Market Commentary: December 2018

Here are this month’s highlights: Global risk assets saw little festive cheer in December, with stocks experiencing their worst quarterly drop since 2011. Having hit notable highs during the year, equities sold off sharply in December as investors continued to fret about the pace of US monetary policy normalisation, simmering US-Sino trade tension, Brexit and geopolitical tensions. Stock and sector-specific concerns weighed on technology and oil counters, while safe-haven buying saw gold tick higher.

Market View

Cash

South African cash provided a solid 60 basis points (bps) return for the month. At an annual performance of 7.29%, cash returns were trumped only by local bond markets. Consumer Price Index (CPI) inflation ticked steadily upward, hitting 5.2% for the first time in 18 months. This is largely attributable to increased transport costs: pump-prices hit new highs during the year, as oil prices surged, and the impact of higher levies (RAF, slate levy) filtered through.

“December saw some respite for cash-strapped consumers, with further relief due early in January 2019.”

Motorists welcomed a petrol and diesel prices drop (R1 and R 1.30 on 2 January respectively), and end-users (often the poorest) saw illuminating paraffin drop by R1.22. But, economists and the South African Reserve Bank remain cautious.

Aside from a still vulnerable and volatile rand, steeper administered prices (potentially to prop up ailing state-owned enterprises) pose significant upside risk to the inflation outlook. Beleaguered state-owned power utility Eskom has already approached the National Energy Regulator of South Africa (Nersa) demanding a 15% tariff hike for 2019, with a further 30% staggered over the next two years. Nersa is unlikely to grant the request, but the manufacturing sector and ultimate consumer will feel the pinch of any increase in input costs.

Bonds

The ALBI yielded a modest 0.64% gain for December, with inflation-linked bonds faring only slightly better at 0.73%. Bonds, however, were the best performing local asset class for the year – yielding 7.74% in 2018.

Despite the difficulties facing the country, foreigners, recognising the positive real yield available to discerning Emerging Market Bond Investors have continued to take up SA government bonds.

“The local debt market, however, was prone to swings in Emerging Market sentiment due to its relatively liquid nature.”

SA-specific sentiment has perhaps improved: Given that the country has received consecutive reprieves from ratings agency Moody’s, the likelihood of a downgrade to sub investment grade (triggering exclusion from major investor indices and a forced selling) is slowly fading from investors’ minds. With the return in risk-off sentiment fuelling a flight to safe-havens, the BarCap GABI closed the month nicely higher, at 2.02%, but was -1.2% in the red for the year.

Global monetary policy was once again in the spotlight, with market-watchers attempting to read between the lines of Fedspeak. As widely expected, US Federal Reserve Chairman, Jerome Powell, announced an increase in the Federal Funds Rate at the December Meeting of the Federal Open Market Committee, while the European Central Bank (ECB) effectively brought its bond purchasing programme to an end. The ECB also confirmed plans to raise rates in the second half of 2019.

“Bond markets were jittery in the face of geopolitical uncertainty and trade tension. December once again saw safe-haven buying, but investors were cautious in their search for yield.”

Lacklustre economic data saw 10-year German Bund dip to 0.24% (prices move in line with demand, and yields move in the opposite direction); Brexit uncertainty continued to weigh on investors and 10-year Gilt yields ended at 1.28%; Concerns around Italy’s budget deficit were tempered as the country reached an agreement with the EU, but yields remained elevated, at 2.75%.

Corporate issuance was muted in the holiday-shortened month, and appetite proved mixed. Credit markets, overall, had a difficult quarter and credit spreads widened during a volatile month.

“As corporates took advantage of relatively easy money in the US, non-financial corporate debt-to-GDP rose to its highest level in 70 years.”

Simultaneously, perceptions around the credit quality of US investment grade bonds have noticeably deteriorated.

Analysts fear that either unanticipated credit events (and/or ratings downgrades) or a faster-than-expected path of interest rate hikes will put pressure on highly leveraged markets. This includes some emerging sovereigns, and high yield markets. Energy counters, which account for a large proportion of the high yield market, staged a slight recovery toward month-end, but high-yield bonds were nonetheless weaker during the quarter.

Equity

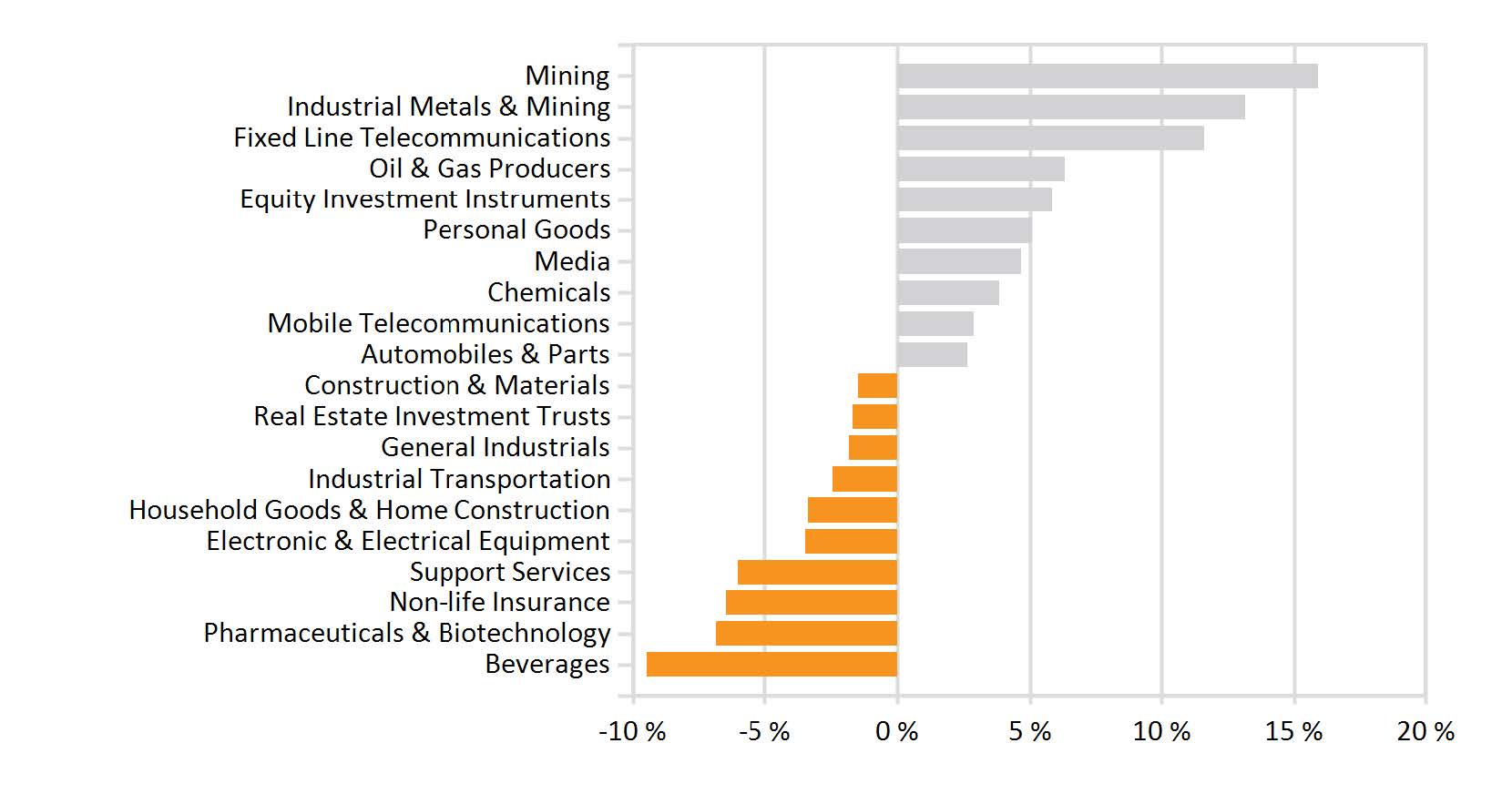

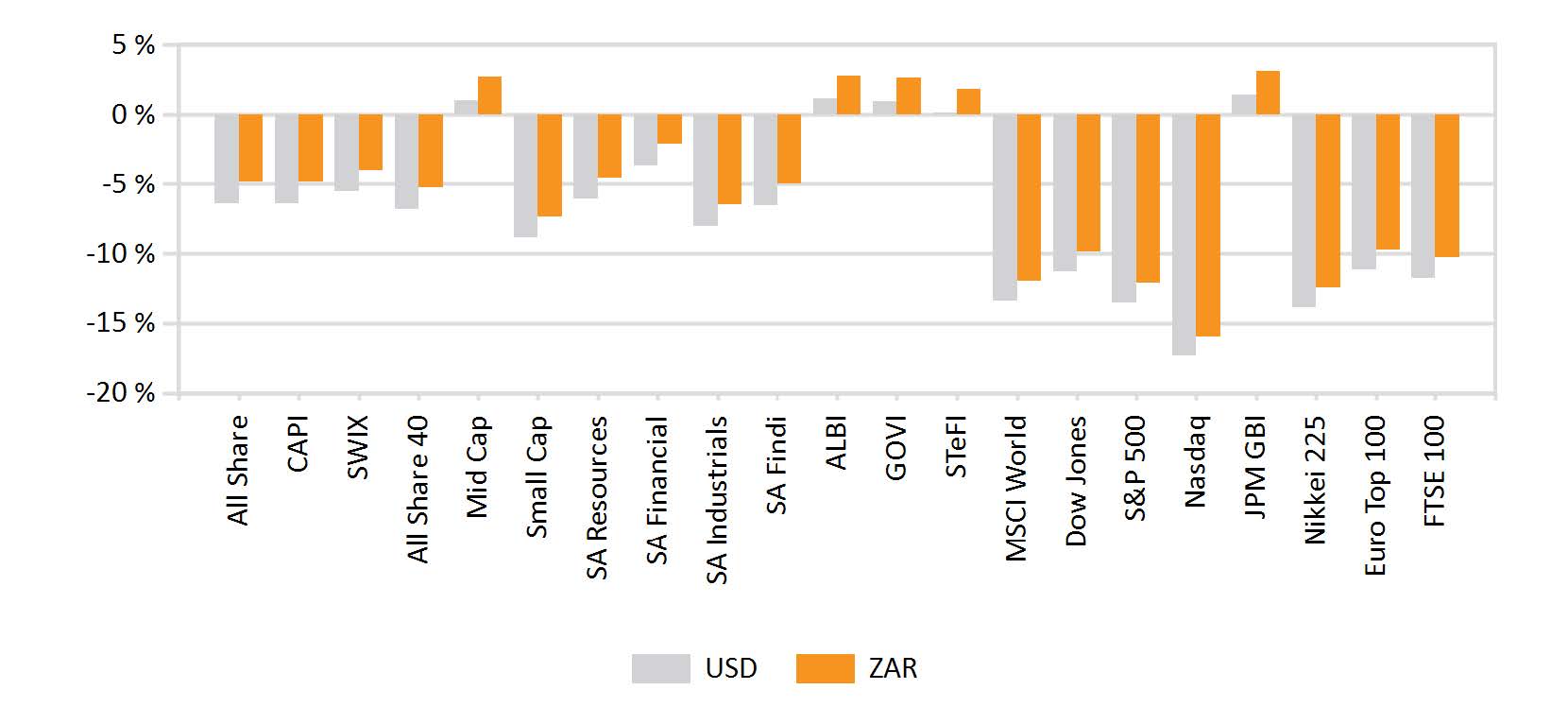

South African equities managed to buck the broader trend, ending in positive territory in December. The All-Share index closed 4.25% higher, largely due to a resurgent resource sector, with the sub index up 12% for the month. Anglo American Platinum was the year’s best performer in the overall index, up 52%, albeit of a low base.

An index of South African gold stocks surged by 25% in December as global trade and growth fears saw investors turn to safe-haven bullion. AngloGold Ashanti was the sector’s best performer for 2018, up 41%.

For the year, Resources overall gained just over 15%, in sharp contrast to the Industrials sub index’s 17% decline. Largely due to the latter, the SWIX saw its worst performance in a decade (a 11% loss). The sell-off in South African equities is partly a reflection of spillovers from broader EM risk-off sentiment — despite a new president, the challenges the South African economy face remain largely unchanged.

Within Industrials, losses are mainly attributed to the slump in heavyweight Naspers’ share price, and a volatile rand’s impact on dual-listed rand hedges.

Naspers registered its worst annual performance since 2001, dropping by over 16%. Although Naspers disposed of a 2% stake in Chinese parent Tencent in March, the company has confirmed that it is not eyeing further disposals for the next three years. Chinese and tech weakness will therefore continue to impact investors in the JSE-listed share. It is, however, looking to expand its e-commerce footprint elsewhere, including in online food delivery start-ups in India and Brazil.

“As the rand remains vulnerable, and was marked by noticeable volatility during the year, so were traditional stalwart rand-hedges such as British American Tobacco (BAT), Richemont and Mondi.”

After posting a dismal November, BAT shares came in for a further bruising, losing 3% during the month and nearly 45% for the year.

Telecommunication had a stronger than expected performance, as MTN rallied by just over 9%. The company reached an agreement with the Nigerian Central Bank, paying USD 52.6 million, with no admission of guilt, for its USD 8.1 billion dispute. The Healthcare sector’s woes continue, and the fourth quarter reweighting of the Top 40 saw Mediclinic dropped from the index.

Local macroeconomic prospects for 2019 are mixed, with the economy still highly vulnerable to exogeneous shocks. Analysts predict that higher real wages and last-ditch fiscal stimulus will boost economic sentiment in the mid-term, ahead of the crucial elections.

“Sentiment remains subdued in the shorter term, as the RMB/BER business confidence index decreased by three points in the fourth quarter.”

The economy nonetheless managed to bounce back from its brief technical recession, and the Absa Manufacturing Purchasing Managers’ Index returned to expansionary territory (at 50.7 for December versus 49.5 for November). The country, despite structural challenges, has certainly made some progress in reasserting good governance practices, combating corruption and reassuring investors as to fiscal discipline. Discerning investors can find ample opportunities for bargain-hunting.

Property

South African listed property shares extended their slump to cap off a dismal year. The more concentrated SAPY lost -1.06% and the ALPI lost -1.25% for December, bringing losses for the year to a staggering 25%. Much of this is attributed to a sharp sell-off in the large cap Resilient group in January and February 2018 (-9.9% in both months). An initial report highlighting governance and cross-holding concerns was followed by allegations of share-price manipulation, which are still the subject of a Financial Sector Conduct Authority investigation. The Group, consisting of Fortress REIT, Resilient REIT, NEPI Rockcastle and Lighthouse Capital (formerly Greenbay), made up over 40% of the index in early 2018, but accounted for only 28% by December.

“Domestic property fundamentals remain weak, reflecting poor prospects for GDP growth, tough credit conditions and oversupply in specific subsectors (notably office and retail space).”

Expectations for earnings and rental income streams have adjusted, and the opportunities for further Mergers and Acquisitions (including in offshore markets) have become scarcer. Having come down from lofty valuations, the listed property sector may still feel some pain over the short-to-mid-term. Nonetheless, given that income yields have adjusted upward as risk premia have risen, the sector is still expected to provide inflation-matching returns.

Global Property easily outstripped the local sector – the FTSE EPRA/NAREIT Developed Rental Index gained 6.06% in US dollar terms for December. The month’s worst performing region proved to be the US listed real estate market, with a drop of -8% (in USD) scuppering the hope of the index ending in the green.

“For the year it is perhaps no surprise that the UK market registered the worst performance amongst developed peers.”

A spate of High Street closures and stiff competition from e-tailers, the growing need for tech-and-eco-savvy investment, and uncertainty around Brexit weighed on British bricks-and-mortar. The UK market shed 18% in USD terms.

Asian markets were the best performers for both the month (Hong Kong at 3.4% in USD) and year (Japanese REITs recorded 9.67% in USD).

For 2019, property yields in developed markets are expected to outstrip 10-year government bond yields, which roughly average 2%. The average Funds Available for Distribution, at an estimated 5.25%, also easily outstrips inflation expectations in developed markets. Selective and active stock pickers, with a knowledge of domestic nuances, can easily generate excess returns.

International Markets

Global equities sold off aggressively in December, capping off the worst quarterly performance since 2011. Investors could find little festive cheer in an environment of rising interest rates, slowing business confidence, tempered growth expectations (in the US, Eurozone and China) and geopolitical hotspots.

The MSCI World closed the month 7.6% lower and registered an annual loss of 8.7%. At -2.66% for December, Emerging Markets (MSCI EM), outperformed their developed market peers for the month, but extended a risk-off rout that saw the index lose nearly 15% during the year.

“The S&P 500 dropped 9% in December, concluding a tumultuous and volatile year for Wall Street.”

For much of the year, investors appeared to be sanguine, at times even exuberant, about US economic growth prospects. The Federal Reserve raised interest rates at its latest Federal Open Market Committee meeting but sounded a note of concern (and a more dovish tone) by projecting two rate hikes for 2019, instead of three. While macroeconomic data remains fairly strong, cracks have started to appear. US unemployment ticked up, albeit from a 49-year low.

The latest Institute for Supply Management Purchasing Managers Index reflected a sharp drop in business confidence: The index fell to 54.1 in December, the largest monthly drop since 2008 and its weakest level since 2016. An index of overall consumer and business confidence showed similar declines: the Economic Optimism Index entails a nationwide survey, gathering data on participants’ six-month economic outlook, personal financial outlook and confidence in federal economic policies. Retail sales and personal spending data for November, while remaining in positive territory, were lackluster (despite Black Friday). With the impact of tax cuts fading and a number of companies advising caution on earnings prospects, investors are fretting that the Fed will hike rates too rapidly.

“On a sectoral basis, perceived safe-haven assets (utilities, healthcare and consumer staples) held up better than most.”

Technology and energy counters were amongst the worst performing. The FAANG stocks (Facebook, Apple, Amazon, Netflix and Google) took a beating. A last-ditch rally from Amazon and Netflix (jumping 4.5%) was not enough to save the Nasdaq’s winning streak. The index lost 3.9% in 2018, snapping a six-year run.

Eurozone weakness persisted, and the STOXX All Europe closed -5.46% lower, led by steep losses in heavyweight Germany (the DAX lost 6.7%). Populist politics remains on the rise in the Eurozone, as evidenced by the developments in France, Spain and Italy. In France, weeks of protests from the so-called yellow vests have started to take their toll on economic activity and business confidence. The latest purchasing managers index data shows that manufacturing and services contracted in December. The protests also present a key challenge to President Emmanuel Macron’s reform agenda, which is key to boost growth and lower the country’s high unemployment rate.

Sentiment toward Italian markets improved, as the coalition government bowed to pressure from Brussels on austerity measures. Unionwide, however, consumer and business confidence waned in December, with trade tension, slowing Chinese growth, and lack of agreement around Brexit weighing on sentiment.

“In another dramatic month in UK politics, Prime Minister Theresa May survived a no-confidence vote and secured her leadership of the Conservative Party for the next 12 months.”

While the EU has already agreed to the UK’s proposed withdrawal agreement, the UK Parliamentary vote is due in mid-January. Bank of England Governor, Mark Carney, is at pains to reiterate that monetary and fiscal policy remains dependent on the nature of the UK’s exit from the EU.

Retailers are under pressure, and the UK housing markets remains subdued as consumers feel the squeeze of the uncertain economic outlook. The dip in oil prices weighed on energy counters; financials were lacklustre and traditionally more defensive stocks (Healthcare) weathered the December doldrums better than expected.

The FTSE 100 lost 3.49% in December, and the pound remained volatile. Stock markets in Japan registered the most substantial losses amongst developed peers, with the nikkei down just over -10%.

“A stronger yen remained a headwind for exporters, and preliminary production figures pointed to a slow-down in export-oriented and economically sensitive areas.”

Japan’s exchange also suffered the fall-out of a decline in bourse-heavyweight Nissan and its alliance partner Mitsubishi. The former has seen its share price lose just over 12% since the re-arrest of the Alliance Group’s (comprising Nissan, Mitsubishi and Renault) former chairman, Carlos Ghosn, by Japanese authorities for alleged “aggravated breach of trust”. The move and Ghosn’s subsequent detention without bail spooked investors, who see elevated political risk when investing in companies that operate under a different legal system.

Japanese macroeconomic data was mixed – while the labour market remains healthy, Japanese consumer confidence dipped, monthly retail sales growth was muted, and business sentiment was largely unchanged. The Bank of Japan is expected to lower its inflation expectations at its month-end meeting, and Japanese monetary and fiscal policy is therefore unlikely to change course.

“Mainland Chinese markets were lower in December, with the Shanghai composite declining over 5%.”

As data points to a deeper economic slowdown, the People’s Bank of China consequently stepped in with more targeted stimulus measures. The bank announced that it would implement further cuts to the reserve requirement ratio, and effectively free up a net USD 117 billion for lending. This is the fifth cut since the start of 2018, as the government tries to support a slowing economy, further bowed down under the weight of US tariffs. Official production figures indicate that manufacturing Purchasing Managers indices – a key barometer of global demand – fell to their lowest reading in two years and entered contractionary territory.

On the other hand, the Caixin/Markit Services Purchasing Manager Index rose to a six-month high and consumer confidence measures ticked higher in November – affirming that the key growth engine for China, the domestic consumer, is chugging along nicely. Sentiment was likely boosted by a 90-day ‘ceasefire’ in the salvo of tit-for-tat tariffs, but a continued stalemate may save an estimated 0.5% – 1% off China’s annual growth rate.

“Asian minnows Indonesia, Malaysia and the Philippines managed positive returns, and proved more resilient than peers.”

Sentiment towards India soured on the unexpected resignation of the Governor of the Reserve Bank of India, and unexpected election setbacks for the ruling Bharatiya Janata Party. The latest data shows that foreign portfolio investors participation in India’s market has been steadily declining, with 2018 marking the largest outflows from equity and debt instruments since the global financial crisis. Despite the country’s strong institutional framework and the prospect of surpassing China in terms of GDP growth, foreign investors remain wary. The bourse, however, staged a late-month rally on declining oil prices (India is a net importer), a stronger rupee and the appointment of a credible new governor, ending only modestly lower (-0.32%).

“Latin American markets were amongst the strongest emerging stocks.”

Mexico posted a positive return of 1.2%, and losses elsewhere were relatively modest. Brazilian equities declined by 1.8%, with macroeconomic data on industrial production and retail sales pointing to a still-stabilizing economy.

Equity markets in Emerging Europe closed mainly lower, capping off a disappointing year fraught with geopolitical tension. Russian stocks lost 1.42% for the month but gained just over 11% in 2018. Sentiment was boosted by improved macroeconomic data, a resurgence in the oil price and the successful hosting of the FIFA World Cup.

“Turkish markets remained in the doldrums and led losses in the region.”

Within emerging EMEA, tension in the Middle East shows little sign of abating, as the situation in Syria and the US relation to Iran deteriorates. The MSCI EFM Africa ex SA index, however, posted a relatively modest decline of 1.42% for December, on broadly supportive commodity prices. The impact of resources is perhaps best illustrated by the disparity between the Zimbabwean sub-indices – the Industrial Index posted a 9.57% loss in local currency terms, whereas the Resources Index closed 9.18% higher.

Currencies and Commodities

The USD index was -1.1% lower in December, with both developed and emerging market currency-pairings presenting a mixed bag of returns.

The safe-haven Japanese yen appreciated 3.5%, much to exporters dismay, while the Australian dollar depreciated by an equivalent amount.

“Within emerging markets the South African rand, Russian ruble and Turkish lira registered losses (ranging from -3.5 to -1.4%) as risk off sentiment flared on geopolitical concerns.”

The Mexican peso, despite the fraught US border/wall situation and concerns about a hard-line new president, gained ground against its neighbour and registered a 3.8% gain.

In Commodities, the GSCI index was dragged lower by substantial losses in the energy sector. OPEC at mid-month agreed to cut production by 1.2 million barrels per day, but analysts were unconvinced that the measures were sufficient to ‘put a floor’ under the slipping oil price. The agreement fails to put in place hard country-specific allotments and timelines, and also falls short in that it cannot enforce cuts on non-OPEC member Russia.

“The International Energy Agency (EIA) estimates that US shale production will grow despite softer prices, and that supply will therefore continue to outstrip demand.”

Supply side interruptions in specific countries (Libya, Venezuela, Iran and Nigeria) are unlikely to offset increased US production.

Oil prices rallied somewhat, but were 11% lower for the month. Industrial metals closed lower, as global and China-specific manufacturing data undershot expectations. Precious metals were higher, with silver gaining 9.5% and safe-haven buying spurring a 4.7% gain in spot gold.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance