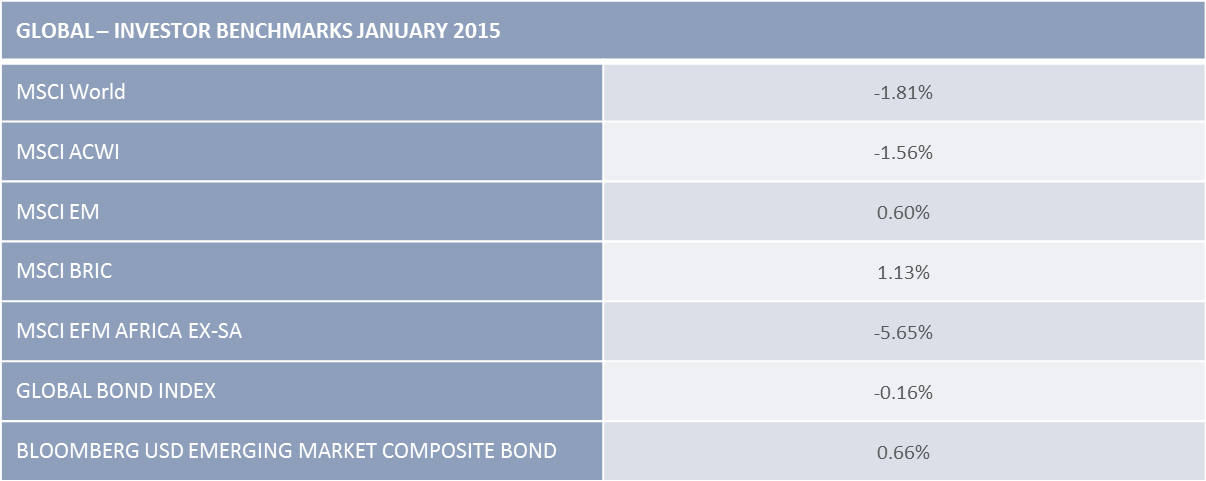

International Market Commentary: January 2015

Introduction

January proved to be a volatile month in global financial markets. Investors will hope that the “ January-effect” (whereby initial performance is the predictor of what’s to follow) does not play out in 2015. A number of themes remain at the forefront: flare-ups of geopolitical tension, sliding commodity prices, and central bank policy decisions chief amongst them. The IMF, in January, revised its global growth forecasts lower, with few exceptions. It cited the slow-down in the Chinese growth engine; political tension in the Eurozone and elsewhere; the slump in commodity prices and consequent downward revision to commodity exporters’ prospects; and deflationary fears in Japan and the Eurozone. According to the IMF, global economic growth will range between 3.5 and 3.7 %, a downward revision of 0.3%. The Euro-area recovery, despite the monetary stimulus, is predicted to be a sluggish 1.2%. Emerging market growth, while stable at 4.3% overall, will be unevenly distributed. The US is the exception to the general downward revision – it’s predicted that growth will exceed 3% in 2015/16, supported by declining unemployment, a moderate fiscal and monetary adjustment, and muted inflationary pressure.

Regional

Despite the IMF’s positive revision, US stocks underperformed their European counterparts, driven by waning earnings optimism, and the protracted pinch of the energy sector. The Dow Jones Industrial Average declined by 3.58%; the S&P500 and NASDAQ by 2.08 and 3% respectively.

US investors were on the back-foot to kick off 2015. Business confidence and general economic activity has ebbed: The Institute of Supply Management reports that the Purchasing Managers’ Index increased to 53.1 for January 2015, and durable goods orders fell by 3.4% during December – whilst manufacturing is still expanding, the rate has slowed considerably. US jobless claims and unemployment increased slightly to 5.7%, 257 000 new jobs were added. 4th quarter GDP growth, at 2.6%, was lower than anticipated and well-below the present IMF trajectory.

The sentiment on Wall Street dipped markedly toward the end of January, as investors mulled a spate of disappointing corporate earnings results. Across sectors, major market players (including tech-heavyweight Microsoft, construction giant Caterpillar; Dupont and Procter&Gamble in the traditionally more defensive pharmaceutical sector) undershot expectations. Corporates cited the pass-through from the energy sector, a poor global growth outlook, and reduced export competitiveness due to the stronger greenback. In the already-tough commodity, fixed income and currency spaces, financial and banking stocks were buffeted by further headwinds in the form of additional regulatory fines.

In the face of simmering political tension, Eurozone stocks recorded their best monthly performance in 4 years. The regional uberperformer, Germany’s DAX was up by 9.06%, while the FTSE100 ticked up by a more modest 2.89%.

Two ‘non-news’ items are particularly noteworthy: The outcome of the Greek elections; and the announcement of the European Central Bank’s stimulus package. As predicted, the Syriza party took the helm following the Greek general election. Honouring the election promises to a disenchanted populace, new Prime Minister Tsipras has already begun rolling back a number of austerity policies – measures which were key to securing the country’s $ 272 billion international bailout in 2010. The new government has confirmed that it intends to reject either an extension in term, or any new debt-servicing schedule, when its present loans expire on the 28th of February. The beleaguered banking sector will effectively be cut off from much-needed ECB funding. The Athens Stock Exchange’s reaction to the default-threat has been predictably sharp – falling by 12% on the day.

The initial wider market reaction, however, was muted. This belies the belief (at the time) that a sovereign default and Greek exit from the Eurozone was avoidable, and at any event would pose less of a systemic risk than during the 2012 crisis. (Recent developments point toward a greater likelihood of an exit, and have kept global markets on edge. In the first week of February, the Athens Stock Exchange has tanked by a further 14%, and S&P downgraded Greece’s debt rating from B to B-). The tempered reaction bears testament to the confidence engendered by the ECB’s announced stimulus package.

Markets gave the long-awaited announcement of European Quantitative Easing (QE) a resounding welcome. €60 million has been earmarked for bond-purchases on a monthly basis (from March 2015 to September 2016). The ECB has reiterated that inflation expectations are its primary target (though a pass-through to currency markets is acknowledged): the intention is to combat deflation, ease liquidity-constraints, foster lending and ultimately lift the region’s largely stagnant economic growth. Analysts debate the size of the ECB’s teeth and the timing of its bite in terms of medium-to-long run effectiveness. Yet the short-run impact has been fairly clear. Eurozone stocks shot to 7-year highs on the day of the announcement, and the momentum carried markets broadly higher for the month. The Purchasing Managers’ Index increased to 51.0, a long-awaited expansion. Business sentiment is upbeat, with the ECB reporting demand for credit at an 8-year high. The impact is also anticipated to outweigh the deflationary pass-through from lower oil prices (as Eurozone inflation somewhat perversely declined by 0.4% to -0.6% in January). Within the Eurozone, Germany was one of the best performers, the UK underperformed its peers. Politically fraught Russian and Greek economies predictably lagged. In common with the US and elsewhere, sectors which dragged on the respective exchanges included the oil-and-gas sector (Oil giants Royal Dutch Shell; BP), and mining houses. The British elections in May elections could herald changes to housing policy, particularly regarding the availability of mortgages and eligibility for housing grants. UK House price growth declined during January, and the construction index faltered in an environment of uncertainty. Traditionally defensive stocks and dividend-yielding sectors were highly in demand (with telecommunications and life insurance firms clear winners). The bloody stalemate in the Ukraine has prompted the EU to impose fresh sanctions against Russia. Its sovereign bond ratings were cut to junk by S&P, following similar downgrades by Moody’s and Fitch, and its oil-dependent economy is languishing.

Asian markets ended broadly up, in line with their European counterparts. As noted in the previous commentary, a number of countries in the region benefit from the present shift in the balance of purchasing power, from oil-exporters to net oil importers. India was the jewel in the Asian region, its exchange up by a cumulative 6.37%. Japanese shares ended the month modestly higher. Across the region, transportation and defensive sectors performed well. Japanese real estate and financials lagged, with some uncertainty as to the if-and-when of a next round of quantitative easing from the Bank of Japan. Chinese equities rose, despite underlying investor jitters about the sputtering Chinese growth engine. An annual GDP growth rate of 7.4% for 2014, the lowest in 24 years, and a decline in the official Purchasing Managers Index to 50.1 (the first month-on-month contraction in since 2012) has investors weighing the impact on global growth prospects. On the other hand, China should benefit from the lower oil price, and Chinese industrial production and retail sales accelerated during January. It is anticipated that the intended allocation of Chinese foreign reserves to infrastructure spending (inter alia via the Silk Road Infrastructure Fund and the BRICs Development Bank) will further boost industrial production and lift the construction sector. Positive spill-overs to other emerging economies are likely, potentially somewhat offsetting the decline in Chinese demand for raw materials.

Whilst emerging markets remained attractive, diversified Asian countries such as Indonesia and the Phillipines have been the main beneficiaries of foreign capital flows. This reflects the increased weight astute investors’ are assigning to healthy balance sheets; currency-stability and contained inflationary pressures. Central-Europe, Latin America and African nations, suffering from the spill-overs of political tension and the commodity price slump, have experienced more uneven growth and lagged their Asian peers. Emerging Central European countries, heavily dependent on migrant remittances, are feeling the effect of Russia’s tempestuous geopolitical situation. Within Latin America, declines in commodities (oil and copper) and currency weakness saw the Brazilian BOVESPA 6.2% lower, and Chilean markets slipped 4%. The commodity-curse continues to plague a number of African markets – copper-rich Zambia and oil-rich Nigeria both faced a difficult January. Boko-Haram led violence has seen the postponement of the Nigerian general election. Continued tension in the African powerhouse and surrounding countries has investors spooked, jeopardising commitments to new infrastructure projects and property investments. The Nigerian All Share index declined by 14.7%.

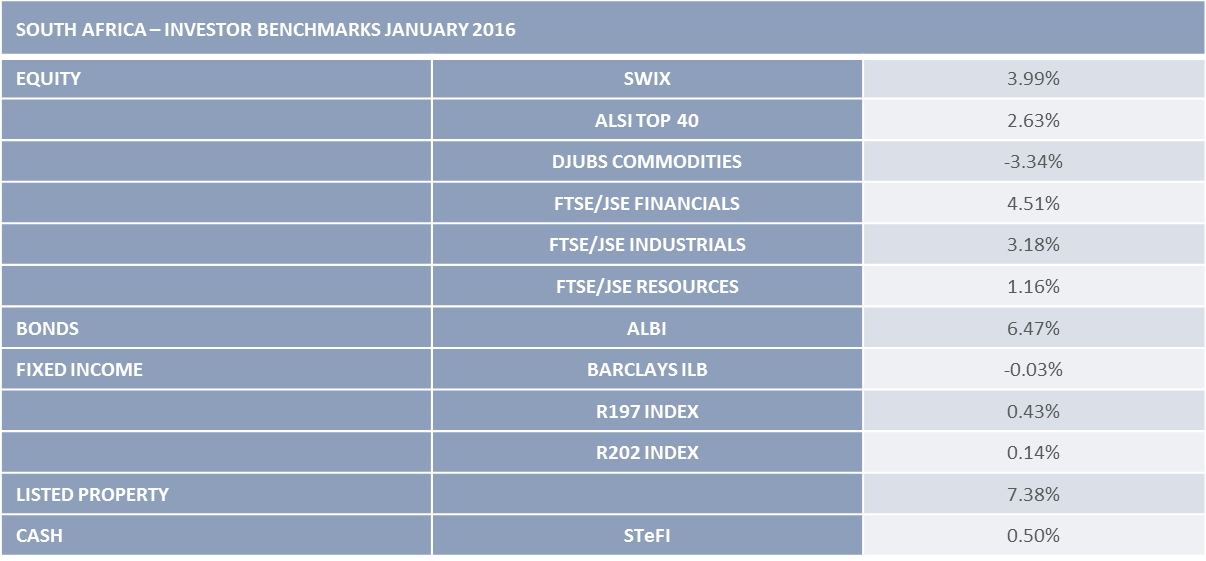

As the region’s best performer, South African markets ended the month in upbeat territory. Consumers are benefiting from the lower oil price, and the inflation outlook remains benign. Local CPI declined to 5.3%. The South African Reserve Bank, however, is maintaining a cautious stance: the repo-rate was left unchanged at the January Monetary Policy Meeting. The Bank is waiting for clear evidence of second-round consumption effects before considering a rate cut. 4th quarter GDP growth somewhat missed expectations, and the IMF has downgraded the outlook for domestic growth for 2015, partially prompted by the potentially debilitating impact of persistent power cuts. On the equity front, the JSE broke through the 50 000 mark, with Financials the best performing sector. Sliding commodity prices somewhat weighed on resource shares (nonetheless up for the month). Dual-listed defensive stocks gained, as the Rand weakened against the greenback. The domestic listed property market performed particularly well. The South African Bond market surged, with the ALBI notching up a total return of 6.47% for the month.

Sectoral

Global bonds made robust gains, with yields declining across the board: 10-year US T-bills registered the biggest drop in 3 years (from 2.17 to 1.64 for the month), closely followed by UK Gilts (at 1.33%) and German 10-year Bunds. As developed country bond yields decline, the appetite for emerging market debt has increased. The depth and stability of the South African financial market have made it a more palatable alternative to offshore investors in search of yield. Investors, however, appear to have learnt from previous bouts of emerging market weakness : capital flows to emerging markets in this round of quantitative easing have been more tempered, and more discriminative.

Commodity markets were weak in January, with the exception of gold. Both soft and hard commodity prices declined – wheat by 15%; copper by 12% and oil by 8% (bringing the cumulative decline in Brent since June 2014 to -55%). After a brief recovery, the oil price retreated again, as the new Saudi King confirmed that the present production level, and the policies of his late predecessor, would be maintained. Oil futures are therefore pricing in only a longer-run stabilisation: current projects, representing sunk costs, will be allowed to run, but investments in new projects are likely to be shelved. Gold, however, has somewhat bucked the trend, gaining 9% for the year, and breaking through the $1300 level for the first time in 5 months. The metal is increasingly attractive to investors hedging against inflationary fears and anticipated Eurozone currency depreciation.

Currencies experienced bouts of extreme volatility and divergent fortunes, as central bank policy took centre stage. In a surprise move on 15 January, the Swiss National Bank opted to abandon the Swiss Franc’s peg to the Euro. The Bank, anticipating sizeable monetary shocks in the form of ECB intervention, regarded the peg as too expensive. Intra-day, the Swiss Franc appreciated by as much as 30% against the Euro. January perhaps saw the clearest-cut illustration of the divergent trajectories of developed market monetary policies. With the announcement of the European Central Bank’s stimulus package, the Euro declined by 6.7% against the Dollar. The Bank of Japan is contemplating another round of quantitative easing, and the Yen remains under pressure. On the other hand, after the end of US QE (with a merciful whimper rather than a bang), the Federal Reserve has reiterated that it is unlikely to hike interest rates in the near-term. The Greenback has remained strong, amidst healthy US growth forecasts. In the emerging market currency space, the Indian Reserve Bank announced its first interest rate cut since August 2013 (25bps) – intra-day, the rupee appreciated sharply against major currencies. The Chinese Renminbi has appreciated by a cumulative 17% over the past 6 months. The troubled Russian rouble had depreciated by nearly 50% during the last quarter of 2014: Hit by fresh sanctions, and a continued decline in oil prices, the currency is unlikely to recover. Though most currencies declined against a resurgent greenback, in Latin America and Africa, the Real (Brazil) and Nigerian Naira were regional losers

The monetary policy interventions of Central Banks, as always, raises concerns about unintended consequences and spill-over effects. In particular, as quantitative easing continues in Europe, and potentially resumes in Japan, these nations’ respective currencies have depreciated. Deteriorating relative terms-of-trade and reduced export-competitiveness may tempt neighbouring countries (such as South Korea) to embark on similar interventions, without due consideration for the underlying economic fundamentals. A game of currency one-upmanship, though not yet evident, could be particularly detrimental to the long-run growth prospects of more vulnerable economies.

Closing comment

Markets are remarkably resilient: as earnings season draws to a close, global players are already to some extent adjusting to the new normal (slower Chinese growth, weaker commodity prices and cheap oil). Increasingly, Central Bank decisions may be the drivers of capital flows, and investors are likely to seek more forward-looking guidance from policy-makers. This will include whether a gentleman’s agreement on a mainly laissez-faire approach to currency management can be reached, and whether a graceful resolution is found to the Greek dilemma. The latter appears increasingly unlikely, and the February market mood is an edgy one.

More information?

To have the monthly International Commentary delivered to your inbox, please subscribe here.

Media contacts

For media enquiries in South Africa, please contact Courtney Atkinson via email or on +27 (0)21 673 6999.

In the UK, contact Andrew Slater via email.