International Market Commentary: December 2016

Summary – Monthly Commentary

December 2016 saw global equity markets mixed, emerging markets fall from favour, central banks remain steady and commodities mixed. Read more below.

- Global equity markets mixed:

- US markets hit new highs as underlying economic data remains upbeat, reacting positively to newly-elected President’s pro-business stance.

- Despite Brexit jitters, UK markets tick up, with oil counters supported by OPEC agreements and underlying economic data positive.

- Japanese markets modestly higher, with stock markets at +1% as relative Yen weakness supports exports. Eurozone markets mixed, but mainly higher – Italian stocks surge 13% on referendum results, despite resignation of Prime Minister. Fellow peripheral Spain ticks higher (+8%) and powerhouse Germany still strong (+7%) despite renewed security concerns.

- Year-end sentiment guided by politics rather than economic fundamentals:

- anti-populist political tensions still evident as local elections loom for France, the Netherlands and Italy closely watched, with Germany regarded as less of a wild-card. Le Pen likely to call for French referendum if elected in April. Renzi’s resignation in Italy opens the door for Grillo of populist 5-Star-Movement to call euro-referendum if elected at year-end,

- geopolitical tension escalates. A ceasefire in the Middle East tenuous at best,

- widespread security concerns on recent terror-related incidents in Germany and Turkey, and

- Trump proves willingness to test diplomatic relations with China, Israel and Russia.

- Emerging Markets fall from favour, on higher Developed Market interest rates and improved US and Eurozone growth prospects:

- Federal Reserve rate hike, likelihood of protectionist policies and lower precious metals weigh on emerging economies, amidst mixed economic data.

- Investor sentiment toward emerging Latin American mainly positive: Colombian peace deal, direction of overall economic fundamentals in powerhouse Brazil.

- Emerging Middle East and Africa remains unsettled as:

- Turkey flounders on ongoing political tension with renewed violence – Erdogan’s continued crackdown on opposition, assassination of Russian diplomat, nightclub terror attacks; Syrian ceasefire tenuous at best, and

- Emerging Africa mainly higher – ABInbev and Coca-Cola deal bolsters investor perceptions regarding ease of doing business on continent; Ghana and Nigeria outperform on copper and oil; Zimbabwean stocks 5.2% higher despite little change to fundamentals, as market signals approval of move to new exchange mechanism (bond note).

- Emerging Asia struggles, despite largely stable economic fundamentals:

- Chinese markets lag – US-China relationships look set for a rollercoaster ride and investors are wary that trade agreements could be renegotiated, while government continues to tighten regulations to prevent asset bubbles,

- Indian stock markets pare losses, but continue to adjust to banknote-shock to cash-driven economy. Markets cautious as spillover of demonetisation and Trump-politics to corporate earnings and trading prospects, budget and GST unclear, and

- Taiwan appears to find favour from US President-elect, but muted month-end gains in tech stocks as Taiwanese dollar stabilises (Hon Hai Precision, main chip supplier to Apple Inc rises only 0.7%, despite a 5% uptick in Apple shares).

- Russian equities rise sharply by +12.5% on higher oil prices, despite allegations and recriminations regarding US electoral interference.

- Latin American markets tepid, despite improved commodities and currency backdrop as well as improved Brazilian prospects

- Central Banks keep steady – acting in line with expectations:

- Federal Reserve Bank hiked interest rates by 25 bps for the first in time in a decade. Bullish tone heightens odds of less modest escalation in 2017.

- Bank of England maintained interest rates and stimuli unchanged, citing more dovish global growth prospects and slight upward momentum in inflation.

- European Central Bank announced modest easing of size of QE programme from April 2017 and extends duration to December 2017.

- Bank of Japan keeps rates steady, with inflation continuing modest improvement.

- US Treasury yield curve shifts higher as interest rates rise across the curve, high yield and investment grade credit spreads tighten, as do spreads to Emerging Markets (EM) bonds with:

- EM sovereigns facing tighter spreads and borrowing cost, ratings agency action on reform laggards,

- banking and financials favoured by prospects of higher profit margins and easing of European financial stability concerns,

- oil price increases favour high-yield bonds, and

- pharmaceuticals or healthcare issuance remaining subdued post Clinton loss, on Obamacare uncertainty, but ticks up.

- Commodities mixed: Energies continue upward trend, boosted by OPEC agreements, precious metals soften appetite for industrial metals stabilises and ticks up as Chinese prospects improve.

Key Indices and Economic Indicators

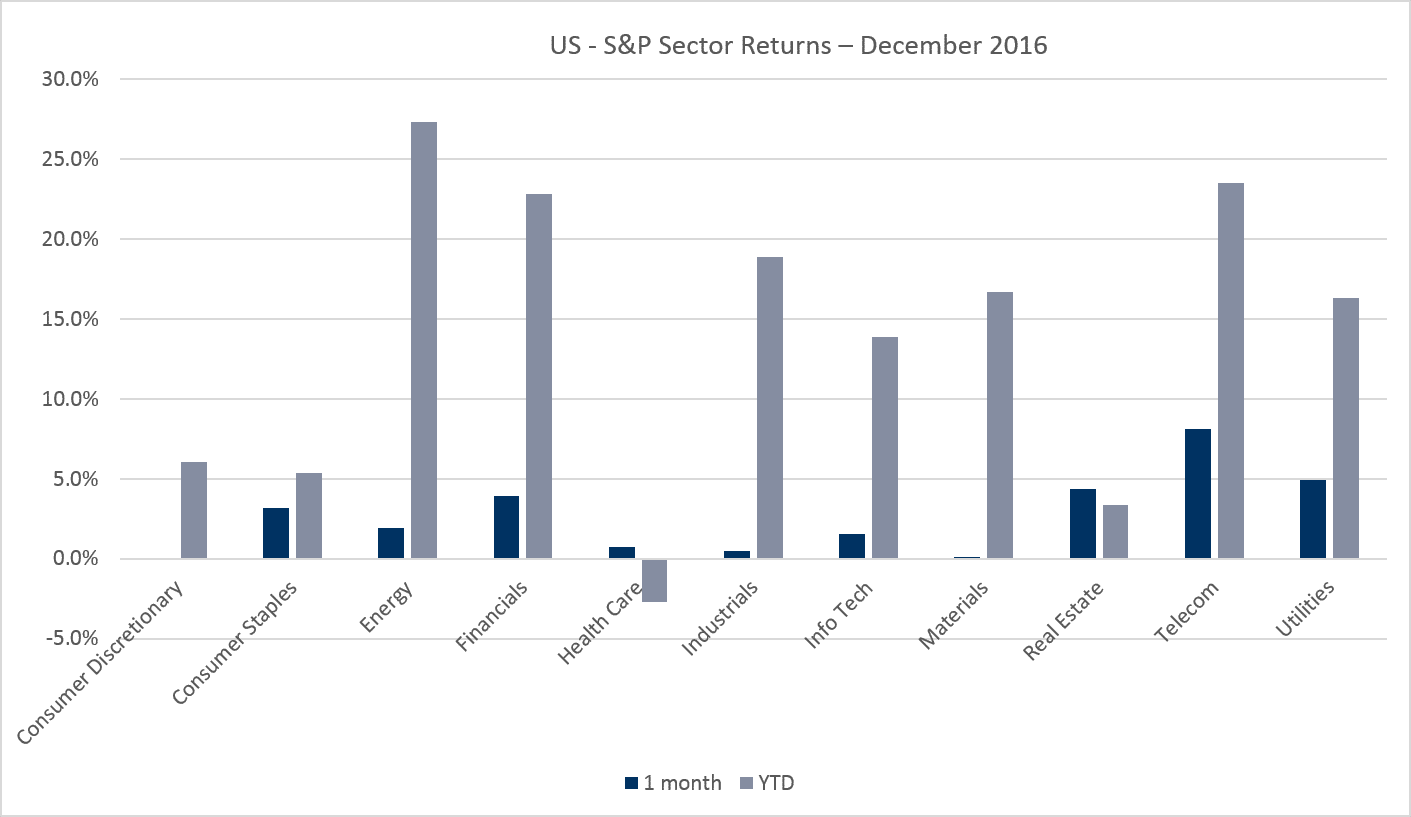

Sector Returns

Healthcare, the only negative sector for the year, while Energies and Financials outperform. Defensive sectors favoured during December, as interest rates rise.

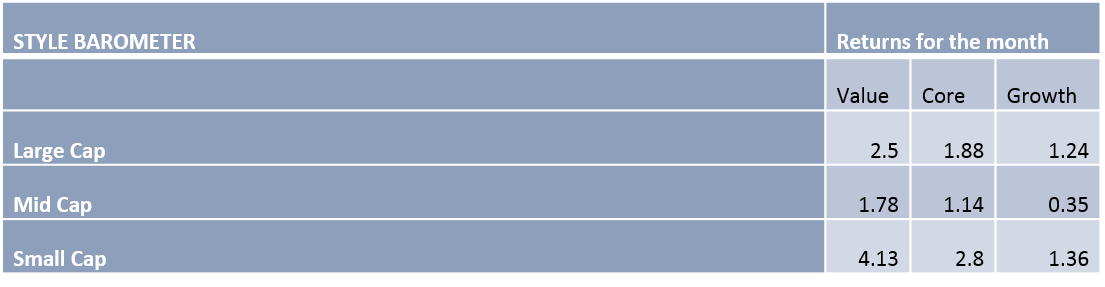

Style Returns

December 2016 saw global equity markets mixed, emerging markets fall from favour, central banks remain steady and commodities mixed

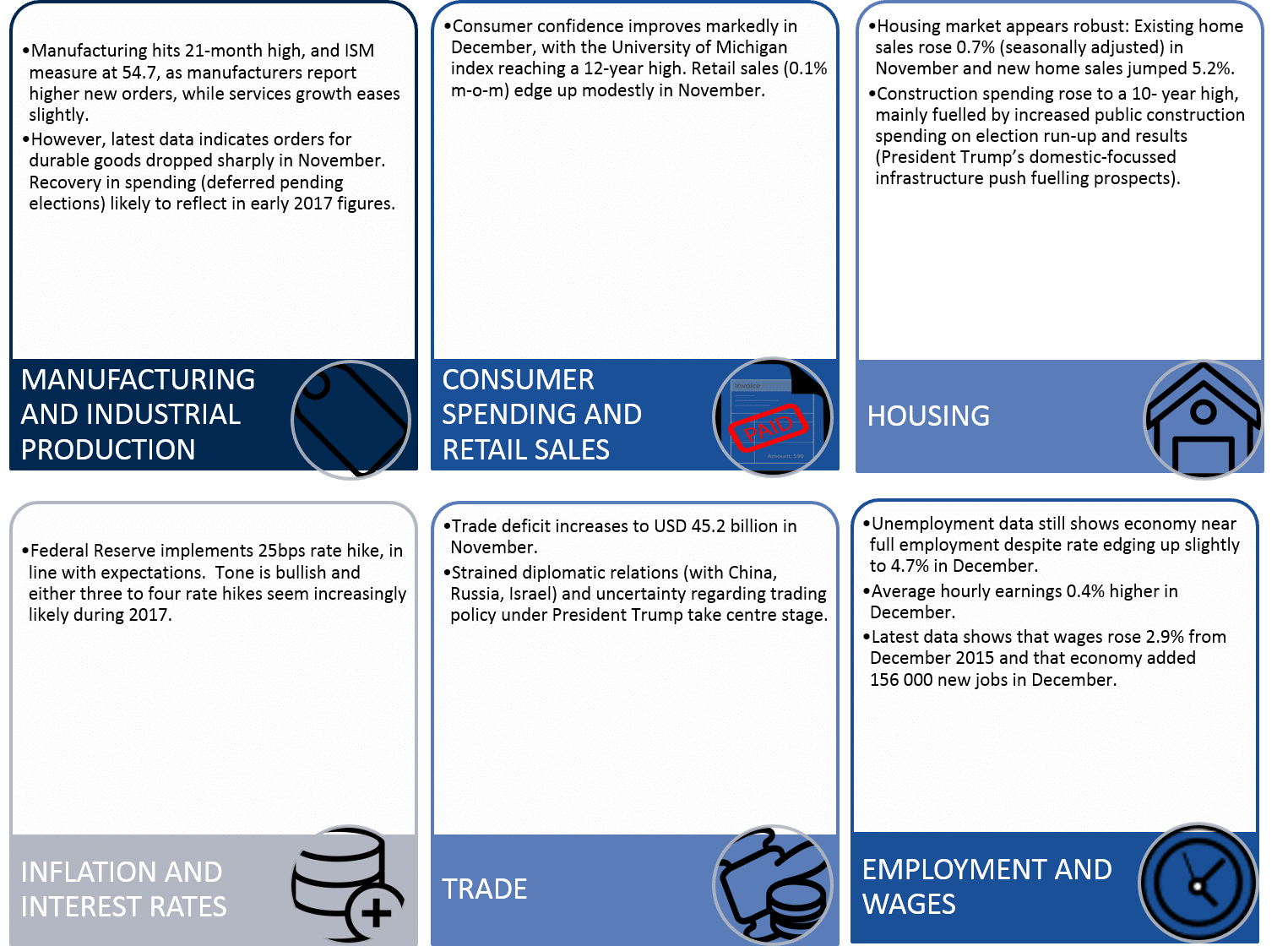

US

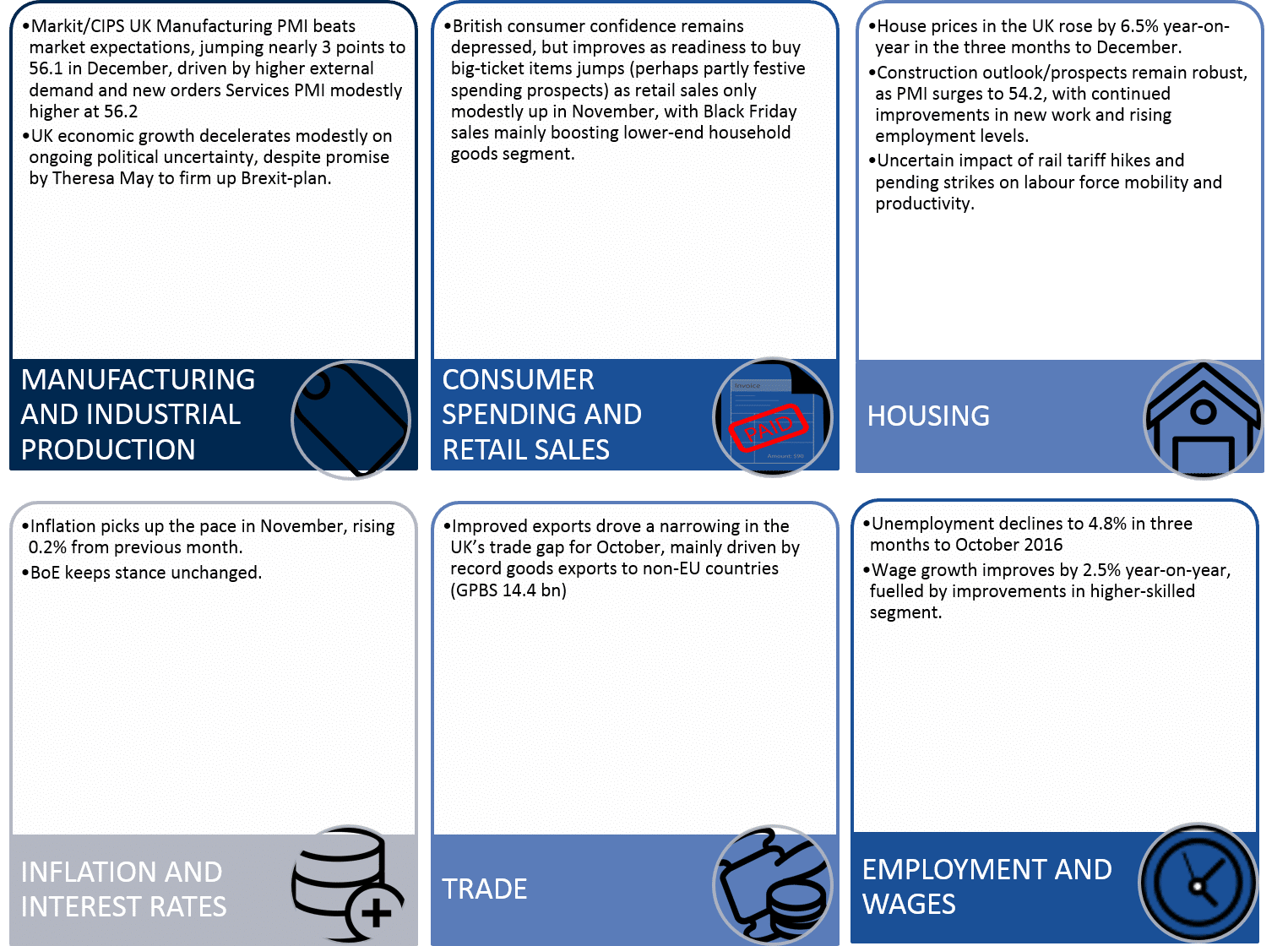

UK

Eurozone

Japan and China

South Africa

Emerging Markets

Monthly commentary – Commodities, Currencies and Fixed Income

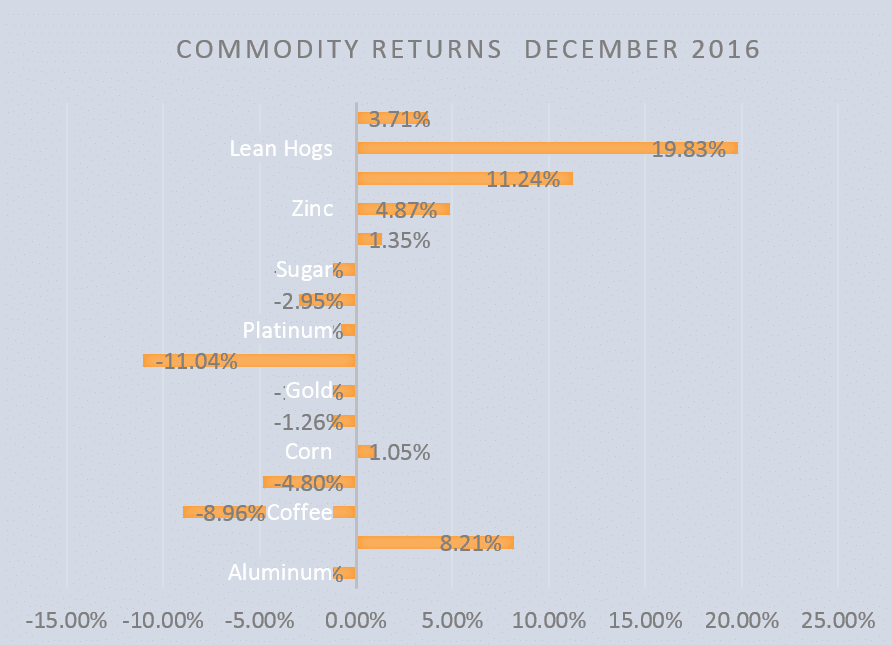

The Bloomberg Commodity Index strengthened modestly in December, showing a gain of under 2%. Gold prices continued to slide, as the dollar strengthened (the trajectory of the gold price has historically been inversely linked to the dollar index – gold is priced in dollars and the opportunity or relative costs of holding the physical asset increase when the dollar appreciates). The Federal Reserve Rate hike and prospects for further increases in 2017 has dimmed the relative appeal of non-interest-earning safe-havens. Despite investors seemingly undecided on what President Trump’s incumbency will hold, his pro-growth, pro-business sentiment will likely weigh on spot prices for the short-to-medium term. After a sharp bounce-back in 2017, gold saw gains pared at year-end. It closed December 2.19% lower, but gained a cumulative 8% for the year. Views on commodity prices’ trajectories are typically divergent, but a bullish sentiment seems to hold for 2017. Analysts cite demand-side factors which include the lingering safe-haven appeal against a backdrop of still-elevated political risks and potentially destabilising electoral outcomes and looming supply-side constraints.

Annual production might be near a record, but mining supply is expected to dwindle by 2019. The number of new finds (low hanging fruit) has declined sharply in the past decade by 85%, at a time when companies have cut their exploratory budgets. In general, capital expenditure was curtailed sharply after the 2011 slide, meaning that existing mines may have seen their life-spans shortened considerably (minimal maintenance) while few new mines or shafts were explored. The combination of fewer discoveries and reduced mine life has eaten into major producers’ reserves (a 40% dip since 2011).

The desire to replenish reserves, while avoiding the uncertain prospects of new ventures, has led to a wide-spread resurgence in Merger and Acquisition (M&A) activity – more deals have been made for bullion producers in the past year (at USD 16.5 billion) than in other commodity sectors including for beleaguered diversified mineral or diversified metals companies. M&A has been an actively pursued overall strategy, with a number of South African companies seeking diversification opportunities. Sibanye’s recent announcement that it would pay USD 2.2 billion for US-based Stillwater Mining Company. This acquisition sees the SA miner take charge of the highest grade deposit of platinum-group metals globally.

This builds on the company’s previous acquisitions of platinum assets from Anglo American Platinum and Aquarius Platinum. The backdrop of consolidation and cost-cutting is likely to feed into the anticipation of tighter supplies in many other base metals too. The platinum sector, under close scrutiny, has already seen considerable restructuring and far-ranging cost-cutting measures. The aluminium subsector saw the second largest number of M&A deals in 2016 (USD 12.5 billion). Platinum closed the month just over 1% weaker, but ended the year a relatively modest 1.3% higher. However, the biggest annual gains were recorded for industrial metals. Copper gained 16% for the year, palladium surged by 23%, zinc gained over 50% and iron-ore leapt nearly 81% over the course of the year. The iron ore rally continued into December, spot prices posting gains of 6.7%.

The story has been dominated by China – fears around an asset class bubble and hot money flows notwithstanding, supply and demand-side factors have played their part in the rally. Chinese President Xi Jiping’s supply-side reform programme has seen efforts intensified to cut capacity in crowded sectors such as coal and steel, sending metallurgical coal prices higher. Notably stricter rules around emissions, especially in the pollution-plagued major cities have simultaneously prompted many mainland steel-mills’ to substitute high grade iron ore for metallurgical coal in a bid for greater efficiency. The latest round of headlines – Chinese cities choked by smog – may spur a further environmental crackdown and keep iron ore prices elevated into 2017. A slowdown in copper prices (December saw a -4.8% decline) accompanied the USD rally, perhaps also reflecting analysts’ overall caution on hedging positions (open interest and long positions on copper remained at record highs, and may need to stabilise somewhat).

Energy prices maintained their upward momentum, with OPEC commitments to reduce supply reiterated over the course of the December despite some scepticism. Brent crude, having registered 18 months highs, closed the month 8.21% up and registered a 25% gain for the year. Gains were slightly tempered at on month-end reports that US crude inventories had risen unexpectedly, but the impact was muted (with trading light on the last days of the year). A noted red flag as to the de facto commitments to OPEC cuts, was the organisation’s November monthly report, released mid-December. It showed that the group increased output by 150 thousand bpd in November. This implies that production would need to be cut by more than had originally been envisaged (1.37 million bpd versus 1.2 million) in order to reach its 32.5 million cap – a cap which had already proven a hard sell to many member states. With a meeting scheduled for the 21-22 January 2017 between OPEC and non-OPEC producers to discuss compliance, the Kuwaiti authorities, amongst others, have moved to reassure markets that the bloc would be able to report that it was on track. Anecdotally, the state-run Kuwait Petroleum Corporation had reportedly told customers it would implements cuts on vessel loadings from 1 January 2017. This reassurance should perhaps be seen in juxtaposition to earlier unconfirmed reports that Iraq’s national oil company, in turn, had drawn up detailed oil-shipment programmes which showed plans to increase loadings by 7%.

Aside from concerns about compliance, it was previously noted that US shale producers would try to ramp up production, dampening the short-to-medium run impact of supply cuts. The latest forecasts from the Energy Information Administration predict that January will indeed see the first monthly increase since April 2015. The active rig count has also been rising steadily since June 2016, with 21 new rigs added in the first half of December. Predictions forecast that the US’s so-called shale-boomers would be quick to capitalise on any give from OPEC. The broad agricultural subsector saw further coffee and sugar prices decline (-8.96 and -1.47% respectively), with soybean and soybean oil erased prior month gains (-3.72 and -6.94% for December respectively). Grain prices and livestock were the exception, but remain substantially lower for the year to date: both corn and wheat posted just over 1% for the month, but lost roughly 10% and 25% over the course of the year; livestock (cattle and lean hogs) posted an average 10% for December, but lost 5.63% cumulatively in 2016. Overall, a pullback from hedge funds is weighing on demand for soft commodities (including coffee), while improved weather conditions and crop prospects (supply side factors) add to the overall agricultural price-weakness.

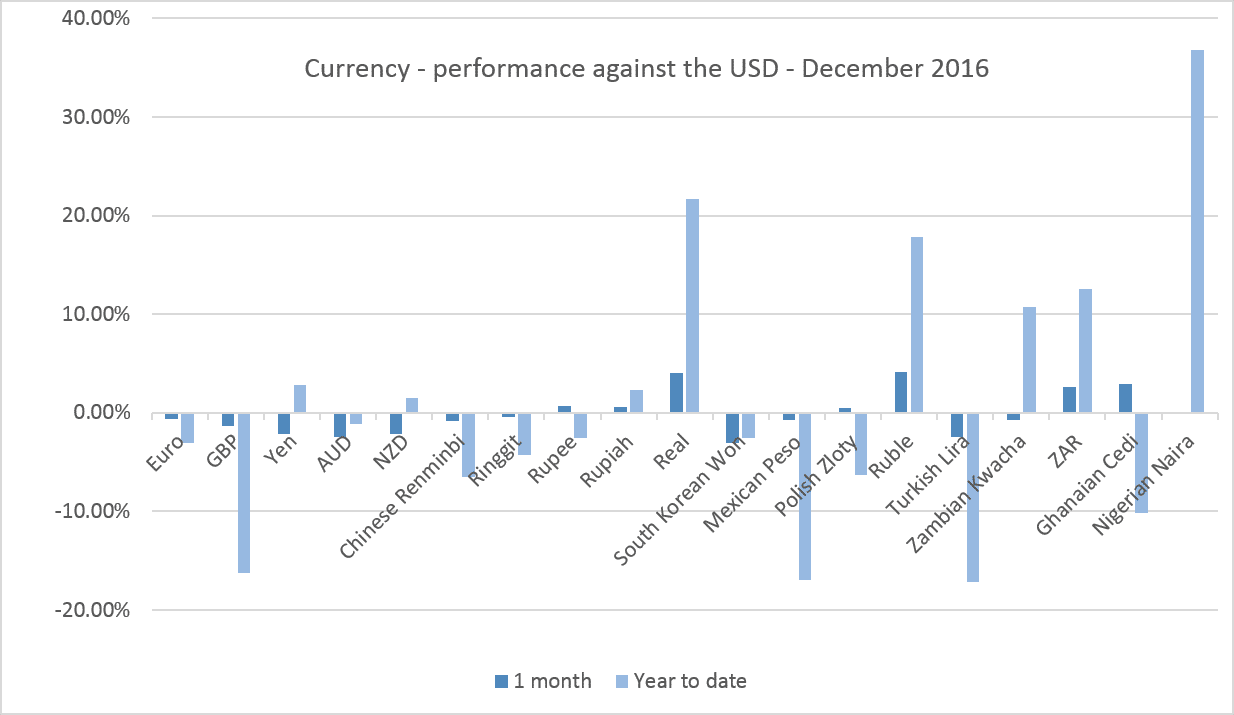

The US dollar index continued its Trump rally, gaining 0.7% in December and trading at a near 14-year high. Peer currencies’ performances in both Emerging and Developed market peers was mixed. Commodity-linked developed market currencies were poor (Australian and New Zealand dollars losing between 2.1 and 2.4%, more or less in line with the gold price), while Japanese exporters welcomed the -2.2% depreciation of the Yen. Having clawed back some ground after its Brexit induced crash, the Pound dipped again in mid-December as it was announced that Article 50 would be triggered in time for the March 2017 deadline. The Rouble continued its rally, in line with global oil prices, and closed the month 4.2% higher against the USD. A sour tone to diplomatic relations – with 35 Russian diplomats expelled and sanctions sharpened – pared currency gains. The Rand was one of the better performing emerging currencies. It strengthened after the S&P ratings reprieve, wobbled mid-month on global developments, and ended the year near a two-week high supported by a softer dollar and a narrowing trade deficit. After the December 2015 crash, the relative stability was welcomed by investors, and the unit managed a nearly 12% improvement over the course of the year. A number of emerging and developed market policy-makers have recently proven their willingness to step into the management of their currency regime. Devaluations were implemented for the Egyptian Pound and the Nigerian Naira, the Chinese exchange rate regime moved toward a managed float and more subtle measures included the Bank of Japan’s ramp-up of its ETF purchase programme. Market participants will remain wary of beggar-thy-neighbour policies and geopolitical fall out in the currency space. The possibility of surprise moves has been highlighted by the under-the-radar intervention of Chinese authorities. On 30 December, the Central Bank suspended three banks from conduction some foreign exchange business (including liquidations of spot positions). Authorities had previously warned banks that it would block arbitrage channels if they continued to engage in lucrative carry trade (with spreads widening post the August Yuan devaluation). The move is seen as a measure which will temporarily ease foreign exchange buying pressures and ease depreciation pressure. It should also ease the speed of the drawdown on the foreign exchange reserves, which have dropped by USD 400 billion as authorities supported the Yuan. The unit has been under increasing pressure since November, with the onshore unit losing 1.44% and both onshore and offshore units hitting five-year lows, fuelling speculation that Beijing would permit further deprecation. Potentially destabilising beggar-thy-neighbour currency and trade policies will be under the spotlight in 2017.

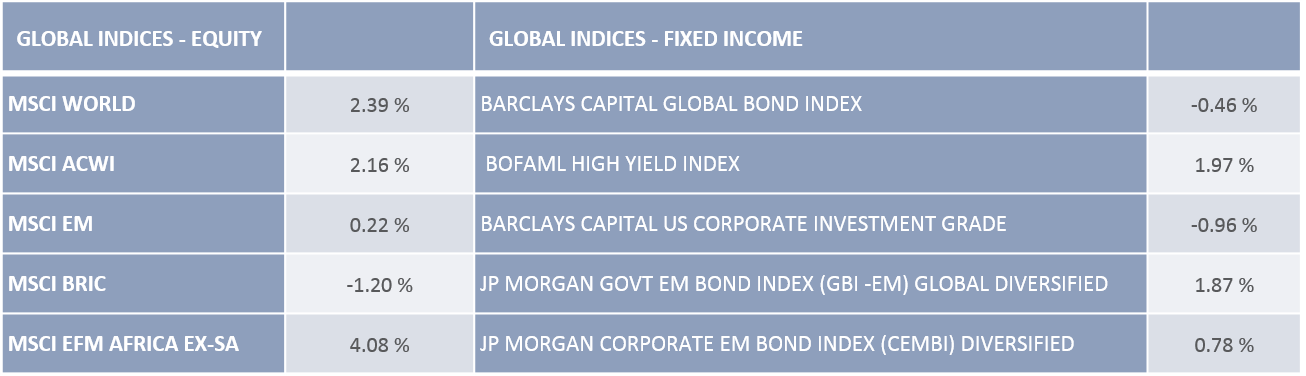

In bond markets the widely-expected Federal Reserve rate hike (25bps) eased some of the selling pressure on government bonds. The yield on 10-year US T-bills rose 6bps to 2.44%, while UK Gilt equivalent yields fell 18bps to 1.24%, with 10-year Bunds ending the year in positive territory at 0.21%. Peripheral bonds were boosted by the outcome of the Italian constitutional referendum, which saw Prime Minister Renzi resign and the news that the Italian government would step in to bail out troubled bank Monte de Paschi de Siena. Financial markets were further reassured as to the systemic stability of the European Banking system by the lower-than-expected settlement reached by Deutsche Bank with the US Department of Justice. The lawsuit against Deutsche is one of a string brought by the Department against European Banks (including Barclays, Credit Suisse) for mortgage-related loan offences and sparked concerns regarding spill-overs and the systemic vulnerability of the European banking system. The interim agreement of USD 7.2 billion is considerably lower than authorities had asked for (USD 14 billion) in the initial filing.

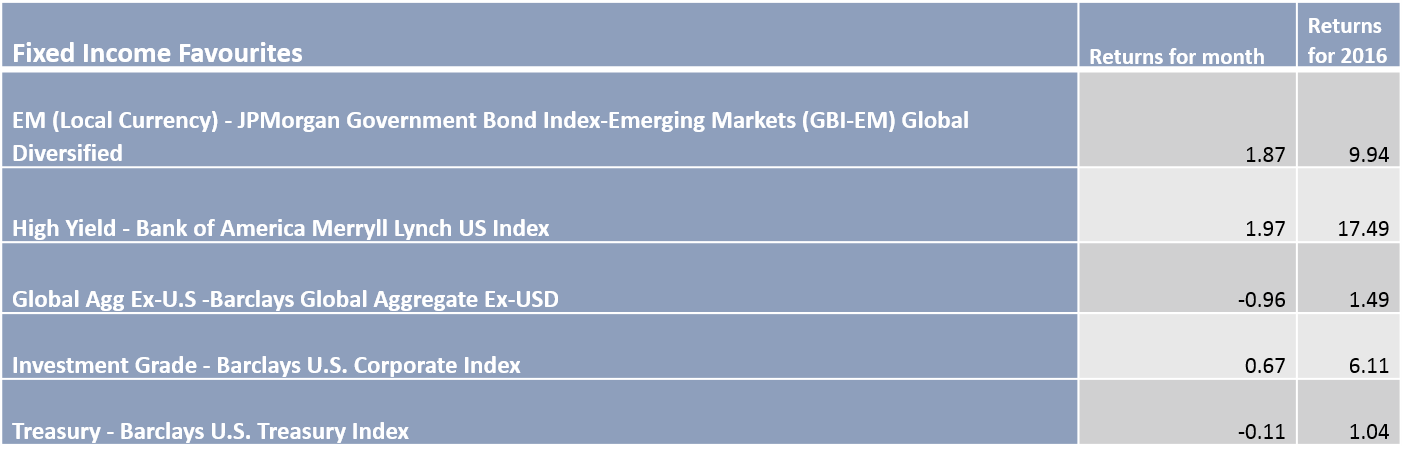

The European Central Bank’s announcement that it would extend the duration of bond purchases to December 2017, but reduce it by €20 billion from April, proved to be generally supportive of European bonds. EU Government Bonds Corporate bonds outperformed, their US counterparts for a monthly total return of 0.29%. However, the return on Emerging Market Government Bonds – 1.87% for December – continued to easily outstrip developed and less risky peers despite a narrowing credit-spread in December. Similarly, high yield bonds continued their ascendency, with US high yields providing a return of 1.97% for December, versus the 0.67% of US Corporate Investment Grade. Easing concerns on tougher measures in the healthcare sector following Hillary Clinton’s loss, subsequent renewed activity in the biotech and pharmaceutical space and the rise in energies, provided further support for high yield bonds. The riskier fixed income asset classes emerged as clear favourites in 2016, within the still-benign but Fed-hike-poised interest rate environment. US high yields outperformed at just over 17% for the year, closely followed by Emerging Markets Sovereigns’ with a jump of just under 10%, with US Investment Grade returns 6.11% for the year, US T-bills generated 1.04% and European Union Government Bonds against the backdrop persistent near-and-below zero rates, and consecutive periods of negative yields on German Bunds, for example, sustained a -1.33% loss.

This year is likely to see significant volatility in fixed income. Populist politics is at the forefront of investors’ minds – Europe will see a number of key elections; Theresa May is set to announce the plan for Brexit and newly-inaugurated President Trump will begin implementing US policy changes. Geopolitical noise too remains elevated, with ongoing tension amidst oil-producers and in the Middle East, Emerging Europe and Africa. While there are direct spill-overs, for instance into the energy-dominated high yield market, the more subtle unintended consequences as to risk-appetite remain more difficult to predict.

Additional Insights

Monthly commentary – South African Asset Classes

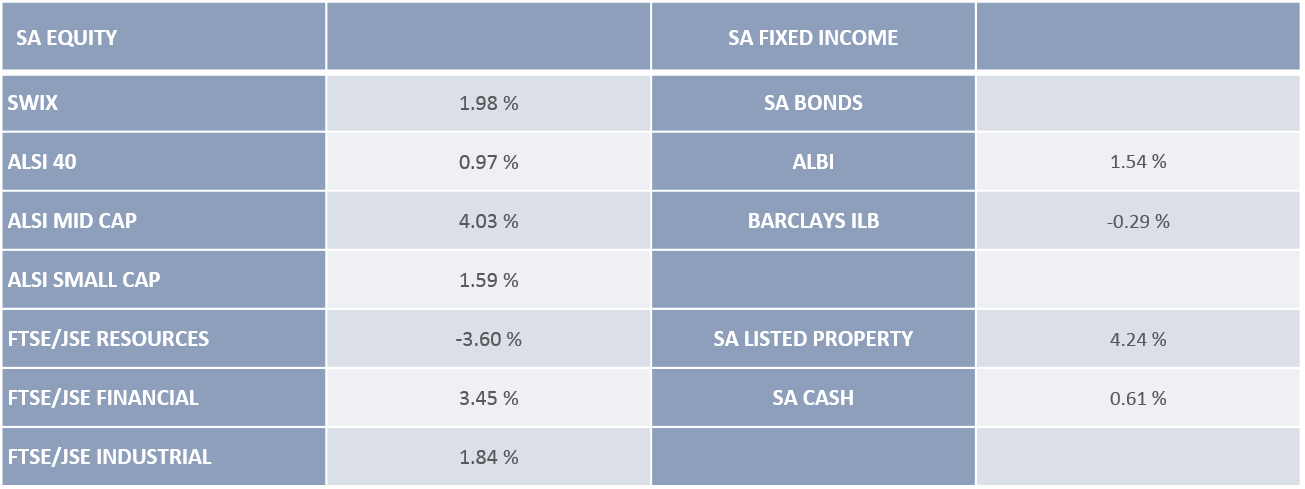

South African equities lagged developed market peers, but outperformed a broad basket of Emerging Market peers – the All Share gained 0.97% (the MSCI World and MSCI EM returned 2.39% and -0.22%). South African equities, as with global counterparts, had a somewhat roller-coaster year, but ended in the black with a cumulative gain of 4.13% for the SWIX. Company news was fairly thin on the ground and there was a welcome lull in domestic political noise. Investors therefore took most of their guidance from developments abroad. Although the resource sector slumped from prior-month highs, the sector is still the year-to-date winner closing 34% higher. December saw a -3.6% return to the subindex, as a number of mining counters struggled. AngloGold saw additional pressure arising from industrial action. The resource sector slumped from November’s high, losing -3.6% in December. However, the widely noted resource story remains clear with resources up 34.24% for the year. Gold prices lead the rally, gaining 21.7% for the year: Safe-haven buying may have pulled back sharply after the initial kneejerk reactions to Brexit and US elections, but the outlook remains positive. Uncertainty around the implementation of Trump’s policy stance is likely to spark further safe-haven buying, despite the backdrop of rising interest rates.

South African Financials and Industrials posted solid returns in December, up by 1.84% and 3.45% respectively. A stronger, relatively stable Rand and the ratings reprieve boosted South African Financials. Industrials, particularly Rand Hedges, fell. However, the sub-index pared losses at month-endas Naspers jumped on positive moves at its biggest asset Tencent (the launch of an improved WeChat and the expansion into digital mapping). The Shoprite and Steinhoff merger, to create Retail Africa, was announced formally mid-month. Shoprite acquires Steinhoff’s Africa operations, including the clothing chains Pep and Ackermans, and the furniture and appliances holdings via JDGroup, in exchange for shares. Markets reacted unfavourably, dual-listed Steinhoff slumped 7% and retail giant Shoprite dropped 10% in the immediate aftermath, though paring back losses toward month-end.

In a reflection of the difficulties still facing SA consumers, the latest figures show that retail sales declined by an unexpected 0.2% in October, with retailers in household furniture, appliances and equipment seeing a sharp 6.4%. The construction industry has seen a remarkable recovery in share prices in 2016, despite being haunted by the fall-out from the 2013 bid-rigging scandal and struggling to effectively gain from widespread downsizing due to tougher domestic conditions. The share prices of six listed construction companies increased by over 30%, with Aveng leading the pack. The package of remedial measures which companies undertook to repair reputations and relationships with government included the demonstrating serious commitment to transformation. Markets greeted these developments positively, rewarding the Aveng announcement that 45% economic interest in Aveng Grinaker-LTA would be sold to Kutana Construction (a female-owned emerging black construction company) and Murray and Roberts’ 100% sale of local construction and building operations to black-owned Firefly Investments. Spillover-expectations from Trump’s infrastructure push may mean that the subsector and related industries are well positioned for 2017.

Fixed Income assets were mixed in December: The All Bond Indices (ALBI) gained 1.54%, taking top spot of performing SA asset class for the year (cumulative 15.42%); The Barclays Inflation Linked Bond (ILB) index, on the other hand, a modest -0.29% lower, for a year-to-date return of 6.27%. The month kicked off with a ratings reprieve – on 2 December Standard and Poor’s (S&P) confirmed the country’s sovereign credit rating at one notch above junk status, albeit with a negative outlook – and local bond markets bounced back from November lows. Foreign investors continue to turn to the relatively deep and liquid South African bond markets in the ongoing search for yield, despite a somewhat changed climate of lingering EM risk aversion and rising US interest rates. The initial shock of Trump’s victory has dissipated, while renewed terror attacks and geopolitical uncertainty in Middle Eastern economies (namely, Turkely) and a relatively stable period in domestic politics added to the relative appeal of SA bonds. Recent figures suggest that foreign rand-denominated government bonds comprised about 40% of local currency government debt. Analysts remain concerned about the potential impact of large and unpredictable outflows. Historically, foreign investors are more sentiment-prone and quicker to reallocate cash than domestic institutional investors are. Managed offshore funds with predefined allocations to SA bonds are also more prone to relatively uniform rebalancing, potentially resulting in substantial flows. During the first week of December an additional net foreign outflows of R4.6 billion, was added to the November sell-off (R15 billion from SA bonds ahead of the US Federal Reserve hike and S&P ratings review). Bond investors remain wary, as analysts price in a strong chance that rating agencies downgrade the country’s debt to sub-investment grade by June 2017.

SA listed property gained 4.24% during December. The asset class maintained double-digit year-to-date returns of 10.20%, but relinquished its three-year reign as top performing asset class. Despite a slow-down in acquisition&A activity and a sluggish global and local economy, the sector still raised more than R32 billion in new equity during 2016. The R3.8 billion listing of the Liberty Group’s property offering Liberty Two Degrees (L2D) constituted a significant portion of local raises. The majority, however, was accounted for by listings of offshore-based companies: notable entrants included Eastern European-focused Echo Polska Properties, and FTSE stallwart Hammerson. Significantly, Hammerson’s market cap at listing was R 91.6 billion, of the R 731 billion JSE Real Estate sector, and 2017 is likely to see further listings from offshore-based companies searching for yield in still-low interest rate environments.

The announcement of a deal between New Europe Property Investments (Nepi) and Rockcastle Global Real Estate is viewed as the first sign of the global M&A reawakening in this sector. The deal will see the establishment of NewCo (NEPI Rockcastle, which is set to become the largest listed real estate company on the JSE and the sixth largest in Continental Europe). The Department of Public Works has started to renegotiate its leases with the Public Investment Corporation (as part of the government’s drive to manage a medium-term saving of R25 billion), after an internal investigation had highlighted half of the portfolio was subject to rental rates nearly 45% above market-related prices. The new property management strategy includes renegotiation of leases, property disposals and acquisitions, and aims to save at least 20% in the immediate term. Prudent management teams and landlords may be able to take advantage of some opportunities arising from the reshuffling of the government’s R112 billion domestic property portfolio. However, effective foreign exposure and political risks require close monitoring.

South African inflation rose in line with market expectations for November, ticking up 6.6% year-on-year. Food price increases remained elevated at 11.8%, despite a welcome moderation in maize prices – maize declined between 15% – 20% since February – and some respite from the drought. Some dam levels are reported to be at 60%, a three-year high, and farmers have welcomed the respite. Food price inflation is estimated to have peaked in Q4 2016, as the El Nino effect dissipates. Prospects for transport and petrol-price inflation are less predictable. The transport component was another key contributor for November: the lagged impact of currency weakness has kept vehicle price inflation (and service and maintenance costs) high, and a 25 cent hike (net over November and December) kept it costly to keep the wheels turning. The impact of OPEC agreements on South African pump-prices is difficult to foretell, particularly given currency volatility – a 50 cent hike in early January promises little relief for South African drivers. Despite political and geopolitical uncertainties, the South African Reserve Bank has maintained a fairly benign stance. Inflation is anticipated to return to within the 6% upper limit in 2017 and the bank has again hinted that the tightening cycle is near its end. Cash (STeFI Returns) earned 0.61% for December, for a full-year cumulative return of 7.42%. The Rand was one of the better performing emerging currencies. It stabilised after the S&P ratings reprieve, wobbled mid-month on global developments with developed market rhetoric and geopolitical risks heightening EM risk aversion. The currency also managed to weather the decline in the gold price (-2.2% for the month) better than other commodity-currencies (both the Australian and New Zealand dollars fell in line with gold prices) and ended 2016 near a two-week high (supported by a softer dollar and a narrowing trade deficit). After the December 2015 crash the relative stability was welcomed by investors, and the unit managed about 12% improvement in 2016. Investors have taken heart from a ratings reprieve, but are at best cautiously optimistic about SA assets. The still-sombre economic data releases, with unemployment at a new peak of 27.1%, highlight the importance of meaningful structural reform. Domestic political noise is likely to be elevated in mid-2017 as the ruling party approaches its leadership conference. The first half of 2017 is anticipated to be relatively quiet – measured against the extremely volatile geopolitical situations in emerging market peers, such as Turkey and Russia. Surprises notwithstanding, nimble allocators can take advantage of significant pockets of return in SA Inc.