Market Commentary: April 2022

Global Market Themes: No peaceful end in sight to Russia-Ukraine conflict Global food and energy prices tick higher, further fuelling inflationary fears United States (US) equities slumped, as earnings disappointment added to investor jitters – S&P500 8.8% lower for March European equities lacklustre, powerhouse German bourse (DAX) loses more than 2% Energy-rich United Kingdom (UK) sees equities buck trend and FTSE100 modestly in the green Risk aversion, political wrangling and poor performance from Chinese stocks drags Emerging Markets (EM). MSCI EM closes 5.5% lower SA Market Themes: As Covid-related National State of Disaster (SoD) ends, floods force the declaration of another SoD Costs of flooding in KwaZulu-Natal (KZN) and the Eastern Cape mounting – estimated at R17 billion South African (SA) consumers spared worst of petrol price increase, as general fuel levy reduced Equities end in the red, Capped SWIX nearly 4% lower Local currency plunges against greenback, with nearly 8% depreciation Inflation Linked Bonds (ILBs) gain ground, bucking the broad trend

Market View

Global Market Themes

The conflict in Ukraine continues unabated, with no end in sight. Several countries stepped into the ring in an attempt to mediate, including Israel, France and Turkey, with little to no positive result. Global investors consequently remained risk-averse, and equities sold off sharply. The MSCI World lost more than 8% in USD (United States Dollars). Fixed income assets didn’t fare much better, as the BarCap GABI (Barclays Capital Global Aggregate Bond Index) closed 5.5% lower and global listed property dipped by a similar amount.

The US bourse saw one of its worst months in recent history, and the S&P500 slumped by 8.7%. The market appears to be increasingly pessimistic about the country’s inflation outlook and growth prospects. As the month kicked off, initial predictions regarding the Federal Reserve Bank’s (the Fed’s) next move were for a 0.25% interest rate hike, but the figure changed to a 0.50% hike as the month wore on (and some pessimists flirted with 0.75%). Similarly, predictions of a so-called hard landing (a sharp downturn following a period of rapid growth) morphed into predictions for a recession in 2023. This view was supported by a serious “miss” in terms of forecast quarterly growth: expectations were for a first-quarter expansion in Gross Domestic Product (GDP) of 1.1% but the American economy contracted by an annualised 1.4% in the first three months of 2022. For many market watchers, one underlying contributor is of particular concern.

“The marked slowdown in gross private domestic investment growth (from 36.7% in the previous quarter to 2.3%) is thought to belie underlying investor pessimism.”

Private payroll data from ADP, released in the first week of May, came in well under expectations (247 000 jobs versus expectations of 390 000).

Quarterly earnings have, thus far, beaten estimates, although coming in far lower than the record fourth quarter of 2021. In company news, the so-called FAANGs struggled. Amazon shares slumped at month-end as the company registered its slowest growth since the dot-com bust; Apple shares dipped after Chief Financial Officer (CFO) Luca Maestri warned that constraints (including supply constraints) could hurt sales by up to USD 8 billion; Alphabet delivered weak earnings and revenue reports and Netflix shares tanked by 25% mid-month as the company lost subscribers for the first time in a decade. On the flipside, Meta (previously Facebook) spiked on better-than-expected quarterly earnings and several banks reported improved revenue and earnings (e.g. Deutsche Bank and Barclays). It would be remiss not to mention one of the most talked-about transactions in recent history.

“Billionaire Elon Musk acquired Twitter for USD 44 billion. In the days following the announcement, the company reported a modest miss in expected revenue (USD 1.2 billion versus USD 1.23 billion), better-than-expected earnings per share (EPS) and a sharp uptick in “Monetizable Daily Active Users” (mDAUs). For the most part, the companies’ management has cautioned that the road ahead is likely to be bumpy.”

European markets continued along a choppy path, as sentiment swung depending on perceptions about the likelihood of a Russia-Ukraine peace deal. The STOXX All Europe closed the month modestly lower, losing 0.6% during April 2022 Eurozone inflation keeps hotting up, hitting a record high for the sixth consecutive month. The European economy expanded by 0.2% for the first quarter of 2022, which is the slowest growth rate since the bloc exited its recession last year. Germany, a powerhouse in the region, hasn’t delivered much good news of late. The DAX posted its fourth consecutive monthly decline and the country’s economic growth prospects have been severely impacted by the war in Ukraine. This is largely because Germany depends rather heavily on imports of certain goods, notably energy. Overall, import prices in Germany spiked by 31% year-on-year in March (the most since 1974), driven by a 160.5% surge in energy prices. German inflation is also hotting up, reaching its highest in more than 40 years in March.

Overall, the Eurozone faces strong headwinds: a looming aggressive tightening cycle from the US Fed (and a less pronounced cycle from the European Central Bank); slowing Chinese growth due to ongoing Covid-related lockdowns; inflationary pressures; the impact of ever-more-stringent sanctions on Russia (and Russian imports); and dampened consumer sentiment will all weigh heavily on growth prospects.

The FTSE100 extended its gains, edging 0.7% higher in April. The energy-heavy UK bourse is well placed to benefit from surging energy prices, and UK companies have, for the most part, reported earnings which beat expectations. Notable EPS “beats” included Barclays, AON, GlaxoSmithKline, and AstraZeneca. Despite largely upbeat earnings, changes in business and consumer sentiment are being driven by expectations of higher inflation and slower GDP growth.

“Retail sales tumbled to their lowest reading since March 2021; the GfK consumer confidence indicator slumped to a near-record low; and business morale, as gauged by the CBI’s (Confederation of British Industry) manufacturing optimism index, fell to a two-year low. “

Although manufacturing output and orders have continued to grow, the war in Ukraine is exacerbating the existing Covid-related supply crunch and concerns about the availability of raw materials at a nearly-50-year high. Market participants are anticipating that the Bank of England’s (BoE) next move will be another interest rate hike, particularly given that it was one of the first amongst its peers to take this step to combat inflation.

Emerging Markets (EM) bore the brunt of the April malaise, with the MSCI EM closing the month more than 5.5% lower in USD. Very few constituents were spared the impact of global risk aversion. Russian equities, as might be expected, lost a substantial 9.5% in local currency terms, as the impact of sanctions and the escalating war weighed heavily on the economy. Its natural wealth in commodities did little to boost Brazil’s stock market this month (as commodities were largely softer), and the BOVESPA closed more than 10% lower in Brazilian Real. The war between Russia and Ukraine continues to drive global food inflation higher, with a disproportionate impact on the most vulnerable population groups in EM. Wheat prices are forecast to increase more than 40% this year. The sharp rise in other input prices, such as energy and fertilizer (which uses natural gas as a production input), is likely to lead to a reduction in food production, particularly in developing economies. The combined knock-on impact is likely to affect food availability, rural incomes and the health and wellbeing of the poor.

Chinese markets closed significantly in the red, with the MSCI China and MSCI China A Onshore closing 4% and 10.2% lower.

“Chinese authorities, having kept Covid under tight control for the majority of the past two years, are now struggling to contain the latest outbreak. Draconian restrictions have been implemented in Shanghai, Beijing and Hangzhou.”

Although the country’s Politburo pledged to boost economic stimulus after its month-end meeting, reports have been light on detail. It appears as though the focus will be on infrastructure, tax cuts and consumption support. In the meantime, the zero-tolerance policy is costing the country dearly. Many foreign residents have left affected cities and towns, and factories have struggled to get back up to speed. Manufacturers with operations in China, including General Electric (GE) and Mercedes Benz, have warned of supply chain disruptions and an uncertain business outlook. The Yuan also recorded its biggest monthly drop on record, declining by 4.2% against the dollar over the month, as foreign investors broadly shunned Chinese assets.

Energy prices continued to run hot, with the price of oil ticking up a further 2.3% in USD over the month (bringing year-to-date gains to nearly 38%). Natural gas posted substantial gains, due to a combination of supply-side constraints and demand-side pressure. US natural gas has become increasingly in demand, as the West attempts to break its dependence on Russia. Simultaneously, US natural gas production has slowed. The result was a hefty 26.9% price increase. Metals were largely lower, as lockdowns in China caused a dip in demand for industrial metals. Platinum was 4.7% lower at month-end and copper lost 5.7%. Additionally, gold lost some of its lustre, with the price declining by 2% during the month. In an inflationary environment, this seems counterintuitive at first (the yellow metal is a traditional inflation hedge), but with global central banks likely to tighten policy, the opportunity cost of holding a “zero-yield” asset increases when short term interest rates and bond yields tick higher.

