Market Commentary: August 2018

Here are this month’s highlights: It was a mixed month for global risk assets – Emerging market equities struggled, with geopolitical tension and dollar strength feeding into perceived vulnerabilities. US growth continued to be particularly strong, while consumers globally felt the bite of sharp oil-price increases.

Market View

Cash

South African cash with a return of 0.59% for August, outperformed fixed income peers. The Consumer Price Index ticked higher, reaching 5.1% in July, above market expectations. This is the highest level since September 2017, as fuel price increases, higher VAT rates and a weak rand have started to feed through. The South African Reserve Bank is unlikely to alter its stance, but more tempered assessments for the interest rate path are likely toward year-end, particularly if the rand stays weak.

Bonds

South African fixed income performed poorly, with bonds declining in line with a weaker rand. The ALBI posted a -1.87% loss, while inflation linked bonds were down at -0.16%. Emerging Market (EM) contagion aside, a tweet from US President Donald Trump, regarding land expropriation without compensation, somewhat dragged on international sentiment towards SA government bonds. South African Credit Default Swaps spreads – an indication of perceptions of creditworthiness – widened during August 2018, albeit not by as much as other EMs.

“A degree of risk aversion returned to bond markets, with political uncertainty and continued noise around trade wars weighing on sentiment.”

The Barcap GABI was up 0.1 % in dollar terms, but South African investors, given the relative rand weakness, would have gained just over 11%. US 10-year yields traced lower toward month-end, dropping from mid-month highs of 2.95%. Bond yields in peripherals tracked higher, as Brexit tension raised the spectre of anti-Eurozone campaigning and resulted in risk-related selling. Italian government bond yields rose from 2.72% to 3.23%, while Spanish yields rose to 1.47% (bond prices and yield move in opposite directions).

Primary issuance in the investment grade corporate sector picked up, and demand largely kept pace with supply off the back of a strong corporate earnings season.

“Sectors more sensitive to trade tension, including the automotive sector and transport, however, were slightly lacklustre.”

UK gilt yields were down, tempered by a more hawkish tone from Governor Mark Carney and increased fears of a “no-deal” Brexit. High yield bonds managed to outperform investment grade, partly as energy counters continued their strong year-to-date showing.

Equity

South African equities outperformed EM peers, with the ALSI posting a 2.34% gain. Resources led the charge on the local bourse, up more than 5%. The BRICS summit yielded several positive outcomes regarding continued substantial infrastructure-related investment, and a commitment to improve the balance of trade between South Africa and China. The latter has committed to import more value-added products from South Africa (versus the traditional resource-based import). Rand weakness, though weighing on consumer sentiment, boosted export-oriented resources and rand hedges including British American Tobacco, and Richemont.

Consumer-oriented domestic counters, however, were noticeably weaker, with poor earnings hampering retailers like Shoprite and Truworths. Telecomms dipped toward month-end, as news emerged that MTN would face additional penalties from the Nigerian authorities. Elevated volatility is quite amply illustrated by the movement in Naspers share prices: The heavyweight dipped by over 5% at its mid-month low, on poor results from Chinese parent Tencent and increasing Sino-US trade tension, only to close the month modestly higher.

“StatsSA released its latest GDP results in the beginning of September, bearing out analysts’ worst fears — a second quarter of contraction signals that the country has entered a technical recession.”

On a positive note, improved perceptions regarding governance, even as the enquiry into State Capture kicked off, has allowed a beleaguered Eskom to apply to international lenders for a much-needed boost to its coffers. Sentiment, presently, has seen several fundamentally sound domestic counters suffer from knee-jerk reactions. Astute investors can therefore position themselves well in pockets of value.

Property

South African listed property markets improved during the month, with results from the Resilient Group bolstering sentiment. The SAPY gained 2.15%, while the ALPI was up 2.49%. The sector, however, is likely to face headwinds — weak domestic economic outlook hampers investors overall willingness to buy and the ability of consumers to take on debt. Growthpoint management, in their year-end reporting, reiterated that it takes a dim view of South African property fundamentals. Annual growth in house prices, for instance, has been slowing and has not kept pace with inflation.

The office sector has continued to see oversupply, and retailers have been reluctant to take up the slack.

“Declining foot-traffic reflects a highly-burdened South African consumer – both in terms of disposable income and travel cost.”

This has made it increasingly difficult for retail-landlords to attract and retain tenants. Nonetheless, the rapid decline in the local listed property sector, down by over 20% for the year-to-date, seems overdone. SA-centric and dual-listed offshore companies are still trading at attractive forward yields above the long-term South African Government Bond proxy (RLRS).

Careful, agile and opportunistic allocators can take advantage of pockets of value. Analysts broadly expect that the sector — once some of the Resilient Group jitters have subsided, companies have re-rated and earnings have normalised — to again deliver inflation-beating returns over the longer run.

Global property, slightly lagging South African markets on a relative basis, closed 1.48% (FTSE EPRA/NAREIT) higher in USD terms. South African investors would therefore have seen a substantial gain, and the sector would have been an excellent hedging mechanism, given the rapid depreciation in the rand. The overall index, however, masks a fairly wide disparity on a regional basis.

“The new trend is omnichannel retail, which has seen a number of traditional brands embrace e-commerce platforms.”

It has also seen pure e-tailers take up not only logistics, distribution and warehousing space, but also invest in physical shop space.

A-grade quality malls and centrally-located logistics continue to trade at a premium with e-tailers such as Amazon, for instance, taking up quality space in Cape Town recently. Healthy real estate fundamentals are being underpinned by global growth trends, with a smattering of political impetus. In this regard, aside from the selected European centres that are vying for the title of alternative financial centre (versus London), some manufacturers are likely to relocate amidst ongoing trade tension. This illustrates the need to take into account unintended consequences, a bigger macroeconomic picture and the need for diversity on an overall portfolio level. Careful selection, timing and monitoring is crucial in this regard.

“While US markets continued to be strong, UK markets were troubled.”

Consumer weakness in the latter has translated into lower rents for High Street properties, and Brexit tension has somewhat tempered expectations for the Financial District. Overall, nonetheless, global real estate fundamentals are sound as global growth remains on track. Perhaps most importantly, demand in key economies and sectors (including logistics, US single family residential, German residential, emerging Eastern Europe) have remained healthy.

Management teams that follow disciplined practices in terms of capital allocation and portfolio management are therefore able to take advantage of pockets of strength. Judicious selection, and a clear view of the bigger macroeconomic picture are therefore critical.

International Markets

As risk aversion took central stage, global developed markets comfortably outperformed their emerging and less developed peers. The MSCI World gained 1.24%, versus the -2.7% drop in the MSCI EM and an even more pronounced -4% decline in the MSCI BRICS.

The S&P500 was one of the strongest performers, registering more than 3% and retaining the momentum from a strong corporate earnings season and GDP print. Higher household spending, an uptick in retail sales and low unemployment continue to bolster the economy.

“The Institute for Supply Management’s Manufacturing PMI in the US jumped to 61.3 in August from 58.1 in July, beating market expectations of 57.7.”

This reading points to the fastest expansion in factory activity since May 2004 amid faster increases in new orders, production, employment and inventories and lower inflationary pressures.

Manufacturers, however, remain overwhelmingly concerned about tariff-related activity, including retaliation and potential impacts on current manufacturing locations.

“UK markets were lower, with little progress from the British government in soothing Brexit tensions.”

The FTSE 100 declined by just over 3%. Adding to the UK bourse’s woes, several mining companies and financials have significant exposure to EMs and Asia. These sectors performed poorly in the face of EM weakness, softer metal prices and the Chinese slow-down.

Continental Europe was also weaker – the STOXX All Europe closed 2.23% lower. Eurozone financials, many of which have substantial exposure to Turkey, were noticeably weaker.

“Trade woes have made themselves felt in major markets such as Germany, where the trade surplus narrowed to its lowest level in four years.”

Automotive makers have been plagued by both trade concerns and tighter rules on EU emissions. Vehicle-makers and suppliers registered the third-worst performance for the year-to-date on the broader STOXX Europe Index. Towards month-end, however, the EU’s top trade official sounded a conciliatory tone, indicating a willingness to exempt US automakers from tariffs – beleaguered BMW shares rose by as much as 1.8%, reaching an 11-week high. Nonetheless, Europe’s largest economy reflected a less benign growth environment, with German Industrial output down 1.1%, and factory orders by 0.9%. Eurozone peripherals saw the impact of Euroskeptic jitters, although the populist Italian government moved fairly quickly to reassure markets that it would respect the European Union’s fiscal restrictions. The Italian stock exchange , however, ended August just over 9% lower.

“Japanese stock markets lacked clear domestic impetus, and ended the month 1% lower.”

The Ministry of Finance, however, in a post-month-end announcement indicated that the economic recovery is on track. Second quarter Capex rose 12.8% year-on-year and government is set to implement additional fiscal stimulus. Elsewhere in Asia, markets braced for another round of US tariffs.

Chinese markets ended the month 4.98% lower, with little progress being made on US-Sino trade relations. Instead, the latest escalation sees the Trump administration threaten to slap tariffs on USD 200 billion more of Chinese imports on 6 September. China’s stance toward the US has been mainly ameliorating, but the authorities have proven that they are more than willing to retaliate, with spillovers materialising in neighbouring Asian countries.

Elsewhere in EMs, Latin American equities underperformed, with currency weakness dragging markedly on Brazilian counters, and current account weakness leaving Argentina vulnerable. Turkish equities were the weakest performer, the sharp depreciation in the lira on fraught US diplomatic relations, has highlighted the most vulnerable EMs. Several other emerging markets felt the spillover effects, including South Africa.

“The opportunity has therefore arisen, given potential mispricing, for agile investors to pick up substantial bargains.”

On a sectoral basis, IT, Consumer Discretionary and Healthcare were amongst the best performing sectors. Technology stocks were buoyed by robust gains in Amazon and Apple. The latter hit USD 1 trillion market cap value in early August, and the former in September. Materials (-0.5%), and Industrials (+0.3%) were the worst performing sectors. Large cap growth (+5.5%) outperformed large cap value (+1.5%) in August.

Currency

In currencies, the USD Index continued its upward march, up by a further 0.6%. EM currencies were under severe pressure – developments in Turkey, Argentina and Venezuela causing widespread selling pressure. The Turkish lira lost 25% against the US dollar during the month. Its diplomatic spat with the US regarding the detention of an American pastor has spilt over into the trade arena, with the two countries trading tit-for-tat tariffs. Venezuela and Argentina, too, have seen high inflation rates and tense domestic political situations feed into concerns regarding their current account deficits, resulting in sharp adjustments to their respective currencies.

“As some of the casualties of investors ‘turning Turkey’ toward Emerging Markets, the South African rand and the Brazilian real have also depreciated sharply.”

South Africa and Brazil’s outlook has not been particularly bright — tempered by poor GDP growth expectations, political uncertainty, and spillovers from the slow-down in China. It is fundamentally unchanged from the previous month. The depreciation in these countries’ more liquid currencies, hovering around 10% seems to be a somewhat knee-jerk reaction to EM aversion.

In developed markets, commodity-linked currency pairing deteriorated (as Chinese demand showed signs of slowing down), and the Australian and New Zealand dollars were amongst the biggest losers (-3.2% and -2.9%).

The broader Bloomberg commodities index posted a negative return of -1.93%.

“Agricultural commodities were lower.”

There were noticeable losses in soybeans, as Chinese tariffs take their toll on US producers, while declines in coffee and cotton prices can be attributed to improved weather, favourable harvests and currency weakness in dominant producers like Brazil.

The slowdown in Chinese demand, and the ongoing US-Sino tension, continues to weigh noticeably on industrial metals. The energy sector, however, was supported by an increase in Brent Crude. Although OPEC has increased supply, US sanctions against Iran and unrest in Venezuela have added constraints.

Precious metals were softer, with gold bullion receiving little support. Analysts cite the ongoing outflows from ETFs, record-high speculative shorts and upbeat US economic data as some of the major headwinds. August month-end heralded the fifth consecutive monthly dollar decline, and the longest dollar price drop since 1989.

Performance

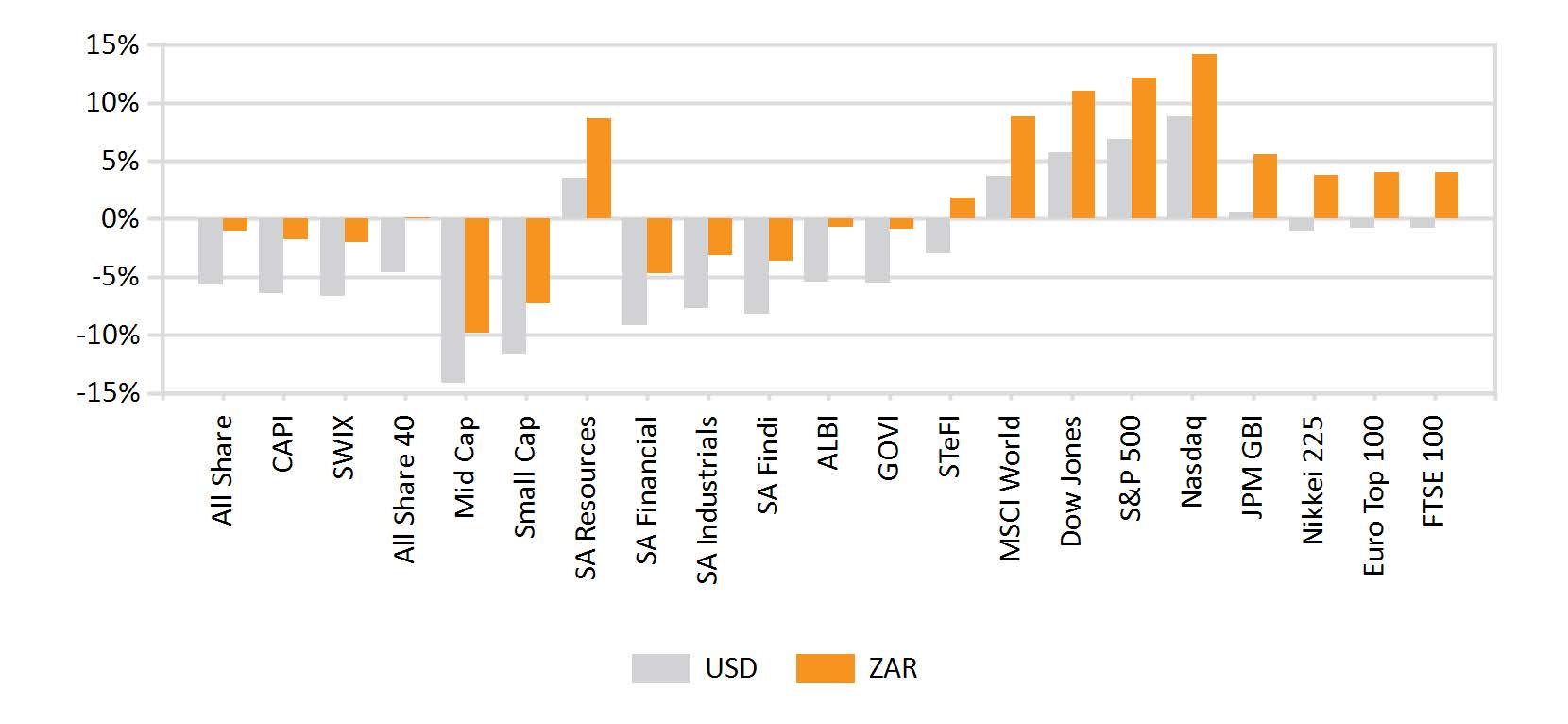

World Market Indices Performance

Monthly return of major indices

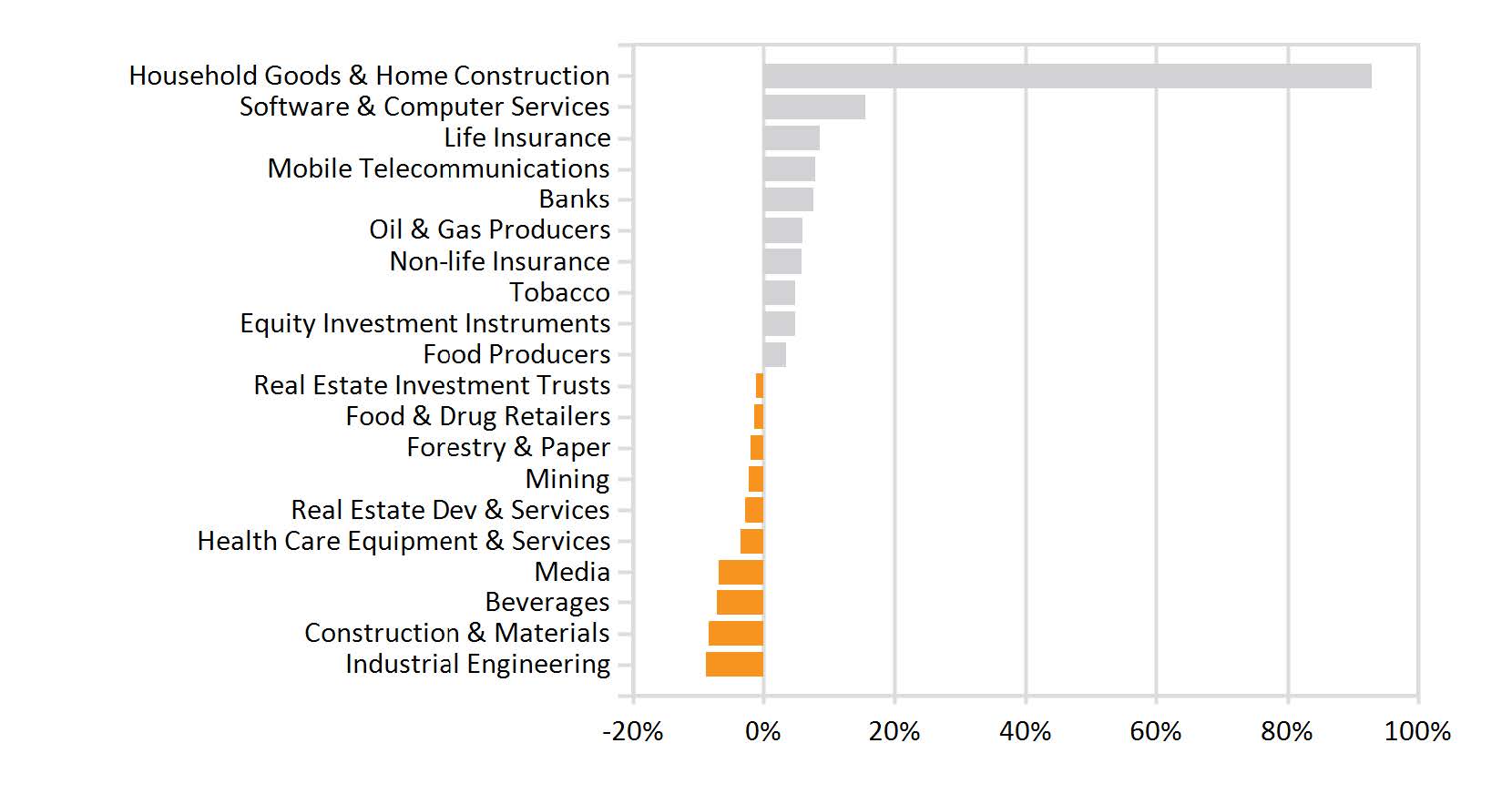

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance