, as local currencies notched gains against the dollar.

Equity

Local equities posted decent gains, with the SWIX ending 3.68% higher. Resources were the best performing of the sub-indices as global commodity prices ticked up. Industrials and Financials, although lagging, still managed to generate positive returns.

The South African economy’s outlook took a turn for the worse, post Eskom’s most recent round of crippling loadshedding.

“The World Bank, in the first week of January 2020, became the first international institution to downgrade its growth forecasts for the country.”

The World Bank expects the economy to expand by a meagre 0.9% in 2020, specifically citing electricity supply concerns. The continued power outages and the uncertainty surrounding State Owned Entities is dragging on an economy that is already in its longest downward cycle since 1945. Finance Minister Tito Mboweni, at the same time, has warned that government’s failure to ramp up structural reforms will lead to the country losing its last remaining investment-grade credit rating from Moody’s.

Somewhat perversely, macroeconomic data does not yet reflect the full extent of the country’s woes. The RMB/BER business confidence index showed a quarterly increase for the first time in two years, with sentiment improving amongst constructors, manufacturers and retailers. Analysts note, however, that the gauge was compiled prior to the newest round of loadshedding, and that (at such low levels) it is still consistent with an economy plodding along at near-recessionary levels. Underscoring this fact, the composite PMI dipped further into contractionary territory, industrial production decreased, and consumer confidence measures declined.

“With global commodity prices improving, resource companies were amongst the biggest gainers.”

Sibanye gained an impressive 24% during the month, even as the mine faced the difficult process of retrenching workers from its Marikana operations. Harmony and Anglogold gained 13% and 15%, respectively, and platinum miners Northam and Angloplat also notched decent gains.

The share price of Sasol, after months in the doldrums, rose by an impressive 15%. This came off positive news regarding its Lake Charles Chemical Project in the US – the LCCP Ethane Cracker, was operating at only 50% – 60% capacity and is due to significantly increase production after the replacement of a key component.

Financial stocks were lacklustre, though market darling Capitec still managed a 2% gain for the month. Naspers and spin-off Prosus boosted the index, partly as a result of the impact of easing Sino-US tensions on TenCent.

South African investors may be in for a rather bumpy start to the year, with little positive news on the horizon. This means, however, that several high-quality SA Inc stocks are trading at significant discounts, and this creates plenty of opportunity for astute investors.

Property

The South African listed property sector ended in the red for December 2019, making it the worst performing local asset class. The narrowly focused SAPY ended 2% lower, while its offshore component lifted the ALPI to -1%.

“Given the poor macroeconomic outlook, valuers have started to adjust their expectations for rental growth in the residential, office and retail sectors lower.”

With household finances under pressure and business confidence at low levels, the focus is on affordability, value for money and cost-saving.

In the rental property sector, this means a higher demand for rentals which have lower rates and levies and easy access to key transport hubs. The residential sector was relatively stable, with a demographic dividend from a growing young and upwardly mobile population. This includes first-time buyers, who are finding it easier to obtain bank finance and are benefiting from lower interest rates. Until overall economic sentiment improves, however, it will remain a buyers’ market and turnover is likely to be low.

Within the office sector, vacancies are high at about 11.2% according to the latest South African Property Owners’ Association’s (SAPOA) reports. Office rentals remain the worst performer among traditional property rates, including retail and industrial. Retail sales, nonetheless, were under severe pressure, and dwindling foot-traffic and trading densities continued to exert downward pressure on the sector. Landlords are bearing the brunt, as tenants negotiate shorter term leases and lower escalation rates. The industrial subsector was the most resilient, with demand for modern logistics and distribution warehouses still ticking up. As long as e-commerce and online sales remain buoyant, demand is likely to remain stable.

“Two interesting trends that have reached South African shores are the rise of shared working spaces and the conversion of office stock to alternative uses such as student housing, residential and self-storage.”

The FTSE EPRA/NAREIT Developed Net Rental Index was also lacklustre during December, yielding a muted 0.21% (in USD). The UK, post-election and with less likelihood of a hard Brexit, was one of the best performing markets. It recorded 6.9% in USD terms with UK housing prices growing at their fastest since 2013, and office space seeing a nice recovery, particularly amongst financial services tenants. European markets followed their UK counterparts and gained 4.9% in USD.

The Japanese market was the worst performer in December, with a -1.35% loss. This may reflect a degree of correction, as values had soared in the run-up to and during the Rugby World Cup. Analysts are to some extent pricing in that a similar trend will play out this year as the 2020 Olympic Games approach.

