Market Commentary: April 2021

Global Market Themes: Global equity rally continues, as vaccine rollout gathers momentum Biden’s climate policy lauded as a step in the right direction Eurozone enters technical recession in first quarter of 2021 India’s surging coronavirus cases grab global headlines China reports its highest GDP growth rate on record Sharp rise in commodity prices SA Market Themes: Drop in Naspers and Prosus share prices weighs on local equity indices March inflation numbers come in hotter than expected Rand comes under pressure towards month-end Public sector wage talks off to a rough start ANC in-fighting and Zondo Commission dominate political headlines

Market View

Global Market Themes

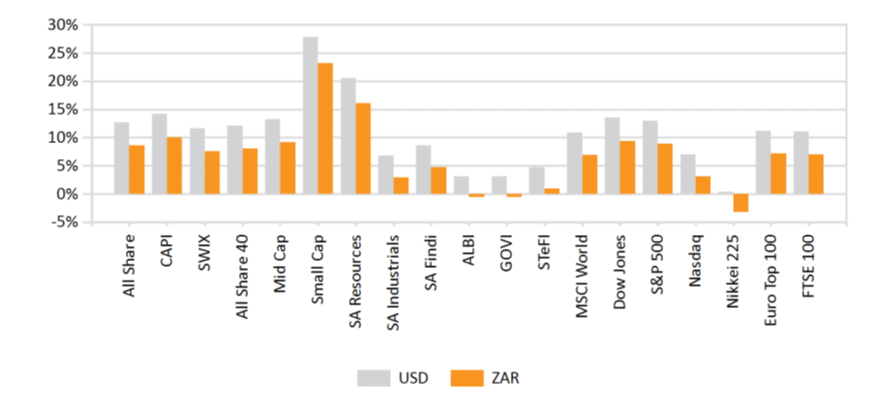

The recent global equity market rise showed no sign of slowing during April. The MSCI World gained 4.6% in USD, bringing its year-to-date gains to 9.8%. The rapid roll-out of vaccines in major developed markets, as well as continued central bank support, is a boon to equity investors.

US markets outperformed developed market peers, with the S&P500 gaining 5.3% in USD for the month. Economic data in the US is mostly positive. The third round of stimulus checks saw personal incomes in March rise by 21.1%, the largest on record. This coincided with increased consumer spending, which rose by 4.2%, the highest since June 2020.

“Retail sales ticked higher, as more states start to relax or do away with coronavirus-related restrictions, and rose by 9.8% month-on-month during March. On the labour front, US data continues to be largely positive: the four-week average of US jobless claims fell to its lowest level since the week ending 14 March 2020 and ADP data (measuring private businesses’ hiring activity) showed the highest increase in private payrolls in six months. This foretells gathering momentum in consumer spending.”

The Federal Reserve Bank (the Fed) left its monetary policy unchanged at its latest meeting, and Fed chairman, Jerome Powell, dismissed any rumours of tapering its asset purchases. Inflation has risen in line with market expectations, but the Fed has reiterated that it sees the underlying driving forces as transitory.

President Joe Biden, who effectively turned ex-President Donald Trump’s climate-skeptic policies on its head, has committed the US to cutting the country’s greenhouse gas (GHG) emissions in half by 2030. His USD 2 trillion infrastructure package specifically addresses climate change concerns and earmarks spending towards appropriate programmes. The ambitious target is to achieve net zero emissions by 2050. While 58 countries have already communicated a net zero target, further announcements are expected ahead of the COP26 summit in November.

Against a backdrop of rising Covid-19 infection rates and extended lockdown restrictions, the Eurozone entered a technical recession in the first quarter of 2021. Despite recent improvements, the 0.6% quarter-on-quarter decline in GDP follows the previous quarter’s 0.7% contraction (signalling a technical recession). Major economies Germany, Spain and Italy continued to struggle under the burden of a high infection rate. Business and consumer confidence in the region, however, are improving rapidly as more economies open up. The European Central Bank (ECB) has also stood pat on its policy, signalling that it will remain unchanged. Strong company earnings also contributed to rising stock prices. The STOXX All Europe registered a solid 2.2% gain in Euro terms.

The United Kingdom’s (UK) FTSE100 outperformed its continental peers, rising by 4.1% in Sterling terms. Purchasing Managers’ Indices, both in manufacturing and services, beat market expectations. Hovering at the 60 point mark, they herald an economy firmly in expansionary territory.

“Chinese equities closed the month in the green, with the MSCI China A Onshore outperforming the MSCI China, at 4% versus 1.3%. This is indicative of the domestically driven economic recovery. The release of stellar GDP growth numbers for the first quarter of 2021 boosted investor sentiment. The annual growth rate was recorded as 18.3%, the highest since records began in 1990.”

Elsewhere in emerging markets, the outcomes were mixed, and the MSCI EM lagged developed peers, registering a 2.49% uptick in USD. Brazilian equities moved higher, with the Bovespa gaining 1.9%, largely off the back of commodity strength.

Indian equities, however, had a lacklustre month and the SENSEX lost 1.4% in local currency terms. The rapid increase in the infection rate in India has caused alarm globally. The country has registered a daily increase of over 300 000 for 10 consecutive days. Hospitals, morgues and crematoriums are overwhelmed and oxygen is in short supply. While developed countries such as the US have extended a hand to the Indian government, Prime Minister Narendra Modi, has thus far appeared reticent to accept foreign help. The government faces widespread criticism for allowing millions of largely unmasked people to attend religious festivals and political rallies through March and April.

African economies, as measured by the MSCI EFM Africa-ex-SA posted positive returns of 4.5%. This was largely led by strong performances from commodity-linked indices.

Commodities posted strong gains, fuelling talks of a commodity supercycle. The sector-wide bull market is being fanned by government spending on post-pandemic recovery initiatives, increasing appetite from China, and bets on the greening of the economy. The greening initiative has seen prices of palladium (used in catalytic converters which filter exhaust fumes), and other lesser known raw materials used in electric motors (such as lithium) increase rapidly.

“Oil prices have continued their steady recovery, as OPEC nations and Russia keep a damper on supply. Oil gained 6.4% for the month. Industrial metals such as copper and iron ore posted even stronger returns, at 11.8 and 18.3% respectively.”

South African Market Themes

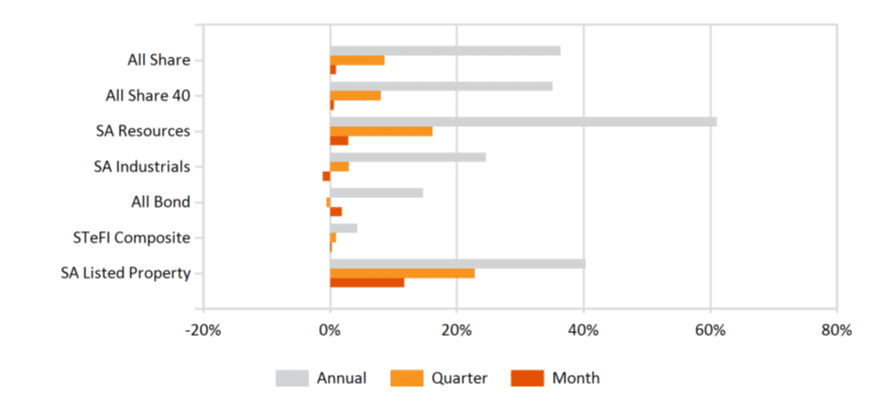

South African equities posted a modest gain, with the All Share Index gaining 0.9% for the month. Industrials were the main laggard, with the subindex losing 1.2%. Naspers and sister company Prosus were the main culprits, with shares in Naspers declining by nearly 11%. The company announced on 7 April that it would reduce Prosus’ share capital in Chinese tech giant Tencent by 2%.

“The transaction would result in a reduced shareholding, from 30.9% to 28.9% in Tencent. Prosus has, however, committed to not selling any further shares in Tencent for the next three years.”

Local fixed income investors had a positive month, as the ALBI gained 1.9% and Inflation-Linked Bonds (ILBs) was 1.1% higher. This is likely a reflection of a benign but rising inflationary outlook. Headline CPI is expected to breach 5% in the next quarter on the back of higher fuel and administered prices, and March’s reading came in hotter than expected; 3.2% y/y.

“The South African Reserve Bank is nonetheless expected to leave interest rates at current low levels. Simultaneously, foreigners appear to have started to look through the noise in the local bond market, recognising the opportunity of substantially higher yields.”

With local inflation and interest rates at current levels, South African bonds are currently offering some of the highest real yields in the world. The yields on longer-dated local bonds are up to 9% higher than US-equivalents.

The local property market appears to be booming, with the All Property Index delivering double digit returns at 11.4% for the month. Listed property came in for a pounding during the pandemic, but locally the sector has recouped about 20% for the year-to-date. Local portfolios are still largely skewed toward the office and retail sectors, which require physical mobility and unrestricted movement of staff and consumers. The recovery is therefore partly attributable to the reopening of the economy, as workers return to offices and retailers face fewer restrictions on trade. The rand came under pressure at month-end, after a particularly strong start to the month. The currency ended at 14.51 against the USD.

“Public sector wage talks got off to a rocky start, with the negotiations said to be deadlocked. The government’s position is that it cannot afford to pay the agreed-upon increases (per an agreement reached in 2018).”

It proposed making R9.4 billion available to adjust salaries for rising living costs but stipulated that this would require cutbacks in other areas of the wage bill (which would for example have implications for progress on the payscale, as employees would not necessarily receive step-up increments for additional responsibilities assumed). Unions have rejected this offer, and the Public Servants Association (PSA) has advised its over 235 000 members to ready themselves for industrial action.

On the political front, in-fighting in the ANC about the controversial step-aside motion dominated headlines. The 30-day window for affected party members to recuse themselves from their positions expired at the end of the month. Little progress appears to have been made, with some of the more prominent party members who remain under investigation failing to honour the resolution.

“The destabilisation of the ruling party appeared to have little effect on market sentiment, however, as investors seemed to shrug it off as ‘just another day at the office’. Events at the Zondo Commission also came under scrutiny. President Cyril Ramaphosa’s circumspect testimony gave little away that was not yet in the public domain. The testimony around state capture of State-Owned Enterprises (SOEs), and most notably Eskom, continues to unfold.”

While the inquiry arguably has value, the average citizen is likely left wondering how, if at all, it will affect the current state of the power utility. The manifold increases in electricity prices and the threat of loadshedding have hamstrung local businesses. The latest news is that the wage negotiations between Eskom and its largest unions are likely to result in strikes. The National Union of Mineworkers (NUM) is entering talks with a demand for a 15% wage increase, which the cash-strapped SOE simply cannot match.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices