International Market Commentary: September 2016

Summary

- Global equity markets mixed

- Elevated volatility ahead of key monetary policy announcements, as investors exercise caution and take profits

- US, UK nearly flat in local currency terms, despite political (US election; pressure on Prime Minister May to speed up Brexit, Labour leadership crisis) and policy uncertainty (US Federal Reserve Rate hikes)

- European stocks show little change, echoing an unchanged policy stance from the European Central Bank, against a backdrop of upbeat fundamentals

- Japanese equities lack catalyst from Bank of Japan, close lower on mixed economic data

- Emerging Markets benefit from risk-on sentiment, as the Federal Reserve maintains rates unchanged

- Higher yielding prospects exert a pull on global investors

- Emerging Europe, Middle East and Africa outperform, Emerging Asia sees an uptick and Latin American bourses lag

- Accommodative monetary policy and easing growth concerns a boon, but country specific idiosyncrasies highlighted

- Better-than-expected Chinese macroeconomic data spurs commodity prices higher, and upbeat investor sentiment lifts peers

- Russia rallies on higher oil prices, interest rate cut and realisation of election predictions (Putin attains landslide victory in State Duma)

- Brazilian markets welcome the steady hand of a new administration, Colombians to vote on peace deal

- Mexican markets under pressure, despite solid fundamentals, as US electoral uncertainty spills over the border

- Turkey ratings cut to junk after a failed coup attempt

- Struggling Nigerian economy unable to participate fully in oil-price boom

- South African assets’ performance tempered by profit-taking at month end, and political uncertainty weighs on sentiment

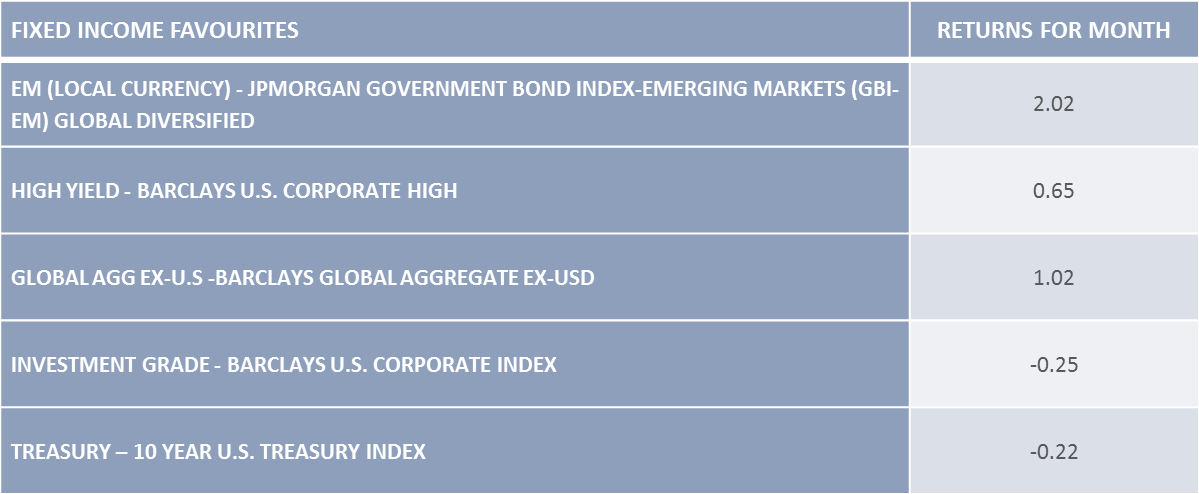

- Monetary policy uncertainty sees bond markets post a weaker September

- US Fed maintain rates unchanged, longer run sovereign yields little changed

- BoJ holds back on further stimuli, but adds ‘yield-curve control’ to policy mix, effectively anchoring 10 yr government bond yield near zero.

- UK gilts, corporates dragged down by pending Brexit, while ECB kicks off expanded QE programme

- Banking sector under considerable pressure, as Deutsche Bank faces USD 14 billion fine

- Yield-curve compression in developed sovereigns, investment-grade corporates favours riskier Emerging Markets

- High yield benefits from rebounding energy sector

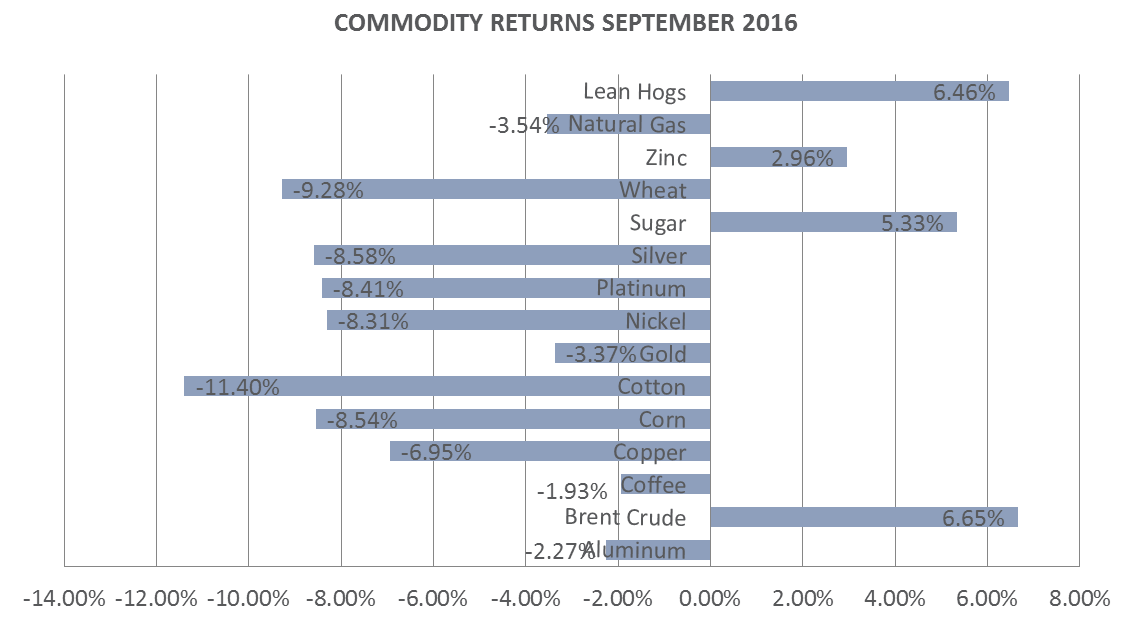

- Commodities index spurred upward by 6% rise in oil prices and stronger industrial metals, as OPEC agrees to limit output and Chinese growth concerns wane.

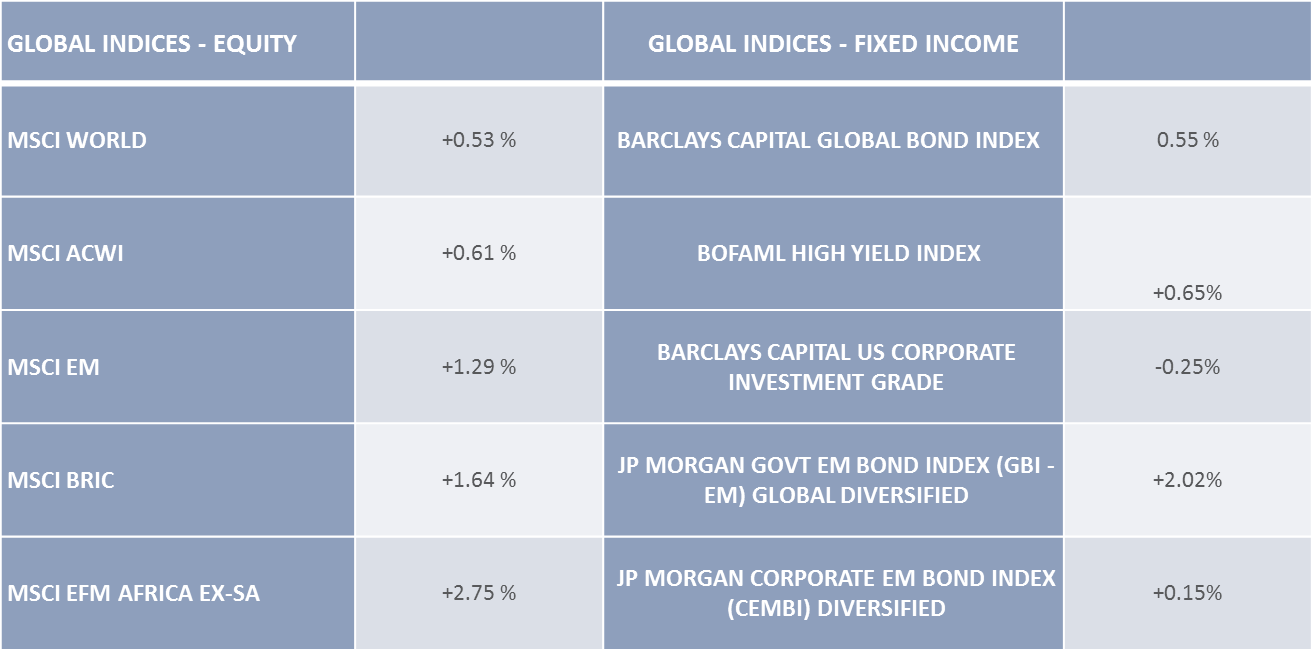

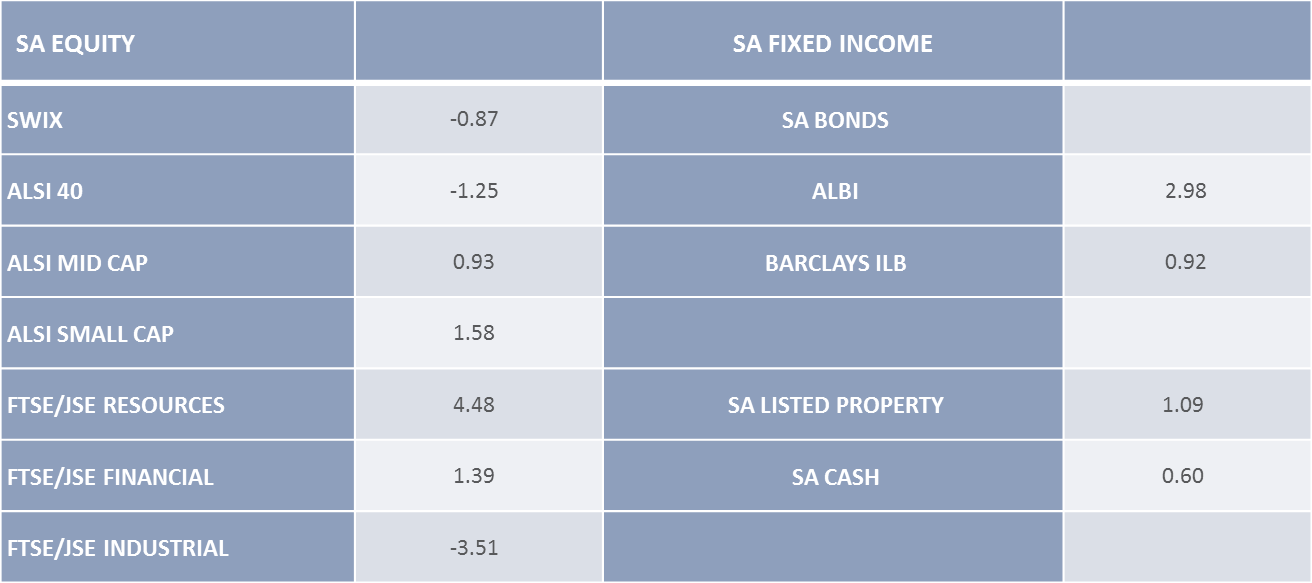

Key Indices and Economic Indicators

US

UK

The Eurozone

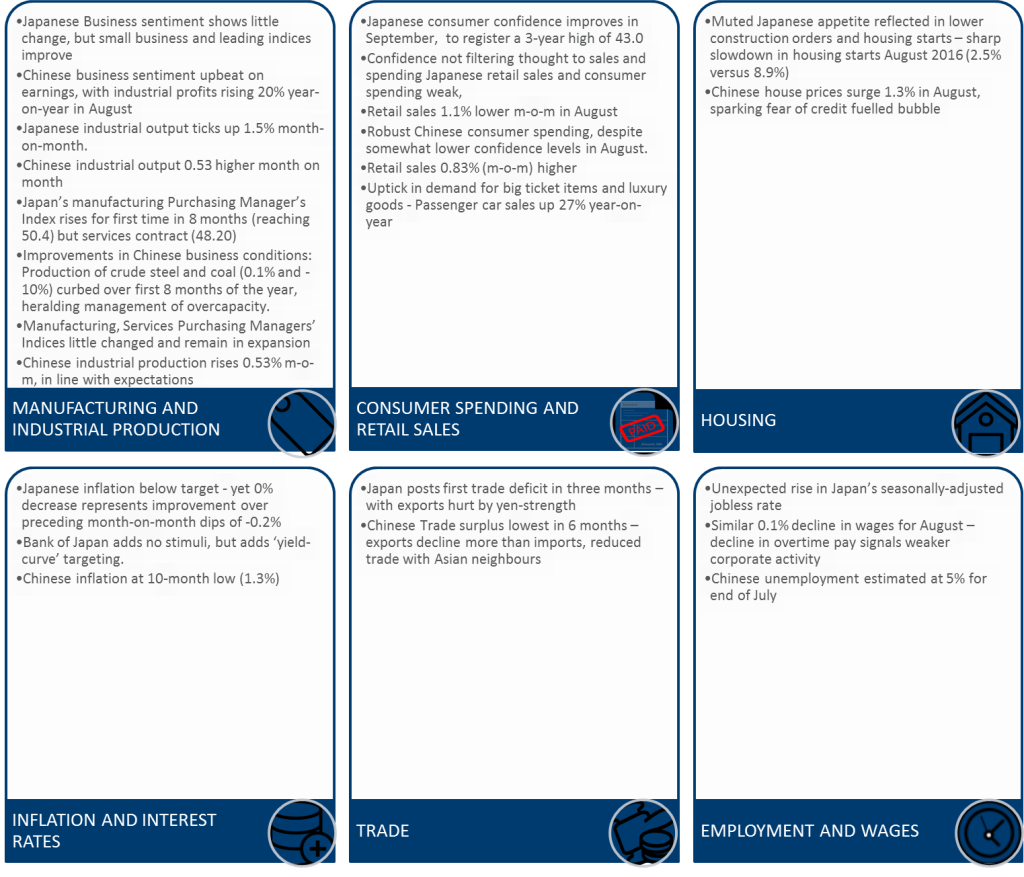

Japan and China

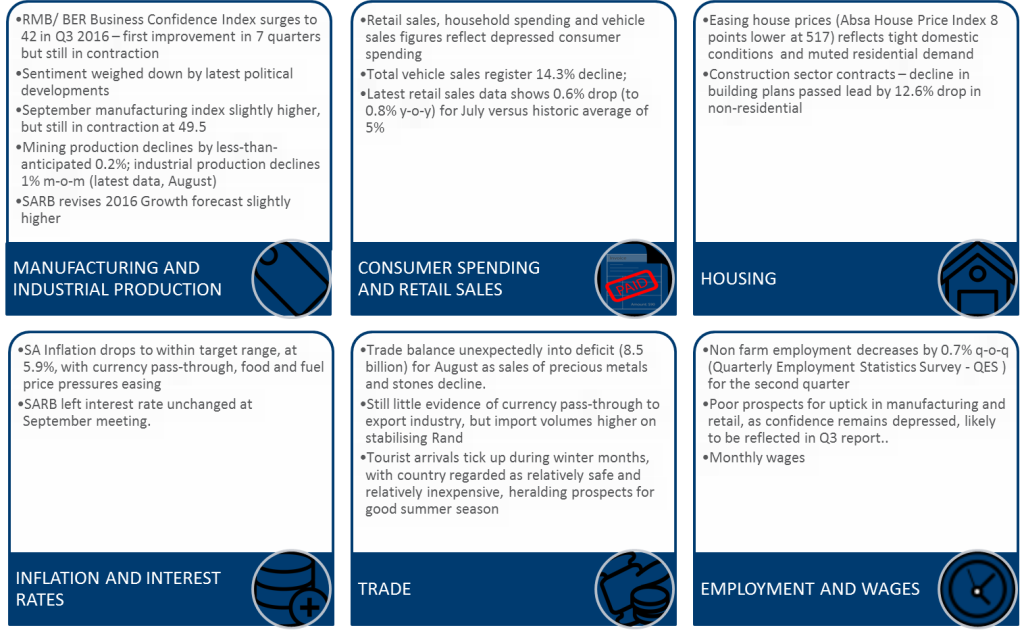

South Africa

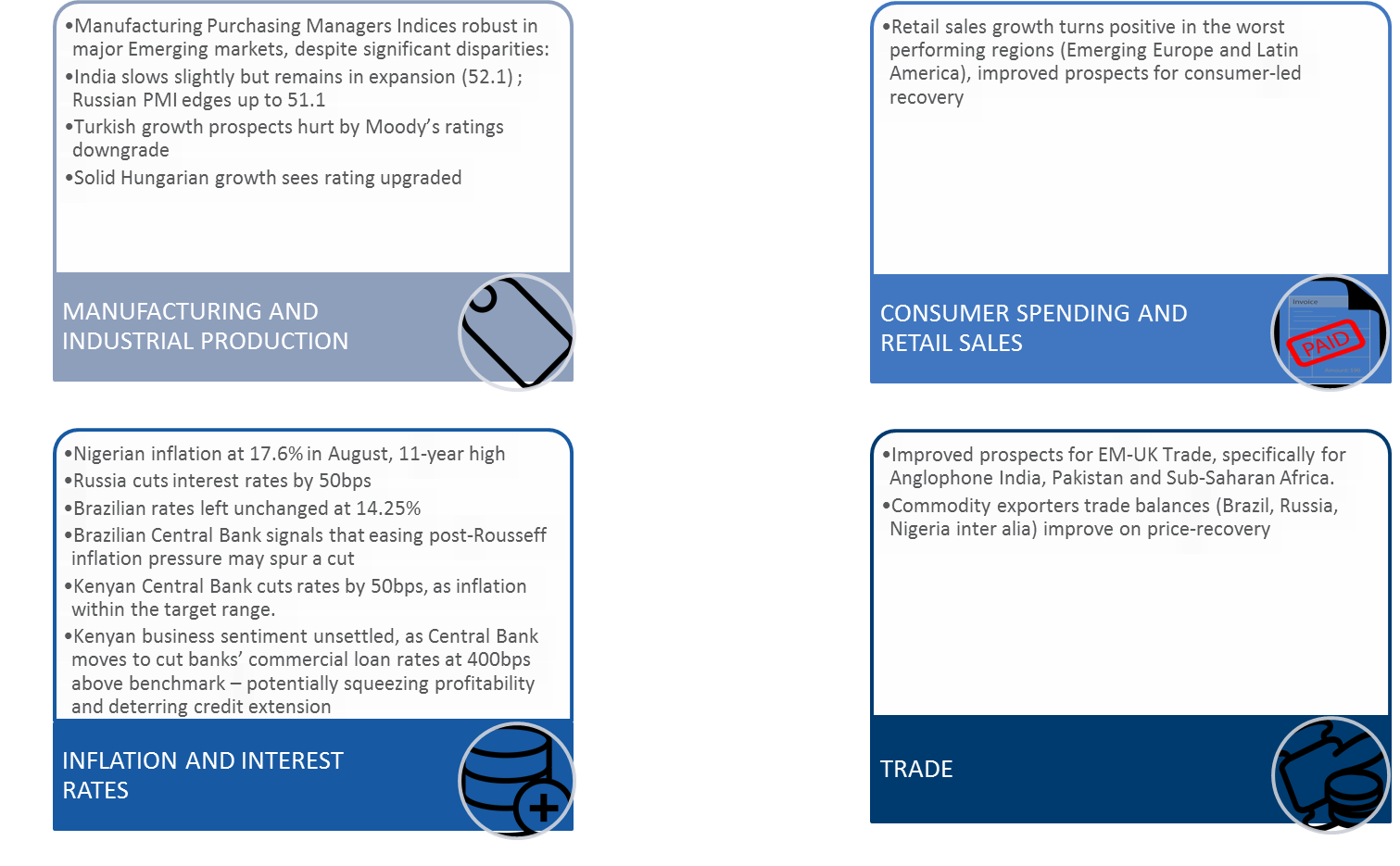

Emerging Markets

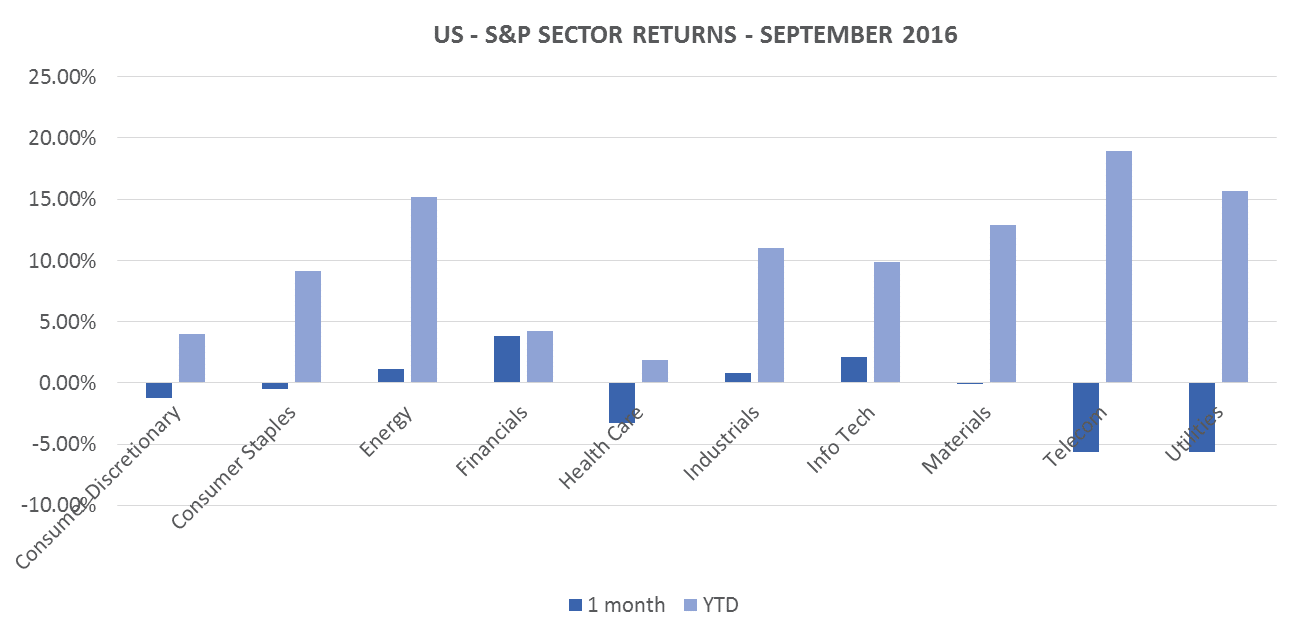

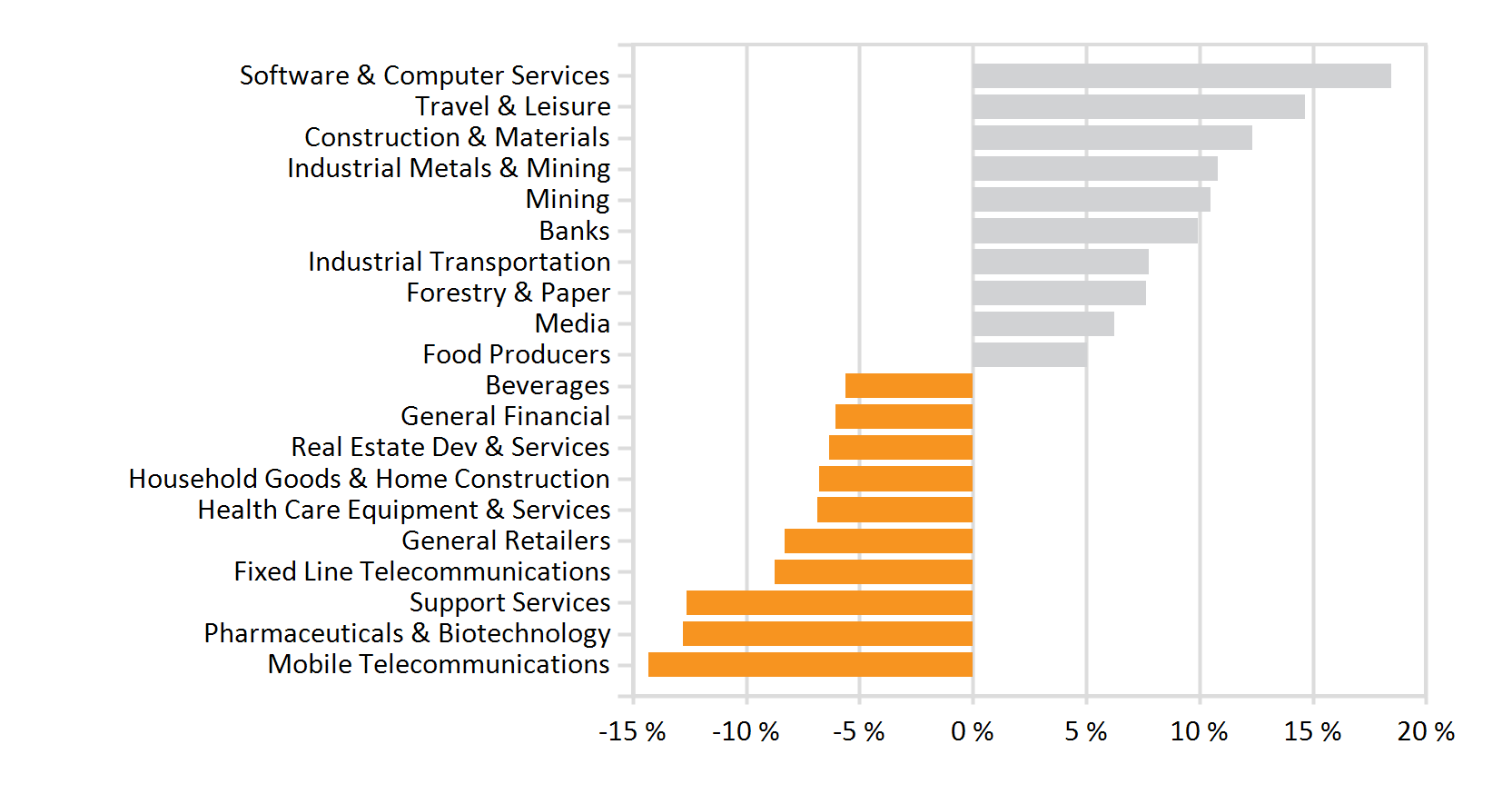

Sector Return

- US trends echoed globally

- Rotation away from defensive stocks, financials recover

Monthly commentary – Commodities, currencies and fixed income

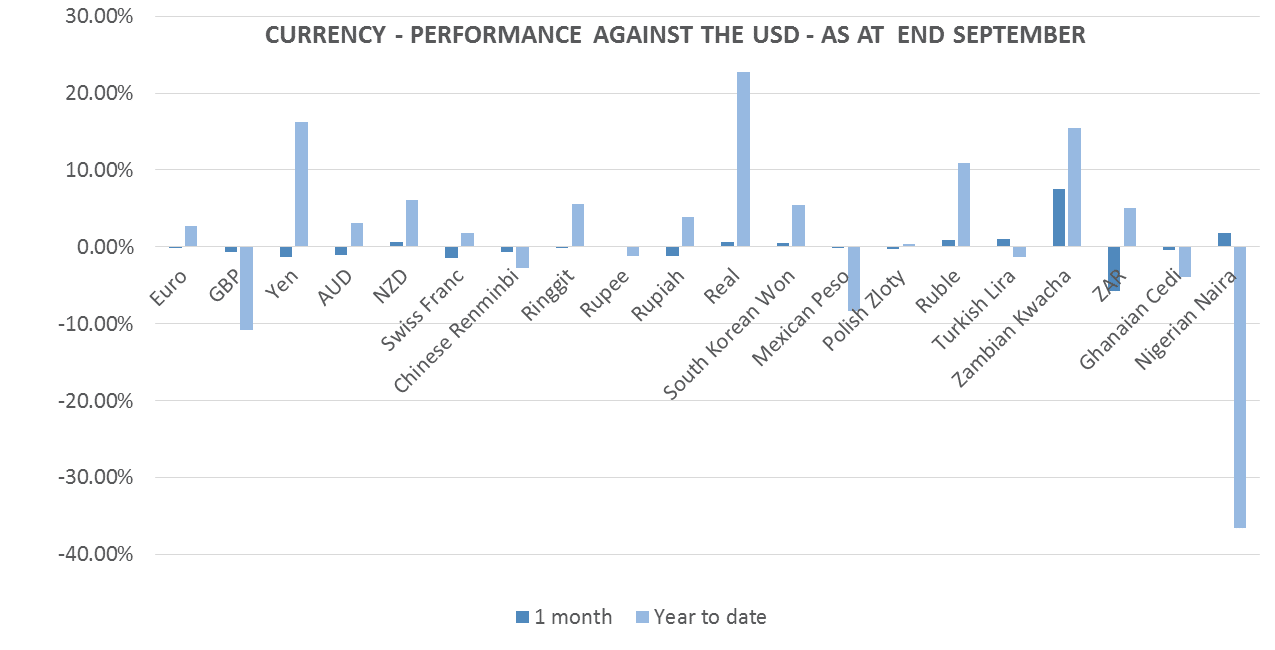

The Bloomberg Commodity Index closed 3.13% higher in September, paring its quarterly loss to -3.86%. Industrial metals had a particularly solid month, as indicators from China signalled stabilising and/or increasing demand. Within precious metals, gold managed only modest gains and platinum declined, as safe-haven buying ebbed.Oil prices surged toward month-end, spiking by more than 5% in a single day. The jump was spurred by an agreement reached between the Organisation of Petroleum Exporting Countries, after protracted and sometimes acrimonious negotiations, regarding managing the volatile oil-market by committing to output limits. The agreement sees OPEC nations agree to a range of 32.5 – 33.00 million barrels per day, at least 1 million barrels less than current levels. While the decision is historic, and is the first such deal since 2008, it is to be noted that individual countries quotas will only be agreed at the next meeting in November. The bloc also intends to invite non-OPEC members (such as Russia) to join cuts. Internal wrangling and power-plays are perhaps inevitable within such a volatile setting – Middle Eastern tensions remain elevated, and speculation is still rife as to the culpability of Russia in the collapse of the Syrian ceasefire. Sceptics are awaiting firm country-specific commitments – likely to be the subject of much wrangling, notably between market-giant Saudi and newly-sanction-free Iran. The (albeit fading) close link between equity markets and oil prices over the course of the past year – with oil prices appearing to proxy for investors’ risk appetite – will see investors keep a close eye on oil futures in the coming quarter. Perhaps indicative that the market is cognisant that oil will remain under pressure : the Oil-and-Gas sector saw its biggest corporate deal in two years, with Enbridge of Canada acquiring Spectra Energy for USD 28 billion. The deal represents a departure for the oil-pipeline specialist: It is effectively a bet on gas versus oil, as the new addition specialises in gas pipelines, as well as a recognition for the need for diversification. On the currency front, emerging market currencies were boosted by the rate-reprieve from the Federal Reserve Bank, with the South African Rand registering one of the strongest performances. The Mexican Peso depreciated significantly – US electioneering has taken its toll on its Latin American neighbour. Anecdotally, the movement of the Peso has been closely linked to Mr Trump’s fortunes as campaigning kicked into high-gear: Pronounced dips are evident when Mr Trump appears to be gaining in the polls, as investors act on jitters around Mexican trading prospects and labour-market implications of a Republican win (Bloomberg). Sterling bonds gave up some of September’s rally, as pressure mounted on Prime Minister Theresa May to speed up the process of negotiating the terms around Brexit. Sterling corporates were particularly hard hit, with the message from the EU resoundingly clear that their passports to the bloc are at risk. The European banking sector witnessed additional pressure from concerns around the health of market-giant Deutsche Bank. The Bank was hit with a potential USD 14 billion fine from the US Department of Justice (It is accused of mis-selling mortgage-backed securities prior to the financial crisis). Deutsche, however, was quick to assuage investors, by quelling subsequent reports of liquidity concerns. Euro Bank bonds nonetheless declined by -0.2% for the month. The Federal Reserve Bank’s monetary policy decision to keep rates on hold appears largely to have been priced in by bond investors: short and medium term yields were little changed, and 10 year-T-bill yields remained anchored near 1.58%. Speculation was rife that the Bank of Japan would introduce further stimuli at its September meeting, but it too stayed its hand. The Bank did, however, refine its package, by indicating that it would target its purchases along the yield curve. Targeted purchases are aimed at effectively maintaining the yield on the 10-year government bond at or near zero. The intention is that this limit the pain experienced by Japanese financials, as margins and profitability are squeezed by negative interest rates. By keeping the risk-free rate near zero, the BoJ is effectively anchoring the spread between Japan’s sovereign issuance and Developed Market peers, as well as limiting margin-squeeze on domestic firms. The overall risk-on sentiment saw Emerging Market sovereigns outstrip developed counterparts, though divergent country-specific risks were highlighted by two ratings agency decisions. Turkey suffered a ratings downgrade after a failed coup attempt, Moody’s citing concerns that domestic unrest and localised political agendas would detract from a policymakers’ commitment to sustainable and meaningful progress on reforms. The downgrade may have had a positive spill-over impact on other Emerging Markets as index trackers and fund managers were set to reallocate an estimated USD 10 billion of sovereign and corporate debt. In direct contrast, Hungary’s sovereign credit rating was upped to investment grade by S&P, on improved fiscal management and accelerating domestic growth. Two of the three international credit ratings agencies (Fitch and S&P) therefore now regard the country’s issuance as investment-grade, meaning that most major institutional investors will be able to allocate capital. Risk-on and a rebound in energy prices boosted the performance of high-yield bonds, while elevated merger-and-acquisition related issuance further detracted from the relative performance of investment-grade corporates.

Additional insights

Monthly Commentary – South African asset classes

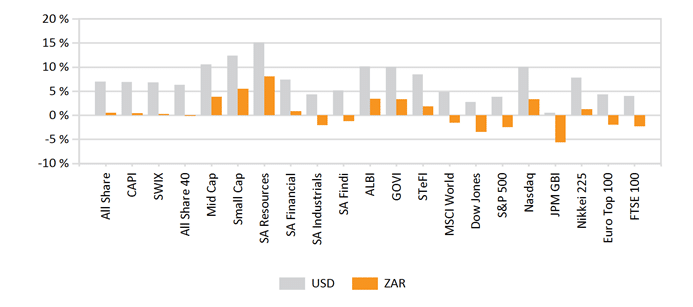

SA equities broadly lagged asset class peers, with the SWIX declining 0.94% for the month. Financials, however, were resilient and registered a 1.39% uptick – positive earnings updates and easing fears around the strength of the global banking sector (despite Deutsche Bank jitters) boosted the banking subsector to a 4.22% gain. Resources similarly rallied, closing 4.48% higher, as Chinese data proved supportive of stabilising or improving demand-side dynamics. Industrials were the main detractor on the local bourse: Major Rand-Hedge counters were under considerable pressure from a resurgent currency, and the overall index declined by 3.51%. Safe-haven buying ebbed over the course of the month, and the JSE Gold Index slumped by 10.76% for the month. The sector nonetheless still retains top spot on a year-to-date basis. The JSE’s quarterly review saw the Top 40 rebalanced during September, with robust growth seeing Gold Fields and Sibanye Gold enter the index. In addition, the completion of the ABInbev SABMiller Merger heralded the latter’s delisting on the 30th of September, with Impala Platinum grabbing a spot in the index. Volatility, however, is likely to be elevated in the coming quarter, with the likelihood of a Federal Reserve hike in December, and the larger relative share of resources in the Top40.

Sentiment too will be swung by local political developments regarding the position of the Finance Minister, and the prospects of a ratings downgrade. For September, however, easing domestic inflation expectations and broad-based risk-on sentiment appeared to trump local concerns. Domestic fixed income netted a positive return – the ALBI closed 2.98% higher; ILBs gained 0.92% for the month and 10-year Government bonds had rallied by 50bps mid September. The local currency, notoriously vulnerable to sentiment, strengthened nicely, outshining a number of Its Emerging Market peers. The currency gained 7.3% against the dollar and 6.5% against the euro over the course of the month. Profit taking and strategic repositioning sparked some month-end weakness, and yields ticked up (bond prices and yields move in opposite directions) and spreads widened. A ratings downgrade to another emerging peer (Turkey) may have had an initial positive impact as EM bond investors reallocated to an accessible South African market. It does, however, raise concerns about the local bond market’s vulnerability to ‘hot money’, and the potential impact on international sentiment of the domestic politics.

SA listed property, with its mix of bond and equity characteristics, benefited from risk-on sentiment and proved more resilient to month-end jitters. Listed property ticked up by 1.09%. The historic yield for the asset class, which exhibits a mix of bond and equity characteristics, was 6.25% for the month, while the yield-to-maturity for Long Term Government Bonds (R186) ended the month at 8.65% (an improvement over August’s 9.05%). The macroeconomic backdrop remains challenging, as the economy struggles to attain a meaningful improvement in GDP growth, and overall business sentiment remains depressed. This is perhaps highlighted by the elevated corporate activity in the sector, as companies aim to consolidate and strengthen their balanced sheets and competitive positions. Growthpoint announced that it is looking to streamline its portfolio, by disposing of R 1bn of office asset over the course of the next year, while Fortress is likely to acquire Lodestone, subject to approval by the Competition Commission, and Redefine Intl had aqcuired a stake in new offshore SA-entrant Echo Polska Properties. Within a still vulnerable overall domestic market, amidst elevated transactional activity and foreign flows, judicious allocation will remain essential.

On the inflation front, the headline figure dipped into the target range, registering 5.9% for August 2016. Investments in SA Cash would have generated a return of 0.6% for the month. The stabilisation in the currency has seen diminished currency pass-through, translating into lower than expected Producer Price Inflation (a leading indicator for CPI). Contributions from the fuel and transport subcomponents have shrunk, largely due to the passing a cumulative 119c petrol-price cut over the course of August and September. An October hike is on the cards, but the impact would be relatively muted if the currency maintains a stable footing. Rand stability, translating into lower than expected Producer Price Inflation (a leading indicator). The South African Reserve Bank elected to maintain rates unchanged at its September Monetary Policy Meeting, a move which was in line with expectations and in lockstep with the decision taken by the Federal Reserve Bank. The Bank’s more dovish tone was perhaps a surprise – currency volatility, renewed oil-price pressure, and the likelihood of a December Federal Reserve Bank Rate hike may yet jog the Bank’s hand into a hike before the year is over.

Quarterly commentary

International markets

The Eurozone

The Brexit vote set the scene for a potentially volatile third quarter, with many market observers predicting a particularly sharp economic downturn in Europe and the UK, and likely spill-overs to the rest of the world. The reality, however, has been a far more muted response. After initial kneejerk reactions had settled, global equities and fixed interest had a solid quarter: The UK FTSE100 ended the quarter 7.1% higher; US equities rose nearly 4%, Japanese equities managed to recoup some of their year-to-date losses (gaining 7.1% for the quarter), and Emerging Markets benefited from the ongoing search for yield. The overall commodity index declined over the quarter. Precious metals, however, had moments of brilliance: safe-haven gold benefited from jitters which coincided with Central Bank policy pronouncements; Platinum rose on improved Chinese demand prospects; and the oil price was notably more stable, though spiking during the last week of the quarter, as OPEC nations reached an agreement regarding output freezes. Investors kept a keen eye on Central Banks for guidance in the still-benign interest rate environment, and sentiment was driven more by policy than by fundamentals. In the United States, a surprising amount of uncertainty surrounds the election, and an unexpected result is likely to herald a new hand at the helm of the Federal Reserve. Across the pond in the United Kingdom, the Bank of England’s intervention and the election of Theresa May helped to ease initial investor jitters. A volatile Pound bore the brunt of the post-Brexit fall-out, with sterling hitting fresh lows against the dollar. Fears are still rife that foreign firms will elect to relocate their head offices (notably in the financial sector) and large plants (notably in the automotive sector), given the loss of preferential access. The mechanics of the exit process are yet to be determined and the process will be lengthy, and not without casualties, but the UK economy is unlikely to be derailed. The Bank, however, has cut its forecast for economic growth for 2017 nearly in half, acknowledging a painful period of adjustment. Elsewhere in Europe, Brexit has highlighted the political fault lines in the European Union: With a rise in populism, the spectre of more countries departing the EU (especially in the peripherals) has materialised. While polling shows that more than half of the populations of France, Germany and Spain favour the common market, any policy/electoral uncertainty spooks investors.

Growth for the Eurozone is predicted to be 1.6% this year, and the ECB disappointed many investors by staying its hand at recent policy meetings. Though developments in Europe dominated headlines, concerns around Chinese growth nonetheless lingered. News from the Asian growth engine, however, was largely reassuring and China was amongst the strongest emerging markets for the quarter. Stabilising manufacturing data (the manufacturing PMI edging into expansionary territory at 50.2); a strong services sector; rising Chinese consumerism, and prospects of still-further easing from the People’s Bank of China all served to boost investor appetite over the quarter. Japanese macroeconomic data remains mixed. Inflation is nowhere near the Bank of Japan’s target and confidence has waned in the feasibility of the goal. An apparent renewed focus on a cohesive policy response to persistently sluggish inflation – Prime Minister Abe announced a stimulatory fiscal package, and the Bank of Japan refined its policy stance with an explicit shift to yield-curve targeting announced at its September meeting – has somewhat reassured equity investors, as has positive corporate newsflow , with company earnings remarkably robust despite the stronger yen.

The third quarter saw Emerging markets consolidate their position as year to date winner against the backdrop of a global search for yield. The importance of country-specific risks and the nuances of investing in the asset class were highlighted by developments in the political arena: The impeachment of President Rousseff and the appointment of market-friendly Vice President Temer saw Brazilian equities rally; while an attempted coup in Turkey sent stocks tumbling.

Lower for longer prospects are likely to remain a boon to riskier assets in the near term, despite expectations of a year-end rate hike by the Federal Reserve Bank. Fundamentals in most major developed and emerging market economies reflect a global economy which is chugging along, albeit slowly. The possibility of idiosyncratic risks and sharp shocks, however, cannot be ruled out. Brexit negotiations, US elections, the rise of populism and spillovers from the ongoing Middle-Eastern conflict all set the scene for a final quarter in which judicious allocation and keen risk-awareness will be essential.

Quarterly Return of Major indices – Global and South African September 2016

South Africa

South African markets saw significant spill-overs from the local political arena during the third quarter. Against a backdrop of alleged undesirable connections between prominent politicians and business figures, and fears around perceived state capture, the success of local municipal elections underscored the country’s ongoing commitment to democratic processes. Investors were reassured by the largely peaceful run-up and conclusion to the election, and political observers were heartened by the fact that a healthy opposition party took power in some of the key municipalities. Having narrowly avoided a ratings downgrade in June, the South African Finance Ministry continued to reiterate its commitment to sound fiscal policy, which would foster economic growth and which helped to boost sentiment toward South African equities and bonds. The characteristically volatile Rand managed to stabilise over much of the period. The hard yards gained, however, were partly undone toward the latter part of the quarter: As tensions between the Finance Minister and Treasury bubbled to the surface again, investor confidence took a knock, and ratings-downgrade fears resurfaced. Market participants are pricing in a heightened probability that ratings agencies will cut credit ratings when revisiting in December. Volatility is likely to be pronounced at year-end, as the timing may coincide with the Federal Reserve Rate hike.

The third quarter was characterised by significant bouts of risk-on trade, notably following global Central Bank action. South African assets benefited from a renewed appetite for risk, albeit to a lesser extent than some emerging market peers. The bond market experienced considerable volatility over the period, as the more liquid South African market proved an easy target for sentiment-driven foreign buying and selling. Despite the damage done by the widely-publicised uncertainty surrounding the Finance Minister’s position, the ALBI closed the quarter 3.42% higher, outstripping the global aggregate (the JPM Global Aggregate lost -5.37%). 10-year Government Bonds rallied close to 50 bps in the third week of September after the Federal Reserve maintained rates unchanged. GOVIs closed 3.37% higher. Renewed currency weakness, however, saw yields kick higher in the final week (bond prices and yields move in opposite directions Inflation eased, with oil price pressures far less pronounced over the period – the petrol price dropped by a cumulative – and currency pass-through was fairly muted. The SARB elected to keep rates unchanged at its September Monetary Policy Committee meeting, though comments on upside inflation risks still hold a hawkish tone. South African Cash netted a tidy 1.86% for the quarter. Listed property, previously the market darling, saw its overall performance marred by a particularly poor August (-4.98%). The asset class, which has a mix of bond and equity characteristics, and lagged fixed income and equity peers for the quarter. The listed sector closed the quarter -0.73% lower, versus the modest 0.48% uptick in the All Share. South African stocks saw significant sector dispersion – resources were the quarterly star peformer, boosted by stronger commodity prices and easing concerns about the economic health of major export destination China. Resources were 8.07% higher for the quarter, lead by gains in the coal, platinum and precious metals subsectors, where returns were in excess of 20%. The muted recovery in financials, post Brexit-kneejerk, was largely driven by the uptick in the Banking sector. As a number of the major banks released robust earnings reports and the sector received a positive review on its overall health, banks returned 9.94% for the quarter, lifting the overall SA Financial Index to 0.85% for the quarter. South African Industrials were the quarterly laggard, declining -2.05% over the period.

Quarterly Industry Performance – South Africa – September 2016

South African investors will be keeping a keen eye on global developments: while the country’s (admittedly glum) fundamentals are unlikely to changed significantly, it remains extremely exposed to global risk sentiment. While investors seldom welcome uncertainty, the environment does create ample opportunities for nimble investors – depressed valuations in some pockets present excellent buying opportunities, while an ability to rotate between stocks and sectors is conducive to profit-taking. The fall-out from domestic politics, and the prospects of a ratings downgrade will therefore loom large in decisions on how to allocate capital.