International Market Commentary: November 2015

14 Dec 2015

- Markets put on a brave face, but are muted in the face of global terror fears

- Ongoing tension in the Eurozone and Middle East; Russia taking an increasingly prominent role

- Eurozone data mainly upbeat, with the ECB promising further stimuli

- Federal Reserve sees US economic fundamentals – labour market conditions especially – setting the scene for December hike

- Some easing of fears around Chinese hard landing, but no respite for other BRICS heavyweights (Brazil, SA)

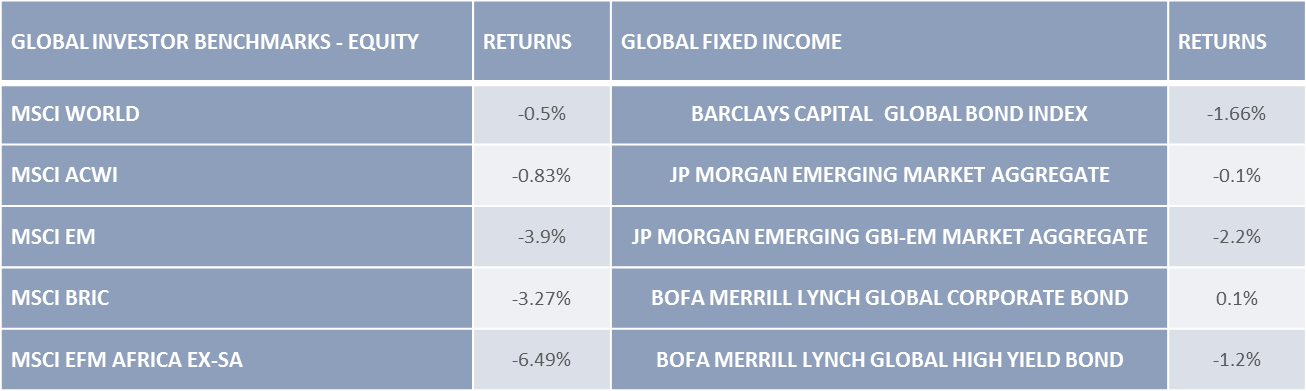

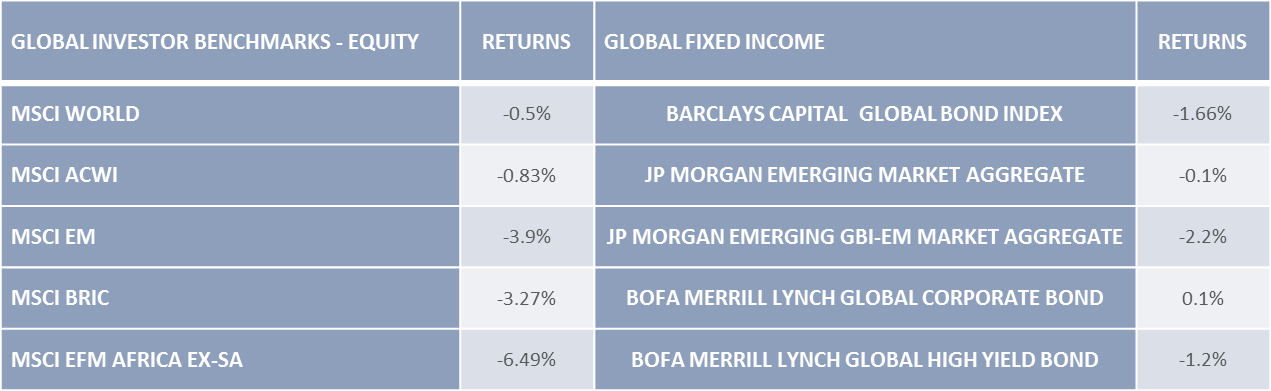

- Policy uncertainty spills into fixed income,currency and emerging market space, and emerging markets lag

- Stock shocks continue – Anglogold, Lonmin, Glencore, BHP Billiton on resource weakness and Brazilian mining tragedy

Introduction

November is best characterised as an uneasy month for markets. Investor sentiment was cautious, against the backdrop of increasing global terrorist activity, and ahead of a number of key Central Bank meetings. European equities proved resilient, on largely upbeat economic data, and outperformed their US counterparts. Japanese stocks posted a modest uptick, with concerns about Chinese economic growth easing somewhat. As commodities slumped further, and the dollar continued its ascendency, emerging markets were firmly on the backfoot.

US Markets

US markets had a somewhat rocky November, with equities unsteadied by the implications of imminent Federal Reserve action, and global security concerns. The S&P closed 0.3% higher, and the Dow registered similar muted gains. While some economic data releases remain disappointing, the consensus view is that US economic fundamentals support the Fed’s hawkish stance, and markets are pricing in a 75% likelihood of a December rate-hike. US third quarter growth has been revised upward by 60bps to an estimated 2.1%. US business confidence appears to be robust, with notable upticks in new orders and durable goods orders, which rose by a seasonally adjusted 3%. Perhaps more indicative of the turnaround in business spending patterns, is an increase in orders for non-defense capital goods of 1.3% during November – the year to date pattern having seen a 4% decline in the first 10 months of 2015. Consumer confidence, however, remained somewhat subdued, with retail sales figures coming in below expectations. The Conference Board’s consumer confidence index fell to its lowest level for the year, and consumer spending barely budged in the run-up to the silly season, ticking up only 0.1% from September to October. Disposable income, however, ticked up by 0.4% over the same period. US consumers, likely wary of interest rate uncertainty, and in anticipation of the holiday season, appeared to favour saving over consumption: the savings rate rose to 5.6%, its highest level in three years. US auto-sales were particularly strong, topping the 18 million mark for the third consecutive month, and increasing at a record 13.6% pace. US housing data was somewhat mixed for the month: While existing home sales declined by 3.4% during October, new home sales rose by 10.7%. The S&P/Case-Shiller house price index (a composite indicator covering 20 US cities) rose by 5.5% year-on-year. This measure is closely watched by the Federal Reserve as indicator of capacity and appetite in the residential real estate market, and therefore continues to be supportive of a rate-rise. The labour market too, after a wobble in September, has regained momentum. During the last week of November, weekly jobless claims fell to 260 000. The number of claims has now remained below the psychological threshold of 300 000 for 38 consecutive periods. The November non-farm payrolls report emphasized the decrease in labour market slack – at 271 000 new jobs created, November saw the biggest increase for the year-to-date. This is despite the continued pressure US manufacturers are facing from the resurgent dollar. The notable increase in the US trade deficit (to 3.4%), is largely attributable to the concomitant decline in export competitiveness.

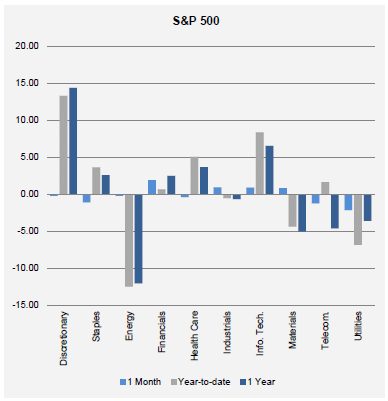

On a sectoral basis, financials were boosted by the prospect of higher interest rates, and despite rating cuts from S&P to a number of large US banks. Investors remained optimistic that rate-rises are likely to drive profit margins higher. Traditional safe-haven dividend-secure sectors such as telecommunications and utilities declined, in line with bonds. Merger and Acquisition Activity, which has remained elevated, was notable in the healthcare sector. A $160 billion merger between Pfizer and Allergan is on the cards. It is the latest in a series of deals which would see a US firm move its headquarters abroad (to Ireland in this case), in order to take advantage of a more favourable tax regime. The move is likely to see tax rates decrease from 25% to 17% or 18%. The current trend sees increasing scrutiny by US officials, lest the corporate tax base diminish significantly.

US Sector returns

Source: Eaton Vance

The Eurozone

European equities outperformed their developed market peers. Investors, although unsettled by global security concerns, remained stoic, spurred by expectations that the European Central Bank would boost its stimulus package early in December. The German DAX gained &&&, the Stoxx $$$ and the CAC $$$. The UK FTSE lagged its continental counterparts, registering only 0.33% uptick against the Stoxx’s 2.77% gain.

The broad-based recovery remains on track, with the region expanding at 1.6% year-on-year during the 3rd quarter – the best rate recorded since 2011. Manufacturing continued to expand, with the Flash Composite Purchasing Managers Index (PMI) at its highest in five years, at 54.4 (well above the key 50 mark, the threshold distinguishing expansion from contraction). Positive business sentiment is also reflected in the pace of hiring, and in the ‘backlog of work’ indicators. The latest Bank Lending Surveys show that Eurozone businesses’ appetite for credit is still expanding, ticking up by 0.6% year-on-year in October. Whilst headline third quarter earnings results were lacklustre, at an average negative -5.9% earnings-per-share growth year-on-year, much of the decline can be attributed to the energy sector (as expected). If it is stripped out, the average is 7.4%, far healthier than for other developed market corporates. The German Ifo Business Confidence Index rose modestly, despite ongoing regional tension around the migrant crisis, global security concerns and the prospects of tough negotiations at the COP21 climate-change conference (scheduled to take place in terror-hit France in mid-December). Germany proved to be the regional leader, while political uncertainty dragged on peripheral markets. The newly sworn-in Portuguese president, Antonio Costa, is a representative of the Socialist Party, raising concerns that he will muddy the waters within the European Union in a bid for greater budget flexibility. The Union is being closely watched for further dissent – either related to the migrant crisis, or to austerity measures – which may threaten cohesive policy responses. Spanish markets, in turn, were unsettled by company-specific news: Abengoa, a leader in the energy and construction sectors, filed for protection from its creditors after a negotiations with a key investor fell flat. A failure would the biggest bankruptcy in Spanish company-history. On a sectoral basis, Eurozone consumer staples were amongst the better-performing sectors, as the positive afterglow of the Anheuser-Busch Inbev/SABMiller bid persists. Tourism and leisure stocks were left reeling in the aftermath of the Paris attacks. Stocks associated with the defense and military, conversely, ticked up in anticipation of increases in governments’ budgetary allocations. The overall economic picture for the Eurozone is perhaps far more positive, and consistently upbeat, than elsewhere. The Zone, however, continues to struggle with a high, albeit stable unemployment rate of 10.7%. Moreover, the inflationary outlook is still extremely subdued, likely necessitating additional intervention from the ECB. The UK FTSE lagged its regional peers, with equities ending relatively flat, albeit in the black at +0.6%, in local currency terms. Resource heavyweights’ woes, and the downward lurch in the oil price continued to weigh on the bourse. Domestic economic data was mixed: house prices received support from improved credit conditions; unemployment continued to decline, inching down to 5.3%; and real wages ticked up. The Chancellor of the Exchequer, George Osborne, in his Autumn report, however, sounded cautious on the speed and sustainability of the recovery – signaling that Britain’s age of austerity will remain in place for the foreseeable future. Notable features of the Autumn spending review were additional measures aimed at first-time homebuyers, and an increased budgetary allocation to defence. The measures are likely to prove a boon to the construction sector, which lagged in November, and had already boosted share prices in a number of companies. BAE Systems led peers in key defence-sectors (equipment, support and aerospace, inter alia) higher. Domestically focused retailers, and tourism and leisure stocks lagged, as elsewhere. Telecommunications company Vodafone announced stronger-than-expected interim results, providing a signficant boost. Financials were also reassuringly steady, as the Bank of England concluded stress-testing on the largest British lenders. Inflation, however, saw another negative print, on fuel and food-price declines. For the present, the BoE elected to maintain interest rates unchanged, forecasting that the pick-up in prices would be gradual (with inflation expected to remain below 1% until the second half of 2016).

The ECB’s measures, at the event, undershot expectations. The period of planned purchases was extended by 6 months, additions were made to the range of instruments that could be purchased and the deposit rate was lowered by 0.1%. Investors, however, had been expecting more aggressive expansion and could not help but display their disappointment, and the Euro rose to its highest level in 7 months. The graph shows a snapshot of the kneejerk market -reaction, subsequent to the Bank’s announcement on the 3rd of December.

Source: Reuters

Japan and China

The Japanese stockmarket closed 1.4% higher for November, despite the release of mixed macroeconomic data. GDP data indicates consumption increased by 2.1% during the third quarter. Retail sales rose by 1.1% in October, indicating a still-healthy appetite amongst Japanese consumers. The country recorded a trade surplus of Yen 111.5 billion, as imports declined for the 10th straight month. Industrial output rose by 1.4% in October, and the Nikkei-Markit Survey indicated that manufacturing in November recorded its fastest monthly pace since March 2014. Simultaneously, however, the data confirmed that the economy was in recession for the fourth time in the past five years. The quarter-on-quarter contraction of -0.8% in the third quarter of 2015, was a negative surprise (as estimates were for only -0.2% quarter-on-quarter) and confirms that Japanese growth is considerably lagging the US and Europe. Though investors have remained attuned to the positive, weariness with the government’s ‘Abenomics’ programme is beginning to tell. Japanese Prime Minister Abe, in an effort to reassure his constituency and jump-start the economy, announced a fiscal stimulus package of Yen 3 trillion. The package will include an increase in the minimum wage, and investments in child and frailcare. The latter is aimed at alleviating some of the burden of caregivers, freeing them up to work outside the home and improving the labour-force participation rate. The Bank of Japan has stayed its hand in any additional monetary stimulus. This is despite little or no improvement in the inflation data: While headline inflation ticked up during October to 0.3%, this is largely attributable to food price inflation. Core inflation remained in negative territory, at -0.1%. In corporate news, there were very few negative surprises at the conclusion of the third quarter results season in early November. Sustained yen-weakness has been a boon to corporate profits. Concerns about demand-side spill-overs from China, however, have tempered optimism about forthcoming results seasons. On a sectoral basis, performance was diverse. Technology and metal stocks recorded gains. Utilities and tourism-related stocks (including airlines) lagged, as elsewhere. The November-listing on the Tokyo Exchange of previously solely-state-owned Japan Post (as three separate entities: Japan Post Holdings, Japan Post Bank and Japan Post Insurance) was well received by market participants. All three entities traded at a premium to original allocation prices, significantly boosting market sentiment.

And in other headline news: The 7.9 trillion yen loss sustained in October by the Japanese Government Pensions Insurance Fund, the world’s largest pension fund. This is the first monthly loss since the Fund increased its allocation to local equities in October 2014, a measure which had boosted the Japanese stockmarket considerably.

Chinese macroeconomic data remains a source of concern, a seemingly oft-repeated refrain, and Chinese equities ended the month lower. The latest official Purchasing Managers’ Index registered 49.6, while the Caixin-Markit measure (regarded as more representative) came in at 48.6. This is a slight improvement on the previous month, but both measures, at any event, remain below the threshold of 50, indicative of a contraction in the manufacturing sector. Despite the reassurances by President Xi Jinping that the country is on track to achieve 7.4% growth, the latest data indicates that Q3 came in at a disappointing 6.9%, the slowest rate in 6 years. Official growth targets are due to be released in March 2016, and analysts expect that there will be a considerable downward revision (to a more modest 6.5% per annum). Chinese consumers, however, have remained a resilient and increasingly reliable driver of the economy: consumption reportedly accounted for 60% of the country’s GDP in the first half of 2015, a 5.7% year-on-year increase. Retail sales rose by 11.2% during November, beating analysts’ expectations. The figures were boosted by the somewhat unique online shopping day, known as Singles’ Day, which occurred on the 11th of November. Alibaba, the e-commerce giant, sold goods in excess of 91 billion yuan (USD 14.3 billion) on this day alone. In addition, the latest news from China’s Bureau of Statistics indicates an uptick in industrial output growth to 6.2% in November. This is despite the continued decline in Chinese exports. November saw the fifth consecutive slide (of -6.8%), sparking some concern about the prospect of further currency devaluations. Interventions in the currency market, however, have become increasingly unlikely, as the IMF voted to grant the Yuan Special Drawing Rights. Chinese authorities regard this as a significant and hard-fought win, as it is symbolic of the recognition of the China’s status in the global financial system. Perhaps more critically, however, it signals that the IMF believes that the Yuan is a stable, reliable and freely convertible currency. The unit is to be included in the SDR basket alongside the Yen, Dollar and British Pound as of October 2016. Until such time, policymakers are unlikely to intervene in a manner which is regarded as destabilising. While the outlook on China is therefore still cautious, the likelihood of severe and unanticipated spill-overs to other (developed and emerging) markets is waning.

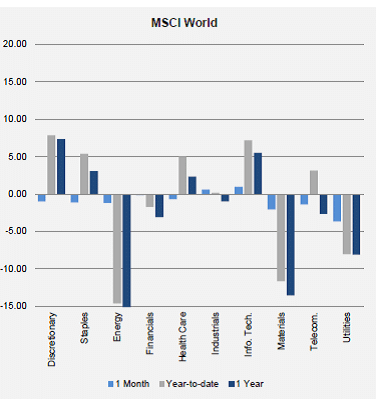

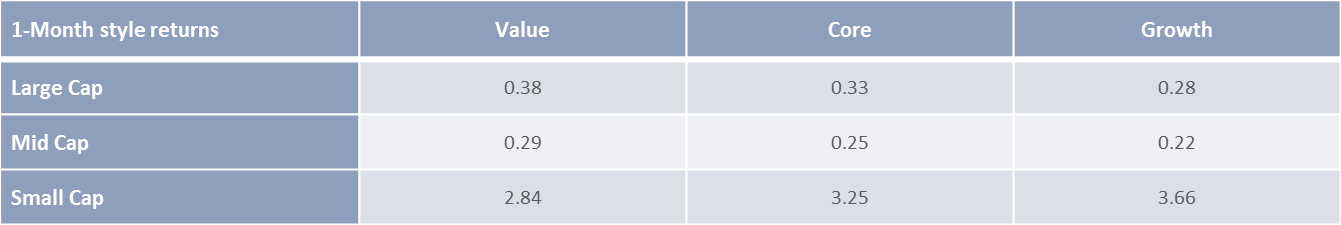

Style and sector returns

Source: Eaton Vance

Emerging Markets

Emerging markets saw broad-based declines in November, as investors tilted away from the groups and asset classes most vulnerable to knock-on effects from the Fed-hike. This particularly volatile third and fourth quarter have seen some of the largest outflows since the global financial crisis.

Asian markets outperformed emerging peers slightly, with concerns around Chinese growth on the backburner temporarily, as immediate focus has shifted somewhat to global security and central bank action. Chinese equities, though slightly ahead of Emerging Peers nonetheless finished lower in absolute terms, and weakness spilled over into other Asian markets. Export powerhouse Korea declined on Won-weakness and disappointing industrial data. A stronger Rupiah, and positive news on progress in infrastructure projects lifted the Indonesian bourse relative to regional peers. Indian investors had a troubled month: The defeat of the ruling BJP Party in the Bihar region, cast doubt on the ability of Prime Minister Modi to continue pushing through reforms. Corporate earnings growth was disappointing, while inflation ticked up noticeably (as elsewhere, partly due to the impact of the El Nino effect on global weather patterns and food prices). The Bank has held rates steady, but may need to react once the Fed hikes. India still maintains its position in terms of solid GDP growth (7.4% for the third quarter). Latin American markets performed poorly. The Brazilian political and politico-economic (SOEs) landscape continues to be battered by scandal. President Rousseff faces a tough impeachment battle, and a potential government overhaul can only further delay much-needed fiscal reforms. Moody’s is likely to follow S&P in cutting the country’s credit rating to junk, and GDP growth declined by -4.5% for the third quarter. The Mexican market, boosted by an improved domestic outlook for inflation and rising real wages, was at the head of a lagging market group. Emerging Europe saw extremely mixed returns: Greek banks declined dramatically on ECB stress-test concerns, while the Hungarian bourse strengthened. Russian equities ended slightly up, apparently untroubled by the country’s increasing militance toward the Middle-East. President Putin has also been fairly aggressive in dealings with Egypt and Turkey (suspending flights to the former, and imposing sanctions against the latter).

African market-volatility was exacerbated by (inter alia) terror-attacks in Tunisia, Boko-Haram and the spillover of anti-Islamic sentiment in Chad and Cameroon. The Egyptian market declined by -11.56%, with investors losing patience with the speed of government reforms. Tourist arrivals in the country are projected to decline by a further 45.7% over the next 6 months, and the concomitant decline in tourism revenues (estimated – USD 3.1 billion) will intensify the current shortage in the forex market. On a stock level Orascom Telecoms registered a 33.3% loss, in a sector which is one of the sectoral laggards on a year-to-date basis. The Zambian exchange was sharply higher (+20.73%), as the sharp recovery in the Zambian Kwacha (which surged by 21.1% against the USD over the course of the month) and light trading volumes counteracted continued commodity weakness. Kenyan stocks closed November higher, with gains in previously neglected sectors (construction and media) and traditional high-quality stocks (Safaricom gained 9.3%). Continental heavyweight Nigeria declined, although still outperforming large Sub-Saharan and North-African peers. The Nigerian ALSI was -6.1% lower, with large domestic banks particular laggardly (Guaranty Trust and Ecobank, inter alia, lost -13.3% and -17.4% respectively). The month’s performance, is perhaps more negative than is merited by recent developments. November bore witness to a number of potentially significant, positive developments in the political and economic arena. During the month, the Nigerian Central Bank (CBN) made a 2% cut to the Monetary Policy Rate for the first time in 6 years, bringing it to 11%. Simultaneously, the Bank lowered the cash reserve requirement to 20% and slashed the bank deposit rate from 11% to 4%. The measures are all aimed at injecting liquidity, foster domestic lending and spur growth. Other positive developments included a 60bps decline in inflation during October (to 9.3%); news that the key services-sector expanded by 4.0% in Q3 , while the oil-and-energy sector registered expansion for the first time this year; and the news that non-oil government revenue had ticked up nicely by 21.5% month-on-month. The extent to which the country is further able to reduce its dependency on oil-revenue will be keenly watched, as will the potential for developing alternative sources of finance (for instance the slated USD 25 billion Infrastructure Development Fund). An interesting recent development, in gauging the potential influence of Nigeria in the oil market, is the appointment of Petroleum Minister Diezani Alison-Madueke as president of OPEC. The composition of President Bihari’s first Cabinet has been greeted positively by global investors and local businesses, both for its strong anti-corruption stance and as potential catalyst for further reforms. Investors, however, remain wary of an unorthodox mix of policies aimed propping up the Naira. The extent to which the Namibian equities declined for the month, but a performance of -3.02% (year-to-date in USD terms at 30 November) still places the near-South African neighbour bourse at a relative advantage.

South Africa

The resource-slump – the index slipping by more than 20% to its lowest level in 10 years – and domestic idiosyncratic risks translated into a dismal November for South African investors.

Concerns about the country’s long-run growth prospects remain at the forefront of investors’ mind.

No reassurance from the Cabinet Reshuffle. The manner in which well-respected Finance Minister Nhlanhla Nene was axed on December the 9th has increased the likelihood of further rate cuts. The reaction of the currency and equity markets was rapid and devastating. The South African public is voicing its resounding dismay on social media. The unintended consequences are set to continue well into the New Year, with volatility likely to be exacerbated by US monetary policy tightening.

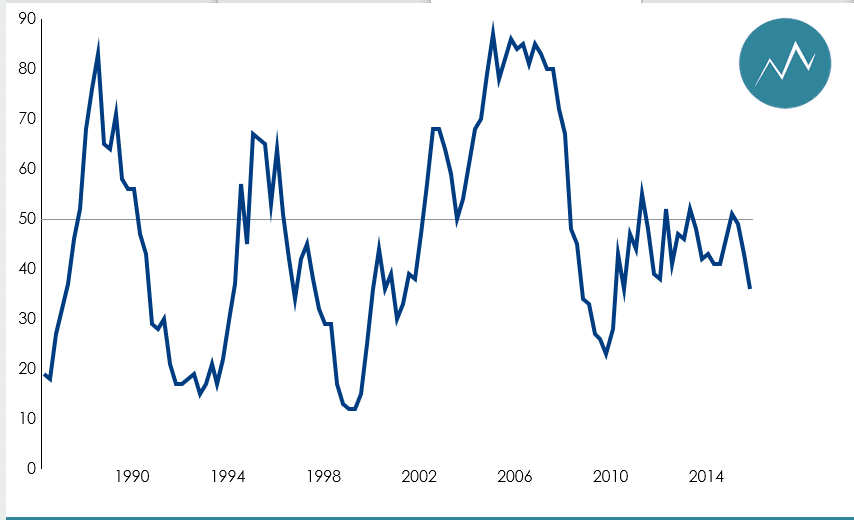

Perhaps most telling of the underlying uneasiness is the recent Fitch credit ratings cut – the country’s sovereign credit rating is now one notch above junk-status. The economy narrowly avoided a recession in the third quarter, as GDP growth was recorded as 0.7% quarter-on-quarter, on a seasonally adjusted and annualised basis. Manufacturing remains in the doldrums, with the manufacturing Purchasing Managers’ Index declining to 48.1 in October (below 50, implying continued contraction). The labour market is feeling the fall-out, evident in the decline in the average-number-of-hours-worked-per-factory worker, and more anecdotally, in the lack of job advertisements in the Sunday Times. The October trade deficit was higher than expected, at R 21.39 billion. This added to perceived fiscal pressure, and sent the Rand weaker-still against the dollar. A number of factors were significant in adding to the trade deficit: The export value of gold, copper, iron ore and steel (prices and volumes both declining during November) plunged; Rand-weakness inflated the import bill for downstream components; and the continued drought translated into additional food imports. It is encouraging that Private Sector credit extension rose to 8.9% year-on-year. This growth, however, is significantly skewed toward corporates: Households now only account for 48.3% of overall private credit extended, a sign of the lack of capacity/appetite for household debt. The uptick in corporate debt, unfortunately, by no means shows increased business confidence – the recent RMB/BER Business Confidence Index registered a reading of 36 for the Fourth Quarter (declining 2 points from Q3 to a 5-year low). The poor reading (as per below graphic) is not on par with the depths reached during the financial crisis, but the fairly rapid decline in many respects appears to mimic trends which have historically preceded downturns/economic recessions. The latest statistics on electricity production and consumption (typically regarded as a leading business cycle indicator) provide little reassurance: (Albeit with the caveat of Eskom’s constraints) production has declined by -3.2% year-to-date, and consumption by -2.7% over the period.

Source: Beareau for economic research

Thus far, though food retailers in particular have taken considerable care to limit the inflation pass-through from a growing import component, there is an implied short-term upside risk to inflation. Over a longer horizon, even should oil-price-related components in the domestic consumer basket remain cheap, Eskom’s application for 16% tariff hikes is likely to inflate energy-related spending. The South African Reserve Bank, with a firm eye on the upside risks to inflation, elected to raise key rates at its November Monetary Policy Committee meeting. The market, at any event, had been split as to its expectations regarding the timing of the first hike – anticipating that the pending Fed hike would induce concomitant measures on the part of the Bank. While many analyst feel that the Bank has acted precipitously, Governor Kganyago highlighted that any delay might result in a stronger policy response being required at a later junction (with a sharper impact of growth). The Bank, at any event, forecasts that inflation will breach the upper band in the first two quarters of 2016.

On a sector and asset-class basis, losses were broad-based. Platinum shares bucked the trend and expanded by 2.36% (mainly paring prior months’ losses). Industrials outperformed Financials and Resources, and stand out on a year to date basis. There is considerable divergence within the sector however: November saw boosts from specific heavyweights, including Sappi (14.5% higher), Nampak (13.1% up) and Naspers (6.3%). Consumer goods are up by 30% year to date, mainly on the strength of the large rand-hedge stocks. Construction, however, remains in the doldrums, declining by 37% year to date. Small caps fairly easily outperformed larger cap peers, given the bias of the latter toward mining and resources.

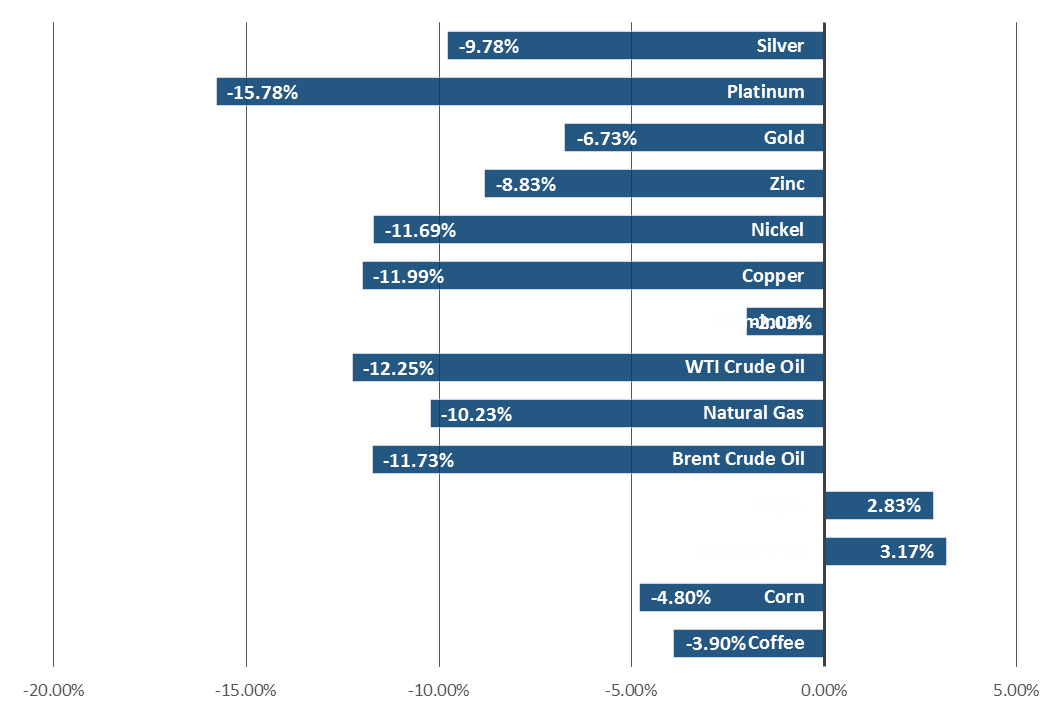

Commodities, Fixed Income and Currencies

Commodities slumped anew, as the overall Bloomberg Commodity Index declined by -7.25 % for the month. Weakness was broad-based, with only two agricultural commodities (sugar and soybean oil) managing gains. Platinum declined dramatically, adding to the woes for producers such as Lonmin. The decision taken by OPEC on the 27th of November to maintain production at present levels, makes any near-term recovery in oil prices unlikely. Moreover, a reversal in this stance is unlikely, as the bloc’s newly elected Nigerian president has made it clear that her country intends, at the very least, to maintain output. Manufacturing weakness from China has continued to drag on industrial metals, with copper and nickel declining by nearly 12%.

Central Bank guidance became firmer during November, and November was a positive month for most bond markets. The Federal Reserve left little room for doubt as to its intention to raise rates in December, the Bank of England was decidedly dovish in its statements and the ECB emphasized its commitment to further easing. Bond markets were therefore somewhat less volatile, although the 10-year T-bill yield rose by 7 bps following Ms Yellen’s Congressional testimony. European bonds again outperformed their US peers, with yields on German Bunds declining from 0.52 to 0.47% (Bond yields and prices moving in opposite directions). The 10-year Gilt saw a 9bps decline in yield, to 1.83%. In the US, contrary to movement in Gilts, the changes were more pronounced for shorter-dated bonds, leading to a further divergence in the profile of yield curves. The souring of sentiment toward emerging markets was echoed in bond markets: the JP Morgan Emerging Market Global Diversified Composite Bond Index, denoted in local currencies and therefore reflecting the impact of currency volatility as well, declined by -2.2%. Credit spreads on EM corporates and many sovereigns widened, as political shenanigans (in Brazil inter alia) spilled over into perceived default risk (The credit spread refers to the additional compensation an investor demands for holding an asset with credit risk/default potential, over the yield offered by a government-backed/risk-free security). Investment Grade Corporates, off the back of relatively solid earnings seasons, outperformed both their high-yield and sovereign counterparts.

The dollar continued its year-to-date rally, buoyed by prospects of the Federal Reserve hike. The idiosyncratic 21% appreciation in the Zambian Kwacha is the most notable outlier, with the Colombian Peso registering the worst performance (a 7.93 depreciation). The Euro, British Pound and Yen registered declines of -4.01, -2.42 and -2.02 % respectively, while the beleaguered Rand declined by 4.33%.

Conclusion

A quiet festive season is not on the cards for global investors. Political and economic developments will be closely scrutinised in the holiday-shortened month of December. Heightened terror-threats have not yet had any paralysing impact on major developed markets, but disharmonious policy responses are potentially destabilising. Markets, at any event, are unsettled by the unpredictable and pervasive nature of the threat. Investor-jitters are also likely around scheduled Central Bank action, despite forward-looking guidance. Whatever the policy-outcomes, volatility is likely to be elevated going into 2016.