Market Commentary: April 2018

Here are this month’s highlights: April saw a continuation of the risk assets rollercoaster. The Syrian strike and additional US sanctions against Russia unnerved investors, China’s more conciliatory tone soothed the markets, and a mixed month-end saw the potential implosion of the Iran-nuclear deal even as peace on Korean peninsula seemed imminent. Despite resurgent oil prices and some renewed risk-appetite, Emerging Markets posted their weakest relative performance for the year-to-date. South African equities outshone global peers, largely boosted by the rally in resources and Rand-hedge blue chips. The US dollar regained its ascendancy, and buoyant corporate earnings boosted developed market equities.

Market View

Cash

Annual inflation has remained on a downward trajectory. The latest available results show that South African consumer prices rose by only 3.8% year-on-year during March 2018, the lowest since 2011. This is well within the South African Reserve Bank’s (SARB) target range. SARB cautions, however, that transport costs may balloon in the newer readings, as recent Rand weakness, higher fuel prices and the impact of the higher General Fuel Levy and RAF Levy feed through. After a welcome rate-cut in March, consumers should not bank on further reprieve in June. South African Cash posted modest gains of 0.6% for April.

Bonds

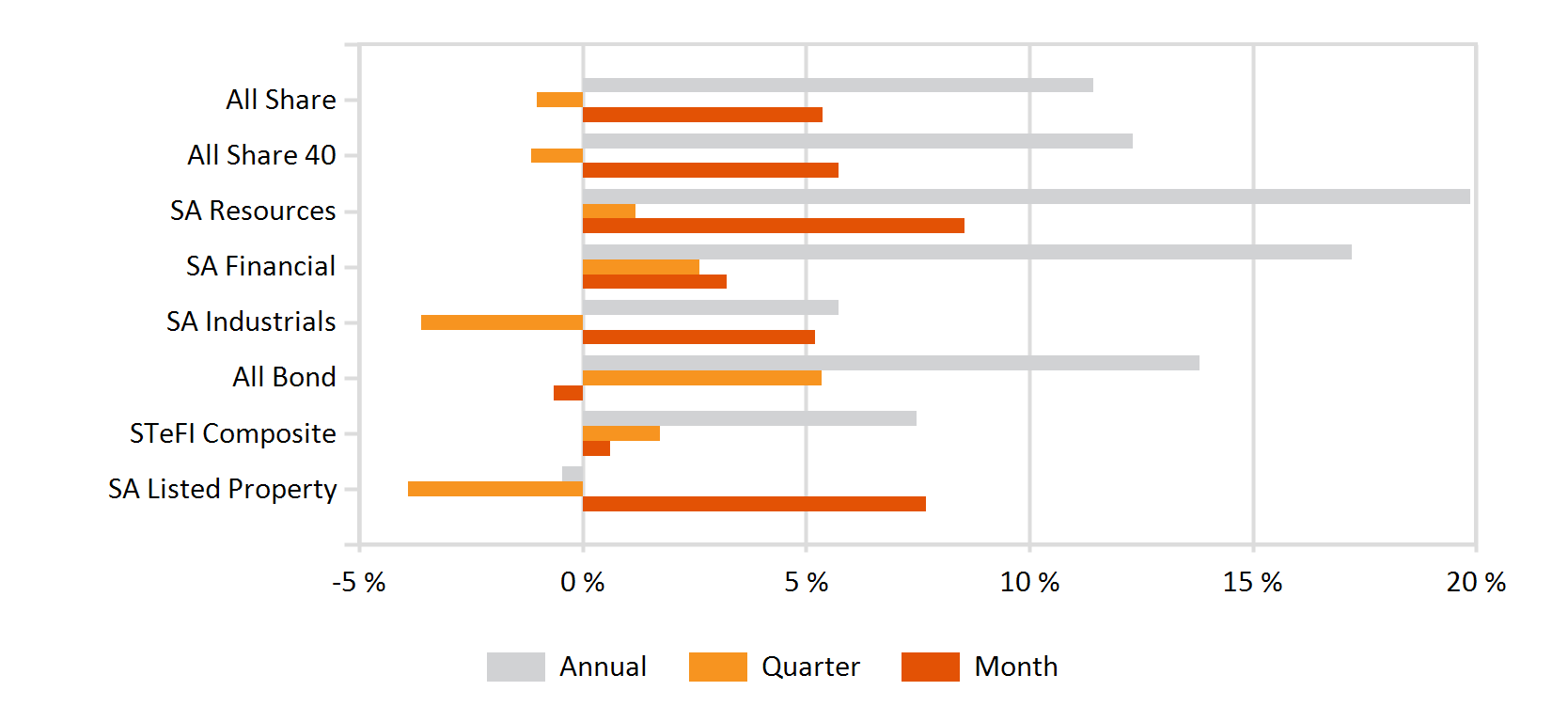

South African Fixed Income indices suffered noticeably in April, with the Inflation-Linked Bond Index registering a 3% loss, and the ALBI inching 0.66% lower, underperforming global peers. This is partly a reflection of rising US yields and the dollar’s recovery, which saw a broader sell-off in Emerging Market (EM) Debt. Local currency EM Bonds saw an overall -3% decline. The changes in South African policy direction, Moody’s revised outlook and the widespread interventions at state-owned enterprises (SOEs) may have enticed foreign investors back into the local bond market. The total listed credit issuance in the first quarter came to R31 billion, largely driven by bank issuance. It did, however, include issuances by a private placement from Eskom, the Land Bank, and the South African Roads Agency. Further JSE listings are expected for 2018 from the likes of Vivo Energy and Libstar, which is likely to increase the universe fixed income investors can select from.

Bullish sentiment appeared to wane in April, partly a reflection of ebbing “Ramaphoria” and a recognition of the tough pricing environment and inherent structural constraints still facing SOEs and large listed entities. Spill-overs from global trade tension and souring EM sentiment may have had a lesser impact than on less developed EM peers, as the SARB has maintained a steady hand at the helm. Conversely, the improved inflation outlook and increased supply is likely to have hurt ILBs, as inflation protection is seen as less urgent. A resurgence in appetite for SA Inc also contributed to the rotation away from fixed income.

Global government bond yields ticked up in April. Conciliatory trade-talks and Korean/Brexit resolutions toward month-end appeased global investor jitters, and increased risk appetite. Core Personal Expenditure, a key measure that the US Federal Reserve Bank’s monitors, appeared to be in line with expectations, and markets were not pricing in any unanticipated rate changes. US Treasury Yields therefore resumed their upward path in April, on a hawkish Fed tone and higher inflation readings.

The 10-year T-bill yield rose sharply, passing the psychologically important 3% level toward month-end, but closing at 2.95%. The rise was less pronounced at the shorter end of the curve. Equivalent Gilts and German Bunds followed the US higher, but the increases were less marked. UK gilts rose initially, but were tempered by disappointing GDP data and the waning likelihood of an interest rate hike from the Bank of England. The 10-year Gilts ended at 1.42% (7bps higher), while 10-year Bunds rose 6bps to 0.56%.

Peripheral yields held up, with Spanish yields reaching 1.28%. Investment Grade Corporate Bonds were mainly flat, with an outperformance from financials supported by some positive earnings results. The resurgence of risk appetite, and buoyant energy prices, however, saw High Yield bonds easily outstrip less risky peers. Barclays reported Euro 8.6 billion of High Yield issuance during April, a notable uptick from the previous year. EM bonds saw negative total returns, particularly local currency denominated debt, as the dollar rallied and as EM Central Banks implemented some aggressive monetary policy interventions in Argentina and Turkey.

Property

The domestic property market seems to finally have emerged from the doldrums. The SAPY jumped by 7.7% in April, outperforming equity market peers, cash and bonds. As the land expropriation topic surfaced as an important issue for the property sector, property fundamentals remain essentially unchanged. The ANC’s public policy statements regarding expropriation without compensation, have been clear on the importance of food security with an emphasis on redistribution to increase agricultural production.

Perhaps reassuring to many REIT investors, is that these listed property funds are typically mainly exposed to ‘unsuitable’ commercial parcels of land.

“The recently released South African Property Owners’ Association office vacancy rate survey for the first quarter of 2018 shows that vacancies remain elevated. ”

Analysts expect that quality properties in prominent locations will nonetheless continue to perform well and keep up with or exceed asking rental rates of 3.1%.

The sector entered its reporting season in April, but May is likely to see more of the heavyweights releasing results: Greenbay, Redefine, Vukile, Investec Property, Equites, Arrowhead and Rebosis are all due to provide updates.

“During April, however, a report of a somewhat different nature saw the Resilient Group emerge as one of the leading counters.”

After suffering under allegations of market manipulation, insider trading and concerns about the Group’s crossholdings, an independent review, could find no evidence of market manipulation or insider trading. To address crossholding concerns, the Group unbundled its shares in Fortress B. The Financial Services Board and JSE investigations are yet to be concluded, but markets appear soothed and share prices rebounded by 36%. The overall outlook, with upbeat consumer confidence and improved investor sentiment, is likely to be supportive of longer run growth. Analysts estimate inflation-beating growth and distributions of over 5% in the next year.

Global Property counters also kicked off their reporting in April, with the industrial sector its star performer. The FTSE EPRA/NAREIT index ticked up nicely to register 1.52% (net USD) for April 2018. Hong Kong continued to be a strong performer, while Japanese REITs wobbled and lost 0.42%.

“The retail sector, facing stiff competition from online retail, remains a tale of two malls: High-end, high-quality retail space is trading at a premium, while lower-quality malls suffer.”

An interesting development in the office sector has been the growth in companies such as WeWork, an American company that provides shared workspaces for entrepreneurs and small businesses that has rapidly expanded in major centres such as London. It is reportedly one of the most aggressive buyers in the past 5 years.

In UK property news, the stamp duty cut appears to have had the intended effect, as it helped nearly 70 000 first-time home buyers enter the market, and house prices edged higher in April. Listed property giant Hammerson withdrew its offer for Intu at the same time as Klépierre pulled out of plans to acquire the UK company. The move by Klépierre is perhaps a reflection that the UK market, despite improving, is certainly not out of the woods. Overall real estate fundamentals remain attractive when contrasted to government bonds, but selective allocation is crucial. In Europe, listed REITs returned 2.71% in USD terms, while the 10-year government bond yield was 0.93% (Total Europe).

Limited core investment options within some real estate markets may yet mean that capital is competing or searching for attractive opportunities, even in alternative segments. Innovative offerings such as WeWork are a prime example of opportunities that can be exploited. Unlisted property, globally and locally, also continues to be an attractive proposition, as does investment in frontier markets. In a higher-risk environment, active asset management, selectivity, a sound value proposition and the ability to add long-term value, and risk-management are essential.

Equity

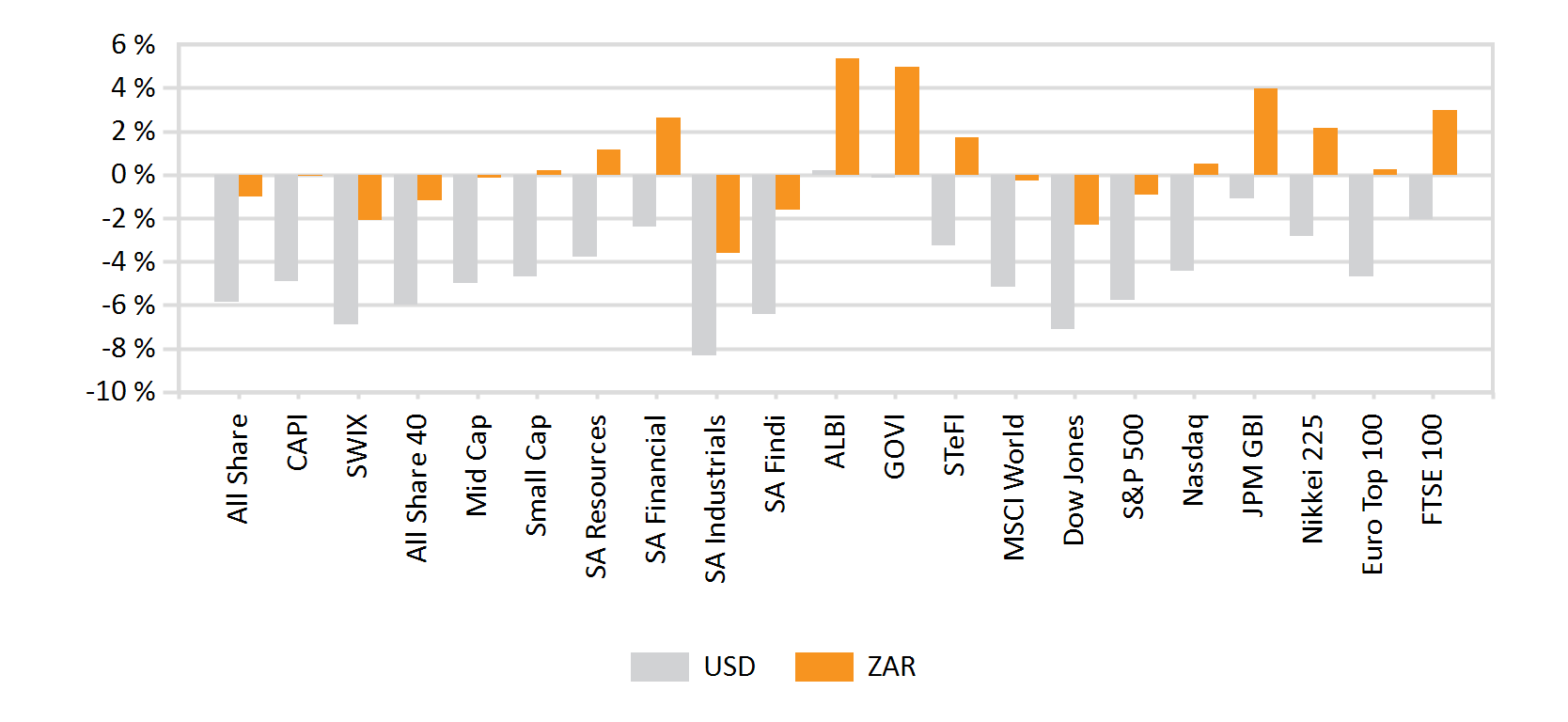

South African equities outperformed global counterparts for most of April, though stalling toward month-end despite noticeable Rand weakness. The All Share Index closed 5.4% higher in April. The local bourse, boosted by a surge in resources and a recovery in Rand Hedges, consequently outperformed the MSCI EM and MSCI BRICs as well as the MSCI EFM Africa ex SA.

“The domestic market was boosted by some positive macroeconomic data. Consumer confidence reached an all-time high in the first quarter of 2018.”

This was reflected by the Bureau of Economic Research’s Quarterly Consumer Confidence Index. The index measures sentiment regarding households’ positions in the coming 12 months, the country’s overall position in the next year and consumers’ perceptions regarding their present ability to buy durable goods. All three measures were noticeably improved, after three years of negative readings.

A dissipation in inflationary pressure, particularly regarding food inflation, has boosted household purchasing power. While the recent Rand weakness, petrol price increases and VAT-hikes are still set to filter through, the SARB feels that inflation will remain well below the upper limit of the target.