While political developments undoubtedly had an impact on global property prices, Hong Kong was a surprise package. House prices remain stubbornly high in the face of the ongoing protests. Recent poll results, however, suggest that a drop is imminent, and that luxury residential property and the high street are likely to bear the brunt.

Overall, nonetheless, the listed property sector looks attractively priced relative to bonds, with pockets of value offering substantial returns for astute investors.

International Markets

Risk-on sentiment rallied during December, as the US and China reached a phase one trade deal that was signed on 15 January 2020. The MSCI World gained 3% in USD, but developed markets were easily outpaced by their Emerging Market counterparts: The MSCI EM gained 7.4%, the MSCI BRIC ticked up to 7.7% and Chinese equities notched more than 8.3%. The MSCI EFM Africa ex SA was somewhat more muted, but posted a solid 4.9% gain in USD.

“US stocks closed out their best year since 2013, led by huge gains in technology stocks.”

The S&P500 was 3% higher for the month, despite some mixed economic data. Business confidence has dipped, with the ISM Manufacturing Purchasing Managers’ Index (PMI) falling to its lowest since June 2009, and remaining firmly in contractionary territory. Global trade was the most significant cross-industry issue and analysts therefore expect that several industry sectors will recover off the back of the phase one deal.

The ISM Non-Manufacturing PMI beat market forecasts, as the service sector expanded at the fastest pace in four months. Industrial production also improved on a month-on-month basis, as November numbers reflected the end of a protracted strike at General Motors. Data from the US Department of Labour showed that 266 000 new jobs were added in November and average hourly earnings rose by 3.1% from 2018. Consumer confidence measures were higher going into a usually-buoyant festive spending season, and retail sales were boosted by a surge in online purchases. On a sectoral basis energy and tech stocks led gains. A month-long bounce-back in the price of oil saw Brent crude reaching its highest level since mid-September.

“The outcome of the UK’s December general election, a resounding victory for the Conservative Party, yielded an improvement in overall investor sentiment.”

The FTSE 100 gained 2.7% for the month. The confirmation of a majority government means that the UK could pass a European Union withdrawal bill that activated a transition period during which very little will change. The period, however, only extends until the end of 2020, leaving the government with not much time to agree a free trade deal to avoid a hard Brexit. Nonetheless, it has removed some of the uncertainty that was plaguing market participants. The impact has been reflected most noticeably in UK manufacturing data, which slumped to a seven-year low (at 47.5 in December as measured by the IHS Markit/CIPS Manufacturing PMI).

The Composite PMI was boosted somewhat by a stabilisation of service sector activity, but remained in contractionary territory. Consumer sentiment improved from its lowest level in seven years, but failed to break into positive territory.

“In company news, two large market players revealed errors in their accounts.”

Luxury clothing retail company Ted Baker revealed a GBP 25 million overstatement in its inventory, and subsequently issued a profit warning and the resignation of its Chairman and CEO; Advertising firm M&C Saatchi, after an independent accounting review revealed a GBP 11.6 million error, similarly issued a profit warning and announced a slew of resignations from its board of directors.

The Stoxx All Europe gained 2.46% for the month, despite mixed economic data. Aside from the end to the trade war and Brexit woes being in sight, politics were also at play in the Eurozone: In Spain there is still some uncertainty as to whether the Socialist Party and Unidas Podemos will form a coalition government, bringing to an end months of deadlock.

In Germany, the Berlin political establishment was somewhat shaken by the election of left-leaning co-leaders Norbert Walther-Borjans and Saskia Esken at the helm of the Social Democrats (SDP). They are likely to push for a renegotiation of the alliance between the Social Democrats and Angela Merkel’s Christian Democrats. On the positive front, the SDP leaders are calling for a rise in spending on infrastructure and a stimulus package to help the German economy through its current weak patch. French protesters have also continued to agitate in response to President Emmanuel Macron’s planned pension reforms, set (inter alia) to increase the retirement age for many French workers. On the macroeconomic front, the composite PMI in the Eurozone has improved slightly, but measures for European Union-wide business confidence deteriorated, as did consumer confidence. The experience diverged across economies: German business confidence improved to a three-month high, but manufacturing contracted for the 12th consecutive month. The GfK consumer confidence indicator in the powerhouse also edged down heading into the new year. German unemployment also rose more than expected, reflecting the recessionary manufacturing environment. Spanish and Italian manufacturing PMIs have also dipped, even as consumer confidence measures ticked up. Improvements in the expectations of future conditions are likely a reflection of the decreasing likelihood of a hard Brexit and easing of trade-war tensions, boding well for exporters. On a sectoral basis, financials, energy and materials made the biggest gains. Communication and consumer staples, the more defensive sectors lagged.

Japanese markets ended the month higher, with the Nikkei closing 1.73% higher in local currency terms. The index had its best year-end close in 29 years. Technology and financial stocks were amongst the biggest gainers during December.

On the macroeconomic front, Japanese data was mixed. Consumer confidence and retail spending rose month-on-month, but business confidence waned. The Bank of Japan’s Tankan index for big manufacturers’ sentiment fell to a six-year low, and the Jibun Bank Flash Japan Composite PMI was revised lower to 48.6 in December 2019, signalling the sharpest contraction in private sector business activity in over five years. One of the key problems facing the economy is its aging demographic and the cost of supporting a rising grey population. It is estimated that over 12.4% of the Japanese workforce is 65 years or older, which is the largest percentage of retirement-eligible workers ever.

“In addition, the Welfare Ministry estimates that the number of births has declined to below 900 000 in 2019, the lowest since 1899 and that the country’s indigenous population is shrinking by 500 000 annually – roughly one person per minute.”

Chinese equities had a bumper December: MSCI China A and MSCI China A Onshore shares closed 8.3% higher in US dollar terms. The US and China reached a phase one trade deal in December, with President Donald Trump ending the year with a tweet confirming that the deal would be signed on 15 January 2020. Some details are not yet in the public domain, but under the outline phase one agreement, the US would reduce existing tariffs on USD 120 billion of Chinese goods from 15% to 7.5% and China would increase purchases of US agricultural goods.

Economic data was mixed, but largely supportive of the positive investor sentiment. The Caixin China General Composite PMI dipped, but remained in positive territory. Manufacturing growth slowed to a three-month low, and the services sector expanded at a softer rate than in November. Chinese consumers remained upbeat, with retail sales ticking nicely higher in November 2019. The positive numbers were helped by record-breaking Singles Day Sales on 11 November, with Alibaba reporting that sales topped USD 38 billion. Investors also anticipated that the People’s Bank of China (PBOC) would introduce additional measures to support the slowing economy, an expectation which it fulfilled on the first day of the new calendar year. The PBOC announced that it would cut the reserve requirement ratio (RRR) by a further half-point, effectively releasing roughly USD 115 billion into the financial system as of the 6th of January.

Overall, Emerging Markets ended the year on a positive note. Latin American markets were particularly strong, boosted by higher commodity prices, a weaker US Dollar and interest rate cuts. Brazilian equities finished the year on a positive note, with the local bourse gaining 6.85% in local currency terms. Brazil’s central bank took advantage of a benign inflationary outlook to reduce interest rates to a historic low of 4.5%. Mexican monetary authorities followed suit, reducing rates by 25 bps to 7.25% in the light of moderating inflationary pressure.

Sentiment toward Mexican equities was also boosted by the approval, after protracted stalling, of a revised US, Mexico and Canada Trade Agreement. Higher copper prices benefited Chilean markets, as the country is the world’s biggest copper producer.

“Positive trade-deal sentiment spilled over into emerging Asian markets, with South Korea, Taiwan and, surprisingly, Hong Kong, outperforming.”

Hong Kong’s stock market was amongst the world’s best performing markets, the Hang Seng closing more than 7% higher. The rally caps off a year marred by ongoing and increasingly violent protests, against the backdrop of an economy in recession and the sovereign state’s worst political crisis in decades. Taiwan continued to benefit from the buoyant technology sector, with Taiwan Semiconductor leading markets higher.

Indian equity markets ended in positive territory, but underperformed peers and had a somewhat volatile month. Higher energy prices had a negative impact on the net oil importer, which has also been labouring under rising fiscal pressure. The Reserve Bank of India kept interest rates on hold. The bank also seemed to affirm expectations of lower economic growth by cutting its forecasts for 2020 by 110 bps to 5%.

Russian equities finished the year on a high note, although December’s gains were more muted than other EM peers’. Markets were bolstered by lower interest rates, higher oil prices and the gradual fading of sanction risks. There is also the perception that Russian companies have become more shareholder-friendly, with companies such as Sberbank and Gazprom delivering generous dividend payouts during 2019. Turkish stocks found support from its central bank’s lowering the benchmark interest rate by 2%.

African equity markets were mixed in December. The MSCI EFM Africa ex SA registered a 5% gain in USD. Zambian and Nigerian equity markets were bolstered by strength in copper and oil prices respectively. Egyptian markets were under pressure from rising energy prices and production costs, but the outlook is positive. Given the most recent stimulus packages announced, including incentive plans for the auto industry and a review of general industrial energy prices (including electricity), the market has significant upside potential.

Currencies and Commodities

The GSCI commodities index closed higher in December, with the energy subsector leading gains, and overall commodity prices supported by the US-China trade deal. News of the deal bolstered the demand outlook for oil and prices ticked up by 9%. Prices had already been boosted by an agreement in early December from the Organization of the Petroleum Exporting Countries (OPEC) and Russia to make further production cuts to firm up crude oil prices.

“Industrial metals were stronger, given the expectation that a roll-back in tariffs would lead to improvements in Chinese manufacturers’ demand.”

Copper prices jumped by 5% to a seven-month high. China is the world’s biggest user of copper, accounting for nearly half the world’s consumption, and the dispute with the US had been weighing on the market for over a year. Platinum prices improved by just under 8%. Precious metals were also higher, but slightly lagged industrial peers, with gold prices strengthening by 3.6%.

In currency markets the US Dollar Index closed 1.8% lower. Commodity based developed market indices shower the biggest gains against the greenback, with gains in the oil-backed Norwegian Krone (+5.1%) and the gold-linked Australian and New Zealand dollars. The yen was modestly stronger in December and ended the year mostly unchanged from its 2018 year-end level. Sterling rallied off the back of a resounding Conservative Party election victory. Emerging Market currencies were mostly stronger, with the biggest gains in the Brazilian Real and Russian Rouble. The South African Rand proved resilient despite the Eskom-induced gloom and appreciated by 4.8% during the month.

Performance

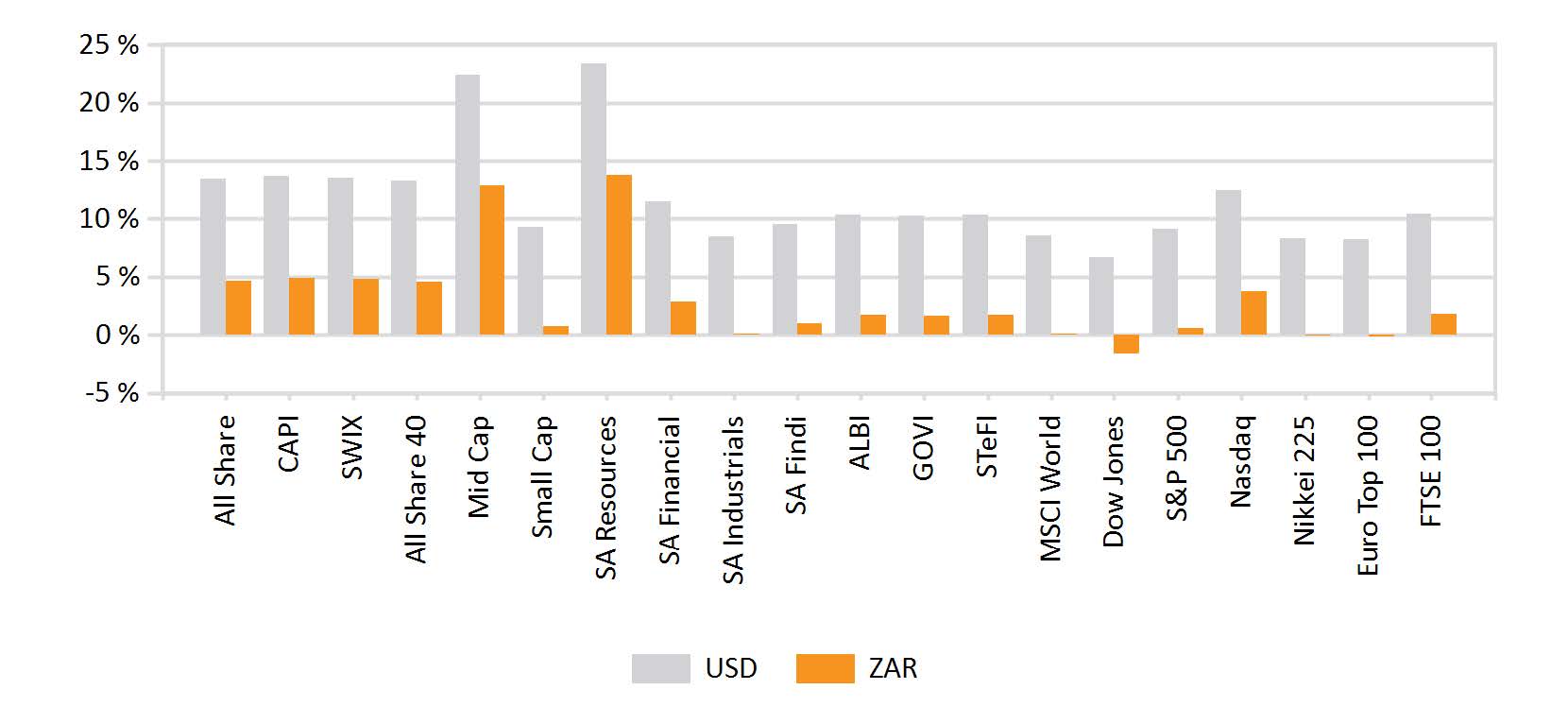

World Market Indices Performance

Monthly return of major indices

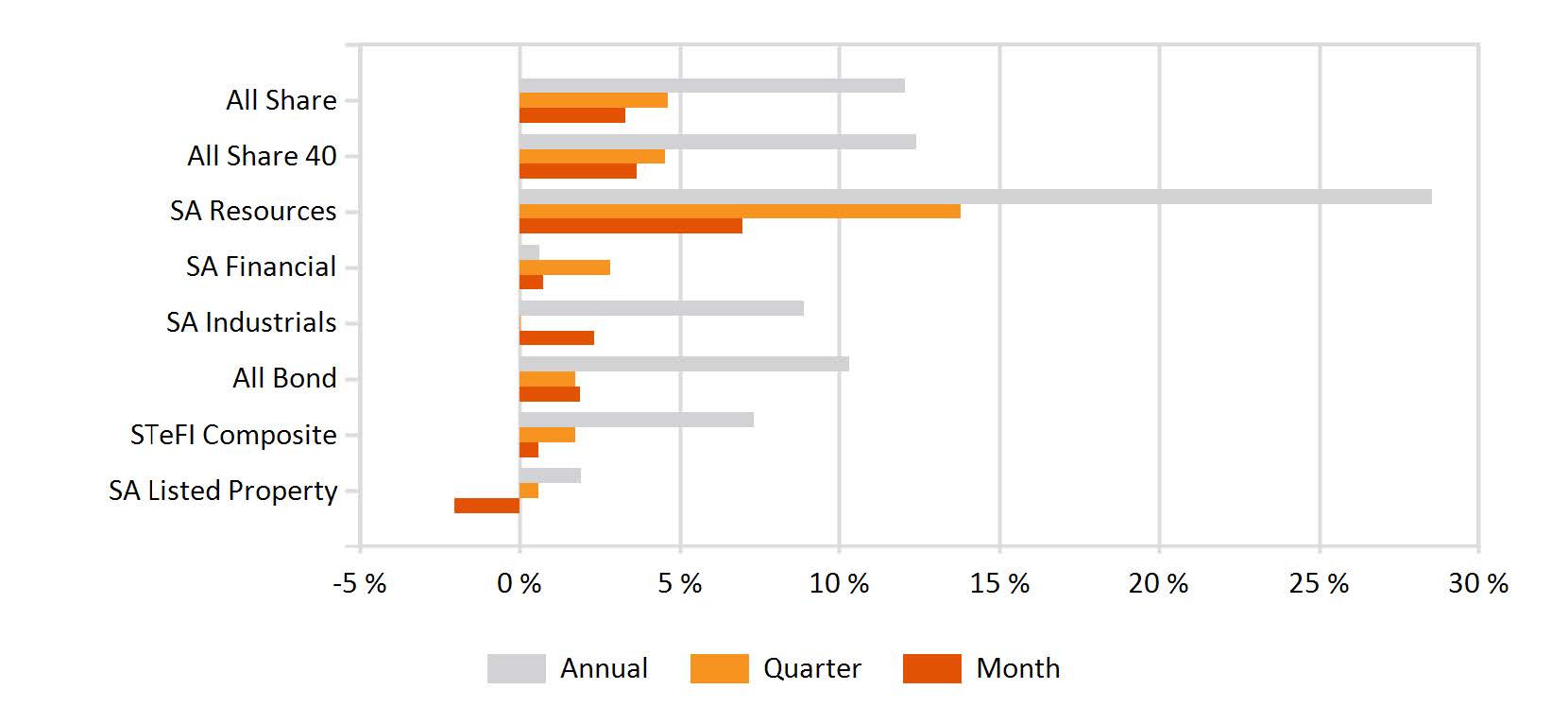

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

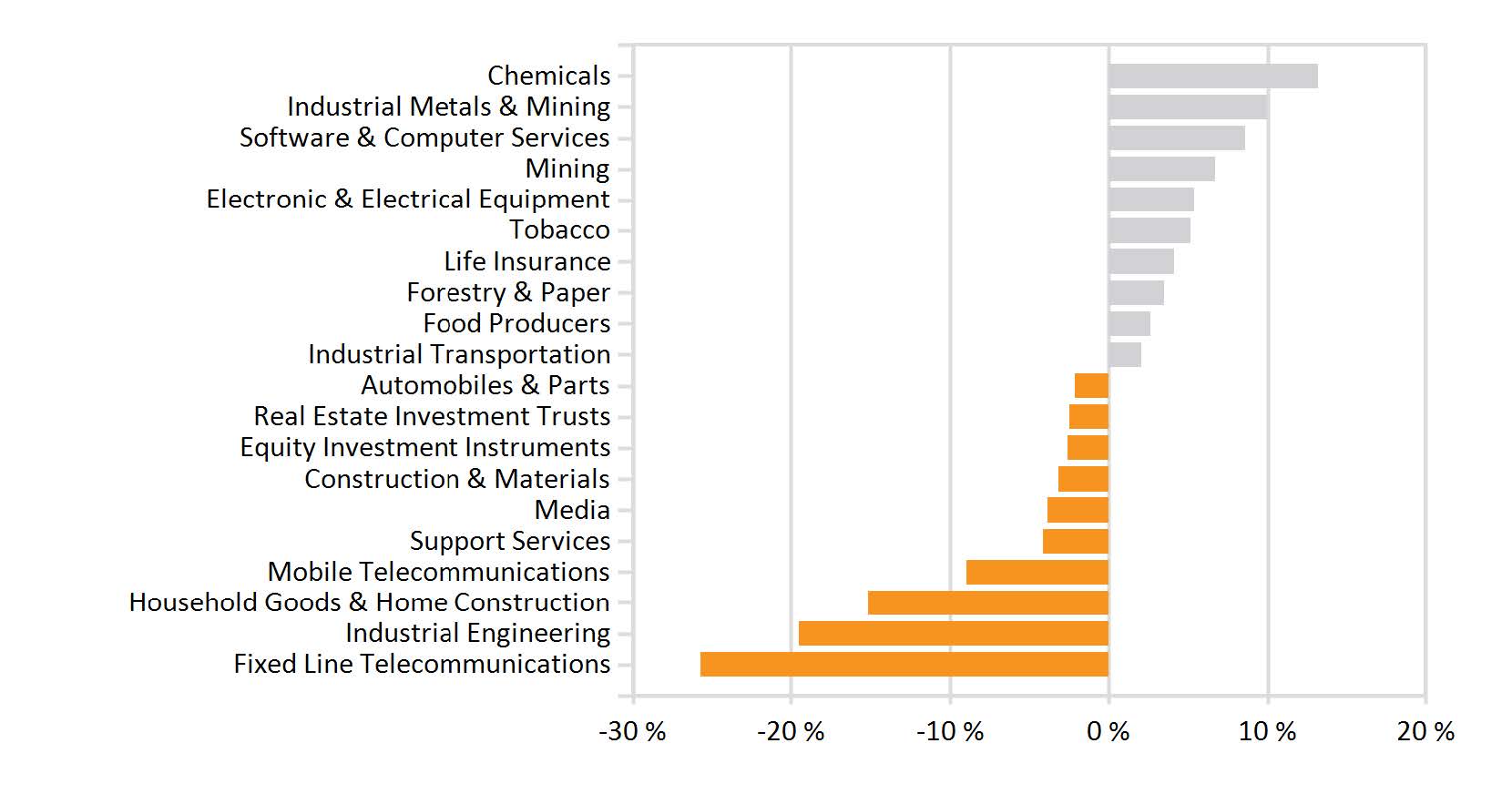

Monthly Industry Performance