International Market Commentary: September 2015

12 Oct 2015

- Global Growth woes – the Federal Reserve leaves rates unchanged

- Equities decline amidst risk-off sentiment, and volatility remains elevated

- US economy shows signs of slowing

- Eurozone economic data upbeat, but political tension flares

- Knock-on effects of corporate news: Resources and materials, auto-related and healthcare

- Emerging markets remain weak, on tail-risk from China, declining commodities and a stronger USD

Introduction

Geopolitical tension, US monetary policy decisions and corporate news all served to unnerve already skittish global investors during the month of September. Somewhat contrary to previous guidance, the US Federal Reserve Bank opted to maintain interest-rates at record lows. Previously, accommodative nods from policymakers were greeted with stock market exuberance, but the tone was decidedly different this time. With the Fed citing concerns about the outlook for global growth, the spill-over effects of a sputtering Chinese growth-engine and emerging market weakness, sentiment was notably risk-off.

US Markets

US equity markets, although outperforming their developed market peers, posted a third consecutive month of losses. The Dow lost -1.35%, the S&P 500 declined by -2.47% and the NASDAQ closed -3.27% in the red. The tail-risk from China, and the trajectory of the Federal Reserve’s normalisation path was certainly at the forefront of investors’ minds worldwide. Domestic political uncertainty and mixed economic data, however, added to US investors’ anxiety.

On the political front, a government shutdown was narrowly averted, partly by the resignation of Republican House Speaker John Boehner on September 25. Congress was able to pass a so-called ‘continuing resolution’ to keep the various branches of government operational until the necessary appropriation bills can be passed. The likelihood of a December shut-down, however, has increased. The associated costs (per insert) are likely to be higher, with investors already nervous, and the Fed clearly indicating that policy decisions are data-dependent.

Domestic economic releases were mixed, but indicative that slowing global growth is rippling through to the US economy, and perhaps to a greater extent than the Fed had envisaged. US manufacturing was weaker in September, on easing demand and a still-strong US Dollar. The Markit Flash Purchasing Manager’s Index (while still above the 50 mark and therefore in expansionary territory), declined to 53, with the Services Sub-Index declining more markedly to 55.6. Similarly, the Institute for Supply Management Index declined to its lowest level since May 2013 – at 50.2, barely above the critical point. Previously buoyant, US consumer sentiment has slipped. The University of Michigan Sentiment Survey registered a 5 point decline, hitting its lowest level since October 2014. Housing sales were mixed: Existing homes sales declined by 4.8% year-on-year in August, partly as a result of rising prices and the lack of appetite for mortgages in a rising-rate environment. New home-sales, conversely, rose by 5.7% to beat seven-year highs. New vehicle sales, typically indicative of the longer-run consumer outlook, were similarly robust.

The Federal Reserve, which acknowledges keeping a close eye on the American labour market, may have proven remarkable foresight in its decision to delay the rate-hike – September’s labour market report (published some two weeks after the decision) has been described as gloomy at best. Job gains were well below expectations (consensus expectations of 200 000 new jobs, realised gains of 142 000) and August’s figures were revised lower. The Labour Department’s measure of average hourly earnings indicated zero effective wage-growth, hourly wages ticking up by only 1 cent. Perhaps one of the most disappointing data points in terms of the medium-term outlook, is the continued decline in the labour force participation rate. With only 62.4% of the working-age population actively employed or seeking employment, it is at its lowest level in four decades. Despite public reassurances from the Federal Reserve that it foresees the economy being on track for a rate-hike in 2015, there is considerable doubt that it will materialize at all this year. Lower-for-longer now seems to be the consensus view.

US Government Shutdown Woes:

Congress had been unable to reach consensus on any of the 12 appropriation bills, largely due to the stalemate between the Democrats and Republicans. The appropriation bills ratify the funding for, and ensure the continued functioning of, each branch of government and all federal programmes. The ‘continuing resolution’ defers the decision to a later date.

Boehner’s resignation has provided only temporary respite. A new House Speaker will be elected in November and will immediately be challenged to broker agreements on various complex and contentious issues. These include: renewals of tax breaks; the extension of the High Trust Fund, which is a key driver of infrastructure development and employment across the country; and, potentially the most problematic, the raising of the debt ceiling.

The current debt ceiling of $18.1 trillion was breached in March this year. Since then, Treasury has been employing ‘extraordinary measures’ to ensure that the US continues to service its external debt. These measures are set to run out in November.

Failure to agree on the debt-ceiling caused a 16-day shutdown in 2013. It is estimated that the event added $2 billion to the government’s budget shortfall for the year (since contracts must still be honoured, and salaries paid during the period), and shaved 0.1% to 0.2% off GDP growth for the fiscal period. Delays in data collection also distorted the economic picture in subsequent periods. The very-real threat of US default caused a sharp spike in T-bill yields, and earned the country a credit-rating downgrade from Standard and Poor’s.

The equity sell-off was not limited to any particular sector, but industry-specific factors proved to weigh more heavily on some subsectors. Healthcare stocks posted large losses, as did Materials. Allegations of price-gouging, and the subpoena of the records of pharmaceutical giant Valeant Pharmaceuticals International, raised concerns about stricter regulations and tightening profit margins in the richly valued Biotechnology subsector, weighing on Healthcare. Indicative of the slowing pace of US growth and industrial production, Industrials bellwether Caterpillar lowered its revenue forecast and announced 10 000 job cuts. Corporate news-flow from Europe also weighed on Materials and Automakers.

The Eurozone

Despite a largely upbeat European economic backdrop, European stocks witnessed broad-based declines. The Stoxx All Europe declined by -4.03%, the FTSE gave up -2.86%, Italian equities lost -3.25% and the German bourse proved a regional laggard, declining by -5.84%.

On the economic front, Eurozone manufacturing grew at a slightly more modest pace in September, with the Markit Composite Purchasing Managers’ Index declining to 53.9. New orders rose to a five-month high, and regional retail sales grew for the fifth consecutive month – the longest winning streak since 2006. Boosted by a somewhat weaker Euro and relatively insulated from the Emerging Market slowdown, Eurozone exports increased at the fastest rate since 2011. As an uptick in the German Ifo Business Climate Index showed, European businesses remained fairly confident. The pace at which new workers were hired (the fastest in 18 months), is practical testament to the supportive business environment. The European Central Bank has indicated its willingness and ability to step in, should a global slowdown necessitate further Eurozone stimuli. The Bank, however, is circumspect in assessing how well the region weathers the recent upheaval.

During September, political and corporate events, however, cast a pall on the brightening picture. While the agreement reached in August averted a Greek exit from the European Union, the re-election of Alexander Tsipras must surely raise concerns as to the continued political commitment to implement reforms (Plus ca change…). Dissension is also stirring within the broader European Union, as the migrant crisis escalates and members feel their sovereignty undermined by central decision-makers in Brussels.

Corporate news from Europe was dominated by the Volkswagen scandal, and the wild gyrations in the share price of mining and commodities giant Glencore. Following the news that the German automaker had doctored the results of its US emissions-testing, the company saw roughly €25 billion wiped from its market value. The effect spilled over into broader indices, notably the German DAX, of which VW represents 3%. An analyst questioning the levels of indebtedness, and long-run financial soundness of Glencore, sparked a somewhat frenzied selling. Here too, the effects spilled over into the mining and materials sectors, and the resource-heavy FTSE suffered. The copper giant was able to rally after reassuring investors as to the health of its balance sheets, and the proactive positioning of the company to withstand the current commodity crunch. Yet markets remain wary. The UK FTSE, partly in the aftermath, declined by -2.86%. UK economic news was mainly positive: Unemployment decreased for the three months to July, and wages ticked up by 2.9% for the same period. Businesses appear confident of an improved outlook and regulatory environment, and retail sales rose nicely. On a sector basis, as elsewhere, domestically focused and defensive stocks (such as consumer staples and utilities) were amongst the better performers. Healthcare, materials, and energies lagged. Merger and Acquisition activity remains elevated, with the approach from Anheuser-Busch Inbev to SABMiller, for a refreshing £65 billion, the most publicised development. It is noted that the UK (though accepting some asylum-seekers) has opted out of any quota obligation. The extra degree of separation from the EU fuelled further speculation as to a potential Brexit during next year’s referendum.

The Migrant Crisis

The fuse on this potential powder-keg, noted in the previous month’s commentary, is nearing its end. The plight of migrants has been well-documented in recent news, as have the flare-ups of anti-immigrant violence in Italy, Greece and Hungary inter alia.

The ability and willingness to accommodate asylum seekers, and legal and illegal arrivals, differs widely across EU-states.

Although the medium-to-longer-term macro-economic impact is likely to be positive – migrants shifting the ageing European demographic, providing complementary skill-sets and acting as fiscal stimulus – tension is thick on the ground. This is particularly true at the first-landing points, which include struggling Greece. EU policymakers voted on the implementation of a system of quotas on the 22nd of September. It aims to deal with the humanitarian crisis more equitably, effectively requiring that each member state accept a share of immigrants, to be relocated from the hot-spot first landing points. The so-called refusniks (Hungary included) are left with little choice but to comply.

Japan and China

Japanese equities posted sharp declines, with the TOPIX sliding -7.9%. The outlook was subdued, partly a reflection of the country’s close ties with China. China historically accounts for 18 % of Japanese exports. Coupled with a somewhat stronger Yen, the slowdown resulted in new export orders declining at the sharpest rate in nearly three years. The Markit/Nikkei Flash PMI slid to 50.9 for September, and retail sales and wage growth were disappointing. Housing starts, however, increased for the 6th consecutive month. Of greater concern to Bank of Japan policymakers: The Core Consumer Price Index (CPI) declined by 0.1% year-on-year, its first annual decline since April 2013. This is partly a reflection of the pass-through from lower oil prices and food inflation, as headline inflation remained in positive territory at 0.2%. The Bank of Japan elected to keep interest rates on hold during its September meeting, with governor Kuroda reaffirming the belief that inflationary pressures were building. Standard and Poor’s, however, downgraded the country’s sovereign credit rating to A+, a move which (in combination with the weak domestic data) is likely to add pressure to the Bank for further stimuli. Economic updates from China were somewhat mixed, but did little to allay global investors’ fears. The Shanghai slid by -4.81%. The Caixin-Markit PMI declined to 47.0, a seven-year low. While authorities’ figures paint a more positive picture, the official number of 49.8 still indicates contraction in the manufacturing sector. Fixed investment growth came in at its slowest in 15 years, and industrial output ticked up only modestly to 6.1% for August. Retail sales, however, grew at 10.5% in September, and housing sales have been resilient (up 18.7% for the year to date). The resilience of the retail and property sectors are consistent with an economy moving, albeit painfully, toward its new growth-path. During a recent visit to the US, President Xi Jinping reiterated his belief that the Chinese economy was functioning with the ‘proper range’. The President also defended the market-interventions from Beijing, particularly in the currency space, and did not rule out similar future measures. The authorities still have some scope for devaluing the Yuan, although the August intervention saw Chinese foreign exchange reserves plummet by $ 93.9 billion. The Peoples’ Bank of China, however, in its relatively youthful exuberance, would do well to bear in mind that global markets do not react well to surprises. Black Monday bore witness to the far-reaching and unintended consequences of unanticipated or ill-timed policy moves.

Emerging Markets

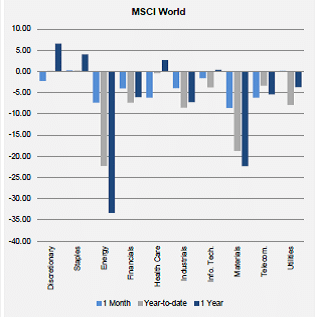

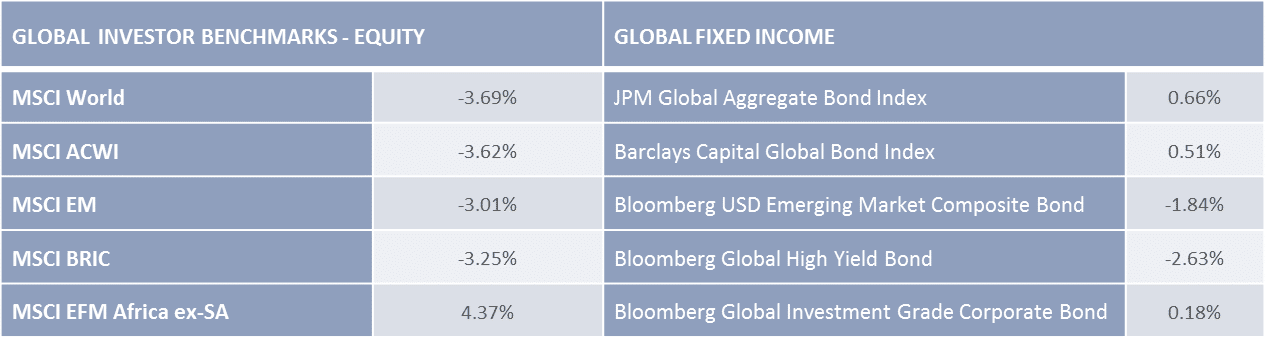

Investor skittishness was quite apparent in emerging markets, although the broader MSCI EM outperformed the MSCI World by 50bps. Little has changed regarding the headwinds facing the group: The USD remains resurgent, the Federal Reserve still intends a rate-hike before year-end, China remains in the doldrums and the commodity slump continues. Potential opportunities and pockets of strength, however, are therefore more notable. Within Emerging Asia, the Korean bourse substantially outperformed its peers. The KOSPI managed a 1.1% gain. The country’s sovereign credit rating has recently been upgraded, and its political environment is fairly stable. Its exposure to nascent North America bodes well for export-oriented and trade-induced growth. Although the SENSEX declined for September, India remains the Asian darling. The Reserve Bank of India remains accommodative, cutting rates by more than anticipated during its September meeting. Projected growth rates of 7% far outstrip its regional and global peers. Geopolitical tension continued to weigh on Emerging European markets. Russia’s military intervention and air-strikes in Syria have added to an already volatile situation, and exacerbated migrant-related tensions. Fraught Turkish elections, meanwhile, are set to take place on the 1st of November. The candidacy of ex-Prime Minister Ali Babacca (respected for his market-friendly policies) on behalf of the ruling AK Party temporarily boosted markets. Sentiment is jittery, however, and the Turkish Lira sunk against the dollar. Latin America emerging markets saw yet another month of declines. In a seemingly regular refrain, the Brazilian Real fell to all-time lows, alongside President Rousseff’s approval ratings. The bourse gave up -5.20%. Mexico, a country traditionally better insulated than its peers, due to its close ties with North America, registered sharp losses during September. The Mexican Central Bank maintained interest rates at record lows, in an attempt to boost flagging domestic growth. African equities struggled alongside their emerging peers. Oil-rich Nigeria’s Central Bank elected to lower the cash reserve requirement, injecting some liquidity in the local economy. The Governor cited fears that the country would enter a recession in 2016 if GDP growth did not pick up. As the second-largest copper producing nation in Africa, Zambia has already been hard-hit by the price-slump. The local bourse declined further on Glencore’s woes, with the company announcing imminent mine-closures and the loss of 3800 jobs.

South Africa

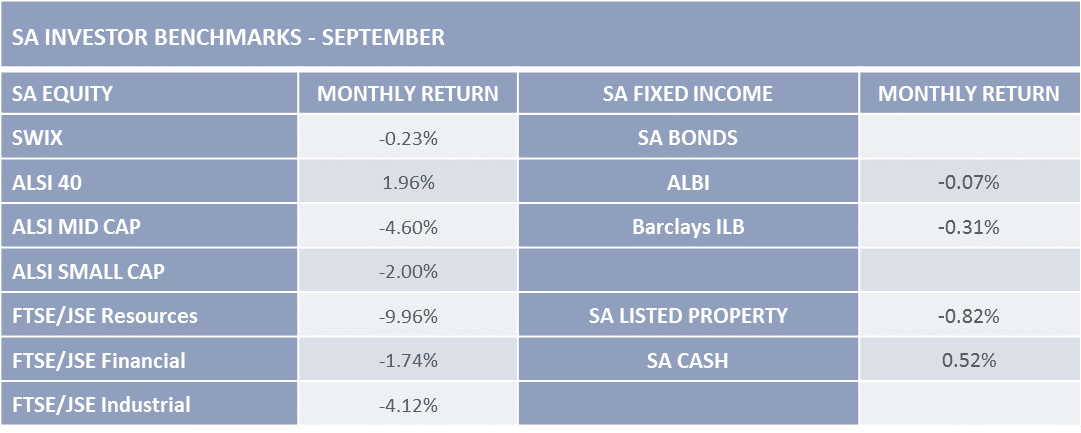

The JSE ALSI closed 1.96% higher, with the local bourse outstripping expectations and global peers in another volatile month.

Business confidence (as measured by the Bureau for Economic Research (BER) Business Confidence Index), however, remains at an extremely subdued 38 points for the third quarter. Survey respondents in the retail sector cited significant concerns about the impact of higher tax rates, interest-rate increases, escalating job losses and weakening consumer demand. Retail sales growth, while showing a year-on-year increase of 3.3% from July 2014, remains near flat on a monthly basis. Domestic vehicle sales – typically considered a key gauge of consumer appetite, and of the ease of attaining credit – slowed down by 9% in September, according to the Department of Trade and Industry. Slowing global demand and sticky domestic wages continue to deter private fixed investment in the manufacturing sector. The widening terms of trade-deficit (R9.9 billion in August, from R1.1 bn in July) provides some measure of the impact of the global slowdown and still-low commodity prices on exporters: Despite a sharp depreciation in the local currency, mineral and base metals exports (which represent roughly half of exports on a monthly basis) declined by R 6.7bn in August. The Markit/Standard Bank September Purchasing Manager’s Index affirms the somewhat gloomy economic outlook, and the further contraction of the manufacturing sector, declining to 47.9 in September. The recent South African Reserve Bank Quarterly Bulletin contains a sharp downgrade to the Bank’s growth forecast for 2015 to 1.5%. On such sluggish domestic growth and against the backdrop of a global slowdown, the Monetary Policy Committee stayed its hand in the September rate-meeting, maintaining the repo rate at 6%. It is noted however, that the SARB had been given leeway by the Federal Reserve’s decision to delay the US rate hike. At any event, South African CPI inflation slowed from 5% in July to 4.6 % in August (largely due to slower food price inflation, and petrol price decreases), leaving the Bank some modest breathing space.

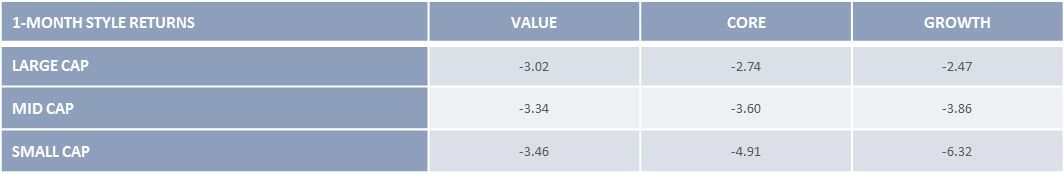

South African Fixed Income assets fared better than equities, although the local bond market was not spared the fall-out of policy-induced uncertainty. Yields on Inflation Linked Bonds ticked up toward month-end, particularly for longer-dated government bonds. The resource sector registered the largest declines, losing nearly 10%. Small and mid-caps, generally more susceptible to risk-off sentiment and market momentum, underperformed large caps. South African Listed Property, although still the year-to-date darling, lost 0.82% during September. The BER’s BCI index indicated a concomitant decline in Building and Construction Industry sentiment, which had been one of the more buoyant to date. The cautious tone of US Federal Reserve comments reinforced the USD’s dominance as sought-after store of value within the currency space. The local currency depreciated significantly, albeit to a lesser extent than some emerging peers, losing 4.2% and 3 .9% against the USD and euro respectively.

Commodities, Fixed Income and Currencies

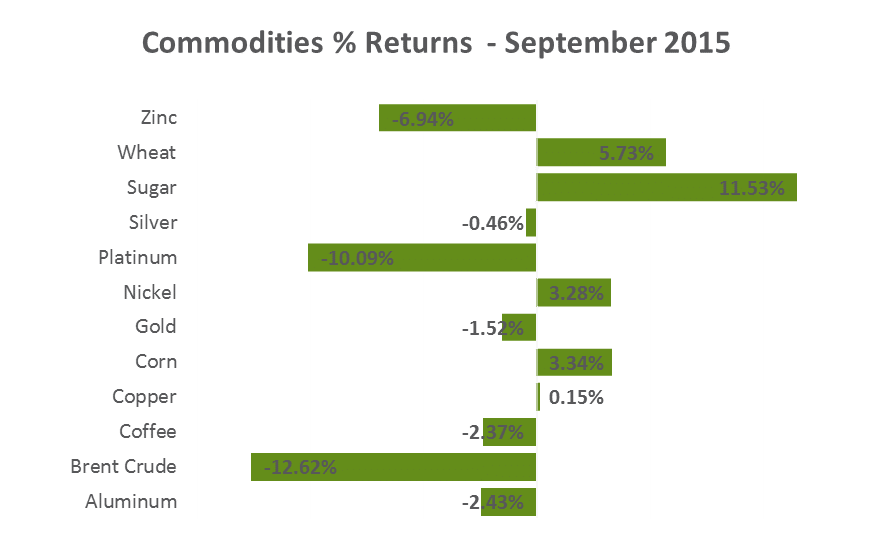

Commodity weakness continued in September, with the Bloomberg Overall Commodity Index slipping by 3.42%. Metals have remained under pressure, with a dour outlook for Chinese industrial growth, the continued strength of the USD and negative industry news-flow weighing on the subsector. Gold prices rallied at mid-month, as a wave of short-covering followed the announcement that the Federal Reserve would keep rates on hold. The metal gave back its safe-haven gains toward month-end, however, subsequent to Ms Yellen’s reiteration that a rate-hike was still on the cards. The renewed anticipation that interest rates would rise from their ultra-low levels raised the perceived opportunity cost of holding gold, and boosted the USD. Physical demand for gold from China and India moderated considerably. Platinum suffered sharp losses, as the fall-out from the Volkswagen emissions-fixing scandal played out in the automobile sector (platinum is used in diesel catalysts). Palladium, in contrast, received a massive boost on market expectations for renewed appetite for the metal used in gasoline auto-catalysts. It registered its best month since December 2011, gaining roughly 9%. Copper eked out slight gains, partly as a result of producers’ supply-side responses to slowing global demand. Oil witnessed further declines, as there is little indication that the global supply glut will be curtailed. Oil futures (for delivery in 2016) remained fairly range-bound, at USD 50 per barrel. Some limited improvement is therefore being priced in, but ‘lower-for-longer’ is echoed in this market.

Fixed income markets saw some volatility, as investors kept a close eye on the Federal Reserve Bank’s interest rate decisions. As global equities struggled, however, investors turned toward safer Developed Market sovereign bonds, boosting prices and sending yields lower. The 10-year US T-bill closed at 2.04%, 10 Year Gilts at 1.76% and the 10-year Bund at 0.59%. Peripheral European yields declined even more steeply: Consistently upbeat economic data, and sound balance sheets make the relatively less expensive sovereign debt of (prior laggards) Italy and Spain an attractive prospect in times of market stress. Emerging market sovereigns and corporates remained under pressure on heightened global uncertainty and political risk-factors. Turkish and Brazilian government debt, in particular, was widely spurned. Spreads on EM corporates widened to 500-600 bps (The credit spread refers to the additional compensation an investor demands for holding an asset with credit risk/default potential, over the yield offered by a government-backed/risk-free security). However, while this asset class has witnessed large outflows for the year-to-date, September brought relatively muted flows and some reversals. Investment Grade corporate bonds outperformed High Yield bonds, in a continuation of the year-to-date trend. Corporate credit spreads were volatile, notably in the period surrounding the Federal Reserve’s decision. The initial doubts surrounding the health of Glencore’s balance sheets, the Volkswagen scandal and prospects of tighter regulations also spooked investors in the corporate credit space. The knock-on effect at any event, is that corporates, particularly those in highly visible or highly politicized sectors, will have investors (and particularly those in the institutional sphere) scrutinise their balance sheets and their ESG (Environmental, Social and Governance) credentials closely. In the prevalently risk-off environment, High Yield bonds underperformed. During the last week of September, US High-Yield bonds saw their biggest weekly outflows in three months (mainly in the biotechnology and energy arena). Simultaneously, on the supply-side, elevated M&A activity puts gross issuance at its highest level in 8 years.

While the decision to delay an interest rate hike initially sent the USD lower, subsequent Federal Reserve statements saw it rally anew. The dollar index, a trade weighted measure of dollar strength against a basket of currencies, closed the month 0.5% higher. The Yen, similarly valued for its safe-haven status, appreciated 1.36% against the USD, the Euro appreciated modestly and the Indian Rupee gained ground on easing inflation fears. The hardest-hit currencies were in emerging markets, with the Brazilian Real tumbling 8.28%, the Maylasian Ringgit by 4.61% and the South African Rand by 4.15%. As Chinese authorities have not ruled out further devaluation of the Yuan, currency one-upmanship is still a disturbing possibility, particularly in emerging Asia. To date, however, it appears that policymakers are cognisant of the potential costs of what ultimately remains a zero-sum game.

Conclusion

The actions of monetary policymakers, and the continued tail-risk from China are likely to remain at the forefront of global investor’s minds. Indications of moderating growth could keep US interest rates lower-for-longer, and spur further easing from central banks elsewhere. Easy monetary policy usually boosts riskier asset classes. The lack of clarity as to the timing of Fed rate-hikes, as well as broader political concerns, however, mean that markets may be in for a protracted period of volatility.