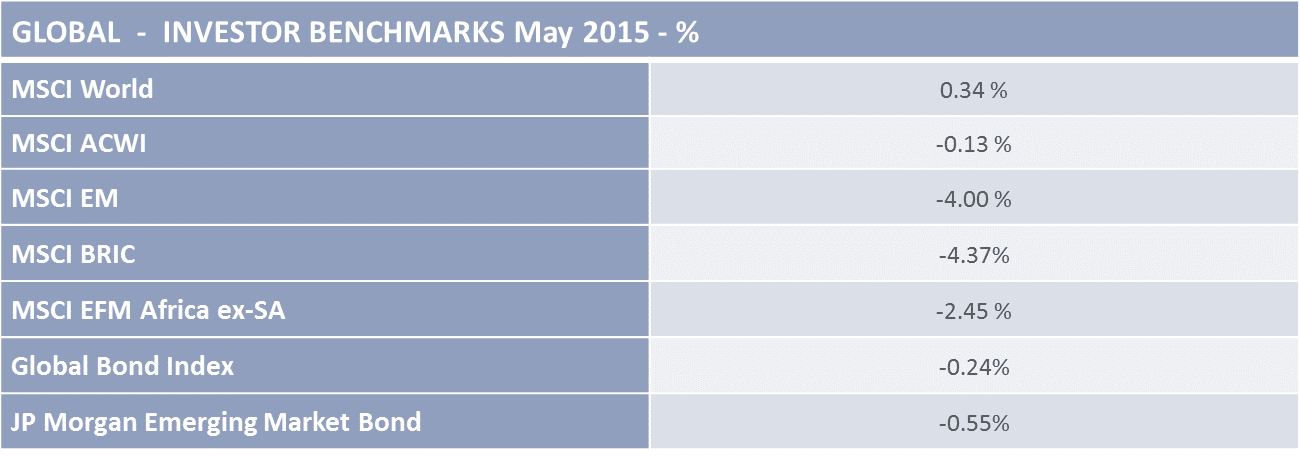

International Market Commentary: May 2015

Financial markets were volatile during May, against a backdrop of divergent macroeconomic news. First-quarter Gross Domestic Production growth came in below expectations for most regions, notably for the world’s largest economies (the United States of America and China). News for the Eurozone and Japan, however, was more positive. Developed market equities outperformed emerging markets, as US markets still managed gains, despite the disappointing data. Volatility in both fixed income and currency markets remained heightened throughout the month by ongoing concern about a stalemate in Greek-debt talks, and the timing of the US Federal Reserve Bank’s first rate hike. Added to the political-and-economic mix, is the potential of the United Kingdom exiting the European Union and the doubts around the efficacy of China’s increasingly aggressive attempts to stimulate growth.

US and Eurozone Markets

US stocks surged during May, with the S&P500 hitting a new all-time high mid-month. Mixed economic releases, however, saw a late month sell-off pare equity gains. The S&P500 ended 1.29% higher, the Dow notched a 1.35% gain and the NASDAQ closed 2.6% up.

Disappointing first-quarter Gross Domestic Product (GDP) growth data was chief amongst the disappointing economic releases which weighed on investor sentiment. The US Department of Commerce reported that the world’s largest economy contracted by -0.7% during the first quarter, substantially undershooting initial estimates for growth of 0.4%. The slow-down was partly anticipated, as the headwinds the economy had faced were widely noted (adverse weather, the West Coast port strike, a higher dollar and volatile energy sector). Markets were further unsettled by disappointing industrial production data for May: The Chicago Purchasing Managers’ Index (PMI) declined from 52.3 in April, to 46.2 in May (well below the expected 53 mark); Industrial production was down -0.4% and core non-durable goods orders fell by -0.5%. Retail sales and consumer spending remained depressed, with sentiment surveys giving a mixed read on consumer sentiment. Whilst the Conference Board survey was positive (sentiment ticking up to 95.4), the University of Michigan Survey reported its biggest decline since 2012 (to 90.7). Spending trends during June will tell which barometer proved a more accurate gauge.

On the construction and housing fronts, the news was certainly more positive: Housing starts rose by 20.2% month-on-month in May, the median selling price increased and new home sales were up by 6.8% in April. Labour market data, too, painted a rosier picture. Non-farm payrolls data showed the addition of 223 000 new jobs during April, after a lacklustre March; The four-week average number of jobless claims declined to its lowest level in 15 years; Hourly earnings rose by 2.2% year-on-year. The unemployment rate decreased to 5.4%, a level consistent with the Federated Reserve Bank’s historic view of full employment. The Reserve Bank remained upbeat about economic growth prospects for the second half of 2015. Investors, after initially pushing out expectations for a rate-hike to 2016, took heed of the hawkish tone of Fed comments, and markets are anticipating the first hike in September 2015.

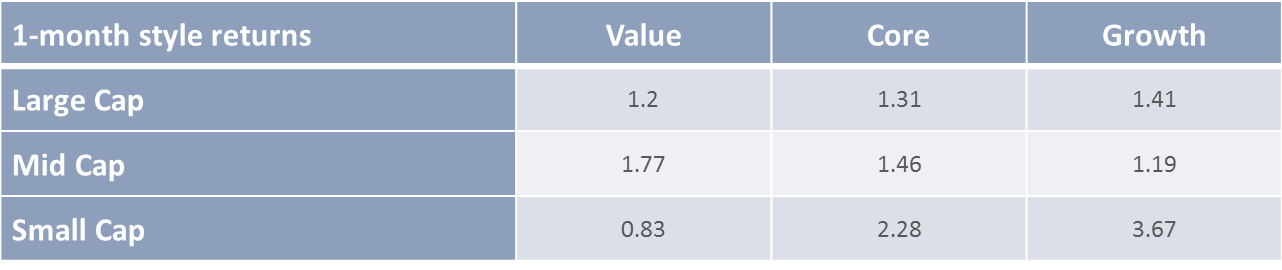

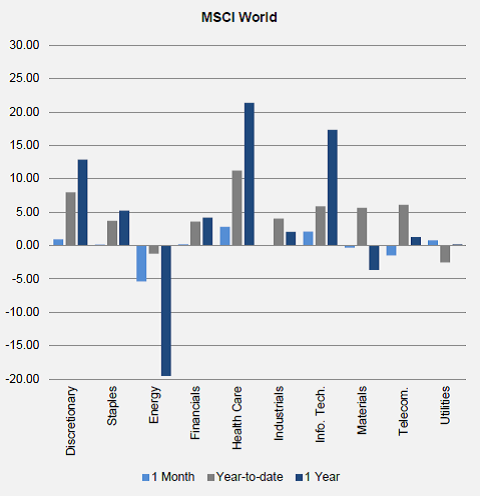

Equities’ strong performance during May was partly a reflection of the conclusion of earnings season, and partly boosted by elevated Merger and Acquisition (M&A) activity in specific sectors. As the majority of companies had reported better-than-expected full-year earnings and profits by May, it became clear that the upside surprise was broad-based, and investors re-entered the market. Overall average earnings growth of 0.7% was a welcome relief (as a decline of -5% had been anticipated, in line with the stronger USD, troubled energy sector). Moreover, if energy companies were excluded, earnings growth is estimated to be 8.5% for the full year. Not surprisingly, energy companies such as Exxon Mobil and ConocoPhillips issued lower earnings/profit reports, causing a sharp drop in share prices during May and erasing some of April’s gains. On a sector basis, energy was one of the poorest performers for the month, the S&P energy registering a drop of -4.76%. Healthcare gave the best showing (4.53%) and remains the year-to-date star performer, Information Technology (IT) did well, and Financials and Industrials managed modest gains. Elevated M&A activity was a boon to the Telecommunications and IT sectors: As part of one of the biggest waves of consolidation since the 1990s dotcom-bubble, Verizon bid for AOL, and Avago acquired Broadcom (both of which manufacture microchips for the communications devices, including Apple’s i-phone). Overall, M&A surged by 23% in 2014 after a 3-year lull, and $620 billion in deals (some mega-deals in the IT, Healthcare and Energy sectors) have been announced year to date. Analysts predict that, with companies balance sheets still fortified by lower interest rates, M&A will remain elevated during 2015, and selected stocks and sectors will be closely watched to pick winners and losers. Overall, small cap equities outperformed mid and larger caps during the month, and growth stocks trumped value stocks. The latter is in keeping with the prevailing view that investors turn their focus to stocks which report high dividend growth (as opposed to high dividend yield). Companies in the Consumer Discretionary and IT sectors are likely gainers.

Sector Returns

Sector returns – Global average

(Source: Eaton Vance)

European equities ended the month with modest gains (for year-to-date gains of 19.8%), amidst encouraging signs of economic recovery in the 19-member European Union. The DAX, however, declined slightly at $$$, the Italian MIB gained $$$ to register the best equity market performance, STOXX. Eurozone first-quarter GDP growth was recorded at an average 0.4%. France, Italy and Spain provided notable upside surprises (at 0.6%, 0.3% and 0.9%), signalling a turnaround in previously sluggish economies. Inflation edged up, and Eurozone unemployment registered improvements. The manufacturing PMI ticked up, though the services index dragged on the overall PMI. The German IFO Business Climate Survey edged up to 108.6, and consumer sentiment surveys were positive. The European Central Bank (ECB) indicated that corporate lending had remained steady across the region. Despite the uncertainty surrounding Greek membership, and jitters around various state’s election results (Britain, Spain, Portugal), Eurozone corporates have not been deterred from spending and investment. The optimism induced by ECB stimuli has thus far outweighed Greek-exit and contagion fears. The announcement that the Bank would front-load asset purchases during the coming months (in anticipation of a summer-slowdown in debt issuance), saw an equity market rally. The resulting depreciation in the Euro (-2% against the USD over the course of May) continues to stimulate Eurozone exporters, and potentially heralds a summer-boom in travel-and-tourism related industries (including the lagging service sector).

As in the USA and Japan, corporate earnings season concluded on an upbeat note. European technology stocks outperformed during May, as elsewhere, partly due to M&A deals. Nokia, in particular, recovered lost ground as investors warmed to the planned acquisition of Alcatel Lucent. Utilities did well, National Grid reporting a 5% increase in operating profits and a 2% rise in the full-year dividend pay-out. Healthcare rose 1%, boosted by cross-border M&A speculation and an upward revision of profit and sales forecasts (on the lower Euro). In line with an improved consumer outlook, an uptick in real wages and investors’ focus on dividend-growth, Consumer discretionaries ticked up by 1%. Retailers and luxury goods in particular advanced on expectations of higher summer sales.

UK markets welcomed a decisive Conservative Party victory in the May elections. The result sees an outright Conservative majority government formed for the first time in 23 years, potentially alleviating uncertainty about policy direction and avoiding protracted policy wrangles. The FTSE100 ended 1.4% higher. Gains were broad-based: Construction and housebuilders regained lost ground, as did utilities. Gaming stocks ticked up nicely, and British Financials did particularly well, banking on the Conservative Party to reject proposed new bank taxes and lending restrictions. Cross-border M&A again boosted Telecommunications and Consumer Discretionaries, as Vodafone and Imperial Tobacco respectively rallied. Energy stocks were the main detractor to equities’ performance. The sector saw a -4% decline, as BP, Royal Dutch Shell and Total reported poor earnings results and large losses on softer oil prices.

UK-EU relations, and EU politics in general, will be closely watched over the coming months. The Conservative election victory has put the referendum regarding Britain’s EU-membership firmly back in the spotlight. Greece has not yet left either the spotlight or the Union, but creditors’ patience is wearing thin. The country has negotiated the ‘Band-aid’ extension to its repayment of IMF loans (initially due on the 5th of June), making it the first country to do so since the 1980s. Moreover, the somewhat surprising result of Spanish regional elections belies the fact that austerity-fatigue has not been limited to the Hellenic citizens. As always, any political tension and electoral uncertainty is likely to unsettle equity and bond markets.

Asian heavyweights – Japan and China

Japanese equities continued their rally, with the TOPIX up by 5.1% for May (and close to 20% for the year-to-date). May saw some encouraging macro-economic data, as the country reported annualised GDP growth of 2.4% for the first quarter of 2015. Unemployment, at 3.3%, is at an 18-year low, and April retail sales data reflected improved real wages (ticking up by 1%). The composite PMI moved back to above 50, as industrial production increased by 0.4%. CPI data showed that headline inflation had moved into positive territory (0.6%), though core inflation remained at 0.0%. Business sentiment appears to be positive, as the Bank of Japan (BoJ) reported that corporate lending had remained steady. The growth and inflation outlook remains benign, and the Bank consequently left rates unchanged. Yen weakness – the currency is at its lowest level against the USD in twelve years – remained a significant boon to export-oriented companies. Especially automakers benefited, with Honda’s shares climbing 5% (despite two separate vehicle recalls during the month), and Toyota’s sizeable full-year profits taking the top spot in Japanese companies’ record books. Financials strengthened, as corporate lending increased in an environment of upbeat earnings estimates, heightened M&A activity, and commitments to higher dividend pay-outs. Utilities performed well, with Tokyo Electric surging by 45% on news of cross-border cooperation/consolidation with Thailand’s state-owned power utility and on speculation that nuclear programmes could be resumed. Electronics were the poorest performing sector: Sharp plunged by -33% on the announcement of a restructuring deal, and Toshiba’s ‘accounting discrepancies’ (which delayed full-year reporting and caused the cancellation of its dividend) cost it -10%. Japanese equities will continue to receive a boost from the rotation from bonds to equities, led by giants in the public investment scheme space, notably the Government Pensions Investment Fund and the Postal Savings System.

May saw a sharp pull-back in Chinese equities, as economic news from the world’s second largest economy continued to disappoint. The overall PMI declined to 51.3, while the key HSBC manufacturing PMI fell to 48.9, its lowest level since April 2010. Imports declined by 16.1% and Chinese exports by 6.2% year-on-year. Investors were unsettled by the introduction of new regulatory measures which look set to curb the recent (perceived) excessive valuations. These include a clampdown on margin trading and tighter regulation of brokerage firms. Also apparently unnerving to the market, a raft of new share sales came on board via Initial Public Offerings (IPOs). The Hang Seng retreated by -2%. Technology and Telecommunications were amongst the worst performers. Tencent gave up -3%, after a strong showing in April. Disappointing earnings releases, and increased competition in the Smartphone market saw tech-heavyweight Samsung decline sharply.

The People’s Bank of China cut lending and repo rates by 25bps, the third such reduction in 6 months. As the authorities see the 7% growth target slip further away, monetary policy easing remains its go-to tool to ease the economy toward its new-normal consumer-led growth path. To date, stock indices have cheered the increasingly aggressive stimuli. Yet it sounds alarm bells as to the pace of the Chinese slowdown, and the efficacy of the easing mechanism. Moreover, as Chinese policymakers grapple with the soft landing scenario, domestic political pressures have led to an increasingly obstreperous/ ‘beggar thy neighbour’ stance toward other sovereigns. China has of late expanded its operations in the South China Seas (an area widely regarded as international waters), prompting the USA to dispatch air and naval forces. Japan too is likely to consider a more resolute defensive stance, and any territorial tension is likely to spill into Asian and global markets.

Emerging Markets

As overall first-quarter GDP figures disappointed, and the USD resumed its rally, sentiment toward emerging market soured toward the end of May. The MSCI Emerging Markets ended 4.61% lower, underscoring the group’s vulnerability to a (perceived imminent) Fed rate-hike and a strong USD. All but one of the BRICs nations (India) posted significant losses.

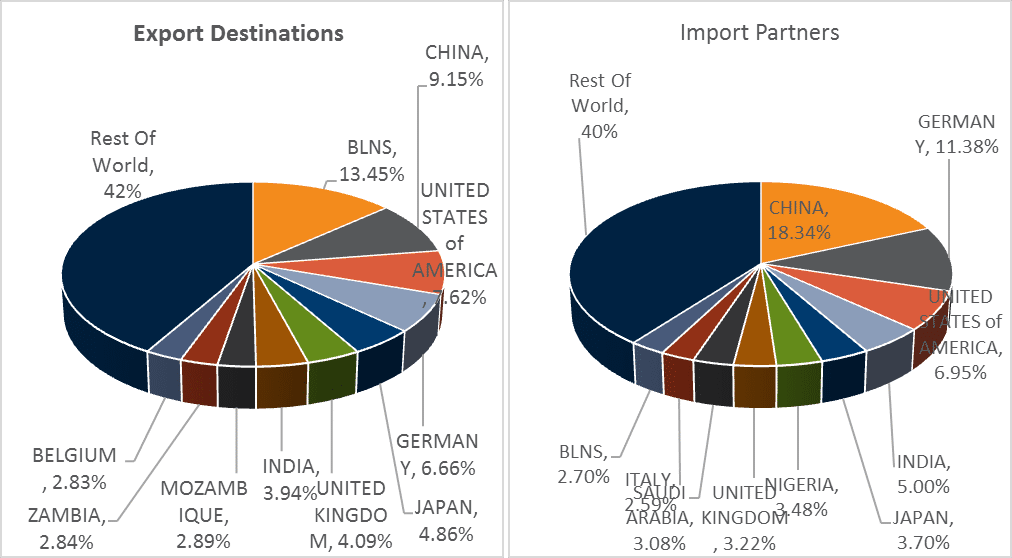

China’s poor showing spilled over into emerging Asian markets, with Thai and Philippine markets sliding due to weaker trade data and poor first-quarter GDP growth. Korean markets, after a strong April, declined on profit-taking. The Indian market, at 3.14%, outstripped its BRICs peers and the broad emerging group. After consecutive months of underperformance, valuations again became attractive and enticed investors to re-enter the market. The outlook on Indian growth remains positive, with first -quarter GDP growth registering 6.1%. A low inflationary environment and sound fundamentals create scope for further monetary policy easing, and many analysts are pricing in a 25bps rate-cut at the next monetary policy meeting in June. Domestic expenditure (consumer and corporate investment) and manufacturing strength support the Indian growth story, with the country set to overtake China. The Indonesian market closed ahead of its Asian peers, as first-quarter growth surprised to the upside. The Indonesian government has reaffirmed its commitment to growth-oriented policies and structural reforms. Standard and Poor raised its outlook on the country’s credit from stable to positive, and signalled that it might raise the sovereign bond rating to investment-grade within the next year. Within the broadly declining Asian markets, healthcare and consumer staples were the most resilient sectors. Latin American equities were the Emerging Market laggards – registering -7.1%. The Brazilian market plunged 12%, buffeted by profit-taking in the energy sector and the continued headwinds from lower oil prices, a strong greenback, and poor domestic growth prospects. Whilst the announcement of a $53 billion trade, finance and investment deal with China is set to boost infrastructure spending, persistently high inflation (at a record 8.2%) and unemployment underscore an economy facing a deep recession, with little room to manoeuver. Investors were also unnerved by the prospect that authorities would soon be forced to halt tax breaks granted to equity investors. The Colombian market was the regional loser, declining by just over 12%. Mexico managed a modest gain, reporting better-than-anticipated GDP growth. Retail sales strengthened, with expectations high that the States’ spring thaw will have cross-border benefits. Emerging European markets were dragged down by Russia, as the oil price softened and the rouble depreciated sharply against the dollar. Russian financials had a particularly poor showing, with bad loans and a sluggish economy telling on reported earnings. Off the back of somewhat surprising election results, Polish stocks declined sharply, and the currency (the zloty) depreciated by 4% against the USD. The consensus view (fear) is that the newly elected opposition party is likely to implement additional banking taxes, and backtrack on austerity-measures. Turkey, conversely, edged higher despite similar electoral jitters. Returns in Africa were mixed, with markedly volatile trading in oil-producers and financial stocks. Copper-rich Uganda posted a -4.98% decline (as copper prices slumped). Kenya saw gains in insurers Pan Africa Insurance and Liberty wiped out by a large loss in CFC Stanbic. Nigeria declined by -1.15%, with noted volatility and disparate performances in financials and oil companies. In the last week of trading, Mobil Oil Nigeria and Forte Oil dropped by 4.7 and 5.9% respectively, but were offset by Total Nigeria’s 15.6% rise. Ghana ended the month as one of the region’s star performers, ending 3.94% up despite similar volatility. South Africa registered the worst performance amongst Emerging European, Middle-Eastern and African (EMEA) countries.

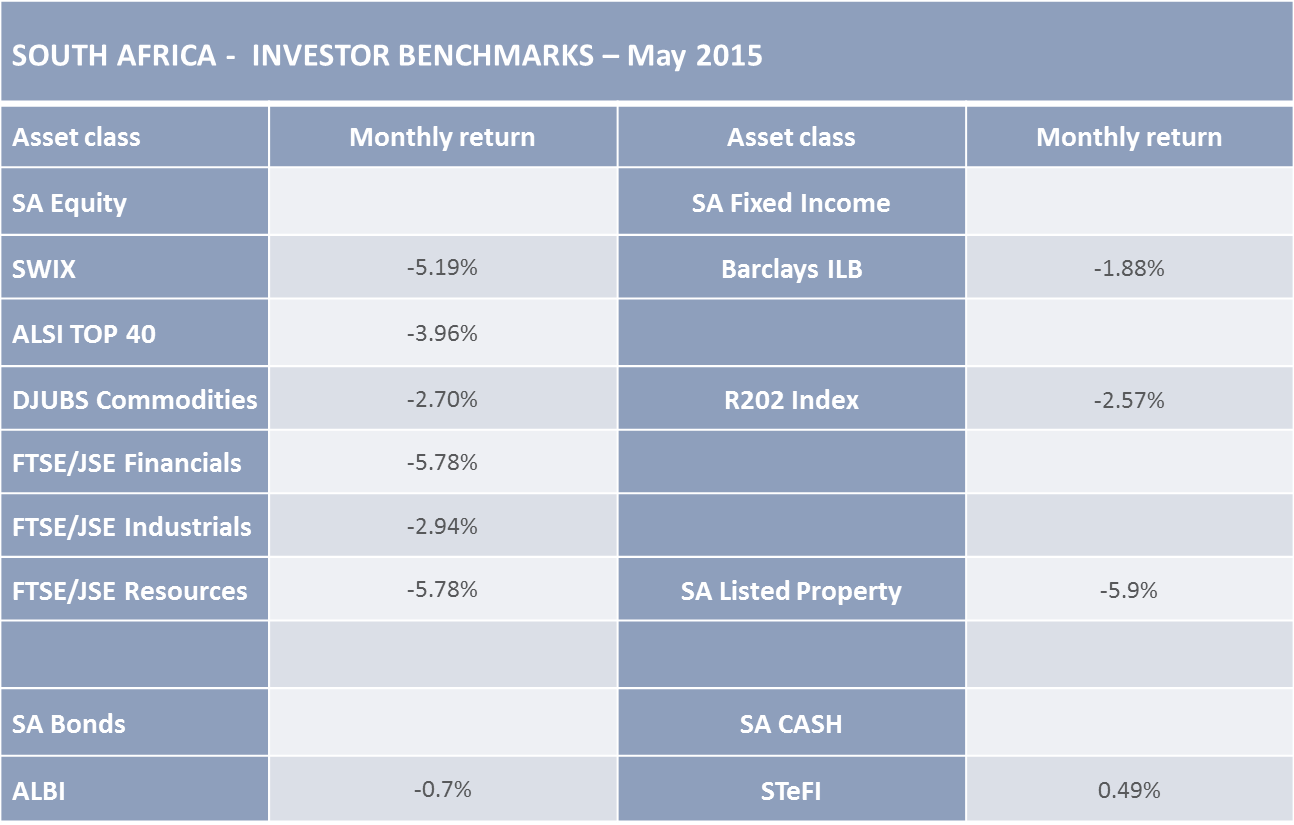

The Johannesburg Stock Exchange (JSE) retreated sharply in May, as domestic data painted a rather gloomy picture of the country’s economic prospects. Statistics SA reported first-quarter GDP growth of 1.3%, well below estimates. The impact of the global slump in commodity prices, and slowing demand, was compounded by particularly weak manufacturing (hamstrung by electricity shortages). Labour Force Survey data was similarly bleak: Unemployment has risen to 26.4% (the worst level in a decade), with only 139 000 new jobs added in the first quarter of 2015. The additions, moreover, were mainly in the domestic and agricultural sector, whilst the formal sector shed 114 000 jobs. The South African Reserve Bank kept repo rates on hold, reflecting its expectation that inflation would trend upward (and breach the upper limit of the 3-6% band by Q1 2016). South Africa’s previously high-flying financial stocks were particularly hard hit in the last trading week, as earnings and interest rates were seen to be ‘at-risk’ factors. Nedbank, Standard Bank, Old Mutual and MMI Holdings all posted losses in excess of 5% during the week. Industrials, in a universe consisting of losers, was the best-performing sub-index. At -2.9%, it far outstripped Resources and Financials (-5.2 and -5.9%). Small cap stocks outperformed mid and large caps (-0.7% versus -4.7 and -4% respectively). The Rand was on the defensive, losing 2.61% in the last week of trading and local fixed income and credit markets ended in the red. Listed property, the year-to-date star performing asset class, declined by -5.9%. The ALBI was down -0.7%, and Inflation Linked Bonds returns -1.9%.

Fixed Income, Currencies and Commodities

Fixed income markets generally had a choppy month, as did most major currencies versus the Greenback. European bonds sold off sharply in the first two months of May, amidst liquidity concerns and an improved Eurozone economic outlook (with investors rotating into equity, on concerns that the ECB would slow its bond purchases). The yield on Eurozone bonds rose steeply in consequence – German Bund yields climbed by as much as 75bps. As uncertainty remains about the timing of the Fed rate-hike, high-quality sovereign debt investors therefore in turn rotated away from US T-bills. Longer dated Treasuries were hardest hit, with the US 30-year bond yield edging up above 3% for the first time this year. The ongoing Greek saga has added to European bond markets’ volatility, particularly in so-called peripheral markets such as Italy and Spain. The sell-off, however, eased toward the latter part of the month, as the ECB’s front-loading policy apparently reassured investors, and markets begin to price-in a September US interest rate increase. US 10-year Treasuries ended at -0.2%, German Bunds gave up -1.1%, and Italian and Spanish bonds lost -2.1%. UK 10-year gilts ended 0.4% higher, a rally boosted by a more certain economic policy environment with a majority government at the helm. Emerging market bonds declined, reflecting waning global risk appetite, with the JPMorgan Emerging Market Bond Index (at -0.39%) underperforming peer aggregates.

High-yield corporates again outperformed investment-grade corporates. As oil-related companies form a large part of this universe, oil price stabilization will continue to support this asset class. Investment grade corporates underperformance of both high-yield and sovereign debt is partly attributable to a supply glut. Issuance was high during May, against a backdrop of elevated M&A activity and with many companies apparently rushing to the markets while US interest rates were still on hold.

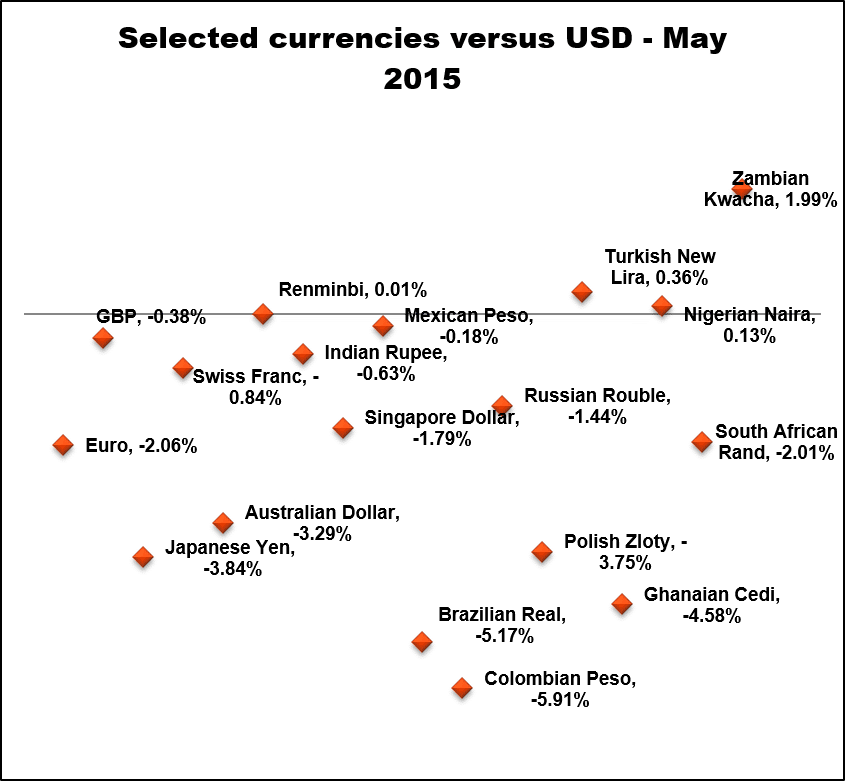

Major currency-pairs moved downward over the month, as the Dollar resumed its rally. The Yen deprecated by 3.84%, Sterling by a more modest 0.38%, and the Euro by 2.06%. The single European currency has remained on the back-foot, with volatility spiking as a Grexit by turns (depending on current commentary and reports) is seen as either more or less likely. The Pound, conversely, strengthened on potential Brexit (appreciating sharply on the confirmation of the Referendum in 2016). Amongst emerging market currencies: The Colombian Peso and Brazilian Real were the biggest decliners against the dollar (-5.9 and -5.7% respectively); the Rand was mid-range (-2.01%); and the Naira, Renminbi and Turkish Lira held their own (at 0.13, 0.01 and 0.36%).

Commodity prices were lower, with industrial metals (zinc, aluminium, copper and nickel) sinking an average of -7.7%. The broad energy sector lost -2.12% and agricultural commodities fell -3.5%. Copper, in response to weaker demand from China, declined by -2.5%. Brent crude prices trended lower (-1.8%) with demand/supply imbalances causing concerns that the previous month’s recovery was overdone. US inventories remain high, oil companies may respond to the price-recovery by ‘unshelving’ some projects and it is likely that supply from Iran will come online in 2015 (pending the signing of a nuclear agreement with the USA). Precious metals, however, were mainly up, led by silver and gold (+3.39% and 0.54% respectively).

Conclusion

Markets may remain fairly political animals in the near future, as politicians and Central Bankers are set to take centre stage in June: Though Greece’s deadline for repaying the IMF has been extended to month-end, crunch-talks and hard bargaining will be required before any deals are reached. The US Federated Reserve Bank is set to meet on Wednesday the 17th of June, and investors will keep a keen eye out for its policy stance.