International Market Commentary: December 2015

International Market Commentary: December 2015

11 Jan 2016

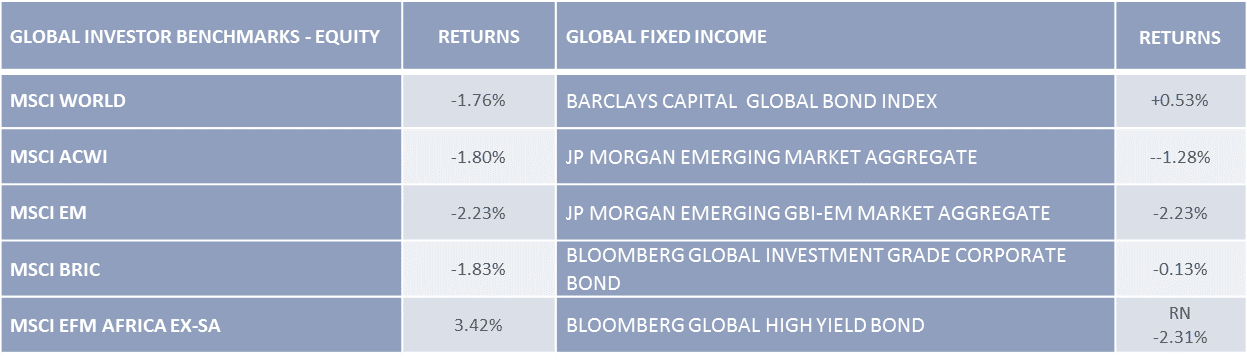

- Traditionally-quiet December was lively on policy action:

- As anticipated, the Federal Reserve hiked rates;

- The ECB expanded its quantitative easing, but markets were disappointed; and

- South Africa’s ministerial merry-go-round induced a mini-crisis.

- Chinese hard landing fears resurface toward month-end, with little respite for commodity-dependent emerging markets.

- Oil price volatility spills into equity markets, limiting the hope for a Santa-rally.

Introduction

December bucked the traditionally-quiet holiday trend. The month was marked by notable Central Bank action. As the Federal Reserve Bank embarked on its much-anticipated interest-rate normalisation, a number of emerging and developed peers followed suit. In contrast, the European and Japanese Central Banks moved to expand easing measures, though markets were disappointed by the extent of the stimuli. Global investors were perturbed by a South African Cabinet reshuffle, and the simultaneous downgrades in credit ratings to another Emerging Market heavyweight, Brazil. Toward the latter part of a month relatively light on economic data, stock and bond markets were tightly correlated to movements in oil and commodity prices. Volatility was heightened, against a backdrop of flaring geopolitical tension in the Middle East, and renewed concerns regarding an ongoing oil-supply glut and a slow-down in Chinese manufacturing.

US Markets

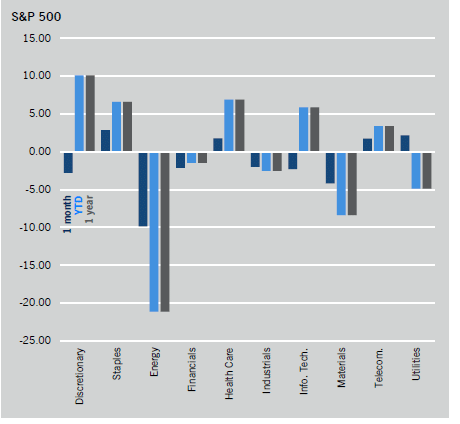

US equities and bonds closed lower in December, rounding off a turbulent 2015. The S&P500 closed -1.58% lower. The Federal Reserve, after months of building expectations, implemented a 25bps rate hike – its first since 2006. Markets had been pricing in the increase, and the reaction was largely favourable. An important rider to the hike: continued reassurance from Federal Reserve Chair Janet Yellen that the path of normalisation will be slow and steady. Macroeconomic fundamentals continue to show improvement, with the Federal Reserve predicting further tightening in the labour market, and concomitant upticks in real wages and inflation. Labour market data was somewhat mixed during the month: Unemployment remains at a record-low of 5%, and the broader measure (which includes workers who are employed part-time, but seeking full-time employment) is at 9.9%. At the height of the recession, the respective measures attained levels of 10 and 17.1%. In a blip on the otherwise positive picture, data from the US Department of Labour showed that first-time claims for unemployment had risen for the first time in 6 months. The number (287 000), however, remains low by historical standards, and readings are known to be volatile during holiday-periods. Indeed, the latest release from the US was resoundingly positive: the labour market capped off a robust year, adding 292 000 non-farm payrolls in December. Sentiment elsewhere was somewhat mixed: The ISM Chicago general business barometer fell to a 6 ½ year low, and the Chicago Purchasing Managers Index (PMI) came in at a 42.9 for December, a significant contraction from November’s 48.7 (and the level below 50 indicating contraction in manufacturing). The non-manufacturing sector, however, remains robust, as does consumer sentiment. The University of Michigan Consumer Sentiment survey ticked up, as did the December Conference Board Index. Consumer sentiment, driven by improved personal finance, is in the ascendant going into 2016. Strong household consumption, and strong service sector growth, is likely to drive market gains in the new year. Spending on big-ticket items remained robust, with auto-sales rising nicely, and the Case-Schiller House Price Index increasing more than expected. Toward the end of the year, with the first rate hike done-and-dusted, and light on economic news, markets were tightly correlated to notably volatile oil and commodity prices. Energy stocks were the worst performers for the month, with no reduction in the US and global supply glut in sight. Materials and Information Technology lagged, as elsewhere. Health care and consumer staples, and traditionally defensive utilities, were amongst the strongest performers. Consumer staples, after initially disappointing foot traffic in stores in the run-up to Christmas, were boosted significantly by online-sales figures in the latter part of the month. The sector returned 2.86% for the month. In the healthcare sector, hospital stocks were boosted by a wider-than-anticipated uptake of the subsidised health care insurance (dubbed Obamacare), and by merger and acquisition news. Baxalta, in the biotechnology sector, indicated entertaining advances from a wider offshore audience, including UK-based firm Shire; the merger between Pfizer and Allergan remains on the cards; and Dow and Dupont announced an intended merger. Large-cap stocks easily outstripped their small and mid-cap brethren.

US Sector returns

Source: Eaton Vance

The Eurozone

European equities ended the month lower, and underperformed the US. The muted end to the year is partly a reflection of still-lingering disappointment with the ECB stimuli measures implemented in early December (as per previous commentary, markets were underwhelmed), but also reflect caution on global growth, the implications of US rate rises and continued global terror threats. The Stoxx All Europe ended December -5.02% lower, with the MSCI Europe -2.57% lower. The DAX declined by -5.61%, with the heavyweight German bourse somewhat underperforming peripheral markets such as Italy (-5.47%) and Spain (-3.32%). Eurozone economic data was largely positive over the quarter, despite the December lull. The region remains in expansionary territory, with the Markit Composite Purchasing Manager’s Index (PMI) at 54.3 in December (an improvement on November and above expectations). Data suggests that, despite tough global conditions, growth in the 4th quarter was the fastest in 4.5 years. Annual inflation ticked up in November to 0.2% for the zone, and unemployment remained at 10.7% in November. The increases in staffing levels in Germany, Italy, Spain and Ireland are particularly encouraging Less impressive perhaps, but nonetheless signalling a turnaround: levels of staffing in laggardly France remained stable, after three consecutive months of job cuts, and after posting 18-year highs in the 3rd quarter. This does speak to concerns about the unevenness of the recovery: regional leader Germany powers along, and a number of peripherals are leap-frogging (Spain, Italy). Germany posted a 20.6 billion trade surplus in November, with imports growing by 5.3% and exports by 7.7%. The country’s motor manufacturing sector has recovered remarkably well from the Volkwagen emissions scandal. Indeed, Eurozone auto-demand has been extremely strong, with new passenger car registrations increasing by 13.7% year on year in November. This is regarded as a key indicator of healthy consumer appetite and sentiment, as well as of still-easy credit conditions. The German Ifo Business Climate Index, however, ticked down slightly in December to 108.7 (from November’s 109). On a stock and sector level, as elsewhere, energy and basic materials led decliners. Traditionally defensive sectors such as utilities and healthcare proved the most resilient. Political tension remains elevated in the EU: while shared security concerns are a unifying element, increasing anti-migrant and anti-austerity sentiment will test Union’s leadership. Recent inconclusive general elections in Portugal and Spain are indicative of ground-level tension. In Spain, two new parties took a significant share of the vote, with the anti-austerity Podemos party making substantial gains. France, in turn, narrowly avoided a right-wing take over as the National Front came up short.

The UK FTSE ended -1.71% lower. Resources, mining heavyweights and oil-and-gas companies nursed hefty losses for the year and the FTSE, indeed, has experienced its worst year since 2011. The commodity price route, spurred by Chinese growth concerns, saw Anglo American, Glencore and BHP Billiton lose 75.1%, 69.7% and 41.4% (over the course of 2015) respectively. Domestic economic data was largely positive, with UK unemployment falling to 5.2% for the 3-month period from August to November. This is the lowest (three-month) level since January 2006, and near to the Bank of England’s Natural Unemployment Rate (NAIRU).

The NAIRU is the specific level of unemployment that exists in an economy, without prompting prices to increase. As such, it is regarded as a key indicator for labour market and economic slack. The measure is widely used by economists to predict whether Central Banks are likely to intervene in monetary policy, in an attempt to manage inflation. The Bank of England, however, is unlikely to intervene with a rate rise in the near term. Even the habitually more hawkish members of the Monetary Policy Committee have indicated that still-sluggish wage growth and concerns about a commodity-induced growth slowdown will stay the Bank’s hand. Analysts who had initially been anticipating that the UK would follow the US in the first part of 2016 in implementing its first post-crisis hike, have since pushed out expectations to the latter part of 2016.

Wage growth, however, slowed in the same period, from 3% to 2.4%. December saw a somewhat disappointing revision to third quarter growth – coming in at 0.4%, well below expectations. The Markit Purchasing Manager’s Index for December indicated that manufacturing had slowed down somewhat, although still in expansionary territory. The reading fell to 51.9 for December, from 52.5 in November. While export orders had increased, the strength of sterling dragged on prices. November retail sales data proved disappointing, slowing down by 0.4% from the previous year despite significant Black Friday shopping. Anecdotal evidence suggests that a Santa-rally may have boosted High Street sales in December: Retail intelligence company Springboard reported that foot traffic was up by 11.7% on the previous year. The UK construction sector experienced a booming December: The Autumn spending review had already included additional measures to assist first-time housebuyers, and widespread flooding in many areas subsequently fuelled expectations for increased construction activity, to be further boosted by government assistance in the rebuilding process. Preliminary housing data indicated that house prices had increased by 0.8% in December, bringing the year to date figure to 4.5%. UK construction companies Wimpey Taylor and Barrat Developments ticked up notably. Mid- and small cap domestically focused UK stocks outperformed under-pressure large cap counterparts.

Japan and China

The TOPIX registered a loss in December, although macroeconomic data was mainly positive. After widespread concerns about the country entering a technical recession, revised Third Quarter GDP growth data released in December indicated a 1% expansion, well above the initial expectation for a 0.8% decline. The Bank of Japan’s (BoJ) quarterly Tankan Survey, however, was lacklustre, with inflation still extremely muted. Investors were largely disappointed by the Bank’s response: The Quantitative Easing programme was tweaked to include more asset classes (Exchange Traded Funds and Real Estate Investment Trusts), but neither the size nor duration of the injection were expanded. Sentiment, however, was boosted by a BoJ report on the impact of the 2020 Tokyo Olympics and Paralympics. The Bank estimates that, mainly off the back of increased building activity, infrastructure and new tourist arrivals, GDP growth will be lifted by an average of 1% by 2018. Japanese factory output declined from a strong October showing, contracting by 1.0% in November, despite ongoing support for exporters from a relatively weaker Yen. The Yen, over the course of four years, has weakened by nearly 35% against the dollar, boosting soaring Japanese profits and equity prices. The currency strengthened somewhat during December, undermining corporates’ expectations for a festive profit-boost. Indeed, a quarter of Bloomberg analysts, believe that the currency is significantly undervalued, and that further appreciation is on the cards over the next 12 months. . On a sectoral level, defensive sectors such as utilities and tourism stocks proved amongst the more resilient, while IT stocks underperformed.

Chinese macroeconomic data was mixed. Initial data releases indicated that November retail sales and fixed asset investment had picked up nicely. The latest Purchasing Manager’s Index data, however, sent sentiment tumbling. The Index confirms a manufacturing sector which remains in the doldrums. The Caixin Markit PMI fell to 48.2 in December, well below expectations. Tepid manufacturing data has harmed the financial performance of mainland Chinese companies: Data released in December indicated that profits fell 1.4% year-on-year in November, sending markets sharply lower toward month-end. The Shanghai Composite Index fell by as much as 4.1% after the release. Chinese manufacturers therefore continue to trim expenditures and reduce staffing levels. Chinese trade data for November served to underscore the global and domestic slow-down, with exports 6.8% lower, for a fifth straight month of declines. Imports declined at a more modest pace of 8.7%, after the marked 18% slowdown in October. The spill-over effects of reduced Chinese imports remains most severe in emerging trading partners. Imports from India declined by 19%, while ASEAN countries saw a 10.7% drop. South Africa and Russia, both struggling with already weak domestic demand conditions, were particularly hard-hit: Imports from the latter declined by 20.6%, and from the former by 33.7%, as demand for commodities and basic materials in manufacturing continues to slide. The two-speed growth rate the country experiences as it transitions, is perhaps best illustrated by the contrast between the (non-official) services PMI and the official and Caixin Markit Manufacturing measures. The former shows that service sector activity expanded from 53.6 in November, to 54.4 in December. The Chinese property sector has proved resilient, with house prices in major regions ticking up nicely over December. Analysts, however, have voiced concerns about the re-emergence of an asset class bubble. At present, however, the slow-and-steady increases are not unexpected, given a budding consumer-led recovery, and still-easy credit conditions.

Chinese economic growth slowed to 6.9% during the third quarter of 2015, and the International Monetary Fund (IMF) indicates that annual growth of 6.8% is likely to be realised for the year. A further slowdown, to 6.3%, is anticipated for 2016. The predication has bolstered expectations that the People’s Bank of China, after introducing a slew of supportive mechanisms throughout the year, will ramp up stimuli in 2016. A source of concern remains whether measures will include intervention in currency markets. The inclusion of the Yuan in the IMF’s SDR basket, announced in November, alleviated initial reservations as to aggressive intervention. The Bank nonetheless announced in December that the currency should be measured against a broader base of currencies, indicating that it would allow further managed depreciation. The announcement spurred the unit to its lowest level in four years.

Emerging Markets

Emerging markets, despite perhaps having pre-emptively borne some of the pending pain of the Federal Reserve hike, nonetheless underperformed developed market peers. In Latin America, all of the region’s Central Banks (aside from Brazil) followed the Federal Reserve’s cue, hiking rates in December. Deteriorating economic fundamentals and ongoing political wrangling have left Brazil’s policymakers very little room to manoeuvre. December saw the start of impeachment proceedings against the President, and the resignation of the country’s Finance Minister. The latter was partly prompted by downgrades received from two credit ratings agencies, with both Moodey’s and Fitch rerating the country to non-investment grade. This sparked additional stock and bond market volatility, with index-tracking and balanced funds required to off-load Brazilian holdings. Unsurprisingly, the Brazilian market was the poorest performing in Latin America, losing 3.42% over the course of the month, followed by Mexico. Both countries were hurt by a sharp depreciation in their currencies (2.36 and 3.67% respectively). Chile outperformed its regional peers and macro-economic data signalled a recovery, with growth estimated to be a healthy 2.2% year-on-year. Emerging Asian markets were mixed during December. Investors were rattled by renewed oil-price weakness and resurfacing fears of a Chinese slow-down. Most equity markets, however, recovered from initial Fed jitters, with Indonesia and Malaysia the regional leaders. Both countries had seen significant currency weakness in 2015. The stabilisation of the Rupiah and Ringgit respectively, boosted investor sentiment. Indian equities were fairly resilient, despite mixed macroeconomic data. Investors were troubled, however, by an apparent year-end policy inertia in implementation of further reforms, with no progress being made on the long-awaited Goods and Services Tax Bill before the end of the winter session of Parliament. The SENSEX registered a modest loss of -0.11%. Thai markets were regional laggards, as there is little confidence in the ability of military leadership to steer the economy. Within Emerging Europe, central European macroeconomic data was fairly positive: Polish retail sales increased by 3.3% year-on-year in November; the Czech Republic showed continued growth, with Q3 GDP growth figures ticking up 4.5% year-on-year; and Hungarian markets posted sharp gains. Russian equities ended the month -0.55% lower. The loss is modest, given the wild swings experienced in the energy sector over the course of the month, and the significant appreciation of the Rouble against the dollar. Economic news was disappointing, as data indicated that both real wages and retail sales had declined year-on-year. Ongoing military intervention in the Middle-East and the potential resurfacing of Ukrainian tension, is putting President Putin’s (relatively nascent) political capital at risk (though gaining him favour in certain strategic alliances). There is no sign that tension in the Middle East will abate: Saudi Arabia has cut diplomatic ties with Iran, and called for its regional allies to take similar action. This followed the raid of the Saudi Embassy in Teheran, itself the result of the execution of a prominent Sunni cleric by Saudi authorities. Equity markets in Qatar, the United Arab Emirates and Egypt, nonetheless finished the year on a winning note. African markets were not spared the initial fall-out of the Federal Reserve rate hike and volatility in the energy sector. Currencies bore the brunt of the adjustment, as trading was muted on the continent’s bourses in the holiday-shortened month. The Botswana stock exchange emerged as a regional leader for 2015, gaining more than 11% in local currency terms. Commodity-dependent Nigeria, Zambia and Ghana, however, were regional laggards. The Ghanaian market, in a quiet month on the African bourse, closed near the flat line in local currency terms, as did Kenya, Zambia and Uganda. The Nigerian ALSI was 0.46% higher, weathering continued oil-price volatility fairly well. The Nigerian government has announced a record 2016 budget of NGN 6 trillion expenditure. The government projects that the budget deficit will reach 2.2% of GDP, on the fairly conservative assumption that oil prices stabilize at $38 per barrel and production is maintained at 2.2 million barrels per day. Expectations are, however, that the deficit will nonetheless widen fairly significantly.

Nigeria Budget Deficit Growing in 2016

Source: BMI Research

Finance minister Kemi Adeosun has indicated that the deficit will be funded by a combination of local and foreign debt. The country is therefore likely to come to market with a Eurobond issue in early 2016, with potential yields at 9%. The government has also been lauded for the inclusion of significant measures aimed at improving social welfare programmes, and plugging fiscal leakages. This includes better policing of revenue-collection from various government agencies, notably in energy-related areas. International investors, however, remain concerned about the country’s reliance on oil-revenues and a somewhat unorthodox mix of policies. One of the main issues, perhaps, has been the dogged defence of the country’s currency. The IMF, in a recent meeting between President Buhari and Managing Director Christine Lagarde, urged for greater flexibility in the exchange rate regime. Analysts speculate that this may indeed be a precursor to a managed devaluation. Nigeria’s headline inflation rose from 9.31% year-on-year in October to 9.38% in November, mainly due to an increase in food-price inflation. In company news, markets were somewhat cheered by Dangote Industries’ purchase of Tiger Branded Consumer Goods for a nominal sum of a nominal $1. The move is a response to the large losses, and reputational damage, experienced at the Tiger group’s main Nigerian venture: In a strategic move, since called into question, the group purchased its 65% stake in Dangote Flour Mills in 2012 for a sum of $200million, and has written down a total of R2.7 billion (including R400 million in debt).

South Africa

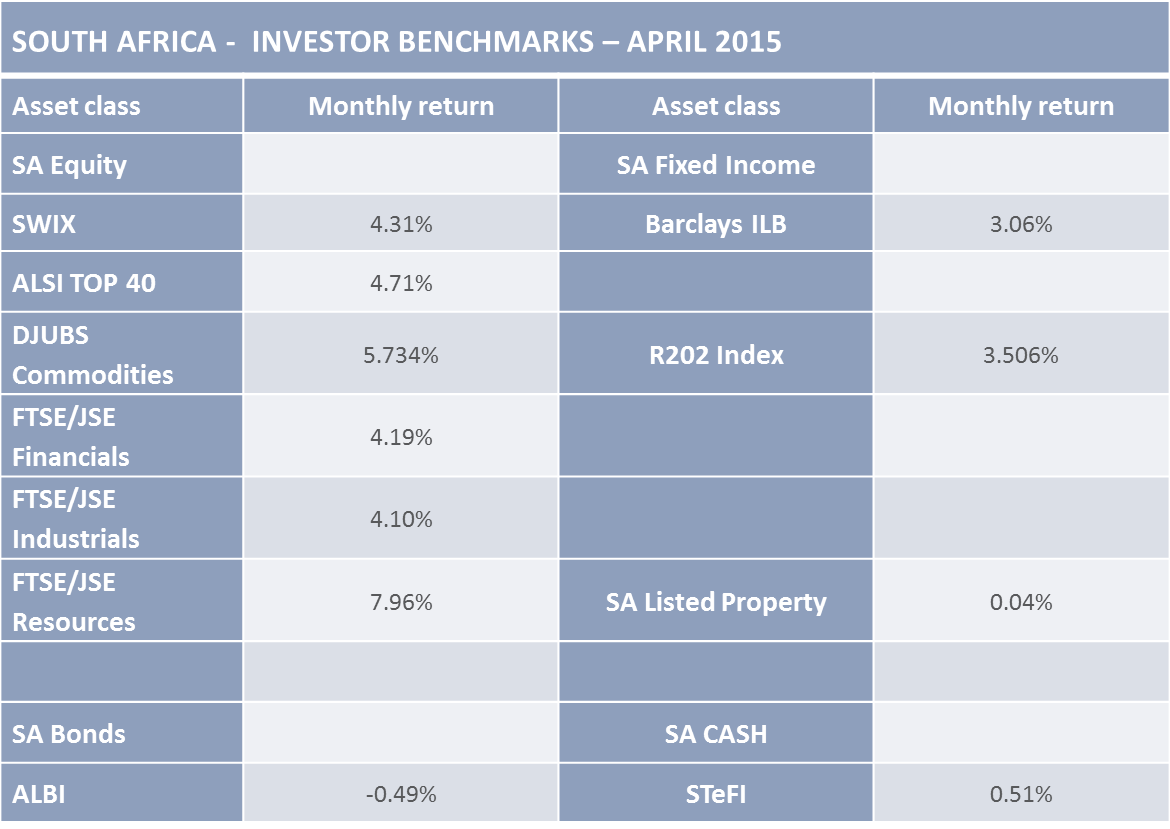

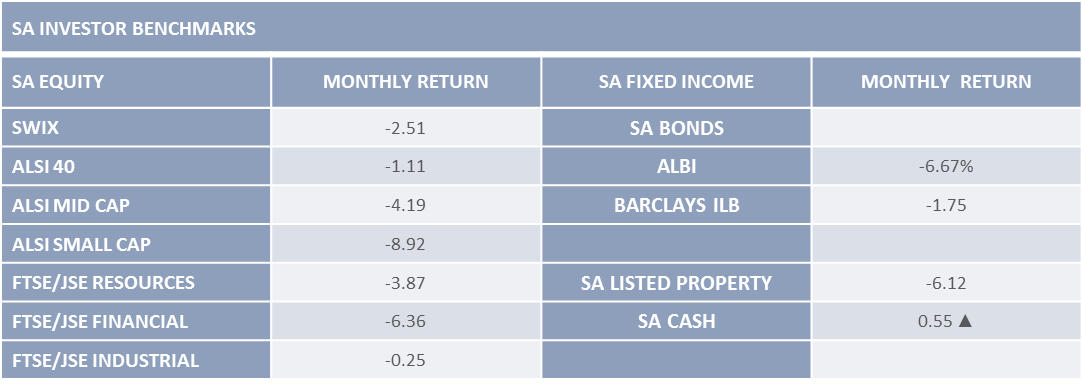

South Africa Investor Benchmarks

South African investors had a somewhat bumpy festive season, as markets were unsettled by a Cabinet reshuffle, the (anticipated) Federal Reserve rate hike and continued commodity weakness.

Economic data was mixed during the month: Automotive industry vehicle production remained on a solid footing for 2015, largely on the back of higher new vehicle exports. November also saw some recovery in commercial vehicle sales, although the consumer-sentiment driven new-car market remains under pressure (declining 0.6% year-on-year in November). According to the FNB/BER consumer confidence index, confidence slipped to its lowest level in 14 years during the fourth quarter: registering a negative level of -14, and down by 9 points from the 3rd quarter. Average monthly earnings for non-farm workers rose 6.2% year-on-year, with the mining sector recording the biggest gain of 10.5% in Q3 2015. Somewhat ironically, workers in the electricity sector are reported to have earned the highest average wage. SA Private Sector credit extension grew at 9.53% year on year in November, a fairly significant increase from October. One of the concerns, however, and a major drag on the current account, is the persistent income account deficit (which makes up roughly 2/3rds of the whole). The income account of the government is to a large degree dependent on foreign appetite for South African assets. While offshore investors remained willing take on SA exposure, mainly in the form of portfolio inflows, there has been a market decrease in the rate of flows. Most notably, in December, local and offshore investors were spooked by the merry-go-round in the Finance Ministry. The dismissal of Minister Nene on the 9th of December, and subsequent short tenure of Mr van Rooyen, did little to reassure markets as to the consistency of government stewardship of the country’s finances. Market reactions were stark.

Investors, perhaps somewhat indiscriminately, voted with their feet, and the JSE saw exceptional trading volumes. The average daily volume of equity market trading on the 10th and 11th of December was R47.8 billion, more than double the daily average for the rest of the year. The entire JSE market capitalization fell by 1.49% over those two days, from R11.35 trillion to R11.18 trillion.

The currency bore the brunt of the reaction, with the Rand plummeting through the psychologically important level of ZAR 15.00 to the USD.

Despite some stabilisation of the local unit, the Rand has been unable to regain its footing. The broad trend in emerging market and commodity-related currencies make a significant recovery unlikely. News that the country’s trade deficit had swung into a R1.77 billion surplus, from the previous deficit of R21.4 billion, failed to boost the currency. In addition, although oil prices reached new lows during the month, the boon on the import-side has largely been counteracted by forex weakness, and an elevated drought-related agricultural bill. As currency woes have added to upside-inflation risk, the SARB looks likely to follow the Federal Reserve Bank’s cue – a January rate hike may well be on the cards for South African consumers, despite the country’s already constrained economic growth. With Fitch and S&P lowering the country’s sovereign ratings only days before the December 9th announcements, concerns that ratings will be cut to junk have been exacerbated. The prospect of rising interest rates, and policy uncertainty, has also had a knock-on effect on fixed income assets. The previously stalwart property sector, for instance, has seen a notably slow-down. Analysts expect that growing debt defaults, and a more modest rate of house-price growth will serve to curb some of the exuberance of prior years. Simultaneously, however, given the elevated levels of stock market volatility, perceived safe-haven assets will continue to exert their pull on more risk-averse investors.

Unsurprisingly, traditionally-quiet December was therefore a fairly lively month for SA investors, particularly in bonds, bond-like and financial asset classes. The listed property sector declined by -6.12% and the All Bond index by -6.67%. Financials and Mobile Telecommunications were the worst performing amongst equity sectors, losing -6.36% and -6.37% over the course of the month. Both sectors were impacted by significant regulatory fines imposed on industry heavyweights: Standard Bank was hit by a $32 million fine in the UK, in a case relating to the historic bribery of Tanzanian government officials; and MTN’s Nigerian fine (though reduced by $1.8 billion) came due on the 31st of December. In an effort to boost investors’ confidence, the group also announced a number of key management changes aimed to improved governance and regulatory compliance across its Middle Eastern and African operations. Overall, the South African All Share Index managed to outperform BRICs and Emerging Markets peers.

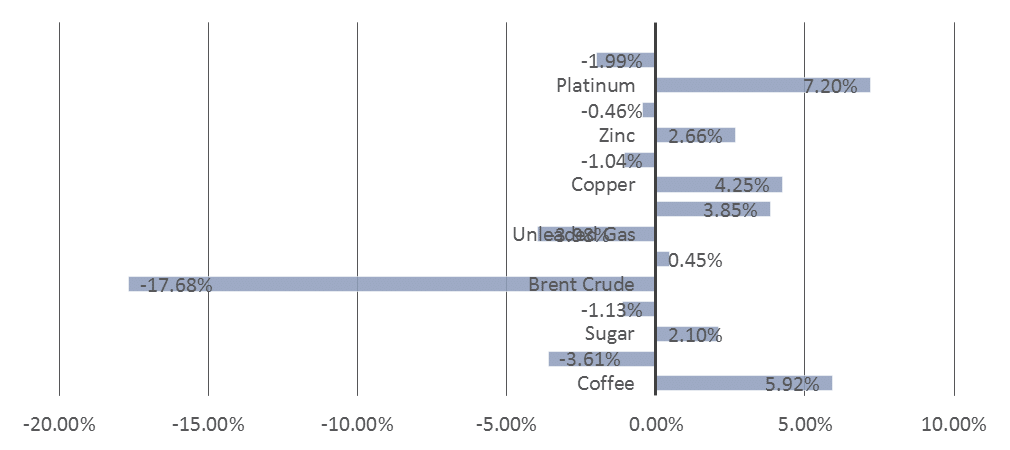

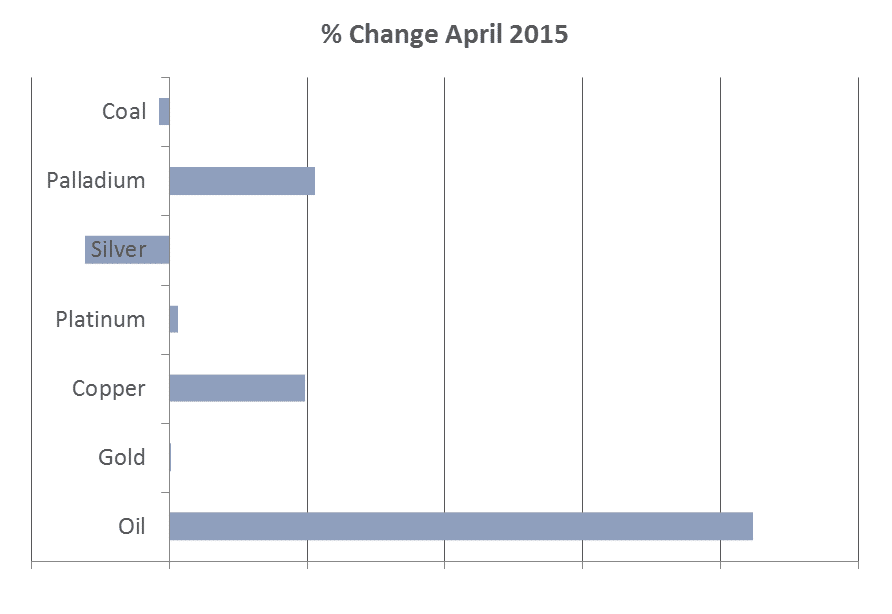

Commodities, Fixed Income and Currencies

Commodities returns were mixed during December, and the overall Bloomberg Commodity Index declined by -3.09%. Oil and gas stocks, after a year of wild fluctuations, saw a similarly volatile December. Brent Crude oil slumped to a new 11-year low of $37 per barrel just before Christmas, and closed the year 36% lower. Elevated tension between OPEC states saw an early end to the December meeting, with members failing to reach agreement on the oil-production quota. Increased military support from Russia to Iran and Syria has added to the extremely volatile situation in the Middle East: Saudi leaders remain at loggerheads with their oil-producing neighbours and have upped oil-production to support increased military spending. While US-Iranian relations are under pressure, sanctions are nonetheless set to ease, and Iran indicates a readiness to boost global supply, adding to the current glut. The lifting of the ban on US oil exports is likely to add a further interesting dynamic: During the 70s, the US implemented an export ban, with a view to energy independence. Solely reliant on domestic demand, and in the face of the protracted oil-price slump, US drillers and manufacturers have had a punishing time of late. West Texas and North Dakotan producers will welcome the ability to export, as it is likely to stabilise demand. The competition for markets, however, can only intensify. Although Chinese manufacturing data proved disappointing, the month-end release nonetheless allowed industrial metals some respite, and the sub-index gained 3.38%.

Central Bank policy drove returns in bond markets during the month. Initial disappointment with European Central Bank stimuli, prompted selling in peripheral European sovereigns. Peripheral European banks saw additional weakness, as new European banking laws were scheduled to come into effect on the 1st of January: The new laws require senior bond holders to accept losses if banks go bust. The Greek banking sector, somewhat predictably, bore the brunt of the sell-off. Credit spreads on emerging market corporates and a number of sovereigns widened subsequent to the Federal Reserve rate-hike, as perceived default risks increased. (The credit spread refers to the additional compensation an investor demands for holding an asset with credit risk/default potential, over the yield offered by a government-backed/risk-free security). High-yield bonds, characterised by their large concentration in the energy sector, substantially underperformed investment-grade corporate peers.

The Yen appreciated against the dollar over the course of the month, and analysts predict that further steady appreciation is likely during 2016. They Euro too, showed a recovery, gaining support from Central Bank stimuli. Despite potential Federal Reserve bank jitters, a number of emerging markets currencies remained in a narrow trading range of the ascendant dollar: The Turkish Lira, after losing nearly 20% over the course of the year, depreciated by a modest 0.12%; The Chilean Peso gained 0.36%, slightly paring the year-to-date loss to -14.42%; The Malaysian Ringgit, having lost -18.56% for the year, declined only -0.8%. Commodity-currencies however, were hamstrung by volatility in oil prices, and renewed commodity weakness on further fears of a Chinese slowdown: The Russian Rouble depreciated by -8.41%; and copper-rich Zambia saw a -5.41 depreciation in the Kwacha. South African currency woes were exacerbated by the Cabinet reshuffle, and the Rand lost -6.6% over the course of the month.

Style and Sector Returns

Source: Eaton Vance

Conclusion

A turbulent year for global investors drew to a somewhat disappointing close. After an initial flurry of central bank action, the latter part of the month was light on significant economic direction. The lack of alternative market-guidance paved the way for heightened geopolitical tension to spill into energy and equity markets. There has been some easing of jitters around Central Bank policy direction into 2016, but volatility is likely to remain elevated