Market Commentary: August 2019

Here are this month’s highlights: Global equities had a tough August, with little respite from the trade war between the US and China, and no end in sight to Brexit wrangling. The inversion of the US yield curve has also fuelled fears of an imminent recession, and downbeat sentiment saw investors turn to safe-haven assets. Gold, the US Dollar and the Japanese Yen were therefore in high demand, while Emerging Markets struggled against their Developed Market peers.

Market View

Cash

Cash investments provided a 60 basis points (bps) return for August, making it one of the better performing local asset classes. The latest data shows that the annual consumer price inflation retreated to 4% in July, down 0.5% from June. Price drivers included the fall in fuel and transport costs, reflecting lower international oil prices, and a dip in food and non-alcoholic beverage prices.

“The Automobile Association warned that a September fuel price increase is imminent.”

The rise is attributable to rand weakness – had the rand/dollar exchange rate remained flat, lower international prices would have seen a price drop of up to 30 cents a litre for diesel and 53 cents for petrol. Instead, motorists are likely to pay, respectively, 25 cents and 10 cents more at the pump.

The upside risk to inflation makes it unlikely that the South African Reserve Bank (SARB) make any change to interest rates at its September Monetary Policy Committee meeting.

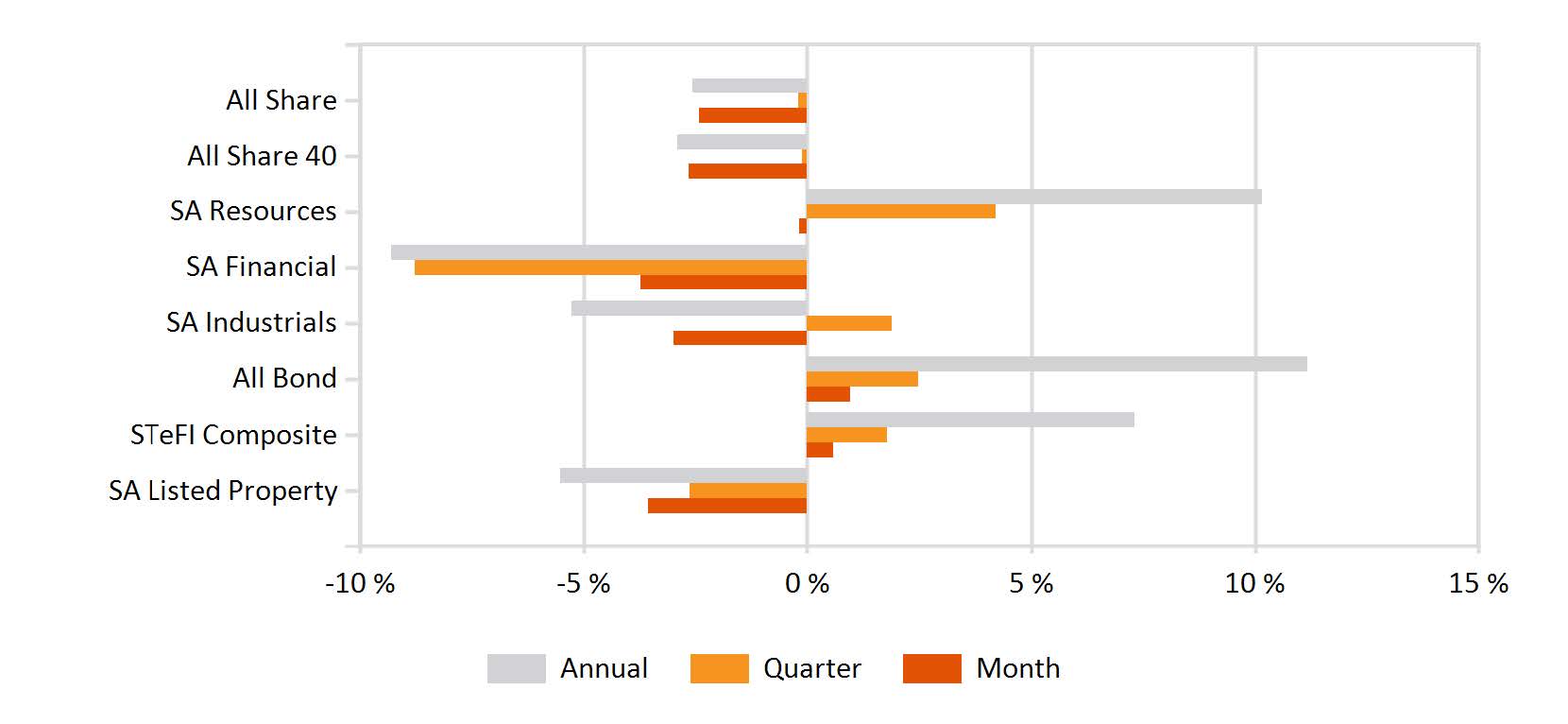

Bonds

Bonds proved to be the best performing domestic asset class during August, with the ALBI providing a 95 bps return. Inflation Linked Bonds (ILBs) closed 69 bps lower, and local bonds were well behind their developed market counterparts. The BarCap GABI posted a 2% gain in dollar terms.

Riskier emerging market (EM) and high yield bonds fell from favour, as the market mulls the implications of the inversion of the US yield curve. At best, the inversion signals a slowing economy. At worst, it heralds a recession. Both prospects saw the demand for safe haven assets such as US T-bills, Developed Market and Corporate Debt and hard currencies such as the dollar and yen, pick up rapidly.

US money markets are pricing in some fairly aggressive interest rate cuts over the next 18 months (four cuts between 2019 and 2020) and South African investors are pricing in a further two from the SARB over the next nine months. As short rates are pricing downward and longer end rates feel pressure from general risk concerns, the South African yield curve saw further steepening.

While the spread between EM and DM bonds looks attractive, risk aversion has trumped the search for yield.

“Foreign investors continue to reduce SA bond holdings based on the country’s derating relative to its peers, and on increased uncertainty as to the country’s fiscal health.”

Recent speculation that the government may apply for the International Monetary Fund’s (IMF) assistance, and ongoing concerns regarding the funding of SOE ‘bailouts’ have done little to reassure foreign investors.

Globally, August was another month of bond market milestones, as escalating trade tension fans recession fears, pushing borrowing costs further and further into negative territory. Some USD 17 trillion of global debt, including corporate and sovereign bonds, now yields less than 0%. Yields are negative across all maturities of German Bund.

In the UK, political risk also added to the mix. Boris Johnsons’s tough stance on Brexit fanned fears of a no-deal Brexit. The 10-year UK Gilts continued to rally, ending the month 13 bps lower at 0.48%. The collapse of the ruling populist Italian government led to a rise in Italian bond yields. Expectations of a solution, however, saw government bonds rally somewhat. Nonetheless, a 55 bps decline means that the 10-year Italian Government Bond (BTP) ended at 0.998%, the first time it has ever been below 1%.

Equity

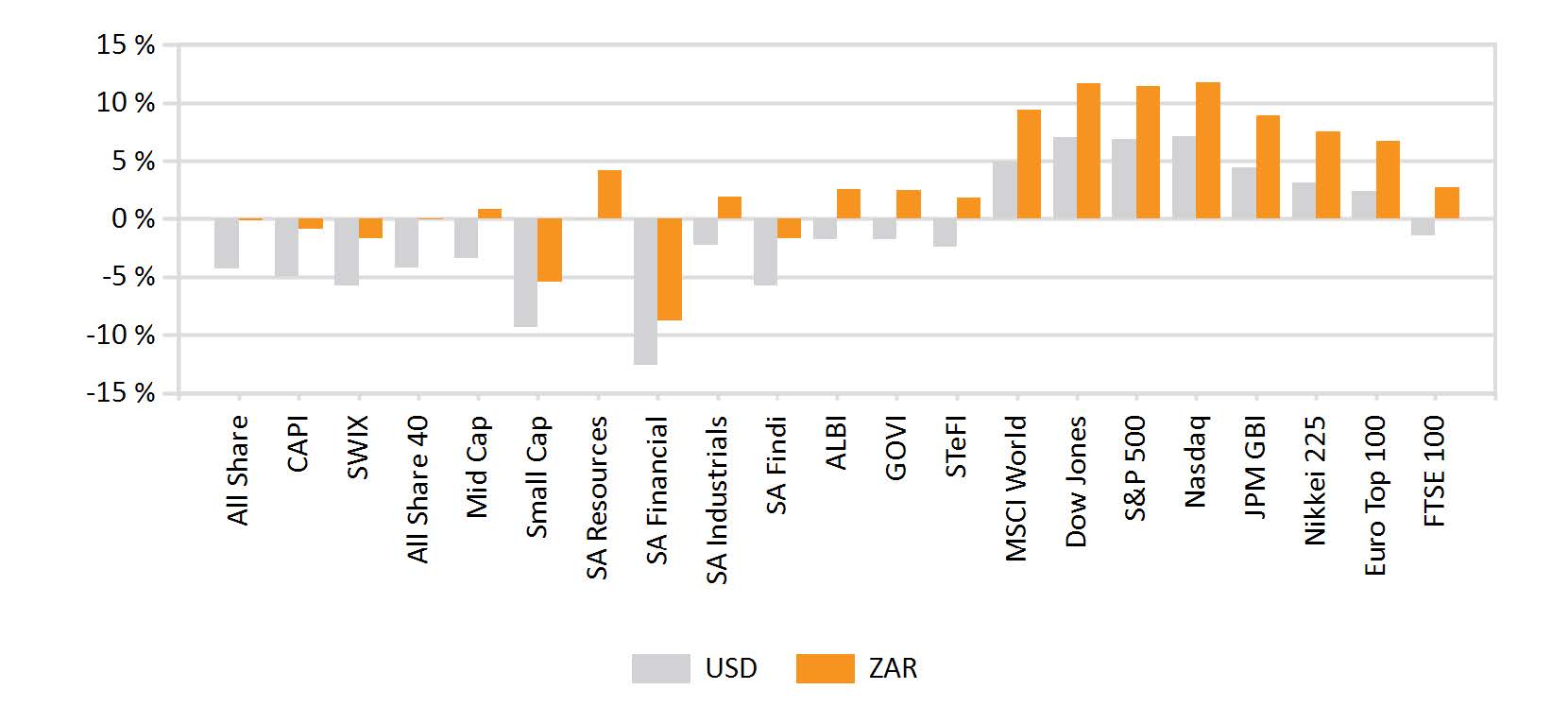

The domestic equity market closed the month in the red, with the SWIX down 2.5%. Domestic counters, however, outperformed most Emerging Market (EM) peers and only modestly underperformed the MSCI World, which lost just over 2% in dollar term.

Sentiment toward the country took a knock during August, as the Zondo Commission continues to reveal how deep the extent of State Capture had spread, Eskom’s woes seemed far from over and speculation mounted that the beleaguered state coffers would necessitate an IMF bailout.

“The currency bore the brunt of the uncertainty, proving volatile and registering a 5.5% depreciation against the greenback.”

Month-end saw some positive developments: Finance Minister Tito Mboweni outlined a series of economic interventions aimed at boosting economic growth between 2% and 3%, and creating 1 million jobs; and the consensus opinion emerged that South Africa did not fit the profile of countries that had historically requested IMF assistance.

Market participants and foreign investors have responded well to Minister Mboweni’s plan, which contains some noteworthy action points including, but not limited to: The relaxation of regulations impacting small business, such as labour laws and bargaining council agreements; Allowing third party access to the country’s rail network, ending Transnet’s dominance and allowing for better use of transport infrastructure; Reviewing fuel price regulation and measures which have supported non-performing entities such as Sasol; The sale of Eskom’s coal-fired power stations in order to alleviate the SOE’s R450 billion debt burden, and the concession that private power producers be allowed to sell back to the grid.

Moreover, the consensus opinion from major market participants, including asset managers such as Futuregrowth is that despite the gloomy picture of the country’s sovereign debt burden, the debt profile does not point to the need for a bailout. Analysts point out that the financing of the growing deficit has been astute, comprising predominantly the issuance of long-dated nominal bonds, avoiding to a large extent inflation linked bond-issuance and, more importantly, limiting the issuance of foreign currency debt. A further positive note has been sounded by the latest GDP data from StatsSA (released in early September).

“It has revealed that the country has avoided a recession, with second quarter GDP growth ticking up to 3.1% on a seasonally adjusted annualised basis.”

Mining was the strongest performer in the second quarter – at 14.4%, it is the industry’s strongest showing in three years.

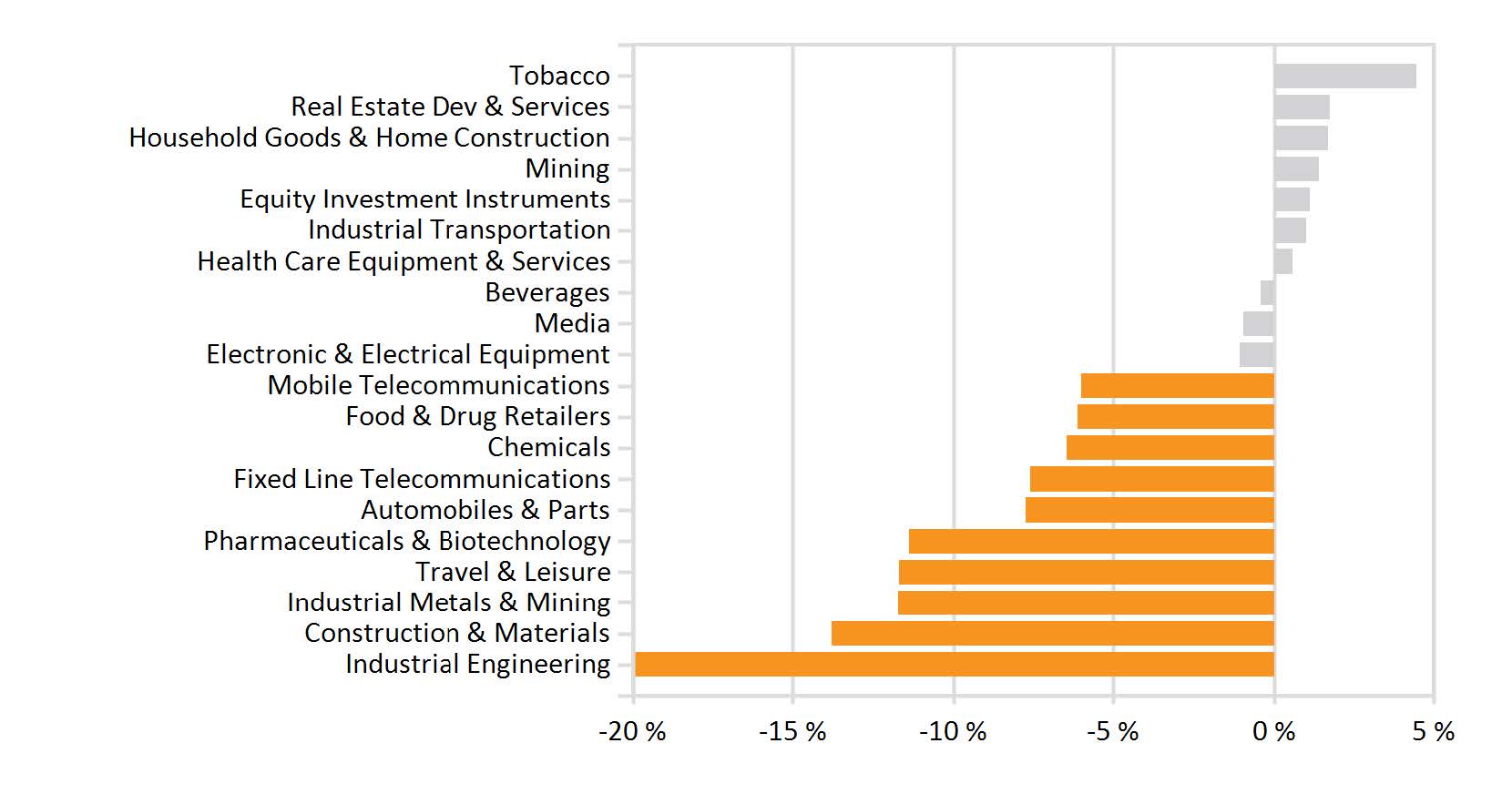

By sector, resources proved to be the most resilient, giving up only 18 bps, despite facing some headwinds. Sibanye Stillwater reported a headline loss of nearly R1.3 billion for the six months to end-June, due to a protracted strike between November 2018 and April 2019. Gold production at the company started normalising in August, but management expects a solid turnaround, thanks in part to the soft commodity’s surge. Gold is trading at its best level in six years, and Sibanye saw its share prices tick up 14.5%, while fellow goldminers DRD Gold and Harmony surged between 46% and 50%.

Sibanye is also set to continue benefiting from the increase in platinum group metal prices, which registered 34% over the past six months. Angloplat saw its share price gain over 8% for the month, while Northam Platinum jumped by over 24%. Financials were the poorest performing sector, losing 3.74%, despite some positive corporate results. Absa Group Limited, for example, reported an increase in headline earnings and revenue of 3% and 6%, respectively. Standard Bank reported a healthy increase in headline earnings of 6%, slightly exceeding that of FNB (5%). Naspers shares had a somewhat rollercoaster month, dipping to a three-month low at the beginning of the month, but recovering to end near three-month highs.

Retailers also struggled during the month, reflecting the fact that South African consumers and business players remain downbeat. The Absa Manufacturing PMI for South Africa slumped into contraction at 45.7 for August, its lowest level since May.

Despite the gloom and doom, the latest GDP data has provided a much-needed fillip to consumer and business sentiment. A number of analysts point out that there are significant buying opportunities amongst the sectors that have struggled most.

“Quality SA Inc is due to stage a comeback, and astute investors can position themselves accordingly.”

Property

South African listed property was the poorest performing local asset class for August. The SAPY lost 3.57% and the ALPI 3.06%. Given rand weakness, dual-listed property companies outperformed for the month. UK-centric Hammerson and Capital&Counties, as well as Australia-focused Investec Australia did well at 17%, 11% and 5%, respectively. South African consumers are feeling the pinch, putting retailers under pressure. Retail landlords are struggling to negotiate better escalations and lease terms.

In August, StatsSA‘s release of the building statistics for the second quarter pointed to a still weakening near term picture. On the residential front, the StatsSA release shows that the ‘New Development Sector’ is facing a significant challenge due to affordability. FNB Property Insights show that the affordability index has increased by 59% relative to an early 2013 multi-year low. Building cost inflation, relative to household incomes and existing house price growth, has made it more difficult for the ‘New Development Sector’ to bring a competitively priced stock to market. The existing home market is also well-supplied and priced competitively, so it is expected to remain attractive for buyers.

“Despite it being a ‘buyers’ market, South Africa is in its longest business cycle downturn in the post-World War II era, and appetite and ability to purchase are muted.”

The FTSE EPRA/NAREIT Developed Rental Index posted a positive return of 2.66% in US Dollar terms, and South African investors into global real estate saw particularly healthy rand returns, given currency weakness.

Japan was the best performing global real estate market, partly on optimism ahead of the Rugby World Cup in September, and gained 5.7% for August. Against the backdrop of escalating tension and increasingly violent pro-democracy protests in Hong Kong, the market lost 7.1%.

In the UK, Brexit uncertainty continues to hold the property market down. Affordability is still stretched for the majority: Halifax, the UK’s largest mortgage lender reported that the average house is 5.59 times average earnings, and substantially higher than it has been historically, up 4.29 times since 1983.

According to the latest release from the US Department of Commerce, homebuilding fell for the third straight month in July, in conjunction with a steep decline in the construction of multi-family housing units. Confidence amongst homebuilders, however, nudged higher, as did US construction spending, and building permits surged by 8.4%, an 18-month high.

Global real estate fundamentals remain healthy and the estimated forward funds available for distribution (FAD) is 4.6%. The sector continues to provide a relatively safe haven, with careful selection, against a backdrop of global geopolitical tension and a lower-for-longer rate environment.

International Markets

Global equity markets struggled during August, impacted by escalating trade tension, increasing uncertainty around Brexit and concerns around global growth. The MSCI World was 2.05% lower, Emerging Markets declined by 4.88% and Chinese equities were 4.03% lower. The MSCI EFM Africa ex SA bucked the trend, up 2%.

In the US, the S&P 500 closed 1.58% lower and stocks were particularly volatile. The month saw as much volatility as an average four-year period, the VIX volatility index hitting a six-month high. The inversion of the US yield curve has weighed heavily on investor sentiment, further adding fuel to recessionary fears, as the curve has historically been a leading indicator of recession. The US Curve has inverted before every recession over the past 50 years and offered a false signal only once over that period. Historically, the measure has meant that markets should expect a recession anywhere between six to 18 months into the future. Analysts, however, are taking this predictor with a healthy pinch of salt.

US markets started off the month on a subdued note, as President Donald Trump tweeted that the as-yet-untouched remaining USD 300 billion of Chinese imports would be subject to a 10% tariff going forward. This came as a surprise to most participants, since the US and China had agreed to a ceasefire at the May 2019 G20 meeting. China retaliated by announcing tariffs on roughly USD 75 billion of US imports, including agricultural goods, crude oil and cars.

“Against this backdrop, US consumers have become increasingly uneasy: Consumer confidence measures hit their lowest level since October 2016, although retail sales continued to grow at a healthy pace.”

Part of the uneasiness lies in the potential knock on effect of the tariffs. There will be a direct impact on costs of goods from China, but the USD 2300 estimated annual cost to a US family of four will have a knock-on impact on consumption of services, and consequently on US employment.

The ripple effect, according to a study by economic consulting firm, Trade Partnership Worldwide, will be most felt in job losses in US service sectors, as people stop going out to dinner/entertainment events, put minor surgery and other big ticket services spending on hold or are cutting back on using Uber and the subway. The study found that the US faces a net loss of over 2.2 million jobs if all tariffs continue and will cause a sales decline.

The US jobs data was mixed: Non-farm payrolls increased by 130 000 for August, undershooting expectations; initial claims for unemployment benefits ticked higher; average wages showed a modest improvement; and the unemployment rate remained unchanged at 3.7%.

The ISM Manufacturing PMI fell into contractionary territory for the first time since January 2016, as trade tensions dragged on business sentiment. The IHS Markit US Services PMI registered a commensurate fall of 2.3 points. Although remaining in expansionary territory, at 50.7, it is the weakest reading since February 2016.

With oil prices falling to their lowest levels in six weeks, the energy sector led equity market losses. Financial stocks were also impacted by increasing trade tensions, as demand for so-called safe haven assets sees lower long-term yields (which narrows the spread banks can earn on longer term assets). Utilities, real estate and consumer staples (the traditionally defensive sectors) were in positive territory.

In the UK, economic data gave rise to concern: it showed a slowdown in economic growth during the first half of 2019, a result of weaker business investment, elevated Brexit fears and slowing global economic growth. The Zew Economic Sentiment Index decreased to an all-time low in August 2019; the IHS Markit/CIPS UK Manufacturing PMI fell to 47.4, the steepest contraction since July 2012; UK consumer confidence dipped to a seven-month low; UK unemployment edged up from its 44-year low.

The latest move in the Brexit saga saw new Prime Minister Boris Johnson ‘prorogue’ parliament from the 9 September to 14 October. It has done little to reassure market participants, and has instead sparked a political furore. Opposition MPs and erstwhile conservatives have backed the Benn Bill, legislation, which blocks a no-deal. It stipulates that government either has to reach a deal or obtain approval for a no-deal Brexit by 19 October or request another extension (to 31 January 2020). The EU, in the meantime, has indicated that it would not grant the UK an extension under the current conditions.

“A report issued by KPMG on 9 September, the day of the Parliamentary suspension, predicts that the UK will enter its first recession in a decade should there be no deal.”

The inversion of the UK yield curve, similar to the US and widely regarded as a bellwether for a recession, seems to support this view.

On a sectoral basis, energy stocks dragged on the wider bourse. With Sterling bearing the brunt of uncertainty and continuing to lose value against major currencies, export-oriented firms performed modestly better. There was also an increase in M&A activity, as offshore investors took advantage of depressed and demoralised local prospects. In August, for instance, a GPB 4.6 billion deal saw Hong Kong investment firm, CK Asset Holdings, acquired the largest pubs and brewery group in the UK, Greene King. The FTSE 100 closed 4.08% lower.

European markets closed lower, weighed down by global growth concerns and Brexit uncertainty, as well as weakness in regional powerhouse, Germany. The STOXX All Europe lost 1,61%. In Germany, macroeconomic data came in weaker than expected: The German manufacturing PMI came in at 43.6, well into contractionary territory and business confidence, as measured by the Ifo Business Climate Index, declined. The Zew Economic Sentiment Index dipped to its lowest level since 2011 and consumer confidence remained at a two-year low.

Germany is now on the verge of a recession, as the economy contracted by 0.1% in the second quarter, and the Bundesbank expects the downturn in cars and industrial orders to continue. The downturn has, however, spurred anticipation of stimuli.

Political developments in Italy also weighed on markets: The coalition between the populist Five Star Movement and the right-wing League split when then-Deputy Prime Minister Matteo Salvin pulled the plug, apparently in the hope of triggering elections that would see him move to power. Instead, he was ousted as Minister of the Interior amid the formation of a new coalition government between the Five Star Movement and the centre-left Democratic Party. Market responded favourably, as the new coalition is likely to take on a much less confrontational stance toward the EU and would implement a more conservative economic policy. The new government is also likely to take a more humane attitude to migrants, thereby reducing tension with other member states. The FTSE MIB gained ground, rising almost 4%, on the day of the announcement of the new coalition, but investors are still wary, as there is a distinct possibility that the somewhat tenuous agreement will dissolve.

Against this backdrop, non-cyclical defensive sectors had a strong showing on a sectoral basis, led by Consumer Staples, Healthcare and Utilities.

“Japanese markets suffered a sharp dip in early August, and failed to recover during the month, resulting in a 3.72% loss for the Nikkei 225.”

This is more a reflection of the escalating trade tension between the US and China and global growth concerns than of Japanese domestic factors. Macroeconomic news was largely positive: the economy grew at a greater-than-expected 1.8% in the second quarter; the August Composite PMI (at 51.9) pointed to the strongest pace of expansion since December 2018, with the uptick in services outstripping the dip in manufacturing; and the unemployment rate hit a fresh 27-year low. Indeed, the jobs-to-applicant ratio in Japan is a remarkable 1.59 – implying that there are more jobs than applicants.

Chinese equities underperformed global peers, as the month saw the rapid re-escalation of the Sino-US tit-for-tattery. The MSCI All China and MSCI China A Onshore ended 4.19% and 4.03% lower, respectively. Domestic data was largely positive however, The Caixin China General Manufacturing PMI rose into expansionary territory in August, it strongest showing since March at 50.4, the Composite PMI registered a similar jump and the latest retail sales data indicated resilient consumer spending.

Without the prospect of a trade deal, and against a backdrop of slower growth, the Chinese authorities were moved to add new stimulus measures in August. These included the announcement by the People’s Bank of China of a lending rate reform, which would lower financing costs. The bank also allowed the Renminbi to break the psychological level of 7 versus the dollar.

Elsewhere in Asia, the ongoing and escalating pro-democracy protests saw Hong Kong as the region’s weakest performer, while Korea was the weakest of the emerging Asian markets.

The KOSPI closed 3.4% lower, impacted by the knock-on effect of sour US-China relations, as well as by the country’s own trade spat with neighbour Japan. Indian equities ended the month only modestly lower, even though GDP growth came in at a six-year low of 5% for the second quarter of 2019.

The Reserve Bank of India consequently cut its key lending rate by 35 bps, and analysts expect further monetary policy support. Amongst other emerging markets, those most sensitive to US Dollar strength came under pressure. This included EMEA markets Turkey and South Africa, which proved to be the biggest laggards. The former, however, recovered somewhat toward month-end, as the economic confidence index improved and inflation eased (from 16.7% to 15%).

The weaker oil price weighed on Russian and Saudi markets. Conversely, weaker oil prices proved to be a boon to oil importers. Egyptian equities were also boosted by a larger than expected interest rate cut from the central bank. The performance of the Egyptian market, with the EGX100 delivering 8% in local currency terms, as well as the relative outperformance of the Nigerian Stock Exchange (the Nifty lost only 0.69% in local currency terms), helped to lift the MSCI EFM Africa ex SA into positive territory.

Latin American markets were the weakest amongst emerging peers. Argentinian investors felt that the election defeat of incumbent President Mauricio Macri raised the likelihood of a sovereign default. Brazilian markets also underperformed due to currency weakness and declining oil prices. Macroeconomic data however, was mildly encouraging, with Q2 GDP growth slightly ahead of expectations at 1% year-on-year.

During an otherwise tough month, Mexican markets found support from the decision of the central bank (Banxico) to lower interest rates by 25 bps in an attempt to bolster slowing economic growth.

Currencies and Commodities

In currencies the US Dollar Index was 0.4% higher in August. Emerging market currencies were mostly lower against the USD, with the Brazilian Real, South African Rand, Turkish Lira and Mexican Peso experiencing the biggest losses (-8%, -5.6%, -5.5% and -4.6%, respectively).

“The People’s Bank of China allowed the Yuan to depreciate by nearly 7%, causing the US to accuse it of currency manipulation and competitive devaluation.”

Sterling had a rough and volatile month, as political newsflow continued to impact currency markets. The British Pound eventually closed the month near the flatline, after suffering a 1.6% depreciation toward mid-month. The Japanese Yen was stronger against the dollar, putting pressure on export-oriented firms, while amongst emerging markets the Thai Baht also posted modest gains. Amongst Developed Markets, the Norwegian Krone, Australian Dollar and New Zealand Dollar fared poorly.

The GSCI index was 5.6% lower, although Precious Metals posted strong gains (7%). Silver gained 11.1%, Gold strengthened by 6.5% on safe-haven appetite, and Platinum Group Metals put in a solid performance, up 6.2%. The energy sub-index closed 6.6% lower, as oil prices softened off the back of demand-side concerns due to slowing global growth.

Agricultural commodities were also noticeably lower (-6.8%), led by a substantial loss in the price of corn and by pressure on soybean prices. The latter was lower on the prospects of a large South American crop and in the light of ample domestic supplies. The former was also impacted by healthy yield predictions, as well as favourable weather, export sales below expectations and the news that the output of corn-based ethanol in the US had dipped to a six-month low.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance