Chinese consumer brands on the rise

China was relatively muted in June, with limited policy signals from Beijing and no major announcements. Nevertheless, the equity market held up well, with key indices maintaining their upward momentum driven by improved trade dialogue with the US. and rising confidence in the economy’s stabilisation. The MSCI China, MSCI China All Shares, and MSCI China A Onshore indices saw gains, ending the month up by 3.1%, 2.95%, and 3.46%, respectively. Sector wise, semiconductors, renewable energy, and financials were the major contributors. Retail sales in May rose by 6.4% year-on-year, beating expectations and marking the strongest growth since December 2023.

Key insights from the report include:

- How consumer confidence rebounds with strong spending and equity gains.

- The rise of homegrown consumer brands that are challenging established global players.

- How China’s entrepreneurial ecosystem is transforming brand-building dynamics.

Stronger consumer spending and equity gains boost corporate confidence

Travel activity during the Dragon Boat Festival reflected ongoing recovery, with 119 million trips made—up 5.7% year-on-year—and total spending reaching RMB 42.7 billion, a 5.9% increase. Meanwhile, the country’s largest mid-year online shopping event– 618, comparable to Black Friday in the US – recorded all-time high sales, with gross merchandise value (GMV) hitting RMB 855.6 billion, up 15.2% year-on-year.

Official data further indicated a consumption rebound. Retail sales in May rose by 6.4% year-on-year, beating expectations and marking the strongest growth since December 2023. Inflation data also surprised on the upside, with the consumer price index (CPI) rising by 0.1% year-on-year, snapping a downward trend over the past four months.

The strong performance of equity markets has lifted overall sentiment and reignited corporate fundraising activity.

The soaring equity markets certainly helped boost sentiment, attracting a renewed interest from companies to raise fresh capital, with the number of listings (both primary and secondary) on the Hong Kong Exchange hitting an all-time high of 208 in the first six months of the year.

The rise of incredible consumer brands

The recovery of the Chinese equity market and its strong outperformance relative to the US have led to renewed attention to the growth stories of individual companies that had either been forgotten by global investors or have only just emerged to prominence over the last five years.

We have seen a rise of incredible consumer companies in recent years, many of which are performing strongly after listing on the Nasdaq or Hong Kong Stock Exchange.

Examples include Popmart, Laopu Gold, Giant Biogene, Maogeping, Mixue, and Chagee. The share price of Popmart, the company behind the viral Labubu designer plush toy, has surged more than sevenfold over the past year.

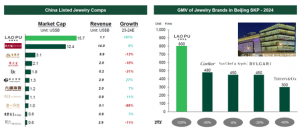

The share price of Laopu Gold, the first high-end luxury jewellery brand in China to take market share from Cartier, has seen its share price increase 14-fold since its IPO last year. Furthermore, there is a long list of fast-growing consumer companies that are expected to go public over the next 12-18 months.

Source: BA Capital; Capital IQ; iFind | Notes: 1. Comps with market capitalization of no less than HK$1B are counted. 2. Market value as of date Mar 31, 2025 in HKD.

It’s hard to believe that so many new companies have emerged during what has been one of the most challenging periods for Chinese consumers in living memory.

However, we’ve been here before. Revlon, the cosmetics company, was created amid the Great Depression in 1930 to provide affordable products to Americans. Coach, the American handbag company, started in 1941 in the midst of World War II. There are many more similar examples. In the past five years, Chinese companies have aspired to deliver better quality at a lower price, as consumers look for alternatives to more expensive global brands, be that coffee, toys, or pet food.

Insights from our trip to Shanghai

Our recent trip to Shanghai focused on trying to understand this trend of emerging Chinese consumer brands, the reasons behind their success, and whether there are more opportunities to come. The key takeaway is that we believe this is just the start. Smart, ambitious Chinese entrepreneurs are tapping into the needs of an ever more sophisticated consumer base. They are using China’s leadership in supply chains, digital advertising, and artificial intelligence (AI) to build brands quickly and efficiently. Perhaps what is very different this time is how swiftly these brands are going global once they achieve domestic scale.

Popmart is already the first Chinese retailer to open shops on Oxford Street and in Stratford in London, and more are likely to follow.

Lastly, local players are enhancing, and in some cases, reinventing, the retail experience. For instance, at Popmart’s flagship store on Nanjing Road in Shanghai, visitors are drawn in by an immersive experience, imaginative decor, and toy displays that seamlessly blend fantasy with commerce. The blind box format gamifies the shopping experience, creating a sense of excitement, and encouraging repeat purchases. Meanwhile, coffee brands like Luckin Coffee and Manner Coffee operate very small, efficient stores tailored to busy office workers who want a quick, pre-ordered, grab-and-go coffee on their way to work.

Changing habits in the world’s largest consumer market

China has more than 1.1 billion internet users. Its consumer market has already demonstrated that if you are the largest in China, you are large globally. Furthermore, it is difficult for established foreign brands to compete with local players for a multitude of reasons that don’t exist in other emerging markets. For example, the same US tech giants that dominate India have made it almost impossible for an ‘Indian Tencent’ to emerge.

Chinese consumer behaviour has also evolved rapidly in the last five years. There are four main trends to take note of:

- More value for money in a challenging economic environment, for example Starbucks customers switching to Luckin Coffee at a cheaper price.

- Increased self-confidence, leading to products that celebrate Chinese heritage, seen in the rise of tea chains and high-end local jewellery.

- Increased confidence in local brands as they prove their ability to deliver the highest quality products that now match, if not exceed, international standards. The increasing popularity of domestic cosmetics brands is a great example of this.

- Fast growing demand for experiential and emotional value, particularly among the youth, is seen in surging interest in domestic tourism, box office, and home-grown toy IPs.

Lower barriers to entry for newcomers in China

Trusted global giants such as Procter & Gamble and Nike used to boast of barriers to entry that were historically difficult to breach. Only the largest brands used to enjoy the ability to distribute globally (including to emerging markets), supply chains that minimised the cost of products, and the substantial marketing budgets to secure advertising on prime-time TV or at events such as the Olympics or FIFA World Cup. All this has changed, especially in China.

The scale advantage of distribution was first to go with the emergence of e-commerce providing the opportunity to sell any product, anywhere in the world. The Dollar Shave Club was one of the first to demonstrate this by taking on Gilette.

Then come the supply chains. China already manufactures goods across the spectrum from the lowest quality to the highest. Most of these OEMs (original equipment manufacturers) may very well have one or two dominant global clients but they have all diversified their client base to include other global clients, and local ones.

As long as smart entrepreneurs know the ins and outs of their respective industries, they can outsmart their slower, old school global competitors, at least in China to start with.

Being physically closer to the supply chains allows entrepreneurs to respond instantly to feedback from customers and rapidly iterate a product to meet the customer’s exact needs.

The democratisation of brand development and marketing is a further development. Highly sophisticated social media and influencer marketing based on expert and customer reviews gives the Chinese customer the ability to try lesser-known brands that they otherwise wouldn’t have. It’s only a matter of time until this trend spreads globally.

The viral Labubu doll is a perfect example that clever digital marketing can be more effective than big-budget campaigns.

An influencer or celebrity putting an ugly-cute doll around their handbag can be just as effective as sponsoring an advertisement during the Super Bowl. A pet food company can promote their brand for less by sponsoring pet rescue charities as opposed to asking for endorsements from celebrities. AI-optimised ad targeting can further help optimise marketing strategies in real time. All this means that it no longer requires billions to build a brand. Meanwhile, many global brands still haven’t mastered how to promote themselves on social media in China, missing a critical channel for consumer engagement.

A few remarkable case studies

Popmart

Soon after starting Popmart, the founder focused on the business creating new characters, given his view of the stale nature of Western IP like Disney and Barbie. A visit to a Popmart store is a truly unique experience; hard to describe in words except to say we haven’t seen anything like it for a long time.

The artists behind the Popmart characters hold a direct stake in the IP’s revenue. The company grew steadily in China and internationally, with multiple product lines, but when celebrities began attaching Labubu dolls to handbags, the brand went viral. What is fascinating is that this ugly-cute character was one of the least performing product lines until it achieved celebrity status.

As a result, Popmart saw its 2024 sales surge to $1.8 billion, with profits more than tripling. Analysts expect the company’s profits to more than double again this year.

Laopu Gold

This company has achieved the seemingly impossible. It is the first time a homegrown Chinese luxury brand has taken market share from the European titans such as Cartier. Laopu is focused on gold jewellery rooted in Chinese heritage. The reason for their success is that the company tapped into a market that didn’t exist before.

Every business decision is carefully made to ensure the brand builds steadily as intended. For example, they have scarce number of stores focusing on the very high end, and staff have high fixed salaries rather than commissions. This ensures that they treat each customer equally as opposed to only focusing on their loyal customers to secure their sales. In 2024 Laopu grew its sales by 166%, while some global competitors experienced negative growth in the Chinese market.

Source: BA Capital

Moody Tiger

This is like the Lululemon for children that sells premium activewear for children. It is still a fledgeling brand which only started in Hong Kong in 2019. However, we find it interesting for a few reasons in addition to the fact that it’s a premium brand. Firstly, it started its international expansion very early on with stores across Southeast Asia and Dubai. Secondly, it was interesting to learn how its early adoption of AI, in both design and marketing, increased the pace of content creation and reduced costs.

Other numerous examples

During our recent research trip, we came across too many exciting companies to write about in this short letter, ranging from electric bicycles for the European market, to innovative convenience stores, as well as snack and tea chains. Many of them already have multi-billion-dollar valuations and are planning to list on the stock markets imminently.

So why do we think there is so much more to come?

It is quite simply because there is an abundance of incredibly smart Chinese entrepreneurs building consumer businesses, taking advantage of lower barriers to entry to outmanoeuvre larger global players that are too slow to adapt to ever-changing consumers, not only in China but globally. As such, the structural investment case for Chinese consumer brands is evolving and strengthening.

Subscribe to our Monthly China insights report, providing a detailed and insightful analysis of the state of the Chinese equity m