South African Market Themes

South Africans had a somewhat tumultuous month: President Cyril Ramaphosa finally lifted the National State of Disaster in early April, signalling an end in sight to the more onerous Covid-related restrictions and restoring hopes of a return to normalcy. However, it appears that the country will enter the fifth wave sooner than initially expected, with the infection rate ticking steadily higher. The green shoots of optimism were further dampened by the natural disaster which befell KwaZulu-Natal (and the Eastern Cape to a lesser extent).

Widespread flooding due to inclement weather led to significant losses, some of which are still being tallied.

“At the last count, more than 430 lives were lost, more than 17400 households were affected and more than 13 000 people were either left homeless or housed in shelters. More than 600 schools and more than 60 healthcare facilities were affected.”

The damage to infrastructure was also considerable, and the provincial government has estimated that infrastructure repair alone will cost about R17 billion. The Passenger Rail Agency of South Africa (PRASA) has estimated that it would cost between R2.8 billion and R3 billion to restore the roughly 300 km of rail infrastructure that had been affected, and Transnet is still counting the cost but has indicated that it will take seven weeks to resume operations on the damaged lines.

“The Port of Durban, which is also a conduit for the import of food, had a backlog of 9000 containers which took more than a week to clear. The supply-chain disruptions are likely to exacerbate cost-push factors and spur inflation higher.”

In addition, Indonesia, which accounts for roughly 58 % of global palm oil production, banned exports toward month-end. This exacerbates the global shortfall caused by the Russia-Ukraine conflict, and about 45.7% of the global availability of vegetable oil has been affected. According to FNB Agribusiness economists, South Africa (despite producing a bumper crop of sunflower oil this year) simply cannot substitute the net imported palm oil. Palm oil is widely used in food production, and the shortage will have a significant impact on food prices. The upward trend in South Africa and global inflation is likely to continue.

Business sentiment was left understandably depressed, and the composite leading business cycle indicator, which examines the direction in which real economic activity is moving in real time, edged lower. The composite Purchasing Managers’ Index (PMI) dropped to a four-month low of 50.3 in April (therefore still in expansionary territory, albeit at a subdued rate).

“The implementation of loadshedding and the forecast that South Africa could (in the worst case scenario) expect more than 100 days of outages. “

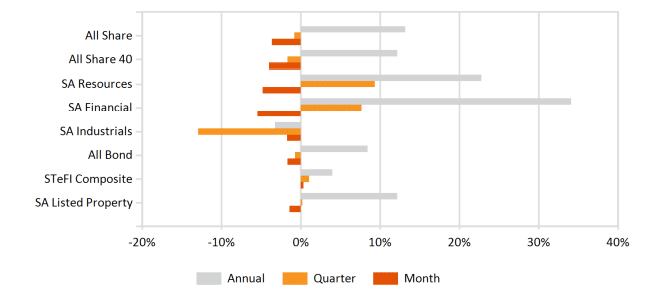

The local bourse was not spared the general risk-off sentiment toward EM. The Capped Shareholder Weighted Index (Capped SWIX) lost just short of 4% during the month. Resources, which had previously been able to boost the index, failed to shine as global commodity prices dipped. The subindex lost 4.8% for the month. Financials were the biggest drag on performance, with the subsector having lost more than 6% by month-end.

During the month, the Rand witnessed its worst daily depreciation in more than five months (-2.4% against the USD) as the impact of the KZN floods, rolling power-cuts and the signs of a Covid resurgence had investors fretting over South Africa’s economic outlook. The currency ended the month with a depreciation of more than 7.6% against the greenback. The yields on long-term government bonds ticked higher (yields move in the opposite direction as bond prices). The All Bond Index (ALBI) closed 1.7% lower. Inflation Linked Bonds, which offer some protection against the expected uptick in inflation, ended the month predictably higher, gaining 1.9%.

Performance

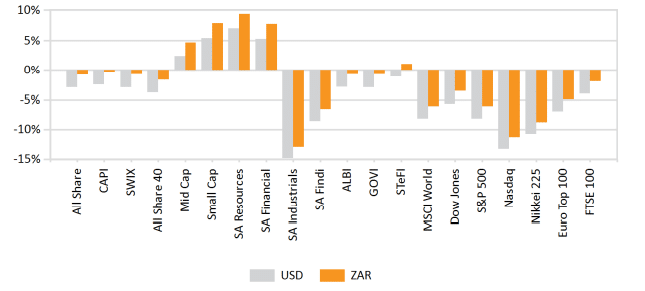

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices