International Market Commentary: March 2015

Introduction

The first quarter of 2015 saw equity markets post widespread gains, with momentum largely driven by Central Bank actions. March, however, was somewhat subdued. US markets, in particular, lagged their Eurozone peers. A series of disappointing economic data releases toward the end of the month saw forecasts for US first quarter GDP growth revised downward to 2.2% (from 3%). Conversely, growth momentum continues to build in the Eurozone, largely fuelled by the European Central Bank’s stimulus package, prompting the Bank to revise its estimate upward to 1.5% for the first quarter of 2015. UK election jitters, and uncertainty regarding the potential of a Greek exit from the Monetary Union, are introducing a degree of volatility, but sentiment remains upbeat. While commodity prices largely stabilised during March, the violence flaring up in the Middle East caused a sharp spike in the oil price and unnerved markets. The Chinese economy continues to slow-down (consensus forecasts indicate 7%) as it rebalances to the ‘new normal’, prompting the Chinese Central Bank to lower interest rates and with a knock-on effect on global demand. Overall, investors are seeing more volatility in financial markets (particularly through currency pass-through and in the emerging market space), as prices react to renewed geopolitical tension, disappointing growth results from the US and China, and divergent monetary policy interventions.

Regional

Tepid economic data and a strong US dollar kept a lid on US equity gains toward month-end, and indices declined off historical highs. The Dow declined by 1.85%, the S&P was down 1.58% and the Nasdaq lost 1.26%. American investors continued to grapple with somewhat disappointing economic data, which points to a slower-than-hoped-for recovery. Fourth quarter GDP growth came in at 2.2%, and first quarter prospects were revised lower to 2.2%. The Institute for Supply Management Purchasing Managers’ Index indicates a fifth consecutive monthly contraction, and core non-durable goods orders declined during March, whilst retail sales growth was revised downward. Consumer spending edged up by only 0.1%, although the Conference Board’s Consumer Sentiment Index remains buoyant (at 101.3, close to January’s 7-year high). The slowdown in some sectors (manufacturing, construction, transportation) is partly attributable to seasonal factors, with bouts of particularly bad weather and strikes on the West Coast taking their toll, and adding to the spring jitters. The sustained dollar-rally (7.8% for the year to date), though a boon to domestic consumers, continues drag on exporting firms.

Investors eyeing the Federal Reserve Bank for direction on interest-rate hikes were somewhat reassured by Chairperson Yellen’s comments following the March 22nd Federal Open Monetary Committee Meeting. The Bank remains non-committal on timing, but the tone is essentially still patient. A number of factors were cited in its decision to keep rates unchanged, including weaker than anticipated jobs, (initial estimates were that US companies had added only 126 000 jobs during March, the slowest increase since December 2013), manufacturing and sales reports. The Fed, aside from the key manufacturing indices, will also be keeping a close eye on the housing market. The read on housing activity and construction (representing a large percentage of the assets held by the non-financial sector, and regarded as leading indicators of consumer demand, job creation) has been somewhat mixed. Housing data from the Department of Commerce indicated an increase of 8% in new home sales during March. First-time buyers, however, were engaged in only 29% of existing housing transactions, and evidence suggests that a proportion above 40% tells of a sustained recovery. The spring selling season may therefore give the market further direction as to the Fed’s stance. For the present, investors have pushed out their expectations of a rate-hike to September.

The combination of the resurgent currency and weaker global demand caused widespread downward revisions to corporate earnings for Q4 2014, and investors are anticipating much-the-same for the pending reporting season. The consequent end-of-quarter sell-off saw $11 billion flow out of US equity funds for the week ending March 25. Momentum stocks (such as biotechnology) were particularly hard hit by the rout, with technology stocks lagging for the month. Consumer staples and the healthcare sector outperformed during March, partly boosted by significant Merger and Acquisition activity (Heinz and Kraft, potentially a winning recipe). Material and telecommunications stocks performed poorly, while small cap companies (proportionately less reliant on foreign sales) outperformed large caps.

Whilst somewhat reassured by the stabilisation in energy prices, the likelihood of a spring pick-up in business activity and the Reserve’s comments, investors remained skittish. Indeed, the month (and year thus far) has been marked by a notable uptick in volatility (especially in contrast to the historically low levels of 2014). The VIX index, a widely used measure stock volatility, swung by 35% per day in March. And with April unlikely to pass without another US ‘tightening scare’, investors may be in for a rather bumpier ride.

European stock markets remained firmly in the ascendant, far outstripping Wall Street on a quarterly basis. The FTSE Eurofirst 300 posted a gain of 15.8% for the first three months, in stark contrast to the 1% eked out by the S&P500. Eurozone equities’ performance has been underpinned by the European Central Bank’s sizeable stimulus package, the consumption-side pass through from lower oil prices, and weakness in the Euro. The DAX ticked up by 4.95% for the month, and France’s CAC by a healthy 1.66% (on a total return basis). Leading indicators were robust across the Eurozone, prompting the ECB to revise its growth forecast for Q1 2015 upward to 1.5%. Eurozone deflation figures, after the initial sharp response to oil-prices, have improved (from -0.6% in January, to -0.3% in February, to -0.1% for March). Eurozone unemployment, though still high at an % 11.4% jobless rate, is at its lowest since May 2012. The Bank for International Settlements reported significant increased appetite for credit during March, and an uptick in Eurozone business confidence. The Flash PMI (moving up to 54.1) confirms another month of manufacturing expansion, boding well for the take-up of labour market and productive capacity slack in the region. European exporters continue to benefit from the depreciation of the common currency, which approached parity (and its lowest level since 2003) at 1.05 Euro to the Dollar in mid-March. Investors are therefore anticipating a solid European earnings season. Growth stocks outperformed value stocks in March. Healthcare, information technology and the automotive industries have outperformed. Aviation/airline stocks and downstream material industries declined sharply in March, partly in response to the Germanwings tragedy. Particularly German automakers are seen to be benefiting from the Euro-depreciation, and concerns have been raised about the uneven pace of the Eurozone expansion. Peripheral markets, however, have also reaped the benefits of the ECB-fuelled momentum, with Italy the region’s second best performer.

The QE-boost has allowed Eurozone markets to largely overlook the potential impact of a Greek default, as has the repeated reassurance from the central role-players that this could be avoided. It remains, however, a looming and very real concern. The current ‘extend-and-pretend’ arrangement is tenuous at best, and is set to be tested every time an instalment is due (the first Euro 400 billion in April). The lack of political will to implement structural reforms means that successive rounds of negotiations will be prickly, protracted and potentially pointless. The firewalls put in place after the 2009 crisis have thus far been effective in protecting the systemic integrity of the common financial union from contagion. They have yet to be tested in a real-world sovereign default, however. Widespread profit-taking on Greek equities was seen toward the end of March (prior to the first payment date) belying that investors remain fearful, and this uncertainty has upped financial market volatility in the Eurozone.

UK equities underperformed their Eurozone counterparts and stock market returns were more volatile, as wary investors face an uncertain political outcome ahead of the May General Election. The FTSE100 declined by 1.95% for the month. Data on the economic front, however, was largely positive. UK unemployment is forecast to fall to below 5% in 2015 and the inflation rate has fallen to 0% for the first time on official record (since 1989). This is translating into real wage growth, and consumer sentiment is upbeat (despite electioneering). The London Stock Exchange’s dominant mining and resource companies exhibited more stable returns during March, in line with commodity/energy prices. The flare-up of geopolitical concerns, however, saw some bottom-fishing in the energy sector. Metal prices found support from the Chinese Central Bank’s (slightly surprising) rate cut, on the hopes that this would boost flagging demand for raw materials. Consumer discretionaries, and healthcare were the best performing sectors. UK markets, and specific market sectors, are likely to remain volatile in April. Present polling indicates that the outcome to the elections is far from foregone. Either Labour or the Conservative Party are likely to rope in support from minority parties to secure a victory of sorts. Whatever the outcome, the prevailing uncertainty undermines business confidence and harms foreign direct investment. In addition, energy firms and large financials fear being penalised by a Labour-led coalition, while European trading partners fear a referendum regarding EU-membership in the event of a Conservative victory.

