International Market Commentary: August 2015

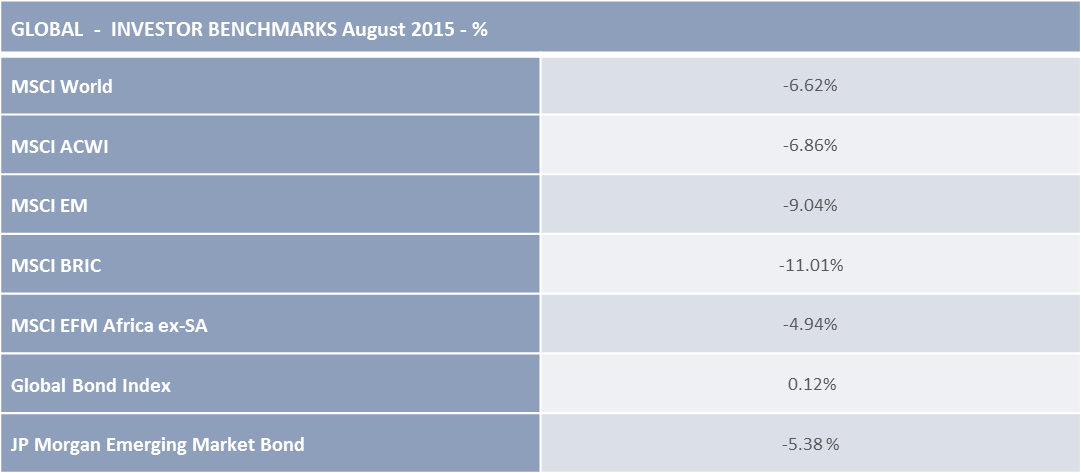

Global markets proved to be volatile in August, with sentiment driving markets broadly lower, despite little change in economic fundamentals. A rapid cooling of the overheated Chinese stock market, and continued policy interventions to boost flagging growth were not entirely unanticipated. Yet the scope and nature of events in the world’s second largest economy apparently caught market participants off-guard. The surprise devaluation of the Yuan on the 11th of August and a selling frenzy on the 24th of August (soon-dubbed Black Monday) continues to ripple through global markets. Against the backdrop of an imminent US Federal Reserve Bank interest-rate hike, weak commodity prices, and weak domestic currencies, emerging markets have been hardest hit by renewed risk aversion.

US Markets

US equity markets ended August significantly lower, despite overall solid macro-economic data, and the positive conclusion of corporate earnings season. The Dow declined by -6.6%, the S&P500 by -6.03% and the NASDAQ by -6.9%. In a month in which volumes are traditionally lighter, China-induced jitters were particularly pronounced: Widely used measures of volatility spiked at levels last seen in 2011, and well above 5-year averages (the S&P500 VIX registering 40.8, compared to a 17.5 average). Investors remain spooked, but analysts are quick to point out that the market, having been in bull-territory for 46 months, was due a correction. The correction saw stock markets register their largest monthly declines in four years.

The VIX, or fear gauge, is a measure of market volatility: It indicates, in percentage points, the expected movement of the relevant index over the upcoming 30 day period. Expectations are quantified by using current option prices.

Analysts view a drop of more than 10% from previous highs or lows as a correction. A drawdown of 10% is not as unusual as many investors believe. Over the past 35 years, the median or most common intra-year drawdown for the S&P500 has been 10.7%.

The latest reading of US economic data points to a resilient economy, and has to some extent re-established investor confidence. Recently published Second Quarter Gross Domestic Product figures from the Department of Commerce indicate an upward revision to 3.7%. US consumers are upbeat, with the Conference Board’s Confidence Index climbing 10 points to 101.5 during August. Consumer spending rose by an estimated 3.1% during the Second Quarter, while personal consumption expenditure rose by 0.07% month-on-month in August. More telling measures of broad-based confidence in the economic recovery: Big-ticket items and durable goods are increasingly in demand; existing home-sales increased by 5.4% month-on-month, while US construction spending (including on new business premises) rose to a 7-year high; and Business’ fixed investment spending rose by 3.2% quarter-on-quarter. The picture on the employment front, closely monitored by the US Federal Reserve for guidance as to the timing of rate-hikes, has continued to brighten. On average, for 2015 to date, US firms hired 210 000 new employees every month. The latest non-farm payroll figure, of 173 000 new jobs for August, is therefore somewhat disappointing, but has been partly attributed to cyclical labour market trends. Nor does it detract from the fact that the States’ unemployment rate, at 5%, is at or near the Fed’s target (NAIRU, representing the level of labour market absorption at which wages, and consequently prices, start to increase at an accelerating rate). The recent market turmoil may have given the Federal Reserve pause for thought. The Fed does tend to avoid raising rates in times of significant market stress, and the hesitance is borne out by New York Federal Reserve Chairman William Dudley’s comment that the case for a September hike was ‘less compelling’. Nonetheless, nearly 75% of economists polled by Bloomberg believe the hike will be announced at this month’s meeting.

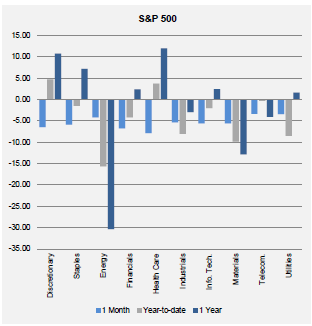

Index Sctor Returns – USA

(Source Eaton Vance)

Despite a buoyant US consumer, all sectors in the broad index registered declines during August. There was a marked reversal in the health-care sector, year to date darling, while the energy sector clawed back ground toward month-end. The latter may be a response to the buying-opportunities in a charred market segment, as exploration companies jockey to take advantage of any uptick in oil prices.

The Eurozone and Japan

European stock markets started the month on an upbeat note. An €86 billion bailout deal between Greece and its creditors, the resignation of Greek Prime Minister Alexander Tsipras and the consequent scheduling of a new election on the 20th of September, staved off some of the Grexit gloom. Sentiment turned troubled toward month-end, however, as East muscled West out of the forefront of investors’ minds. The FTSE100 ended -6.7% lower, the DAX gave up -9.3% and the overall MSCI Europe index lost -7.12%.

News from the continent was somewhat mixed, but fundamentally little has changed. The Eurozone recovery appears to be on track, albeit at a muted pace. Second Quarter GDP growth slowed to 0.3%, from 0.4% in the First Quarter. The European Central Bank, however, revised its growth forecasts down to 1.4% for 2015, in response to sluggish global conditions. The disparity in the recovery is also a noted concern for EU policymakers: while Spanish GDP grew at its fastest pace in 8 years, the French economy is languishing, with investment spending declining for the 6th consecutive quarter. The regional flash Purchasing Managers Index, a key indicator of manufacturing activity (where readings above 50 indicate expansion), ticked up to 54.1 in August. German export orders, boosted to some extent by Euro weakness, jumped to a 19-year high, while the German Business Climate Index rose to 108.3. European unemployment sank to its lowest level in 3 years, at 10.9% in July, and inflation was steady at 0.2% in August. Recent statements from the ECB, however, have highlighted downside risks to the Bank’s inflation target (slowing global demand, lower oil prices, a stronger Euro). President Draghi has therefore indicated the Bank’s willingness and ability to expand its Quantitative Easing Programme if necessary. This is likely to remain a boon to European equities. It is worth noting too, that the Asian spill-over to European exporters is relatively muted. China absorbs nearly 10% of EU exports, mainly in the transport, machinery and chemical sectors, a markedly lower figure than for many of China’s other trading partners. The absolute amount is roughly €165 billion, against the €2.8 trillion in intra-EU trade. Not surprising however, that amongst equity peers, materials lagged during August. Oft-overlooked for its exposure to the burgeoning Chinese middle-class, luxury goods similarly lagged.

The resource dominated UK bourse witnessed its worst month since 2012, with the FTSE100 closing 6.7% lower. The energy, mining and materials sectors weakened sharply, as elsewhere. Poor interim results from industry giants Rio Tinto and Glencore added to the general gloom surrounding commodities and mining. Financials too were a casualty of the Asian rout, as HSBC and Asian-focused Standard Chartered registered amongst the worst performing stocks. Domestically-focused, consumer-oriented and construction firms held up well, reflecting upbeat consumer sentiment. (The UK Consumer Confidence Index reached a 15 year high in August). The Bank of England sounded a hawkish on UK growth prospects. With sharp increases in the minimum wage likely to filter through to wage inflation with a lag, the Bank is likely to hold interest rates steady until May 2016.

Still on the monetary policy front, Japanese inflation, though remaining in positive territory, still doesn’t approach the Bank of Japan’s target rate of 2%. Investors are therefore anticipating further rate increases, but the Bank has held off for the time being, no doubt still assessing the impact of the devaluation in the Chinese currency. Following events in China, the Yen is regarded as something of a safe-haven currency, consequently appreciating significantly against major currencies. Export-oriented Japanese stocks bore the brunt of declines during August, with dominant automakers and steel firms underperforming. Sound fundamentals and a largely positive start to the month, with corporate earnings season wound up on a high note, was overturned by global sentiment. The Japanese market too ended lower, by 7.4% in Yen terms.

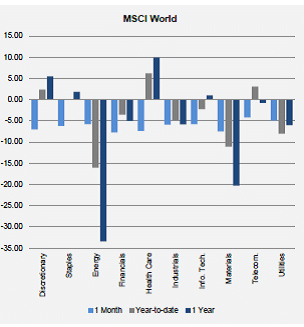

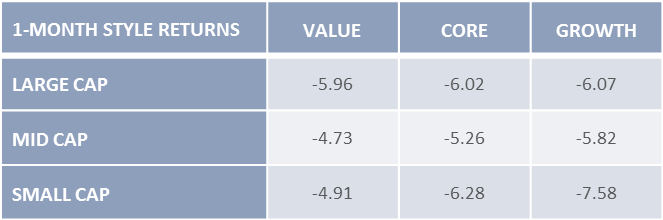

Index Sector and Style Returns – Global Average

Emerging Markets

Emerging markets bore the brunt of the fall-out from China’s stock market swings and growth misses. The MSCI EM lost 9.04 % in August, while the single Shenzen and Shanghai composites lost 15.2 and 12.5% respectively. Asian emerging markets retreated sharply, in line with their largest trading partner. The Malaysian market was the regional laggard, with the effect oil price fluctuations and political uncertainty exacerbated by currency depreciation. Despite the sharp depreciation in the Won, Korean stocks held up slightly better, as diplomatic talks were successful in resolving renewed tension with North Korea. Indian equities, despite solid fundamentals, were not immune to the global emerging market aversion. Commodity weakness continued to weigh on Latin American markets, with currency weakness amplifying losses. Brazil was the weakest regional market, with a Second Quarter GDP contraction of -2.6% a telling indication of the country’s recent fortunes and growth prospects. The economic and political arena saw further upheaval, with the long-running Petrobras corruption investigating extended to ElectroBras and the state-backed development bank BNDES. Amidst wide-spread government protests, President Rousseff’s approval rating has sunk ever lower. Major ratings agencies have downgraded the country’s sovereign credit outlook again, and Brazilian corporates are close to junk status. Emerging Europe saw little change, despite the denouement of the Greek crisis, and weathered the global storm somewhat better than emerging peers. Russia’s economic woes continue: Against the backdrop of rampant inflation, and EU-sanctions, an investment-driven turnaround is not on the cards. Russian equities nonetheless strengthened as the oil price rebounded toward month-end. Middle Eastern markets, traditionally fairly insulated, resurfaced as a geopolitical hot-spot. The economic impact of present militant action in the region will increasingly filter through to Europe as a migrant destination (and where concerns around migrants have all-too-often been a smouldering powder keg. African commodity exporters, heavily dependent on China as trading partner, declined sharply for the month. Copper-rich Zambia saw losses sharply amplified by currency weakness, the Kwacha amongst the biggest decliners amongst emerging peers (deprecating more than 13% against the USD).

This Side Up – Fragile China?

The extent and efficacy of policy interventions in the world’s second largest economy had previously been noted as a source of concern. The unintended consequences were perhaps most evident in global markets during August. Global markets were unsettled by the spill-over of continued efforts by the People’s Bank of China to stimulate growth, and negotiate a soft landing, whilst simultaneously managing the country’s stock exchange. Markets were volatile after the authorities’ surprise move on the 11th of August to loosen the Yuan’s peg to the dollar, thereby allowing it to devalue by 1.9% on a single day. With investors fearing that government support for the stock market would be curtailed, a ‘Black Monday’ selling frenzy in late August saw the index plummet by 9% on a single day. The Chinese market has declined by a whopping 30% since its peaks in mid-June, despite further easing measures. The latest measure saw the PBOC reduce reserve requirement ratios by 50bps, and interest rates by 25bps in an attempt to reassure investors, and restore lost liquidity. Only time will tell. The latest data indicates that the official growth target of 7% is unlikely. The Caixin-Markit PMI for August came in at 47.1, its lowest level since the Global Financial Crisis.

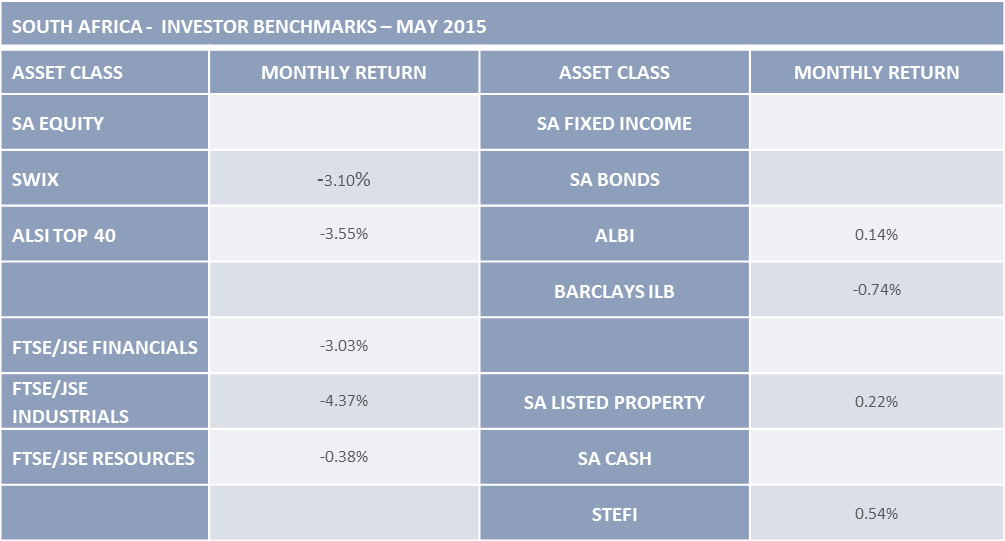

South Africa

The JSE ALSI closed 3.6% lower, outperforming many developed and emerging peers. The less-pronounced decline is in spite of, rather than because, of economic fundamentals. The latest local data does little to soothe investors’ concerns about the country’s growth prospects. Second Quarter GDP was recorded as contracting by 1.3% quarter-on-quarter. Mining-sector growth registered a 6% decline albeit in line with expectations, given commodity weakness and reduced offshore appetite. Manufacturing is reported to have contracted by 6.3% in Q2, with many firms citing irregular electricity supply and union activism as headwinds. The local Manufacturing PMI declined to 48.9 in Augustin August, below the key 50 mark, indicating still further contraction in Q3. Of considerable concern to policymakers in a country grappling with high unemployment, the employment index of the PMI fell even more markedly, showing no uptick in labour market absorption capacity.

The domestic currency weakened to multi-year lows during August. Thus far, though many observers are wary of competitive currency devaluations/depreciations amongst emerging markets, an inability to increase SA’s productivity in line with competitors, has hampered the potential boost to exporters. The trade balance swung into negative territory in July, after two months of surplus. Domestic inflation has risen to 5%, and the SARB has indicated an upside risk to the inflation target. It is likely to hike interest-rates at the next Monetary Policy Committee meeting, which may weaken the currency further.

Within the South African market, low-risk property resumed its favoured status, eking out a positive return for the month. Mid-caps managed a slight gain, outperforming large and small cap stocks. Financials and Industrials lagged, while Basic Materials and Consumer Services outperformed the broader index.

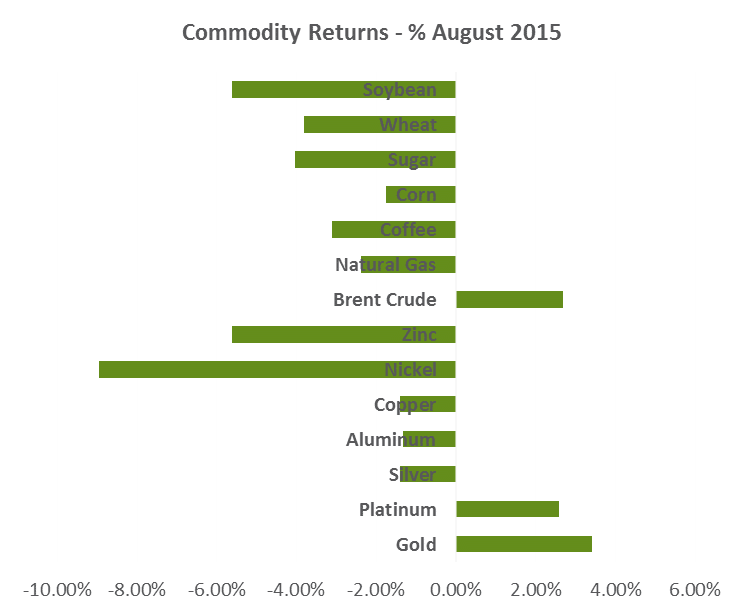

Commodities, Fixed Income and Currencies

The Bloomberg Overall Commodity index weakened a further -0.92% during August, in a continuation of the year-to-date trend. A number of sub-indices, however, saw both positive returns and marked volatility. Oil prices saw sharp reversals toward the latter part of the month, ending in positive territory. The International Energy Regulator reported that supplies were still growing at ‘breakneck speed’, partly taking into account the stated aim of Iranian authorities to add to the current glut. Oil subsequently hit new lows, after having declined by nearly 30% in 6 weeks to mid-August. Reports that US Crude inventory supply growth had unexpectedly slowed, and a new willingness by OPEC for engagement amongst oil-producing nations, heralded a turnaround. Oil prices rallied sharply in the last week of August, with Brent Crude gaining a further 6.5% on the last day alone. Demand for (perceived safe-haven) physical gold remained strong, but unusually aggressive selling in the futures market is indicative of the overall negative outlook for commodities.

‘Black Monday’ bled into fixed income markets, as traditionally more stable bond asset classes witnessed unusually sharp changes in yields and spreads during the month. Investors, initially rotating away from riskier assets, increased their demand for developed market sovereigns, driving yields lower by as much as 30bps. Reassurance – in the form of upbeat updates from the US, UK and Eurozone – and further easing from the POBC, boosted risk-appetite toward month-end. Safe-haven demand therefore declined, and US 10-year T-bill yields clawed back lost ground, ending 4bps higher at 2.22% (as bond prices and yields move in opposite directions). Demand for European sovereigns declined more markedly, with the 10-Year German Bund yield closing 16bps higher at 0.80%, and Spanish and Italian equivalents ticking up by 27 and 19 bps respectively. European sovereigns, however, are likely to receive a boost from the expansion of the ECB’s Quantitative Programme. Emerging Market Bonds continue to see net outflows, with ever-widening spreads (as much as 400bps) to developed market peers. Similarly, high yield bond spreads are at their highest levels since 2011, with the risk-off tone of markets and continued energy-sector weakness dragging down performance. Investment-Grade Corporate Bonds continued their year-to-date outperformance over high-yield counterparts, the BofA Global Corporate Bond Index closing -0.69% lower.

The sharp devaluation of the Yuan rippled through currency markets during August, with emerging Asian currencies hardest hit by consequent depreciations. The apparent change in the Chinese exchange rate policy has been the subject of much concern and speculation about potential currency wars (detrimental cycles of competitive devaluations to gain an export-oriented terms-of-trade advantage). A few key points in this regard are worth noting: Despite the 3% decline, the Yuan remains one of the only currencies – based on the real effective exchange rate, which is weighted against a basket of currencies and adjusted for inflation differentials – to have gained against the USD. For the year to date, it is still 4% higher, versus depreciations in the Korean Won, and Malaysian Ringgit of -2.3% and -7.8% respectively. It would take a much larger, and unlikely once-off intervention for the currency to play a role in boosting China’s export competitiveness over Asian and emerging market neighbours. Monetary policy moves, however, will still be a key determinant of future exchange rate paths. The hand of the Federal Reserve, however, will still be the most dominant in this regard. A September hike is likely to send the resurgent US Dollar still higher.

Conclusion

The somewhat wild fluctuations of the past month aside, the fundamental scenario for global markets remains unchanged: an environment of modest growth, favouring developed markets over emerging peers, with predominantly easy monetary policy and low interest rates. The implied rider is that monetary policymakers’ will continue to provide the market guidance, and the moves of the People’s Bank of China, and the US Federal Reserve, will remain closely scrutinised in the coming month. Near-term volatility is likely to remain amplified, and astute investors would do well to take unintended consequences into account.