“An uptick in appetite for spending is already reflected in retail sales growth, up from 2.9% year-on-year for 2017 to 4.1% for the year-to-date.”

Business confidence, also measured quarterly by the BER, has shown similar improvements, and the South African Trade Balance swung into surplus for March 2018, mainly on increased exports of base minerals, precious metals and stones.

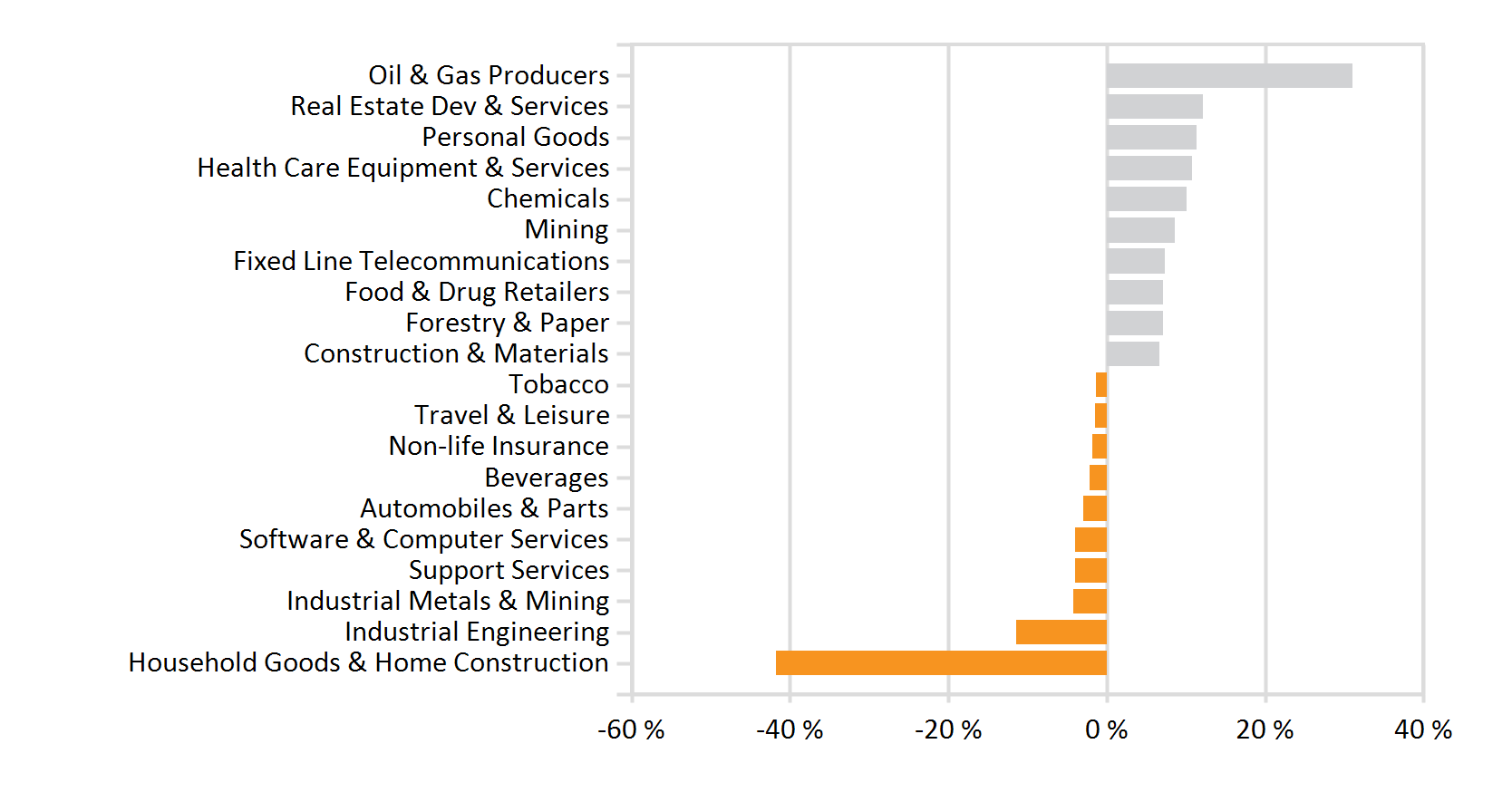

Though disappointed at not receiving a tariff-reprieve from the US, the materials sector remains well-positioned, as trade with main partner China is still on the increase. Despite notable headwinds (safety concerns, the revisions to the Mining Charter, governance issues, supply-side constraints, labour unrest), the latest data on mining production has seen a month-on-month increase of 0.9% for February and a 3.1% year-on-year increase. The FTSE/JSE Resources Index surged 8.69% during April, buttressed by safe-haven demand for gold, an uptick in platinum group prices and Rand weakness.

“The Financial Index, despite late-month losses on waning “Ramaphoria” and expectations of rising US interest rates (and higher long bond yields), closed 3.23% higher.”

The Industrial Index gained 5.2% to claw back some year-to-date losses. The index was bolstered by improved retail sales and consumer confidence, as well as stronger blue-chip heavyweights. Naspers recouped some of its prior month losses. News that Walmart was set to acquire FlipKart and compete with Amazon in India (NPN is the third-largest stakeholder in FlipKart) as well as more positive Tencent-sentiment saw a 5.8% improvement. Blue-chip peer Richemont, partially aided by its rand hedge characteristics, gained over 11%.

Despite the improvements in investor sentiment toward South Africa and local fundamentals, the local bourse remains vulnerable to Emerging Market sentiment. The impact of the ongoing bus-strike and labour-and-land disputes on the economy remains to be seen.

International Markets

April was another mixed month for global risk assets. Geopolitical sentiment seemed to swing between two extremes: The start of the month saw a concerted strike by the US, France and the UK against Syria, sending a clear message on the continued use of chemical weapons; Brexit negotiations continued at a slow and steady pace; Trade-tensions appeared to cool between the US and China; and month-end progress on the Korean peninsula regarding North-South relationships and denuclearisation boosted investor sentiment.

Overall, investors were cheered by a positive start to US and European corporate earnings seasons, with nearly one third of European companies having reported and more than half of US companies having done so.

“About 79% of reporting companies (at the end of April) had beaten analysts’ forecasts, and many US companies were showing their best profit gains in seven years.”

It is notable, however, that the response has been more muted than in previous years.

The US continued to grow at above its long-term average, and GDP expanded at an annual rate of 2.3%.

“Although the US rhetoric regarding tariffs has been heated, several countries were given a reprieve.”

Russia, however, has borne the brunt of trade-war and sanctions, with at least seven oligarchs and 12 companies targeted by fresh sanctions. The US is also considering fresh sanctions against Iran, as the nuclear-deal seems in perilous territory. The US Labour Department released data showing that the country’s unemployment had fallen to below 4% for the first time in 17 years. Investors had been closely watching the key indicator for guidance as to whether the Federal Reserve Bank may accelerate its path of interest rate hikes. The Fed held back during its May 2 meeting, somewhat assuaging investors’ fears. While investors have been somewhat reassured, and sentiment was boosted by a positive earnings season, there remains a lingering sense of unease that rising borrowing costs, rising wages, higher commodity prices and trade tension would dampen future profits.

Nonetheless, US equities erased their year-to-date losses and closed higher for the month. Over half of US companies had concluded their reporting at the end of April, and 79% of reporting companies had beaten analysts’ forecasts. Many US companies were showing their best profit gains in seven years. Some sectors, however, remained volatile. Facebook has not quite recovered from its information sharing scandal, and technology stocks continued to be volatile in April, ahead of earnings reports from major market players. Facebook reported revenue and earnings toward the end of the month that easily beat estimates and sent share prices soaring by 9% on 26 April. Amazon also beat expectations, gaining 4% and Apple, similarly beat estimates, sending shares 5% higher after the bell. The after-hours stock rally showed Wall Street’s relief, after a gloom-and-doom outlook on the burgeoning tech sector going into the earnings report.

“Trade-sensitive sectors were amongst the biggest gainers for the month, with energy the strongest performing.”

The Personal Consumer Spending Index showed its slowest growth rate in five years, with a 1.1% climb perhaps reflecting waning confidence in the Trump administration. The Healthcare sector also remained under pressure, with company specific concerns, regarding Allergan’s business model, and Celgene Corp’s FDA approval, adding to broader regulatory-and-price pressure. Procter & Gamble, Kimberly-Clarke and Phillip Morris were amongst the globally-diversified industry giants to disappoint investors. The S&P 500 closed 0.38% higher for April.

European stocks closed in the green for April, underpinned by robust economic growth and sound corporate earnings results. The STOXX All Europe gained 4.4% for the month. On the macroeconomic front, Purchasing Managers’ Indices stabilised in April, and beat expectations

“Eurozone unemployment levels remained low and consumer confidence was at a three-month high. Indicators for business confidence declined markedly, reflecting the impact of US and UK trade-tensions.”

On the monetary policy front, the European Central Bank stuck to its policy-standpoint. It reiterated its commitment to the bond-buying programme of Euro 30 billion per month, until September 2018, and to keeping interest rates on hold. As elsewhere, oil-and-gas led sectoral gains, while healthcare and industrials lagged.

UK markets were unsettled by political developments, in the run-up to local elections in May. The reaction to Britain’s participation in the Syria strike was mixed, with vociferous criticism from Labour Party leader Jeremy Corbyn and media polls showing that most respondents did not support the move. Month-end also saw MPs vote in favour of an amendment to the EU Withdrawal Bill. This means that Parliament can effectively stop the UK from leaving the union without an acceptable deal, or force Prime Minister Theresa May to return to negotiations, jeopardising the March 2019 exit date.

“The UK stock market rallied to its first positive monthly return for the year, spurred by strong performances from international constituents, the energy sector and a rally in sterling.”

Domestic data, however, was mixed: the three months to April saw weaker-than-expected GDP growth and a decline in consumer spending. Amidst continued uncertainty about job prospects in the financial sector (banks remained under pressure) and in materials (given trade-tariffs), wage growth nonetheless increased at its fastest pace in three years. Rising wages and falling inflation should ease the pressure on UK consumers. Share prices in beleaguered consumer stocks were slightly boosted by the news that supermarkets J Sainsbury and rival store chain Asda would merge, subject to approval by the Competition and Markets Authority. With British American Tobacco surprising to the upside, and an extremely strong showing from BP and oil-counters, the FTSE100 closed the month 6.84% higher.

Asian markets appeared to recover from trade-related jitters. A more conciliatory relationship, partly as China and the US work together to facilitate Korean negotiations, boosted sentiment. The Chinese government also appeared to temper its hard-line stance, with speeches by both President Xi Jinping and Central Bank Governor Yi Gang at the Boao Forum sounding conciliatory. There were concessions regarding intellectual property protection, reductions in import duties, and a relaxation of requirements for joint ventures.

“Chinese growth has remained robust, registering 6.8% in the first quarter of 2018.”

Broad-based manufacturing indices have all shown a consistent upward trend. The country’s reliance on external parties for growth and investment has steadily declined – domestic consumption accounted for 78% of the economy’s growth in the first quarter. The People’s Bank of China has also attempted to facilitate the further growth of small and micro enterprises by snipping the Reserve Ratio Requirement for a wide-range of banks.

In a holiday-abbreviated trading month, the Hang Seng Index closed modestly higher, while the Shanghai Senzen CSI300 declined to 3763, just over 3% lower than April’s opening. The Japanese TOPIX gained 3.6% for the month, as foreigners return as net buyers of equities, following three months of heavy selling. The tide was turned partly in response to positive corporate earnings, but also reflected a slight weakening in the Yen (which boosted exports).

There is some lingering unease to how long Japan’s Prime Minister Shinzō Abe, who has seen his popularity wane, will remain in power. The minister continues to be dogged by the fall-out from the Moritomo Gakuen land sale, where new evidence has come to light regarding falsification of documents by the country’s Finance Ministry.

“The Bank of Japan has seen core inflation hold steady at 0.9% year-on-year and left monetary policy unchanged at its April meeting.”

It did, however, remove a deadline for achieving the 2% inflation target, perhaps reflecting a less optimistic outlook on the efficacy of measures to date.

Sentiment toward Emerging Asia was noticeably boosted by progress on the Korean Peninsula – a historic meeting between South Korean President Moon Jae-in and North Korea’s Kim Jong-un saw the leaders agree to sign a peace treaty in May, potentially bringing an end to years of military conflict. The prospect of a controlled opening of the Korean economy, and the spill-over positive sentiment, saw a rally in the share prices of Korean material, steel and construction companies. EMoon Jae-in and Kim Jong-un lsewhere, the rebound in sentiment saw Emerging Asian markets outshine their peers and come out as the regional winner.

Within Emerging EMEA, performance was varied with Greece posting healthy gains, but Russia suffering the fall-out from US sanctions. Consequently, Russian equities have not benefited commensurately as the oil price has spiked. Turkey emerged as a sore point in EMEA – its government announced early elections to be held in June, and its central bank hiked the benchmark rate to 13.5%, a whopping 18-fold.

Latin American markets, though boosted by stronger commodities, were somewhat more mixed. Concerns about political resistance to economic reform weighed on Brazilian equities, while Colombian markets shone. Mexico, despite the weakness in the peso, and lingering NATO-jitters, posted stronger-than-expected economic growth. Argentina was a notable laggard: its central bank, in a last-ditch effort to defend the currency, hiked key benchmark rates to 40% in the last week of April. Analysts believe that policymakers are running out of options – the bank does not have the reserves to continue intervening in currency markets, nor does it have the political wiggle room to accelerate its fiscal adjustments. The peso is therefore likely to continue to fall.

“Rapid moves by Argentinian and Turkish monetary authorities, and the appreciation of the dollar, have raised concerns regarding an EM debt-sparked sell-off.”

African markets were mostly positive, having benefited from stronger commodities. Zimbabwean equities were a ‘recovery’ story – the main industrials index posted a 13.14% gain for April. Sentiment has been much improved since President Emmerson Mnangagwa took over the reins in November 2017, and the index is 130% up year-on-year.

Currency

The US Dollar rallied during April, gaining 2.1% against a basket of currencies. The worst performing developed market currency was the Yen, though Sterling and the Euro lost equal ground against the dollar. Emerging market currencies were lower across the board, with the best performance from the Korean Won.

“Despite local investors fretting about the slide in the Rand, it was by no means the worst performer – the Rouble slipped 9.9% and held that dubious honour.”

Commodities were largely positive for the month, with the energy component posting the strongest gain. Geopolitical concerns, including uncertainty as to whether the US will withdraw from the Iran nuclear deal, potential disruptions in the Middle East (Syrian tensions), and the sanctions imposed against major oil producer Russia, all exerted supply side pressure. The International Energy Agency has announced that excess oil inventories, which had kept prices low, have been eroded by the success of OPEC production cuts (despite the US’s drill-at-will attitude to shale supply). Prices, having surged 8.3% for April, may run even higher if Venezuelan supply comes under pressure and Iran is taken off-line.

Copper, Iron Ore and Nickel also gained, but Aluminium outshone its peers. US sanctions against Russia included the Aluminum giant Rusal, and supply concerns sent the price 13.6% higher. Gold, after three straight quarters of gains, ended the month modestly softer (-0.5%) as safety-concerns waned.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance