International Market Commentary: October 2015

- Equities snap back as concerns around China ease.

- Birdwatching – Central Bank hawks and doves guide market sentiment:

- US economy continues to show signs of slowing, but the Fed sets a hawkish tone.

- Eurozone data mainly upbeat, and a dovish ECB stands ready to expand QE.

- Chinese fundamentals show little change, but the POBC acts to reassure investors.

- Bank of Japan still broods on further stimuli, despite growth concerns.

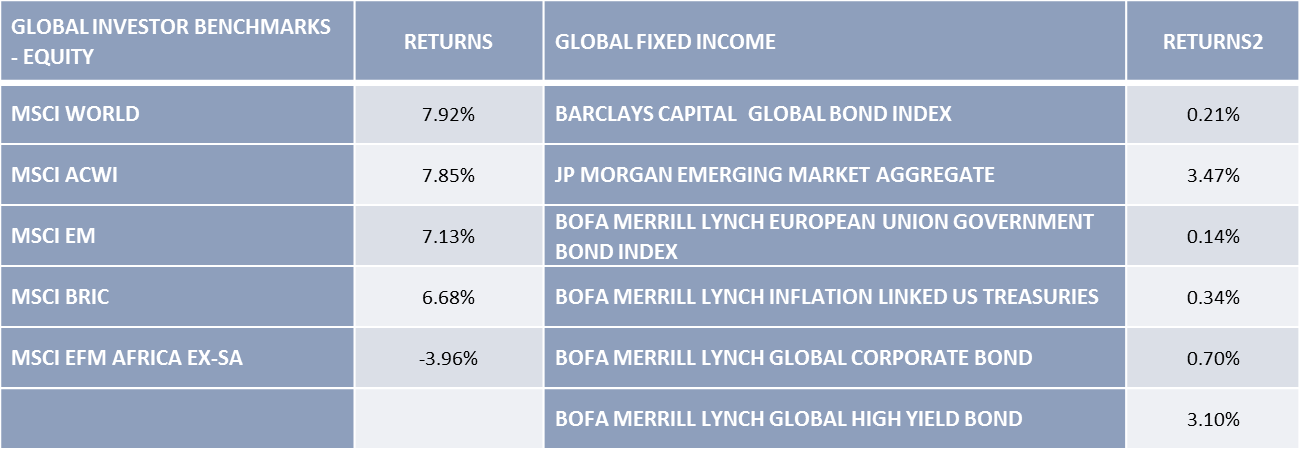

- Emerging markets manage gains, though underperforming developed peers.

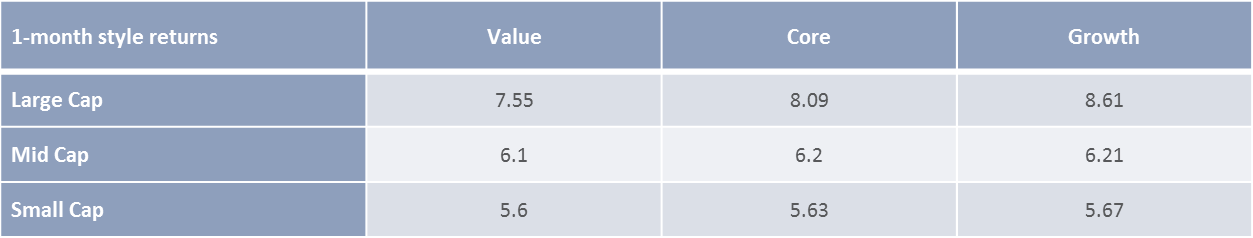

- Risk-on sentiment sees growth counters outperform value stocks, and high yield debt attract inflows.

Introduction

October saw a remarkable turnaround in major global markets. The resurgence of risk-appetite, however, has been guided more by sentiment and rhetoric than by a change in economic fundamentals. Macroeconomic data (though mixed at times) continues to tell of a stronger Eurozone a more modest uptick in the US, and a relatively robust Japanese economy. China’s changing trajectory is fairly clear, though the pathway is neither quite as smooth nor predictable as envisaged. Developed markets are set to outpace their emerging market peers, but the disparities within the latter group will become starker as policy environments change. Indeed, monetary policy proved to be the main driver for the October upswing. Investors (somewhat perversely) responded well to a hawkish Federal Reserve, overlooked the vacillations of the Bank of Japan and took heart from the European Central Bank’s accommodative stance.

US Markets

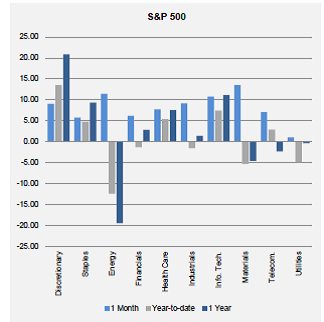

US equities snapped back sharply in October, all but reversing the sharp late-summer sell-off. The S&P 500 ended 8.4% higher, the Dow registered an 8.5 % uptick, and the NASDAQ gained 9.4%. Risk-on sentiment returned to global markets in October, on ebbing concerns about the health of the global economy. With Chinese authorities enacting broad-based policy measures to reassure investors, and on the tentative promise of additional Eurozone liquidity, dovish Central Banks somewhat unusually out-sang the more hawkish Federal Reserve. US equities were boosted by the positive momentum of the 3rd Quarter earnings season. By the 30th of October, 77% of the companies in the S&P 500 had published earnings reports: 38% beat analysts’ expectations, while only 9% undershot. The caveat, however, is that expectations had not set the bar particularly high. Markets had already factored in the demand-side impact of a still-strong US dollar and still-sluggish Chinese economy, and the revenue impact of still-weak energy sector. Estimates were that third quarter earnings would decline by -6.3% year-on-year – a -3.5% decline (to date) is therefore a large upside surprise. The sharp turn-around is also partly attributable to the reversal of some extremely aggressive and defensive short positions, taken by investors who were scalded in the summer sell-off. Particularly the more liquid large cap stocks saw active trading in this regard, outperforming their smaller and mid-cap brethren globally.

Positive sentiment aside, the macroeconomic fundamentals in the US show little change – the data paints a picture of a muted, somewhat patchy recovery. Leading indicators of economic activity (which include gauges of industrial production, labour market conditions, consumer sentiment and business confidence) have largely softened since the summer. The widely watched Purchasing Managers’ Index (PMI) declined to 50.1 in October. While a figure above 50 still indicates an economic expansion, the current level is the lowest since May 2013. The latest release from the Institute for Supply Management (ISM) reports that durable goods orders had contracted by 1.12% in September, and that inventories were increasingly being drawn down. This is consistent with perceptions amongst domestic firms about uncertain demand-conditions. Such uncertainty is also likely to result in further cuts in corporate capital expenditure and fixed investment. The pace of residential fixed investment appears to be slowing too, and US housing data was mixed. While existing home sales increased during October, new home sales declined to a 3-year low. The latest labour market data was greeted with some relief, after a particularly dismal September showing. The weekly jobless claims series is hovering at a 42-year low, 271 000 new jobs were added for the month, and unemployment declined to 5.0%. The Federal Reserve has traditionally regarded this as consistent with NAIRU (the non-accelerating inflation rate), and it certainly sets the stage for interest rate hikes in the foreseeable future. The Quarterly Employment Cost Index, an indicator the Fed watches closely for sustainable real-wage growth, ticked up by 0.6% quarter-on-quarter (and 2.1% annually). Solid, albeit unspectacular, real wage increases further strengthen the case for a rate-hike. And the Bank, in its statements toward month-end, certainly took on a more hawkish tone than markets may have anticipated, signaling that global developments were less likely to delay lift-off. It remains true, however, that the path of normalization will be slow-and-steady, as (apparently) is the economic recovery.

The rally in equities was not limited to any particular sector, though there were notable outperformers. Materials and Energies, which came under heavy selling pressure in previous months, surged by 13.5% and 11.1% respectively. Positive corporate earnings reports (including by Microsoft, Apple and Google) and significant Merger and Acquisitions activity boosted the Information Technology sector. A proposed deal between Dell and data storage maker EMC, at $63 billion, could be the biggest in IT history. The healthcare and consumer sectors, although lagging in absolute returns for the month, also witnessed significant corporate activity (Pfizer’s approach to Allergan, and ABInBev’s bid for SABMiller). The more defensive sectors (such as utilities and consumer staples) fared the worst, but still managed positive returns.

December: Shutdown Averted but Rate Hike on the Cards

As previously noted, the US debt ceiling of $18.1 trillion had been breached in March this year, and the extraordinary measures which had allowed the government to continue servicing its external debt were due to run out in early November. Prior to his departure as house speaker, John Boehner in late October successfully pushed through the passing of a limited extension, deferring the decision to March 2017.

The Federal Reserve Bank has changed its tone in recent statements, and a December rate hike now seems increasingly likely. The change is perhaps best illustrated by anecdotal evidence: At the annual meeting of the International Institute for Finance early in October, emerging market representatives urged the Fed to “just do it” – the somewhat exasperated consensus being that continued uncertainty around the timing of the hike was more detrimental to emerging market currencies, and injected more market volatility than any actual increase would. The response of Fed Vice-Chairman Stanley Fischer, reported at the time: … “and we will do it, probably, at some point, but we’re not going to do it at a time that is not suitable for the US economy”. Toward month-end, however, the testimony of Chairperson Janet Yellen, seemed to indicate that the Fed believes that time is fast-approaching. December was explicitly mentioned as potential date, in a departure from previously more fuzzy guidance as to timing. Markets’ subsequently increased the probability of a hike from 38% to 50%, reflected in the pricing of the Federal Funds Futures rate.

The Eurozone

The European economic recovery remains on track, and is perhaps more entrenched than elsewhere. Eurozone equities ended October sharply higher, with investors reassured by favourable economic data, and the prospect of further Quantitative Easing from the European Central Bank. The previous month’s regional laggard reversed its position, with the DAX gaining 11.8%. Individual Eurozone markets outperformed US counterparts – the DAX’s 11.8% gain, and the CAC rising by 9.5% – but the broader Stoxx lagged somewhat at 8.00%. The UK snapback was less pronounced, the FTSE 100 gaining (only) 5.17%.

Eurozone manufacturing remained in expansion territory, with the Markit Composite Purchasing Managers’ Index inching back up to the 54.00 mark, and sentiment within the zone is upbeat. Industrial production had declined in September, as weakening Asian exports fed through to demand. Yet the latest data from the European Commission’s quarterly survey nonetheless indicated that excess factory capacity was being absorbed at a faster rate, boosting expectations for a near-term uptick. The European Commission’s Economic Confidence index rose by 0.3 points and is currently at a four-year high. The German Ifo Business Climate Index mirrors an improved outlook, as do the longer-run results of the European Bank Lending Survey for the Third Quarter. Demand for credit reportedly rose in all three categories covered by the Survey: loans to enterprises; mortgages; and loans to customers. Simultaneously, the Survey indicates an easing in credit conditions. Both the increased appetite for credit, and the higher propensity to extend credit, point to confident consumers and businesses. Eurozone unemployment declined to a four-year low of 10.8%, despite fears surrounding the impact of an influx of migrants on labour-market dynamics. Retailers are predicting a bumper Christmas season, underpinned by the buoyant labour market, real wage gains and overall positive consumer sentiment. German retail sales, after increasing by 3.6% during a difficult third quarter, are up by 2.4 % year-on-year. Spillovers from the migrant crisis are likely to manifest here as well, particularly within mass- and lower-end retail segments. Political tension around the crisis is still bubbling under the surface in the European Union’s leadership. Election results in Portugal, inter alia, bode for flare-ups between the so-called ‘peripherals’ and ‘refusniks’, and the core.

Eurozone inflation recovered somewhat, registering at 0.0% for October, after popping into negative territory in September. The European Central Bank, having previously exhibited a ‘wait-and-see’ attitude to further stimuli (in the face of a global slowdown, and subdued inflation), is increasingly likely to expand its quantitative easing programme. In Central- Bank language, the statement from ECB President Draghi is quite definitive: the bank would no longer “wait and see, but work and assess”. Market reactions were as expected, with the appetite for risky assets surging, and the Euro declining sharply against the dollar. After a dramatic September, corporate news from Europe was somewhat tame: The fallout of the Volkswagen scandal lingers, but automakers were boosted by particularly positive results from France’s leading manufacturer Renault. Overall, earnings season got off to a solid start, with earnings-per-share growth estimates at 4% year-on-year. Energy, materials and resource companies, predictably, dragged on corporate results. The resource-rich UK FTSE therefore lagged its regional peers in the extent of its reversal, despite some recovery in resource shares. UK political and economic news was somewhat mixed. Quarterly economic growth slowed from 0.7% in the second quarter, to 0.5% in the third quarter of 2015. The slow-down is by no means a disaster, but it is nonetheless enough to give the Bank of England pause for thought in its initiation of its rate-hiking cycle. Expectations are that tightening will be deferred to the second quarter of 2016, but the Bank may be prodded into action sooner (depending on the timing of the Fed). The UK housing market, and construction indices have been particularly resilient, boosted by still-easy credit conditions. UK manufacturing, however, contracted for the third consecutive quarter in Q3. The spillover has also been evident in economically and politically sensitive sectors such as the UK steel industry. Recent mill closures in Scotland and England have been attributed to high electricity costs, cheap Chinese imports and the strength of the Pound. The resultant job losses (with 1 in 6 workers in the industry facing the axe) see political pressure mounting, and increasing dissatisfaction with government’s handling of the crisis. Labour market instability, coupled with slowing growth, potentially puts a raft of reforms at risk, including the implementation of the National Living Wage. Moreover, a significant slowdown in business investment is likely in the run-up to the UK referendum on EU membership. On a sector basis, Resources, Oil-and-Gas and Materials staged a recovery, as noted elsewhere. Telecommunications was boosted by M&A and solid earnings reports. Consumer Goods ticked up nicely, on better-than-expected Q3 earnings results. Notable in this regard: Unilever, seen as a bellwether for demand in Emerging Markets, reported an encouraging increase in sales in China, a further reassurance as to the rise of the Chinese consumer.

Japan and China

The Japanese TOPIX closed 10.4% higher, boosted by an improved outlook on global demand and positive initial corporate earnings results. Macro-economic data, however, was mixed and many observers were surprised that the Bank of Japan elected not to add stimuli at its month-end meeting. On the positive front, Japanese retail sales remained resilient, ticking up by 0.7% in September, and industrial production came in well above expectations ( a 0.1% increase, versus an expected -0.6% decline). Whilst exporters continued to benefit from the weaker Yen, exports to China contracted by 3.5%, resulting in the 6th consecutive monthly trade deficit. The signing of the Trans-Pacific Partnership – a preferential trade agreement with the US – is likely to mitigate somewhat against further tail risk from China. The Bank of Japan nonetheless revised its growth forecast lower by 50bps (to 1.2% p.a). Coupled with the at-best-limited improvement in domestic inflation data, speculation was rife that the Bank would announce further stimuli in its October meeting. Governor Kuroda, however, disappointed markets: The Bank revised its inflation forecast downward from 0.7% to 0.1%, and pushed out the timeframe for achieving its aims, but held back on stimuli. The dip in equities was short-lived, as expectation once again grew for some form of stimulus in the coming months, at any event, with an additional Y80 Trillion fiscal package proposed as alternative to monetary policy tools. Central Bank measures elsewhere certainly helped risky assets to quickly regain their footing. Chinese authorities staged further interventions over the course of the month, with the twin shorter-run aims of easing market volatility and investor jitters, and smoothing the economic transition. The measures also form part of the country’s longer-run liberalisation strategy. The sixth rate cut by the People’s Bank of China in 12 months injected significant liquidity and prompted a rally in Chinese equities (Shanghai snapped back 9.1%) and global assets. The Bank also eliminated the cap on the deposit rates local banks are able to pay. Historically, Chinese banks paid interest that was significantly below inflation. Effectively, citizens were forced to save proportionately more, in anticipation of requiring a substantial reserve to maintain their current lifestyle. This often entailed foregoing present preferential consumption in favour of future needs. With deposit rates now more likely to track inflation, consumers can rotate toward the here-and-now, boosting current demand. A further significant paradigm shift is in the abolition of the one-child policy, albeit with less-clear-cut implications. Policymakers have long realised the potentially debilitating impact of the current demographic trend: A declining working age population; and a rapidly increasing dependency ratio. The Chinese dependency ratio is more akin to those in developed markets, but incomes remain at emerging market levels. This poses a significant fiscal burden. The wider socio-economic implications of the one-child policy (including the marginalizing effect of the hukou registration system, and the phenomenon of ‘hidden’ children) have been widely documented. Whether an official de/pronouncement will have much impact, remains to be seen. Under a previous relaxation in 2014, 11 million couples were eligible to have a second child. Only one million applied to do so.

At any event, the economic news from China is not yet weighted toward the positive. By both the official and the unofficial readings of the Purchasing Managers Index, Chinese manufacturing contracted during October. The non-manufacturing (official) PMI, measuring the services and construction sectors, declined to 53.1. Industrial production is estimated to be at its lowest in 25 years. Urban fixed investment continued to moderate, registering 10.3% for October. Monthly retail sales, however, grew at 10.9% in October, and housing sales have been relatively resilient. Consumer-related corporate news saw the $ 15 billion merger between two of China’s biggest Internet startups, Meituan and Danping both playing in the nascent Chinese online-to-offline consumer space. The companies are backed separately by Alibaba and Tencent, with Meituan a Groupon-like e-commerce website, and Danping a restaurant review smartphone app. The deal is illustrative of the opportunities in the tech-savvy consumer market. The resilience of Chinese consumers, and the prospect of further rotation toward current consumption, is encouraging. The moderation in the services sector, however, is of greater concern, considering that it is a key element of the new-growth path. While overall GDP growth registered a decline (at an estimated 6.9% for Q3), so-called tertiary sector activity accelerated by 8% year-on-year. China-induced fears may be overdone, but Central Bank actions are still likely to guide investor sentiment. Black Monday is still a painfully recent memory.

Emerging Markets

Renewed (central-bank boosted) risk appetite was a boon to emerging markets, with the MSCI EM gaining 7.1% for the month. The group, however, still underperformed developed market peers, having seen few broadbased changes in economic fundamentals. . Emerging Asian markets were followed by their Latin American peers, while Middle Eastern markets were the group-laggards. The Indonesian market registered a particularly strong performance, as the government’s commitment to structural reforms gained credibility, and the Rupiah strengthened against the dollar. South Korean equities were boosted by improved manufacturing data, and strong earnings results from technology heavyweight Samsung. The SENSEX underperformed in relative terms, but India’s market remains a steady bet. Latin American markets saw a welcome reversal of fortunes, led by the Colombian market (the only bourse to outperform the regional index). Robust industrial production, improved consumer sentiment and historically low inflation, boosted investor sentiment to Mexican equities. Brazilian stocks rode on the tailwinds of emerging peers. Within the present economic and political context, material changes in the country’s fortunes are unlikely. The ongoing corruption scandal is engulfing an ever-larger number of political figures. Incumbent and increasingly unpopular President Rousseff’s campaign has not escaped allegations of irregularities, and she may face impeachment. In a telling indictment of the political and economic paralysis facing the country, this may prove to be the best outcome, acting as a catalyst for painful change. Emerging European stocks were spurred on by the dovish stance of the European Central Bank. Investors are cautiously optimistic on Russian, with forward-looking indicators signalling that the worst of the recession. While geopolitical tension remains – skeptics denounce an element of Cold-War-like sparring in exchanges with the US around Syria – President Putin’s overall stance is seen to be more conciliatory, with a longer-term view of the country’s tactical repositioning. The slight resurgence in energy prices also boosted MICEX performance, and it registered a 4.17% gain. The much-anticipated Turkish elections resulted in Erdogan’s retention of power, promising a modicum of stability. The country saw its trade deficit at the narrowest in 6 years, and the Lira strengthened against major currencies. Turkey was the regional outperformer. Elsewhere in Poland, elections added to market fears. The victory of the aptly-named Euroskeptic Law and Justice Party, with its strong opposition to migrant quotas, make for a collision with major EU allies. Stock markets in Africa were unable to gain from the renewal in risk appetite, with the majority of markets registering losses for the month. T The bourses of the largest commodity exporters declined, despite some improvement in selected commodities (oil, platinum and sugar notably). Kenya was a regional laggard, at -6.74%; Uganda lost -5.29% and Nigeria’s bourse declined by -6.49%.. An overvalued naira and policy uncertainty have weighed significantly on investor sentiment toward the latter. Currency controls were first implemented in June with multiple aims (preventing the devaluation of the naira; limiting imports and therefore boosting domestic production; and curbing corruption), but the short-run impact has been stifling. The USD 5.2 billion fine imposed on MTN, whether regarded as justified or excessive, has fueled a perception that tighter regulations are being used to plug a budget deficit. Trading in Africa’s dominant financial sector was mixed: localised arms/subsidiaries of Standard Chartered registered gains for the month, but a number of local banks registered sharp losses (KCB Bank; Banque du Tunisia). Trading in breweries/beverage-related stocks was very active, as the deal between SABMiller and Abinbev plays out in the consumer space. Fortunes were mixed, however, with Nigeria’s Intl Breweries trading at 12-month lows, versus the 12-month highs achieved in Namibian Breweries, SABMiller and Mauritian-based Phoenix Beverages. The Egyptian market declined by -1.26% for the month: Prospects for a recovery are limited, as regional tension remains elevated, and the recent air-disasters detract from tourism-revenue. The Ghanaian market eked out a small gain (at 0.18%), while Namibia and South Africa were the regional leaders.

South Africa

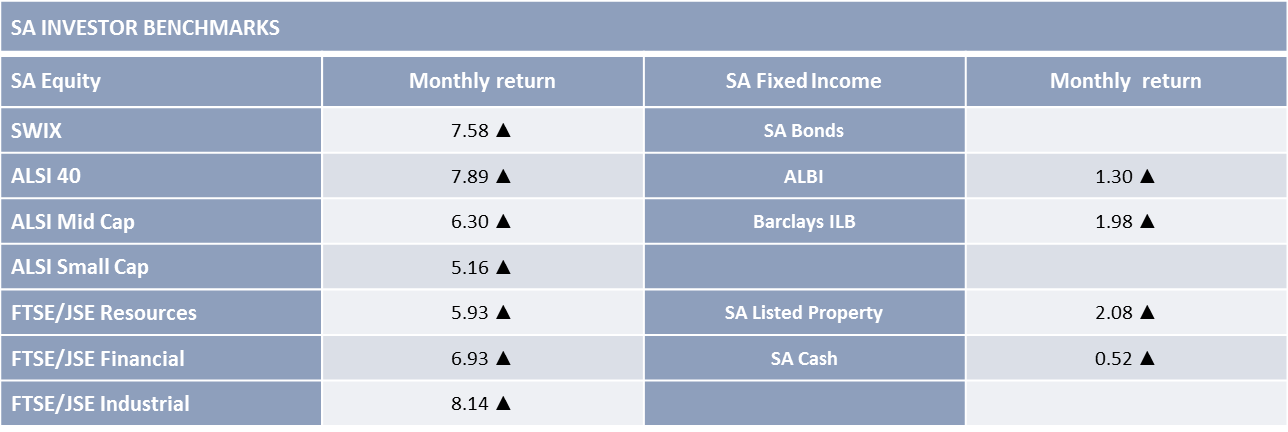

South African equities managed to build on September’s (surprising) momentum, with the Top 40 registering a gain of + 7.9%.

Domestic economic conditions, however, remain somewhat gloomy, with Finance Minister Nene slashing the country’s projected growth for 2015 to 1.5% (from 2%). Official unemployment rose to above 25% in Q3, despite an encouraging 171 000 new jobs. According to the latest Labour Force Survey, the combined number of positions for the year-to-date is a significant 712 000, but only 87 000 of these were in the formal sector. The expanded definition (which includes discouraged workers) indicates a perhaps more realistic-feeling 34.4%, with a staggering 62.1% unemployment rate amongst the youth. The South African Revenue Service reports that the trade deficit narrowed to 0.9 billion in September, a marked improvement from the (upwardly revised) 9.9 billion deficit in August. SA Exports grew at 1.8% year-on-year, while imports increased by 0.5% year-on-year. The strongest export sectors for the month were Vehicle and Transport Equipment and Chemical Products (at 10.9% and 16.4% respectively), reflecting a global uptick in the Automotive Sector. With large parts of the country languishing under drought conditions, however, the positive impact was partly offset by the whopping 62% increase in vegetable imports. Additional food price inflation is therefore in the pipeline for already cash-strapped consumers. The Medium Term Budget also served to confirm that fiscal maneuvering-space is tight: The budget deficit is likely to widen to 3.3% by 2017, with government debt set to reach 50% of GDP (a threshold that Nene has indicated the government will not cross). The state has been hard-hit by the 2015 public sector wage negotiations – above-inflation wage increases of 10.1% see the state wage bill projected to rise to 200 billion by 2018/2019. And, judging by the recent-and-ongoing student protests, it may yet need to borrow more if it is to contribute to some form of subsidised tertiary education. Debt servicing costs constitute the fastest-growing expenditure item, with the subsequent rapid increase in the gross loan-debt-to-GDP ratio flagged by international credit rating agencies Fitch and Moody’s as a risk to the country’s sovereign debt ratings. A downgrade, particularly at a time when the Federal Reserve is strongly hinting at rate rises, is likely to result in large foreign outflows. With the current buoyancy on the JSE partly attributable to the ready flow of foreign money, near-term volatility may increase. This month’s excellent equity returns, indeed, were partly a result of the highs reached by a number of the top dual-listed companies (British American Tobacco, Richemont inter alia). General bargain-hunting (after a dismal September), rand-hedging appeal, and better than expected earnings, boosted demand for quality large caps. The proposed merger between SABMiller and ABInbev, caused ripples through the consumer space, as did the hefty fine imposed on MTN by the Nigerian government in Telecomms.

Commodities, Fixed Income and Currencies

The Bloomberg Overall Commodity Index declined by a relatively modest -0.45% during October, with notable weakness in the industrial metals sub-sector. Iron ore prices dropped below the key psychological level of $50 per metric tonne, and are over 12% lower for the month. According to the China Ore and Steel Association, demand for steel (both from abroad and from China) is declining at an unprecedented speed. Simultaneously, producers such as Rio Tinto are feeding into a supply glut. Precious metals gained ground, as Platinum prices benefited from a snapback in the wider automotive industry. Oil prices rose toward month-end, with data from the US Department for Energy confirming the impact of drilling cutbacks. The Baker Hughes oil-rig count has seen a further 16 rigs closed during October, implying a 64% reduction in numbers from October 2014. Oil production had reportedly already slowed to 45 000 barrels per day in August. Analysts discern a less unrelenting stance from OPEC of late, and are cautiously optimistic that the oil price has bottomed out. The refrain will remain lower-for-longer however.

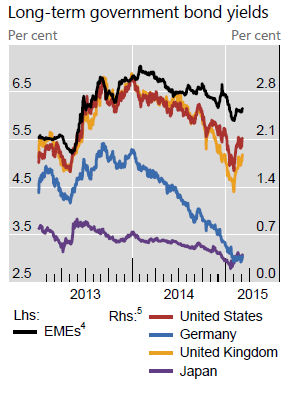

Perceptions that the Federal Reserve would keep rates on hold until 2016 were challenged toward month-end, introducing some volatility in fixed income markets. European bonds outperformed their peers, in anticipation of further easing from the European Central Bank. Overall, however, risk-on sentiment saw a rotation toward equities and high yield bonds. The 10-year US T-bill closed at -0.4%, 10 Year Gilts at -1.2% and the 10-year Bund at 0.5%. . Spreads on EM corporates narrowed somewhat (The credit spread refers to the additional compensation an investor demands for holding an asset with credit risk/default potential, over the yield offered by a government-backed/risk-free security), as did spreads on EM Sovereigns. Within emerging markets, South African debt was one of the worst performing assets in the last two weeks of October, as student protest fuelled concerns about fiscal stability. High Yield bonds outperformed Investment Grade Corporates. The solid earnings season, however, has seen corporate bonds still enjoying strong returns, though sector and company-specific headwinds take their toll (eg beleaguered Valeant in the pharmaceutical space).

The dollar index, a trade weighted measure of dollar strength against a basket of currencies, closed the month 0.6% higher. Emerging market currencies strengthened against the dollar, with the Indonesian Rupiah, Korean Won and Turkish Lira registering the largest gains (at 6.7%, 3.9% and 3.8%). Chinese authorities announced a trial programme on the Shanghai exchange which would allow direct purchase of foreign assets by domestic investors. The move, part of the longer-run liberalization of the economy, was greeted as a positive step to increasing the convertibility of the currency, and the Yuan strengthened. The Euro weakened against the USD, in a continuation of the overall year-to-date trend. The Japanese Yen maintained its position as one of the best performing currencies against the resurgent USD for the year to date. A stronger Yen may add to the pressure on the Bank of Japan to increase its stimulus measures, although fears of a currency war have largely abated.

Conclusion

As year-end approaches, it is unlikely that any single market event provides the catalyst to change the current market trends: Lower-for-longer in many commodity markets, and in the majority of central bank policy frameworks. Developed markets remain on track to outperform emerging market peers. The disparities within both groups, but particularly in the latter group, will become starker as policy environments change. With a number of monetary policy meetings on the agenda before year-end, markets will keep a keen eye on central banks for guidance, and volatility may spike before 2015 draws to a close