Market Commentary: December 2017

Global Risk Assets ended the year on a high note: Emerging Markets saw their best returns since 2009, while US equities consolidate their excellent year-to-date performance. Resurgent oil prices and the energy sector led overall sectoral gains. Macro-economic and inflationary data supported a view that during 2018 global monetary policies would produce few surprises. South African investors were cheered by a change in the ruling party’s leadership, although the stock market was dragged down by the Steinhoff scandal. The Rand, in line with Emerging Market peers, posted considerable gains against the USD, and local fixed income assets rallied.

Market View

Cash

South African inflation eased during November, hitting a lower-than-expected rate of 4.6%. Despite the harsh drought conditions affecting parts of the country, food and alcoholic beverage prices rose at a softer pace (5.2% for November, versus 5.3% for October). The drop in transport costs, partly due to a stronger Rand and lower fuel prices, considerably eased the burden for consumers. Further pump-price cuts are expected to filter through to the December and January readings.

“The new leadership’s ability to maintain fiscal discipline will be severely scrutinized and tested, however.”

Initially, skittish market-watchers responded positively to the outcome of the African National Congress’s (ANC) National Executive Committee (NEC) elective conference, which saw Cyril Ramaphosa elected as the party’s new president. The new leadership’s ability to maintain fiscal discipline will be severely scrutinised and tested, however. Outgoing party president Jacob Zuma’s unexpected pre-conference announcement of free tertiary education will require an extremely tight budget and consumers can expect significant tax-increases in the February budget speech. Overall inflation was well within the target range for the year, registering 5.3% year-on-year (versus 2016’s 6.3%).

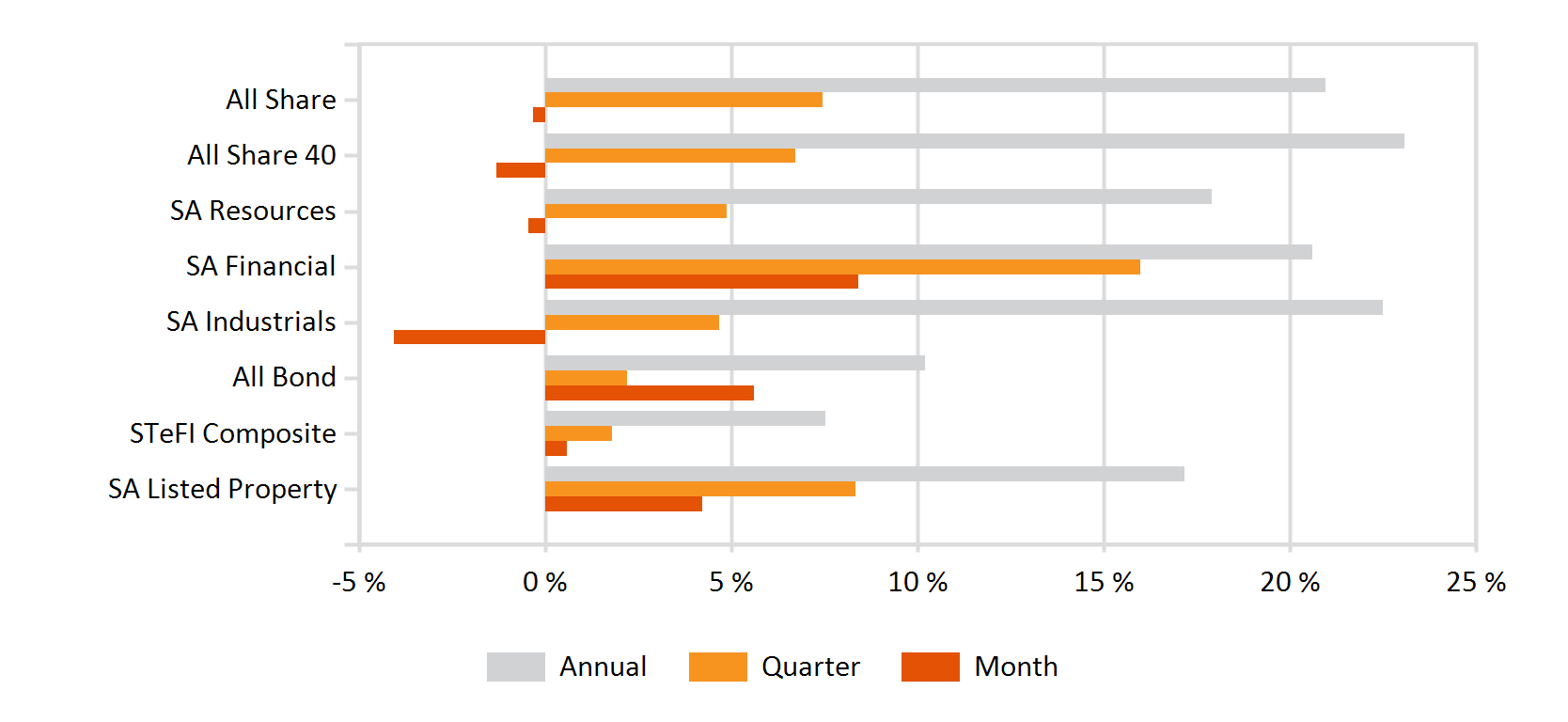

The volatile exchange rate, uncertainty about the pace of global policy normalisation and pending electricity tariff-hikes were cited as upside risks by the South African Reserve Bank (SARB). The repo rate was consequently left unchanged at the last Monetary Policy Meeting for the year (November 2017). The SARB is likely to make a cautious assessment on whether the outlook for the Rand and economic growth merits a moderate interest rate cut in 2018’s first quarter. South African Cash yielded 0.56% for December, and a 7.52% year-to-date inflation-beating return.

Bonds

A cautiously optimistic response to the change in the South African ruling party’s leadership saw the 10-year government bond yield rally by nearly 70 bps in December. Gains were tempered, however, as the market continued to speculate on the possible recall of the country’s president, and the likely pace of policy changes. The ALBI posted a solid 5.6% gain for the month, with inflation linked bonds (ILBs) up 5.7%. The ALBI booked a 10.9% year-on-year gain, demonstrating that local political upheaval, credit-rating woes and poor growth prospects have not quite dampened foreign appetite for emerging market fixed income assets.

“The expectation is that the US tax bill will stimulate growth and inflation, in the most significant overhaul of the country’s tax code in three decades.”

Global Bonds (BarCap GABI) posted a modest 0.35% for the month, with a 7.3% gain for the year. US Treasury yields were volatile in the run-up to the approval of the much-anticipated tax reform bill. The expectation is that the US tax bill will stimulate growth and inflation, in the most significant overhaul of the country’s tax code in three decades. Many market participants, however, speculate that increased government borrowing needs will put pressure on the US bond market. The10-Year T-bill yields initially dropped to 2.34%, before reversing to 2.5%. Overall positive momentum saw the US Federal Reserve raise its 2018 growth estimate to 2.5%, up from 2.1%.

The Bank also, as anticipated, raised interest rates by 0.25 bps in December, the third increase for the year. The US yield flattened, and credit spreads tightened. The 10-year UK Gilts were boosted by apparent progress in Brexit negotiations, though the improvement was tempered by uncertainty. Mid-month saw a rise in European bond yields, partly in response to hawkish European Central Bank comments regarding Quantitative Easing. In USD- and Sterling-denominated markets, corporate bonds outperformed, whilst in Euro-denominated markets high yield bonds outshone their peers. For the year, Emerging Market Debt continued to see a strong uptake and yielded 8.1% for 2017 despite falling from favour in the last quarter.

Property

South African Listed Property overshot expectations: The annual increase remained in the double digits, at 17.15%, up 4.21% in December. Domestic property fundamentals, which were lacklustre for most of 2017, are expected to stabilise during 2018. Weak business confidence, however, continues to impact on retail and office rentals, and improved sentiment will take time to filter through. Within the retail sector, landlords are seeing smaller convenience and local retailers take up the space vacated by struggling large retailers (Stuttafords, the Edcon group etc.).

While the development is positive, retail rental growth expectation has moderated. Within the office sector, vacancies ticked up further to 11.7%. The logistics space has seen an increased uptake of high-spec industrial warehouse developments, as appetite for technologically-advanced modern sites continues to grow.

“Appetite for Asian property remains particularly strong, with Singapore outperforming its listed property peers (total 2017 USD return of 40%).”

Offshore property (measured by the FTSE EPRA/NAREIT Developed Rental Index, Net USD) yielded a solid 1.24% for December, and 8.21% for 2017. The UK property market has seen softening fundamental as it exits the European Union: Since financial institutions seek to maintain a European presence, London office space has lost ground to Frankfurt, Paris and Dublin. Appetite for Asian property remains particularly strong, with Singapore outperforming its listed property peers (total 2017 USD return of 40%). Hong Kong has similarly been boosted by the increased need for high-density housing and a flourishing retail market. The sale of Hong Kong’s 73-storey Centre, located on Central, is recorded as the most expensive single-property transaction globally (acquired by a group of Chinese investors for USD 5.15 billion).

Eastern Europe, too, remains an attractive destination, with South African (SA) companies continuing to consolidate their foothold. Perhaps the most notable trend, as in SA, is how e-commerce and technology are reshaping the retail and industrial sectors: In retail, high foot-traffic high-end spaces are at a premium, as big brand (despite the growing trend in online purchases) regard such showcases as a much-needed branding touch-point. Turning to the industrial sector, the need for ever faster ‘last-mile’ delivery (as in South Africa) bodes well for technologically-suited logistics facilities on the fringes of urban areas.

“Domestic property fundamentals, which were lackluster for most of 2017, are expected to stabilize during 2018…”

Domestic property fundamentals, which were lacklustre for most of 2017, are expected to stabilise during 2018, and the pace of Europe’s recovery bodes well for the global market, and for SA companies with an offshore presence. Improved investor sentiment, and a potentially more sanguine economic outlook, will nonetheless take time to filter through to property fundamentals, particularly given the fact that South Africa may yet be downgraded. Selectivity and nimble asset allocation and an awareness of sector-specific nuances, will therefore remain key drivers of return.

Equity

The South African stock market hit a notable high note in 2017, fuelled by increased year-end optimism regarding a global economic recovery, and positive investor sentiment post the ANC elective conference. The much-anticipated December conference saw Cyril Ramaphosa, hailed as more market-friendly than alternative candidate Nkosazana Dlamini-Zuma, elected as ruling party president. The pace of policy reform, however, may be hampered by an even split with the pro-Dlamini-Zuma camp amongst the so called ‘Top Six’ positions.

Confidence in fiscal discipline for 2018 took a severe knock when incumbent President Jacob Zuma unexpectedly announced the implementation of free tertiary education in 2018 – a legacy promise that the incoming leadership will be hard-pressed to fulfil. The overall bourse ended the month modestly lower (the SWIX lost 0.7% for the month, but registered a whopping 21.21% gain for 2017.

“December’s stock market news was overshadowed by the accounting scandal which engulfed South African-based German retailer Steinhoff International.”

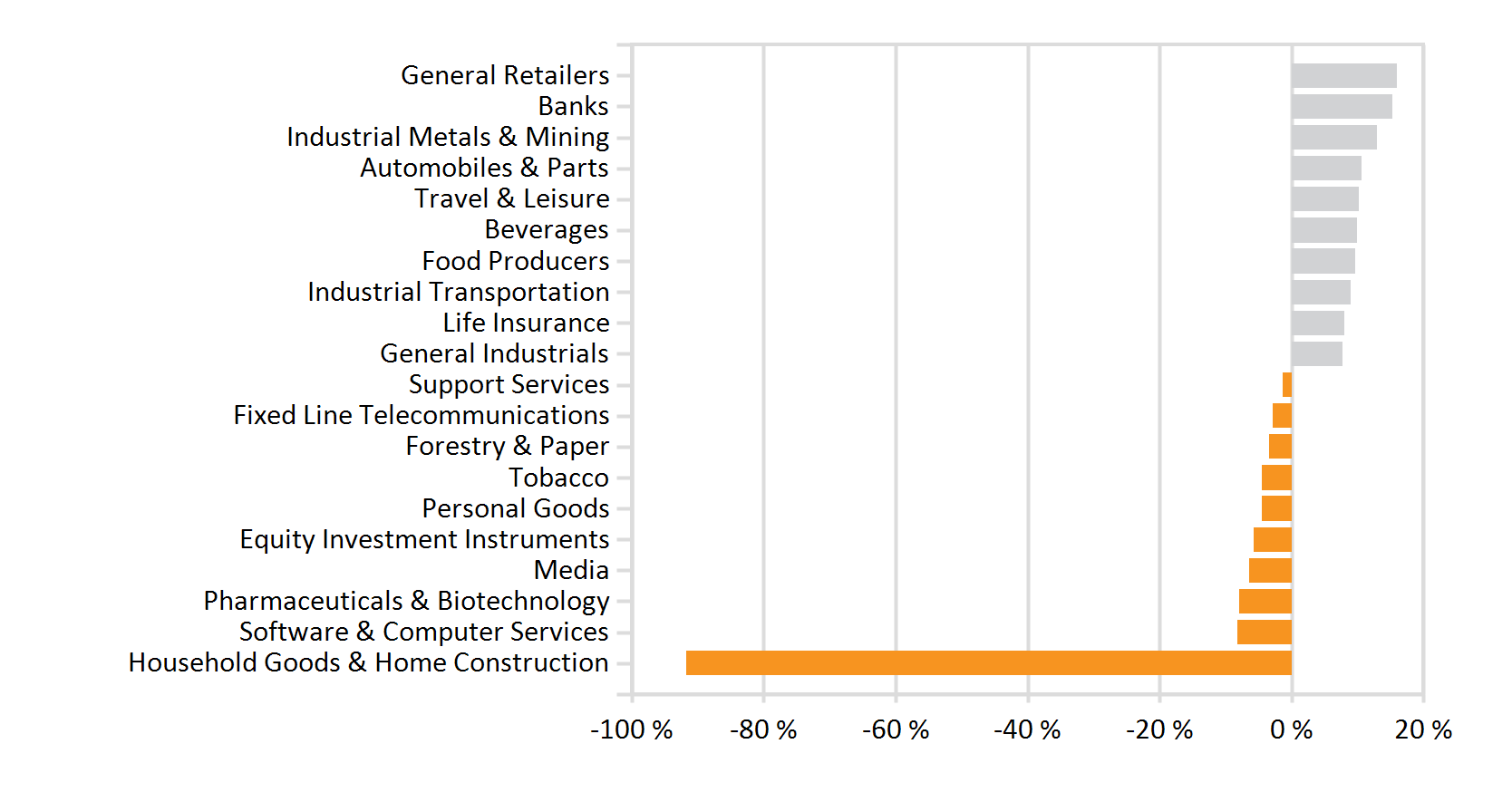

The impact of individual index heavyweights’ performances (both monthly and annual) have been starkly highlighted. December’s stock market news was overshadowed by the accounting scandal which engulfed South African-based German retailer Steinhoff International. Markets were rocked by the news that the company was facing multiple probes into accounting irregularities and corruption, prompting the immediate resignation of CEO Markus Jooste, and of prominent chairman Christo Wiese. Share prices plunged by 60% on Wednesday, 6 December, and losses have since escalated (recent post-resignation figures suggest -80% and more than USD 10 billion wiped off the company’s value). Sentiment toward the share has remained sour, despite measures to reassure investors. This included PwC’s appointment to further investigate accounting irregularities, additional appointments of overseeing board members, turnaround specialists AlixPartners to shore up finances and CFO Ben La Grange’s redeployment to focus on finalising the 2017 accounts, and the ‘preservation and procurement of liquidity within the group’.

In light of a Moody’s downgrade, credit lines have been severely reduced. The company is banking on around USD 400 million (from the sale of SA heavyweight PSG Group) and a further USD 1.2 billion in debt repayment from subsidiary STAR to help plug a USD 2.9 billion hole in its finances. For 2017, Steinhoff share prices were down by more than 63%. In stark contrast, index heavyweight Naspers registered an annual gain of over 70%. The company has gone from strength to strength, boosted by a remarkable performance in Chinese parent company Tencent. While analysts are concerned about the counter’s dominance in the index, its growth has shown little sign of slowing.

“Rand strength put a damper on traditional Rand Hedges’ returns.”

Rand strength put a damper on traditional Rand Hedges’ returns. The industrial sector, after the Steinhoff slump, drifted largely sideways during the rest of December, the index ending the month -4.08% lower. The FSTE/JSE Resources Index closed modestly lower (-0.45% for the month) against a backdrop of improved commodity prices (despite the Rand’s strength). Notable star performers on the JSE for the year included Kumba Iron Ore, on improved Chinese appetite. Overall, the Global Commodities index posted gains (in USD-terms) for December, with significant gains in Industrial Metals (+8%), Energy (+5.9%) and Precious Metals (+2.8%, in line with a 2.7% uptick in Spot Gold). Positive investor sentiment was most evident in the Financial Sector, which posted a gain of 8.4%, fuelled by double digit gains in Barclays and Nedbank.

Although the country has escaped further downgrades from credit rating agencies thus far, and investors are cautiously optimistic, markets are still easily swayed by political and policy pronouncements. Well-considered investment in SA Inc may be warranted, but investors will still be wary going into 2018.

International Markets

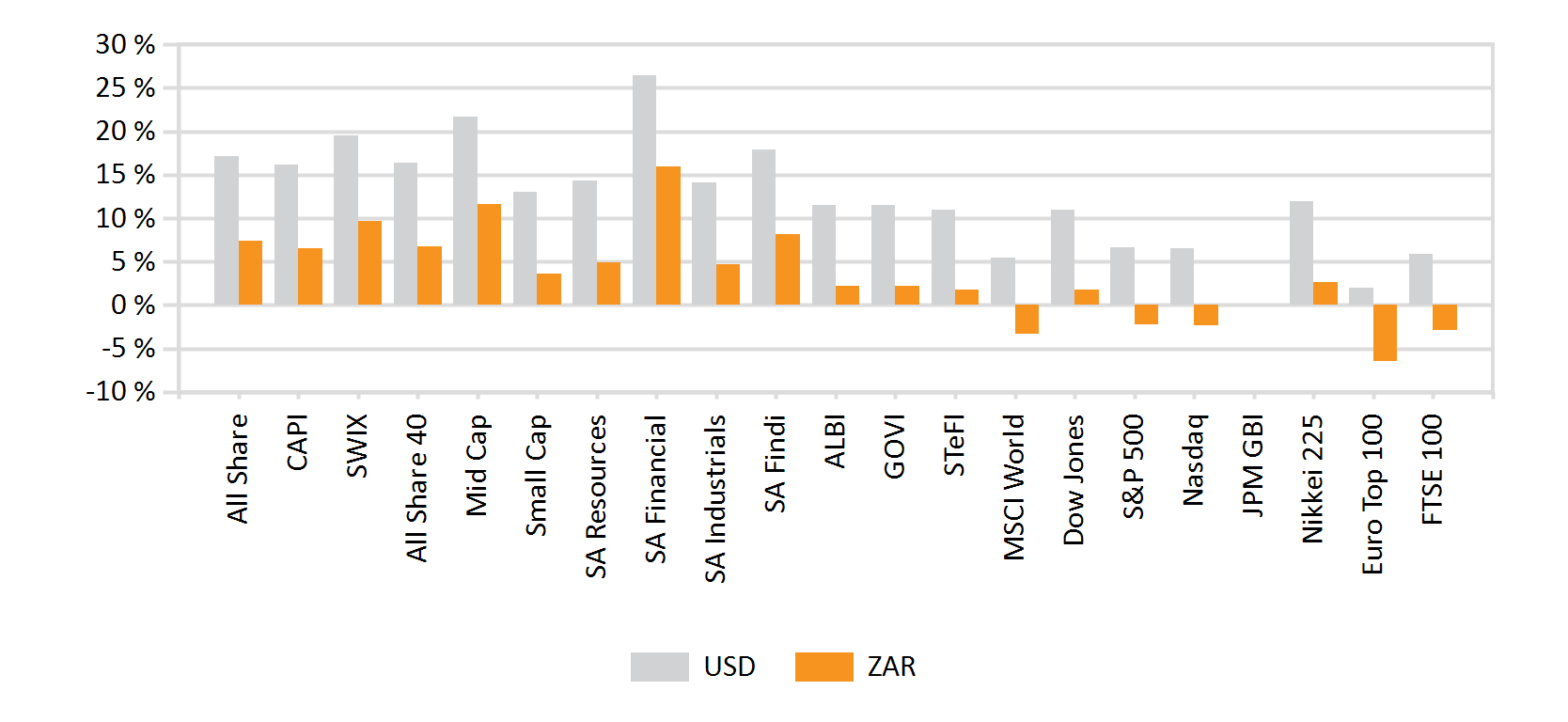

Global equity markets ended the year near all-time peaks, amidst solid corporate earnings and accelerating global economic growth. Developed market equities were mostly higher in December, with the UK’s FTSE leading gains (+5%) and the MSCI World providing a return of 1.35%.

“Emerging markets trumped expectations, with the MSCI EM index climbing 37.28%, in its best year since 2009.”

Emerging markets trumped expectations, with the MSCI EM index climbing 37.28%, in its best year since 2009. Similarly, the MSCI EFM ex SA yielded returns for the year exceeding 20%. Both indices registered more modest monthly returns (3.59% and 0.51% respectively. Amongst emerging markets, Asian markets continued their year-to date rally. They were, however, outstripped by the Emerging Europe, Middle East and Africa for December. The oil price hit its highest level since 2015, providing a significant boost to Russian equities (the index closed 0.43% higher) and growth prospects. Oil-exporting Nigeria, despite ongoing headwinds and pipeline disruptions, provided equity returns of 0.9% for the month. Other African markets that benefited from the improved commodity outlook included Uganda and Tanzania (+10%, +9%).

Latin American markets also ended on a winning note, with prospects of political reform and stability adding to the impetus from commodities. Several Emerging Market Central Banks, including the Bank of Russia and Bank of Brazil, have been able to cut interest rates as inflationary pressure finally eases.

“December rounded off the best year for US equities since 2013.”

December rounded off the best year for US equities since 2013. The S&P 500 has registered a 21% gain for the year (1.1% for December). The US-centred policies and promises of the Trump Administration have thus far been a boon to US companies, as has the recovery in economic growth. The US Federal Reserve raised its expectations for 2018 GDP growth to 2.5, and corporate earnings have largely exceeded expectations. Earnings prospects for US-focussed firms were further boosted by the passing of the US Tax Reform Bill, as they expect to benefit significantly from corporate tax cuts (up to 14% rate reduction).

“UK markets were boosted by the rally in oil and industrial metals.”

The energy sector outperformed peers, as the oil price rebounded to a two-year high. Upbeat consumer confidence, against a backdrop of low unemployment and continued hiring, bolstered US Retailers. UK markets continued to grapple with Sterling strength and Brexit implications. The FTSE100 posted strong gains (+5%) for the month, but lagged its European counterparts for most of 2017. UK markets were boosted by the rally in oil and industrial metals. Aside from the recovery in Brent Crude, the price of Copper rallied by over 30%, and consolidated miners such as Glencore and BHP Billiton were amongst the month’s top performers. Within Europe, Basic Materials consequently, too, outstripped sector peers.

The Euro area ended the year on a buoyant note, with recent data supporting the prospects of sustained economic expansion. The Eurozone Composite PMI rose to a seven-year high, and consumer confidence hit record levels in a decade. Japanese equities produced strong returns for 2017, and the Nikkei was up 0.32% at month-end, boosted by upbeat corporate earnings. The macroeconomic data is largely positive (unemployment is at a 24-year low, higher wages and increased household spending) and inflation has ticked up to 0.9%. The rate, however, is still below the 2% Japanese Central Bank target, and the Bank has left its accommodative monetary policy in place. Chinese equity markets, in a year that was notable for significant liberalisation, consolidated 2017’s robust returns. Shanghai markets closed 0.62% higher. an annual gain of 24%. The Chinese growth trajectory, while taking on a different shape, is nonetheless intact.

“Global geopolitical noise, though settling down somewhat toward the end of 2017, may yet trouble investors…”

Global geopolitical noise, though settling down somewhat toward the end of 2017, may yet trouble investors: the tension on the Asian Peninsula (North/South Korea – Japan – US) is not yet resolved, nor is the Brexit process. The Middle East, remains volatile and prone to flare ups. Though markets have largely shrugged off troubling news from the White House, the Trump administration may find its ability to follow through on election promises in a precarious position. Many investors are likely to adopt a cautious stance going into 2018. Oil and industrial metal prices continued to rally, particularly copper, supporting outperformance in the oil, gas and mining sectors.

Year-to-date the red metal has rallied over 30%, buoyed by demand in China and strengthening global economic growth. Miners Glencore and BHP Billiton were among the market’s top performers in December. Oil and industrial metal prices continued to rally, particularly copper, supporting outperformance in the oil, gas and mining sectors. Year-to-date the red metal has rallied over 30%, buoyed by demand in China and strengthening global economic growth. Miners Glencore and BHP Billiton were among the market’s top performers in December.

Currency

“The local unit appreciated by 10.4% against the USD, with investor sentiment boosted by the outcome of the ANC elective conference.”

The South African Rand proved to be one of the strongest emerging market currencies during December. The local unit appreciated by 10.4% against the USD, with investor sentiment boosted by the outcome of the ANC elective conference. The Overall US Dollar Index lost ground, closing 1% lower against a basket of currencies in December. Commodity-linked Developed Market currencies (Australia, New Zealand and Canadian Dollar) posted a strong showing. While Emerging Market currencies were largely stronger, the Mexican Peso depreciated substantially (-5.3%) against the unit of its somewhat-antagonistic US neighbour. The Rand, despite significant recent gains and 10% overall appreciation during 2017, remains at risk to investor sentiment swings, and is likely to have a somewhat bumpy ride in 2018.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance