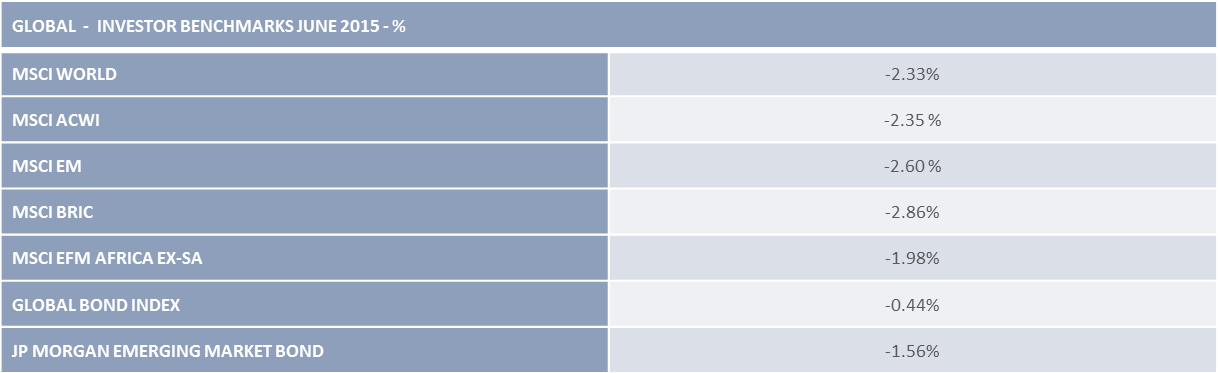

International Market Commentary: June 2015

June was a decidedly unsettled month for global financial markets. As the month drew to a close, Greece failed to secure a deal with its creditors, and the Chinese market ended in bear territory, leading a global rout from equities. Though few markets or asset classes escaped the fall-out, Japanese equities remained amongst the better performing developed markets. The South African stock market too, proved remarkably resilient.

US Markets

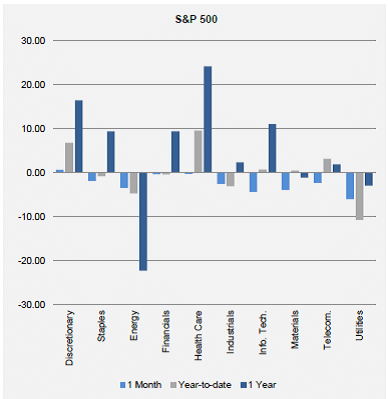

US stocks followed global counterparts lower at month-end, but an upbeat read of selective US data and the Federals Reserve’s forward guidance somewhat tempered the broad-based equity market skid. The S&P500 ended -1.94% lower, the Dow lost -2.06% and the NASDAQ declined by -1.64 %.

Housing data is particularly closely watched by the Federal Reserve, both as a forward looking indicator of the economy’s relative position in the typical business cycle and as an indicator of household spending. Housing and consumption data both remained supportive of an uptick in the pace of economic growth, albeit still at a slower pace than initially envisaged. Existing home sales rose by 5.1% in May, reaching the highest levels in 7 years. New home sales surged to 564 000 annually during May, registering a 20% year-on-year increase. The S&P Case-Schiller House Price Index recorded a 4.2% increase in the value of houses, a measure historically associated with an early-to-mid business cycle. Consumer spending patterns support this view. Consumers are finally reaching into their pockets, as the impact of dollar strength and lower gas prices (which remain 24% lower year-on-year), continue to trickle through. Personal income growth was 0.5% for May, and consumer spending ticked up by a higher-than-anticipated 0.6%. The latter increase is one of the largest monthly jumps since mid-2009. Retail sales increased by 1.2%, and consumer confidence indices showed sentiment turning positive. The Conference Board Consumer Sentiment Index rose above the 100 mark, and the University of Michigan’s reading rose by a marked 5.4 points to 96.1 in June. The latest data from the US Labour Department’s non-farm payrolls report, however, was underwhelming: only 223 000 new jobs were added during June, and the initially high readings for prior months (280 000 for May) were revised downward. Hourly wage growth was modest during June, with an earnings average remaining just below $25 per hour. Business spending and manufacturing data remained soft, with durable goods orders falling by 1.8% in May. Manufacturing output shrank by 0.2% in May, and the flash June Purchasing Managers’ Index(PMI) declined to 53.4 (from 54.0 in May). The Services PMI, at 54.8, sank to its lowest level since January – a cause for particular concern, as 69% of the US economy is service-based. The Consumer Price Index (CPI) rose to 0.4% for May, registering its biggest monthly increase since 2013 largely driven by energy prices.

Overall, America’s economic recovery appears to be on track, albeit at a modest pace, as both the IMF and Federal Reserve Bank revised their forecasts for 2015/2016 GDP growth lower. As a spill-over, the closely-watched 17th June FOMC (Federal Reserve Bank’s Open Monetary Policy Committee) Meeting saw a more dovish tone from the Bank regarding the path of future interest-rate hikes. Investors were cheered by the lower trajectory of the so-called dot-plot (A visual representation of where each individual committee member believes the Federal Funds rate should be at different points in time). The June plot showed a path of gradually increasing rates, with the median estimate for 2016 dropping from 1.87 to 1.62 %. Lift-off is still anticipated for September 2015, but the tightening cycle will be a tempered by the slower pace of economic recovery.

In line with a slower domestic recovery, relative dollar strength and perceived offshore weakness corporates in the States revised their earnings forecasts lower, just ahead of the mid-year reporting season. Lower earnings estimates, and potential supply side competition (pending the outcome of an Iranian nuclear deal), prompted the Energy Sector’s more pronounced decline. As bond markets came under pressure, bond-proxies (equities mimicking the generally more stable performance of this asset class) came under pressure, with Utilities declining sharply. Telecommunications and consumer goods sectors performed well, partly boosted by elevated Merger and Acquisition (M&A) as Fedex bid for data rival TNT Express and on news of a merge which would see the creation of the 2nd largest supermarkets group in the USA (between European groups Ahold and Delhaize).

Index sector Returns – USA

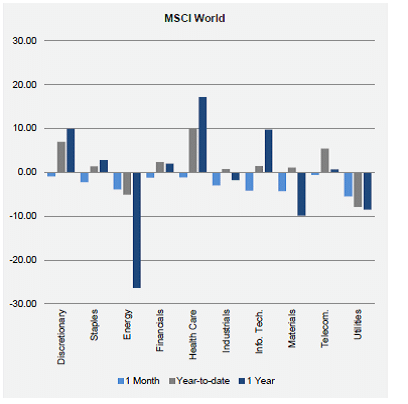

Europe and Japan

Markets in Europe declined by an average of over 2%, following the confirmation that Greece had defaulted on its repayment to the IMF. The Irish bourse was the star performer, and the only market to register a slight gain. The CAC declined by -4.3%, the DAX by -4.1% and the UK’s FTSE100 took a battering to end -6.6% lower.

Large losses in mining heavyweights, on lower commodity prices and pessimistic news from China, exacerbated the fall-out from Greece in UK equity markets. Financials lost ground as elsewhere, but domestic news amplified the decline. HSBC announced that it would cut a further 25 000 jobs world-wide, and dispose of its Turkish and Brazilian businesses. RBS and Lloyds were hit by the government’s announcement that it would dispose of its stakes in RBS (of which it holds 79%) and further reduce its holdings in Lloyds by 1% (to 17.9%). M&A activity remained elevated, as in the US. Gaming stocks were boosted by the pending merger of Ladbrokes and Gala Coral to create the biggest betting Franchise on the High Street. Ferrero International made a sweet deal to buy out chocolatier Thornton’s for GBP 112 million. M&A news in the Healthcare sector sees South African hospital group Mediclinic International set to acquire a 30% stake in the UK-based Spire Healthcare, for an estimated GBP 432 million. Healthcare, however, having put in solid year-to-date returns, was one of the poorest performing sectors, dropping by -8.5%. The worst performing sector was Basic Materials (-9.7%), largely due to the 25% plunge in the Industrial Metals and Mining subsector. As elsewhere, Utilities declined (-7.8%), and Consumer Goods and Services were the better performing sectors (a relatively benign -3.5% lower). Airline stocks rallied on the news that a third runway would at long last be built at Heathrow. Ahead of the mid-year reporting seasons, UK corporates’ earnings estimates have been revised downward. A 10% contraction is predicted, largely due to the preponderance of resource companies. Despite a volatile and jittery June, the overall picture for the UK economy remains stable. Q1 GDP growth was in line with expectations, as 0.4%, and industrial output increased by more than expected. The UK trade deficit narrowed during May, and unemployment declined, with wage growth of 2.7% the highest since 2009. Sterling rallied following the positive jobs data. Inflation remained positive, at 0.16%, and analysts are therefore predicting that the Bank of England (BoE) may start raising interest rates in Q1 2016.

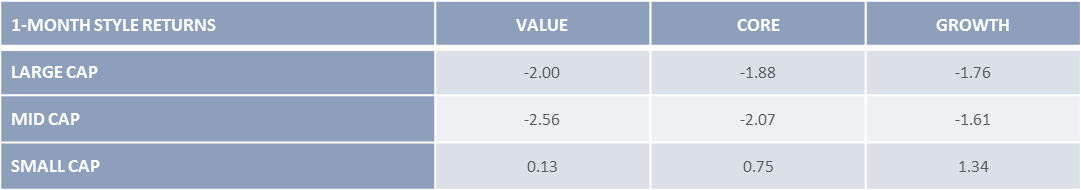

Similarly, and despite the events in Greece, the broader-based Eurozone economic recovery remains on track. The region’s trade surplus widened, with an all-time high recorded in April. Favourable terms-of-trade remain driven largely by the weaker Euro. Though the currency strengthened against the dollar over the month, it is still 8% lower for the year to date. Industrial production and output increased during June, with the PMI ticking up to 52.5. The Flash June PMI came in at a four-year high of 54.1. Eurozone inflation is in positive territory, up to 0.8% for June, and unemployment remained stable at 11.1%. More heartening is that the recovery is not limited to the powerhouse Germany, having taken a firm hold in (traditional laggard) France and with sustained growth in peripheral markets such as Spain. Indeed, the IMF revised its growth outlook for Spain upward to 3.1% (from 2.5%). The country has seen particularly robust manufacturing activity, with the PMI at 54.5, and inflation is positive. This has somewhat alleviated the underlying fears surrounding the impact of a Greek exit on so-called peripheral markets (Portugal, Italy and Spain). Thus far, their economic trajectories have remained relatively unperturbed. This perhaps belies the general belief that an exit is likely to be avoided, and that any contagion will be limited by the effective firewalls put in place post 2011/12. Within the Eurozone, nonetheless, the immediate impact of political uncertainty played out in June’s asset markets. Financial stocks, predictably, were amongst the worst performers. Basic Materials, Energies, Information Technology (IT) and Utilities all posted losses in excess of 4%. The Telecommunications sector was amongst the better performing, boosted by M&A. As elsewhere, small cap stocks outperformed their mid- and large-cap counterparts, while growth stocks maintained their year-to-date advantage over value stocks.

Japan maintained its status as the best performing developed markets, with the TOPIX declining by only 1.7% in the June equity rout. The outlook for the country remains upbeat, with Q1 GDP growth revised sharply upward to 3.9% (a reflection of higher capital expenditures). Recent jobs data indicates rising real wages and a jobless rate of 3.3%, nearly at a level that the Bank of Japan (BoJ) regards as full employment. Consumer sentiment is on the up, and consumer spending rose during May (for the first time in more than a year). Output data for June, however, was disappointing, and exports grew at a slower-than-expected 2.4%. The weakness in near-neighbour China is largely to blame. As elsewhere, Japanese Utilities and Healthcare stocks lagged the composite index. The Technology sector and export-oriented automotive firms continued to benefit from the weaker Yen, while aviation stocks reacted favourably to news that a third runway would be built at London’s Heathrow. Japanese inflation, though in positive territory at 0.1% in June, is nowhere near the BoJ’s target of 2%. The Bank is therefore likely to introduce further Quantitative Easing (QE) measures in the latter part of 2015. Overall, investor sentiment toward Japan continues to be positive on the prospect of further easing, and as the trend toward increased dividend pay-outs and share-buybacks, as well as commitments to sound corporate governance remain on track.

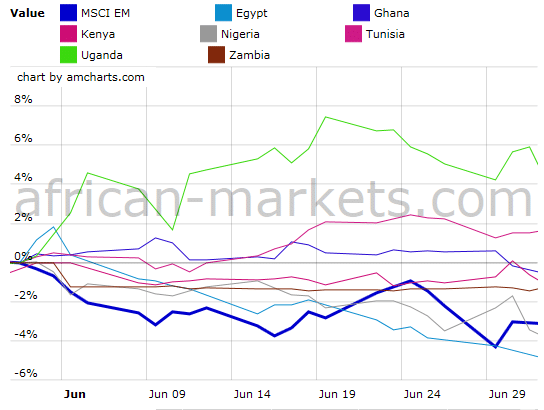

Emerging Markets

The 29th of June saw the MSCI Emerging Markets post its biggest decline in two years, as Greek negotiations broke down and the Chinese stock market entered bear territory. The overall monthly decline was -2.6%. Risk appetite was decidedly on the wane, as investors weighed the potential implications for other heavily indebted countries of a Greek ‘disorderly exit’ and an imminent Federal interest-rate hike.

Amongst emerging markets, the Asian region was particularly hard hit by the latter-month tailspin in Chinese equity markets. As previously noted, global investors had for some time been jittery of the white-hot Chinese stock market. Its apparent disconnect from the country’s economic fundamentals, pointed to a bull (market) feeding on speculative trading. These fears were borne out in June: After hitting a 7-year peak on June the 12th (and up more than 160% from 2014’s lows), the market declined by more than 20% in two weeks and entered a bear market. Chinese authorities moved to clamp down on speculative and margin trading, and investors were forced to sell off for fear of margin calls. The Shenzen and Shanghai composites plummeted, bringing the country’s longest ever bull-market to an abrupt end. Chinese authorities were quick to intervene, introducing measures to curb excess volatility and shore up the equity market (without tempting further speculation). The People’s Bank of China (POBC) moved to ease liquidity by cutting the repo rate by 25bps (the fourth such move since November 2014). Required reserve ratios were selectively reduced, to foster corporate lending. Speculative volatility would be curbed by strict limits on broker selling, and the temporary suspension of Initial Public Offerings (IPOs). Additional measures (some the result of an emergency meeting during the last weekend of June) included government share purchases, an easing of restrictions on foreign ownership, and draft rules which would allow the State Pension Fund to hold up to 30% in Chinese securities. Measures were not enough to halt the June-decline: the composite index ended -5.5% lower, while restricted A-shares slid -8%. On a guardedly positive note, retail sales and industrial output appeared to stabilize during May. Forward looking indicators of consumer and business confidence grew at their highest pace since 2007, partly in anticipation of further easing from the POBC. Elsewhere in emerging Asia, Indonesia was a regional laggard, ending 7% lower. Poor growth prospects and weak industrial output data weighed on investor sentiment, and called into question the ability and political will of the newly elected government to implement meaningful reforms. Indian markets equities were volatile, but were the regional star performer, as they ended just above the flat-line. Initial sharp declines (on hawkish comments from the Reserve Bank) were reversed toward month-end. The timely arrival of the monsoon eased fears of food-price inflation, and the Reserve Bank responded with further easing measures, cutting rates by 25bps. The dovish tone of the US Fed further boosted investor sentiment.

Latin American markets outstripped their emerging peers, aided by a solid performance from regional heavyweight Brazil. The Brazilian market gained ground largely on political newsflow, and despite the country’s deteriorating economic fundamentals. President Rousseff vetoed proposed legislation on retirement benefits which were set to increase social spending by more than $13 billion over the next decade. While not garnering her any popular favour (her approval rating is at the lowest for any leader for the past two decades), it has demonstrated to offshore investors a commitment to sustainable fiscal policies. With inflation running rampant, and the economy slipping deeper into recession, investors appear to be betting that the crisis will spur meaningful structural reforms. This includes the removal of state-regulation of prices in strategic sectors, one of the largest contributors to rising inflation. For the present, the Real is absorbing most of the pressure arising from high inflation and weak growth. Colombian markets edged higher, but Mexico retreated. Reports showing higher Mexican unemployment and lower manufacturing exports underlined the fragility of the economic recovery (and its dependence on near-neighbour the States).

Within Emerging Europe, there had been hopes that sanctions against the troubled Russian economy would be eased, once the current set expired on the 31st of July. European Union (EU) ministers, however, agreed to the extension of sanctions against the key defence, energy and financial sectors until January 2016. Russia, in turn, imposed tit-for-tat food product sanctions, which did little for diplomatic relations (already somewhat soured by the hosting of Greek Finance Personnel). The country remains mired in recession, with little hope of a medium-term recovery. Stocks slid by more than 3% during June. Turkish markets had been jittery in the run-up to local elections. The results did little to quell investor nerves. The ruling AK Party failed to secure a majority, raising the spectre of a second election should no coalition be formed. Stocks declined, and the Lira sank to an all-time low following the results.

Middle Eastern markets, despite weaker energy prices and ongoing terrorist threats, suffered less serious declines than elsewhere. The pegged currencies of oil-producing giants such as Saudi Arabia and the large sovereign wealth funds at their disposal, continues to insulate these markets against commodity shocks. Manufacturing output ticked up again in the broader region, continuing the year-to-date outperformance. African markets were mostly lower during June, with the Ghanaian and Egyptian markets suffering the most serious losses (-6.9% and -4.68% respectively). Declining commodity prices dragged on exporters, as did Eurozone weakness. Notably, however, emerging African bourses outperformed the broader MSCI EM over much of the period. Financials, as elsewhere, performed poorly, with Nigeria’s Access Bank declining 8.8% and Liberty Kenya 9% down during the last week of June. The Namibian market was modestly lower relative to its peers, despite data form the Namibian Statistics Agency that first-quarter growth came in at a disappointing 3.1% (well below the average expected of 4.2%). Investor sentiment toward North African countries was also troubled by the terror attacks in Tunisia. The Tunisian economy, where tourism accounts for 14.5% of GDP, will be particularly hard-hit in the coming months. On a somewhat more positive note, US Congress vetted the extension for a further 10 years of the African Growth and Opportunities Act. As the US is the continent’s second largest export destination (accounting for more than 10% of export earnings over the past 4 years), this is a boon to African growth prospects.

South Africa

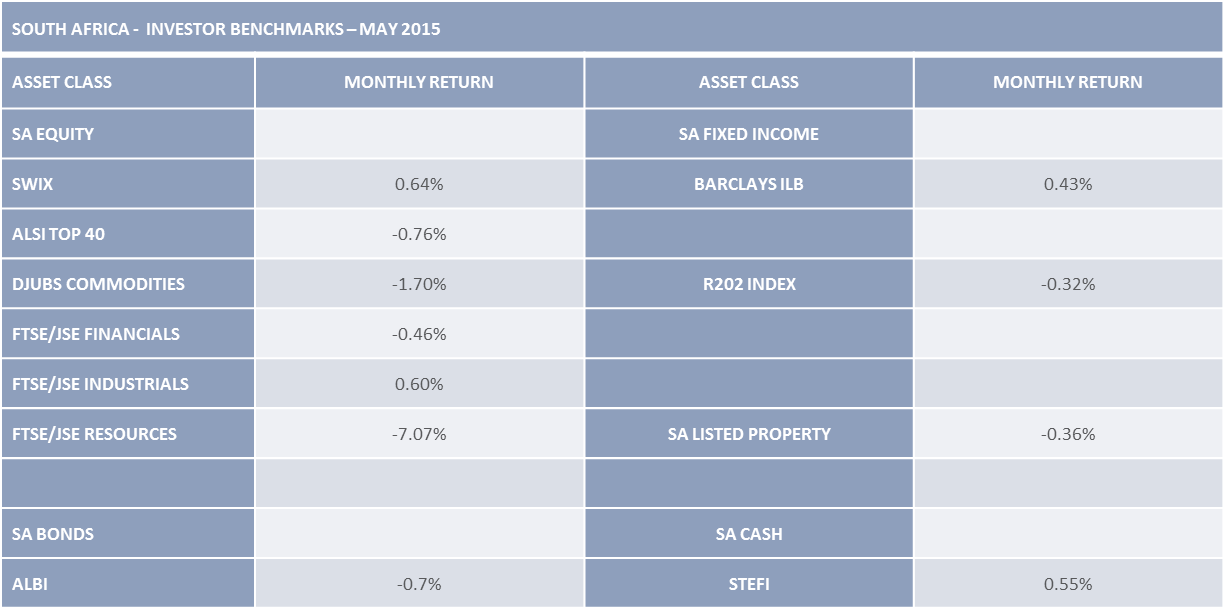

South African assets could not escape the pull-back pressure from increasing global risk aversion, but SA equities displayed some resilience. The ALSI was a relatively modest -0.76% lower. Domestic data was mixed. The Department of Trade and Industry recorded a trade surplus of R5 billion for May, a marked reversal of the prior month’s deficit of R2.5 billion (and the expectation of a R3.2 billion deficit). The Rand rallied briefly on the news. It strengthened somewhat over the course of the month from the lows of the 29th of May, but never breached the key psychological R12 to the dollar level. Private sector credit grew at a better than predicted 9.5% during May, and industrial output stabilised. Whilst consumers were cheered by the news that the National Energy Regulator (NERSA) rejected Eskom’s application for a further 12.7% hike in energy prices, domestic inflation nonetheless increased to 4.6% in June. The labour market remains unsettled and continues to pose a risk to the country’s growth prospects and inflation outlook. National Treasure confirmed during June that the recently negotiated public wage settlement would require additional funding of R66.2 billion, an expenditure not budgeted for in the medium term framework. Such above-inflation wage settlements are a substantial upside risk to the inflation outlook. A recent BER survey reported deteriorating inflation expectations amongst households, businesses and analysts. The South African Reserve Bank (SARB) has cautioned on the additional risk from the weaker Rand and the oil price stabilisation. As the BER’s 2016 projections breach the upper limit of the SARB’s target band, analysts are pricing in a 125bps interest rate hike over the next 18 months.

South African Resources and Mining Sector stocks came under considerable pressure, particularly in the latter half of the month, as earnings per share were revised sharply lower. The resource index registered a -7.1% drop for June. Financials declined by a considerably more modest -0.5%, while Industrials increased by 0.6%. Unlike in offshore markets, South African large caps outperformed small and mid-caps (at -0.2% versus -3.8 and -1.9% respectively), and the Banking sub-sector put in a solid performance to gain 1.6%. Telecommunications and Consumer Services outperformed (at 5.6% and 4.7%), while Construction stocks had a particularly poor month (-10.7%). In line with deteriorating inflation prospects, demand for Inflation Linked Bonds was relatively healthy. ILBs were the better performing South African Asset class (aside from Cash), recording a 0.4% gain. Bonds were under pressure, as elsewhere, with the ALBI losing -0.2%. Listed property lost ground in line with global REITs (after being the market’s darling for the first half of the year), but the decline was not as severe as in May.

Commodities and Fixed Income

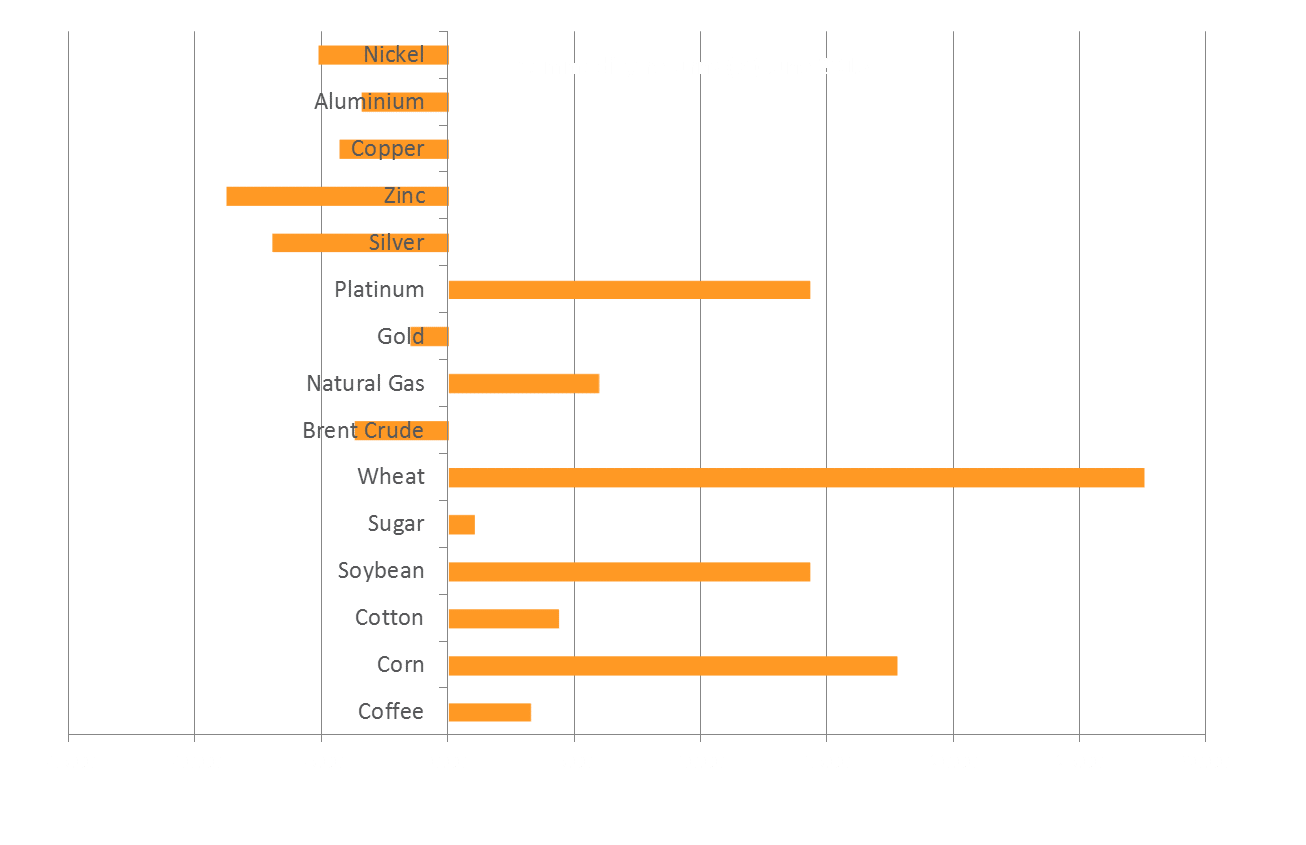

Energy prices declined, on reports of higher than anticipated US inventory data, and with the prospect of Iranian supplies coming on line. Given the rather wild ride oil companies and oil producing nations have thus far experienced, the -3.71% decline has added an air of uncertainty as to the supply-side dynamics going forward. The near-term trajectory of the oil price may yet see significant volatility. Where analysts had previously been predicting that prices had bottomed out, some notable dips are still likely in the coming year, before stabilisation at an estimated $55-$60 per barrel of Brent Crude. Industrial Metals saw sharp declines, on a lack of support from Chinese manufacturers. Gold and Precious Metals ended lower, though the losses in Gold were somewhat pared at month-end with a pick-up in safe-haven trading, and increased demand from India.

Two forces came into play to add significant volatility to fixed income markets, particularly in sovereign debt. During the first part of June, investors continued to rotate toward global equities, expecting an imminent Federal rate hike. By mid-month, sovereign bond yields had therefore climbed substantially: German Bund yields reached 1.0% and T-bills peaked at 2.5%. Toward month-end, however (and after a dovish FOMC Meeting), the failing Greek negotiations saw greater demand for traditional safe-haven sovereigns, and yields declined. For June, however, safe-haven trades could not overcome rate-hike concerns. Sovereign debt, and broader fixed income assets ended in the red. Longer-dated maturities were harder hit, with the 10-year index linked Gilt giving up 2.79% (versus 23 bps at the shorter end of the spectrum), and 10 year T-bills -0.88% lower. Investment-grade Corporate bonds remained in easy supply (particularly on still-elevated M&A, with June for instance seeing the issuance of $10 billion in debt by Heinz in aid of its merger with Kraft), and the asset class underperformed its peers. European corporates declined by -1.97%, with the broader investment-grade corporate class -1.84% lower. High-yield bonds continued to outperform their other debt instruments, at -1.49%. Emerging market debt similarly saw a less pronounced decline. The JPMorgan Aggregate indicator ended -1.56% lower. Within the emerging bond space, however, sovereigns underperformed (at an average of -2.23%), whilst Emerging Market corporate bonds substantially outperformed at -0.92%.

Conclusion

The Greek drama, having taken centre stage for the second quarter, is not yet over. European investors, in particular, will take heed of the potential further fall-out from either an exit or (as is more likely) another bailout. The Federal Reserve has made its stance regarding the trajectory of interest rate hikes fairly clear, and global players may not expect much further guidance in this regard. The policy actions of other Central Banks, however, may present more to mull over: Particularly significant will be whether the actions of the People’s Bank of China can shore up Beijing’s equity market, and boost flagging economic growth in the near-term.