In Asia, the Chinese economy continues to show signs of slowing down as the country rebalances toward its ‘new-normal’. The provisional Flash Purchasing Managers’ Index flagged at 49.2 for March, suggesting a further contraction in manufacturing. A measure of Chinese construction output, measured by the floorspace created, decreased by 50% year-on-year, a telling sign of slacker demand and excess productive capacity. Consumer confidence decreased from 155.5 in February to 144.3 in March, reflecting that consumers are wearying of the adjustment process. The Chinese Central Bank, in an attempt to stimulate demand and ease the ‘hard landing’ has cut lending and deposit rates again in March. Somewhat perversely, as the world worries about the knock-on impact of slowing Chinese demand, global equities surged at the prospect of further Chinese stimuli. Chinese equities hit fresh 7-year highs in March, and have returned 15.9% for the year-to-date. And additional accommodation is likely, if not imminent: Consensus forecasts were that slack domestic demand would cause a decline in Chinese imports, but that exports would rise somewhat (in response to a strong USD, and recovering global growth). Provisional data, however, indicated a more marked slow-down in exports, as (inter alia) US steelmakers sought increased protection from alleged predatory practices, US growth data continued to disappoint; and the yuan held its own against the dollar. At the final count, the data is even more concerning for Chinese authorities: Exports declined by 15% year-on-year during March. The strength of the currency was certainly one factor in the poor export-sector performance. The Central Bank had previously stated that, in keeping with its long term aim of ‘internationalising’ the renminbi, it would adhere to a somewhat more laissez-faire policy with regard to its unit of account. Whilst policy interventions would, and have been used to foster lending, stimulate demand and ease the hard landing, interventions would not be aimed at competitive devaluation of the currency. The most recent data, however, calls into question the ability of the Central Bank to (de facto) maintain this stance.

Japanese equities rose strongly throughout the quarter (10.9% for the year-to-date), and ended the month 2.78% higher. Gains have been supported by the Bank of Japan’s monetary policy, the deterioration of the Yen against major trading partners, and the greater allocation to equity from the GPIF. Economic data during March undershot expectations: manufacturing output declined by 3.4%, and retail sales rose less than anticipated. Labour market data was somewhat more mixed: Unemployment increased slightly, but it is estimated that real wages will rise between 1 and 2% for the year, fostering domestic consumer spending. The healthcare and the pharmaceutical industries, as well as export-oriented electrical appliances, were star performing sectors. Mining and resource companies stabilised, as commodity prices appeared to bottom out. Analysts had previously raised concerns about the excessive correlation between Japanese stock markets and the currency, as it injects additional stock market volatility. During March, the relationship appeared to decouple somewhat, with equities gaining despite Yen-stabilisation. The remaining pass-through from yYen-weakness, however, means that most analysts anticipate upward revisions of Q1 earnings, and further positive news on company profits and dividends. In addition, the latest CPI figures indicate that inflation was 0% for March, leaving the door open to further stimuli from the Bank of Japan, leaving room for equities to move onward and upward.

Overall, Asian economies outperformed their counterparts during the first quarter. Similarly, Asian emerging markets outshone their Latin-American and African peers, whilst the broad peer group outperformed developed markets during March (the MSCI Emerging markets was down 1.42%, versus the 1.57% decline in the MSCI World). Indian stocks posted their largest decline since February 2013, amidst profit-taking and concerns that the recent rally is overdone. The central bank cited pockets of weakness in the economy, and deflationary concerns as the reason for the (somewhat unexpected) March rate cut. The country, however, remains a favoured investment destination. Treasury estimates that the Indian economy will grow by 7.4% in 2015, outstripping China for the first time in 16 years. Minister Modi’s balanced budget and stated commitment to structural reforms have garnered domestic and international support, and netted offshore inflows. Pharmaceutical firms performed well, with notable Merger and Acquisition activity in the sector overall. Elsewhere in Asia, easing moves by the central banks of the Philippines, Korea and Indonesia (and consequent currency depreciation) boosted export-oriented firms. Taiwanese markets were lifted by the technology sector, as international investors vied for a bite of Apple.

In emerging Europe and Latin America, BRICs main-stays Russia and Brazil posted monthly losses of 0.85% and 7.55% respectively. Against the backdrop of lower oil prices, uneasy peace, and consumer inflation of nearly 17%, the Russian Central Bank (despite cutting rates again on the 13th of March) is left with little room to effectively manoeuvre the country out of its slump. Brazil, despite repeated and much-criticised central bank intervention, has been unable to halt its economic slide. The spate of recent populist protests, partly aimed at the country’s corruption-tainted government, underline the generally pessimistic sentiment regarding the country’s growth prospects. Despite some stabilisation in commodity-prices, Latin American exporters with large dollar-denominated debts (such as Colombia) remained vulnerable to currency movements and capital outflows, posting losses in March. The Mexican economy, after being the regional star performer, lost ground in March due to weaker industrial production and manufacturing data. The Mexican Central Bank left rates unchanged, and, as the Mexican peso retreated to record lows, intervened to support the currency. March, therefore, saw a general return of global risk-aversion and stock market volatility, erasing much of February’s gains. Global investors remain particularly concerned about the deepening tension in the Middle East: The stability of the region remains under threat from political and ideological rifts (Yemen/Saudi Arabia; US-Iran; Islamic State). Following the air strikes on Yemen, Saudi Arabian markets plunged whilst oil prices spiked, and investors remain concerned about the spill-over to other regions and sectors.

African markets ended the month on a downbeat note, with a few notable exceptions. The Nigerian election, though not without incident, has largely been judged successful (having passed the Huntingdon-double-turnover test, whereby an elected incumbent hands over power to an elected successor). The Nigerian exchange was the star performer, moving up 12.5% during March, and reversing a portion of prior month-losses. Ghanaian, Zambian and Ugandan markets were supported by commodity stabilisation, and a slight uptick in copper prices in response to Chinese stimulus talks. Solid performance in financials and banking (inter alia for Zenith Bank; StanChart Zambia; Bank Windhoek) boosted the bourses of their respective African domiciles.

South Africa, though not the regional laggard (those honours go to Zimbabwe and Tanzania at -3.76 and -2.94% respectively), lost ground over the month.

The local bourse ended March firmly lower, with the ALSI declining by 1.33%. The JSE, however, maintained a gain for the quarter, but the previous predominantly bullish sentiment may be waning. Offshore investors and rating agencies have flagged South Africa alongside Russia and Brazil; and local investors continue to fret about high valuations; and March saw the release of some fairly dismal economic data (in the guise of the South African Reserve Bank’s Quarterly Bulletin). January retail sales figures were revised downward, and household consumption expenditure reportedly increased by only 1.4% during 2014 (the slowest increase since the recession of 2009). The South African formal sector shed 20 000 jobs during the course of the year. Labour unrest and structural/infrastructure bottlenecks dented the country’s export competitiveness during 2014 (slowing to 2.6% annually). And with historic ‘strike season’ approaching and Eskom’s credit rating cut to below investment grade (by both Standard and Poor’s and Moody’s), both factors will continue to weigh on production figures, the terms-of-trade and FDI flows. Domestic demand is likely to remain subdued, as consumers and taxpayers have been hard-hit by higher personal income taxes (the first hike in 20 years), rates and levies. The South African Reserve Bank left rates unchanged for the present, but revised inflation expectations upward. The nearly R2 per litre increase in the petrol price, and projected (up to) 25% in energy-tariff hike in April is likely to have fairly rapid pass-through (especially via transportation costs), and analysts anticipate an interest-rate hike at the next sitting. The domestic financial sector was the star performer, with the index up by 2.9% for March, and by 11.15% for the quarter. South African Media too performed well, in line with Chinese parent TenCent. South African mining and resources underperformed during March, erasing some of the prior months’ gains, despite a slight uptick in metal prices mid-month.

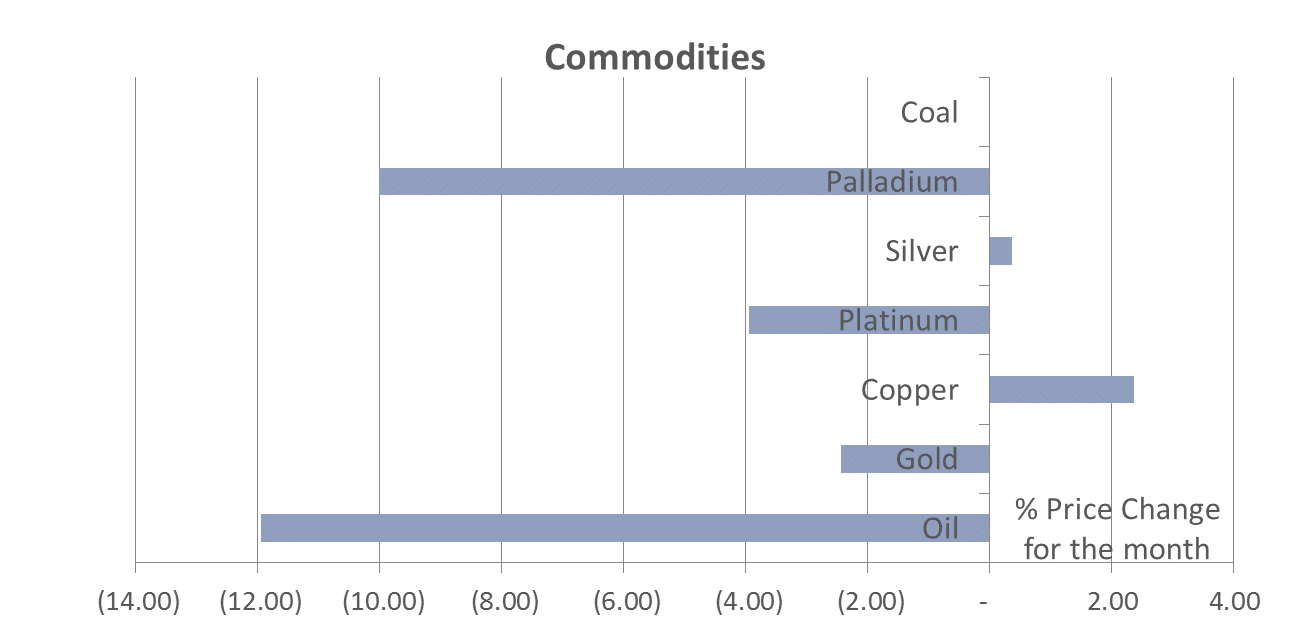

Commodity prices remained under pressure during March. Industrial metal inventories (copper, aluminium and iron ore) have been building up steadily in response to lower global demand. Agricultural commodities, such as sugar and soy, were also softer during March (sugar at a 6-year low due to a bumper crop). Iron ore prices tumbled to their lowest levels since 2009 during March, and the copper price declined by 0.69%. The red metal’s monthly decline was somewhat tempered by a positive market response to Chinese Central Bank stimuli. The year-to-date loss is thought to have been exacerbated by a large-scale sell-off in January by Chinese hedge funds. Oil prices jumped after the attacks on Yemen, but the move proved to be short-lived, and prices were 2.10% lower for the month. Ongoing political tension may threaten global supply routes (with Yemen and the South Suez Canal key components), but the present supply glut can more than compensate medium-term disruptions. Moreover, the US and Iran have resumed negotiations regarding their nuclear policies and large stockpiles of Iranian oil can be released onto the market if sanctions are lifted. The flight to traditional safe asset classes has not been as pronounced during the current flare-up of geopolitical tension, with gold and bond prices showing muted reaction. Holdings in Exchange Traded Gold Funds, in particular, declined during March, indicating waning investor appetite.

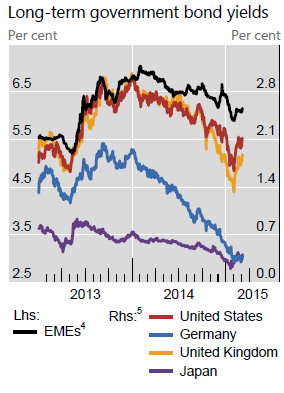

Global risk aversion means that quality government bonds are still highly sought-after, but yields remain exceedingly low and declining in the currently (predominantly) accommodative monetary.

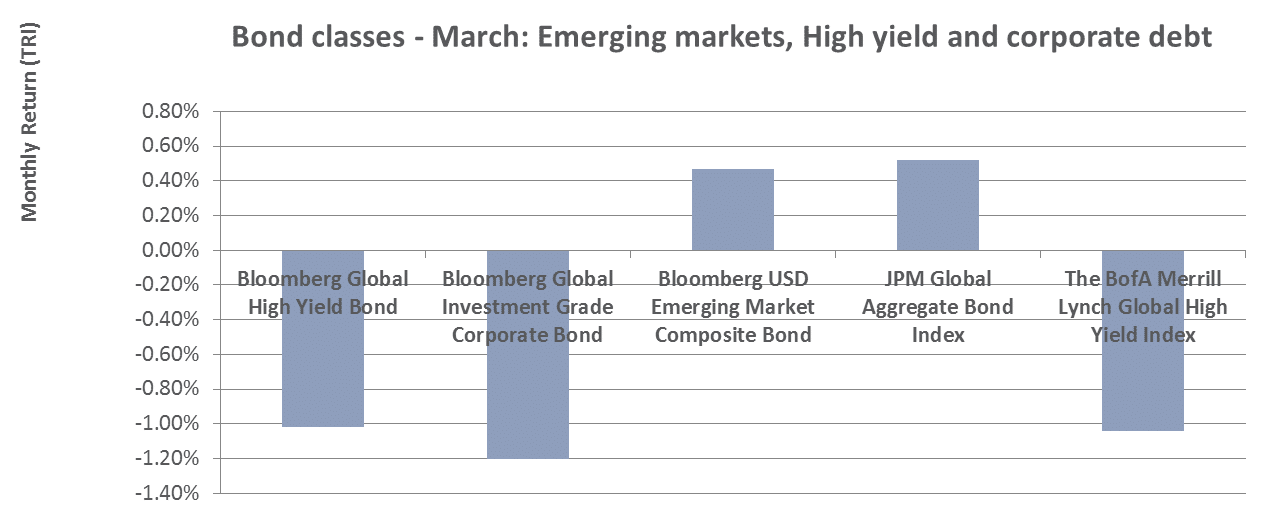

Global risk aversion means that quality government Anchorbonds are still highly sought-after, but yields remain exceedingly low and declining in the currently (predominantly) accommodative monetary environment. March saw further compression along the yield curve, and particularly for longer dated maturities. US T-bill yields rose slightly, coming in at 1.92% relative to the ultra-low (and even negative) sovereign yields prevalent in the Eurozone. 10-year UK gilt yields fell to 1.58% and 10-year German Bunds were at 0.18%. Peripheral Eurozone markets offered slightly better value, with the Italian and Spanish equivalent yields at 1.24 and 1.21% respectively. As investors continue to search for return, high-yield corporate debt has continued to gain favour. With the dearth of quality credit, the current round of quantitative easing has seen European corporate debt funds receive record inflows. Corporate debt has outperformed sovereign debt (the Merrill Lynch index coming in at 2.13%), as have high-yield bonds, with investment-grade emerging market bonds are amongst the best performing within the asset class. As with equity markets, however, two trends are emerging: Investors are ever-more discerning in allocating to emerging markets; and overall asset class volatility is on the rise. The MOVE index (the bond market equivalent of the VIX) is up by 65% from the prior year’s lows.

Conclusion

With the UK election uncertainty a looming factor in Europe, and commodities under close scrutiny, investors will remain keenly aware of the geopolitical landscape. As earnings season approaches, the currency volatility of the past quarter, partly dictated by central bank policies may well play out in corporate results. Divergent central bank actions, at present, appear to remain the dominant drivers in global markets’ momentum. On the one hand, April is unlikely to pass without another global tightening scare from the US, but on the other, further Chinese stimuli are a boon to equities. The extent to which investors are able to anticipate policy moves can ameliorate the severity of potentially harmful capital reversals and currency fluctuations (particularly in emerging and peripheral markets).

More information?

To have the monthly International Commentary delivered to your inbox, please subscribe here.

Media contacts

For media enquiries in South Africa, please contact Courtney Atkinson via email or on +27 (0)21 673 6999.

In the UK, contact Andrew Slater via email.